Focus on What You Want to Focus

BOCHK i-Free Banking service provides you with a comprehensive range of banking solutions, including payroll, investments and personal protection. It always meet your needs and let you focus on your career development.

More than Salary

More than Salary

By choosing BOCHK Payroll Service, you can set payroll e-alert through Internet or Mobile Banking. Keep track of your payroll status, manage your money with ease to meet your financial target!

In addition, you may enjoy various exclusive banking privileges with use of BOCHK Payroll Service.

Get to know more about the rewards and privileges of BOCHK Payroll Service.

Work Hard and Invest in Better Future

We work to enjoy a better life. i-Free Banking Service offers different Monthly Savings Plans to help you save and invest wisely for better future.

Monthly Deposit Savings Plan - Club Deposit

- gives you choice of multiple currencies and fixed return.

Monthly Stocks Savings Plan and Monthly Funds Savings Plan1,2

- Minimum monthly contribution is as low as HK$500. You can set up, suspend (except Club Deposit) or update your plan via Internet Banking anytime anywhere, balancing overall investment effectiveness by Dollar Cost Averaging.

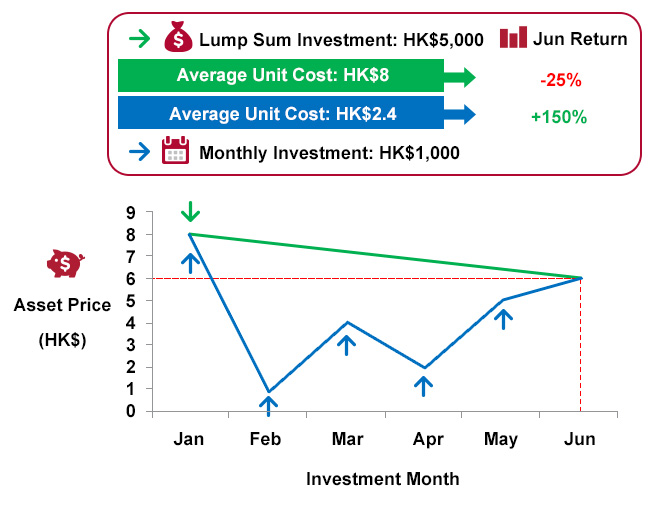

Dollar Cost Averaging illustration

| Investment Month | Monthly Investment Amount (HK$) |

Purchase Price per Unit (HK$) |

Number of Unit(s) Purchased | Total Accumulated Investment Amount (HK$) |

Total Accumulated Unit Purchased |

| Jan | 1,000 | 8 | 125 | 1,000 | 125 |

| Feb | 1,000 | 1 | 1,000 | 2,000 | 1,125 |

| Mar | 1,000 | 4 | 250 | 3,000 | 1,375 |

| Apr | 1,000 | 2 | 500 | 4,000 | 1,875 |

| May | 1,000 | 5 | 200 | 5,000 | 2,075 |

Average Cost per Unit (HK$) = Total Investment Amount÷Total Unit Purchased

= 5,000 ÷ 2,075

= 2.4

Remarks: The above is just an example for reference, with no implication in real market.

Comprehensive Protection to Safeguard your Efforts

Protect you and your family with Personal Life Insurance and Medical Insurance Plans to avoid any unexpected factors that might adversely affect your retirement plan.

Be a Smart Traveler

i-Free Banking helps you plan well, consume wisely and enjoy every trip!

What you Need in a Trip |

Smart Solution |

Comprehensive Protection |

You can enjoy comprehensive coverage with “Universal Smart Travel Insurance Plan” : - Single Travel Plan and Annual Travel Plan are provided - Double Indemnity of Personal Accident, up to HK$4,000,000 (only applicable to Single Travel Plan and not applicable to the insured person aged under 18 or over 70) - Maximum limit for medical expenses up to HK$1,500,000 - Protection for dangerous activities (including bungee jumping, parachuting, rafting, diving and hot-air ballooning, etc.; not applicable to professional sport players nor those engaging in racing or competition nor insured person aged under 18 or over 70) - Optional enhanced benefits (including extended benefits due to act of terrorism and outbound travel alert extended benefit) - Optional cruise benefit - 24-hour worldwide emergency assistance service

|

Spending |

BOC Dual Currency Card - Up to 4% Cash Rebate for Spending via Mobile Payment Transactions - Contactless Payment Function for the Public Transport Systems Stands You in Good Stead in Getting around the Greater Bay Area Please click here for details. |

Foreign Currency Exchange |

i-Free Banking customers can enjoy basis point privileges for exchanging Hong Kong dollar and designated foreign currencies at telegraphic transfer rate.

Together making Banknote Reservation now to get your trip financially well prepared! |

e-Life

i-Free Banking allows you to conduct transactions via Internet Banking/Mobile Banking and WeChat which is convenient and allows you to receive notifications timely. Now, you can also set up time deposit via Internet Banking / Mobile Banking to enjoy preferential interest rates (p.a.)!

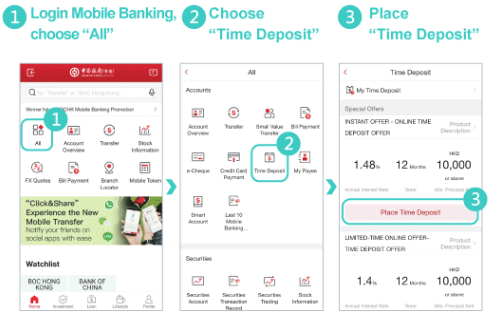

Simply Set up Time Deposit through Mobile Banking Step by Step

Want to know how to use banking services through electronic channels conveniently? Learn more about e-Life now!

Remarks:

1. A transaction fee equivalent to 0.25% of the total monthly contribution amount is charged for each plan of Monthly Stocks Savings Plan. And the minimum charge is HKD/RMB50 per month (including brokerage fee, stamp duty, transaction levy and transaction charge).

2. The minimum monthly contribution for Monthly Funds Savings Plan includes subscription fee. The charge will be calculated on the basis of a certain percentage of the monthly investment amount. Please refer to the relevant fact sheets, Fund Explanatory Memorandum/Prospectus for details. Any latest announcement from the fund house shall be conclusive. Should customers withdraw the Monthly Funds Savings Plan within 12 months, Bank of China (Hong Kong) Limited reserves the right to charge a handling fee (equivalent to 2% of the total investment amount).

General Terms

- i-Free Banking service offered by Bank of China (Hong Kong) Limited (the "Bank") is applicable to personal banking customers only.

- Investment services are only applicable to customers aged 18 or above.

- The above products, services and offers are subject to the relevant terms. For details, please refer to the relevant promotion materials or contact the staff of the Bank.

- The Bank reserves the right to amend, suspend or terminate the above products, services and offers, and to amend the relevant terms at any time at its sole discretion.

- In case of any dispute, the decision of the Bank shall be final.

- Should there be any discrepancy between the English and Chinese versions of this promotion material, the Chinese version shall prevail.

Important Notes about Universal Smart Travel Insurance Plan:

- “Universal Smart Travel Insurance Plan” (“The Plan”) is underwritten by BOCG Insurance.

- Bank of China (Hong Kong) Limited (“BOCHK”) is the appointed insurance agent of BOCG Insurance for distribution of the Plan. The Plan is a product of BOCG Insurance but not BOCHK.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BOCHK and the customer out of the selling process or processing of the related transaction, BOCHK is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the Plan should be resolved between directly BOCG Insurance and the customer.

- The Bank of China (Hong Kong) Limited is granted an insurance agency licence under the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) by Insurance Authority in Hong Kong SAR. (insurance agency licence no. FA2855)

- BOCG Insurance is authorised and regulated by Insurance Authority to carry on general insurance business in Hong Kong Special Administrative Region of the People's Republic of China.

- BOCG Insurance reserves the sole right to determine whether any application for the Plan is acceptable or reject in accordance with the information submitted at the time of application by the Insured and/or Insured Person.

- BOCG Insurance reserves the right to amend or withhold any terms and conditions in respect of the Plan without prior notice. In case of any dispute, BOCG Insurance reserves the final right on decision.

- This promotional material is for reference only. The Plan is subject to the formal policy documents and provisions issued by BOCG Insurance. Details of the coverage of the Plan are subject to the terms and conditions stipulated in the policy by BOCG Insurance. Please refer to the policy document for the details of the insured items and coverage, provisions and exclusions.

- This promotion material is intended to be distributed in Hong Kong only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any products of BOCG Insurance outside Hong Kong. Please refer to the policy documents and provisions issued by BOCG Insurance for details (including but not limited to insured items and coverage, detailed terms, key risks, conditions, exclusions, policy costs and fees) of the Plan.

- For enquiry, please contact the staff of BOCHK.

Risk Disclosure

The following risk disclosure statements cannot disclose all the risks involved and does not take into account any personal circumstances unknown to BOCHK. You should undertake your own independent review and seek independent professional advice before your trade or invest especially if you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment. You should carefully consider whether trading or investment is suitable in light of your own risk tolerance, financial situation, investment experience, investment objectives, investment horizon and investment knowledge.

Risk of Securities Trading

Monthly Stocks Savings Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

RMB Conversion Limitation Risk

RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies. RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

Risk of Funds Trading

Monthly Funds Savings Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. Although investment may bring profit opportunities, each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment products may not be the same as expected by you. Your fund may increase or reduce due to the purchase or sale of investment products. The value of investment funds may go up as well as down and the investment funds may become valueless. Therefore, you may not receive any return from investment in investment funds. Part of your investment may not be able to liquidate immediately under certain market situation. The investment decision is yours but you should not invest in these products unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. Investment involves risks. Please refer to the relevant fund offering documents for further details including risk factors.

Risk of Foreign Currency Trading

Foreign currency investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currency may result in losses in the event that customer converts the foreign currency into Hong Kong dollar or other foreign currencies.

This promotion material does not constitute any offer, solicitation, recommendation, comment or guarantee to the purchase, subscription or sale of any investment product or service and it should not be considered as investment advice.

This promotion material is issued by BOCHK and the contents have not been reviewed by the Securities and Futures Commission of Hong Kong.