Money Safe – Lock it safely, Transact with ease

Worried about your funds being scammed or afraid of falling victim to fraud? BOCHK has launched Money Safe, a service designed to provide protection for your funds like a safe. Whether your funds are in savings accounts, current accounts or time deposits, once locked, Money Safe helps to safeguard them from unauthorised transactions and reduces fraud risks.

Customers can easily apply for Money Safe through BOCHK's Mobile Banking, Internet Banking or visit any of our branches. To release locked funds, you must visit a branch in person and complete the necessary identify verification to unlock them. This ensures maximum protection against fraudulent and unauthorised transactions. With Money Safe, you can lock deposits safely and transact with ease.

Money Safe Features

![]() Fully Secure Locked Funds

Fully Secure Locked Funds

∎ Prevents malware attacks and unauthorised access to your account by fraudsters.

∎ Locked funds cannot be used for any transactions, whether online or offline. This includes local and overseas withdrawals, payments or transfers. Restrictions apply to, but are not limited to:

- Transfers to another Bank of China (Hong Kong) account or another bank’s account

- Payments (e.g. bills, credit card payments, loans, investment, insurance purchases, autopay or tax repayments)

- Execute new or existing payment arrangements (e.g. transfers, standing instructions or preset transfer instructions)

- ATM withdrawals or transfers, Account Fees and Charges

- Cheque payments, mortgage payments, loan payments

∎ Before locking your funds, ensure there is sufficient balance1 in your account to cover your daily and other ad hoc needs or top-up to your BoC Pay+ Wallet.

1 Any scheduled transaction instructions (including but not limited to transfers, mortgage payments, loans or credit card repayments, etc.) that exceed the available balance (that is, the unlocked funds) in your account will be rejected and related fees, charges and/or interests may be incurred.

![]() Lock and Unlock at Any Time

Lock and Unlock at Any Time

∎ Customers can apply for Money Safe through various channels, including BOCHK Mobile Banking, Internet Banking or by visiting a BOCHK branch. For applications made via e-channels, the lock is effective immediately upon confirming the relevant service terms and conditions and satisfaction of all pre-conditions.

∎ For enhanced security, releasing locked funds requires visiting a BOCHK branch in person and completing identity verification and submission of the relevant application. Once released, the funds will no longer be restricted.

∎ Money Safe Service Hours

Via Mobile Banking, Internet Banking (application for locking only) |

Monday to Sunday from 08:00 - 00:00* *Note: Enquiry time is 24 Hours |

Via branch (Including: locking/release/reduction) |

Branch business hours |

![]() Support for Different Types of Accounts

Support for Different Types of Accounts

∎ Customers can lock funds in a single-name or joint-name2 HKD and/or foreign currency savings accounts, current accounts and time deposits. Applicable accounts include:

- HKD/Multi-currencies/RMB savings accounts

- HKD/USD/RMB current accounts (but not applicable to current accounts with overdraft limit and any overdraft limit)

- HKD/other currency time deposits (but not applicable to time deposits pledged to our Bank or time deposits that are subject to our Bank’s overriding rights (e.g. enforcement, set off etc.) or time deposits with maturity instructions of crediting principal and interest to a different name account or a third party’s account (including single name time deposit credits into a joint account, or joint name time deposit credits into a single name account and/or joint account with different names)

2 For joint accounts requiring a single signature, Money Safe can be applied for via Mobile Banking, Internet Banking and branches. Joint accounts requiring multiple signatures must have all account holders to visit a BOCHK branch in person to apply.

![]() Earn Interests While You Lock

Earn Interests While You Lock

∎ Locked funds in a savings account earn interest at the prevailing savings board rate as announced by the Bank, same as the other unlocked funds in a savings account.

∎ Locked time deposits retain the same rights and interest as the original time deposit, and earn interest based on the contracted time deposit rate. For renewal at maturity, the renewal interest rate will follow the time deposit board rate announced by the Bank from time to time.

![]() Set Flexible Lock Amounts to Meet Your Needs

Set Flexible Lock Amounts to Meet Your Needs

∎ Customers can set a locked amount flexibly. The maximum amount that can be locked is the available balance in the account

∎ For savings accounts and/or current accounts3, you can lock partial or all of the funds in the account. The minimum threshold to be locked for each HKD account is HK$10,000.00. For RMB/other currencies accounts, the minimum threshold to be locked is 1,000.00 of such currency.

∎ For time deposits4, you can lock one or more existing time deposits but cannot lock part of the funds within a time deposit.

3 Not applicable to current accounts with an overdraft limit and any overdraft limit.

4 Money Safe is not applicable to time deposits pledged to our Bank or time deposits that are subject to our Bank’s overriding rights (e.g. enforcement, set off etc.) or time deposits with maturity instructions of crediting principal and interest to a different name account or a third party’s account. Money Safe is not applicable to overdue time deposits or time deposits which will be matured on the date of application of Money Safe.

How to Apply for Money Safe?

BOCHK offers various channels to apply Money Safe, including BOCHK Mobile Banking, Internet Banking or branches.

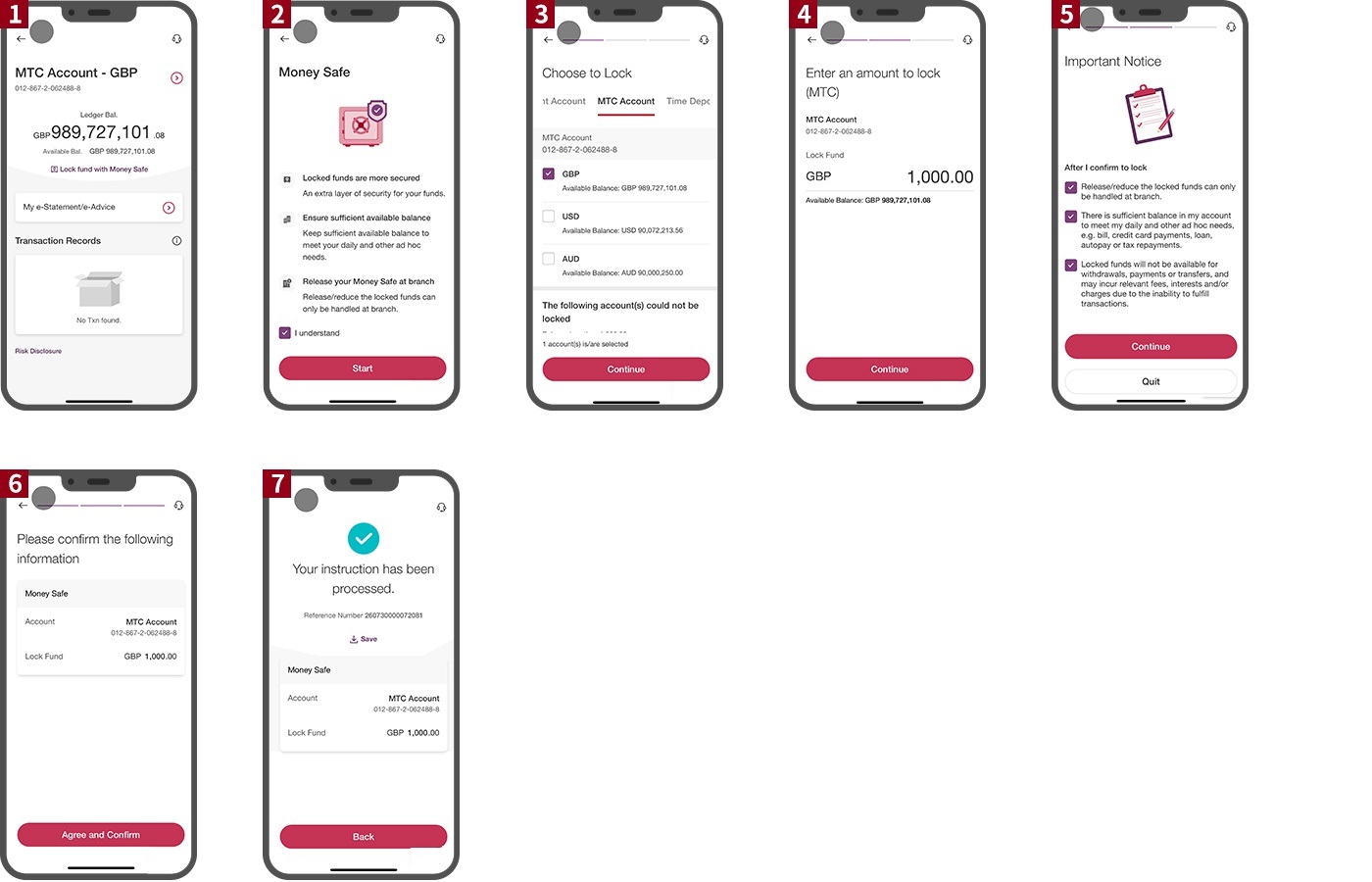

Applying for Money Safe via BOCHK Mobile Banking is quick and convenient. Below is a step-by-step guide:

∎ Lock Funds with Money Safe

1. Click <My Accounts>, select the desired account, and then click the <Lock Fund with Money Safe> icon

2. The Money Safe product page will appear. Click <Start >

3. Select the account to be locked

4. Enter the amount to be locked (minimum HKD10,000.00 for HKD accounts; RMB/other currencies accounts: 1,000.00 of such currency)

5. Confirm for the Important Notice and Money Safe Terms and Conditions

6. Click <Agree and Confirm>

7. Your funds are now successfully locked with Money Safe

∎ Check Locked Funds

1. Check "Locked Funds" in <My Accounts>

2. Check "Locked Funds" in selected account details

Frequent Asked Questions

These FAQs apply to Money Safe (“Money Safe” or “this Service”) of Bank of China (Hong Kong) Limited ("the Bank"). In these FAQs, "the Bank", "we", "our Bank" or "BOCHK" shall refer to Bank of China (Hong Kong) Limited (including its successors and assigns), and "you" or "customer" shall refer to the individual who uses this Service.

What is Money Safe?

1. What is BOCHK Money Safe?

You can apply Money Safe through BOCHK Internet Banking, Mobile Banking or visit a BOCHK branch to lock funds you deposited with us in your existing accounts, as well as the funds in time deposits from being used for any fund outflow through any channel whether online or offline. By locking part of the funds in your account, you can add an extra layer of security to prevent loss of funds in bank accounts due to fraud or potential scam. For the safety of your funds, after locking your funds with Money Safe, you can only reduce or release the locked funds by visiting any BOCHK branch in person after completing the necessary identity verification and procedures.

2. What are the channels for locking funds via Money Safe of BOCHK?

- Mobile Banking, Internet Banking and BOCHK branches in Hong Kong.

3. Why should I use BOCHK's Money Safe?

Fraudsters often use malware attacks and other means to gain unauthorized access to your account or payment information. By locking part of the funds through Money Safe, you can add an extra layer of security to your funds. Even if fraudsters gain unauthorized access to your account, the locked funds in your account will not be available for transactions and will remain safe.

Things to know before setting up Money Safe protection

4. What are the differences in BOCHK's Money Safe coverage for different account types?

- If you have a savings account and/or a current account*, you can lock some or all of the funds in your account(s). (The minimum threshold to be locked for each HKD account is HKD10,000.00, and the minimum threshold to be locked for each RMB/other currencies account is 1,000.00 of such currency.)

*(but not applicable to current accounts with overdraft limit and any overdraft limit) - If you have a time deposit, you can lock the time deposit so that all the funds in the selected time deposit cannot be withdrawn through Internet Banking or Mobile Banking. Please note that Money Safe is not applicable to time deposits pledged to our Bank or time deposits that are subject to our Bank’s overriding rights (e.g. enforcement, set off etc.) or time deposits with maturity instructions of crediting principal and interest to a different name account or a third party’s account. If a time deposit has been locked under Money Safe, it cannot be used as collateral for "Wealth Portfolio Financing" and “General Banking facilities and loan facility(ies)” service and our Bank reserves the right to ask for additional collateral. Money Safe is not applicable to overdue time deposits or time deposits which will be matured on the date of application of Money Safe.

- No matter it is a savings account, current account or time deposit, you can only release or reduce the locked funds by visiting any BOCHK branch in Hong Kong in person after completing the necessary identity verification and procedures.

5. What do I need to know before using BOCHK's Money Safe?

- Please ensure that there is sufficient fund in your accounts to meet your daily and other ad hoc needs (including but not limited to any third parties’ claims), since the locked funds cannot be used for any fund outflow through any channel whether online or offline, including local or overseas withdrawals, payments or transfers. Specific restrictions include but are not limited to: transfers, payments, direct debit authorization, standing instructions or preset instructions (e.g. automatic repayments, payment of utility bills, etc.), investments or insurance payments, ATM withdrawals or transfers, cheque settlements, account fees payment, mortgage payments and loan or card repayments, etc.

- Any preset transaction instructions (including transfers) that exceed the available balance (that is, the unlocked funds) in your account will be rejected, and related fees and/or interest charges may be incurred. If any repayments fail to be fulfilled, our Bank is entitled to debit the funds subject to locking under Money Safe from your account(s) to settle any debts (in whole or in part) you owe us in accordance with any contractual, equitable or statutory set-off rights; and to enforce any security interest and/or any liabilities we hold against the funds including any locked funds. In addition, overdue of the mortgage payments, loan or card repayments, etc may have negative impact on your credit score with our Bank.

- You can lock the funds in your account through BOCHK Internet Banking, Mobile Banking or in person at a BOCHK branch during service hours. You can preview your available balance in all accounts under "Account Overview" in Internet Banking or Mobile Banking. Once the selected funds are locked, you must visit any BOCHK branch in person to complete the necessary identity verification and procedures before the locked funds can be released or reduced.

- For time deposits: Only the entire fund of a time deposit can be locked and Money Safe is not applicable to time deposits pledged to our Bank or time deposits that are subject to our Bank’s overriding rights (e.g. enforcement, set off etc.) or time deposits with maturity instructions of crediting principal and interest to a different name account or a third party’s account.If a time deposit has been locked under Money Safe, it cannot be used as collateral for "Wealth Portfolio Financing" and “General Banking facilities and loan facility(ies)” service and our Bank reserves the right to ask for additional collateral.

- Warm reminder for overseas or mainland China customers: If you plan to go overseas or mainland China, and you expect to use the locked funds during your travel, it is recommended to plan earlier and ensure there is sufficient fund that is not subject to Money Safe.

General Terms

1. The above products, services and offers are subject to the relevant terms. For details, please refer to the Terms and Conditions and Frequently Asked Questions or contact our staff of the Bank.

2. The Bank reserves the right to amend, suspend or terminate the above products and services and to amend the relevant terms at any time at its sole discretion.

3. In case of any dispute, the decision of the Bank shall be final.

4. Should there be any discrepancy between the Chinese and English versions of this web page, the English version shall prevail.

Other Application Channels: