Understanding China Net Zero Solutions Choices

Why China's 2060 Net Zero Goal Matters?

- Hong Kong has been hit by typhoons and extreme weather in recent years, causing record-breaking rainfall and widespread flooding. Reducing carbon emissions is expected to reduce the occurrence of extreme weather events.

- The estimated investment linked to China's net zero target across different sectors reaches CNY110* trillion, creating investment and green jobs.

- To ensure energy security and find new drivers of economic growth, China sets to reach its net zero target by 2060 and gradually moves towards carbon neutral.

What are the Investment Opportunities for China Net Zero?

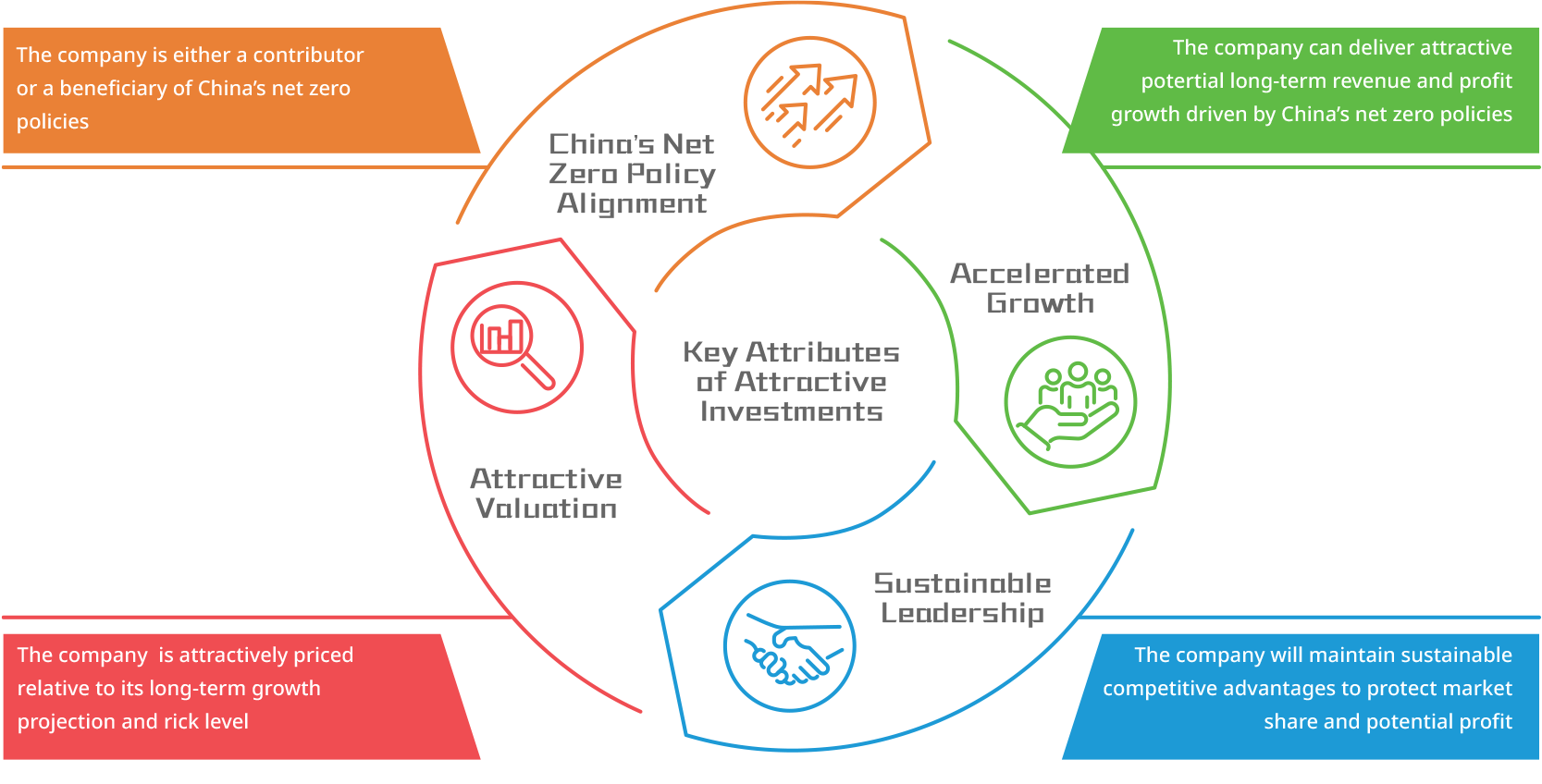

China net zero investment encompasses three primary themes, including alternative energy, sustainable transportation, and infrastructure solutions. Themes are expected to persist, irrespective of changing geopolitical factors.What are the Requirements for a High-Quality Company Aligned with China Net Zero Themes?

Why Pay Attention to Net Zero Investment Opportunities in China?

- Global consensus emerges to combat climate change whilst the bottleneck of global green supply chain needs to be addressed promptly.

- With strong commitment of its carbon neutral target by 2060, China is integral to any meaningful global climate action. Strong implementation of relevant policies is backed by President Xi’s personal involvement which helps China’s political agenda for technology and energy self-sufficiency.

- China is beginning to draft policy details for this multi-decade initiative which is believed to bring about a range of investment opportunities.

Investments involve risks. The above information is provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

- The above videos are for general market commentaries, and is not intended to provide any investment advice and should not be relied upon as such. The above videos and its contents shall not constitute and shall not be construed as providing any professional advice, or any offer, solicitation or recommendation to the purchase or sale of any investment products or services. The Bank does not make any representation, warranty or promise as to the accuracy, completeness or correctness of the information or opinions provided in the above videos, and accepts no responsibility or liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of such information or opinions. The opinions expressed by the speakers in the above videos are subject to changes without notice.

- Part of the information in the above videos is derived from third party sources. Whilst the Bank believes such information to be reliable, the Bank makes no guarantee on its accuracy and such information maybe incomplete or being extracted. All views, forecasts and estimates constitute the judgments made before the publication date, and are subject to change without further notice.

- The Bank shall not be liable to any loss or damage incurred by any person caused by direct or indirect usage of the information in this video or its content stated herein.

- All the contents in the above videos are provided to you for reference only and is not supposed to be edited, copied, extracted or distributed to others by any means.

- Although investment may bring profit opportunities, however each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment product may not be the same as expected by customers. Customers' fund may increase or reduce due to the purchase or sale of investment product. The loss incurred from investment maybe the same or greater than initial investment amount, proceeds may also change accordingly. Part of the investment may not be able to liquidate immediately under certain market situation.

- Past performance is not indicative of future performance.

- Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. For the nature and risks involved of individual investment products, please refer to the relevant offering documents for details. For the nature and risk disclosures of individual investment products, you should read carefully the relevant offering documents for details. If any doubt, you should seek independent professional advice before placing orders.

- The investment decision is yours but you should not invest in any investment product unless the intermediary who sells such investment product to you has explained to you that such product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- Foreign currencies / RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currencies / RMB may result in losses in the event that the customer converts the foreign currencies / RMB into HKD or other foreign currencies.

- RMB Conversion Limitation Risk (Only applicable to Individual Customers)- RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- RMB Conversion Limitation Risk (Only applicable to Corporate Customers)- RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- The contents of the above videos have not been reviewed by the Securities and Futures Commission of Hong Kong.

- Information and/or opinion provided in the above content and video do not represent the standpoint of Bank of China (Hong Kong) Limited (“BOCHK”), and BOCHK shall not be liable for the same.

- ©2024 AllianceBernstein L.P. The [A/B] logo is a service mark of AllianceBernstein and AllianceBernstein® is a registered trademark used by permission of the owner, AllianceBernstein L.P.

Understand Sustainable Investing Choices

What is sustainable investing?

- Sustainable investing focuses on investing in environmentally efficient projects, with the premise that it promotes long-term environmental development. Such investment projects do not only aim to bring positive impacts to the environment, but also to help promoting technological innovation, driving the development of green industry, while creating business opportunities for financial industry.

- As for corporates, sustainable investing implies that their business objectives no longer only focus on profitability. In addition to fighting for the biggest interests for shareholders, they also have to consider the needs of different stakeholders, such as employees, consumers, suppliers and communities, etc.

- As for investors, relevant trends can be reflected from the consideration process of selecting investment products. In the past, investors may only focus on returns. Now, they also hope to exclude stocks with negative impacts, such as tobacco, ammunition and gambling, etc. Furthermore, they also incorporate positive screening into the process of sustainable investing, such as considering environmental, social and governance factors, so as to bring positive benefits to the environment and society.

What are the driving factors of sustainable investing?

- Global temperatures are rising and are on track to reach 3°C by the end of the century3

- 3x increase in electricity demand4

- 2.2 billion of the world’s population lack access to safe drinking water5

- Electricity infrastructure: electricity networks

- Water infrastructure: water networks & water treatments

- Renewables infrastructure: wind, hydropower & solar

- The world’s population is rapidly growing, forecasted to reach 9.7 billion by 20506

- Yet 1.6 billion people in the world lack adequate housing7

- Less than half of the world’s population have access to basic health services8

- Healthcare infrastructure: healthcare facilities & elderly care homes

- Social housing & educational infrastructure: affordable housing & student accommodation

- Affluence and increased demand for global services and products contribute to increasing environmental pressures

- Increasing urbanisation will put more pressure on services in cities, including transport and communication

- Digital infrastructure: data storage & telecommunications tower operations

- Transport infrastructure: sustainable railway network

- Sustainable logistics: sustainable warehousing & sustainable transportation systems

Why consider sustainable investing?

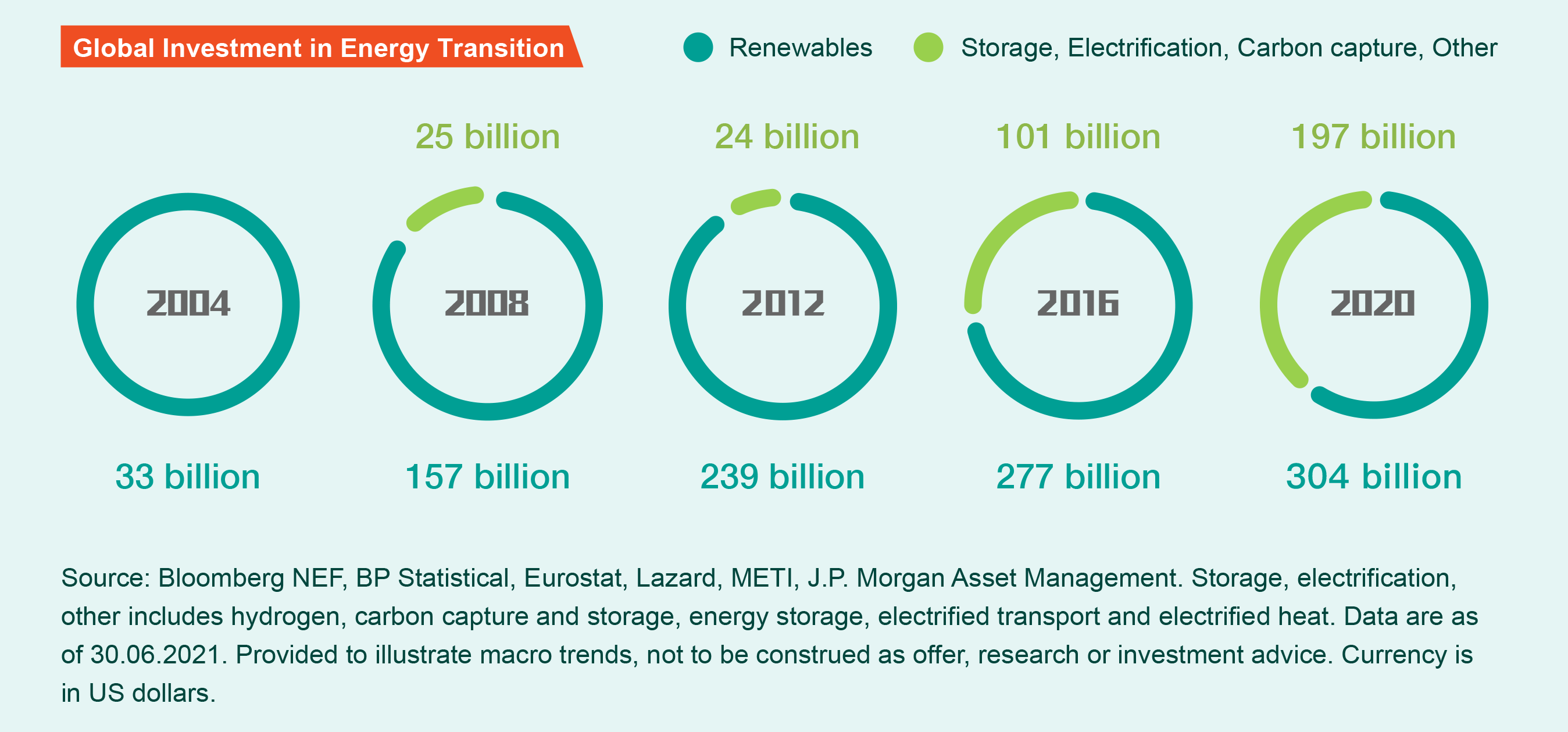

The capital investment in energy transition has been increasing, presenting vast investment opportunities.

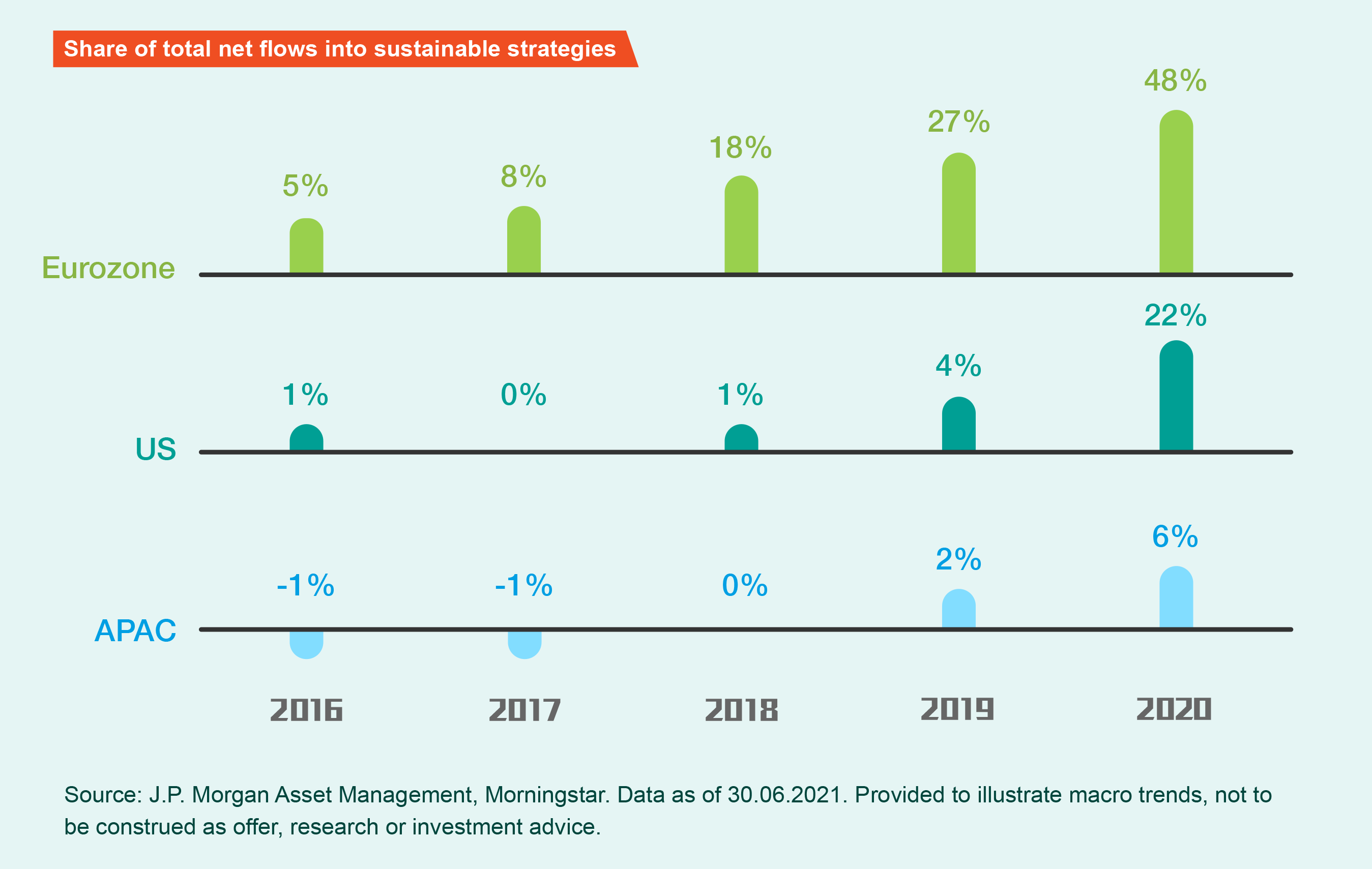

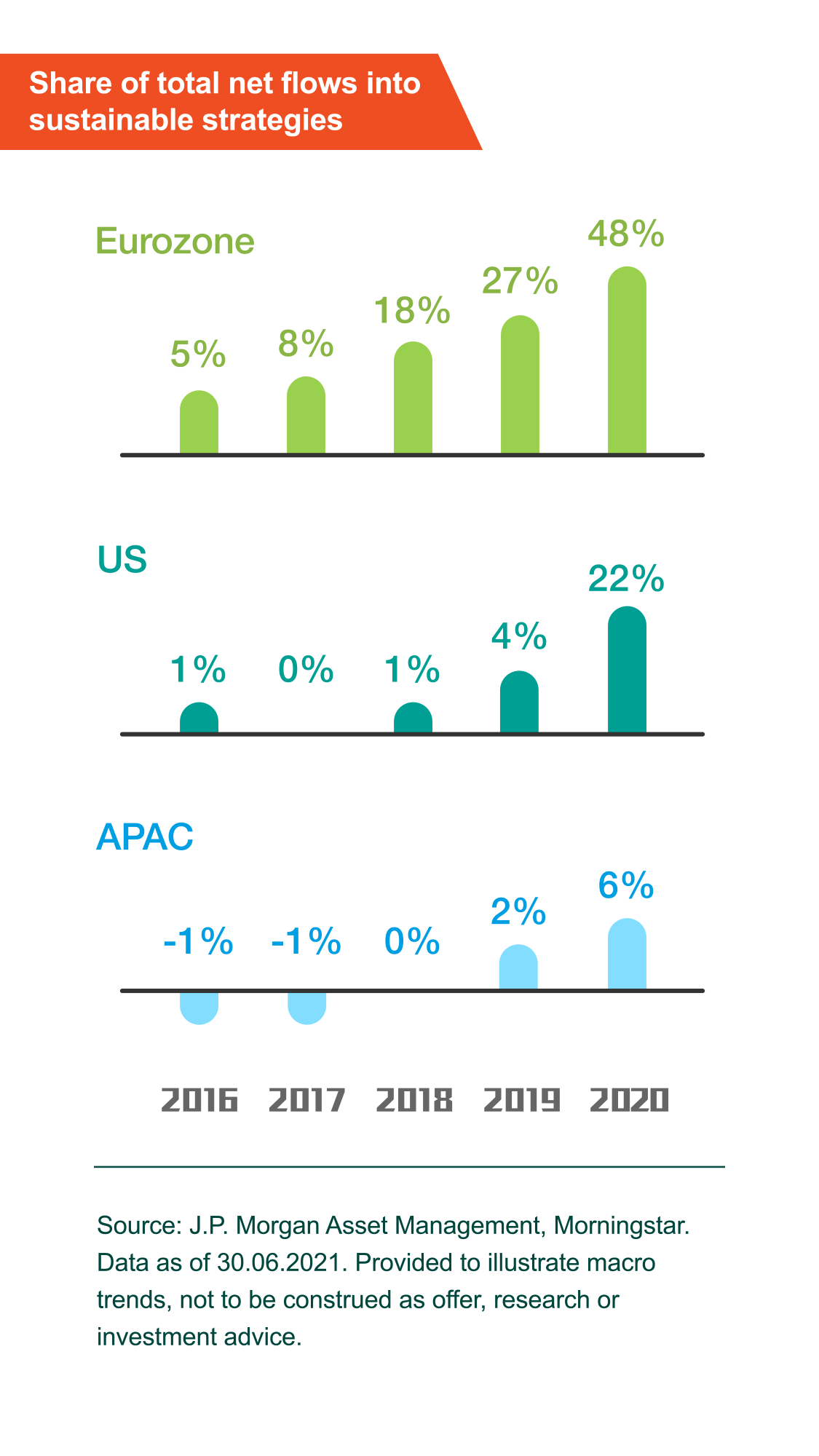

Capital flowing into sustainable funds has been increasing, driving the development of the overall market.

Investments involve risks. The above information is provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

- Source: World Economic Forum, December 2020.

- Source: BP Energy Outlook 2018, December 2018.

- Source: UNICEF, December 2019.

- Source: UNICEF, June 2019.

- Source: Habitat, September 2017.

- Source: Statista, November 2021.

- Source: J.P. Morgan Asset Management, April 2022.

- The above videos are for general market commentaries, and is not intended to provide any investment advice and should not be relied upon as such. The above videos and its contents shall not constitute and shall not be construed as providing any professional advice, or any offer, solicitation or recommendation to the purchase or sale of any investment products or services. The Bank does not make any representation, warranty or promise as to the accuracy, completeness or correctness of the information or opinions provided in the above videos, and accepts no responsibility or liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of such information or opinions. The opinions expressed by the speakers in the above videos are subject to changes without notice.

- Part of the information in the above videos is derived from third party sources. Whilst the Bank believes such information to be reliable, the Bank makes no guarantee on its accuracy and such information maybe incomplete or being extracted. All views, forecasts and estimates constitute the judgments made before the publication date, and are subject to change without further notice.

- The Bank shall not be liable to any loss or damage incurred by any person caused by direct or indirect usage of the information in this video or its content stated herein.

- All the contents in the above videos are provided to you for reference only and is not supposed to be edited, copied, extracted or distributed to others by any means.

- Although investment may bring profit opportunities, however each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment product may not be the same as expected by customers. Customers' fund may increase or reduce due to the purchase or sale of investment product. The loss incurred from investment maybe the same or greater than initial investment amount, proceeds may also change accordingly. Part of the investment may not be able to liquidate immediately under certain market situation.

- Past performance is not indicative of future performance.

- Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. For the nature and risks involved of individual investment products, please refer to the relevant offering documents for details. For the nature and risk disclosures of individual investment products, you should read carefully the relevant offering documents for details. If any doubt, you should seek independent professional advice before placing orders.

- The investment decision is yours but you should not invest in any investment product unless the intermediary who sells such investment product to you has explained to you that such product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- Foreign currencies / RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currencies / RMB may result in losses in the event that the customer converts the foreign currencies / RMB into HKD or other foreign currencies.

- RMB Conversion Limitation Risk (Only applicable to Individual Customers)- RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- RMB Conversion Limitation Risk (Only applicable to Corporate Customers)- RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- The contents of the above videos have not been reviewed by the Securities and Futures Commission of Hong Kong.