in the cardboard to save "Items I Like"

in the cardboard to save "Items I Like"Wealth Solutions

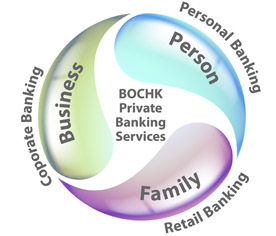

"1+1+1" Service Model

Our unique "1+1+1" service model is the keystone of our commitment to consistently delivering professional services to our clientele. We offer you long-term wealth and estate planning through our diverse and comprehensive Private Banking products and services. At the same time, your transactional banking and mortgage needs are met via our extensive Personal Banking channels and your company’s corporate financial requirements are addressed by our successful Corporate Banking services. As your banking partner, we provide you an integrated banking solution on which you can rely to fulfill your needs.

Comprehensive Service

Built on our strong foundation in commercial banking and backed by our established Corporate and Personal Banking services,

Our tailored, integrated wealth management solutions help you to maximize the growth potential of your wealth. With our professional expertise and meticulous risk controls, we strive to successfully satisfy the needs of you, your family and your business through successive generations and economic conditions, no matter how challenging.

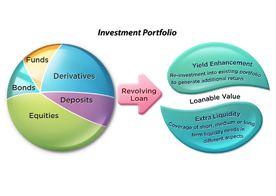

Portfolio Lending

In order to offer you every possible advantage, we meticulously assess your appetite and expectations in order to ensure we fulfill your wealth management needs.

Our portfolio lending service helps to maximize your portfolio’s potential by boosting your liquidity. This increased flexibility means you can not only enhance your investment returns but in addition it gives you the freedom to capture investment opportunities when they arise.