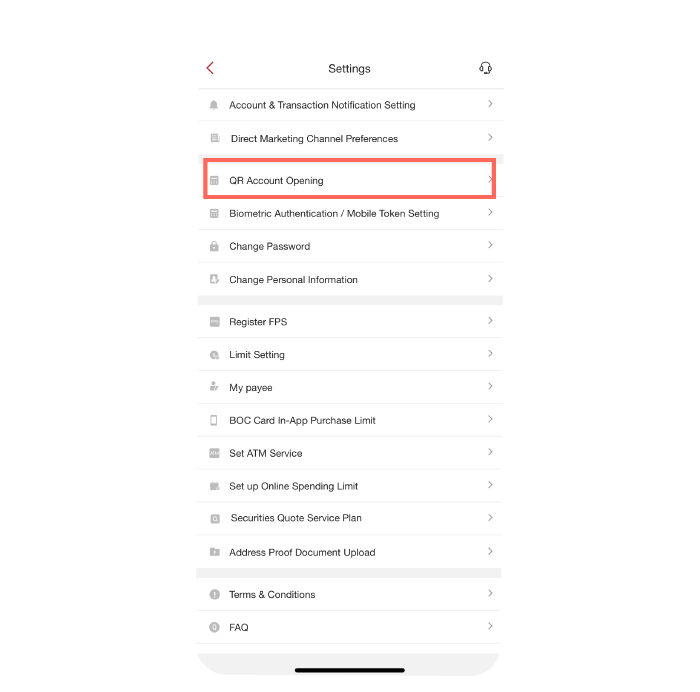

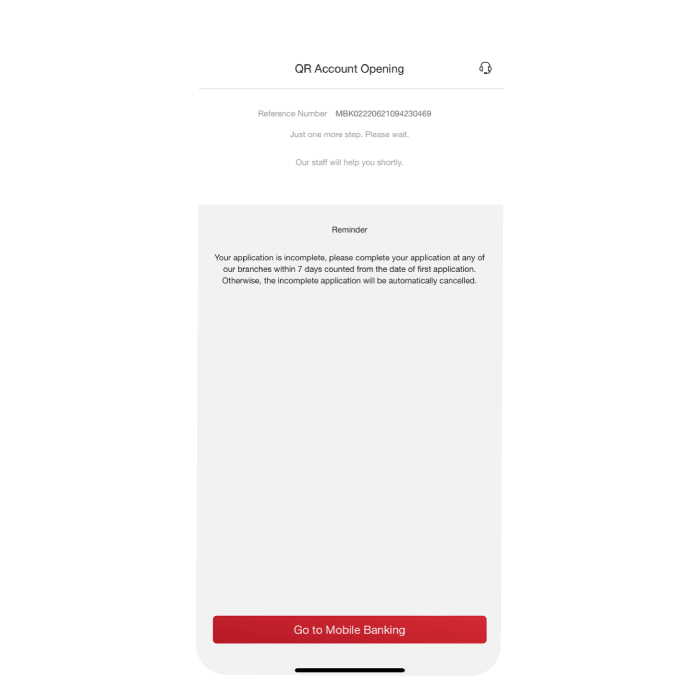

QR Account Opening at Branches

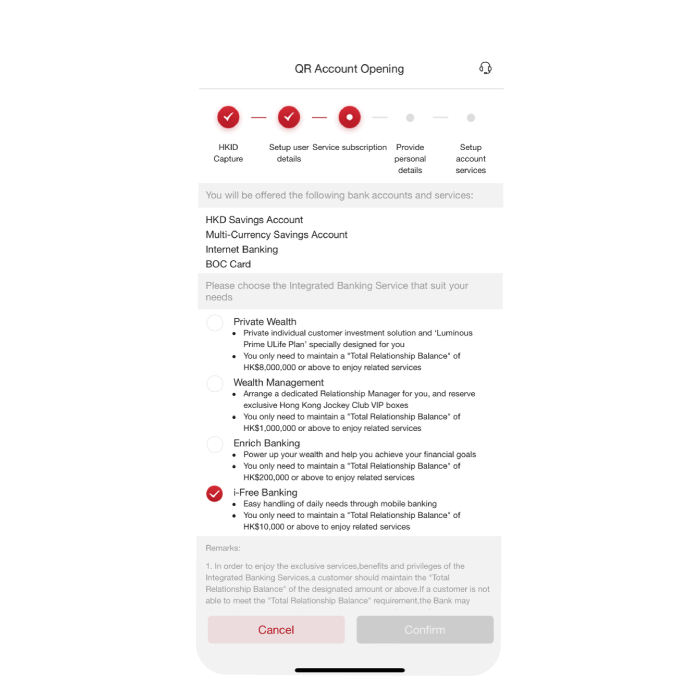

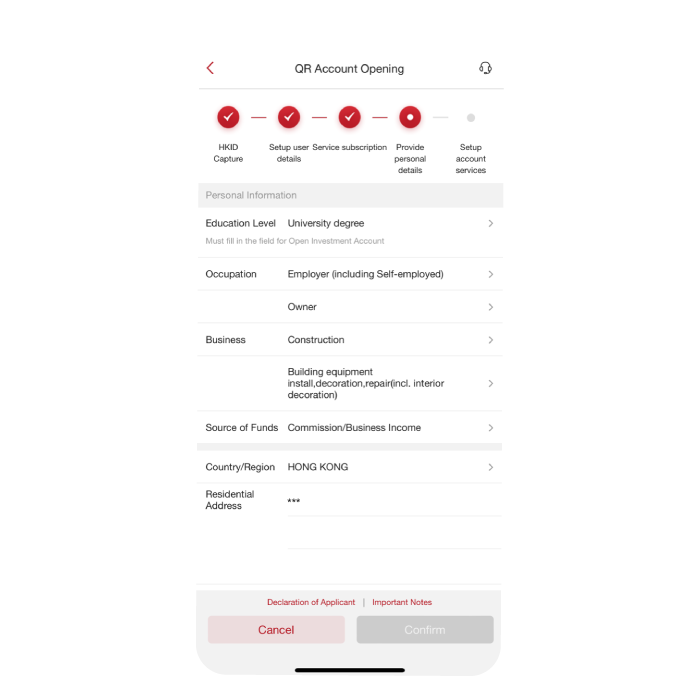

QR Account Opening enables you to enjoy a comprehensive range of services, including: Integrated Banking service, HKD Savings account, Multi-Currency Savings account, Internet Banking service, BOC Card and statement service.

Eligibility :- New customer aged 18 or above

- Open single name account

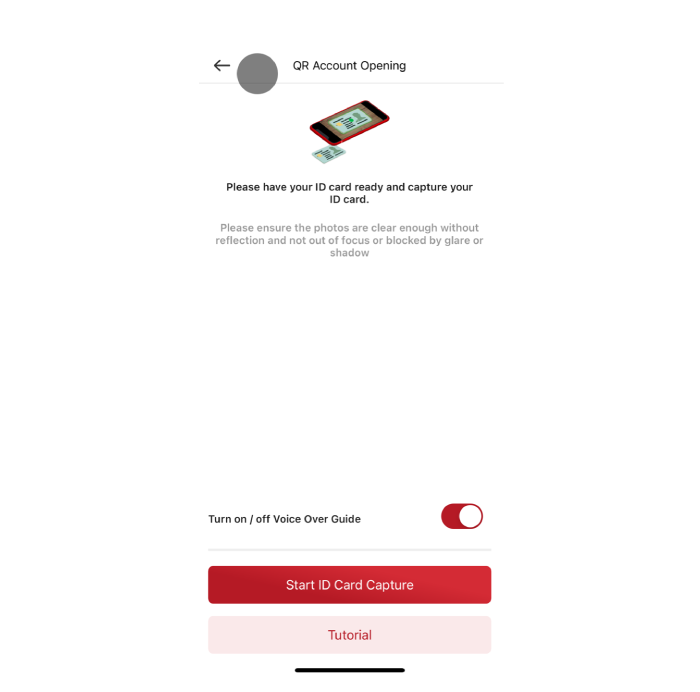

- Hold a valid smart Hong Kong Permanent / Non-permanent Identity Card or People’s Republic of China Resident Identity Card

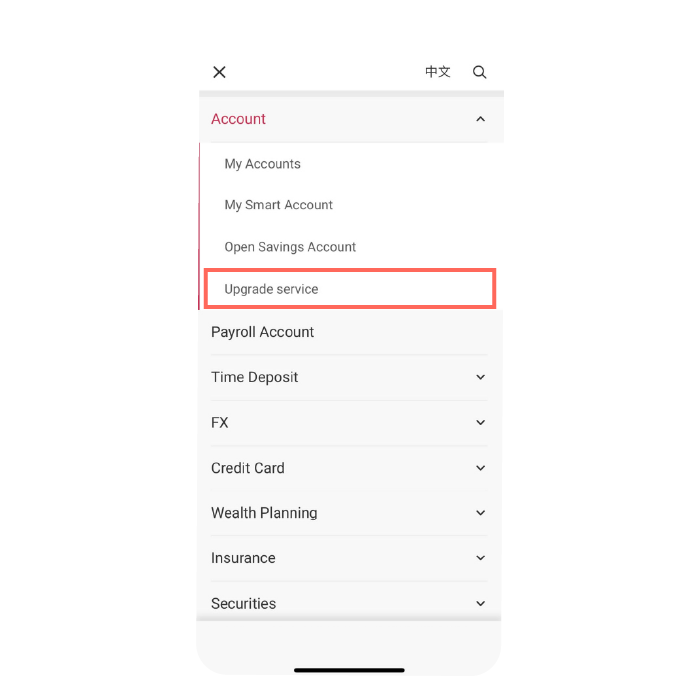

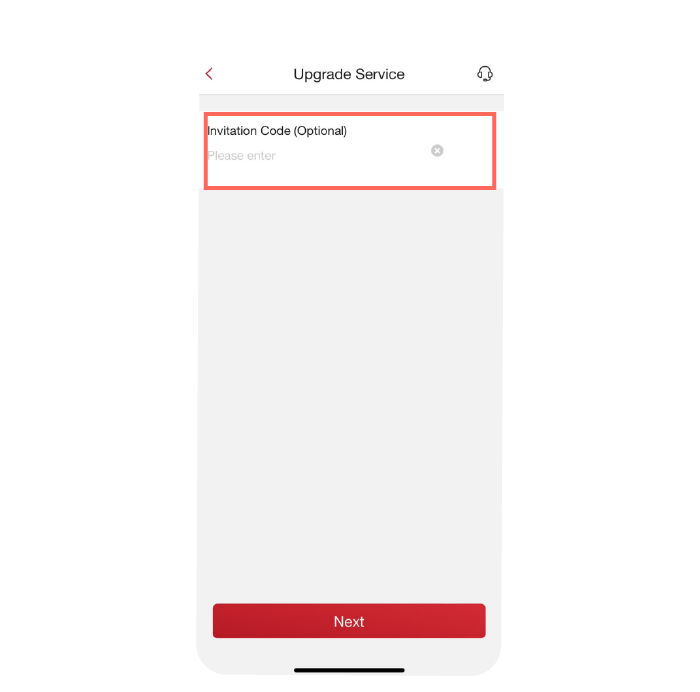

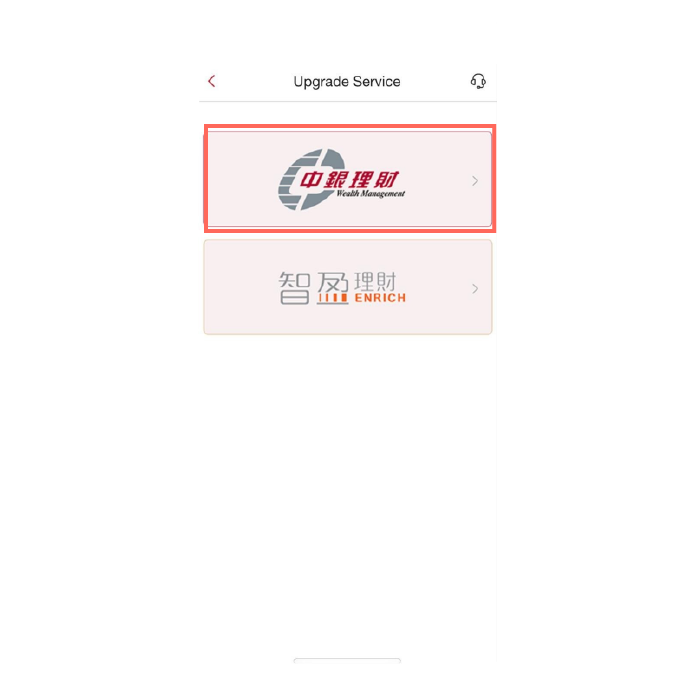

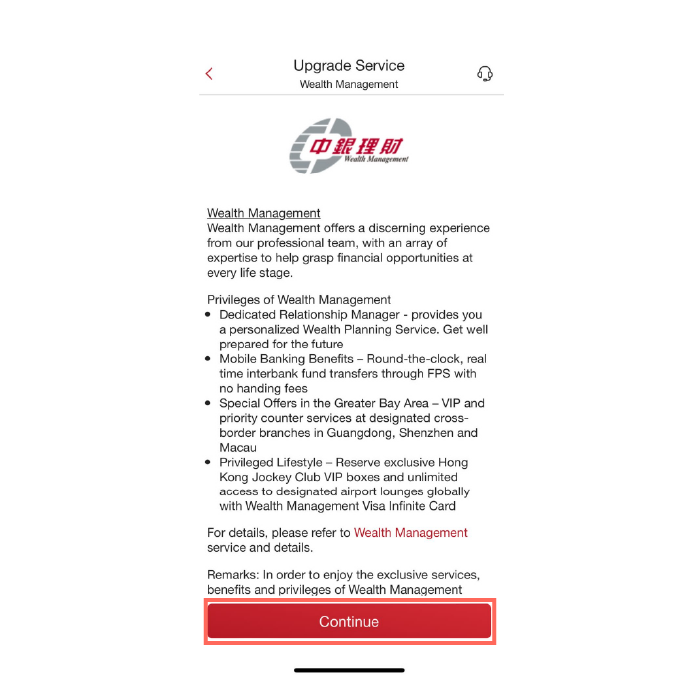

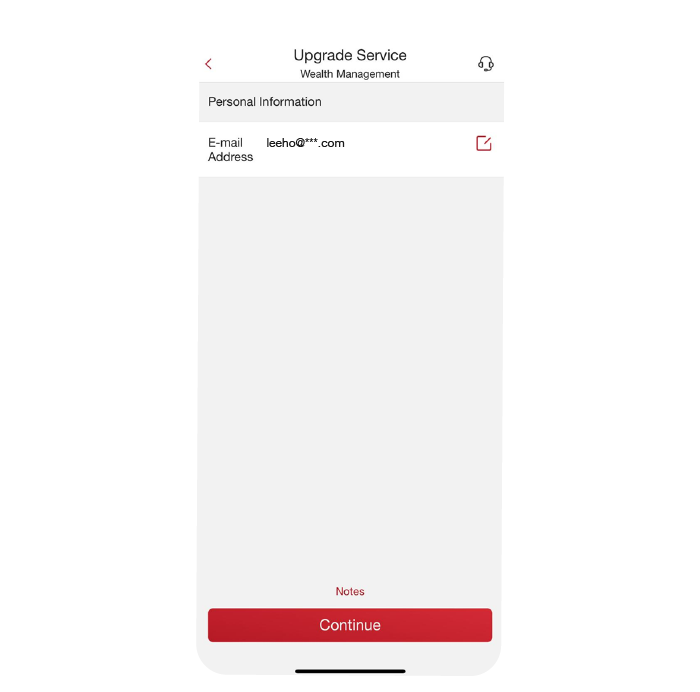

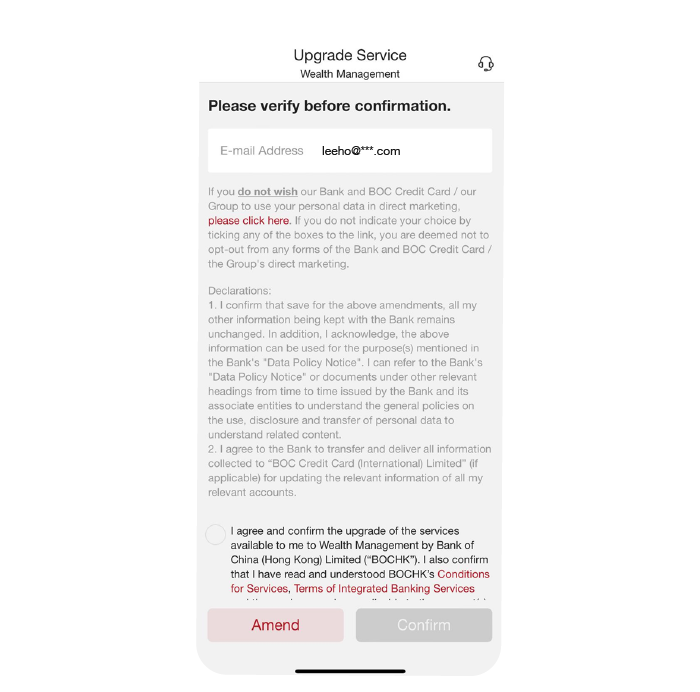

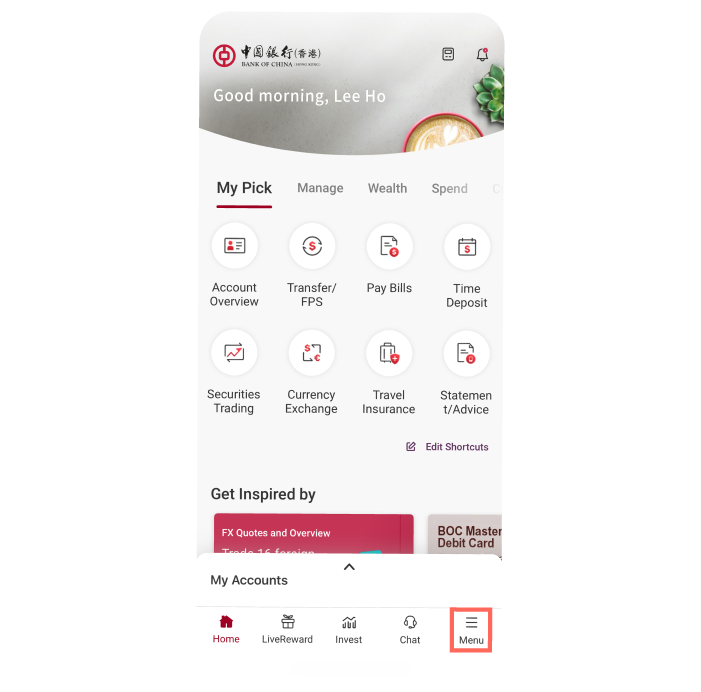

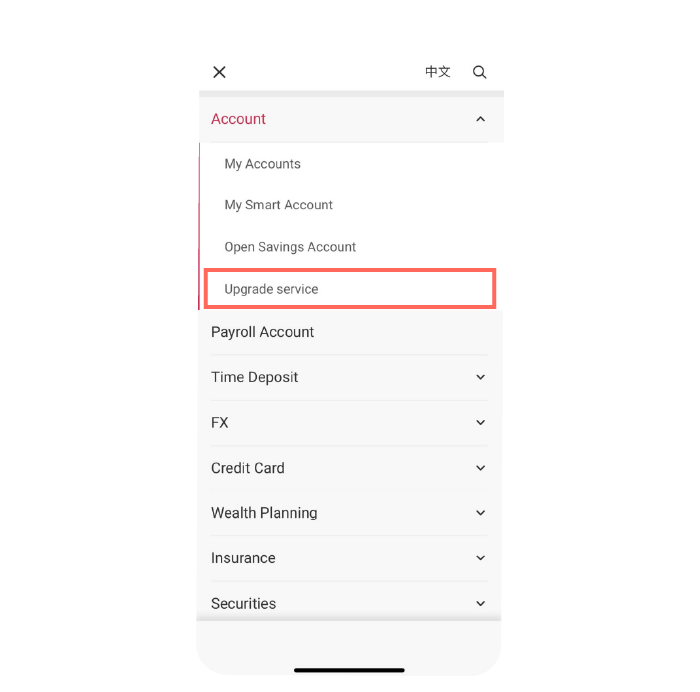

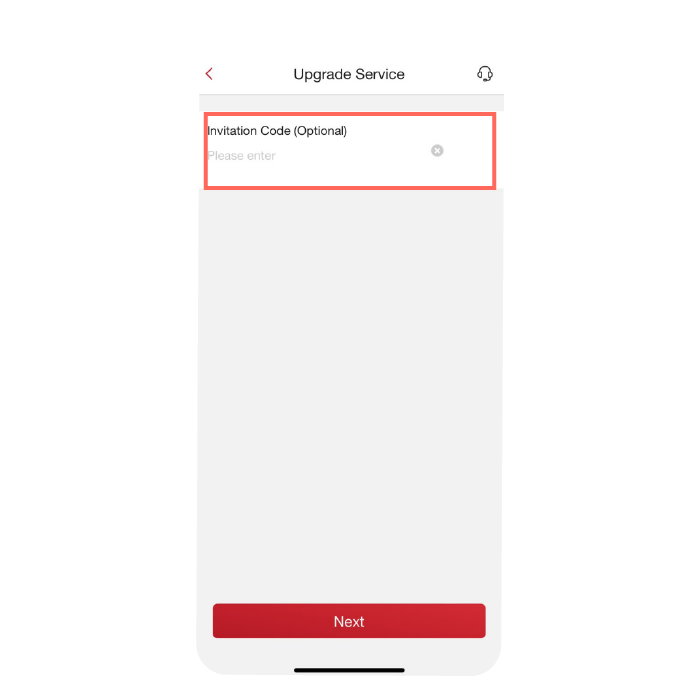

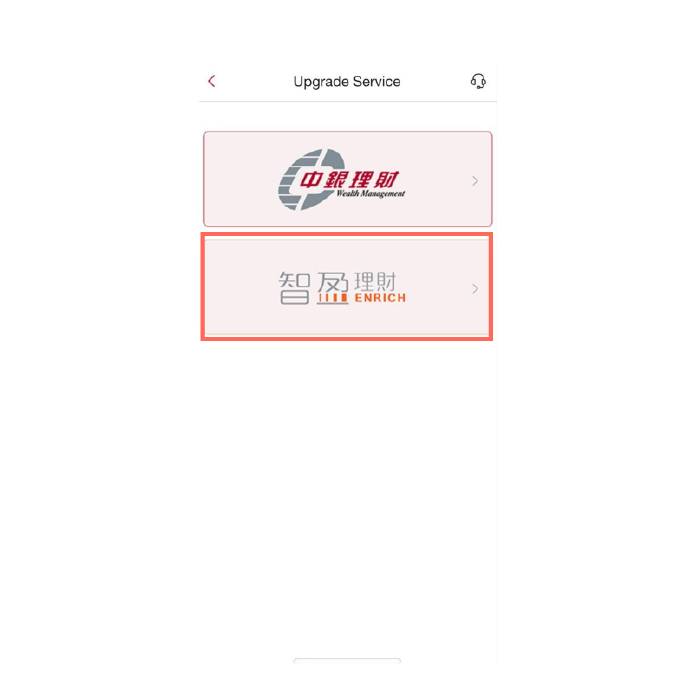

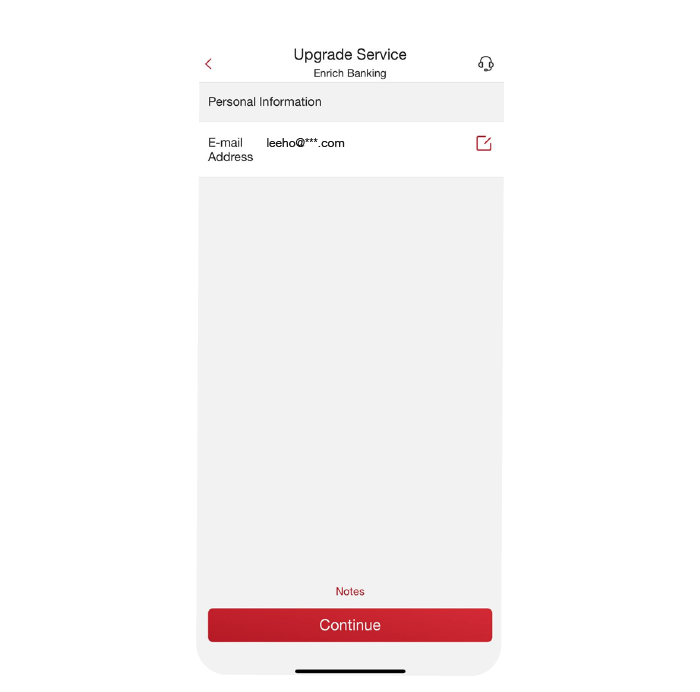

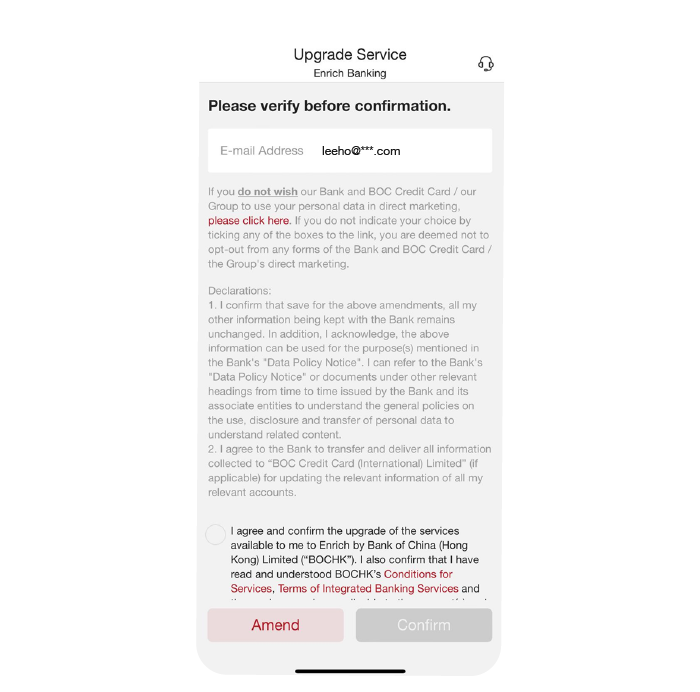

Upgrade Service

Wealth Management

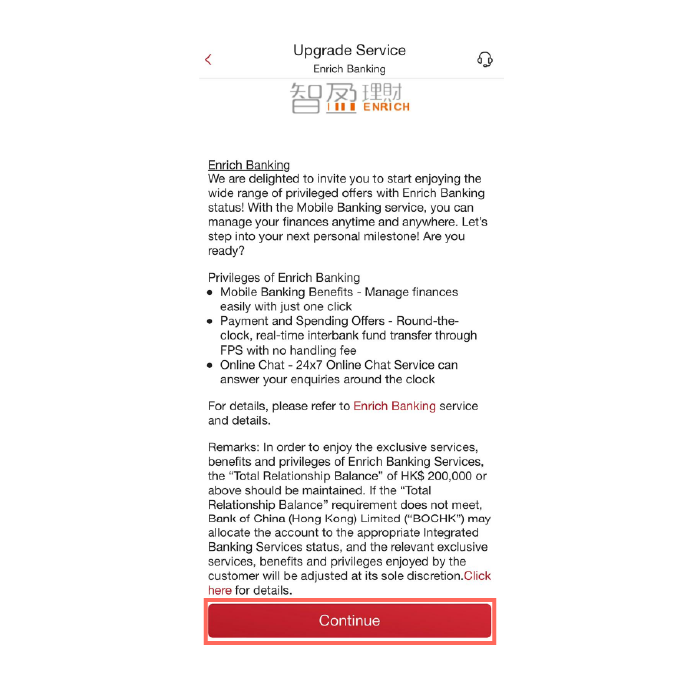

Enrich Banking

Personal Customer Service Hotline: +852 3988 2388|www.bochk.com

General Terms:

- The above products, services and offers are subject to the relevant terms.

- The customer is responsible for paying the relevant data costs incurred by using and / or downloading the BOCHK Mobile Banking.

- Please download the mobile app from the official software application store or BOCHK homepage, and pay attention to the identifying words of the search.

- By using BOCHK Mobile Banking, the viewers agree to the disclaimer and policy of BOCHK on BOCHK Mobile Banking from time to time.

- Private Wealth, Wealth Management and Enrich Banking services are only applicable to personal banking customers aged 18 or above.

- i-Free Banking service is only applicable to personal banking customers aged 11 or above. i-Free Banking customers aged from 11 can apply for HKD savings account, ATM card and Internet/ Mobile/ Phone Banking services including account enquiries and electronic consolidated monthly statements etc. i-Free Banking customers aged from 16 can apply for Multi-Currency Savings Account and enjoy the services of foreign currency exchange, time deposit placement and payment for designated bills (only applicable to Internet Banking) etc. through Internet/ Mobile/ Phone Banking. i-Free Banking customers can enjoy the full range of Internet/ Mobile/ Phone Banking services automatically at the age of 18.

- The above products, services and offers are subject to the relevant terms. Please contact the Bank staff for details or refer to this Terms of Integrated Banking Services, Conditions for Services and General Information. Customer can obtain the related documents from our branch or visit the Bank website www.bochk.com.

- The Bank reserves the rights to amend, suspend or terminate the above products, services and offers and to amend the relevant terms and these terms from time to time at its sole discretion.

- In case of any dispute, the decision of the Bank shall be final.

- Should there be any discrepancy between the Chinese and English versions of this service terms, the Chinese version shall prevail.

Although investment may bring about profit opportunities, each type of investment product or service comes with its own risks. For details of the nature of a particular product and the risks involved, please refer to the relevant offering documents. You should seek advice from an independent financial adviser.

This service terms is issued by Bank of China (Hong Kong) Limited and the contents have not been reviewed by the Securities and Futures Commission of Hong Kong.

This service terms is issued by Bank of China (Hong Kong) Limited and the contents have not been reviewed by the Securities and Futures Commission of Hong Kong.