Supply Chain Finance Solution by BOCHK

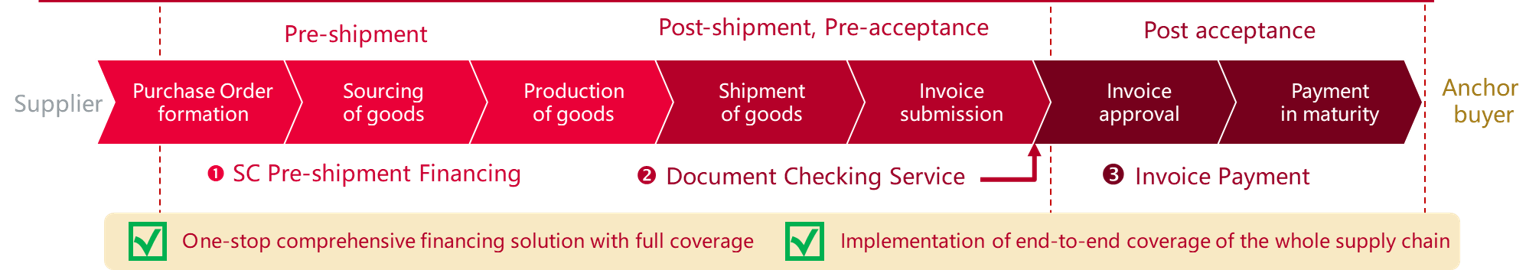

Along with the development of global supply chain model, BOCHK provides anchor buyer and their suppliers an one-stop comprehensive financing solution with full coverage, which helps both parties ensure stability of goods and service supply and support their business expansion.

Invoice Payment

After receiving goods and services from suppliers, anchor buyer might confirm payment upon the invoice submitted.

BOCHK will provide early payment to suppliers by purchasing their account receivables without recourse after receiving anchor buyer’s payment undertaking.

Benefits to anchor buyer

|

|

|

Benefits to suppliers

|

|

|

|

SC Pre-shipment Financing

Suppliers, who would like to have funding support before anchor buyer’s payment confirmation, could apply for SC Pre-Shipment Financing on top of Invoice Payment. SC Pre-Shipment Financing successfully extends funding support to earlier stage which not only allows suppliers' financing as early as procurement stage but also implements end-to-end coverage of the whole supply chain.

Suppliers who joined ‘Invoice Payment’ solution could apply for financing in earlier stage of the supply chain to support the funding needs of raw materials souring, production and packaging. BOCHK would provide short-term financing conditionally based on Purchase Order (PO) provided from anchor buyer or Sales Order (SO) with anchor buyer’s confirmation *.

Benefits to anchor buyer

|

|

|

Benefits to suppliers

|

|

Document Checking Service

Different from L/C model, bank normally would not provide trade documents checking service and corporates shall check themselves. Supply Chain Finance Solution by BOCHK provides Document Checking Service which reduces corporates’administrative burden.

Promotional Materials and other documents

Reminder: To borrow or not to borrow? Borrow only if you can repay!

* Subject to Bank’s final approval