Green Development for a Better Environment

we actively develop sustainable finance through innovative technology, and take measures towards low-carbon and energy efficient operations to promote sustainable development and low-carbon transition.

Development of Sustainable Finance

Innovating green finance products

We continued to enrich our green finance products and services in order to provide a wealth of options for all sections of society to participate in the development of green finance, rapidly becoming a pioneer in multiple local markets.

- The first green mortgage plan in Hong Kong

In collaboration with Sino Group, we provided digitalized and paperless mortgage services to the potential buyers of designated residential projects that have received the BEAM Plus “Platinum” or “Gold” Rating for adopting sustainable building standards and introducing energy conservation measures. This mortgage plan is now available to both primary and secondary market buyers of private and government-subsidised residential projects certified with the BEAM Plus “Platinum” or “Gold” Rating, encouraging citizens to support green building and transition to a low-carbon lifestyle.

- The first personal green time deposit in Hong Kong

We became the first retail bank in Hong Kong to launch a personal green time deposit product that is certified by an independent third party, thus further expanding our green finance services for personal customers. Deposit funds will be used to support projects in green building, renewable energy and pollution prevention, in order to accelerate green and low-carbon transition.

- The first ESG multi-asset retail fund with RMB share class in Hong Kong

We launched the “BOCHK All Weather ESG Multi-Asset Fund” to allow personal customers to participate in ESG investment via asset allocation within a portfolio of fixed-income and equity securities that are consistent with ESG investment principles.

Supporting low-carbon practices through various initiatives

We have actively expanded green deposits and issued green bonds and funds for customers, resulting in continuous growth in related business scale and becoming a green partner to our customers.

- Cross-currency Green Time Deposit Plan

By combining the features of cross-currency and green time deposits, we supported green deposit e-vouchers and encouraged corporates to practise sustainability. Funds are mainly used to support projects in green building, renewable energy and pollution prevention.

- Green and Blue Bond Programme

As a green advisor, we successfully issued “green and blue” bonds, thus providing more diversified products and services for customers.

- Global Environmental Fund

BOCHK and Pictet Asset Management (“Pictet AM”) jointly launched a global environmental fund to offer more high-quality green investment options to retail investors. We have also joined forces with Pictet AM to support the coral restoration programme of WWF-Hong Kong.

Accelerating industrial customers’ transition with green credit

We support the new energy industry and help accelerate the transformation of traditional industries. Our green loans cover multiple industries.

Implementing Green Operations

We are committed to always minimising the potential environmental impact of our business operations and take measures towards low-carbon and energy efficient operations in line with the green banking concept.

Reducing the environmental footprint of our operations

We have taken concrete action in response to the initiatives of the nation and Hong Kong SAR Government with the aim to achieve carbon neutrality in our own operations by 2030.

We have set four green operation goals, covering energy, carbon emissions, water consumption and paper purchase, to manage the environmental footprint of our operations.

Measures for energy saving and emission reduction

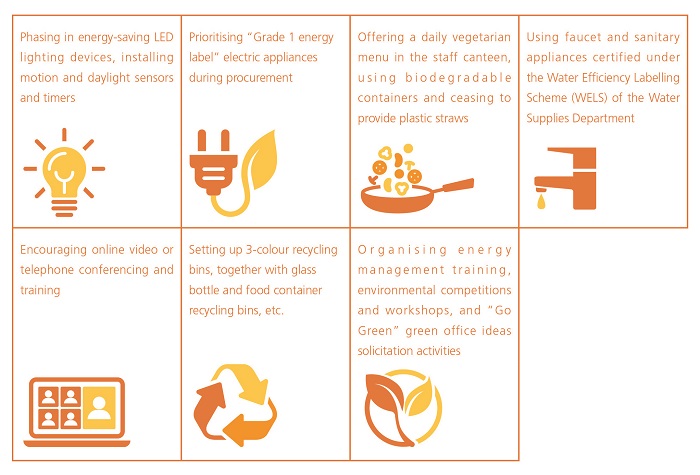

To cope with climate change, we have put in place measures for energy saving, carbon reduction and emission reduction in order to eliminate unnecessary carbon emissions from our daily operations and gradually move towards carbon neutrality:

- Implementing smart energy management. We have applied retro-commissioning (RCx) to chiller systems in core buildings and made plans for BEAM Plus certification to continuously enhance energy efficiency.

- Promoting the development of renewable energy. Solar photovoltaic panels have now been installed at BOC Cheung Sha Wan Building, and we are planning to conduct a series of measures on our other office buildings regarding the installation of solar panels, wind power technology and green roofs.

- High energy efficiency. We are gradually introducing highly energy-efficient equipment and green products, such as energy saving lighting, high-efficiency air-conditioning systems, water-saving sanitary appliances, electrical appliances with Grade 1 energy labels, etc., and selecting low-carbon and recyclable materials for carpets, stone and ceilings, etc., during the renovation and enhancement of our branches.

- Smart lighting. We are adopting natural lighting in our lobbies and installing solar insulation window films to reduce solar gain, in order to save electricity and enhance the efficiency of chiller systems.

- Promoting intelligent banking. We have set up eZones to provide green business services and reduce paper consumption in our banking centres.

Fostering a green culture for carbon reduction

We practise “green, diligent and thrifty operations” to conserve resources in our daily operations and implement multiple measures for energy saving and carbon reduction in our offices.

Green Community

Achieving sustainable development requires collaboration from all sectors of society. By supporting and sponsoring various partners to promote a diverse range of environmental projects, we will build a green future together with our stakeholders.

BOCHK Corporate Low-Carbon Environmental Leadership Awards Programme

- We have sponsored the “BOCHK Corporate Low-Carbon Environmental Leadership Awards”, jointly organised with the Federation of Hong Kong Industries (FHKI) since 2015, encouraging enterprises to adopt green and sustainable measures.

“Towards Carbon Neutrality” Youth Education Programme

- By supporting the “Towards Carbon Neutrality” Youth Education Programme, we cultivated low-carbon lifestyles among young people and strengthened their understanding of national policies, goals and action plans on carbon neutrality.

- Hong Kong students’ paintings about environmental protection were shown at the COP15’s Convention on Biological Diversity held in Kunming in October 2021, expressing local young people’s hopes of protecting biodiversity. The paintings were featured in the World Environment magazine of the Ministry of Ecology and Environment of the People’s Republic of China.

“Conservation for a Better Future on the Planet” Programme

- We supported the “Conservation for a Better Future on the Planet” programme launched by Ocean Park Conservation Foundation Hong Kong and sponsored 12 conservation programmes in Hong Kong and other parts of Asia to promote the conservation of biological diversity.

“Green Climate Pioneer” Programme

- We sponsored the “Green Climate Pioneer” youth leadership programme of Tung Wah Group of Hospitals to raise awareness of climate change and guide students to make innovative reforms and promote environmental protection.

“Human and Nature Inclusion Programme”

- We continued to sponsor the Polar Museum’s “Human and Nature Inclusion Programme” and launched a series of education programmes to support young people to reduce carbon emissions and practise sustainability in their daily lives.

“Carbon Neutrality Challenge” Programme

- By supporting the “Carbon Neutrality Challenge” programme organised by Kadoorie Farm and Botanic Garden, we raised citizens’ awareness of climate disaster risks and explored the use of natural solutions to cope with climate challenges and mitigate climate change.

“The Community Chest Virtual Walk for Millions”

- We sponsored the “The Community Chest Virtual Walk for Millions” activities, integrating carbon reduction, health and charitable giving. Due to the pandemic, the event was run online for the first time. Our employees actively participated in the event together with 5,500 citizens, accumulating nearly 600 million steps.

Computer Donation

- In response to the needs of people with low incomes and new immigrant families for computers, we donated reusable office equipment to various charitable organisations. In 2021, we donated over 8,000 computers, printers and computer screens.