Exceptionally low interest rate in the U.S. could last till mid-2013

Ben Bernanke, Chairman of the Federal Reserve, recently announced that exceptionally low interest rate is likely to remain until mid-2013. Most commentators immediately concluded that interest rate will not be hiked during this timeframe. However, such conclusions are probably premature. In fact, during the Jackson Hole meeting in 2010, Bernanke stated that the danger of setting a timeframe for monetary policy was that market participants might not understand the timeframe would be dependent on economic conditions. In other words, if inflation accelerates or the economic recovery strengthens, rate hikes will be entirely possible.

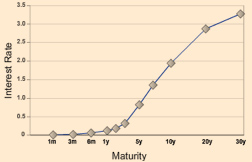

It is undeniable that U.S. growth remains sluggish, and the weak labour market continues to be a major concern. As a result, many analysts are forecasting a double-dip recession or stagflation. During the past 50 years, the U.S. experienced 7 recessions. In each and every instance, the yield curve inverted prior to the downturn. As it stands now, the U.S. treasury yield curve remains steep. The difference between the 3-month and 10-year yields is about 2% and a long way from negative territory. Therefore, we expect that the U.S. economy will continue to grow slowly although the expansion may not be robust enough to considerably reduce the unemployment rate.

U.S. Treasury Yield Curve

The future of the Euro-zone hinges on Italy as a Greek default is almost certain

The situation in the Euro-zone is deteriorating quickly. Although Germany's Constitutional Court upheld the country's rescue of the Euro-zone, the recent departure of Juergen Stark, Germany's representative and member of Executive Board of the European Central Bank, highlights the rift amongst European decision-makers. Moreover, Germany has rejected the idea of Euro bonds, while the debt-ridden countries have shown an inability to reduce deficits by themselves. As a result, the probability of an eventual breakup of the single currency union is rising by the day.

Credit default swap (CDS) prices are indicating the chance for a Greek default is more than 90%. In fact, investors have already shifted their focus to Italy, whose debt load is the third largest in the world and equivalent to Spain, Greece, Portugal, and Ireland combined. Italy's debt to GDP ratio currently amounts to 120%. Should Italy's debt problem worsen, no country or organization would be able to provide sufficient help. In other words, Italy is not too big to fail, but rather, too big to be saved.

Japan's new prime minister lacks economic prescriptions

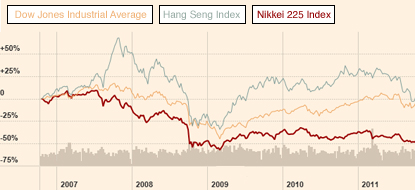

Japan has seen six prime ministers over the past five years, and the lack of a stable leadership has negatively impacted its economy and stock market. The graph below depicts the comparison between the performance of Japan's Nikkei 225, Dow Jones Industrial Average of the U.S. and Hong Kong's Hang Seng Index. If the three indices started from the same origin five years ago, the red curve representing Nikkei 225 has now declined close to 50%, the orange curve representing Dow Jones Industrial Average has now declined about 6%, and the blue curve representing Hang Seng Index remained more or less unchanged. Furthermore, Nikkei 225 is currently at a level that is only 25% of the high that was reached in late 1989 before the bubble burst. In other words, despite a series of ups and downs, Japan's stock market tumbled about 75% in the past 22 years!

Japan's Stock Market Performance in the past 5 Years

Japan is steadily losing its competitiveness in the age of globalization, but its successive government has not shown the determination required to implement badly needed reforms. As it stands now, Japan has the highest corporate tax in the developed world. Prime Minister Yoshihiko Noda has put off tax reforms that could improve Japan's competitiveness but opted to increase the sales tax instead. As a result, it is difficult to be optimistic about Japan's future. If the country's leadership continues to rely on issuing government debts and zero interest rates to maintain the status quo, Japan's lost decade could turn into two decades lost. Investors should not expect handsome gains in Tokyo any time soon.

Risk Disclosure

The above information is for reference only and is not intended to provide investment advice and should not be relied upon as such. The above information is prepared on the basis of materials obtained from sources believed to be reliable but Bank of China (Hong Kong) Limited ("BOCHK") accepts no liability in relation to the use of the above information for any purposes. BOCHK does not make any representation or warranty and accepts no responsibility or liability as to the accuracy, completeness or correctness of the above information. The above information does not constitute an offer or solicitation to enter into any investment arrangement. Investment involves risk. Although investments may bring about profit opportunities, each type of investment product or service comes with its own risks. Due to the fluctuating nature of the markets, product prices may rise or fall beyond customers' expectations dramatically and may become valueless and customers' investment funds may increase or decrease in value as a result of selling or purchasing investment products. It is likely that losses will be incurred rather than profits made as a result of buying and selling investment products. Loss may equal or exceed the amount of the initial investment. Income yields may also fluctuate. Due to market conditions, some investments may not be readily achievable. Before making any investment decisions, customers should assess their own financial position, investment objectives and experience, willingness and ability to bear risks and understand the nature and risk of the relevant product. For details of the nature of a particular product and the risk involved, please refer to the relevant documents. Customers should seek advice from an independent financial advisor.