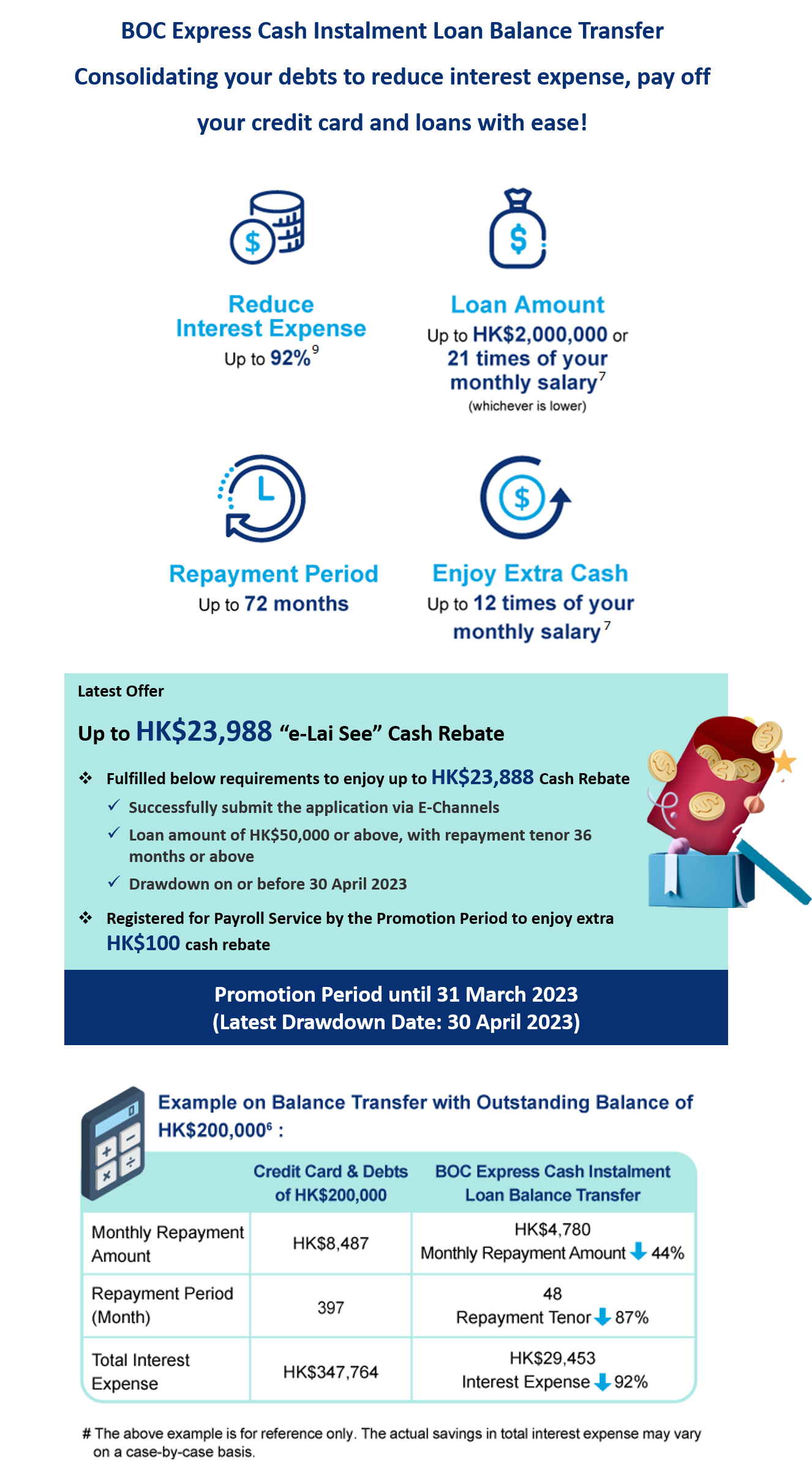

BOC Express Cash Instalment Loan Balance Transfer

Terms and Conditions are issued in electronic copies for all “BOC Express Cash Instalment Loan” applied via the mobile banking. Physical copies of the relevant Terms and Conditions are available upon request to the staff of the Bank.

For the "Key Facts Statement (KFS) for Instalment Loan", please click here.

Apply via e-Channels now to enjoy the Cash Rebate at ease!

(Please download the latest BOC mobile app to experience the seamless online application.)

- Any BOCHK branches

- Application Hotline +852 2108 3688 (From 9:00 a.m. to 9:00 p.m. between Mondays and Fridays, from 9:00 a.m. to 6:00 p.m. on Saturdays, excluding public holidays)

- Apply via the

BOC Express Cash mobile app via

BOC Express Cash mobile app via  or

or  for application

for application

Application Channels

Remarks:

^E-Channels including BOCHK website, Internet Banking, Mobile Banking, “BOCHK” WeChat official account or “BOC CC” WeChat official account.

#The above example is for reference only. The actual savings in total interest expense may vary on a case-by-case basis.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android and the Google Play are trademarks of Google Inc..

The APR of this promotion is from 4.93% - 31.41%.

The APR is calculated according to the guidelines laid down in The Hong Kong Association of Banks. An APR is a reference rate which includes the basic interest rates and other fees and charges of a product expressed as an annualised rate.

The above offers are subject to the relevant terms and conditions, please download a copy of the terms & conditions for your future reference.

Reminder : To borrow or not to borrow ? Borrow only if you can repay !

Terms and Conditions and Remarks of BOC "Express Cash" Instalment Loan/ Balance Transfer