Mutual Recognition of Funds Education Corner

As the premium choice for RMB services, BOCHK offers you all-round “Recognised Mainland Fund” investment services, helping you grasp the investment opportunities in the Mainland.

View the video now to know the potential investment opportunities from the Mutual Recognition of Funds!

-

Introduction of MRF

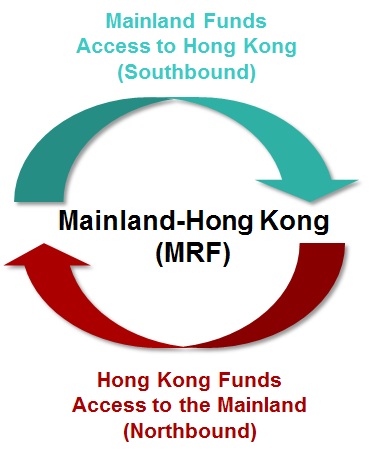

Q: What is Mainland-Hong Kong Mutual Recognition of Funds (MRF)?

A: Effective from 1 July 2015, Mainland and Hong Kong publicly offered funds that fulfill the eligibility requirements are allowed to follow streamlined approval procedure to obtain authorization of public offering in the host jurisdiction:

Q: Any eligibility requirements should the funds meet to obtain the MRF authorization?

A: Both Mainland and Hong Kong funds need to meet the eligibility requirements as below:

Establishment

Requirement- Established, managed and operated in accordance with the laws and regulations of home jurisdiction

- Regulated by regulatory body in the home jurisdiction

- Publicly offered funds domiciled in the home jurisdiction

Year of Establishment - Established over 1 year

Minimum Fund size - Not less than RMB 200 million (or its equivalent in a different currency)

Investment

Scope- Not primarily invested in the host market

- Equity funds, mixed funds, bond funds, unlisted index funds and physical index-tracking exchange traded funds

Value of Sales

- Value of shares / units in the fund sold to investors in the host jurisdiction shall not be more than 50% of the value of the fund’s total assets

Representative - Must appoint a licensed or registered firm in the host jurisdiction to be its representative.

Q: Is there any investment quota restriction on the Mainland-Hong Kong MRF?

A: The investment quota is set at RMB300 billion for fund flows between the Mainland and Hong Kong each way, controlled by the State Administration of Foreign Exchange.

Source: China Securities Regulatory Commission website, Securities and Futures Commission of Hong Kong website, compiled by BOCHK, as of June 2015

-

-

Important Notes

The following Risk Disclosure Statement may not disclose all the risks involved. You should undertake your own research and study before you trade or invest. You should carefully consider whether trading or investment is suitable in light of your own financial position and investment objectives.

Risk Disclosure Statement

The above information is for reference only. This webpage does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit. Although investment may bring profit opportunities, each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment products may not be the same as expected by you. Your fund may increase or reduce due to the purchase or sale of investment products. The value of investment funds may go up as well as down and the investment funds may become valueless. Therefore, you may not receive any return from investment funds. Part of your investment may not be able to liquidate immediately under certain market situation. The investment decision is yours but you should not invest in these products unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. Investment involves risks. Please refer to the relevant fund offering documents for further details including risk factors. If you have any inquiries on this Risk Disclosure Statement or the nature and risks involved in trading or funds etc, you should seek advice from independent financial adviser.

Risks Associated with the MRF Arrangement

- Quota restrictions: The Mainland-Hong Kong Mutual Recognition of Funds (MRF) scheme is subject to an overall quota restriction. Subscription of units in the Fund may be suspended at any time if such quota is used up.

- Failure to meet eligibility requirements: If a Recognised Mainland Fund ceases to meet any of the eligibility requirements under the MRF, it may not be allowed to accept new subscriptions. In the worst scenario, the Securities and Futures Commission may even withdraw its authorization for the Fund to be publicly offered in Hong Kong for breach of eligibility requirements. There is no assurance that the Fund can satisfy these requirements on a continuous basis.

- Mainland tax risk: The tax arrangement on Mainland tax relating to investment in a Recognised Mainland Fund is currently unclear. Investors may be subject to uncertainties in the Mainland tax liabilities.

- Different market practices: Market practices in the Mainland and Hong Kong may be different. In addition, operational arrangements of Recognised Mainland Funds and other public funds offered in Hong Kong may be different in certain ways. For example, a Recognised Mainland Fund may only accept subscriptions or redemption of units on a day when both Mainland and Hong Kong markets are open, or it may have different cut-off times or dealing day arrangements versus other Hong Kong funds. Investors should ensure that they understand these differences and their implications.

Concentration risk / Mainland market risk

The Fund invests primarily in securities related to the Mainland market and may be subject to additional concentration risk. Compared to investment in other markets, investing in the Mainland may give rise to different risks including political, policy, tax, economic, foreign exchange, legal, regulatory and liquidity risks.

RMB currency and conversion risks

RMB is currently not freely convertible and is subject to exchange controls and restrictions.

Non-RMB based investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors’ base currencies (for example HKD) will not depreciate. Any depreciation of RMB could adversely affect the value of investor’s investment in the Fund.

Investors may not receive RMB upon redemption of investments and/or dividend payment or such payment may be delayed due to the exchange controls and restrictions applicable to RMB.

RMB Conversion Limitation Risk

RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

- Only applicable to Individual Customers - RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- Only applicable to Corporate Customers - RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

This webpage is issued by Bank of China (Hong Kong) Limited. The contents of this webpage have not been reviewed by the Securities and Futures Commission in Hong Kong.