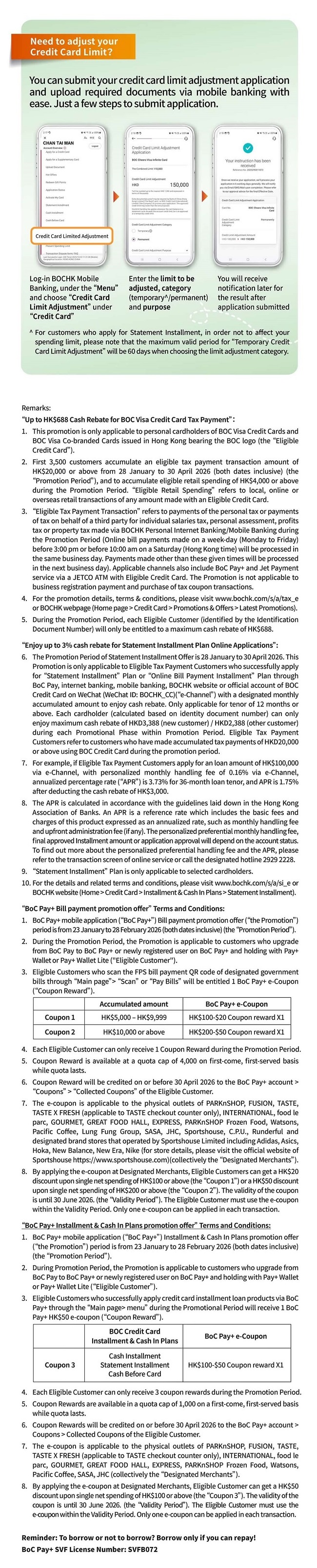

Terms and Conditions

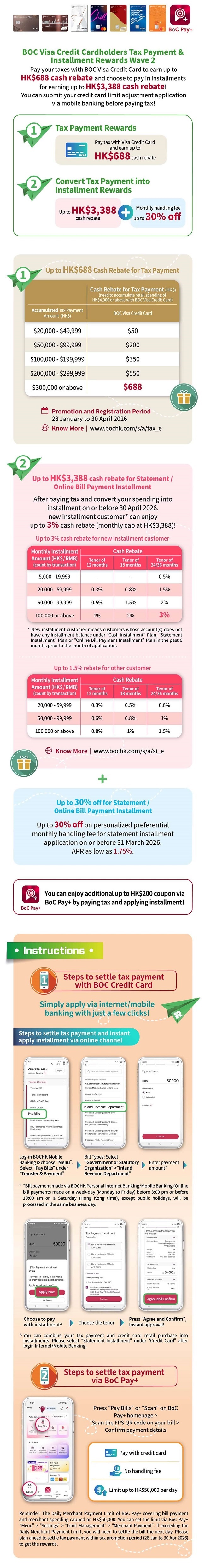

- Terms and Conditions for "Up to HK$688 Cash Rebate for BOC Visa Credit Card Tax Payment"

- Terms and Conditions for “Up to 3% Cash Rebate for Statement Installment Online Applications”

- Important Notes for BOC Credit Card “Statement Pay by Installment” Plan

- Terms and Conditions for the Installment Programs

- Key Facts Statement (KFS) for BOC Credit Card "Statement Installment" Plan

Reminder: To borrow or not to borrow? Borrow only if you can repay!