Kick start your financial journey in just a few steps with

“Banking TrendyToo”!

From now until 31 March 2026 (“Promotion Period”),

earn interests from new account opening, and enjoy exclusive

rewards from

daily spending, stock trading, to new payroll account opening!

HKD Time Deposit Interest Rate 4.8%

Within the promotion period, open an account via BOCHK Mobile Banking App, and input promotion code “BBANEWHKD” to enjoy one-month HKD Time Deposit Interest Rate of up to 4.8% p.a.!

The preferential time deposit interest rate in this promotion material is quoted based on the interest rates of Hong Kong Dollars published on 1 January 2026 by BOCHK and is for reference only. The preferential interest rate is a one-off privilege for each time deposit and the subsequent renewal rates of time deposits will be subject to the quotes by BOCHK from time to time.

Chill Card

Extra HK$168 limited-time cash rebate for “Banking TrendyToo” Customers. Get up to HK$668 cash rebate!

Monthly Stocks Savings Plan

Enjoy year-round $0 transaction fee. Settle the contribution payment by BOC Credit Card to earn gift points.

Reward 1

Banking TrendyToo Customer Smart Saving Deposits preferential HKD savings interest rate offer 2%

From 17 February 2026 to 20 March, new Banking TrendyToo customer* can enjoy Smart Saving Deposits preferential HKD savings interest rate offer 2%

*Applicable to aged 18 and 40 (aged 18 and 40 inclusive) and successfully opened “Enrich” or “iFree” Banking services within the Promotion Period; and do not hold any BOCHK single name / joint name / corporate savings, current, loan accounts or safe deposit boxes within 6 months prior to 17 Feb 2026.

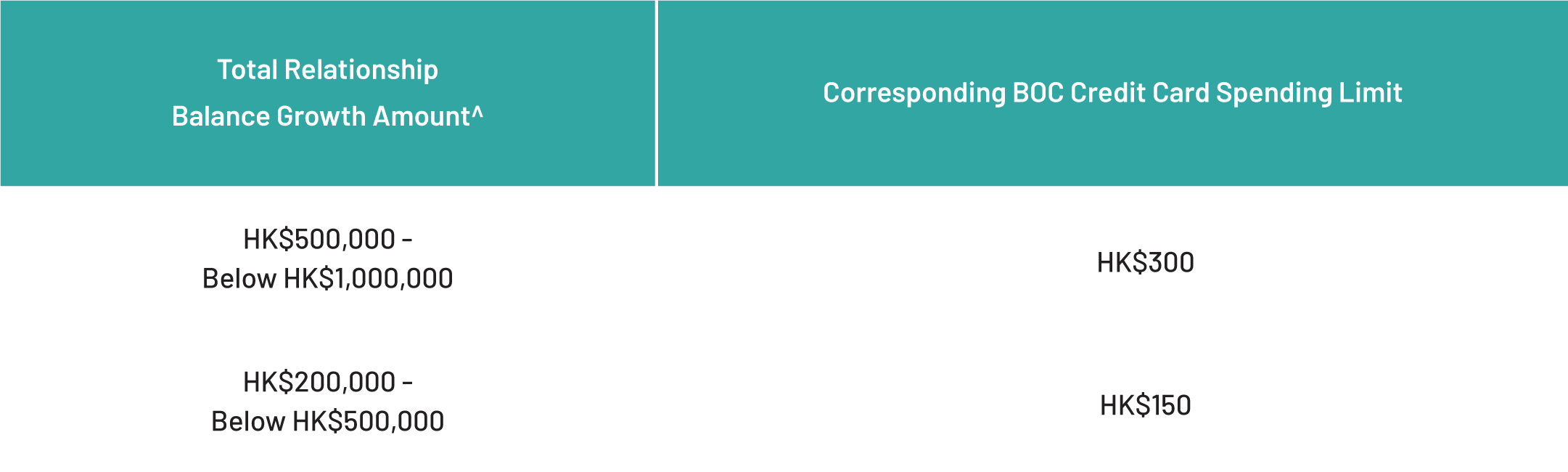

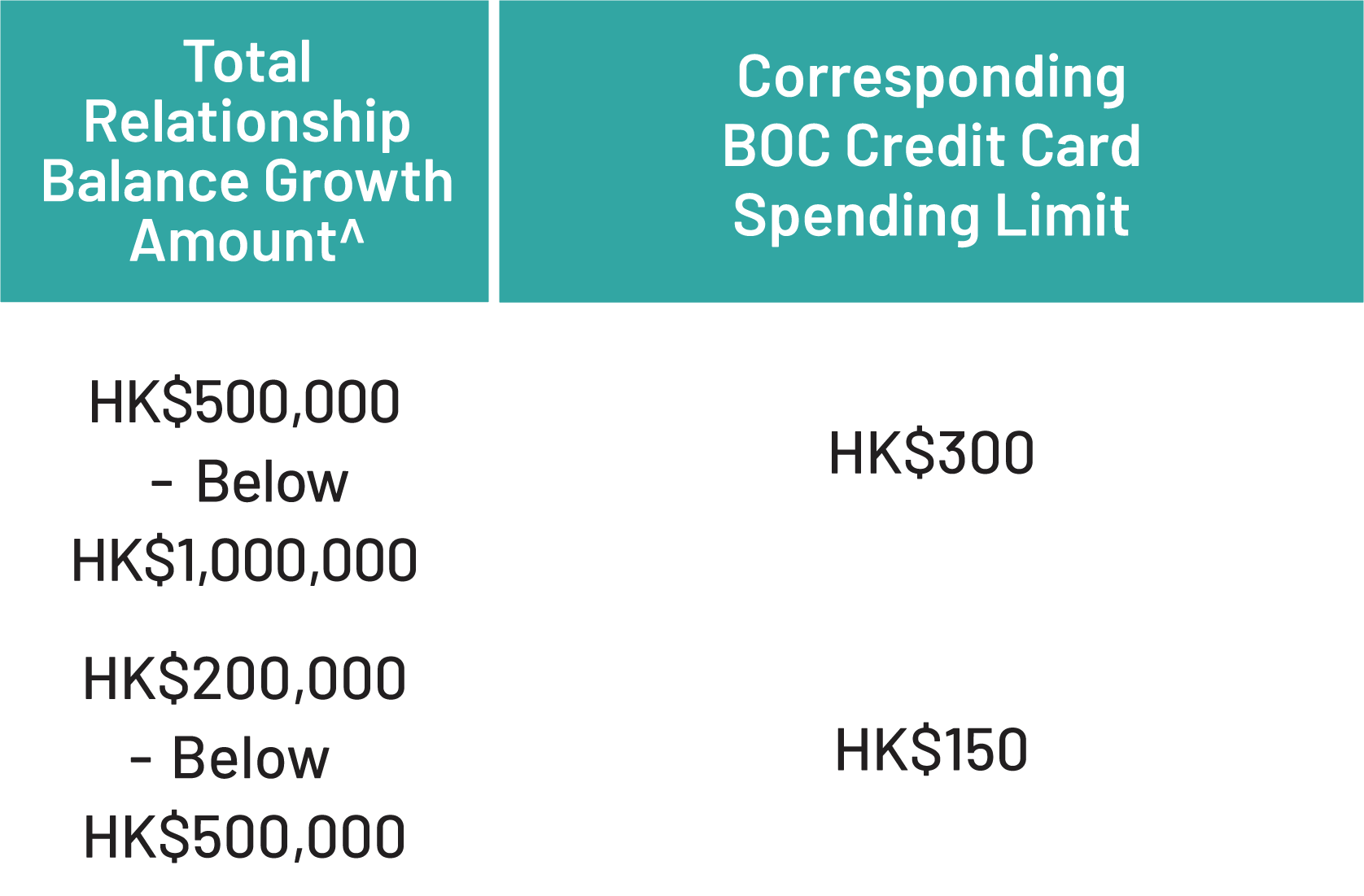

Reward 2

Total Relationship Balance Growth Reward

Customers who have newly taken up or upgraded to Enrich

Banking during the promotion period and fulfill designated

requirements below1,2

^ Comparing the next month’s Total Relationship

Balance after successful account opening or upgrading month

to the Total Relationship Balance of December 2025

1 Prior to 31 March 2026, customers have to

maintain a valid BOCHK Mobile Banking account; and a valid

“Questionnaire on Investment Preference” or complete

“Financial Needs Analysis”.

2 Achieve the following designated amount of

“Total Relationship Balance” growth in the next month after

successful designated account opening / upgrading, and

maintain the designated amount of “Total Relationship

Balance” growth for the subsequent 3 months upon the

successful designated account opening / upgrading month.

BoC Pay+, a must-have for

“Payment Masters”!

You can settle payments, manage credit cards and enjoy Gift Points Rewards in the app! New BoC Pay+ customer* can enjoy a HK$50 Welcome Rewards! Download BoC Pay+ now to enjoy 12% off Gift Points Reward, Bill Payment Rewards and more merchant discounts!

SVF License Number: SVFB072

*Including newly registered and existing customers who upgrade from BoC Pay to BoC Pay+

Eligible customers who successfully refer friends and family members aged 18-40 to open “Wealth Management” / “Enrich Banking” / “i-Free Banking” (“Banking Trendytoo” customers) accounts, and meet all of the conditions can enjoy cash rewards up to HK$3,450*!

Referral Steps:

#“Wealth Management” / “Enrich Banking” / “i-Free Banking” referees are required to be aged 18-40 on the day of account opening (aged 18-40 inclusive), and has not cancelled personal banking or services in BOCHK in the past 6 months prior to 1 January 2026

Reminder: Quota of this promotion is limited, first come first served and available while the quota last

Reminder: To borrow or not to borrow? Borrow only if you can

repay!

Investment and FX trading involve risks and buy-sell

spread. The above products, services and offers are subject to

the relevant terms and conditions.

These Terms and

Conditions will be available for download and store in the BOCHK

website within 30 days of submission of account opening request

or transaction instruction. Such information may not be

available for viewing or downloading after said specified

timeframe.

Terms of the Promotion Offers and

General Terms and Risk

Disclosure (2025 Fourth

Quarter)

Risk Disclosure:

The following risk disclosure statements cannot disclose all the

risks involved and does not take into account any personal

circumstances unknown to BOCHK. You should carefully consider

whether trading or investment is suitable in light of your own

risk tolerance, financial situation, investment experience,

investment objectives, investment horizon and investment

knowledge. You should undertake your own independent review and

seek independent professional advice before you trade or invest

especially if you are uncertain of or have not understood any

aspect of the following risk disclosure statements or the nature

and risks involved in trading or investment.

Risk disclosure of Fund:

Fund products or services are not equivalent to, nor should it

be treated as a substitute for, time deposit. Although

investment may bring profit opportunities, each investment

product or service involves potential risks. Due to dynamic

changes in the market, the price movement and volatility of

investment products may not be the same as expected by you. Your

fund may increase or reduce due to the purchase or sale of

investment products. The value of investment funds may go up as

well as down and the investment funds may become valueless.

Therefore, you may not receive any return from investment funds.

Part of your investment may not be able to liquidate immediately

under certain market situation. The investment decision is yours

but you should not invest in these products unless the

intermediary who sells them to you has explained to you that

these products are suitable for you having regard to your

financial situation, investment experience and investment

objectives. Before making any investment decisions, you should

consider your own financial situation, investment objectives and

experiences, risk acceptance and ability to understand the

nature and risks of the relevant product. Investment involves

risks. Please refer to the relevant fund offering documents for

further details including risk factors. If you have any

inquiries on this Risk Disclosure Statement or the nature and

risks involved in trading or funds etc, you should seek advice

from independent financial adviser.

Trading Risk of Securities Trading:

Monthly Stocks Savings Plan is not equivalent to, nor should it

be treated as a substitute for, time deposit. The prices of

securities fluctuate, sometimes dramatically. The price of a

security may move up or down, and may become valueless. It is as

likely that losses will be incurred rather than profit made as a

result of buying and selling securities.

Risk of Securities Margin Trading:

The risk of loss in financing a transaction by deposit of

collateral is significant. You may sustain losses in excess of

your cash and any other assets deposited as collateral with the

licensed or registered person. Market conditions may make it

impossible to execute contingent orders, such as "stop-loss" or

"stop- limit" orders. You may be called upon at short notice to

make additional margin or interest payments. If the required

margin or interest payments are not made within the prescribed

time, your collateral may be liquidated without your consent.

Moreover, you will remain liable for any resulting deficit in

your account and interest charged on your account. You should

therefore carefully consider whether such a financing

arrangement is suitable in light of your own risk tolerance,

financial situation, investment experience, investment

objectives, investment horizon and investment knowledge.

You are reminded to understand the relevant details, risks,

charges and important notes before investing in Shanghai A

shares or Shenzhen A shares. For details, please read the

“Important Notice of Trading China A Shares and A Shares Margin

Trading via Shanghai-Hong Kong Stock Connect and Shenzhen- Hong

Kong Stock Connect”in BOCHK’s website or the branch staff of

BOCHK.

Important Notice of US Securities:

You should fully understand the details, risks, charges and

important notice before invest in US securities. You should seek

advice from your professional advisors as to your particular tax

position, including but not limited to estate duty and

withholding tax that might arise from investing in overseas

products.

US securities investment services are not applicable to US

persons and might only be applicable to limited jurisdiction.

Any person considering an investment should seek independent

advice on the suitability or otherwise of the particular

investment.

Since the server requires maintenance services, the system will

not be able to provide the trading, fund transfer, checking

securities custody, enquiring transaction records and corporate

action services at certain time.

For HK stocks, A shares and US stocks trading service hours and

system maintenance time, please login to Mobile Banking (click

"Menu" > "Settings" > "FAQ" > "Securities and Securities Margin

Service") or login to Internet Banking (click "Investment" > “HK

Securities” / “A Shares Securities” / "US Securities” > “Help”)

for details.

Risk of Foreign Currency Trading:

Foreign currency investments are subject to exchange rate

fluctuations which may provide both opportunities and risks. The

fluctuation in the exchange rate of foreign currency may result

in losses in the event that customer converts the foreign

currency into Hong Kong dollar or other foreign currencies.

RMB Conversion Limitation Risk:

RMB investments are subject to exchange rate fluctuations which

may provide both opportunities and risks. The fluctuation in the

exchange rate of RMB may result in losses in the event that the

customer converts RMB into HKD or other foreign currencies. RMB

is currently not fully freely convertible. Individual customers

can be offered CNH rate to conduct conversion of RMB through

bank accounts and may occasionally not be able to do so fully or

immediately, for which it is subject to the RMB position of the

banks and their commercial decisions at that moment. Customers

should consider and understand the possible impact on their

liquidity of RMB funds in advance.

This promotion material does not constitute any offer,

solicitation, recommendation, comment or guarantee to the

purchase, subscription or sale of any investment product or

service and it should not be considered as investment advice.

This promotion material is issued by BOCHK and the contents have

not been reviewed by the Securities and Futures Commission of

Hong Kong.