- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

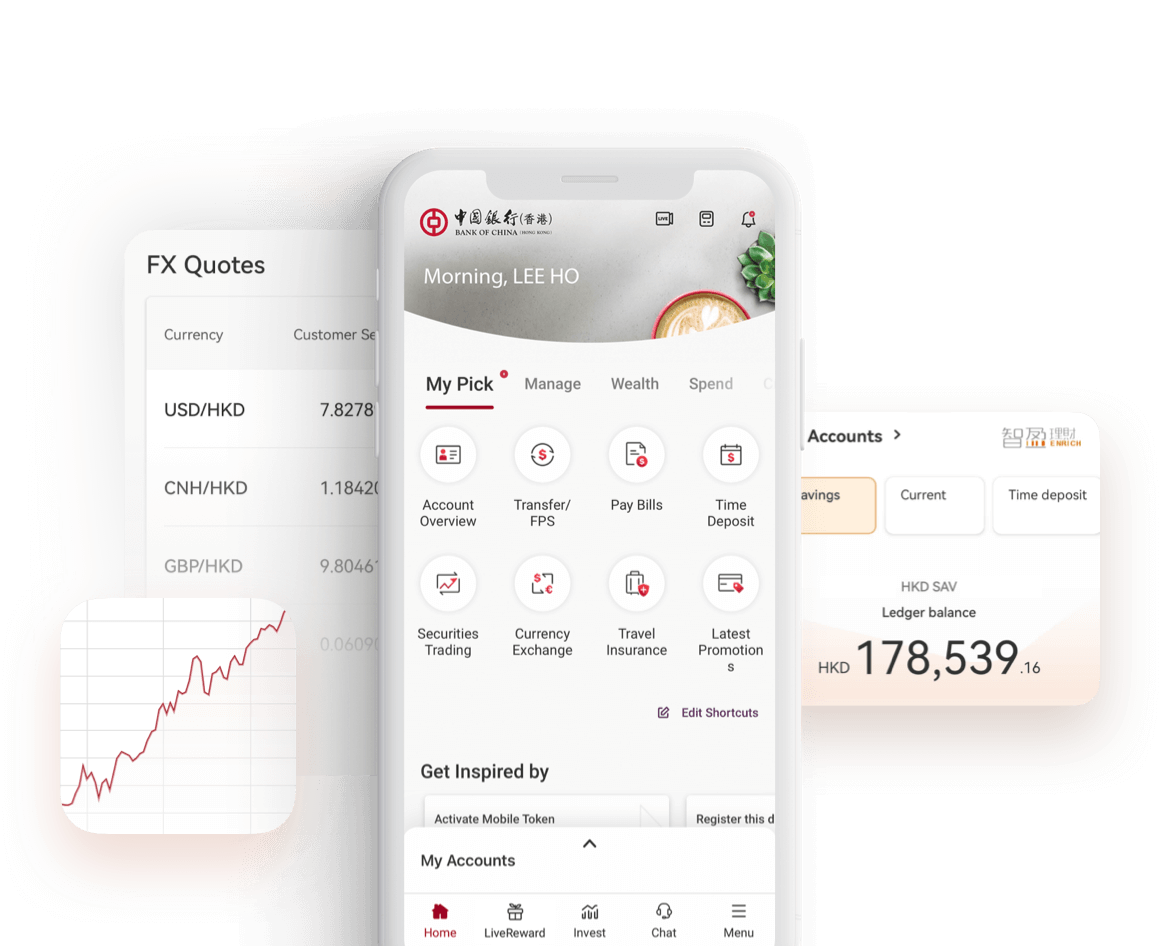

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

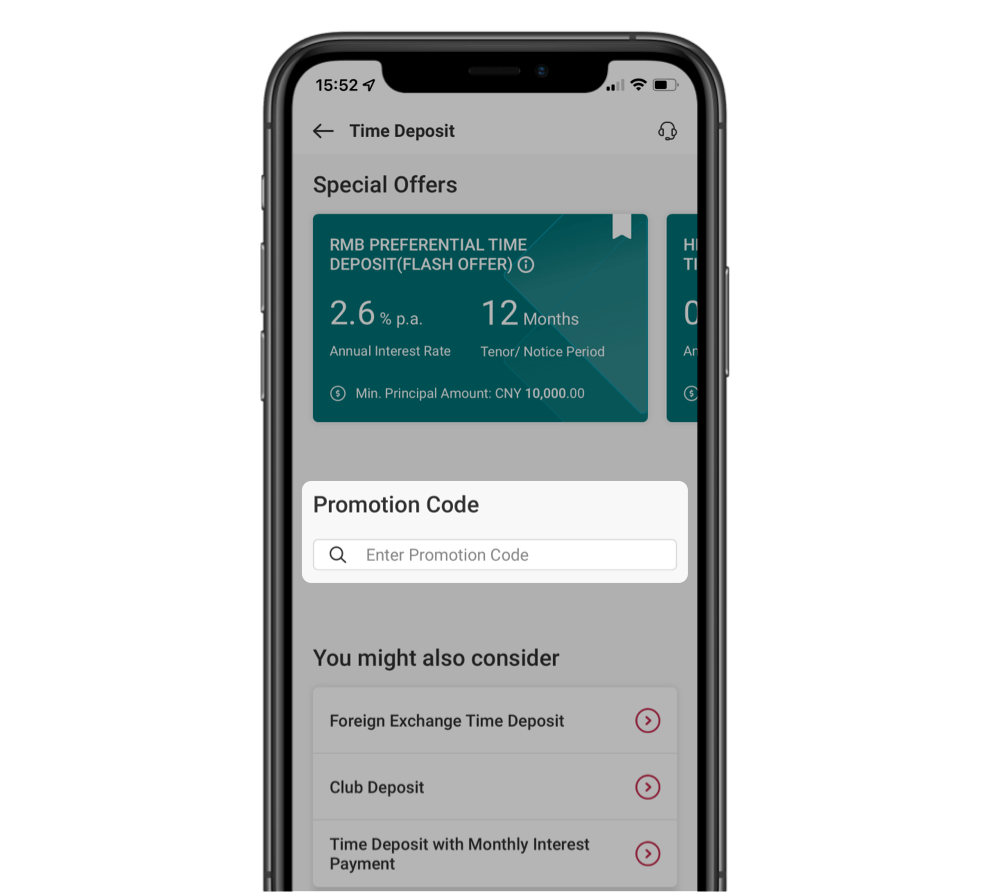

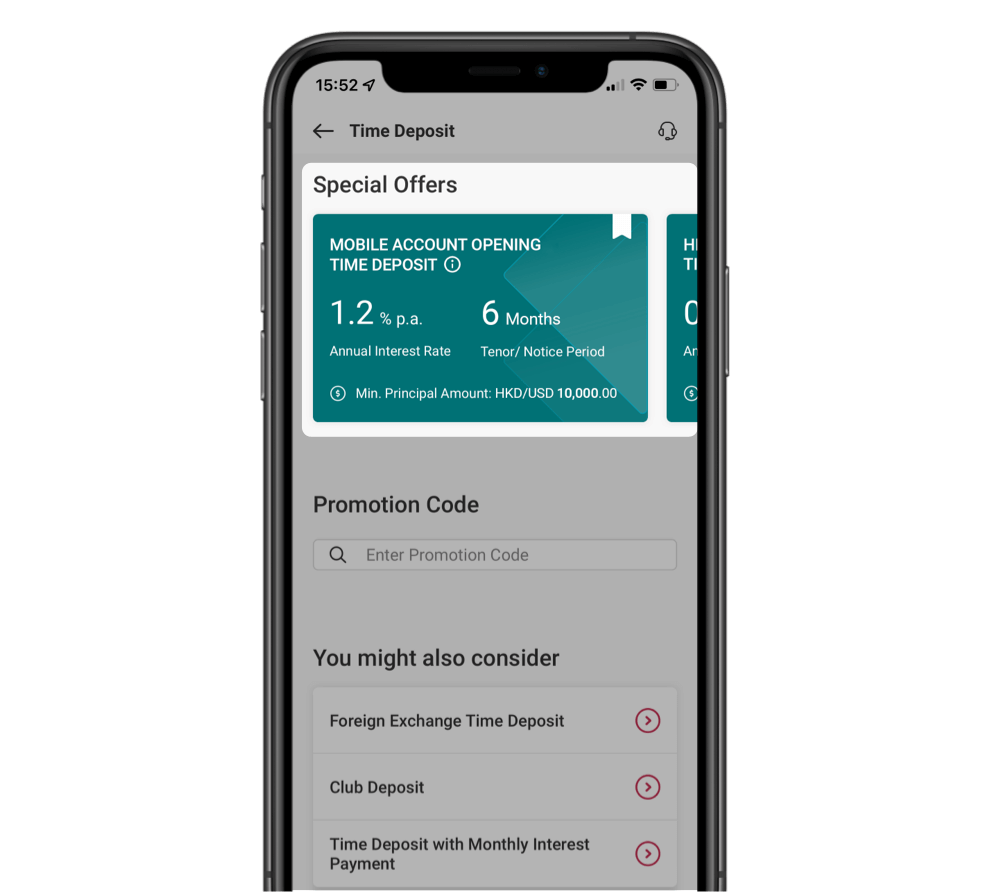

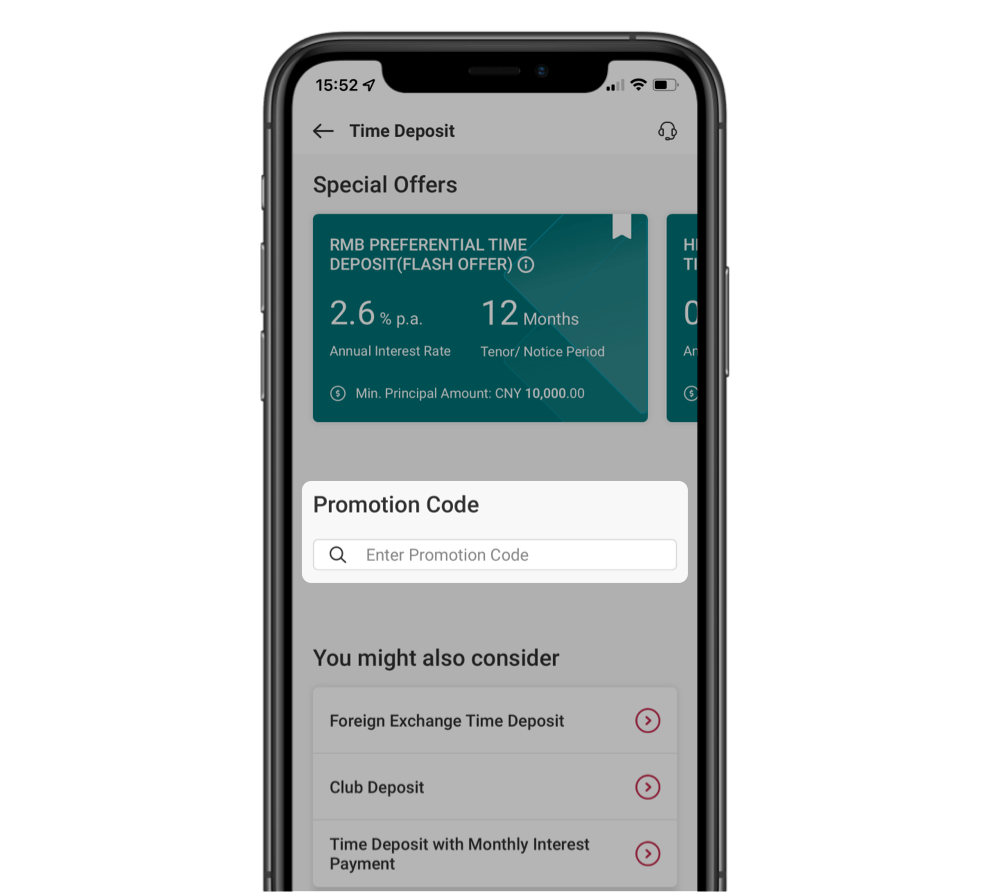

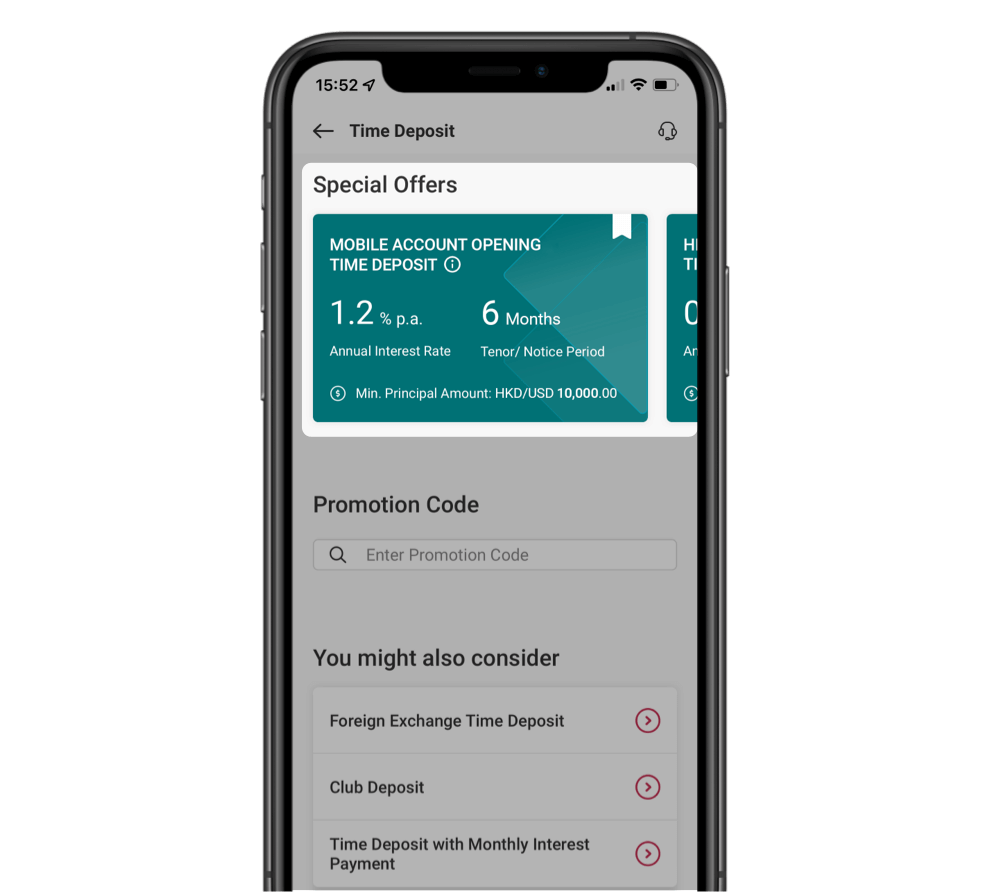

Enjoy 4.8% p.a. Time Deposit Offer

Exclusive Product Rewards

Always On and Beyond

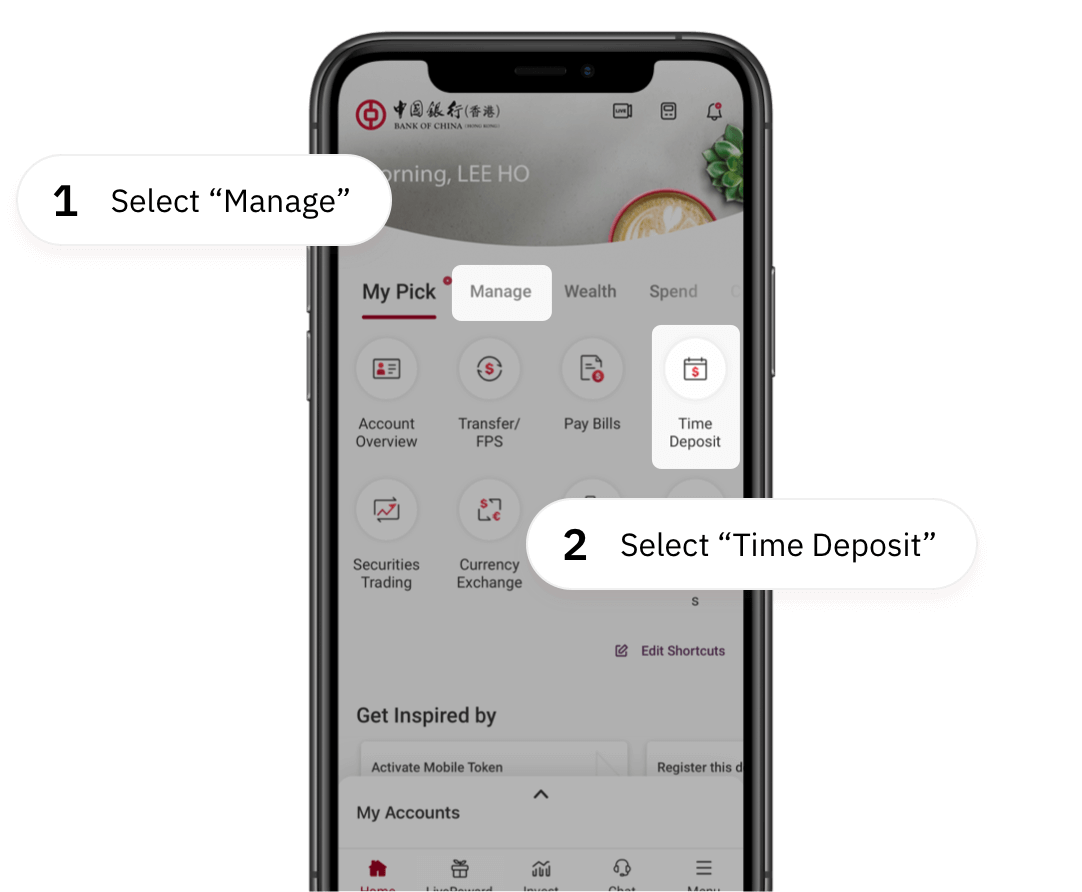

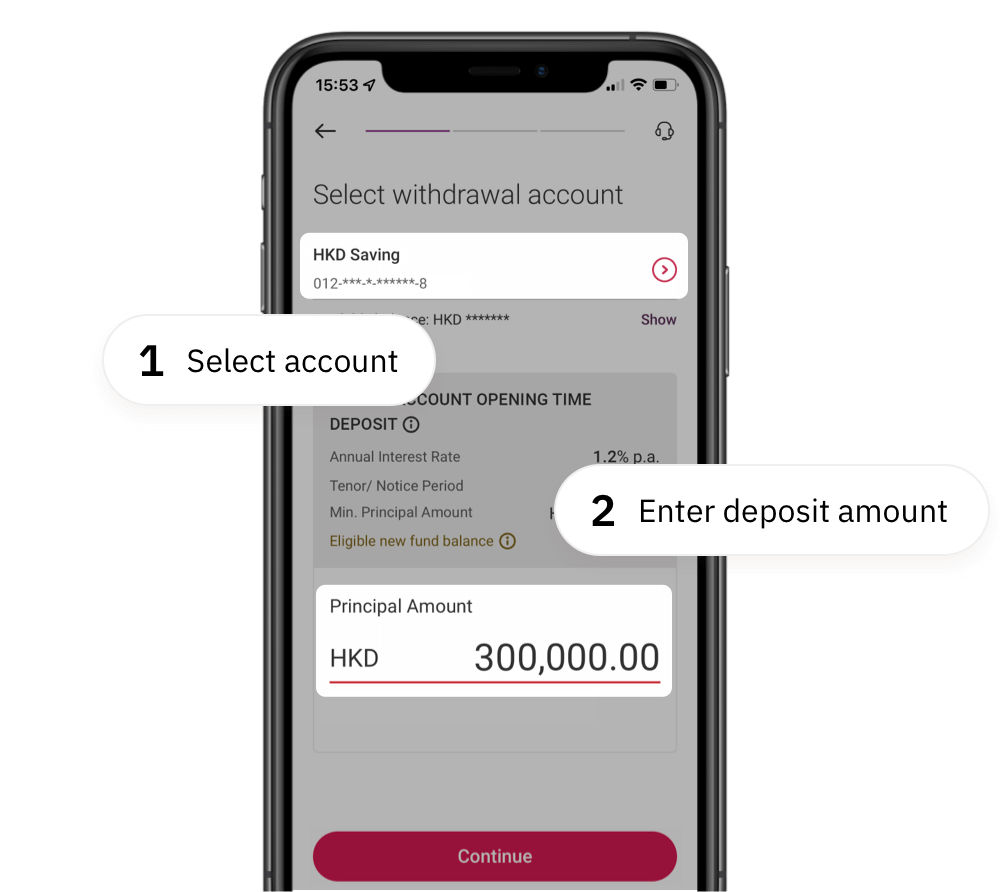

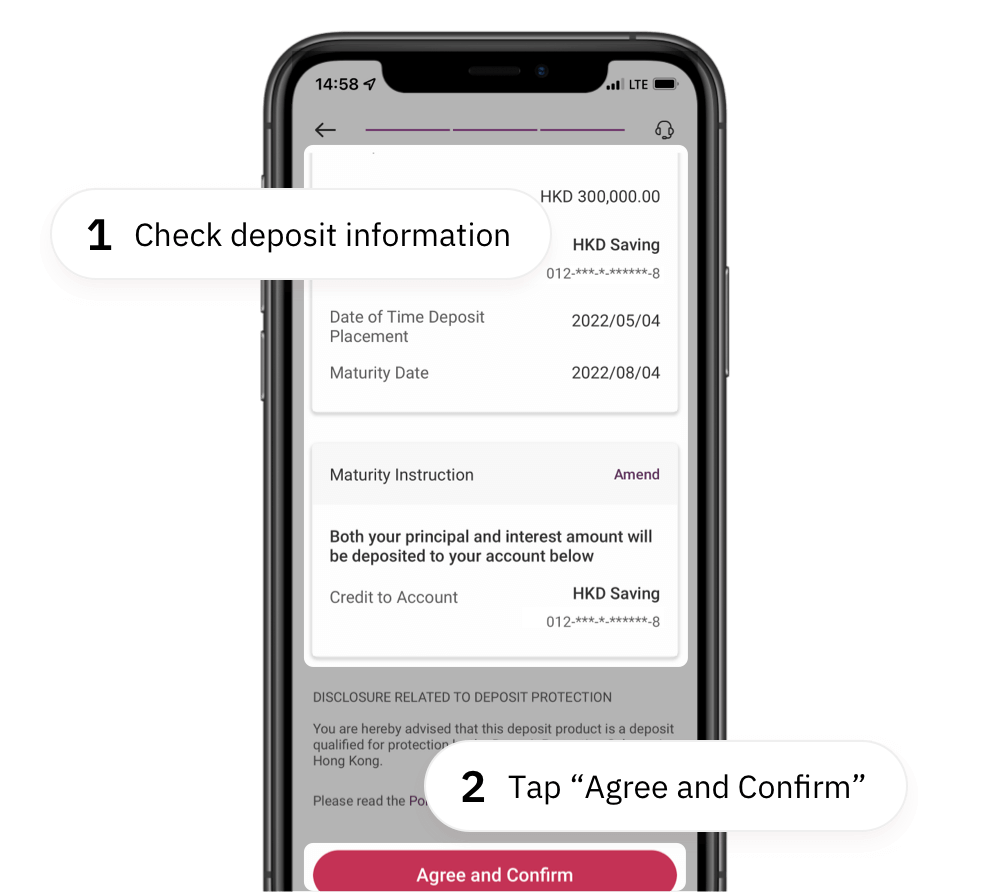

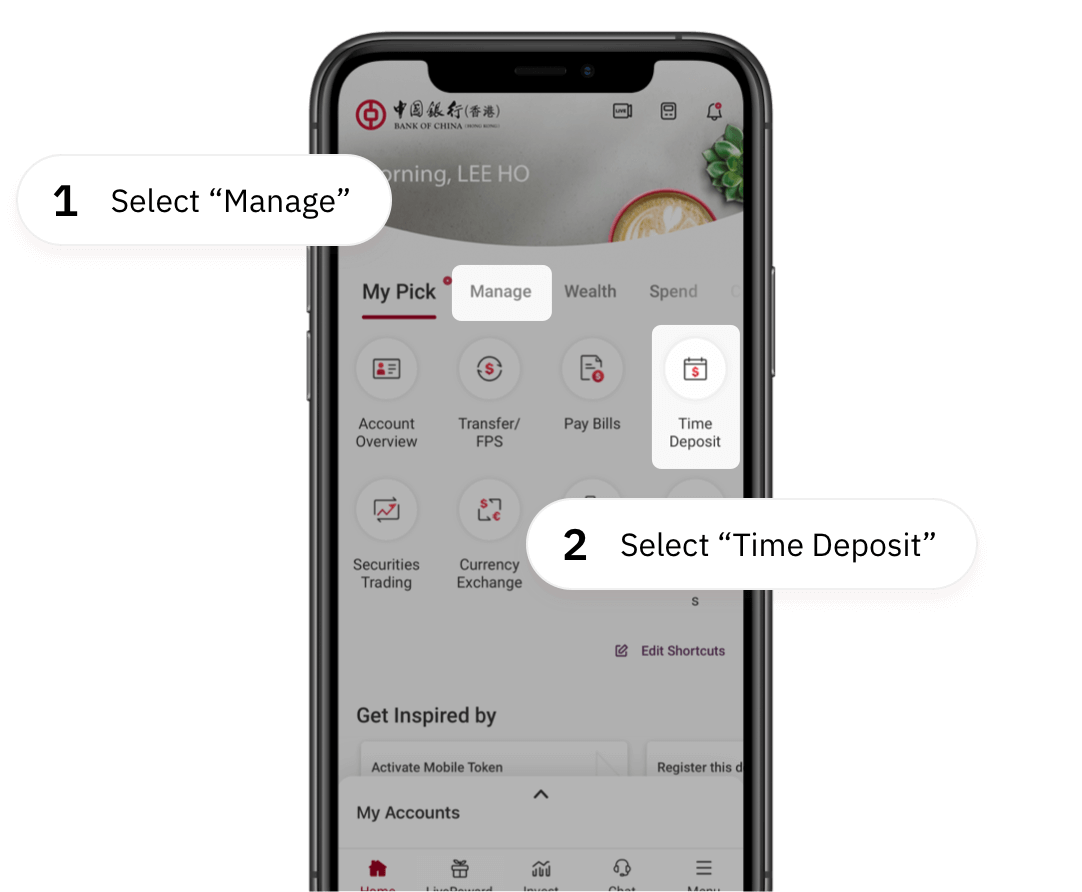

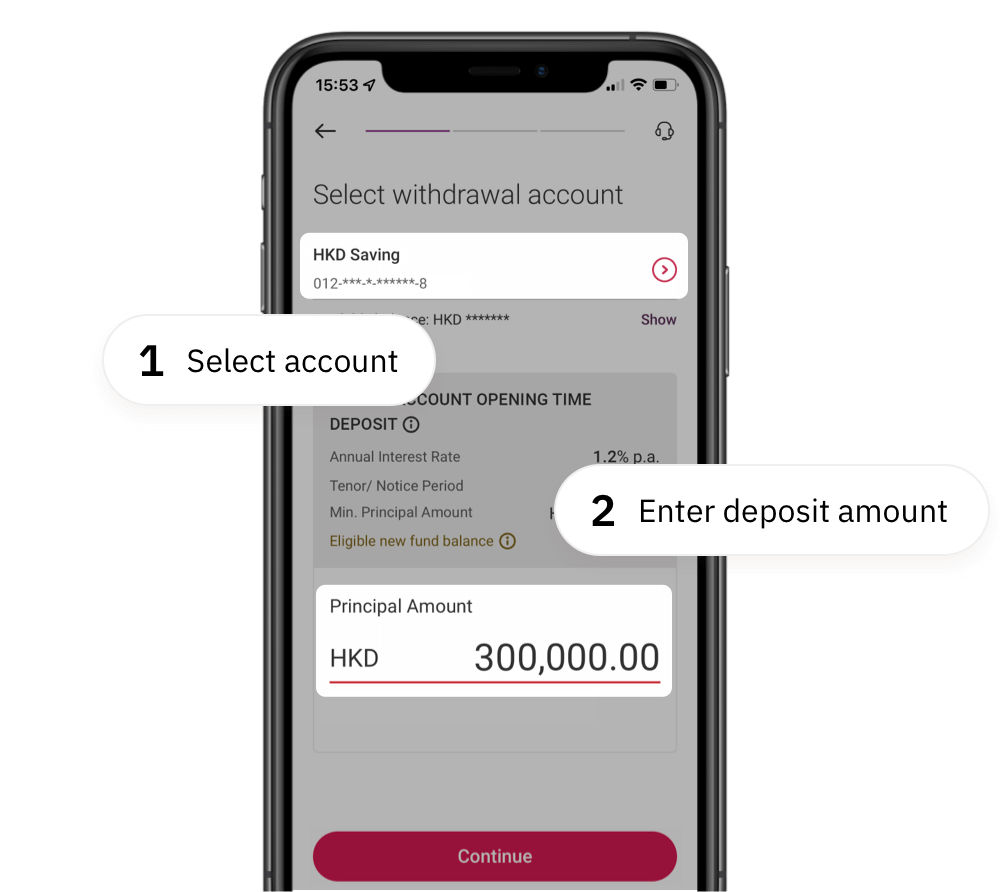

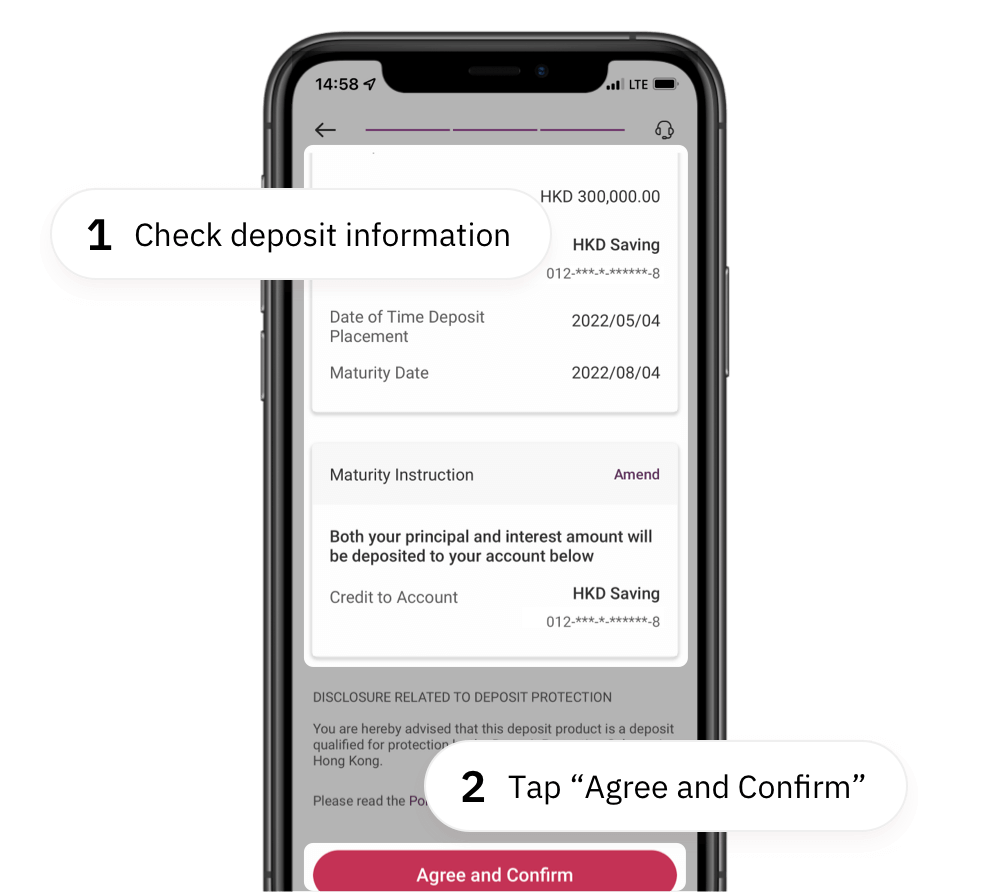

Open Account with Ease in 4 Steps

FAQ

a) Aged 18 or above;

- A new-to-bank customer, or not holding any BOCHK savings or current account in single account / joint account (holding BoC Pay Payment Account or BOC Credit Card is eligible);

- Hold a valid Hong Kong Permanent Identity Card (HKID) (Support smart HKID introduced from 2018);

- Nationality (Country/Region) is China (Hong Kong)/ China (the Mainland) /China (Macao);

- Provide a valid mobile phone number;

Nationality The supported countries / regions of mobile number Mainland China; Macao, China Mainland China; Hong Kong, China;Macao, China, Hong Kong, China Mainland China; Macao, China; Hong Kong, China; Malaysia; Indonesia; The Philippines; Vietnam; Thailand; Brunei; Darussalam; Canada; Australia - Provide valid residential address and correspondence address;

Nationality The supported countries / regions of Residential Address and Correspondence Address Mainland China; Macao, China Hong Kong, China Hong Kong, China Mainland China; Macao, China; Hong Kong, China; Malaysia; Indonesia; The Philippines; Vietnam; Thailand; Brunei; Darussalam; Canada; Australia - Provide a valid email address;

- Provide Taxpayer Identification Number (TIN).

b) Aged 11-17

- A new-to-bank customer, or not holding any BOCHK savings or current account in single account / joint account;

- Hold a valid Hong Kong Permanent Identity Card (HKID);

- Nationality (Country/Region) is China (Hong Kong);

- Residential address, correspondence address and mobile phone number should be registered in China (Hong Kong);

- Provide a valid mobile phone number;

- Provide valid residential address and correspondence address;

- Provide a valid email address;

- Provide Taxpayer Identification Number (TIN);

- Provide a proof of relationship* (e.g. the child’s birth certificate original copy);

- The parent / guardian holds a valid Hong Kong Permanent Identity Card (HKID) / People’s Republic of China Resident Identity Card (PRCID);

- The parent / guardian holds at least one BOCHK account, with registered mobile banking service;

- Applies exclusively to the Parent /guardian of 11-15-year-old child, have registered for the Bank's Mobile Banking service, and have a valid mobile phone number according to the Bank's records

*Proof of relationship includes the child’s birth certificate, Housing Department/Hong Kong Housing Society lease, student handbook with parent or guardian information and school seal, documents issued by relevant government agencies of the country/region, etc. to prove the relationship

- Aged 18 or above;

- Physically located in Hong Kong;

- A new-to-bank customer, or not holding any BOCHK savings or current account in single account / joint account;

- Hold a valid People's Republic of China Resident Identity Card (“PRCID”) and an Exit-Entry Permit for Travelling to and from Hong Kong and Macau (“EEP”) (must be valid for 30 days or above beyond the application date for both documents);

- Hold a valid exit-entry record from the National Immigration Administration (must be issued within 7 days, application date inclusive);

- Nationality (Country/Region) is China (the Mainland);

- Hold valid Mainland China mobile phone number and addresses;

- Provide a valid email address;

- Provide Taxpayer Identification Number (TIN).

If you do not fit these criteria, or your mobile account opening application is not successful, you can visit any of our branches in person for account opening.

BOCHK Mobile App enables you to apply below accounts and services in one-go:

- Integrated Banking Services

- HKD Savings Account

- Multi-currency Savings Account (Not applicable to aged 11-15)

- Mobile Banking and Internet Banking

- BOC Card (ATM Card)

Without visiting a branch, the process is simple and fast. Please download BOCHK

Mobile App (https://www.bochk.com/dam/more/mini/mbk/en.html).

- Aged 18 or above:

If you submit application and open account successfully during service hours (Monday to Saturday 9:00am to 8:00pm (excluding public holidays)), your accounts are ready for use immediately. We will send you SMS andemail notification. You may login Internet Banking / Mobile Banking to check your account number and activate Small Value Transfer with maximum daily transfer limit of HKD10,000. We will review your application information within 3 working days, after that, your BOC Card will be activated, and your total daily transfer limit of Registered Third-Party Account (including remittance) / Small Value Transfer of InternetBanking / Mobile Banking will be increased to HKD210,000. You can login to Internet Banking /Mobile Banking to adjust your limit anytime.

If you submit your application during non-service hours, we will handle the application in next working day. Submit application and/or open accounts successfully, we will send you SMS and email notification. - Aged 16-17:

If you submit application and open account successfully during service hours (Monday to Saturday 9:00am to 8:00pm (excluding public holidays)), your accounts are ready for use immediately. We will send you SMS and email notification. You may login Internet Banking / Mobile Banking to check your account number. We will review your application information within 3 working days, after that, your BOC Card will be activated.

If you submit your application during non-service hours, we will handle the application in next working day. Submit application and/or open accounts successfully, we will send you SMS and email notification. - Aged 11-15:

After you submit your application, we will send out "Activation Code" to your parent or guardian by push notification of Mobile Banking, which is valid for 7 calendar days (including the application date). Your parent or guardian has to login Mobile Banking to complete the authentication process within this period, in order to proceed account opening.

If your parent / guardian completes the confirmation process and opens account successfully during service hours (Monday to Saturday 9:00am to 8:00pm (excluding public holidays)), your account is ready for use immediately. We will send you SMS and email notification. You may login Internet Banking / Mobile Banking to check your account number. We will review your application information within 3 working days, after that, your BOC Card will be activated.

* The Activation Code will become invalid if the confirmation is not completed within 7 days. For example, if you submit your application on 1/1/2024, the Activation Code will expire on 8/1/2024. We will purge the application data for unconfirmed requests, and you will need to resubmit a new application.

- Aged 18 or above:

Except current account opening, you can enjoy various banking services via Internet Banking / Mobile Banking, such as fund transfer, currency exchange and time deposit placement, etc.

To enjoy full banking services, please bring along your identity document to visit any of our branches and provide us a specimen of your handwritten signature, in order to upgrade the accounts to become full function accounts. - Aged 16-17:

You have Internet Banking / Mobile Banking access to check account balances, view e-statements (only available via Internet banking), register for FPS for receiving funds (third parties transfers are prohibited), exchange foreign currencies, place time deposits, pay designated bills* and register for Payroll Service.

* Designated bills can only be paid for merchants that fall under the categories of [Utility providers], [Government or Statutory education], [Primary or Secondary Education], or [Post-secondary or Professional Education]. - Aged 11-15:

You can use Internet Banking / Mobile Banking to check account balances, view e-statements (only available via Internet banking), register for FPS for receiving funds (third parties transfers are prohibited).

For third party fund transfer, you may activate Small Value Transfer with maximum daily transfer limit of HKD10,000 after successful account opening. We will review your application information within 3 working days, after that, your BOC Card will be activated, and your total daily transfer limit of Registered Third Party Account (including remittance) / Small Value Transfer of Internet Banking / Mobile Banking will be increased to HKD210,000, and maximum daily bill payment limit will be increased to HK$1,850,000 (Note). You can login to Internet Banking /Mobile Banking to adjust your limit anytime.

Note: Maximum daily bill payment limit includes: maximum daily bill payment limit for "Bank's Designated Merchants" is HK$1,000,000, maximum daily bill payment limit for "General Merchants" is HK$100,000, maximum daily bill payment limit for "Inland Revenue Department" is HK$500,000 and maximum daily bill payment limit for "Educational Institutions" is HK$250,000. For more information, please refer to Internet Banking > Bill Payment > Merchant Category > Merchant Details.

- HKID holders aged 18 or above

After successful account opening, you can continue to apply for an investment account in Mobile Banking and you have to upload a valid address proof and provide relevant information during the process. We will inform you the status within 3 working days (excluding Saturday, Sunday and public holidays).

Note: Account opening service of investment account is not available in Internet Banking, for customers who opened account successfully via Mobile App. - PRCID holders

Please visit any of our branches for account opening of investment service.

- The above products, services and offers are subject to the relevant terms. For details, please refer to the relevant promotion materials or contact the staff of BOCHK.

- The customer is responsible for paying the relevant data costs incurred by using and / or downloading the BOCHK Mobile Banking.

- Please download the mobile app from the official software application store or BOCHK homepage, and pay attention to the identifying words of the search.

- By using BOCHK Mobile Banking, the viewers agree to the disclaimer and policy of BOCHK on BOCHK Mobile Banking from time to time.

- Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited.

- The above products, services and offers are subject to the relevant terms. For details, please refer to the relevant promotion materials or contact the staff of BOCHK.

- The customer is responsible for paying the relevant data costs incurred by using and / or downloading the BOCHK Mobile Banking.

- Please download the mobile app from the official software application store or BOCHK homepage, and pay attention to the identifying words of the search.

- By using BOCHK Mobile Banking, the viewers agree to the disclaimer and policy of BOCHK on BOCHK Mobile Banking from time to time.

- Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited.