Product Feature

For the "Key Facts Statement (KFS) for Instalment Loan", please click here.

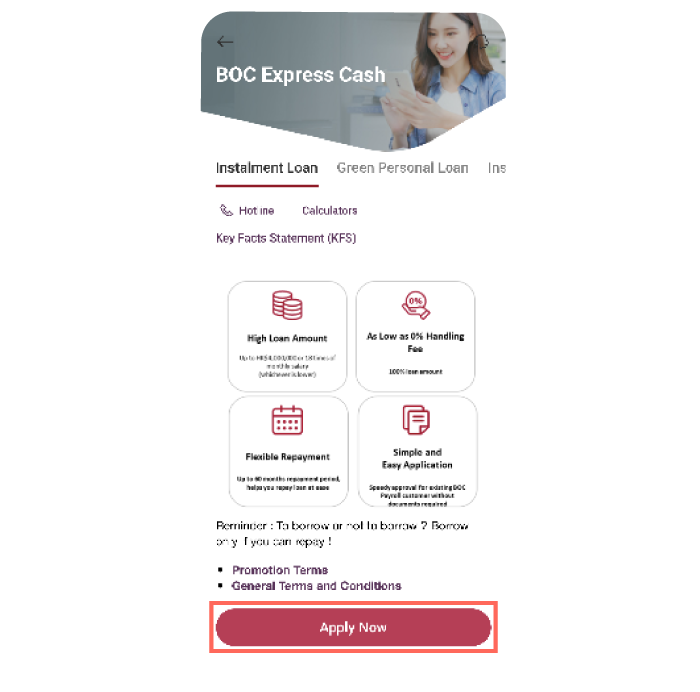

BOC Express Cash Instalment Loan and BOC Express Cash Instalment Loan Balance Transfer, borrow from home and fund disbursement in just a few steps. Cater your unexpected finance needs with ease!

BOC Express Cash Instalment LoanPreferential APR, flexible, get cash at your fingertips and realize your dream faster! |

||||||

|

BOC Express Cash Instalment Loan Balance Transfer

|

||||||

|

The above offer and service is subject to the relevant terms and conditions. For details, please click here.

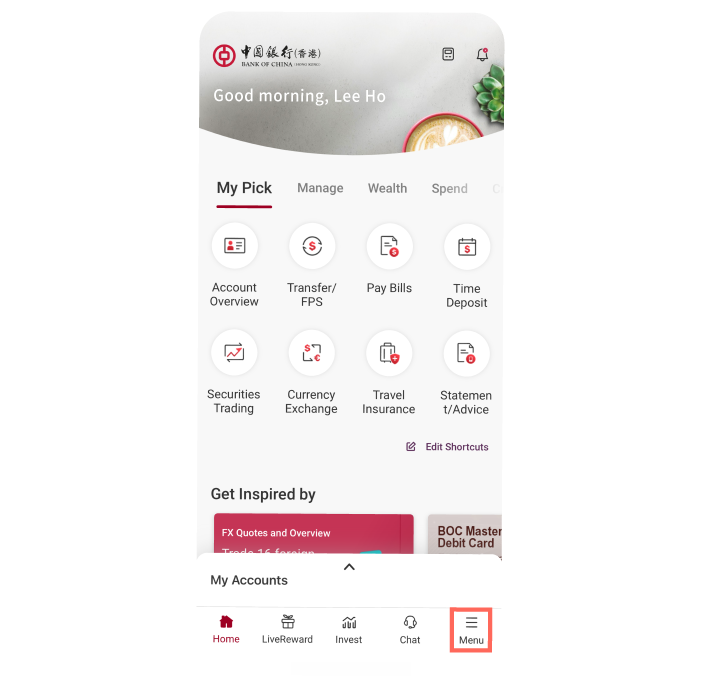

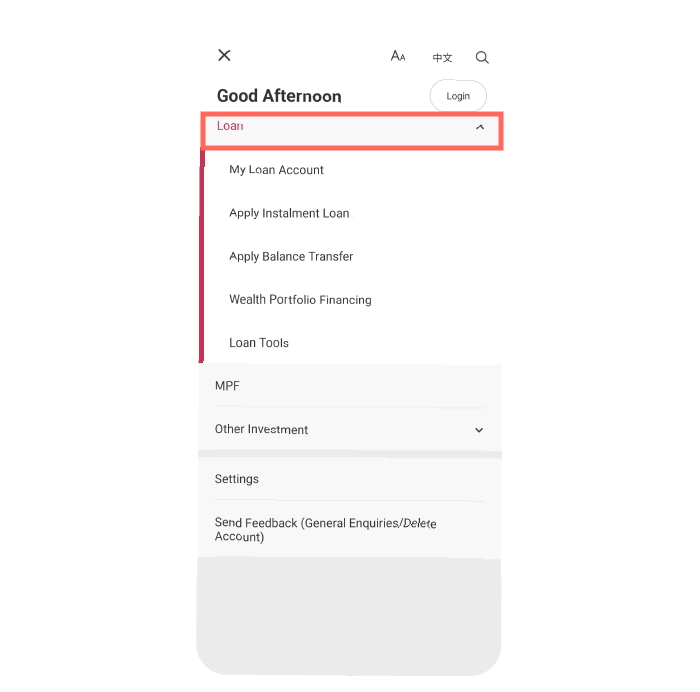

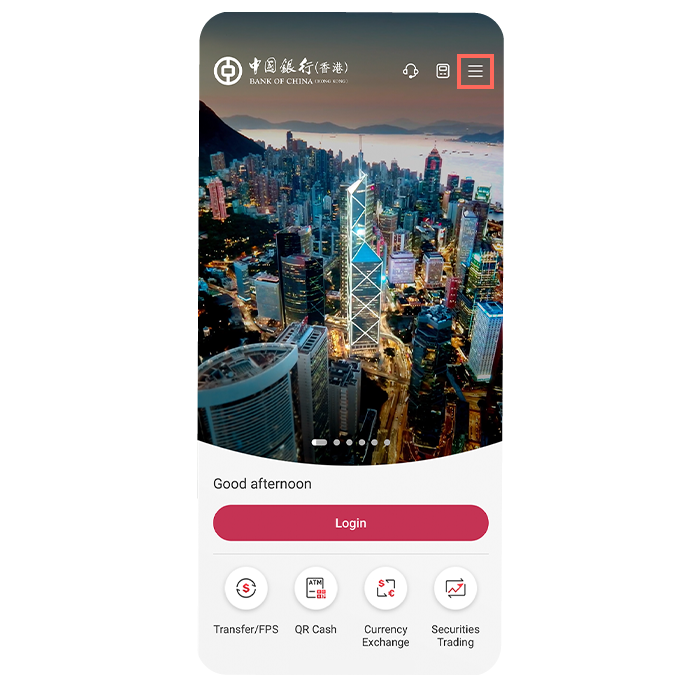

Easy Apply in 3 Steps

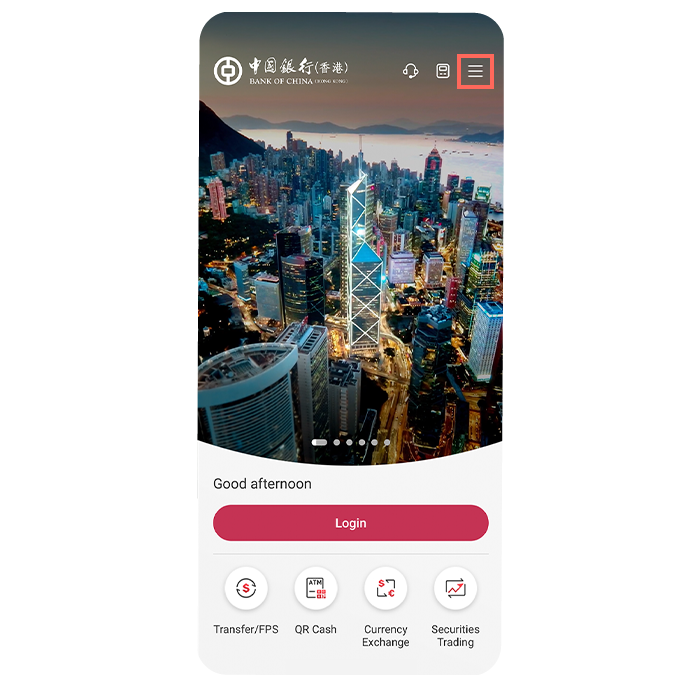

Online loan application services, via App or website, borrow from home at ease

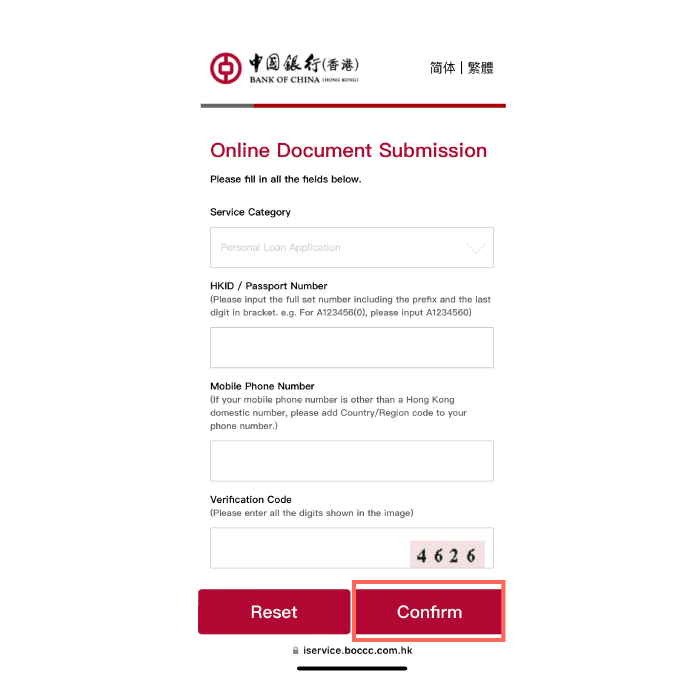

Online submit document with ease

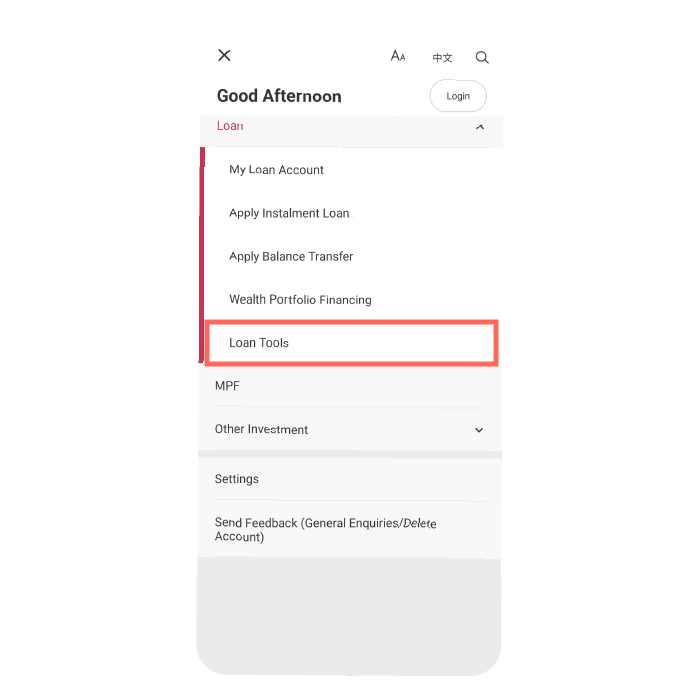

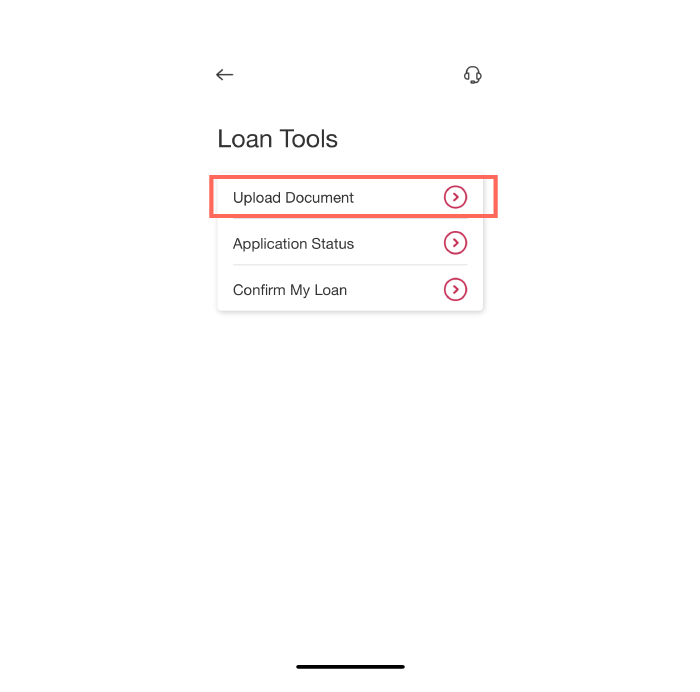

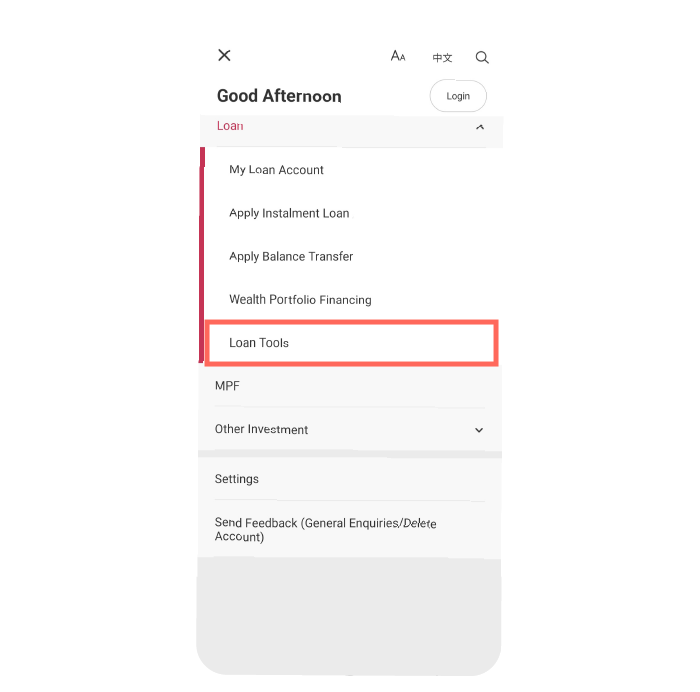

After submit the application, you may upload the required document immediately; or select “Upload Document” under “Loan Tools”

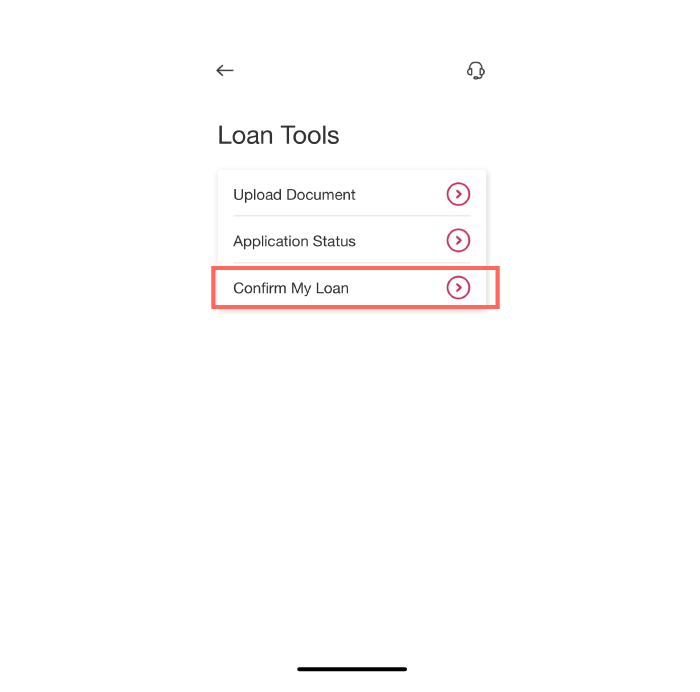

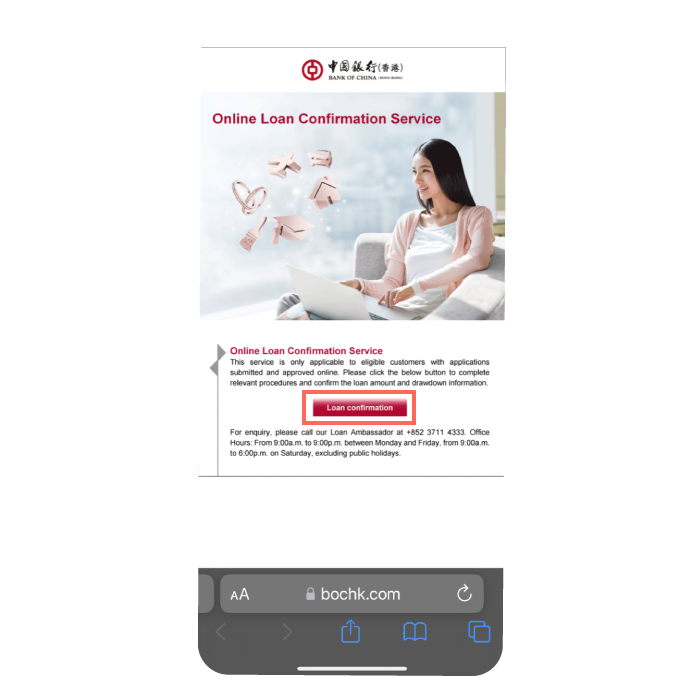

Online Loan Confirm

Other Application Channels

Any BOCHK branches

Application Hotline +852 2108 3688

(From 9:00 a.m. to 9:00 p.m. between Mondays and Fridays, from 9:00 a.m. to 6:00 p.m. on Saturdays, excluding public holidays)

FAQs

1.What is personal instalment loan?

Installment loan allows you to make repayment by fixed monthly instalments during a specific tenor to facilitate your financial situation and expenditure management. A larger proportion of the repayment made in the early stages is allocated to settle the interest and finance charges, with a smaller proportion to repay the principal. Such allocation of the repayment will reverse after more instalments have been made while the total interest expenses will remain unchanged.

You may choose the right kind of loan which suits your financial needs. Our Loan Ambassadors will provide you with professional advice pursuant to your own financial situation.

2.What is Balance Transfer?

If you only make minimum payment each month or are unable to pay off your outstanding credit card balances, your interest expenses could be enormous. Balance Transfer allows you to consolidate all your outstanding credit card and loan balances from different banks and financial institutions and provides you a suitable loan solution pursuant to your own financial situation. You can make repayment by fixed monthly instalments, which ease your burden and avoid accumulated interests.

3.What documents do I need to submit when I apply for a loan?

For general BOC Express Cash Instalment Loan, documents listed below are required application:

- Hong Kong Identity Card; or passport/Document of Identity for VISA purpose/working VISA in the event of a non-Hong Kong Permanent resident.

- Latest 3 months’ residential address proof, e.g. water/electricity bill, or bank statement

- Latest bank statement/passbook showing the salary amount for fixed income earner. (income proof is waived for auto payroll in the last month in BOCHK)

- Latest 3 months’ bank statement/passbook showing the salary amount for non-fixed income earner.

- Business Registration Certificate and the latest company tax return for sole proprietor or self-employed)

- BOCHK may request additional documents in the course of processing your application.

4.Is it necessary to open an account with BOCHK before applying for a personal loan?

If you have not maintained an saving account with BOCHK, you can still apply for the loan services offered by BOCHK. Those who maintain an saving account with BOCHK can set up instructions to make repayment through autopay.

Personal Customer Service Hotline: +852 3988 2388|www.bochk.com

- The above offers are subject to the relevant promotion terms and conditions, please download a copy of the terms & conditions for your future reference.

- Customers are responsible for the relevant data charges incurred by using BOCHK Mobile App or Mobile Banking.

- Please download mobile applications from official application stores or BOCHK website, and ensure the search wording is correct.

- By using BOCHK Mobile App and/or Mobile/Online Banking, the viewer agrees to be bound by the content of the disclaimer and policy as it may be amended by BOCHK from time to time and posted on BOCHK Mobile App and/or Mobile/Online Banking.

- The APR is calculated according to the guidelines laid down in The Hong Kong Association of Banks for reference use only. An APR is a reference rate which includes the basic interest rates and other fees and charges of a product expressed as an annualised rate.

Reminder: To borrow or not to borrow? Borrow only if you can repay!