- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

BOC Cross-boundary Wealth Management Connect 2.0

New wealth management method helps you invest

in the Greater Bay Area ("GBA") unimpededly

in the Greater Bay Area ("GBA") unimpededly

“BOC Cross-boundary Wealth Management Connect 2.0” brings you a brand new cross-boundary wealth management experience in the GBA

Customers of “BOC Cross-boundary Wealth Management Connect” can enjoy exclusive Wealth Management services

All branches of BOCHK offer comprehensive and high quality financial services to you wholeheartedly!

The Northbound Scheme refers to an eligible Hong Kong investor opening a bank account with cross-boundary remittance function ("dedicated remittance account") in Hong Kong, opening an account on the Mainland in eligible banks on the Mainland with investment function ("dedicated investment account"), remitting funds through the dedicated remittance account in Hong Kong to the dedicated investment account on the Mainland via closed-loop management of funds flow between the accounts, and purchasing eligible wealth management products offered by the bank on the Mainland.

Eligible wealth management products in the Mainland under the Northbound Scheme

- Wealth Management ProductsPublic fixed income wealth management products and equity wealth management products issued by Mainland wealth management firms which are assessed by the issuers and Mainland distributing banks as products with risk rating of "R1" to "R3" (excluding wealth management products for the purpose of cash management)

- FundsPublic securities investment funds with risk rating "R1" to "R4" (excluding commodity futures funds)

- DepositsCNY deposits

Remarks

"Aggregate Quota": The cumulative net remittance to the Mainland through the Northbound Scheme should not exceed the aggregate quota of CNY 150 billion at any time.

"Northbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a securities firm for investment under Northbound Scheme, the individual investor quota allocated between the bank and the securities firm will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account, the daily remittance limit is CNY 3 million. Subject to our bank's Individual Investor Quota and the aggregate quota of the Northbound Scheme.

"Northbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a securities firm for investment under Northbound Scheme, the individual investor quota allocated between the bank and the securities firm will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account, the daily remittance limit is CNY 3 million. Subject to our bank's Individual Investor Quota and the aggregate quota of the Northbound Scheme.

Three simple steps to open Northbound Scheme dedicated accounts

- 1. Dedicated Remittance Account OpeningVisit any branch of BOCHK for qualification verification and open a “Northbound Scheme” dedicated remittance account

- 2. Dedicated Investment Account OpeningVisit the Bank of China (“BOC”) in the GBA to open a “Northbound Scheme” investment account in person. If you already have an account with BOC in the GBA, you can designate your existing account as the “Northbound Scheme” investment account through the mobile banking of BOC

- 3. Account PairingComplete pairing the dedicated remittance account and investment account**Note: The final result is subject to the SMS notification from BOC in the GBA

Eligible wealth management products in Hong Kong under the Southbound Scheme

- Funds#

- All "non-complex" funds that primarily invest in Great China equity

- "Non-complex" funds of "low" risk to "medium to high" risk, excluding high-yield bond funds and single emerging market equity funds

- Bonds/ Certificates of Deposit"Non-complex" bonds/ certificates of deposit of "low" risk to "medium" risk

- DepositsRMB, Hong Kong dollar and foreign currency deposits**Foreign currencies include US dollar, Euro, UK Pound Sterling, Australian dollar, New Zealand dollar, Canadian dollar, Swiss Franc, Japanese Yen and Singapore dollar.

- Structure investmentsPrincipal Protected Structured Investments guarantees your capital and minimum returns at maturity. Earn maximum potential returns if the linked currency exchange follows your prediction.

Please refer to the "Important Facts Statement" for details.

Remarks

"Aggregate Quota": The cumulative net remittance to Hong Kong and Macao through the Southbound Scheme should not exceeds the aggregate quota of CNY 150 billion at any time.

"Southbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account. The daily remittance limit is CNY 3 million.

"Southbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account. The daily remittance limit is CNY 3 million.

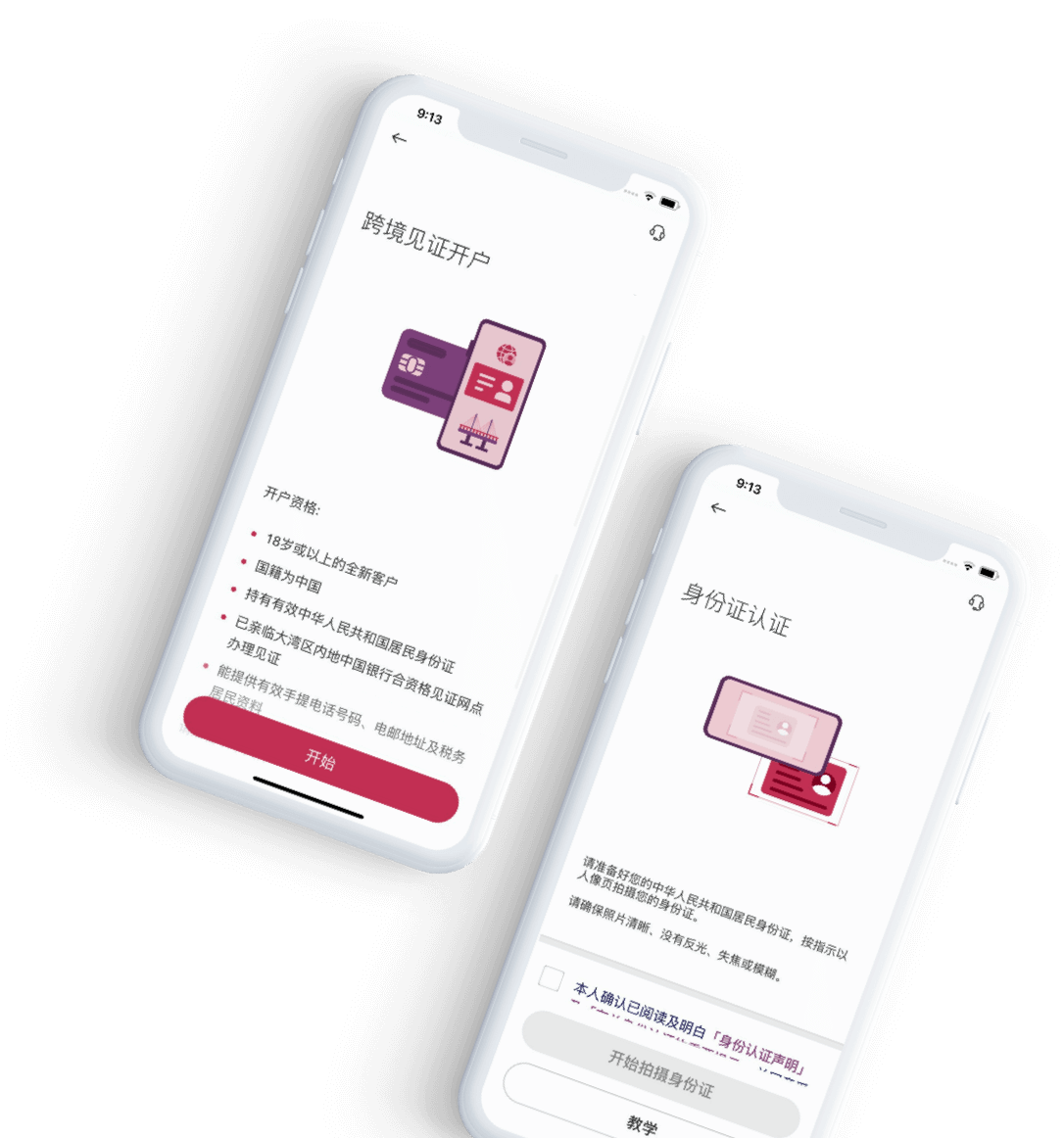

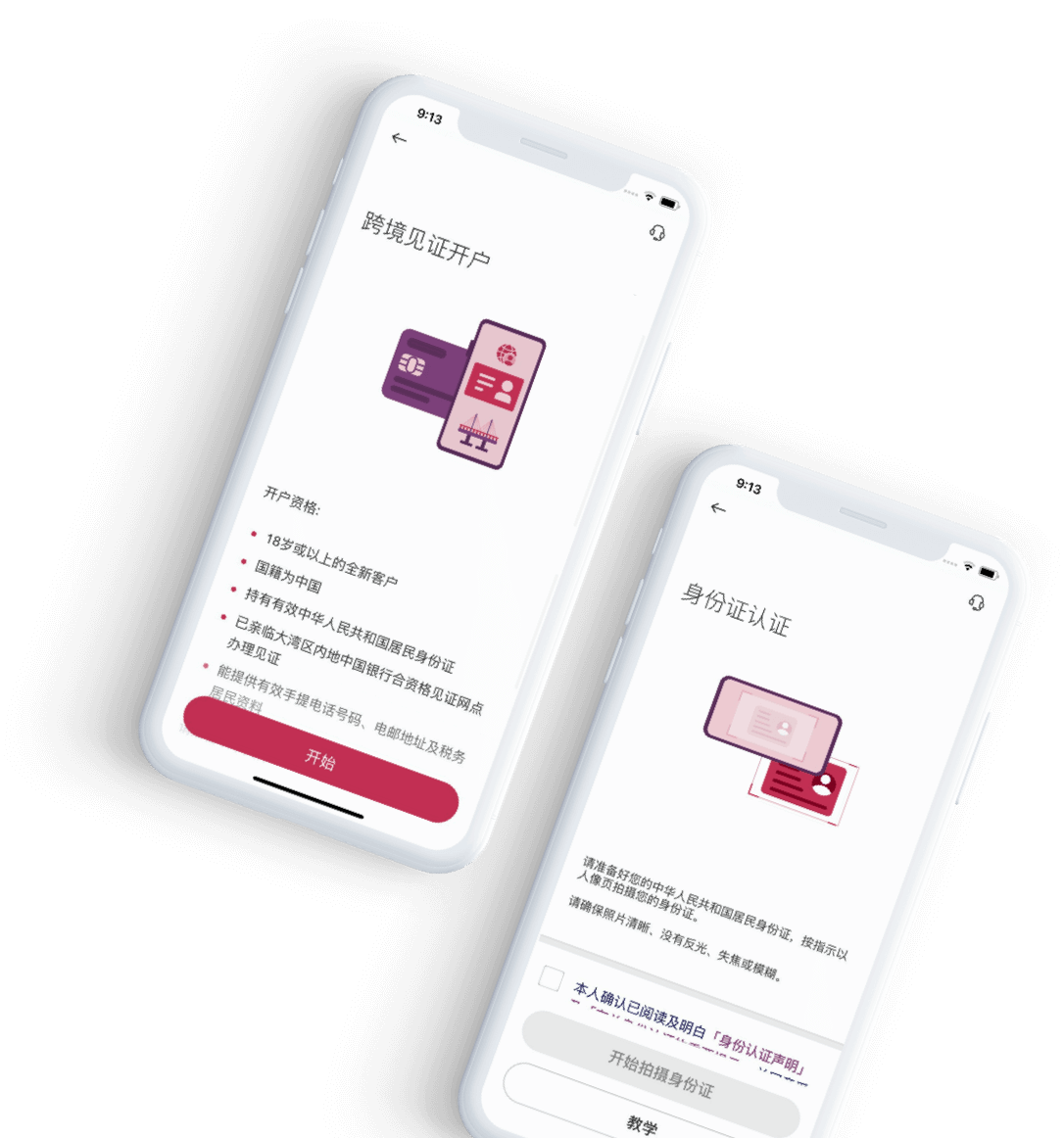

The launch of E-Application for Cross-border Account Opening via Attestation Service

Two simple steps to open Southbound Scheme dedicated accounts

After completing the investor qualification verification at designated BOC branches, you can simply download the BOCHK Mobile App at home to submit the account opening application and complete the rest of the account opening procedures!

- Step 1Dedicated Remittance Account Opening (Mainland)Visit designated Bank of China Greater Bay Area attesting network in person for investor qualification verification, you can open a new account or designate an existing mainland account as the “Southbound Scheme” remittance account

Designated Bank of China Greater Bay Area attesting network - Step 2Dedicated Investment Account Opening and Pairing (Hong Kong)You can open a Southbound Scheme dedicated investment account and pair it with the dedicated remittance account by one of the following ways shown below

- Apply for account opening via BOCHK Mobile App

- Enjoy the attestation service for account opening by visiting the Greater Bay Area BOC branch in mainland

- Apply for account opening by visiting any BOCHK branches

Seize investment opportunities remotely

Register to Receive Information on the Investment Products under the Southbound Wealth Management Connect Scheme ("SWMC")

You can register to receive product information under the SWMC through the "Information Setting for Cross-Boundary Wealth Management Connect" function under the "Wealth Management Connect" section of BOCHK Mobile Banking or Internet Banking. Once you have successfully registered, BOCHK can remotely introduce suitable SWMC investment products to you. You will also receive market updates, such as research reports, and enjoy flexible, personalised investment information and services through multiple channels from time to time. This helps you make the most of new investment opportunities.

1

Login to BOCHK Mobile Banking/Internet Banking

2

Click "Wealth Management Connect"

3

Enable the "Information Setting for Cross-Boundary Wealth Management Connect" function to complete the registration

Eligible wealth management products in the Mainland under the Northbound Scheme

- Wealth Management ProductsPublic fixed income wealth management products and equity wealth management products issued by Mainland wealth management firms which are assessed by the issuers and Mainland distributing banks as products with risk rating of "R1" to "R3" (excluding wealth management products for the purpose of cash management)

- FundsPublic securities investment funds with risk rating "R1" to "R4" (excluding commodity futures funds)

- DepositsCNY deposits

Remarks

"Aggregate Quota": The cumulative net remittance to the Mainland through the Northbound Scheme should not exceed the aggregate quota of CNY 150 billion at any time.

"Northbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a securities firm for investment under Northbound Scheme, the individual investor quota allocated between the bank and the securities firm will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account, the daily remittance limit is CNY 3 million. Subject to our bank's Individual Investor Quota and the aggregate quota of the Northbound Scheme.

"Northbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a securities firm for investment under Northbound Scheme, the individual investor quota allocated between the bank and the securities firm will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account, the daily remittance limit is CNY 3 million. Subject to our bank's Individual Investor Quota and the aggregate quota of the Northbound Scheme.

Three simple steps to open Northbound Scheme dedicated accounts

- 1. Dedicated Remittance Account OpeningVisit any branch of BOCHK for qualification verification and open a “Northbound Scheme” dedicated remittance account

- 2. Dedicated Investment Account OpeningVisit the Bank of China (“BOC”) in the GBA to open a “Northbound Scheme” investment account in person. If you already have an account with BOC in the GBA, you can designate your existing account as the “Northbound Scheme” investment account through the mobile banking of BOC

- 3. Account PairingComplete pairing the dedicated remittance account and investment account**Note: The final result is subject to the SMS notification from BOC in the GBA

Eligible wealth management products in Hong Kong under the Southbound Scheme

- Funds#

- All "non-complex" funds that primarily invest in Great China equity

- "Non-complex" funds of "low" risk to "medium to high" risk, excluding high-yield bond funds and single emerging market equity funds

- Bonds/ Certificates of Deposit"Non-complex" bonds/ certificates of deposit of "low" risk to "medium" risk

- DepositsRMB, Hong Kong dollar and foreign currency deposits**Foreign currencies include US dollar, Euro, UK Pound Sterling, Australian dollar, New Zealand dollar, Canadian dollar, Swiss Franc, Japanese Yen and Singapore dollar.

- Structure investmentsPrincipal Protected Structured Investments guarantees your capital and minimum returns at maturity. Earn maximum potential returns if the linked currency exchange follows your prediction.

Please refer to the "Important Facts Statement" for details.

Remarks

"Aggregate Quota": The cumulative net remittance to Hong Kong and Macao through the Southbound Scheme should not exceeds the aggregate quota of CNY 150 billion at any time.

"Southbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account. The daily remittance limit is CNY 3 million.

"Southbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account. The daily remittance limit is CNY 3 million.

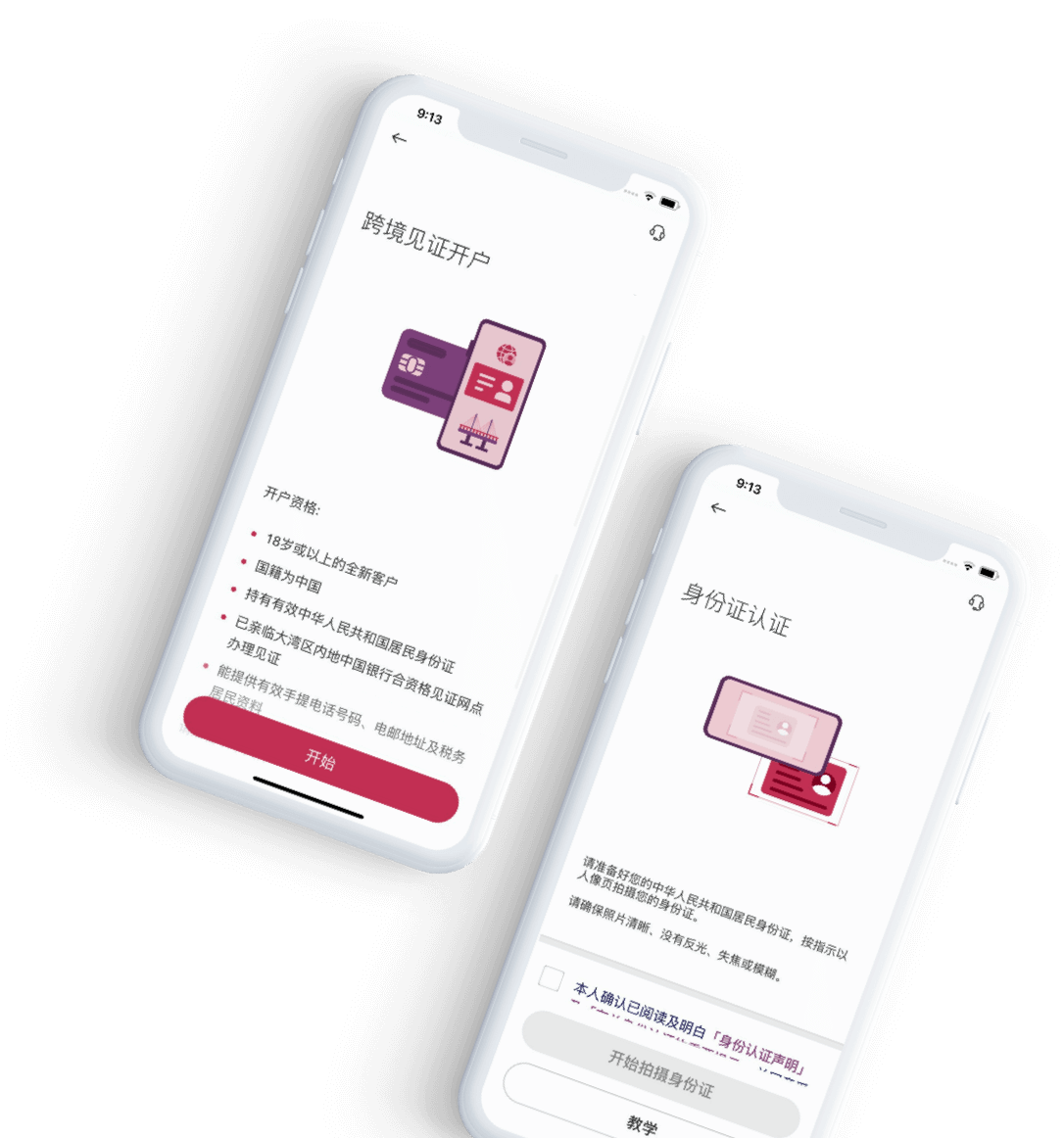

The launch of E-Application for Cross-border Account Opening via Attestation Service

Two simple steps to open Southbound Scheme dedicated accounts

After completing the investor qualification verification at designated BOC branches, you can simply download the BOCHK Mobile App at home to submit the account opening application and complete the rest of the account opening procedures!

- Step 1Dedicated Remittance Account Opening (Mainland)Visit designated Bank of China Greater Bay Area attesting network in person for investor qualification verification, you can open a new account or designate an existing mainland account as the “Southbound Scheme” remittance account

Designated Bank of China Greater Bay Area attesting network - Step 2Dedicated Investment Account Opening and Pairing (Hong Kong)You can open a Southbound Scheme dedicated investment account and pair it with the dedicated remittance account by one of the following ways shown below

- Apply for account opening via BOCHK Mobile App

- Enjoy the attestation service for account opening by visiting the Greater Bay Area BOC branch in mainland

- Apply for account opening by visiting any BOCHK branches

Seize investment opportunities remotely

Register to Receive Information on the Investment Products under the Southbound Wealth Management Connect Scheme ("SWMC")

You can register to receive product information under the SWMC through the "Information Setting for Cross-Boundary Wealth Management Connect" function under the "Wealth Management Connect" section of BOCHK Mobile Banking or Internet Banking. Once you have successfully registered, BOCHK can remotely introduce suitable SWMC investment products to you. You will also receive market updates, such as research reports, and enjoy flexible, personalised investment information and services through multiple channels from time to time. This helps you make the most of new investment opportunities.

1

Login to BOCHK Mobile Banking/Internet Banking

2

Click "Wealth Management Connect"

3

Enable the "Information Setting for Cross-Boundary Wealth Management Connect" function to complete the registration

Eligible wealth management products in the Mainland under the Northbound Scheme

- Wealth Management ProductsPublic fixed income wealth management products and equity wealth management products issued by Mainland wealth management firms which are assessed by the issuers and Mainland distributing banks as products with risk rating of "R1" to "R3" (excluding wealth management products for the purpose of cash management)

- FundsPublic securities investment funds with risk rating "R1" to "R4" (excluding commodity futures funds)

- DepositsCNY deposits

Remarks

"Aggregate Quota": The cumulative net remittance to the Mainland through the Northbound Scheme should not exceed the aggregate quota of CNY 150 billion at any time.

"Northbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a securities firm for investment under Northbound Scheme, the individual investor quota allocated between the bank and the securities firm will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account, the daily remittance limit is CNY 3 million. Subject to our bank's Individual Investor Quota and the aggregate quota of the Northbound Scheme.

"Northbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a securities firm for investment under Northbound Scheme, the individual investor quota allocated between the bank and the securities firm will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account, the daily remittance limit is CNY 3 million. Subject to our bank's Individual Investor Quota and the aggregate quota of the Northbound Scheme.

Three simple steps to open Northbound Scheme dedicated accounts

- 1. Dedicated Remittance Account OpeningVisit any branch of BOCHK for qualification verification and open a “Northbound Scheme” dedicated remittance account

- 2. Dedicated Investment Account OpeningVisit the Bank of China (“BOC”) in the GBA to open a “Northbound Scheme” investment account in person. If you already have an account with BOC in the GBA, you can designate your existing account as the “Northbound Scheme” investment account through the mobile banking of BOC

- 3. Account PairingComplete pairing the dedicated remittance account and investment account**Note: The final result is subject to the SMS notification from BOC in the GBA

Eligible wealth management products in Hong Kong under the Southbound Scheme

- Funds#

- All "non-complex" funds that primarily invest in Great China equity

- "Non-complex" funds of "low" risk to "medium to high" risk, excluding high-yield bond funds and single emerging market equity funds

- Bonds/ Certificates of Deposit"Non-complex" bonds/ certificates of deposit of "low" risk to "medium" risk

- DepositsRMB, Hong Kong dollar and foreign currency deposits**Foreign currencies include US dollar, Euro, UK Pound Sterling, Australian dollar, New Zealand dollar, Canadian dollar, Swiss Franc, Japanese Yen and Singapore dollar.

- Structure investmentsPrincipal Protected Structured Investments guarantees your capital and minimum returns at maturity. Earn maximum potential returns if the linked currency exchange follows your prediction.

Please refer to the "Important Facts Statement" for details.

Remarks

"Aggregate Quota": The cumulative net remittance to Hong Kong and Macao through the Southbound Scheme should not exceeds the aggregate quota of CNY 150 billion at any time.

"Southbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account. The daily remittance limit is CNY 3 million.

"Southbound Scheme Individual Investor Quota": The individual investor quota for each investor is CNY 3 million. If the investor simultaneously selects both a bank and a licensed corporation for investment under Southbound Scheme, the individual investor quota allocated between the bank and the licensed corporation will be CNY 1.5 million each.

"WMC Daily Remittance Limit": Only applies to WMC beneficiary account. The daily remittance limit is CNY 3 million.

The launch of E-Application for Cross-border Account Opening via Attestation Service

Two simple steps to open Southbound Scheme dedicated accounts

After completing the investor qualification verification at designated BOC branches, you can simply download the BOCHK Mobile App at home to submit the account opening application and complete the rest of the account opening procedures!

- Step 1Dedicated Remittance Account Opening (Mainland)Visit designated Bank of China Greater Bay Area attesting network in person for investor qualification verification, you can open a new account or designate an existing mainland account as the “Southbound Scheme” remittance account

Designated Bank of China Greater Bay Area attesting network - Step 2Dedicated Investment Account Opening and Pairing (Hong Kong)You can open a Southbound Scheme dedicated investment account and pair it with the dedicated remittance account by one of the following ways shown below

- Apply for account opening via BOCHK Mobile App

- Enjoy the attestation service for account opening by visiting the Greater Bay Area BOC branch in mainland

- Apply for account opening by visiting any BOCHK branches

Seize investment opportunities remotely

Register to Receive Information on the Investment Products under the Southbound Wealth Management Connect Scheme ("SWMC")

You can register to receive product information under the SWMC through the "Information Setting for Cross-Boundary Wealth Management Connect" function under the "Wealth Management Connect" section of BOCHK Mobile Banking or Internet Banking. Once you have successfully registered, BOCHK can remotely introduce suitable SWMC investment products to you. You will also receive market updates, such as research reports, and enjoy flexible, personalised investment information and services through multiple channels from time to time. This helps you make the most of new investment opportunities.

1

Login to BOCHK Mobile Banking/Internet Banking

2

Click "Wealth Management Connect"

3

Enable the "Information Setting for Cross-Boundary Wealth Management Connect" function to complete the registration

The above products and services are subject to relevant terms and conditions.

Online Appointment for

BOC Cross-boundary Wealth Management

Connect 2.0 Account Opening

BOC Cross-boundary Wealth Management

Connect 2.0 Account Opening

Contact Us

For inquiries about products or services of Bank of China in the Mainland, please contact Bank of China Customer Service Hotline: +86 10 95566; or Visit the Website: Bank of China (Mainland) website. For more details on “BOC Cross-boundary Wealth Management Connect”, contact us by

Mobile Banking

Tap the Chat on BOCHK Mobile Banking to connect with our "Online Chat" which is available 24/7

Chat on BOCHK Mobile Banking to connect with our "Online Chat" which is available 24/7

Dedicated hotline for "BOC Cross-boundary Wealth Management Connect"

+852 2278 3368

for Hong Kong customers

+86 400 800 2388

for Mainland customers

for Hong Kong customers

+86 400 800 2388

for Mainland customers

WeChat Official Account

Get to know more about the market trend and cross-border service information through our WeChat Official Account by searching and following “BOCHK-Banking”

"RM Chat"

Contact your dedicated Relationship Manager and service team (for eligible customers only)

#Remarks: All registered and established in Hong Kong and have obtained recognition from the Securities and Futures Commission of Hong Kong

The above information is prepared by Bank of China (Hong Kong) Limited (BOCHK) based on the latest information provided by the regulatory authorities and is for reference only. The relevant content does not constitute any offer, solicitation, suggestion, opinion or any guarantee for any individual to buy or sell, be invited to subscribe or transact any particular products or services; nor does it constitute BOCHK’s active marketing of “Cross-boundary Wealth Management Connect” to the public outside Hong Kong. Investment products offered by BOC in the Mainland in the GBA have not been authorized by the SFC. Investment involves risks.

The above information is prepared by Bank of China (Hong Kong) Limited (BOCHK) based on the latest information provided by the regulatory authorities and is for reference only. The relevant content does not constitute any offer, solicitation, suggestion, opinion or any guarantee for any individual to buy or sell, be invited to subscribe or transact any particular products or services; nor does it constitute BOCHK’s active marketing of “Cross-boundary Wealth Management Connect” to the public outside Hong Kong. Investment products offered by BOC in the Mainland in the GBA have not been authorized by the SFC. Investment involves risks.

The following Risk Disclosure Statement may not disclose all the risks involved. You should undertake your own research and study before you trade or invest. You should carefully consider whether trading or investment is suitable in light of your own financial position and investment objectives.

Risk Disclosure Statement of Fund

The above information is for reference only. This webpage does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services mentioned in this webpage are not equivalent to, nor should it be treated as a substitute for, time deposit. Although investment may bring profit opportunities, each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment products may not be the same as expected by you. Your fund may increase or reduce due to the purchase or sale of investment products. The value of investment funds may go up as well as down and the investment funds may become valueless. Therefore, you may not receive any return from investment funds. Part of your investment may not be able to liquidate immediately under certain market situation. The investment decision is yours but you should not invest in these products unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives. Before making any investment decisions, you should consider your own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. Investment involves risks. Please refer to the relevant fund offering documents for further details including risk factors. If you have any inquiries on this Risk Disclosure Statement or the nature and risks involved in trading or funds etc, you should seek advice from independent financial adviser.Risk Disclosure Statement of Bond/ Certificates of deposit

Investing in bonds/certificates of deposit involves significant risks. The following risk disclosure statements are not exhaustive and do not take into account your personal circumstances not disclosed to Bank of China (Hong Kong) Limited, you should take your own independent review and seek independent professional advice, if necessary, on whether an investment in bonds/certificates of deposit is suitable for you in light of your risk appetite, financial situation, investment experience, investment objectives and investment horizon. The above information is for reference only. This document does not constitute any offer, solicitation, recommendation, comment or any guarantee to the purchase or sale of any investment products or services. The investment products or services mentioned in this document are not equivalent to, nor should it be treated as a substitute for, time deposit. Although investment may bring profit opportunities, each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment products may not be the same as expected by customers. Customers’ fund may increase or reduce due to the purchase or sale of investment products. The loss incurred from investment maybe the same or greater than initial investment amount, proceeds may also change accordingly. Part of the investment may not be able to liquidate immediately under certain market situation. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice. The investment decision is yours but you should not invest in these products unless the intermediary who sells them to you has explained to you that these products are suitable for you having regard to your financial situation, investment experience and investment objectives. Before making any investment decisions, customers should consider their own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. For the nature and risk disclosures of individual investment products, customers should read carefully the relevant offering documents for details. Customers should seek advice from independent financial adviser.Risk of bonds/certificates of deposit trading

The prices of bonds/certificates of deposit fluctuate, sometimes dramatically. The price of a bond/certificate of deposit may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling bonds/certificates of deposit.This document is issued by Bank of China (Hong Kong) Limited. The contents of this document have not been reviewed by the Securities and Futures Commission in Hong Kong.

Key Risk Disclosures

- Investment risk: The prices of bonds/certificates of deposit may go up and down and may be volatile. The bonds/certificates of deposit may even become worthless. Buying and selling bonds/certificates of deposit may not necessarily result in any profit, and may sometimes result in loss.

- Issuer / Guarantor credit risk: The return on bonds/certificates of deposit is linked to the credit of the Issuer and Guarantor, as applicable. The credit ratings assigned by credit rating agencies do not guarantee the creditworthiness of the Issuer and Guarantor, as applicable. In the event that the Issuer defaults, it is possible that you may lose all your investment, including the principal.

- To be distinguished from savings or time deposits: The bonds/certificates of deposit are an investment product and are not equivalent to a time deposit, and are unsecured and are not guaranteed (if there is no guarantor). The bonds/certificates of deposit are not protected deposits under the Deposit Protection Scheme in Hong Kong. The bonds/certificates of deposit are not principal-protected. The investment in bonds/certificates of deposit involve risks not associated with regular bank deposits and should not be regarded as a substitute for regular savings or time deposit.

- To be distinguished from savings or time deposits: The bonds/certificates of deposit are an investment product and are not equivalent to a time deposit, and are unsecured and are not guaranteed (if there is no guarantor). The bonds/certificates of deposit are not protected deposits under the Deposit Protection Scheme in Hong Kong. The bonds/certificates of deposit are not principal-protected. The investment in bonds/certificates of deposit involve risks not associated with regular bank deposits and should not be regarded as a substitute for regular savings or time deposit.

- Interest rate risk: Changes in interest rates may have a significant impact on the market price of the bonds/certificates of deposit. For example, bond/certificate of deposit prices generally fall when interest rates rise - In this situation, you may incur a loss from the decrease in market price of the bonds/certificates of deposit if you sell the bonds/certificates of deposit before the final maturity date.

- Currency risk: For bonds/certificates of deposit not denominated in your home currency, if the currency in which the bonds/certificates of deposit are denominated depreciates against your home currency during your holding period, and if calculated and settled in your home currency, exchange rate fluctuations may have an adverse impact on, and the potential loss may offset (or even exceed) , the investment return.

- Tenor risk: The bonds/certificates of deposit have a specified investment period. The longer the investment period of the bonds/certificates of deposit, the more likely changes in interest rates, exchange rates, market environments and the Issuer’s financial and operating conditions may affect the bond/certificate of deposit value during the investment period. Your actual return (if any) may be substantially lower than expected and you may even suffer losses.

- Liquidity risk: The bonds/certificates of deposit are designed to be held to maturity and there may be no active secondary market quotations for the bonds/certificates of deposit. If you try to sell your bonds/certificates of deposit before maturity, it may be difficult or impossible to find a buyer, or the sale price may be much lower than the amount you had invested. You may suffer a loss if you sell your bonds/certificates of deposit before maturity.

- RMB Conversion Limitation Risk: RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

(Only applicable to Individual Customers) RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

(Only applicable to Corporate Customers) RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance. - Emerging Market Risk: Investing in emerging markets involves certain risks and special considerations not typically associated with investing in other more established economies or securities markets. Such emerging markets may lack the social, political or economic stability. Exposure to these markets may entail more volatility than investments in more established markets. (Applicable for RMB Bonds/Certificates of Deposit)

- Other risks: There may be other risks associated with the investment of each particular bond/certificate of deposit which are not mentioned above, please refer to each individual Term Sheet for details.

Risk Disclosure Statement of structured investments

Not a time deposit - Structured Investments is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

Derivatives risk - Structured Investments is embedded with a European digital currency option which can only be exercised on the final fixing date if the specified condition for exercise is satisfied, in which case you may either receive the interest amount calculated at a higher interest rate, or otherwise, you will receive the interest amount calculated at a lower interest rate. The interest amount is therefore unknown in advance.

Limited potential gain - The maximum potential gain is limited to the interest amount calculated at the higher interest rate as prescribed in the term sheet of this product.

Principal protection at maturity only - The principal protection feature is only applicable if the Structured Investments is held to maturity.

Not the same as buying any currency of the currency pair - Investing in Structured Investments is not the same as buying any currency of the currency pair directly.

Market risk - The return on Structured Investments is dependent on movements in the exchange rate of the currency pair. Currency exchange rates may move rapidly and are affected by a number of factors including, national and international financial, economic, political and other conditions and events and may also be subject to intervention by central banks and other bodies.

Liquidity risk - Structured Investments is designed to be held till maturity. Once the transaction for this product is confirmed, you will not be allowed to early withdraw or terminate or transfer any or all of your investment before maturity.

Credit risk of the Bank - Structured Investments is not secured by any collateral. If you invest in this product, you will be taking the credit risk of the Bank. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your principal amount and the potential interest amount.

Currency risk - If the investment currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you should note that exchange rate fluctuations may have an adverse impact on, and the potential loss may offset (or even exceed), the potential return of the product.

RMB Conversion Limitation Risk - RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

(Only applicable to Individual Customers) RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

(Only applicable to Corporate Customers) RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

Emerging markets - Investments in emerging markets are more sensitive to social, political or economic development in the region. than those in developed markets, and subject to risk such as market suspension, restrictions on foreign investment and control or repatriation of capital. There are also possibilities of nationalisation, expropriation or confiscatory taxation, foreign exchange control, political changes, government regulation, social instability or diplomatic developments which could adversely affect the economics of the emerging markets or the value of your investment.

No secondary market - Structured Investments is not a listed security. There is no secondary market for you to sell the Structured Investments prior to its maturity.

Potential conflict of interest - Although the Bank will act in good faith and in a commercially reasonable manner in making determinations and calculations with respect to the Product, the Bank may encounter conflict of interest arising out of the activities of the Bank and/or any of its affiliates (collectively, the “BOC Group Entities”).The BOC Group Entities may engage in transactions involving or affecting the underlying exchange rate for its proprietary accounts and/or for the accounts of others and/or to hedge against the market risk associated with the Product. These transactions may positively or adversely affect the movements in the underlying exchange rate and thus the return of the Product. None of the BOC Group Entities is under any obligation to avoid or disclose any of the above conflicts.

Not covered by Investor Compensation Fund - Structured Investments is not covered by the Hong Kong Investor Compensation Fund.

Not a time deposit - Structured Investments is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

Derivatives risk - Structured Investments is embedded with a European digital currency option which can only be exercised on the final fixing date if the specified condition for exercise is satisfied, in which case you may either receive the interest amount calculated at a higher interest rate, or otherwise, you will receive the interest amount calculated at a lower interest rate. The interest amount is therefore unknown in advance.

Limited potential gain - The maximum potential gain is limited to the interest amount calculated at the higher interest rate as prescribed in the term sheet of this product.

Principal protection at maturity only - The principal protection feature is only applicable if the Structured Investments is held to maturity.

Not the same as buying any currency of the currency pair - Investing in Structured Investments is not the same as buying any currency of the currency pair directly.

Market risk - The return on Structured Investments is dependent on movements in the exchange rate of the currency pair. Currency exchange rates may move rapidly and are affected by a number of factors including, national and international financial, economic, political and other conditions and events and may also be subject to intervention by central banks and other bodies.

Liquidity risk - Structured Investments is designed to be held till maturity. Once the transaction for this product is confirmed, you will not be allowed to early withdraw or terminate or transfer any or all of your investment before maturity.

Credit risk of the Bank - Structured Investments is not secured by any collateral. If you invest in this product, you will be taking the credit risk of the Bank. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your principal amount and the potential interest amount.

Currency risk - If the investment currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you should note that exchange rate fluctuations may have an adverse impact on, and the potential loss may offset (or even exceed), the potential return of the product.

RMB Conversion Limitation Risk - RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

(Only applicable to Individual Customers) RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

(Only applicable to Corporate Customers) RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

Emerging markets - Investments in emerging markets are more sensitive to social, political or economic development in the region. than those in developed markets, and subject to risk such as market suspension, restrictions on foreign investment and control or repatriation of capital. There are also possibilities of nationalisation, expropriation or confiscatory taxation, foreign exchange control, political changes, government regulation, social instability or diplomatic developments which could adversely affect the economics of the emerging markets or the value of your investment.

No secondary market - Structured Investments is not a listed security. There is no secondary market for you to sell the Structured Investments prior to its maturity.

Potential conflict of interest - Although the Bank will act in good faith and in a commercially reasonable manner in making determinations and calculations with respect to the Product, the Bank may encounter conflict of interest arising out of the activities of the Bank and/or any of its affiliates (collectively, the “BOC Group Entities”).The BOC Group Entities may engage in transactions involving or affecting the underlying exchange rate for its proprietary accounts and/or for the accounts of others and/or to hedge against the market risk associated with the Product. These transactions may positively or adversely affect the movements in the underlying exchange rate and thus the return of the Product. None of the BOC Group Entities is under any obligation to avoid or disclose any of the above conflicts.

Not covered by Investor Compensation Fund - Structured Investments is not covered by the Hong Kong Investor Compensation Fund.

Risk of Foreign Currency Trading

Foreign currency investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currency may result in losses in the event that customer converts the foreign currency into Hong Kong dollar or other foreign currencies. Currency exchange is also subject to cost (being the spread between the buy and sell of relevant currencies).RMB Conversion Limitation Risk

RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies. Currency exchange is also subject to cost (being the spread between the buy and sell of RMB). RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.The above products, services and offers are subject to terms and conditions.

Corporate Banking

© 2026 BANK OF CHINA (HONG KONG) LIMITED.

ALL RIGHTS RESERVED.

Make an Appointment for Account Opening

Bank of China (Mainland) website

Redirecting you to Bank of China (Mainland) website for inquiries about Products and services of Bank of China in the mainland. Please kindly be reminded that this website not being operated by Bank of China (Hong Kong). And investment products offered by the Mainland partner bank have not been authorized by the SFC and the relevant offering documents have not been examined by the SFC, and that investors should exercise caution in relation to such offer. For further inquiries please contact Bank of China Customer Service Hotline: +86 10 95566.

Close

Close