For the "Key Facts Statement (KFS) for BOC Credit Card Statement Installment Plan", please click here.

Credit Card Limit Adjustment

You can submit your credit card limit adjustment application and upload required documents via mobile banking with ease.

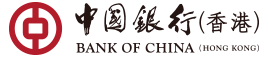

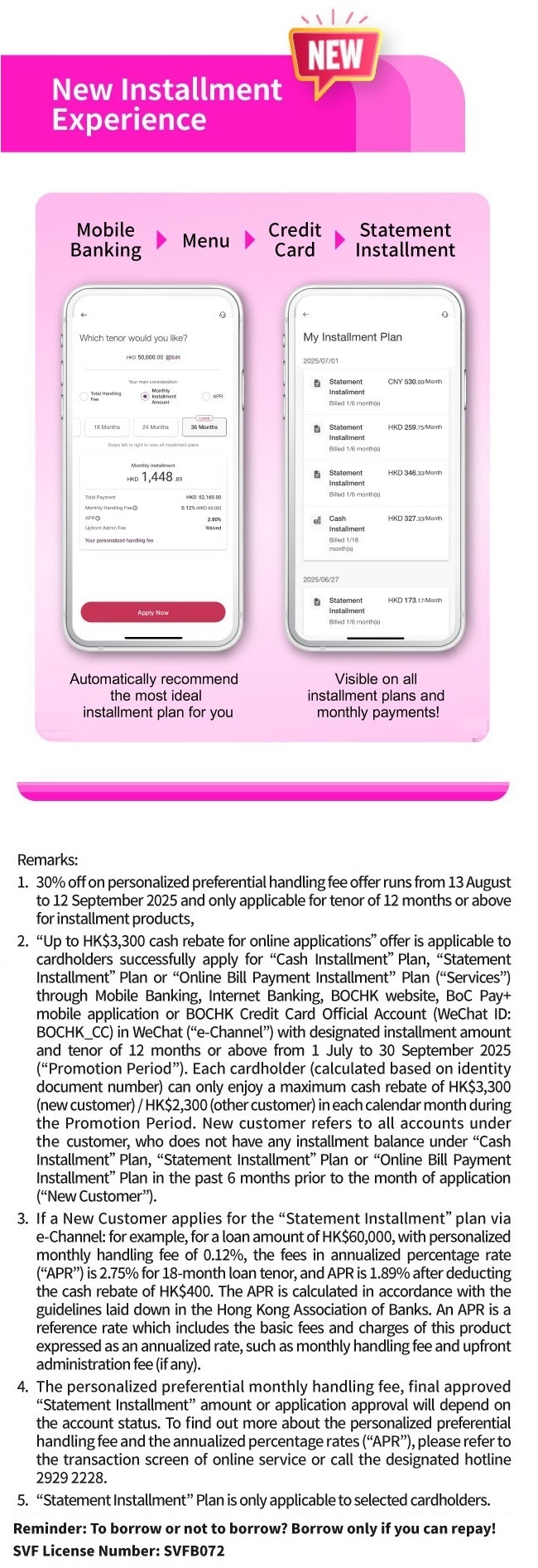

Login your BOCHK mobile banking >Menu > Credit Card > Credit Card Limit Adjustment.

Related Products:

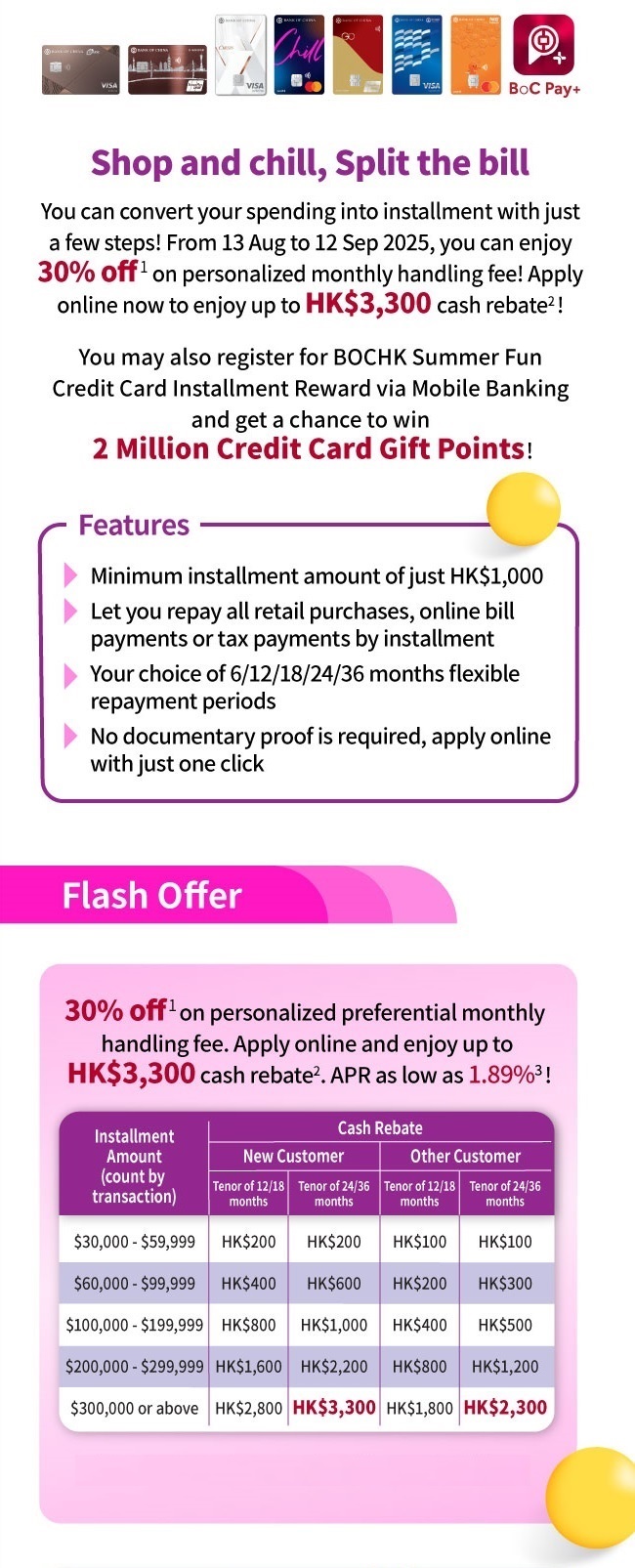

Cash Installment 〉Provides you with the flxibility to convert your available credit limit into handy cash with a personalized preferential monthly handling fee |

Cash Before Card 〉Turn your available credit limit into cash and enjoy up to 56 days interest-free repayment period |

Bill Payment 〉Transfer your outstanding balance from other credit cards to BOC Credit Card and enjoy up to 56 days interest-free period |

Terms and Conditions

Important Notes for BOC Credit Card “Statement Pay by Installment” Plan

Terms and Conditions for the Installment Programs

Key Facts Statement (KFS) for BOC Credit Card "Statement Installment" Plan

Terms and Conditions for “Up to 3% Cash Rebate for Statement Installment Online Applications”

Please click here for the Monthly Installment Amount Calculator.

Reminder: To borrow or not to borrow? Borrow only if you can repay!