FPS Registration

Transfer/FPS via Mobile No., Email or FPS ID

Transfer/FPS via Account No.

FAQ

FPS

1. FPS Introduction

(1) What is Faster Payment System (FPS)?

Faster Payment System (FPS) is a system launched by Hong Kong Monetary Authority (HKMA). Key features of FPS include:

- allow 24-hour real-time interbank transfer

- support Hong Kong Dollar (HKD) and Chinese Yuan (CNY)

- connect accounts between bank and SVF

- bill payment to merchant and institution

- support pay and receive via QR code

(2) FPS Service Hours

The FPS operates on 24x7 basis. You may initiate local interbank transfers at any time via mobile banking. Kindly note that some banks / institutions may provide limited services during system maintenance. When you initiate real-time payments (e.g. paying at stores with QR Code), please check carefully and ensure no message indicating possible delay on settlement before confirming the payment.

(3) Which currencies does FPS support?

The FPS supports payments in the Hong Kong Dollar (HKD) and the Chinese Yuan (CNY).

(4) How do customers use "FPS"?

Local Transfer via FPS:

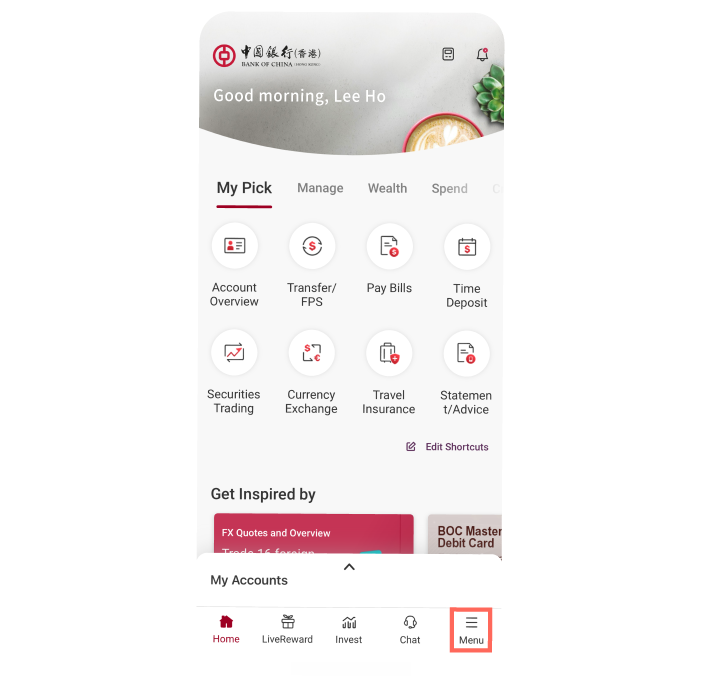

After logging into Mobile Banking on home page please select “Menu” > “Transfer & Payment” > “Transfer/FPS”.

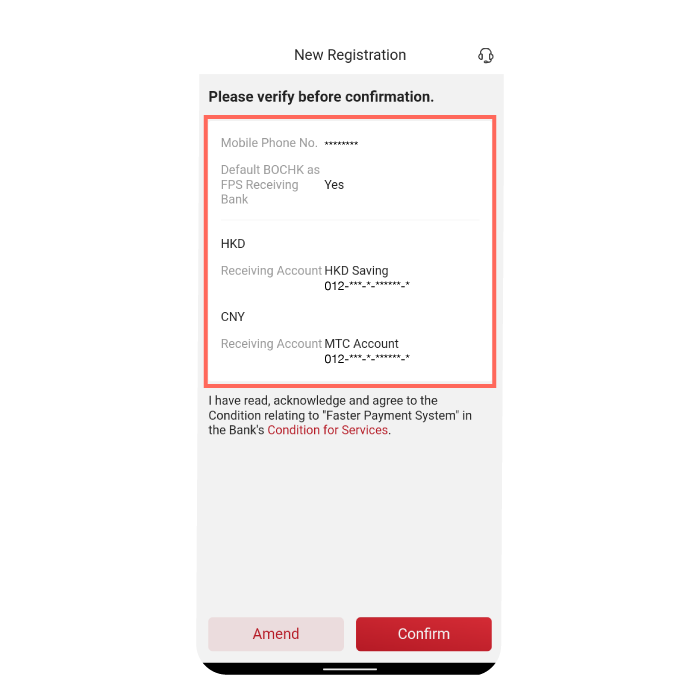

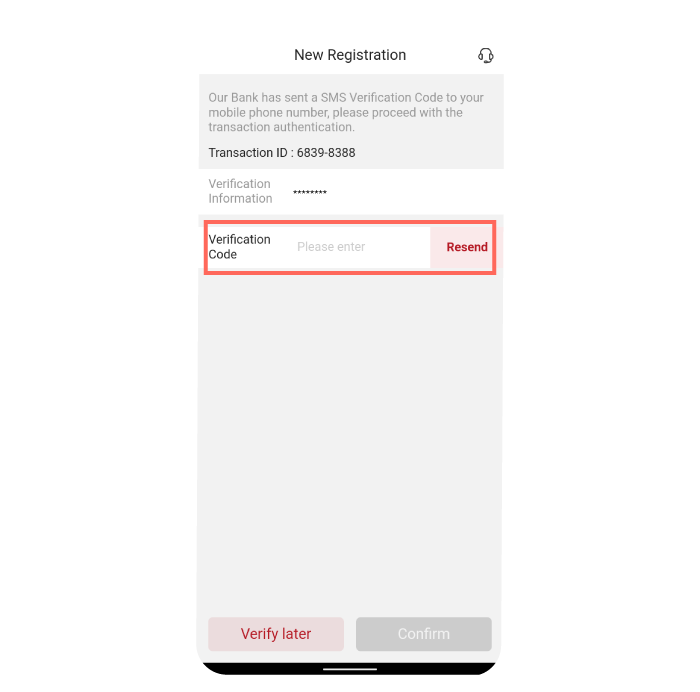

Registration of Addressing Service for Receiving Payments:

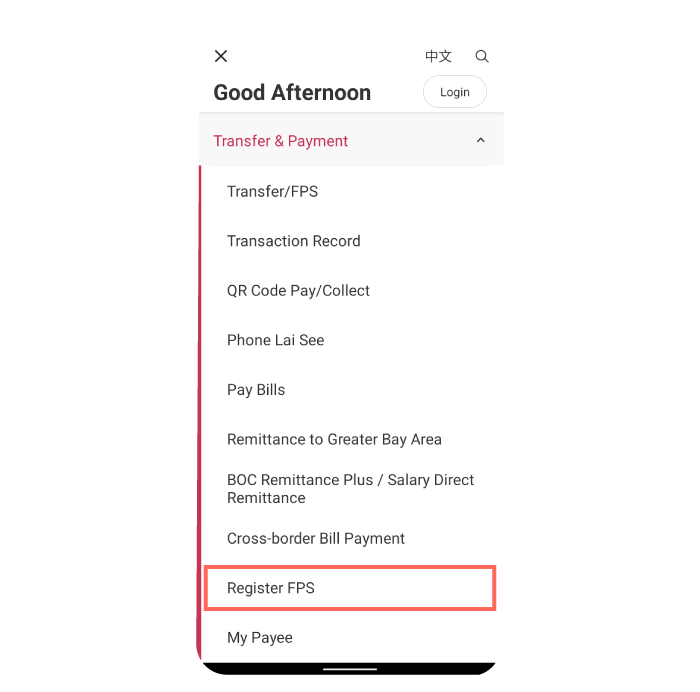

After logging into Mobile Banking on home page please select “Menu” > “Transfer & Payment” > “Register FPS”.

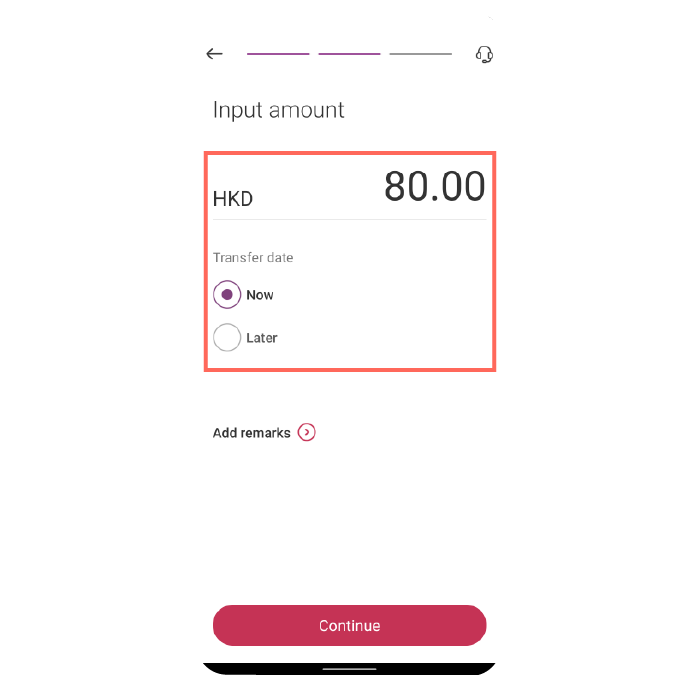

(5) FPS Fees and Charges

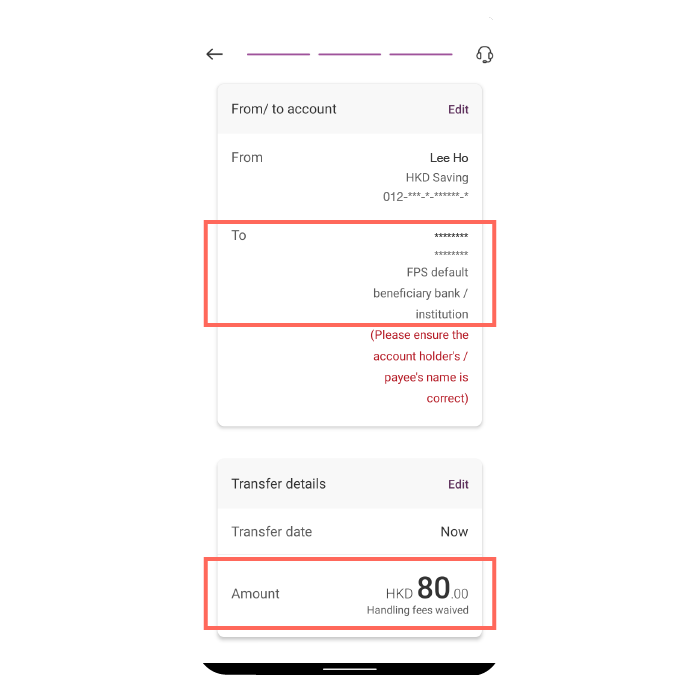

Currently for personal customer fees and charges are waived for both sending and receiving payments via FPS.

2. FPS Addressing Service

(1) What is FPS addressing service?

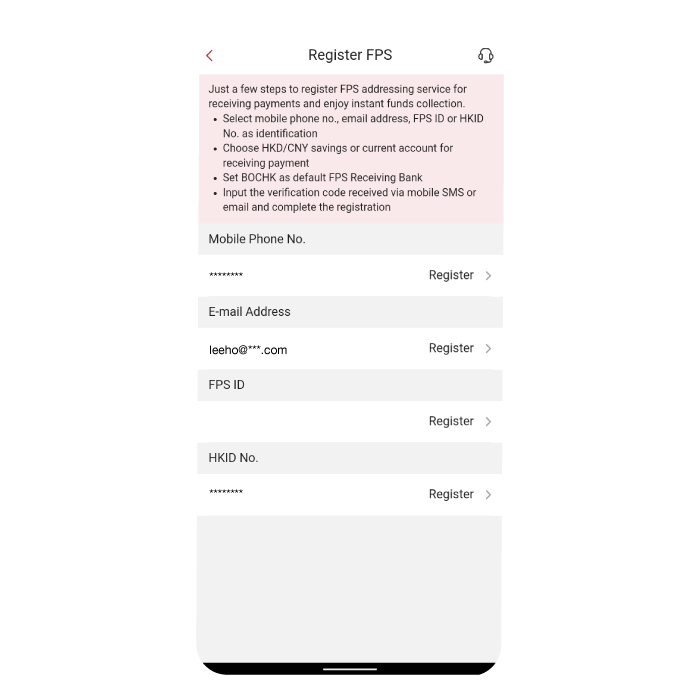

- You may register Addressing Service with your mobile phone number or email address or Hong Kong identity card (HKID) number, or apply a FPS Identifier (FPS ID) as your FPS Proxy ID and link up the Proxy ID with your BOCHK account (e.g. HKD Savings Account, HKD Current Account, Renminbi Savings Account, Renminbi Current Account).

- Upon successful registration, the Proxy ID can be used to identify your account for receiving fund or to identify the debit account when setting up direct debit authorisation (eDDA). (Not applicable to the proxy ID registered with HKID number)

- A Proxy ID registered with HKID number can only be used to receive payment and transfer from institutions, corporates and the HKSAR government. For clarity, this type of Proxy IDs cannot be used to identify the debit account when setting up direct debit authorisation (eDDA).

(2) How to register FPS addressing service or check registration records?

After logging into Mobile Banking on home page please select “Menu” > “Transfer & Payment” > “Register FPS”.

(3) I have deleted my registered FPS ID, what happen if I registered for FPS ID again?

If you register for FPS ID again within 60 days since deletion, you’ll have a FPS ID same as the previous one. For 60 days or beyond, FPS system will generate a new FPS ID for you.

(4) Which accounts can I register with FPS?

You may link up your FPS proxy ID (mobile phone number or email address or HKID number or FPS ID) with accounts of the following types:

- HKD and/or CNY savings account (including single-sign joint account)

- HKD and/or CNY current account (including single-sign joint account)

- Smart account (can only be used as HKD account for receiving payments with maximum account balance HKD 10,000, not applicable to the proxy ID registered with HKID number)

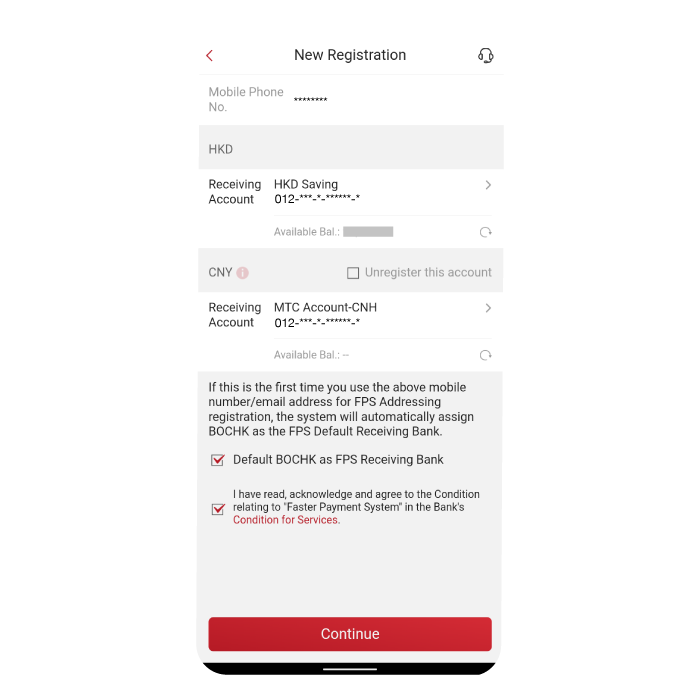

Each proxy ID is required to link up with one (and only one) HKD account (including smart account) and at most one CNY account for receiving payments.

(5) If my account for receiving payment via FPS is a smart account, is there any restriction?

If your account for receiving payment via FPS is a smart account, you’ll also need to meet limit requirements of smart account, including but not limited to daily transaction limit and account balance limit.

(6) If I’d like to register for FPS addressing service with my mobile number or email address or HKID number, do they need to be the same in BOCHK records?

Yes.

(7) Can mobile phone numbers of other countries/regions be used for addressing?

You may register a FPS proxy ID with a non-local mobile phone number that is already in BOCHK records. However, please ensure your mobile phone number can receive SMS message in order to complete the registration process.

(8) Can I link my mobile number/email address to several accounts?

You may link your mobile number/email address to one HKD account and one CNY account in BOCHK. The same mobile number/email address can also be used to connect accounts in other banks/institutions. If you’ve registered your mobile number/email address with multiple banks/institutions, you’ll need to set one of them as your default option to receive payments.

(9) If mobile number is changed, how to continue using FPS service?

If your mobile phone number in our records is no longer up-to-date, please visit one of our branches to update your mobile phone number with us. You are also suggested to delete the FPS registration with the old mobile phone number via Mobile Banking or Internet Banking if any. Once the mobile phone number update is completed, you would be able to complete your FPS registration with your new mobile phone number.

(10) How can I delete an addressing record?

After login, you may select "Menu at the right bottom corner" > "Transfer & Payment" > "Register FPS" > "Delete".

Please note that you would no longer be able to receive payments with the cancelled mobile phone number or email address or HKID number or FPS ID. However, you can still receive funds via FPS with your account number.

(11) Do I need to register for FPS addressing service before sending funds to others?

No need.

(12) If I am not yet 18 years old, what FPS service can I use?

If you are 11 years old or above, you may register FPS addressing service to receive payments by your Proxy ID.

(13) What do I need to pay attention to when registering FPS addressing service?

If you are under 18, you may consult your parents or guardian before registering FPS addressing service. Please note that you can only register your own proxy ID for your account and you need to make sure your proxy ID is correct to receive payment or transfer. If you have changed your mobile number or email address, please promptly contact our bank to update the record and your FPS addressing settings. Since proxy ID may include your personal information, please pay attention to data security when disclosing your proxy ID. Also, please be aware that HKID number is sensitive information that will not be used for transfer between individuals. It can only be used to receive payment and transfer from institutions that hold HKID number of payee (e.g. corporates, institutions and the HKSAR government). Except for the above scenarios, please do not disclose your HKID number to others for receiving payment or transfer.

Transfer

Fund Transfer

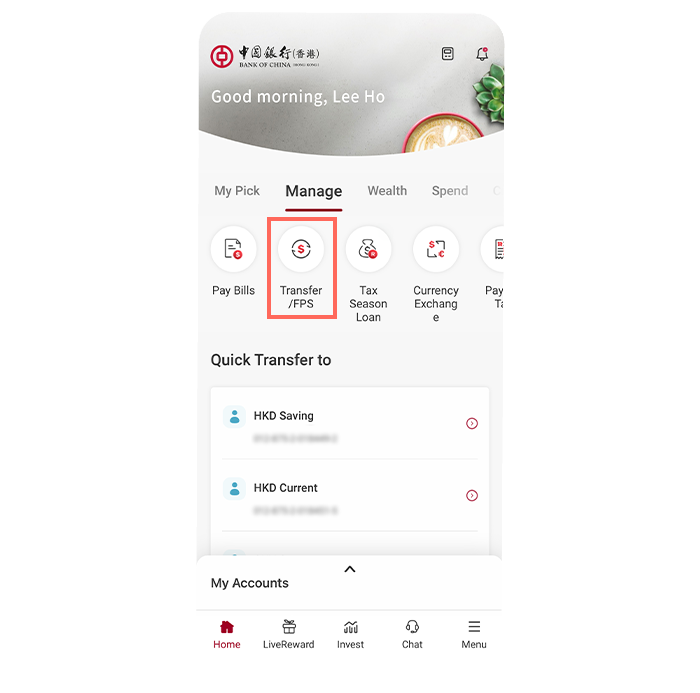

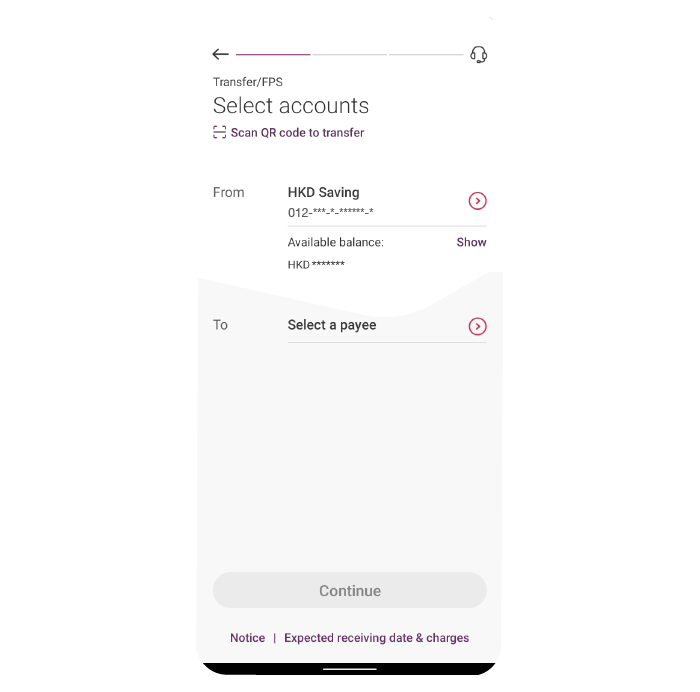

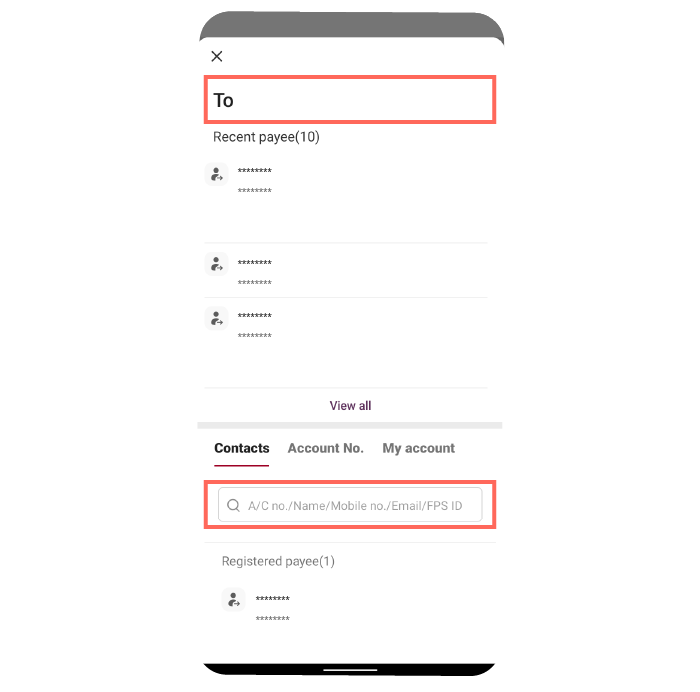

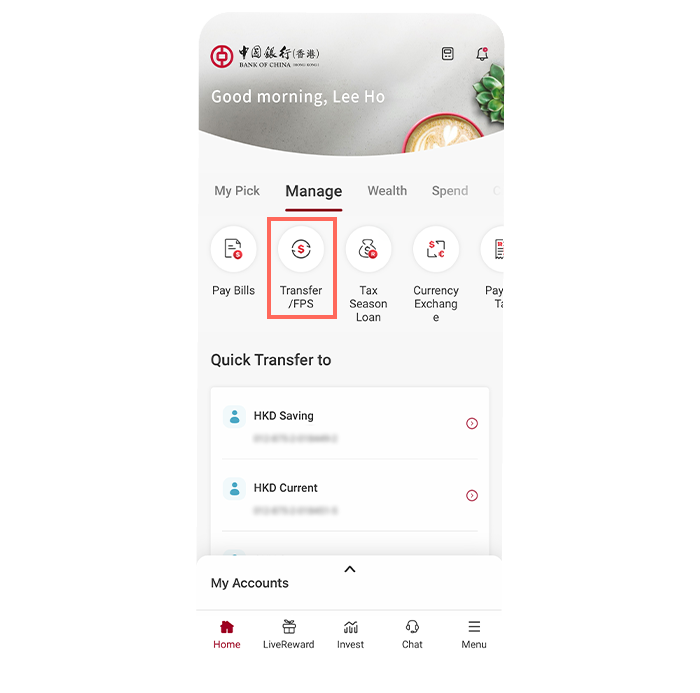

(1) How to transfer via Faster Payment System (FPS)?

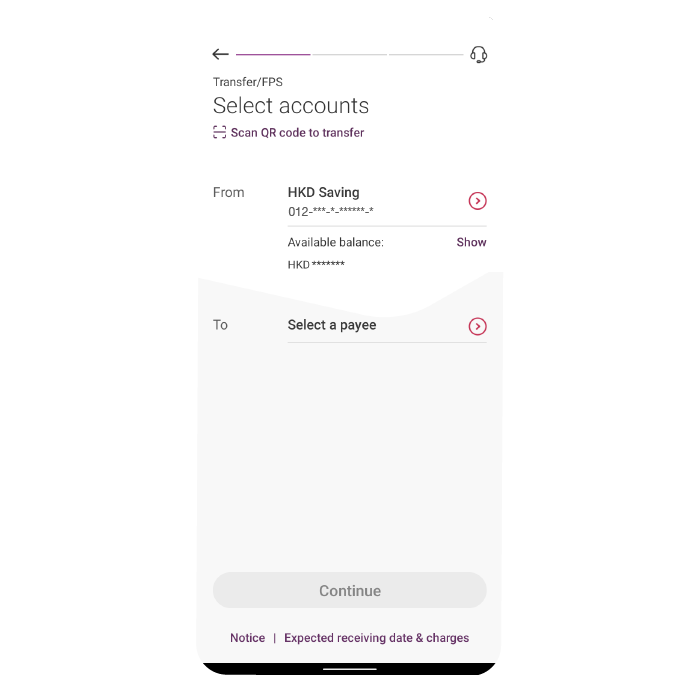

After logging in Mobile Banking, please select "Manage" > "Transfer / FPS".

You may transfer to accounts of BOCHK or other local banks/institutions (including SVF) via FPS in HKD or CNY.

(2) Which currencies does FPS support?

HKD and CNY are applicable to FPS; USD and EUR are applicable to Express Transfer (RTGS/CHATS).

(3) How to transfer in U.S. Dollar (USD) or Euros (EUR)?

You may transfer in USD and EUR through “Transfer/FPS” function via Mobile Banking, the transfer will be conducted via CHATS automatically.

(4) Can customers make transfer of funds to overseas banks via FPS?

"FPS" does not support transfer to accounts outside Hong Kong.

(5) Service hours for transfer

The service hours and cutoff time for fund transfer are as follows:

- FPS in HKD and CNY: operates on 24x7 basis

- Express Transfer (RTGS/CHATS) in USD and EUR: Weekdays*, instructions submitted between 09:00 and 17:45 (service hours) will be processed on same day; instructions submitted outside service hours will be processed within service hours on next settlement day.

(*Except public holidays)

(6) Will receiving bank or institution receive funds instantly or within the same day?

- Via FPS:Receiving bank/institution usually receives the funds in real-time. However receiving bank/institution may impose restrictions on fund collection, actual arrival time depends on receiving bank/institution. Please contact relevant bank/institution if necessary.

- Via Express Transfer (RTGS/CHATS): In normal circumstances, transfer instructions submitted before daily cutoff time (17:45)* on settlement days will be processed through the Real Time Gross Settlement System of Hong Kong Interbank Clearing Limited and the receiving bank will receive the funds on the same day. Processing time of each receiving bank may vary, actual receiving time is subject to the arrangement of the receiving bank.

(*Not available on Saturdays, Sundays, and public holidays).

(7) I have selected BOCHK as the receiving bank and entered the payee’s mobile phone number. Can the payee receive the funds if the payee has not registered the mobile number for FPS addressing service?

- Although the payee has not registered for FPS addressing service, under certain conditions the payee may still be able to collect the funds. The payee needs to maintain a valid mobile phone number in BOCHK records, provided that the mobile phone number is not shared with other customer records. In addition, the payee needs to maintain a HKD savings or current account in single name (not applicable to joint accounts) for fund collection.

- You’ll need to check and confirm the masked payee name shown on the transfer screen.

- If the payee has not registered “FPS” account addressing, the fund will be deposited into the account according to the following priority.

- HKD savings account (single name only)

- HKD current account (single name only)

Note: within same type, if the payee holds more than one savings or current account, the account opened most recently will have priority.

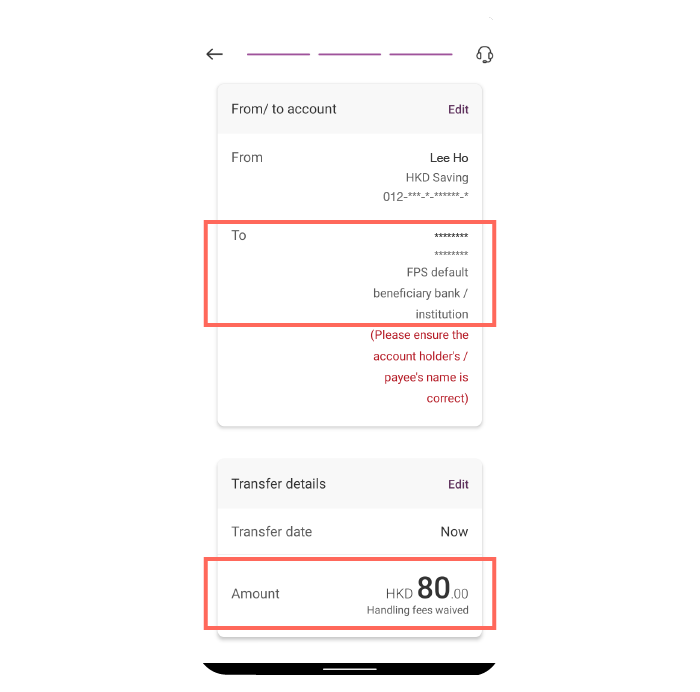

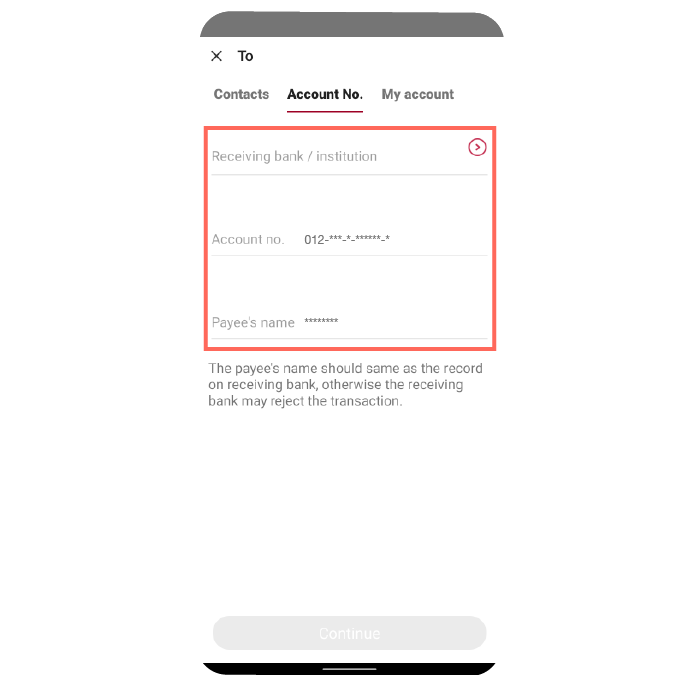

(8) I have sent money via FPS with a mobile phone number, which bank/institution will the funds be deposited?

- There is a default receiving bank/institution specified by the payee in each FPS addressing record. If the payer does not select a specific receiving bank/institution in FPS transfer, the funds will be sent to the default receiving bank/institution.

- If you’ve selected a specific receiving bank/institution, the funds will be sent to the specified receiving bank/institution.

- For both cases, you’ll need to check and confirm the correctness of payee by the name displayed on the transfer screen. (For individuals, the name will be masked.) In case of doubt or uncertainty, please contact the payee and confirm the details before submitting the transfer instruction.

- If the mobile number entered is not associated with any FPS addressing record, a message will appear on the transfer screen and remind you modifying the payee details.

(9) Can the HK dollar transferred in be deposited to the CNY account via FPS?

No. FPS doesn’t support currency exchange. Funds can only be deposited to accounts in same currency.

(10) Can individuals transfer to corporates via FPS?

Yes. You may transfer to corporates by using corporates’ account number/mobile number/email address/FPS ID.

(11) How can I enquire my latest fund transfer transactions conducted via Mobile Banking?

After logging in Mobile Banking, on home page please select "Menu" > "Transfer and Payment" > “Transaction Record”; or

After logging in Mobile Banking, on home page please select "Menu" > "Last 10 Activities" > “Mobile Banking”.

(12) How can I ensure the fund transfer instruction has been submitted successfully?

You may check whether the transfer instruction is successful or not on Mobile Banking:

- The Reference Number upon transfer completion; or

- After logging in Mobile Banking, on home page please select "Menu" > "Transfer and Payment" > “Transaction Record”; or

- After logging in Mobile Banking, on home page please select "Menu" > "Last 10 Activities" > “Mobile Banking”.

(13) How many payee’s accounts can be registered?

- 99 payee accounts for mobile phone number or email address

- 10 payee accounts for non-BOCHK account

- 25 payee accounts for BOCHK account

The maximum registered payee account is 134.

(14) How can I update transfer limit for my registered payees?

After logging into Mobile Banking on home page please select “Menu” > “Transfer & Payment” > “My Payee”

(15) How can I update Non-registered Payee Daily Fund Transfer Total Limit?

After logging into Mobile Banking on home page please select “Menu” > Scroll down to “Setting” > “Limit Setting”

(16) Can I use the contact list of my mobile phone for transfer?

Yes, you can select payees from the contact list of your mobile device directly.

(17) What if I have questions or enquiries regarding the Transfer service?

You can call our customer service hotline (+852 3988 2388) or contact our branch staff.

(18) What can I do with “Phone Lai See”?

By "Phone Lai See", you may give red packets to one or multiple accounts (maximum 10 accounts each time) of BOCHK or other local banks/institutions (including SVF) via FPS in HKD.

(19) Which currencies does "Phone Lai See" support?

"Phone Lai See" is for giving out red packets in HKD.

Transfer Limit

(1) Are there any limits for transfer?

Transfer limits include Small Value Transfer Daily Transfer Limit, Non-Registered Payees Daily Total Transfer Limit and Registered Payees Daily Total Transfer Limit.

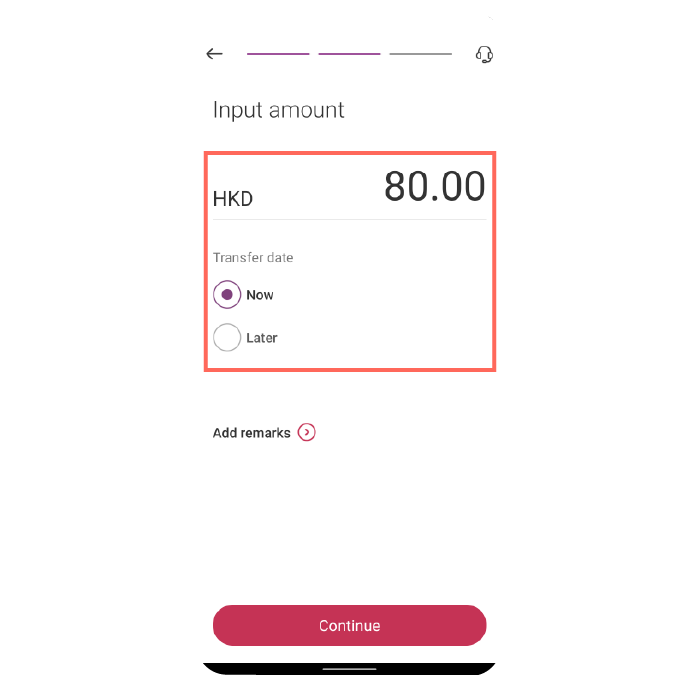

(2) What’s the transaction limit of transfer?

- Small Value Transfer Daily Transfer Limit can be set to HKD 10,000 in maximum, which is applicable to Mobile Banking only. Two factor authentication is not required during transfer with this limit.

- Non-Registered Payees Daily Total Transfer Limit can be set to HKD 400,000 (or equivalent) in maximum, which is applicable to Mobile Banking and Internet Banking. Two factor authentication is required during transfer with this limit.

- Registered Payees Daily Total Transfer Limit can be set to HKD 3,000,000 (or equivalent) in maximum which is applicable to Mobile Banking and Internet Banking. If your transfer amount is more than the maximum limit, please visit our branches. Two-factor authentication is not required when your transfer amount is within the limit.

- You may set or update the limits via Mobile Banking. After logging in, please select "Menu" on homepage > Scroll down to “Setting” > “Limit Setting”. Please note that if you want to set the limit to more than HKD 1,000,000.00, you will need to pass biometric authentication during login.

- Daily accumulated limits will be reset at midnight daily.

(3) What currencies can Small Value Transfer Limit support?

Small Value Transfer support transfer instructions in HKD.

(4) When will the Small Value Transfer Limit be affected?

Your setting of Small Value Transfer Limit will be set to 0 if:

- you changed/deleted the mobile phone number in our bank’s record;

- you deleted the e-mail address in our bank’s record;

- you have not transferred with Small Value Transfer Daily Transfer Limit in last 18 months;

- you canceled the personal internet banking service in our bank;

(5) When will Non-registered Payees Daily Total Transfer Limit be affected?

Your Non-registered Payees Daily Total Transfer Limit will be set to 0 if:

- you‘ve not transferred with Non-registered Payees Daily Total Transfer Limit in last 18 months

(6) What is the transfer limit of "Phone Lai See"?

Small Value Transfer Daily Limit (HKD10,000 in maximum) is applicable to transfer in HKD instructed via "Phone Lai See".

Security

(1) Will registering for FPS services increase account security risk? How should I protect my account?

Registering for FPS services mean you link your mobile number or email address to your account. After successful registration, payers can send fund to your account by entering your mobile number or email address.

The payer won’t see any account information except your family name and initials of your given name (e.g. CHAN T** M**) solely for transfer confirmation purpose.

So registering for FPS services won’t increase account security risk. However, please note that you shall not link your mobile phone number or email address to other’s account. Otherwise the funds will be transferred to someone else’s account.

(2) What ‘s the security tips for using FPS?

To ensure your financial security, please carefully verify the merchant name or payee name (partially masked) before making FPS payment by Mobile Phone No., E-mail Address, FPS Identifier or making QR Code Payment after login to Personal Mobile Banking. If you receive any suspicious payment request, please confirm with the payee before making payment.

Personal Customer Service Hotline: +852 3988 2388|www.bochk.com

- The above products and services are subject to the relevant terms.

- Customers are responsible for the relevant data charges incurred by using BOCHK Mobile App or Mobile Banking.

- Please download mobile applications from official application stores or BOCHK website, and ensure the search wording is correct.

- By using BOCHK Mobile App and/or Mobile/Online Banking, the viewer agrees to be bound by the content of the disclaimer and policy as it may be amended by BOCHK from time to time and posted on BOCHK Mobile App and/or Mobile/Online Banking.