Hong Kong people have increasingly decided to relocate within the Greater Bay Area ("GBA"). Some of them are studying, working or starting business ventures, while many are retiring or enjoying a long vacation. They may also be considering buying residential properties. Prior to buying a property, they may want to be better informed of the housing policy and legal requirements that vary across the different municipalities.

The Greater Bay Area comprises the two Special Administrative Regions of Hong Kong and Macao, and the nine municipalities of Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing in Guangdong Province. Each of them plays a unique role.

| Permanent resident population: 6.04 million | |

| Average price per square metre: RMB12,000 | |

| Features: Electronic information and petrochemicals are pillar industries. | |

| Transport facilities: High-Speed Rail (Huizhou South Railway Station), and cross-border bus |

It is convenient to drive your own if you live in the mainland. The Shenzhen Bay Police Medical Postal Service Station, which is a 15-minute walk from Shenzhen Bay Port, provides you with a one-stop solution, including physical examination, photoshooting, application and delivery of the licence to your home. The station processes 11 kinds of applications, including direct issuance of Mainland small vehicle and motorcycle driving licences, renewal of driving licence, replacement of driving licence, replacement of driving licence (transfer in), downgrade of driving licence, renewal and replacement of the Certificate of Roadworthiness, replacement of qualifying marks, 6-year exemption from inspection, temporary licence plate for new cars, change of contact details of the motor vehicle driver, and change of contact details of the motor vehicle owner. Applicants are only required to bring their HKID card, Mainland Travel Permit for Hong Kong and Macao Residents and valid Hong Kong driving licence to reserve the service free of charge. For enquiry, please call +86 755 8827 7214.

Of course! In 2019, the Central Government promulgated "16 Measures to Benefit Hong Kong Residents" to enable them to buy residential properties in the mainland cities of the Greater Bay Area by exempting some requirements of paying individual income tax and contribution to social insurance, and registration requirements of living, studying or working in the city. Before buying a property, Hong Kong buyers need to know more about the transaction procedures, the required documents, and property purchase restrictions. For purchase requirements, there is a difference between Hong Kong residents and local residents. It is also necessary to check the respective policy measures of each city for Hong Kong and Macao residents.

Each city in the mainland has its own residential policies to regulate the house market, which generally involves the number of houses to be purchased, the loan-to-value ratio, and how long it takes to resell after purchase. It is advisable to understand the latest policies of the relevant market before planning to buy a house.

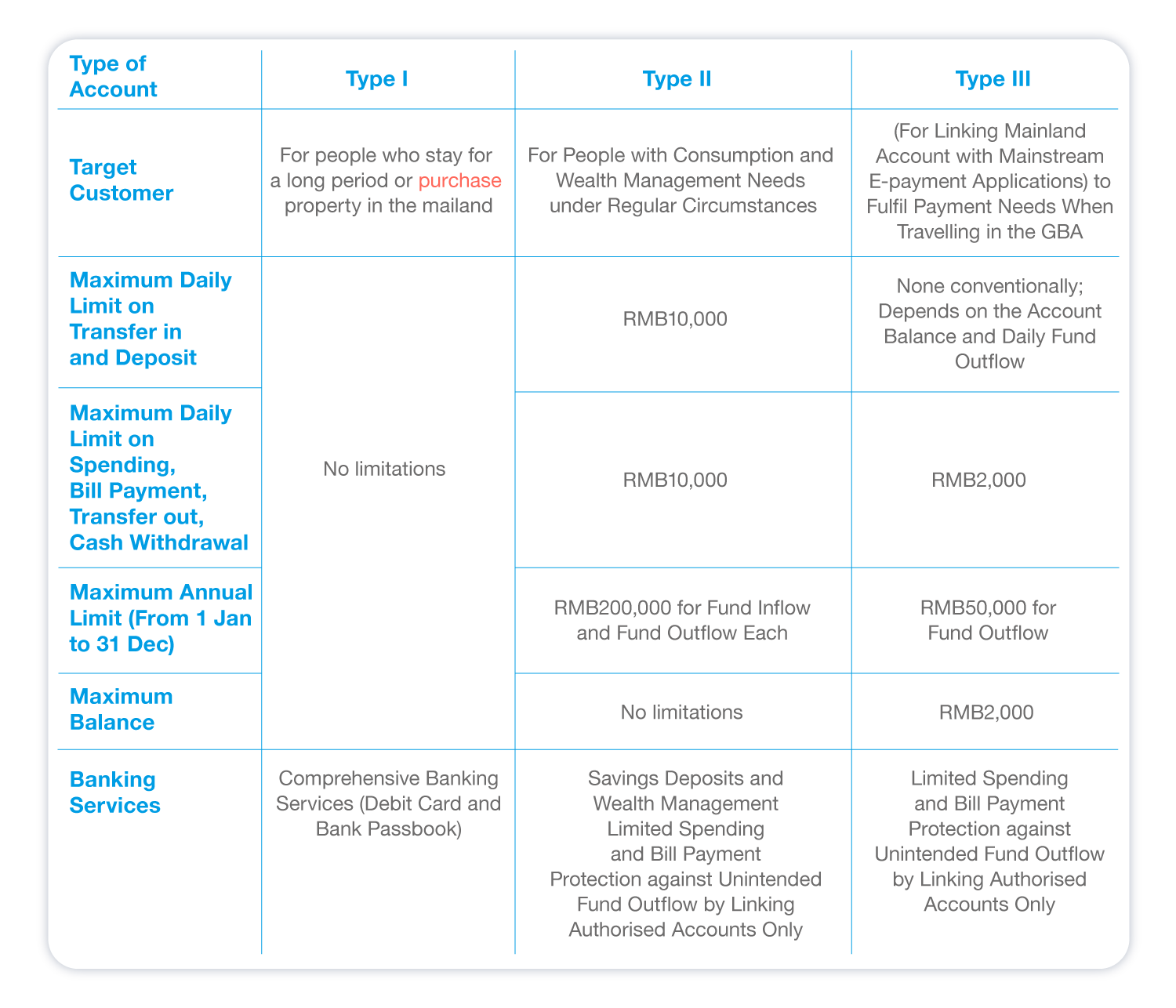

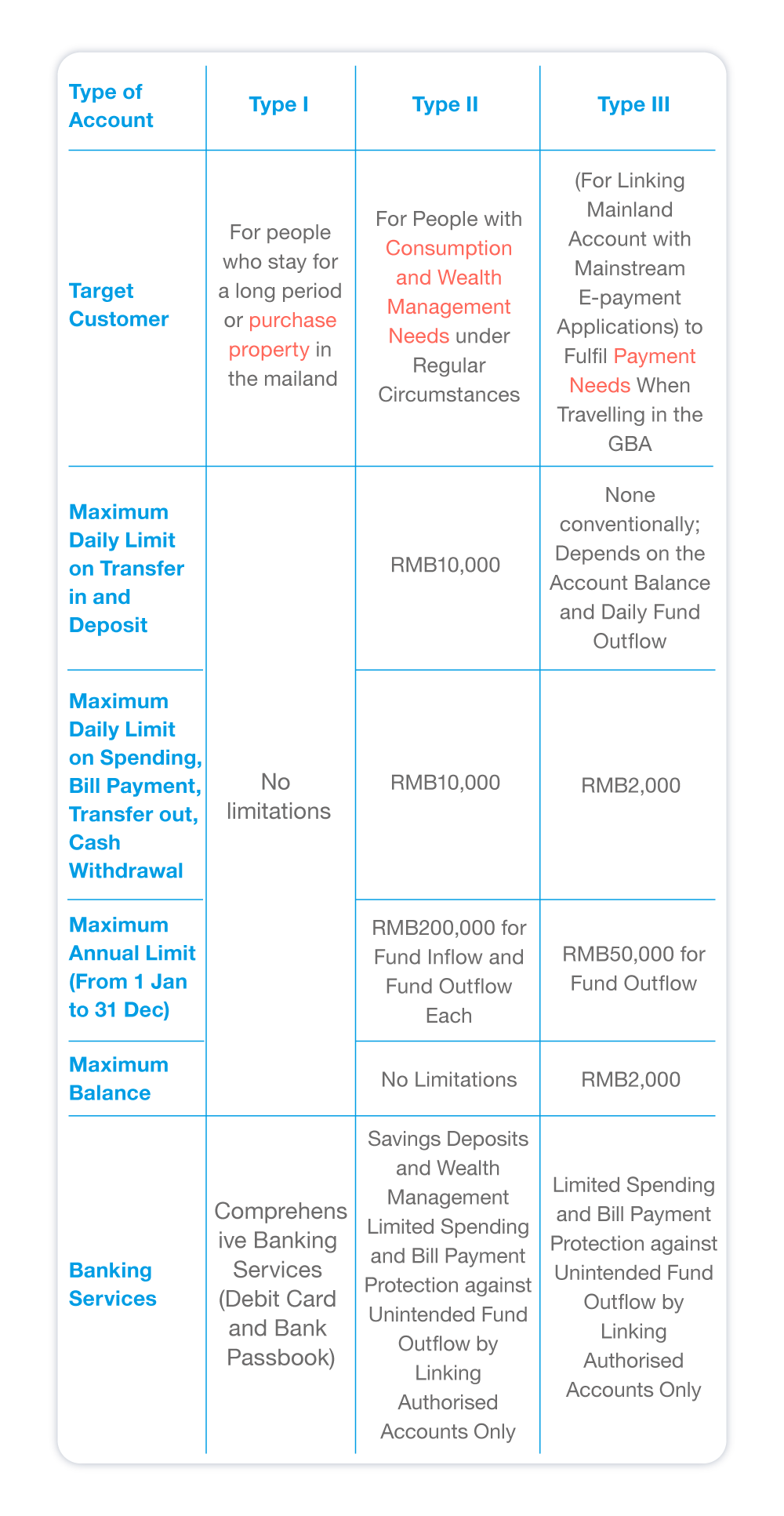

When opening a mainland bank account, you should note that the People's Bank of China categorises personal bank accounts into three types. All three types can be linked with a mainland e-wallet, and you can choose to open the most suitable account based on your needs.

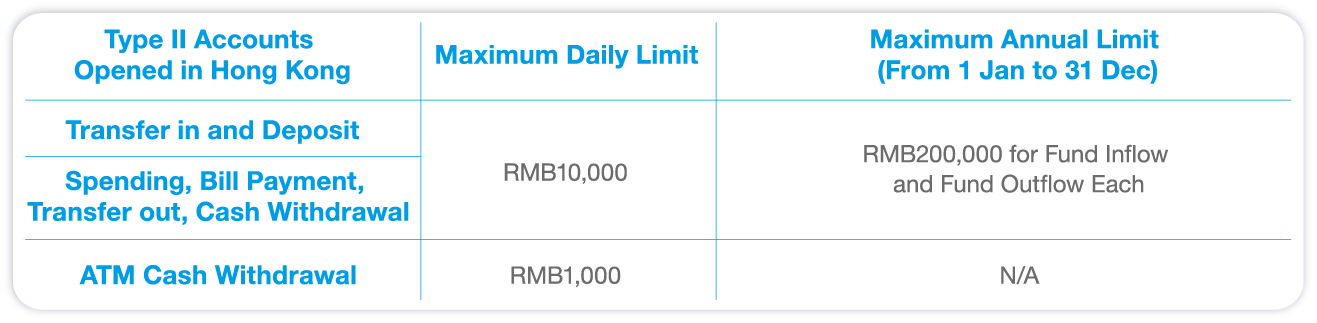

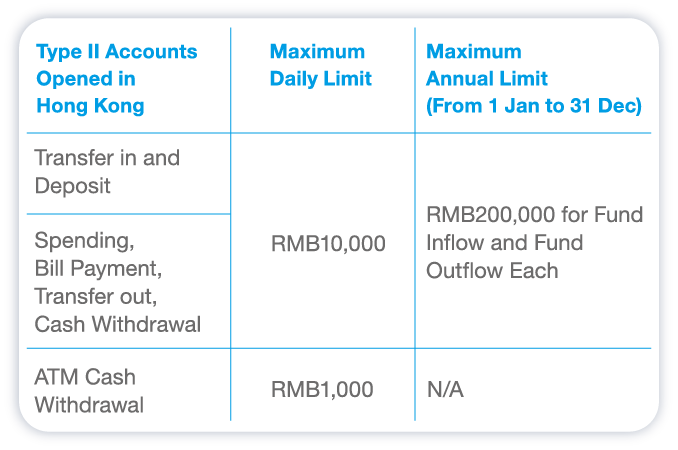

Differences between three types of personal mainland bank account:

If you have not yet decided to buy a property, before travelling to cities in the GBA, you may use the Greater Bay Area Account Opening Service to open a mainland BOC account without leaving Hong Kong. You can also link your mainland account with mainstream e-payment applications in the mainland via cross-border e-wallet BoC Pay+ ![]() to enjoy travelling with ease.

to enjoy travelling with ease.

(1) Hong Kong Identity Card,

(2) Mainland Travel Permit for Hong Kong and Macao Residents

#The Applicant must be 18 years of age or above and is a BOCHK personal banking account holder. The applicant needs to provide a self-owned Hong Kong or mainland China mobile number, otherwise linking with mobile electronic payment applications on the mainland may be affected. Mainland account services are provided by BOC and BOC relevant T&Cs apply.

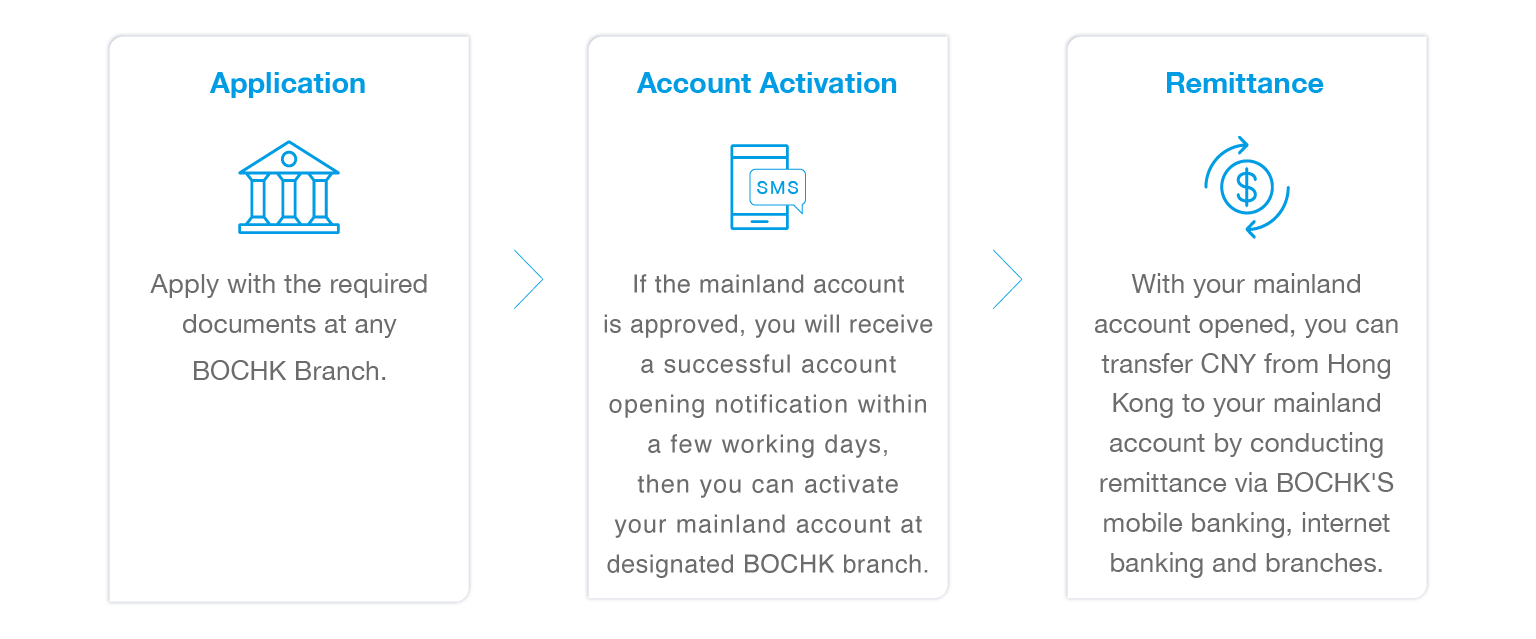

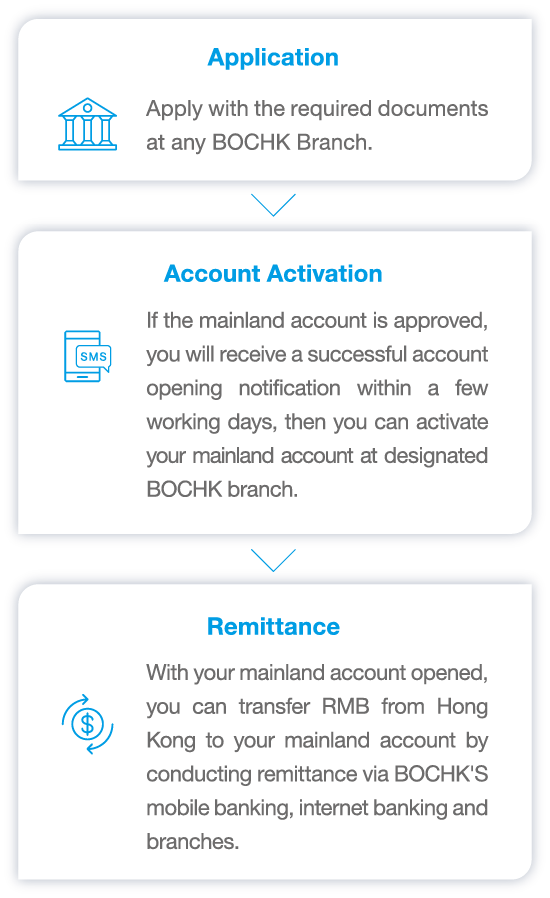

Three easy steps to use BOCHK's GBA Account Opening Service without leaving Hong Kong:

Remark: BOCHK's GBA Account Opening Service and cross-border e-wallet BoC Pay+ are services rendered by BOCHK in Hong Kong only.

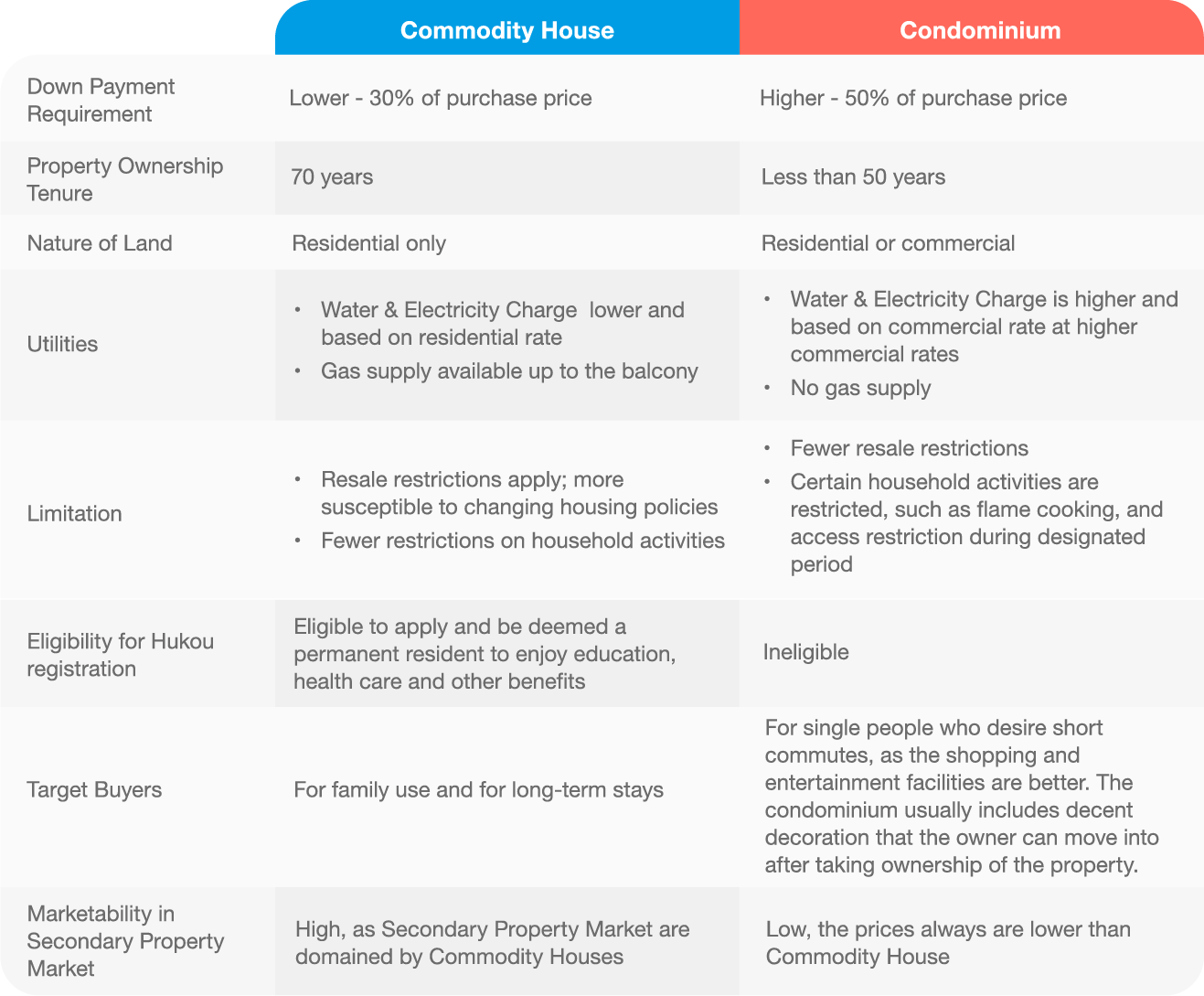

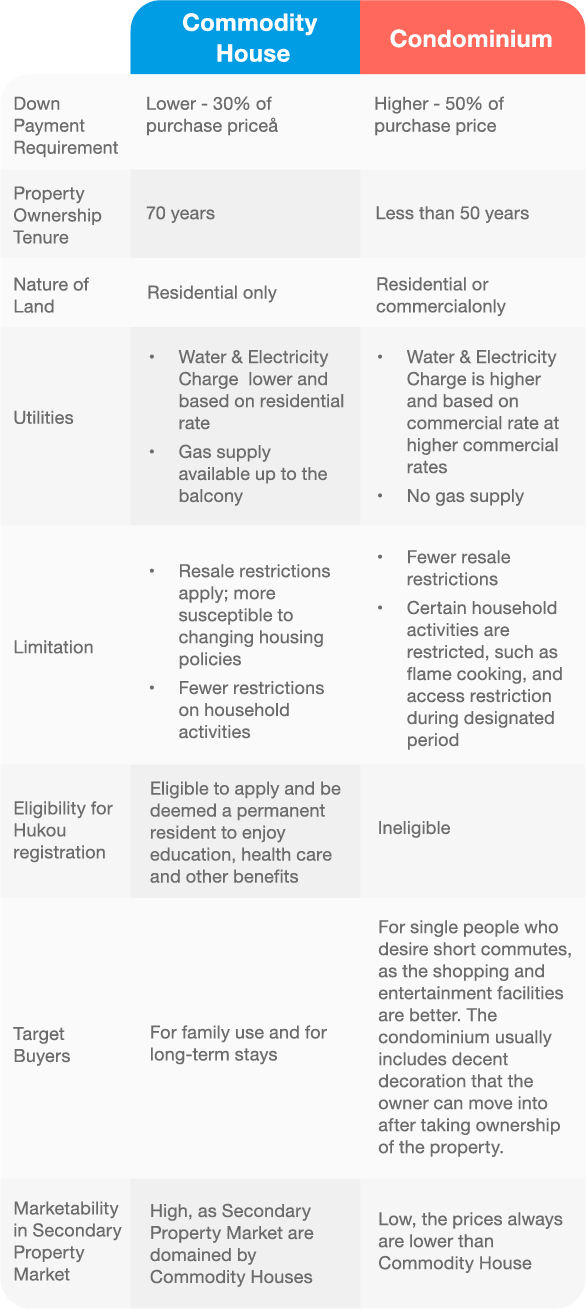

Mainland residential properties are categorised into "Commodity House" (Note 1) and "Condominium" (Note 2). The related rights and facilities between them are different, therefore it is important to ascertain which type you are buying before making a purchase decision.

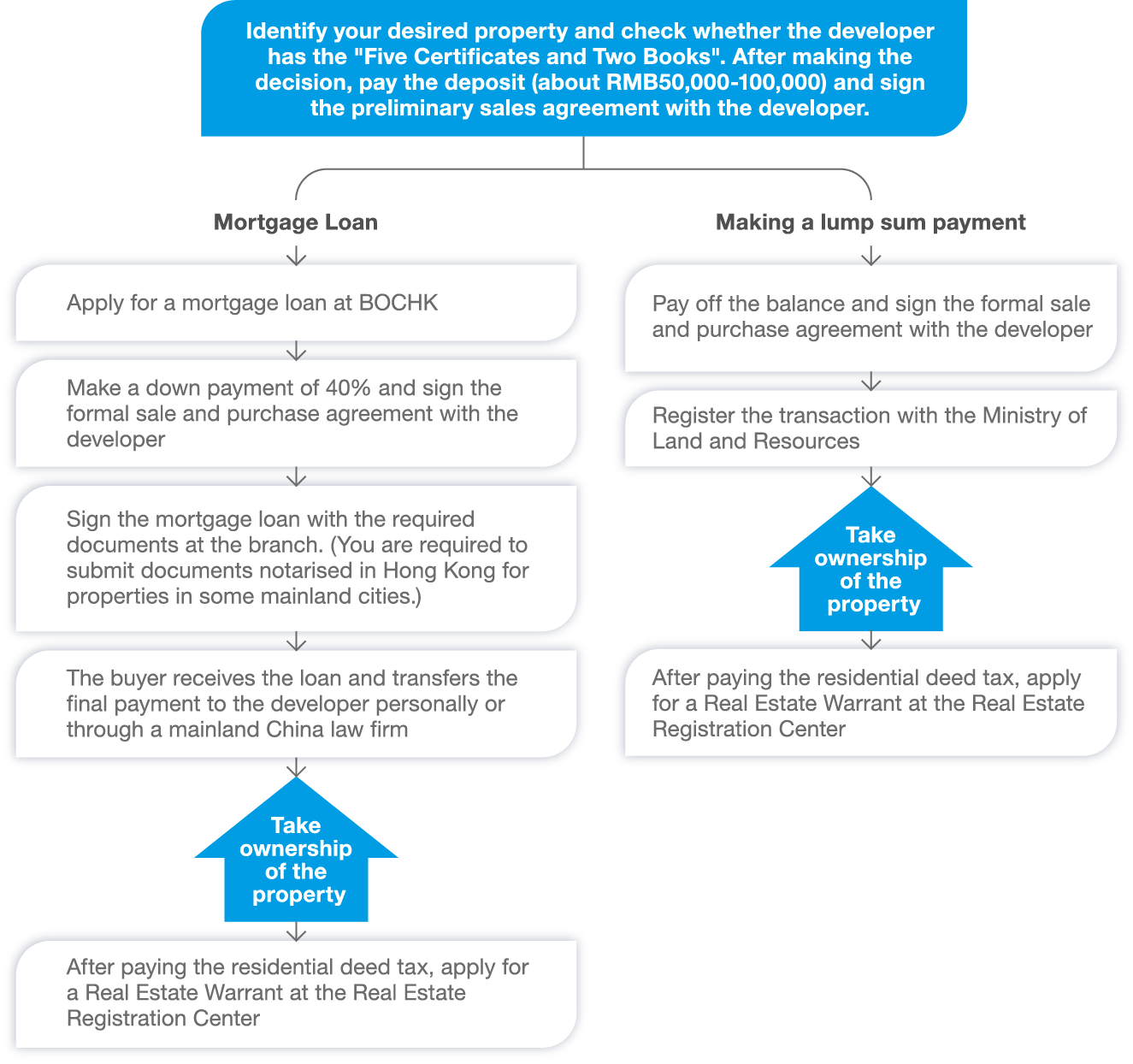

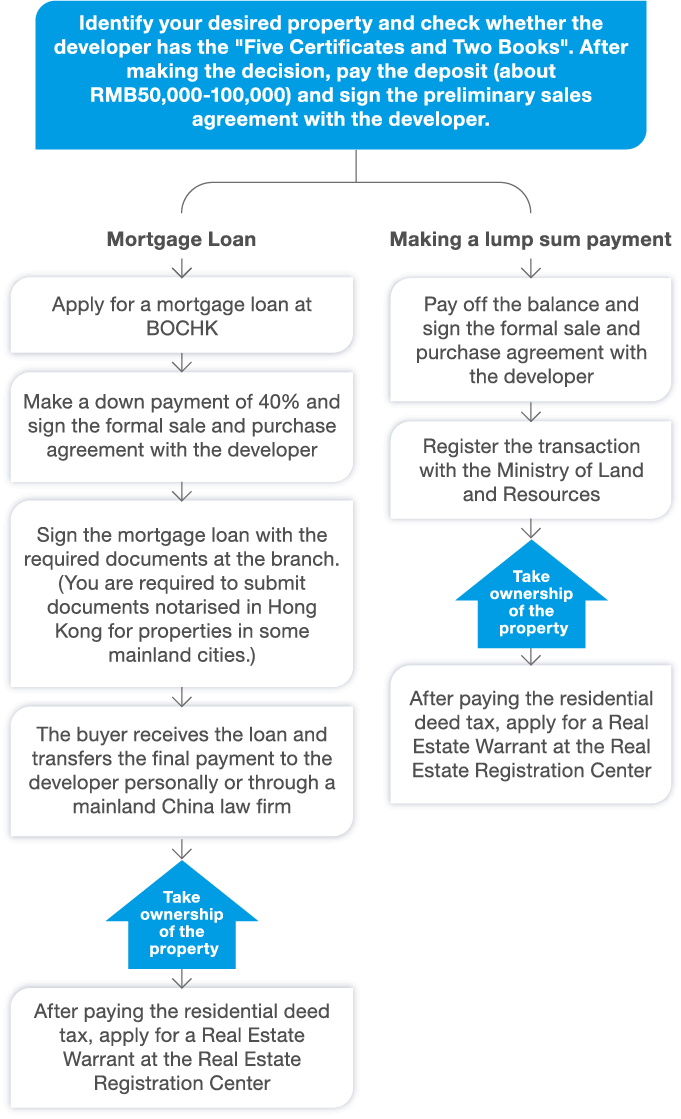

When buying residential property in the mainland, Hong Kong people may appoint estate agents in Hong Kong or contact mainland developers directly (Note 5). Mainland developers usually appoint mainland salespersons to sell properties instead of negotiating directly with potential buyers. Therefore, Hong Kong clients should hire agents familiar with the Greater Bay Area real estate market. These agents will deal with related issues such as cross-border remittance and document exchange. "Inspection Tours for Mainland Property" are regularly held, which will give you a complete picture of the residential developments prior to making a decision.

It is always sensible to choose a reputable developer when buying property in the mainland to avoid "abandoned projects". It is necessary to check the developer's "Five Certificates and Two Books". Properties can only be legally sold with the "Five Certificates" (Note 3). The "Two Books" (Note 4) are important documents when taking ownership of the properties.

Property Sales Contract

Go to the housing management department where the property is located to complete the property sales contract. It is advisable to make reference to the official contract template. The contract should be drafted according to the contract templates issued by the central government and local municipal governments.

"Down Payment" vs "Deposit"

Note the difference between "down payment" and "deposit". "Deposit" merely shows an intention; if it is not fulfilled, it can be returned to the buyer. "Down payment" represents a promise; if it is not fulfilled, it cannot be returned and there will be applicable compensation responsibilities.

Terms

Similar to Hong Kong, before signing a contract, you should check the material details such as the date of completion, the deadline of applying for a deed, unit area, contracted unit quality, arrangements for property management, breach of contract clauses, etc. Any blank spaces should be filled in or removed to avoid ambiguity with potentially costly consequences. If it is necessary, you may require the developer to explain the contract terms in greater detail.

Supporting Documents

According to the "16 Measures to Benefit Hong Kong", you are only required to provide identification documents (Hong Kong Permanent Identity Card, Mainland Travel Permit for Hong Kong and Macao Residents), proof of not owning any property in mainland China, and a written commitment for property purchase. It is necessary to sign the Sales & Purchase Agreement with the real estate developer, or directly sign the Commodity House Pre-sale Contract or the Commodity House Sales Contract. Then register the contract and wait for its completion when the property sale is finalised.

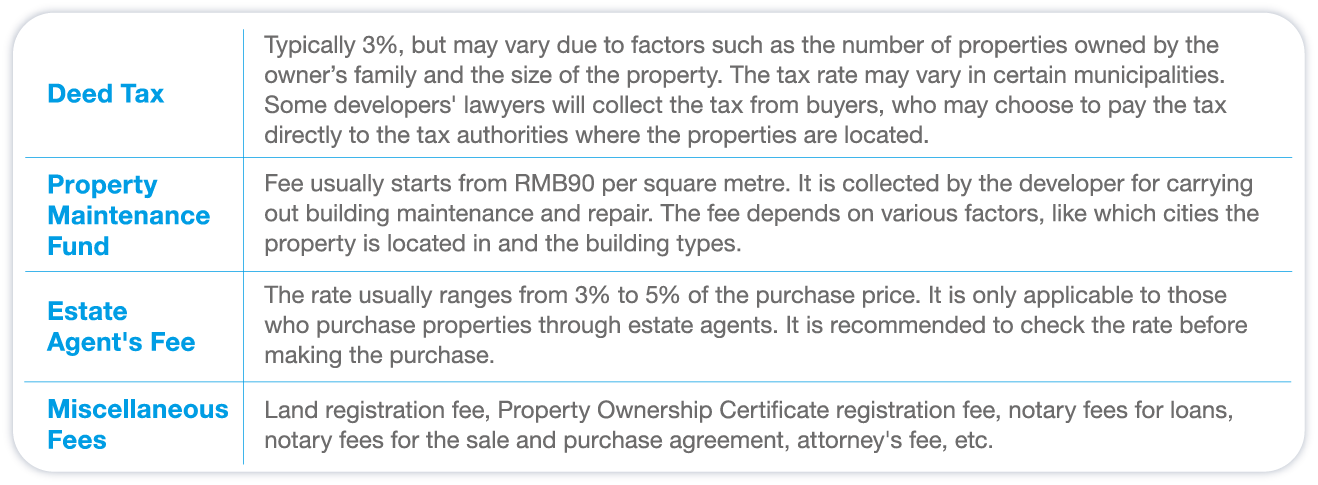

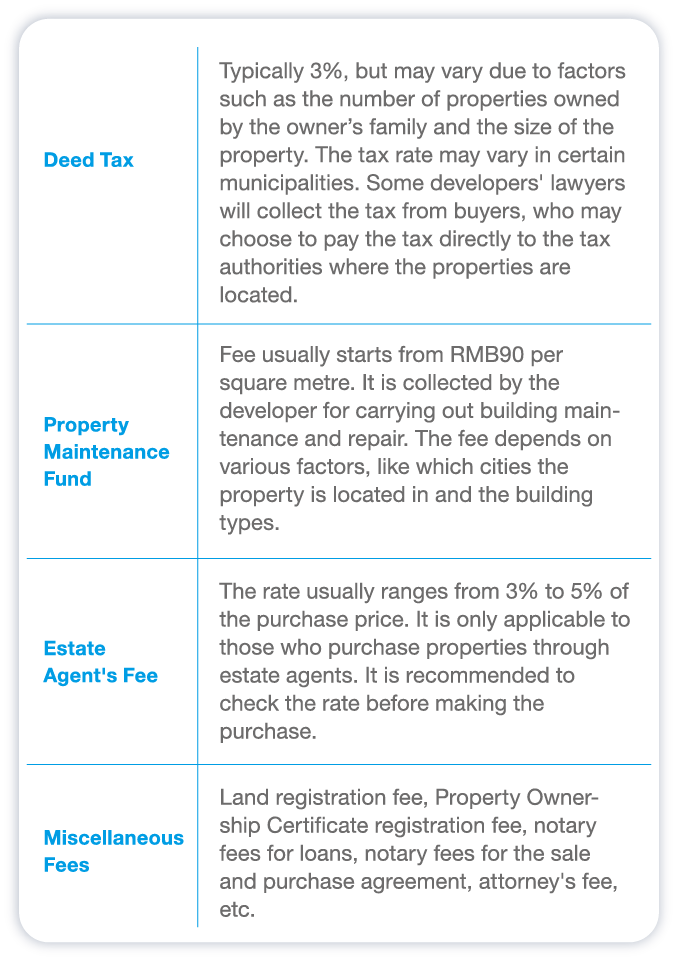

In the mainland, the following taxes and miscellaneous fees must be paid in addition to the price for property purchases:

When a buyer chooses to pay for the property in lump sum, most developers in mainland China would conventionally expect to receive the remaining amount within 7-14 days after the down payment. For BOCHK clients who apply for the Greater Bay Area Loan - Mortgage Loan, they have the flexibility to make the down payment within around 1 month.

Deposit payment, one-off cash payment, down payment or final payment may all involve transferring large sums of money to the Mainland. The compliant way is to use remittance services provided by banks in Hong Kong. Customers can remit funds to their Type I account in the mainland, converting foreign currency into RMB, which is often referred to as foreign exchange settlement in the mainland (Note 6). When handling foreign exchange settlements, it is necessary to submit proof for the use of funds, such as a purchase and sales agreement for the banks to report to the State Administration of Foreign Exchange. In addition, with the implementation of payment facilitation measures for Hong Kong and Macao residents purchasing properties in the Greater Bay Area, Hong Kong residents can also remit RMB to developer accounts, personal accounts or custodial accounts when purchasing properties in mainland cities in the Greater Bay Area.

Hong Kong citizens need to provide the following documents and information to open a Type I account in a mainland bank. As requirements of different banks may vary, you are advised to check with the banks before applying in person in mainland branches.

1)Hong Kong Permanent Identity Card

2)Home Visit Permit

3)Mainland mobile phone number registered under your name

4)Proof of Hong Kong address

5)Mainland address

If you would like to open a full-featured Type I mainland account, you can either visit any BOCHK branch for referral or visit any BOC branch in the mainland.

Only debit cards issued by mainland banks are accepted for paying a deposit or down payment to the mainland developers. BOCHK has increased the spending limit of its BOCHK UnionPay debit cards for Hong Kong people when making down payments in the mainland. When customers apply for a mortgage loan in the Greater Bay Area through BOCHK, they may make the down payment for the designated property to the mainland developers with UnionPay debit cards with a daily limit of up to RMB1 million. For consultations, call the GBA Loan Service Hotline: +852 3669 2888.

Remark: BOCHK UnionPay Debit Cards are products of BOCHK and are available only in the Hong Kong market.

| (Note1) | Commodity house conventionally refers to any property built by developers and sold in the form of commodities. They are residential properties built on land mainly for residential use. |

| (Note2) | Apartments are properties involving some commercial purpose, built on lands for commercial or residential purpose, including various living facilities. The property can be used for commercial or residential propose. Examples are residential apartments, serviced apartments, luxury serviced apartments, youth apartments, white-collar apartments, youth SOHO, etc. |

| (Note3) | "Five Certificates" include "Land Use Certificate for State-Owned Land", "Construction Land Planning Permit", "Construction Project Planning Permit", "Construction Permit" and "Commodity House Sales (Pre-sale) Permit". |

| (Note4) | Two Books" include "Residential Quality Guarantee" and "Residential Manual". The former documents the developer's guarantee given to the buyer for the quality of the property, including inspection quality, maintenance scope, maintenance responsibility, etc. The latter contains the specifications of the unit, including the unit plan, structure, utilities details, etc. |

| (Note5) | "Developers" refers to real estate developers (similar to real estate developers in the HKSAR). |

| (Note6) | Foreign exchange settlement refers to the exchange between RMB and currencies processed by a bank for its customers. |

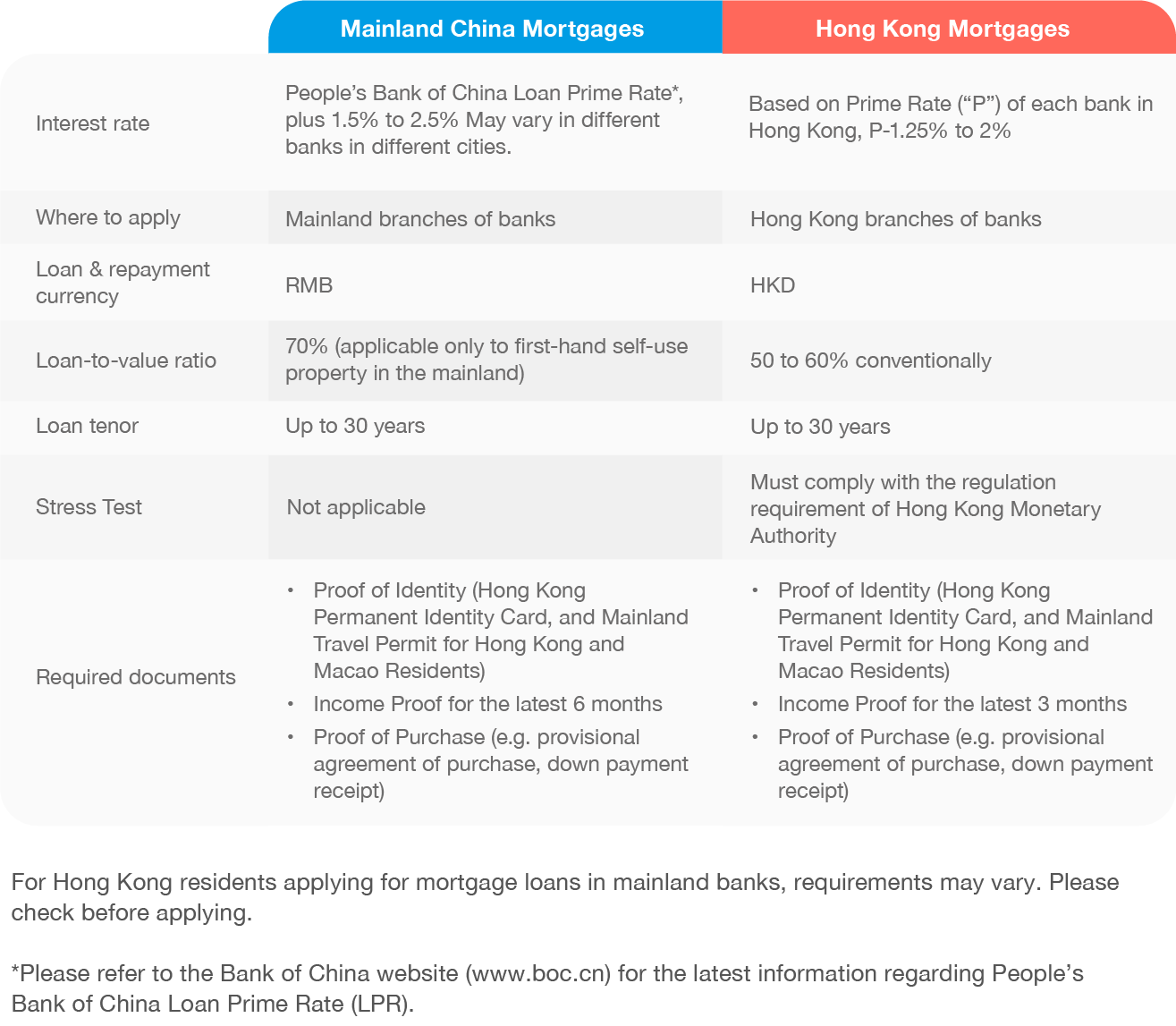

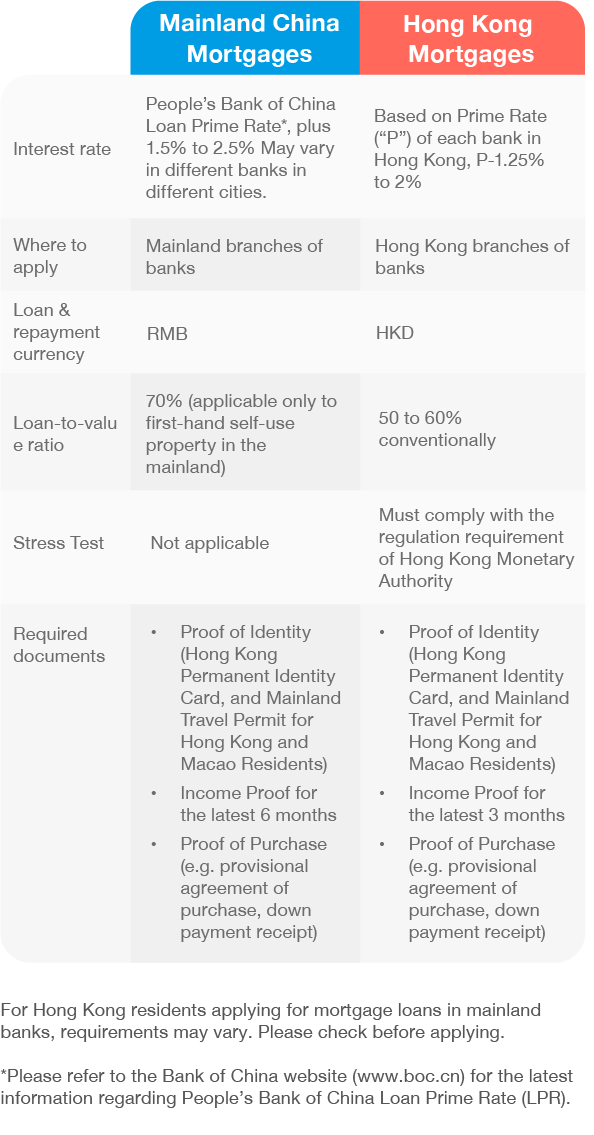

For Hong Kong residents planning to purchase properties in the mainland cities of the Greater Bay Area, they may choose to get a mortgage from a mainland bank or from a bank in Hong Kong.

You can apply for Greater Bay Area Loan in Hong Kong and enjoy the privileges of "Hong Kong Rate, Hong Kong Dollar Loan, Apply in Hong Kong". You can purchase or refinance your property with a wide range of mortgage options. We offer 2 types of loan to suit your financial needs.

Greater Bay Area Loan - Mortgage Loan

Greater Bay Area Loan - Property Refinancing

Once a new residential property is completed, you are one step closer to becoming an owner. As you are busy planning your home sweet home, you have to pay attention to certain details when taking ownership of the property. In the mainland, after the construction of a residential property is completed, the developer can issue each owner a "Small Confirmation of Ownership" and a "Real Estate Warrant". This is done after the developer has completed the "Large Confirmation" and obtained the "Real Estate Title Certificate".

As per practice, the developer will prepare the "Real Estate Warrant" for each prospective owner within 90 days of the latter taking possession of the property, where they will also be informed to pay the maintenance fund. If the quality of construction needs to be evaluated, the developer's "Certificate of Project Approval" can also be verified.

The inspection process is basically the same as that in Hong Kong. It is necessary to identify material defects in specific areas including water leakage, structure, floor, wallpaper, etc. Buyers may hire qualified inspectors to carry out the inspection. You may choose to hire building inspectors from Hong Kong, while most real estate developers in the mainland offer local building inspectors for assistance.

Do you remember the "Five Certificates and Two Books" mentioned in the previous article? Among them, the "Two Books", namely "Residential Quality Guarantee" and "Residential Manual", may come in handy. When inspecting the property, items can be cross-checked against these two books. If any discrepancy is identified, you should report to the inspection staff, and ask the developer to make repairs as soon as possible.

You are now ready to move in after taking ownership of the property. To settle into your new home, you need to set up the utilities such as signing up for water, gas and electricity. The owner needs to submit a proof of residence to the relevant utility companies to activate the service. Usually, online applications are available and it is advisable to have a mainland phone number when applying. Once the services are activated, you can purchase a prepaid card and recharge through bank transfer, or you may pay the bills through digital payments. The payment methods may vary in different mainland cities, and even in different districts in the city. It is advised to check with the estate management for details.

BOCHK's Greater Bay Area Account Opening Service allows you to open a mainland BOC account in Hong Kong. You can link your mainland account with mainstream mobile electronic payment applications in the mainland. You can also settle your utility bills with ![]() , our cross-border payment mobile application.

, our cross-border payment mobile application.

Home insurance plans and fire insurance plans are offered by most insurance companies.

Remark: BOCHK Greater Bay Area Easy Account Opening Service and cross-border payment mobile application BoC Pay+ are offered by Bank of China (Hong Kong) and are only available in the Hong Kong market.

If you want to sell a residential property in mainland China, you need to check the duration you have owned the property. Taxes on various duration of second-hand property transactions are different. For example, for a residential property constructed less than two years ago, the seller needs to pay about a 5% value-added tax (also known as business tax). For a residential property with less than five years ownership, or where the seller owns two or more residential properties, the seller needs to pay a 20% individual income tax. In addition, different levies such as urban maintenance and construction tax and education surcharge may be applicable.

You will usually hire a mainland estate agent to list your property. You are advised to prepare all the required documents, such as Real Estate Warrant to save on travel time to compile the documents. You may expect a buyer to take some time to prepare documents and apply for a mortgage, and the transaction cannot be completed immediately after the purchase is confirmed by a buyer.

The money will be deposited into a mainland bank account upon completion, and it is possible to remit the funds to Hong Kong. The remittance procedure should be done according to the capital control measures in the mainland.

From grabbing a quick lunch to addressing your everyday needs, all you need is a convenient and comprehensive payment solution. Paying with smartphones has become part of the daily routine in China as digital payments have grown prevalent. You can enjoy a trendy lifestyle and pay in physical stores throughout the Greater Bay Area by readily setting up digital payments on your smartphone. As an added bonus, you can even get a credit card to use in the Mainland.

Travel throughout the GBA with a BOC Go CardYou can travel around the Greater Bay Area with just one BOC Go Card. Swipe the card to take the Guangzhou-Shenzhen China Railway Highspeed Rail, ride the Guangzhou and the Shenzhen Metros and make mobile payments on designated Shenzhen taxies. A world of contactless payment awaits you.

You can also enjoy a Cash Rebate of up to 4% with spending via BoC Pay+ and other mobile payment and a 0% handling fee for overseas spending. Bind your BOC Dual Currency Credit Card with BoC Pay+ ![]() to make QR Code payments at merchants in mainland China without a mainland bank account. In addition, you can offset your spending with Gift Point at numerous merchants.

to make QR Code payments at merchants in mainland China without a mainland bank account. In addition, you can offset your spending with Gift Point at numerous merchants.

Terms and Conditions are applicable to the above offers and services. For details, please visit www.bochk.com/s/a/gba_e

Reminder: To borrow or not to borrow? Borrow only if you can repay!

Practical Guide for Hong Kong ResidentsThe HKSAR Government has prepared a "Practical Guide for Hong Kong Residents Living in the Mainland", which provides an overview of the different aspects of living in the mainland and some tips for settling in. You may visit the website for more details: https://www.gdeto.gov.hk/en/useful_info/guide.html

|

Where to See a Doctor?

It is very common in mainland China to visit hospitals for most health concerns. There are three types of hospitals, namely: public, international and private. The hospitals in mainland China are rated according to a "three-tier, ten-level" system. The gradings are given according to respective levels of service provided. The three grades are A, B, and C with a special grade of 3AAA. Grade 3A hospitals are currently the most prominent in mainland China, which integrate the functions of specialised medical treatment, medical education and scientific research. One has to first make an appointment prior to seeing a doctor. An appointment can be made by going to the registration window at the hospital, via phone call, Internet, WeChat or mobile apps. They then need to take tests and pay fees where necessary. After the doctor gives a prescription, the patient needs to pay the fee and collect the medicine from the hospital pharmacy. For Hong Kong people who plan to retire in the Greater Bay Area, healthcare service is always a primary concern. Although the cost of living in the Greater Bay Area is considered much lower than that in Hong Kong, the costs of medical services provided by Hong Kong-owned healthcare institutions in the Greater Bay Area are similar to those charged by private hospitals in Hong Kong. For example, in a Hong Kong-owned healthcare institution in Guangzhou, the consultation fee of a family doctor is around RMB600 and that of a specialist is around RMB1,000. |

|

What Additional Protection is Needed?

Hong Kong citizens working or living in mainland China are required to enrol in the country's social insurance scheme (note 1). Although medical insurance is included, one's needs might not always covered. Therefore, you may consider buying optional insurance to obtain better coverage on different kinds of medical care. |

|

Medical Protection

The "BOC Worldwide Medical Insurance Plan" (the "Plan"), underwritten by Bank of China Group Insurance Company Limited ("BOCG Insurance"), is a medical plan with comprehensive protection and abundant coverage. It provides flexible worldwide medical protection and a lifetime benefit of up to HK$66,000,000. The coverage of the Plan extends beyond hospital and surgical expenses to include benefits for those suffering from serious illnesses and post-hospitalisation rehabilitation services. |

|

Personal Accident Protection

The Personal Accident Comprehensive Protection Plan is also underwritten by BOCG Insurance which provides a maximum benefit of HK$4,000,000 for death or permanent total disablement resulting from an accident, and up to HK$50,000 for medical expenses protection. |

|

Travel Protection

With the "Greater Bay Area Travel Insurance Plan", underwritten by BOCF Insurance, whether you are travelling on vacation, for business or a short-term study trip in the Greater Bay Area other than Hong Kong, all-round travel protection will be provided to ensure a worry-free journey. |

Now the government offers an array of preferential policies, subsidies and financial incentives for start-ups in the Greater Bay Area. When many people think of starting a business, Shenzhen is always on the top one of their list. You can feel a strong entrepreneurial atmosphere in Shenzhen. There are numerous entrepreneurial incubators, such as Shenzhen Virtual University Park. In addition, various concessionary policy initiatives have been introduced by other municipal governments in the Greater Bay Area to provide entrepreneurial support to youths from Hong Kong and Macao who intend to start their business. Multiple innovation and entrepreneurial incubators have been set up including Haizhu Hong Kong Macao Youth Entrepreneurship Center in Guangzhou, Inno Valley HQ in Zhuhai, Guangdong Hong Kong Youth Entrepreneurship Incubator Base (Guancheng) in Dongguan, and Demonstration Base on Innovation and Entrepreneurship Base in Daya Bay in Haizhou.

The GBA Youth Card is launched by Bank of China (Hong Kong), in cooperation with the Greater Bay Area Homeland Youth Community Foundation, Guangdong Youth Federation, Hong Kong United Youth Association and Macao Youth Federation. It is a comprehensive youth service card that provides support and living convenience in the Greater Bay Area. The GBA Youth Card links all cardholders to YO PLACE youth services platform (www.yoplace.org.hk) and other youth associations, providing Hong Kong youths with information, professional consultation services and assistance in the GBA.

1. 5% Cash Rebate on spending in mainland China, Hong Kong and Macao.

2. Ride public transportation in the Greater Bay Area (Guangzhou/Shenzhen Metro) easily with a single swipe.

3. Enjoy exclusive mobile monthly plans offered by China Mobile Hong Kong and a free mainland China number.

4. Exclusive fuel products discount of up to HK$5/L at SINOPEC service stations in Hong Kong.

For Terms and Conditions, please visit: www.bochk.com/en/creditcard/details/cobrand/cobrand/gbayouth.html

| (Note 1) | China's Social Security System consists of five different kinds of mandatory insurance, in addition to a housing provident fund. The types of insurance are: pension, medical, work-related injury, unemployment and maternity. |

Reminder: To borrow or not to borrow? Borrow only if you can repay.

General offer Terms and Conditions:

The above products, services and promotional offers are subject to the relevant terms and conditions of Bank of China (Hong Kong) Limited ("BOCHK"). For more details, please contact BOCHK's staff. BOCHK reserves the right to amend, suspend or terminate the above products, services and offers, and amend their relevant terms and conditions at any time at its absolute discretion without prior notice. In case of any dispute, the decision of BOCHK shall be final. BOCHK reserves the right to approve and reject the loan application at its absolute discretion. The actual loan amount, interest rate, handling fee and applicable terms and conditions are subject to BOCHK's final approval. In case of any discrepancy between the Chinese and English versions, the Chinese version shall prevail.

Important Notes:

The above information is updated as of September 2021. This information guide is not intended to provide any advice and therefore anyone should not be relied on it in respective purpose. This information guide and its contents do not constitute and should not be construed as providing any professional advice, or an offer, solicitation or recommendation for any product or service. Part of the above information is derived from information provided by third parties, although such information is derived from the sources believed by BOCHK to be reliable, BOCHK has no representation as to the accuracy, completeness or correctness of the information or opinions provided above , guarantee or promise, and will not be liable for any loss caused by any person directly or indirectly using the above information or opinions (in whole or in part). The contents of this information guide may be updated at any time without prior notice. BOCHK expressly prohibits any quoting, reproduction or redistribution of this overview in any way (whether in whole or in part) without written permission. BOCHK shall not assume any legal responsibility for any consequences arising from such acts by third parties.