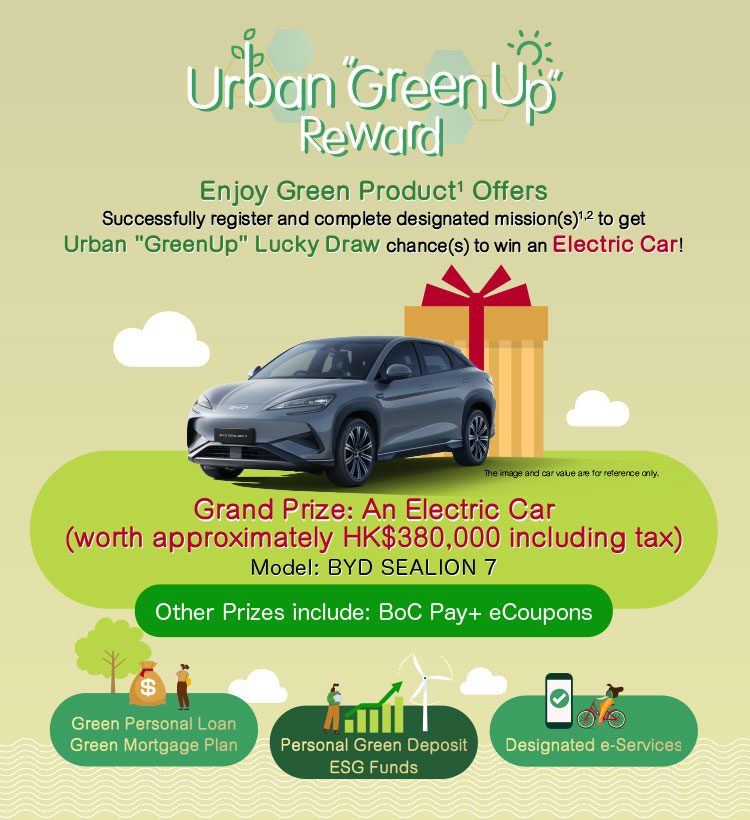

- The "Green Products" missions include: Green Personal Loan, Green Mortgage Plan, Personal Green Deposit and ESG Funds.

- The "Designated e-Services" missions include: BoC Pay+, Electronic Statements, "BeLeaf", first-time activate and enable account alert in mobile banking and promotion notification in BoC Pay+.

Upon successful registration and completion of the missions of "Green Products" or "Designated e-Services" to get lucky draw chance(s)! Act Now

Promotional Period: From 27 June 2025 to 30 September 2025

Green Personal Loan

- Apply with Reference Code "GL" via e-Channels3

- Successfully submit the application within the promotional period and successfully drawdown the loan on or before 31 October 2025

Green Mortgage Plan4

- Submit mortgage loan application through BOCHK Home Expert Mobile APP / Mobile Banking / website's "Instant Mortgage Application" service

- Successfully submit the mortgage loan application and confirm5 the Loan within the promotional period

- Successfully drawdown the mortgage loan within the promotion period

Personal Green Deposit

- Successfully place a "Personal Green Deposit"

ESG Funds

- Lump sum subscription of ESG Funds6

BoC Pay+

- Register or upgrade to BoC Pay+ and either spend a total of HK$1,500 or more at merchants, or make a single transfer of at least HK$1,500 to a third-party

- Successfully enable Promotion Notification in BoC Pay+ for the first time7

Mobile Banking

- Use “BeLeaf” for the first time8

- Activate and set-up account alert for the first time9

Consolidated Statements

- Successfully select and enroll in the electronic consolidated statements service10

- e-Channels including BOCHK website, Internet Banking, Mobile Banking, BOCHK_Banking WeChat Official Account or BOCHK Credit Card WeChat Official Account

- If the account is a joint account, only the primary account holder of such account will be entitled to the entries for Lucky Draw under Green Mortgage Plan.

- To qualify for the lucky draw, confirmation is required to be conducted via telephone during the promotional period.

- Customer must complete the Fund Subscription via single-name fund account (does not include Monthly Funds Savings Plan).

- Only applicable to customers who have not enabled BoC Pay+ Promotion Notification on or before 26 June 2025.

- Only applicable to customers who have not used BOCHK "BeLeaf" Services on or before 26 June 2025.

- Only applicable to customers who have not used BOCHK "Enable Account Alert" services on or before 26 June 2025.

- Excluding Credit Card Monthly Statements and/or other accounts and/or Product Monthly Statements

Personal Green Deposit

- Annual interest rate of up to 3.6%13 on "Personal Green Time Deposit" in USD

More

More

ESG Funds

- New fund customers enjoy 0% subscription fee on their first fund subscription fee waiver up to HK$6,00014

More

More

-

The quoted interest rate is calculated based on a loan amount

of HK$1,500,000 with repayment tenor of 12 months, monthly

flat rate of 0.0754% and handling fee waiver, the Annualized

Percentage Rate ("APR") is 1.68%.

The APR is calculated according to the relevant guidelines set out by the Hong Kong Association of Banks. The APR is a reference rate, which expresses the basic interest rate and other fees and charges of banking products as an annualised rate. - Eligible customers must successfully draw down a mortgage loan on or before 31 January 2026, with the loan amount of HK$1,000,000 or above. If the aforementioned cash rebate and/or gift voucher and/or fee-free spending amount exceeds 1% of the mortgage loan amount, the entire cash rebate and/or gift voucher and/or fee-free spending amount must be included in the calculation of the loan-to-value ratio of the mortgage.

- The above preferential annual interest rate for time deposits is based on the annual interest rate of the "Personal Green Time Deposit" announced by BOCHK on 27 June 2025, and is for reference only. The actual annual interest rate will be subject to the rates announced by BOCHK from time to time.

- The ESG Fund promotional period runs from 2 July 2025 to 30 September 2025(both dates inclusive).

Investment involves risks. Before making any investment

decisions, you should consider your own financial situation,

investment objectives and experiences, risk acceptance and

ability to understand the nature and risks of the relevant

product. The investment decision is yours but you should not

invest in these products unless the intermediary who sells them

to you has explained to you that these products are suitable for

you having regard to your financial situation, investment

experience and investment objectives.

Due to dynamic

changes in the market, the price movement and volatility of

investment products may not be the same as expected by you. Your

fund may increase or reduce due to the purchase or sale of

investment products. The value of investment funds may go up as

well as down and the investment funds may become valueless.

Therefore, you may not receive any return from investment funds.

This promotion material does not constitute any offer, solicitation, recommendation, comment or guarantee to the purchase, subscription or sale of any investment product or service and it should not be considered as investment advice.

Risk of Foreign Currency Trading

Foreign currency investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currency may result in losses in the event that customer converts the foreign currency into Hong Kong dollar or other foreign currencies. Currency exchange is also subject to cost (being the spread between the buy and sell of relevant currencies).

This promotional material is issued by BOCHK, and the contents have not been reviewed by the Securities and Futures Commission of Hong Kong.

BoC Pay+ SVF Licence Number: SVFB072

Reminder: To borrow or not to borrow? Borrow only if you can repay.

Green Banking

- Green Mortgage Plan

- Green Personal Loan

- Personal Green Deposit

Clothing

We have launched new, lightweight, eco-friendly uniforms and plan for all branch staff to wear them during their working day.

The grey short-sleeved top is made with approximately 40% recycled polyester fibre from plastic bottles — equivalent to around 6.5 bottles of 550ml. The casual straight-leg trousers contain approximately 55% recycled fibre from old clothes, equivalent to about 0.7 piece of a single garment.

Food

BOCHK supports Food Angel's "Meals on Wheels" programme, which flexibly delivers assistance to remote and under-resourced communities. It provides food and daily support to low-income families and isolated elderly individuals who have been referred by local charities and assessed for eligibility, thereby enhancing their quality of life. In 2024, over 210,000 people have benefited from this initiative.

Housing

- Supporting certified green buildings that use sustainable construction methods and energy-efficient technologies, helping to reduce daily carbon footprint

- Enjoying a fully digital mortgage application process – apply, submit documents and receive confirmation, all on your mobile

- Choosing paperless bank statements

Travel

Back in 2022, BOCHK was the first to introduce Green Personal Loan in the market, the loans can now be used for a wider range of purposes, including buying electric vehicles.