Mobile Cheque Deposit Service(Corporate)

BOCHK Hong Kong introduces its new Mobile Cheque Deposit Service, allowing you to conveniently deposit cheques, view cheque images, and check the status of your deposits anytime, anywhere. iGTB customers can simply log on to the BOCHK iGTB MOBILE app and use their mobile phones to capture cheque images for online deposits. No more queue line at the branch for cheque deposits - it's convenient and time-saving.

Benefits

Deposit cheques while staying at home

- With BOCHK iGTB MOBILE app, you can deposit cheques online, no more waiting in line

Support multiple major currencies

No additional fees

- We accept ordinary/special-printed cheques, cashier's orders, and dividend cheques drawn on BOCHK, and support HKD, USD&CNY. No additional charges applied by BOCHK

Up to 5 cheques per transaction

Quick and easy to use

- You can deposit with an upper limit of HKD100,000/CNY 100,000/USD10,000 per cheque. Up to 50 cheques per currency can be deposited per business day

Real-time deposit records

Convenient for tracking

- You can view the deposit status and download electronic receipts on iGTB NET/BOCHK iGTB MOBILE app once the depositor successfully submits instructions via the ‘Mobile Cheque Deposit Service’

Customise beneficiary notice

As you wish

- Depositors can customise the email address of the contact person. After successfully submitting instructions, the Bank will send a cheque processing email to the designated email address

Notifications to cheque issuer

Stay informed about the deposit status

- The cheque issuer will receive an email or SMS notification once he/she successful submits the deposit instructions

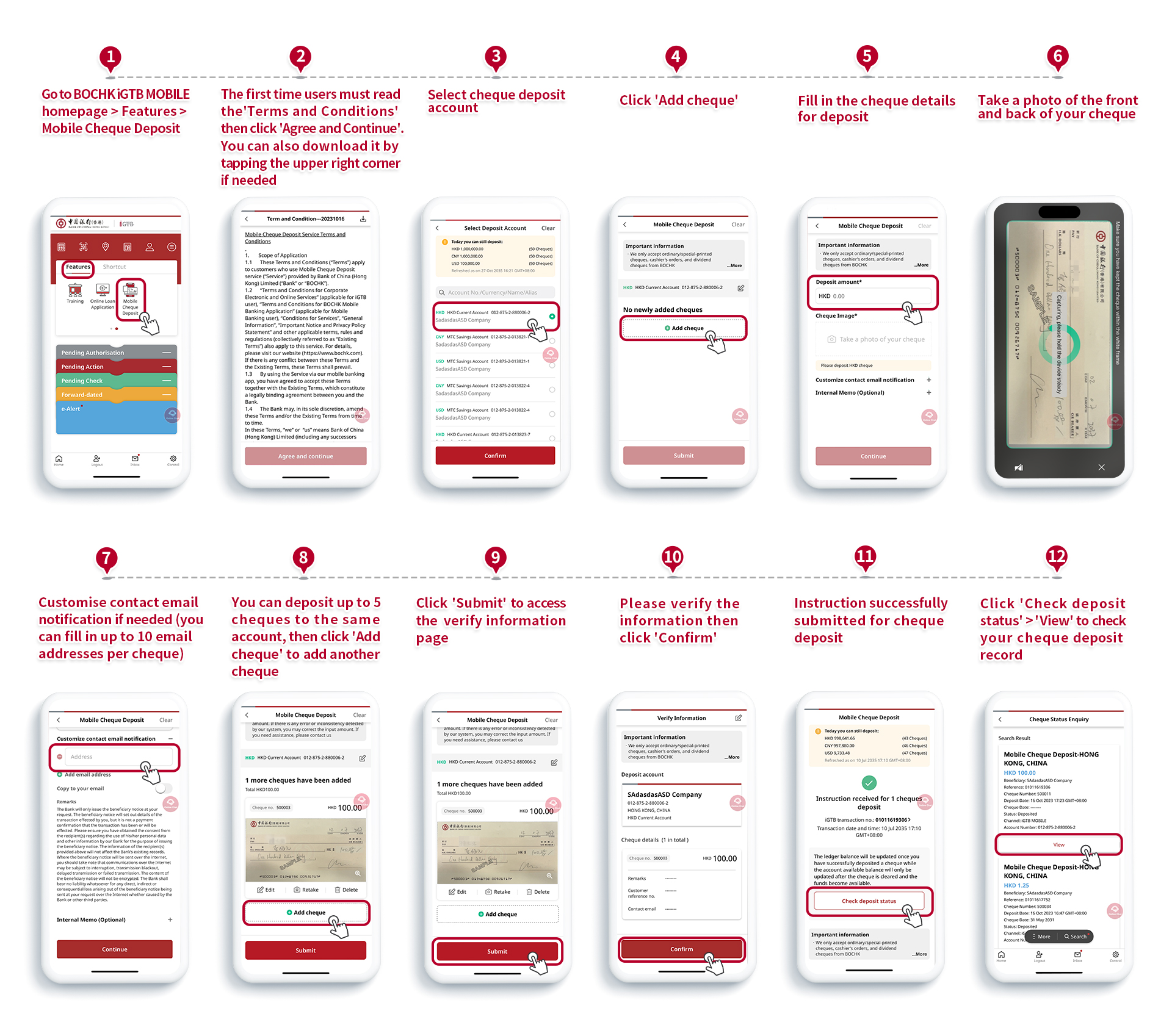

How to use Mobile Cheque Deposit Service

1. Go to BOCHK iGTB MOBILE homepage > Features > Mobile Cheque Deposit

2. The first time users must read the 'Terms and Conditions' then click 'Agree and Continue'. You can also download it by tapping the upper right corner if needed

3. Select cheque deposit account

4. Click 'Add cheque'

5. Fill in the cheque details for deposit

6. Take a photo of the front and back of your cheque

7. Customise contact email notification if needed (you can fill in up to 10 email addresses per cheque)

8. You can deposit up to 5 cheques to the same account, then click 'Add cheque' to add another cheque

9. Click 'Submit' to access the verify information page

10. Please verify the information then click 'Confirm'

11. Instruction successfully submitted for cheque deposit

12. Click 'Check deposit status' > 'View' to check your cheque deposit record

Frequently asked questions

Q1 Where can I find the Mobile Cheque Deposit service in the BOCHK iGTB MOBILE App?

You can find it under 'Features' on the homepage in your BOCHK iGTB MOBILE App, then swipe left to select 'Mobile Cheque Deposit' service. You can also click on the menu bar on the upper right-hand corner of the screen once logged on iGTB, then select 'Deposit' > 'Mobile Cheque Deposit'.

Q2 What types of cheques are eligible to deposit?

We accept cheques issued by Bank of China (Hong Kong) Limited including:

• Ordinary cheques;

• Special printed cheques*;

• Dividend cheques;

• Cashier's orders; and

• Any other payment instruments.

*Designated check issued by the company.

Q3 Is there a limit on how many cheques or the total amount I can deposit via the app per day?

Commercial customers can deposit up to 5 cheques at once with an upper limit of HKD100,000/CNY100,000/USD10,000 per cheque, and up to 50 cheques with maximum value totaling HKD1,000,000/CNY1,000,000/USD100,000 per business day*.

* It means from 12 a.m. of that day to 11:59 p.m. of that day.

Q4 Should I keep my original cheque after making a mobile cheque deposit?

Yes, it is recommended that you keep your original cheque for at least 180 days after successful submitted the images and cheque deposit instruction by using the Service even the funds are deposited into your account.

Q5 What can I do if I fail to capture the cheque image?

When taking images of cheques, please:

• Place the cheque on a solid dark-coloured background

• Ensure there is good lighting

• Ensure that you have kept the cheque within the white frame

• Hold the device steady

Other Corporate Collection Management Solutions

- Autopay-in Service

- Sub-account Collection Service

- Payment Collection Service

- Cheque and Document Collection Service

- Cash Collection Service

- e-Cheques Services (Corporate)

For more details, please call the Cash Management Services Hotline +852 3988 1288.