in the cardboard to save "Items I Like"

in the cardboard to save "Items I Like"Investment Strategies

Portfolio Management

At

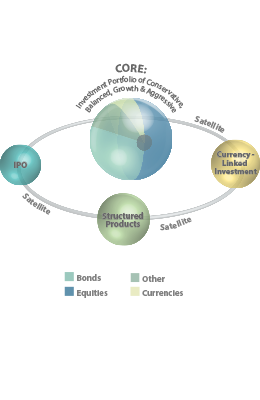

Via exposure to low risk assets, your "Core" holdings provide stability to your portfolio while generating a steady income. Reflecting your risk appetite and return expectations, "Core portfolio" aims at less turnover and low cost whilst being aligned to your Strategic Asset Allocation (SAA).

Your "Satellite" holdings comprise more thematic plays and higher risk strategies in order to maximize portfolio returns. With a greater potential for higher performance, these alternative strategies contribute strongly to your overall portfolio performance. A smaller position size is recommended to mitigate the impact of any underperformance. Actively managed and closely monitored, the Satellite portion of your portfolio is used to implement your Tactical Asset Allocation (TAA).

Asset allocation across different asset classes is determined according to your risk profile. Within each asset class, decisions are made around the proportion of "Core" and "Satellite" holdings. The mix of them may vary across different portfolios from Conservative, Moderately Conservative, Moderate, and Moderately Aggressive to Aggressive.

Market Outlook

For in-depth updates and market developments across the globe, please do not hesitate to contact your relationship manager. CLICK HERE for our contact information.

Renminbi Expertise

As appointed by the People's Bank of China (PBOC), since 2003

The Bank has been a major player in the offshore RMB market. This is attributable to our integrated RMB business platform, professional service team and continuous innovation towards products with enhanced business functions.

With

At

Please note that reports are available only in traditional Chinese.

Global Securities

We enable you to successfully track and seize potential opportunities in Hong Kong and US stock markets, providing you with up-to-date real time information that allows you to find the right investment opportunities.

Global Bonds

We scour the globe for different bonds as issued by governments, corporations and financial institutions. Our strong international network gives us the resources to keep a close watch on various bond ratings, giving you stable income and a greater chance of enhancing your return.

Foreign Currencies Investment

With spot, forward and non-deliverable forward rates on a wide range of foreign currencies, as well as foreign exchange margin trading services, we can help you make the best of foreign investment opportunities all around the world.

Our Precious Metal/FX Margin Trading services are available only to persons who are permitted to use those services by applicable laws. Before you open a Precious Metal/FX Margin Trading account or place the instruction of Precious Metal/FX Margin Trading, you are responsible for satisfying yourselves that you may do so under the laws of the geographical location in which you are situated and that you are aware of and observe all relevant restrictions that apply to your geographical location.

Precious Metals

In volatile markets, it is beneficial to have more secured options. We can put your commodity investment potential to work with our flexible Loco London gold and silver trading platform, offering you efficient hedging tools to cope with volatility and insecurity.

Investment Funds

Looking for the right fund requires considerable research and strong understanding of financial markets and strategies. At

Derivatives

To suit alternative investment strategies, we provide a selection of over-the-counter option investment products on foreign exchange, securities and precious metals, which enable you to cope with risks and benefit in ever-changing market conditions.