Promotions

For the "Key Facts Statement (KFS) for Instalment Loan", please click here.

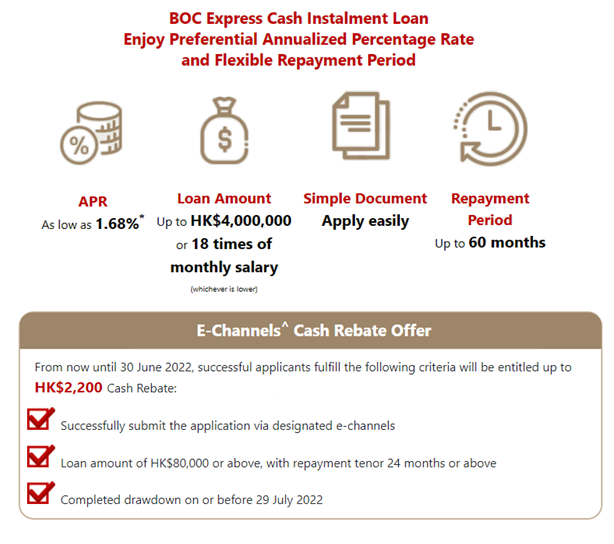

Apply via e-Channels now to enjoy the Cash Rebate at ease!

- Any BOCHK branches

- Application Hotline +852 2108 3688 (From 9:00 a.m. to 9:00 p.m. between Mondays and Fridays, from 9:00 a.m. to 6:00 p.m. on Saturdays, excluding public holidays)

- Apply via the

BOC Express Cash mobile app via

BOC Express Cash mobile app via  or

or  for application

for application

Application Channels

*The quoted interest rate is calculated based on a loan amount of HK$3,000,000 with repayment tenor of 12 months and monthly flat rate of 0.0754%. The annualised percentage rate is 1.68%, with handling fee waiver.

^E-Channels including BOCHK website, Internet Banking, Mobile Banking, “BOCHK” WeChat official account or “BOC CC” WeChat official account.

The APR of this promotion is from 1.68% - 30.90%

The APR is calculated according to the guidelines laid down in The Hong Kong Association of Banks. An APR is a reference rate which includes the basic interest rates and other fees and charges of a product expressed as an annualised rate.

The above offers subject to the relevant terms and conditions.

Reminder︰To borrow or not to borrow?Borrow only if you can repay!

Terms and Conditions and Remarks of BOC "Express Cash" Instalment Loan/ Balance Transfer