Board of Directors

| Contents |

| The Board of Directors |

| Members of the Board of Directors |

| Board Committees |

| Mandate of the Board and Board Committees |

The Board is responsible for supervising the management of the business and affairs of the Group with due regard to maximising shareholder value and enhancing corporate governance standard of the Group. The Board is obliged to act honestly and in good faith and to make decisions objectively in the best interests of the Group and its shareholders as a whole.

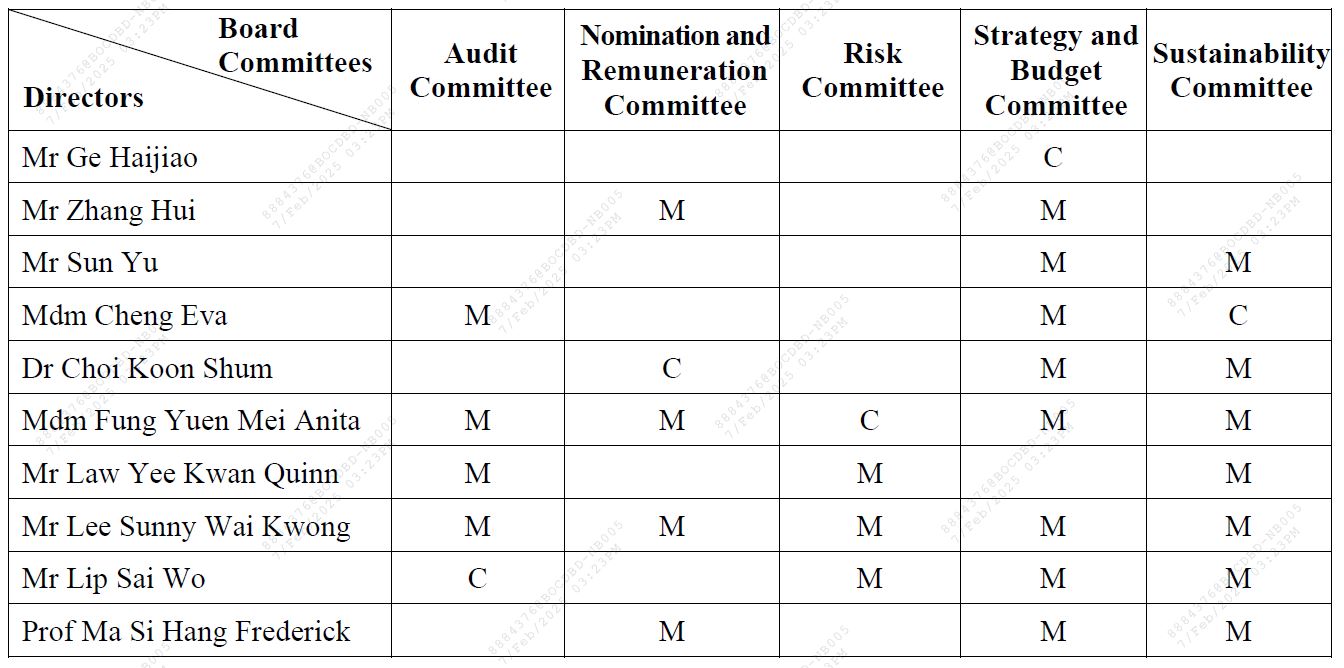

The Board has established five standing Board Committees which are delegated with different responsibilities to assist the Board in performing its duties. They are Audit Committee, Nomination and Remuneration Committee, Risk Committee, Strategy and Budget Committee as well as Sustainability Committee. All Board Committees comprised a majority of Independent Non-executive Directors with most of them chaired by an Independent Non-executive Director.

The Company is led by a high caliber Board with strong representation of Independent Non-executive Directors. The Board has a well-balanced composition of the Executive Director(s), Non-executive Directors and Independent Non-executive Directors.

The Board maintains an appropriate level of checks and balances to ensure independence and objectivity of the decisions of the Board, as well as the impartial oversight of the Management. The Board acts honestly and in good faith so that decisions are made objectively and in the best interests of the Group with a view to delivering long-term and maximum shareholder value and fulfilling its corporate responsibility to other stakeholders of the Group.

The Company recognises the importance and benefits of board diversity. In order to promote the Board’s effectiveness and standards of corporate governance, the Company has adopted the Board Diversity Policy which will be observed when identifying suitable and qualified candidates to be a Board member and whenever a Board member is proposed to be re-elected. The said policy provides that in designing the Board’s composition, board diversity should be considered in various aspects, including but not limited to gender, age, cultural and educational background, ethnicity, geographical location, professional experience, skills, knowledge and track records, etc., to ensure an appropriate diversity of skills, backgrounds and viewpoints. At the same time, all Board nominations and appointments are made on merit, in the context of the competencies, skills and experience the Board as a whole required.

Members of the Board of Directors:

Please click here for Biography of Directors

The members of the Board of Directors and their positions in the Bank and the special committees under the Board of Directors are listed as below:

Notes:

C Chairman of the relevant Board Committees

M Member of the relevant Board Committees

The committee is mainly responsible for:

• oversight of the integrity of financial statements and financial reporting process;

• oversight of risk management and internal control systems;

• review of performance of the internal audit function and the General Manager of Group Audit;

• review of the appointment of external auditor and assessment of its qualification, independence and performance and, with authorisation of the Board and shareholders at general meeting, determination of its remuneration;

• review of the periodic review and annual audit of the Company’s and the Group’s financial statements, and financial and business review;

• oversight of compliance with applicable accounting standards as well as legal and regulatory requirements on financial disclosures;

• oversight of corporate governance framework of the Group and implementation thereof.

2. Nomination and Remuneration Committee

The committee is mainly responsible for:

• review of overall human resources strategies of the Group;

• selection and nomination of Directors, Board Committee members and Senior Management;

• regular monitoring and review of structure, size and composition (including but not limited to gender, age, cultural and educational background, ethnicity, geographical location, professional experience, skills, knowledge and track records, etc.) of the Board and Board Committees;

• assisting the Board to establish, approve and review the standards of director independence, and assess the independence and term of office of Independent Non-executive Directors;

• review of the effectiveness of the Board and Board Committees;

• ensuring the participation in training and continuous professional development of Directors and Senior Management;

• review and recommendation of remuneration strategy and incentive framework of the Group;

• review of the remuneration of Directors, Board Committee members, Senior Management and Key Personnel.

3. Risk Committee

The committee is mainly responsible for:

• formulation of the risk appetite and risk management strategy of the Group and determination of the Group’s risk profile;

• identification, assessment and management of material risks faced by various business units of the Group;

• review and assessment of the adequacy and effectiveness of the Group’s risk management policies, systems and internal controls;

• review and monitoring of the Group’s capital management;

• review and approval of the Group’s target balance sheet;

• review and monitoring of the Group’s compliance with risk management policies, systems and internal controls, including the Group’s compliance with prudential, legal and regulatory requirements governing the businesses of the Group;

• review and approval of high-level risk-related policies of the Group;

• review and approval of significant or high risk exposures or transactions;

• review of risk management reports, including risk exposure reports, model development and validation reports, and credit risk model performance reports.

4. Strategy and Budget Committee

The committee is mainly responsible for:

• review of the Group’s medium to long-term strategic plan for the Board’s approval;

• monitoring of the Group’s implementation of medium to long-term strategy, providing guidance on strategic direction for the Management;

• review of major investments, capital expenditure and strategic commitments of the Group, and making recommendations to the Board;

• review and monitoring of the Group’s regular/periodic (including annual) business plan;

• review of annual budget for the Board’s approval and monitoring of performance against budgeted targets.

5. Sustainability Committee

The committee is mainly responsible for:

• review of the Group’s sustainability strategies, goals and priorities as well as material sustainability related policies;

• review of environmental, social and governance issues which are material to the Group and the related measures;

• oversight of the Group’s sustainability performance;

• oversight of the Group’s corporate culture and review of related policies;

• determination of the appropriate reporting principles and boundaries and review of the Sustainability Report.

Mandate of the Board and Board Committees

Summary of the Mandate of the Board of Directors

Mandate of the Audit Committee

Mandate of the Nomination and Remuneration Committee

Mandate of the Strategy and Budget Committee

Mandate of the Sustainability Committee