- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

- Home >

- Investment >

- Structured Products >

- Structured Investments >

Principal Protection at Maturity with Higher Potential Returns

We have made investing easy without the need of opening an account.

At maturity, receive your principal & potential interest.

*The above information is only a summary of the product features. Please refer to the "Important Facts Statement" for details. Terms and conditions apply.

Product Features

Principal Protected with Guaranteed Returns

Principal Protected Structured Investments guarantees your capital and minimum returns at maturity. Earn maximum potential returns if the linked currency exchange follows your prediction.

Bespoke Currency Combinations

Invest in our daily updated in-house currency combinations. Select from HKD, USD, CNY, AUD, NZD, GBP, CAD, EUR or JPY. We're here to make investing easy.

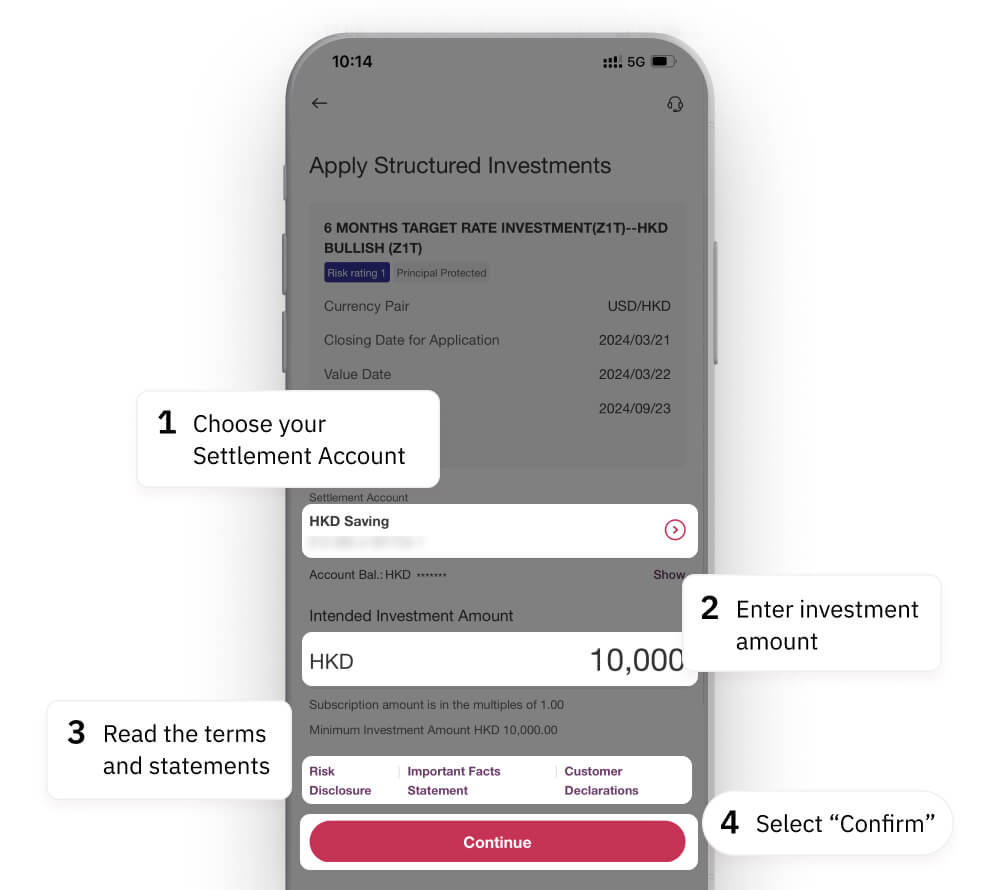

Varying Tenors with a Low Investment Threshold

Investment Period can range from 1, 3, 6 or 9 months. The minimum Principal Amount is HKD$10,000 or its equivalent in another currency and designated amount for tailor-made products. Here to provide flexible choices for your various investment needs.

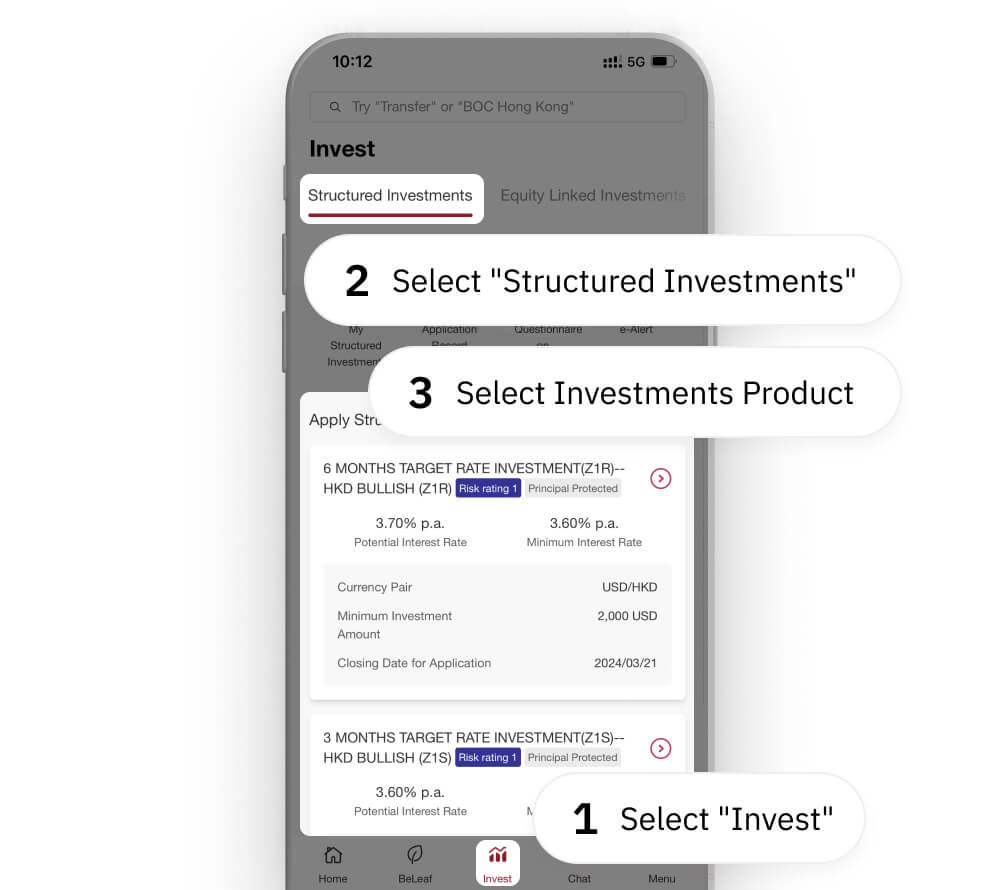

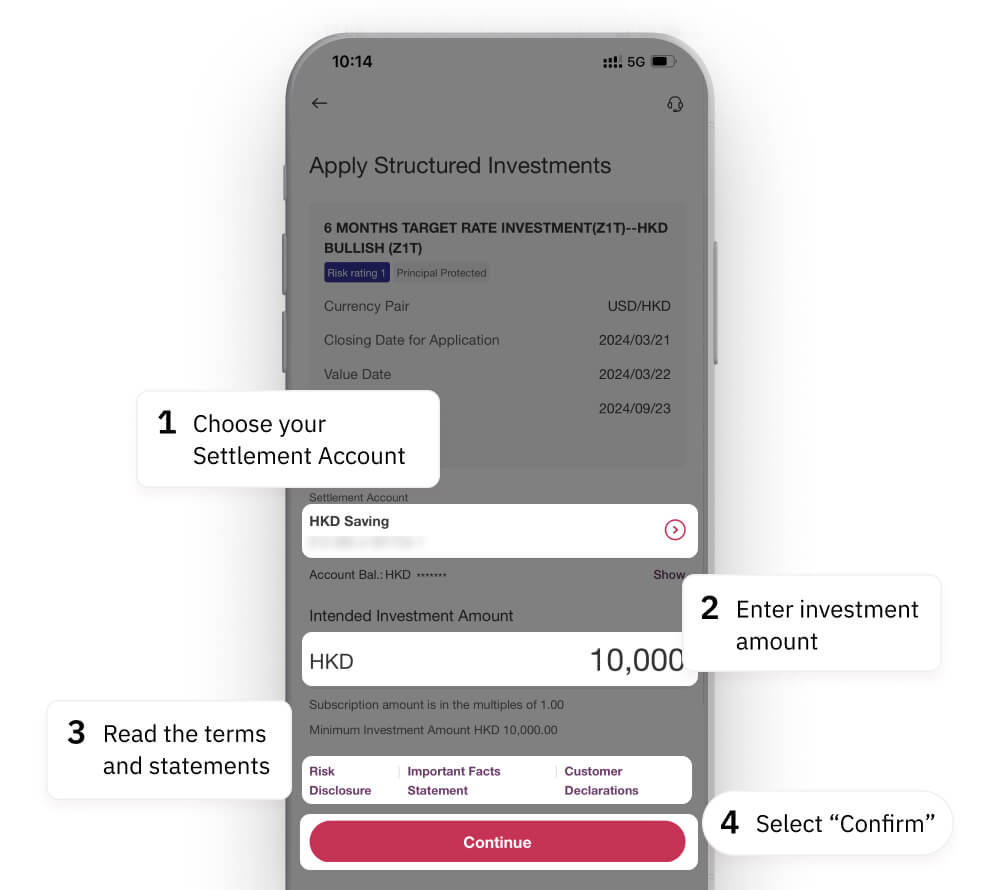

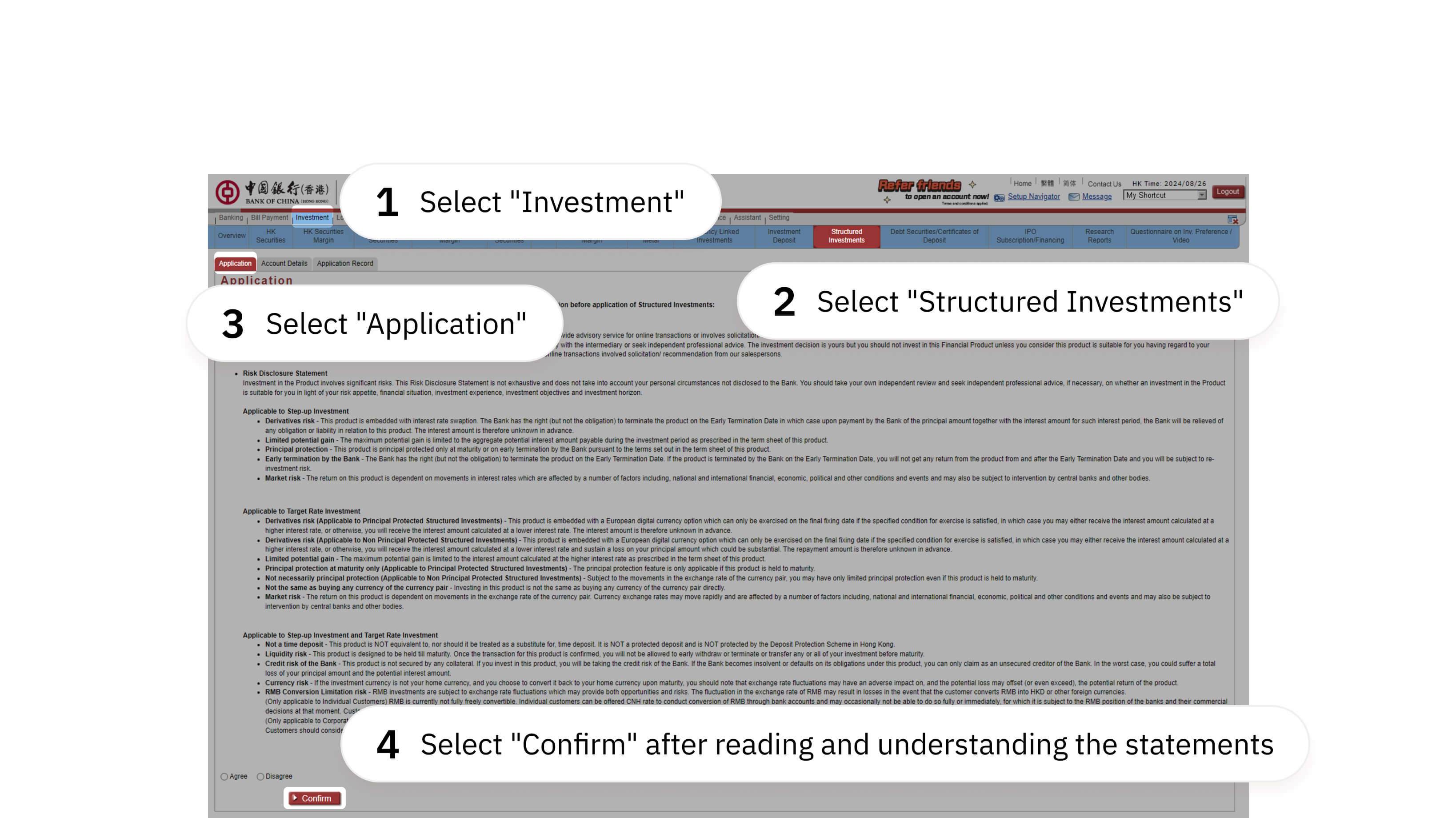

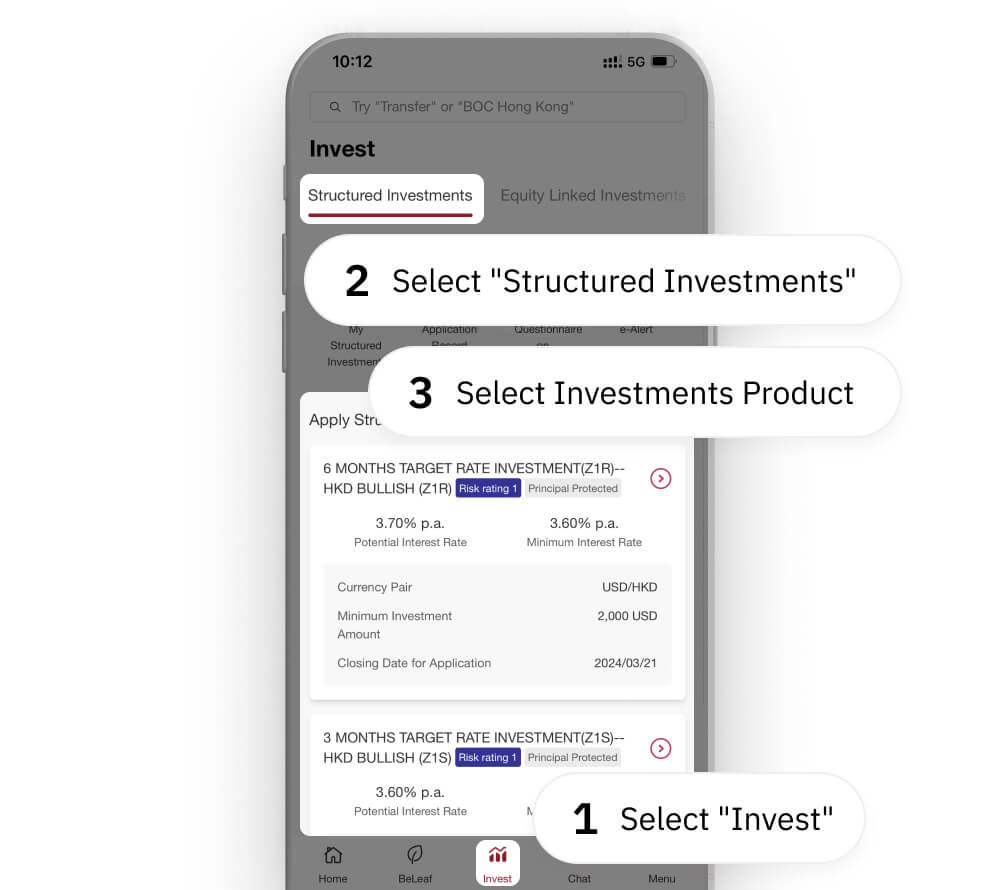

Multi Trading Channel

Subscribe to our investment products via Mobile Banking or Internet Banking.

Trading hours: Mondays to Fridays 8:00am to 8:00pm Saturdays 9:00am to 1:00pm except public holidays

*The above information is only a summary of the product features. Please refer to the "Important Facts Statement" for details. Terms and conditions apply.

Examples

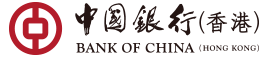

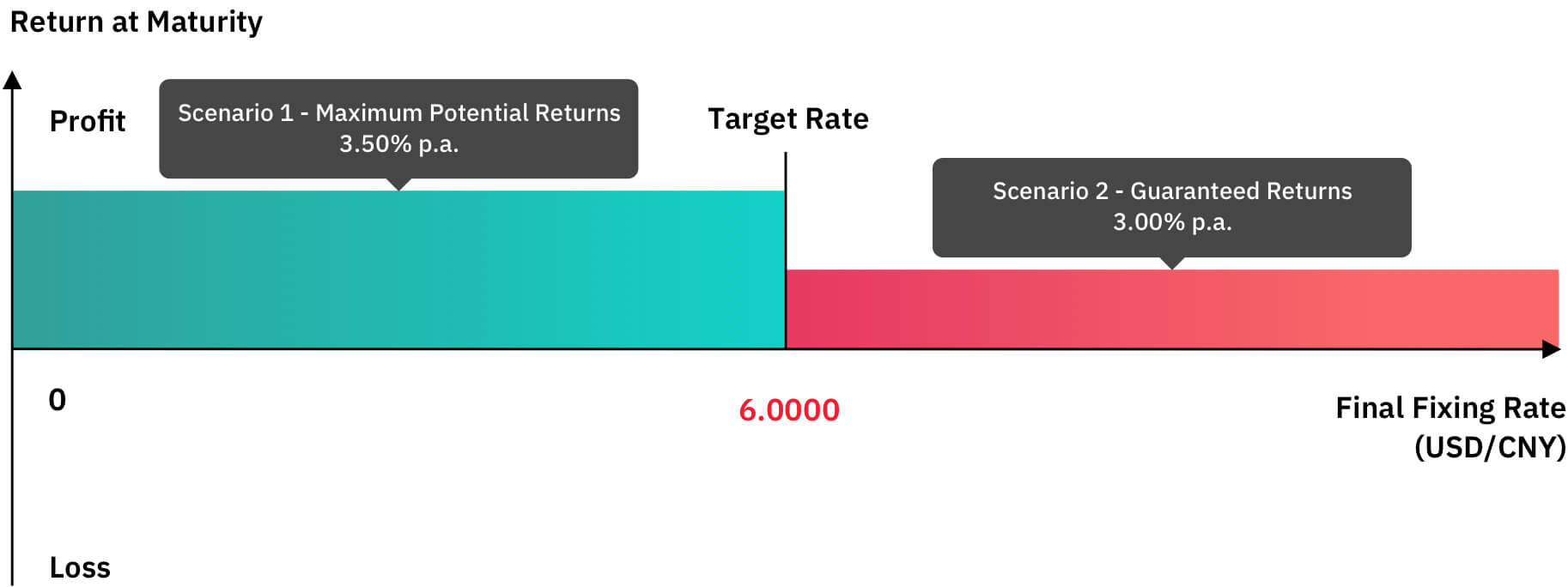

CNY is selected as the Investment Currency. Within 3 months, the client expects a depreciation from 6.2000 to 6.0000 or less with USD against CNY. The Principal Amount and the Interest Amount calculated at Potential Interest Rate (3.50% p.a.) or Minimum Interest Rate (3.00% p.a.) will be received according to the Final Fixing Rate.

Terms

Principal Amount

CNY100,000

Investment Currency

CNY

Currency Pair

USD/CNY

Investment period

3 months (90 days)

Potential Interest Rate

3.50% p.a.

Minimum Interest Rate

3.00% p.a.

Target Rate

Initial Fixing Rate - 0.2000 = 6.0000

Initial Fixing Rate:

6.2000

Scenario 1 (Maximum Potential Returns)

If the Final Fixing Rate is

equal to or below the Target Rate 6.0000The amount received at maturity:

¥100,875

Principal 100%

+3.50% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.50% x (90/360)) = CNY100,000 + CNY875

Scenario 2 (Guaranteed Returns)

If the Final Fixing Rate is

above the Target Rate 6.0000The amount received at maturity:

¥100,750

Principal 100%

+3.00% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.00% x (90/360)) = CNY100,000 + CNY750

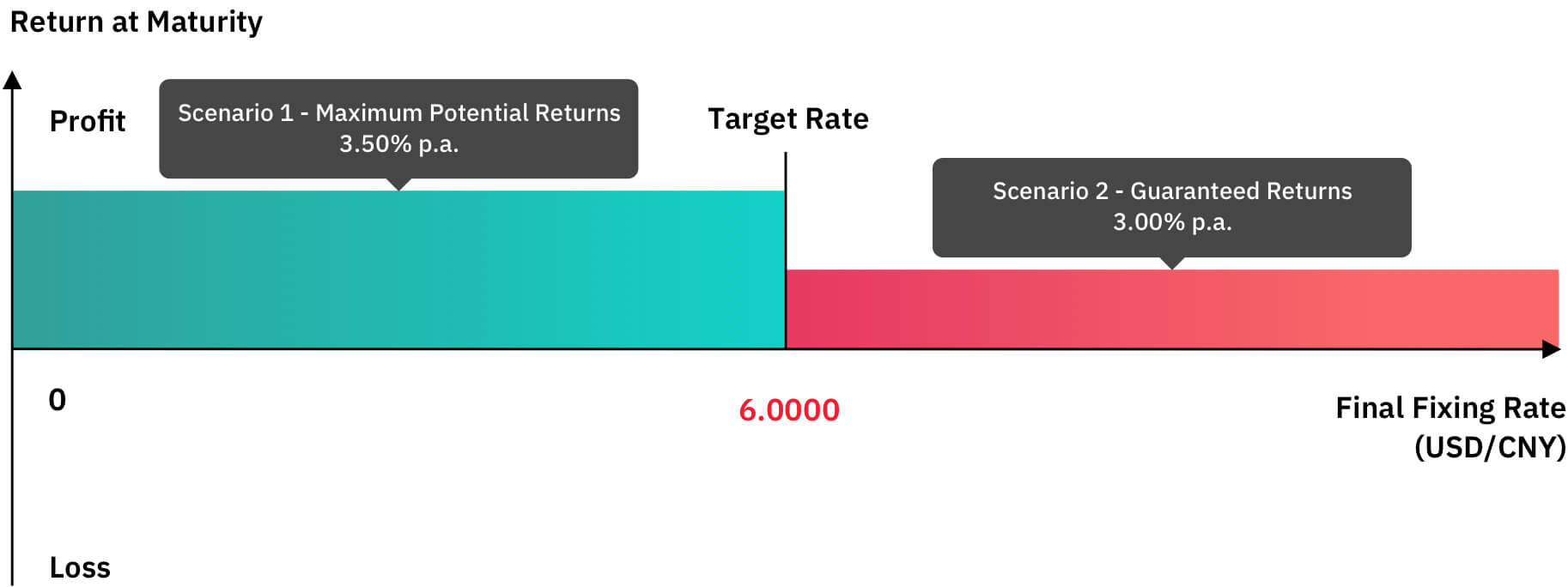

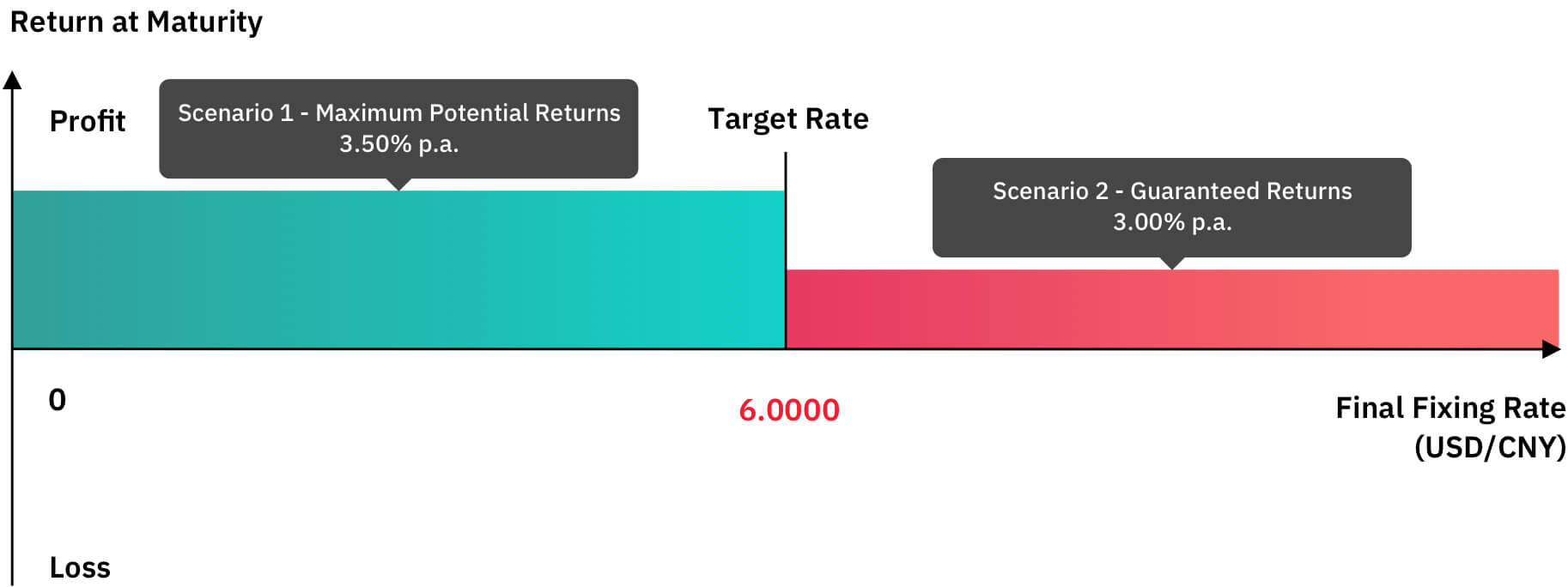

CNY is selected as the Investment Currency. Within 3 months, the client expects an appreciation from 6.2000 to 6.4000 or more with USD against CNY. The Principal Amount and the Interest Amount calculated at the Potential Interest Rate (3.50% p.a.) or Minimum Interest Rate (3.00% p.a.) will be received according to the Final Fixing Rate.

Terms

Principal Amount

CNY100,000

Investment Currency

CNY

Currency Pair

USD/CNY

Investment Period

3 months (90 days)

Potential Interest Rate

3.50% p.a.

Minimum Interest Rate

3.00% p.a.

Target Rate

Initial Fixing Rate + 0.2000 = 6.4000

Initial Fixing Rate

6.2000

Scenario 1 (Guaranteed Returns)

If the Final Fixing Rate is

below the Target Rate 6.4000The amount received at maturity:

¥100,750

Principal 100%

+3.00% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.00% x (90/360)) = CNY100,000 + CNY750

Scenario 2 (Maximum Potential Returns)

If the Final Fixing Rate is

equal to or above the Target Rate 6.4000The amount received at maturity:

¥100,875

Principal 100%

+3.50% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.50% x (90/360)) = CNY100,000 + CNY875

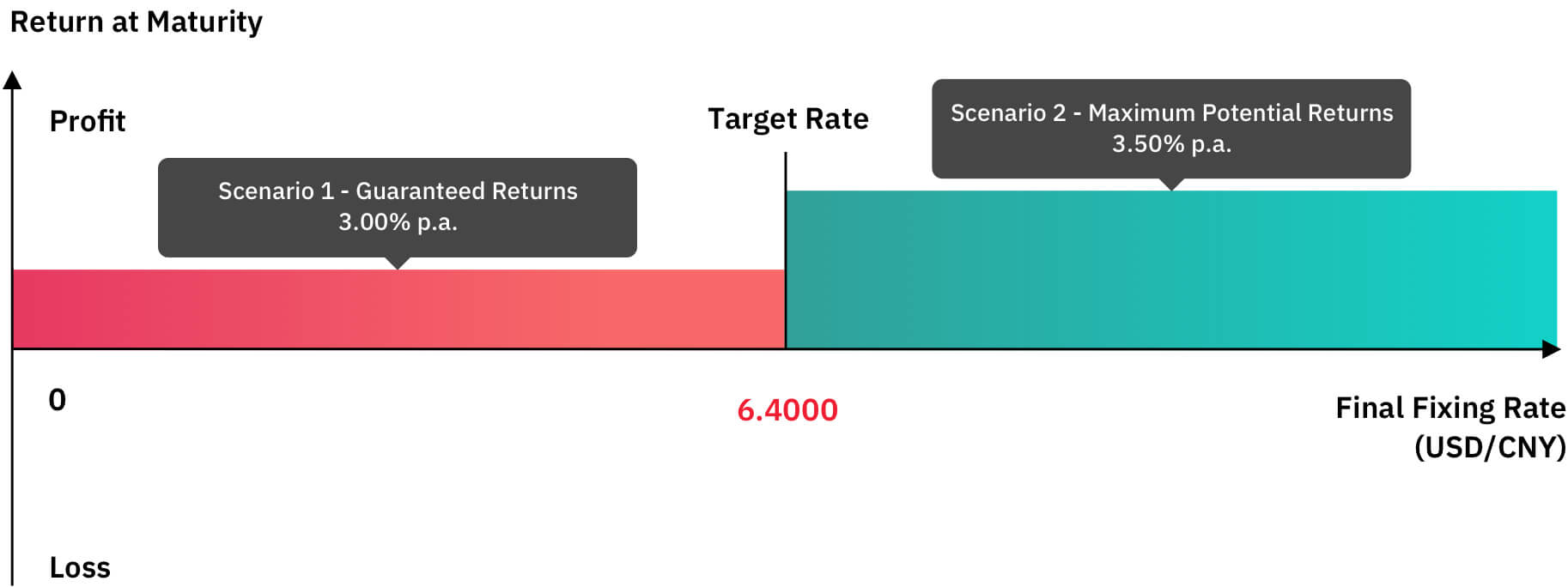

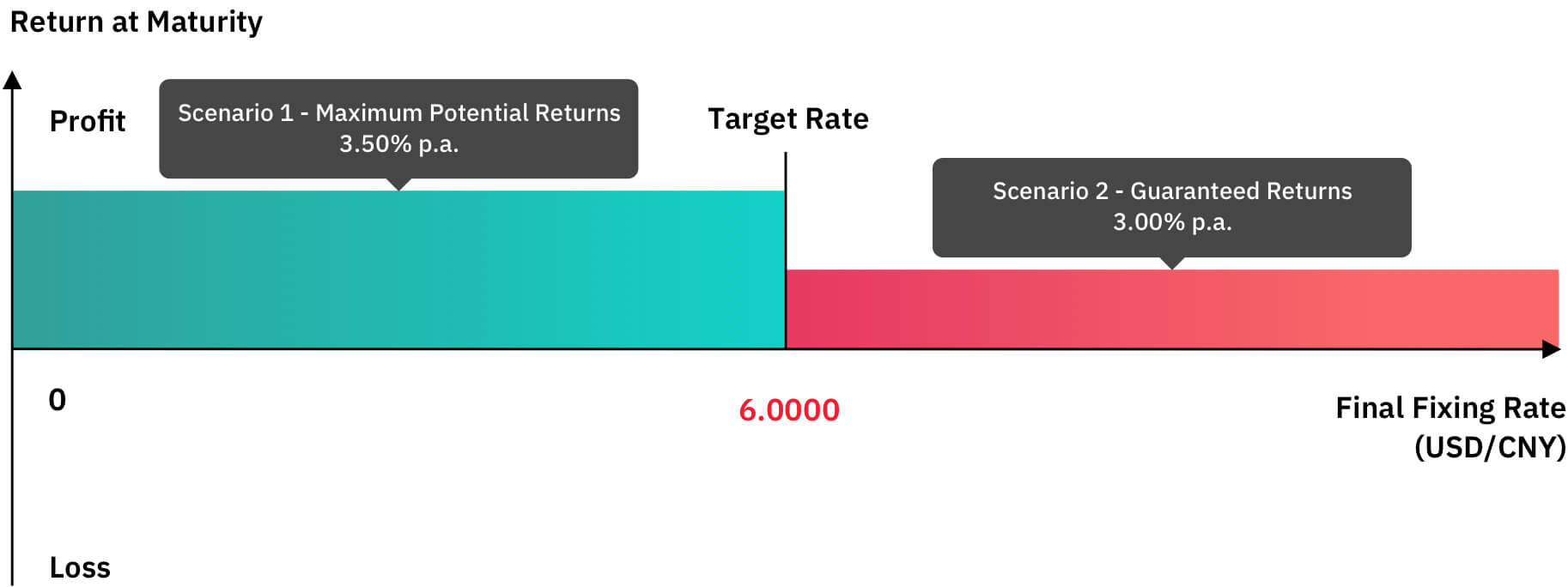

CNY is selected as the Investment Currency. Within 3 months, the client expects a depreciation from 6.2000 to 6.0000 or less with USD against CNY. The Principal Amount and the Interest Amount calculated at Potential Interest Rate (3.50% p.a.) or Minimum Interest Rate (3.00% p.a.) will be received according to the Final Fixing Rate.

Terms

Principal Amount

CNY100,000

Investment Currency

CNY

Currency Pair

USD/CNY

Investment period

3 months (90 days)

Potential Interest Rate

3.50% p.a.

Minimum Interest Rate

3.00% p.a.

Target Rate

Initial Fixing Rate - 0.2000 = 6.0000

Initial Fixing Rate:

6.2000

Scenario 1 (Maximum Potential Returns)

If the Final Fixing Rate is

equal to or below the Target Rate 6.0000

The amount received at maturity:

¥100,875

Principal 100%

3.50% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.50% x (90/360)) = CNY100,000 + CNY875

Scenario 2 (Guaranteed Returns)

If the Final Fixing Rate is

above the Target Rate 6.0000

The amount received at maturity:

¥100,750

Principal 100%

3.00% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.00% x (90/360)) = CNY100,000 + CNY750

CNY is selected as the Investment Currency. Within 3 months, the client expects an appreciation from 6.2000 to 6.4000 or more with USD against CNY. The Principal Amount and the Interest Amount calculated at the Potential Interest Rate (3.50% p.a.) or Minimum Interest Rate (3.00% p.a.) will be received according to the Final Fixing Rate.

Terms

Principal Amount

CNY100,000

Investment Currency

CNY

Currency Pair

USD/CNY

Investment Period

3 months (90 days)

Potential Interest Rate

3.50% p.a.

Minimum Interest Rate

3.00% p.a.

Target Rate

Initial Fixing Rate + 0.2000 = 6.4000

Initial Fixing Rate

6.2000

Scenario 1 (Guaranteed Returns)

If the Final Fixing Rate is

below the Target Rate 6.4000

The amount received at maturity:

¥100,750

Principal 100%

3.00% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.00% x (90/360)) = CNY100,000 + CNY750

Scenario 2 (Maximum Potential Returns)

If the Final Fixing Rate is

equal to or above the Target Rate 6.4000

The amount received at maturity:

¥100,875

Principal 100%

3.50% p.a.

Principal amount + Interest amount

= CNY100,000 + CNY(100,000 x 3.50% x (90/360)) = CNY100,000 + CNY875

Note: When converting the Repayment Amount back to your home currency at maturity, the customer shall take into consideration the fluctuation in the exchange rate of the Investment Currency against your home currency as there can be a gain or loss.

*The above illustrative example and the scenario analysis are prepared with hypothetical data, and not based on the past performance of the currencies as stated herein. They are for reference only and do not guarantee or represent the final returns of Structured Investments. The above hypothetical examples should not be relied on as an indication of the actual performance of the Linked Currency or this product. You should not rely on these examples when making an investment decision.

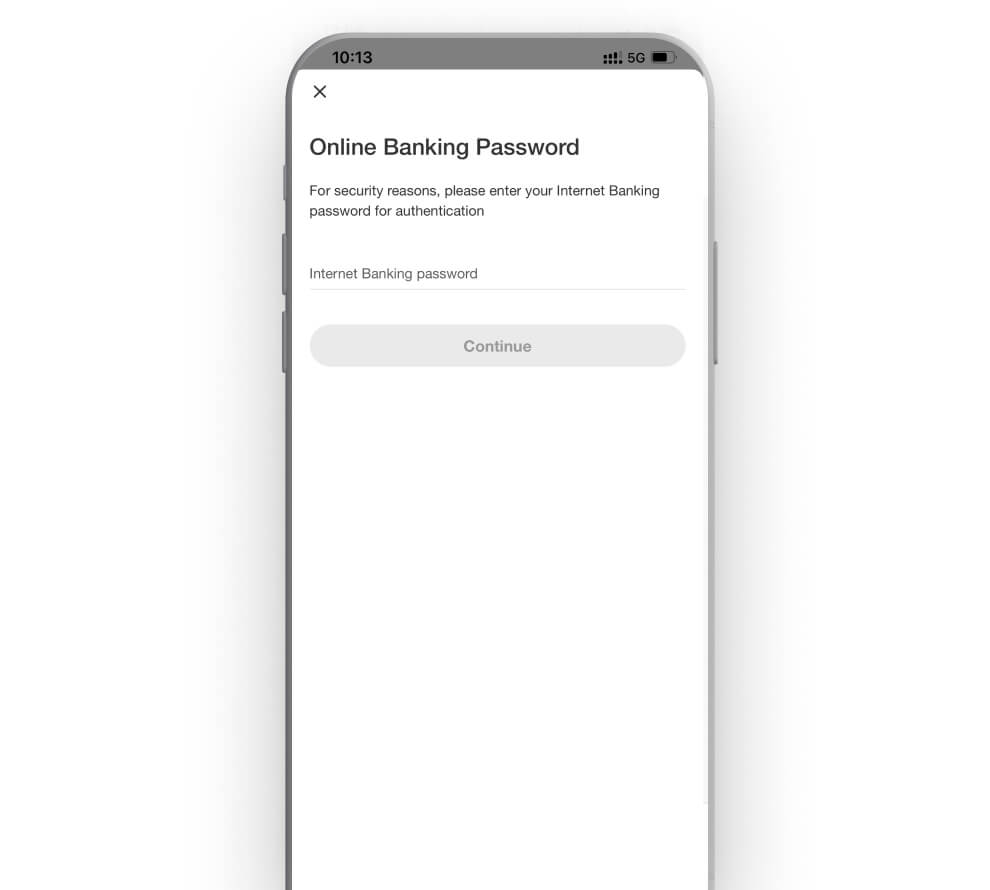

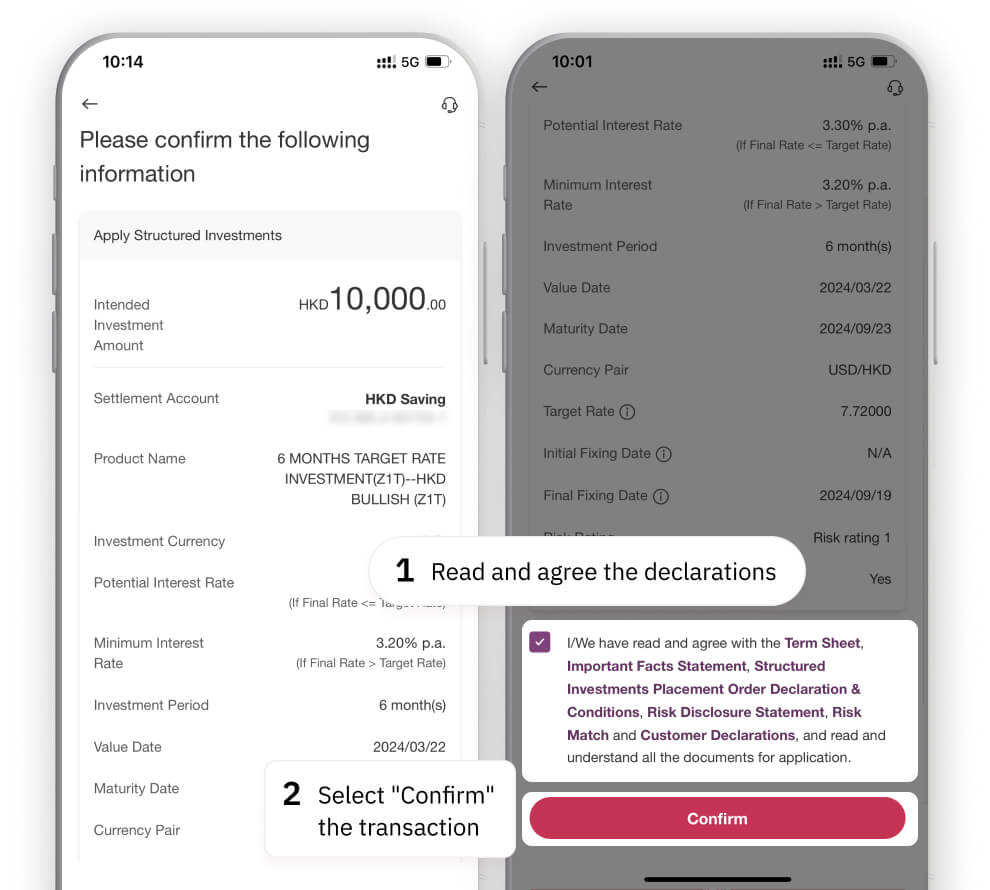

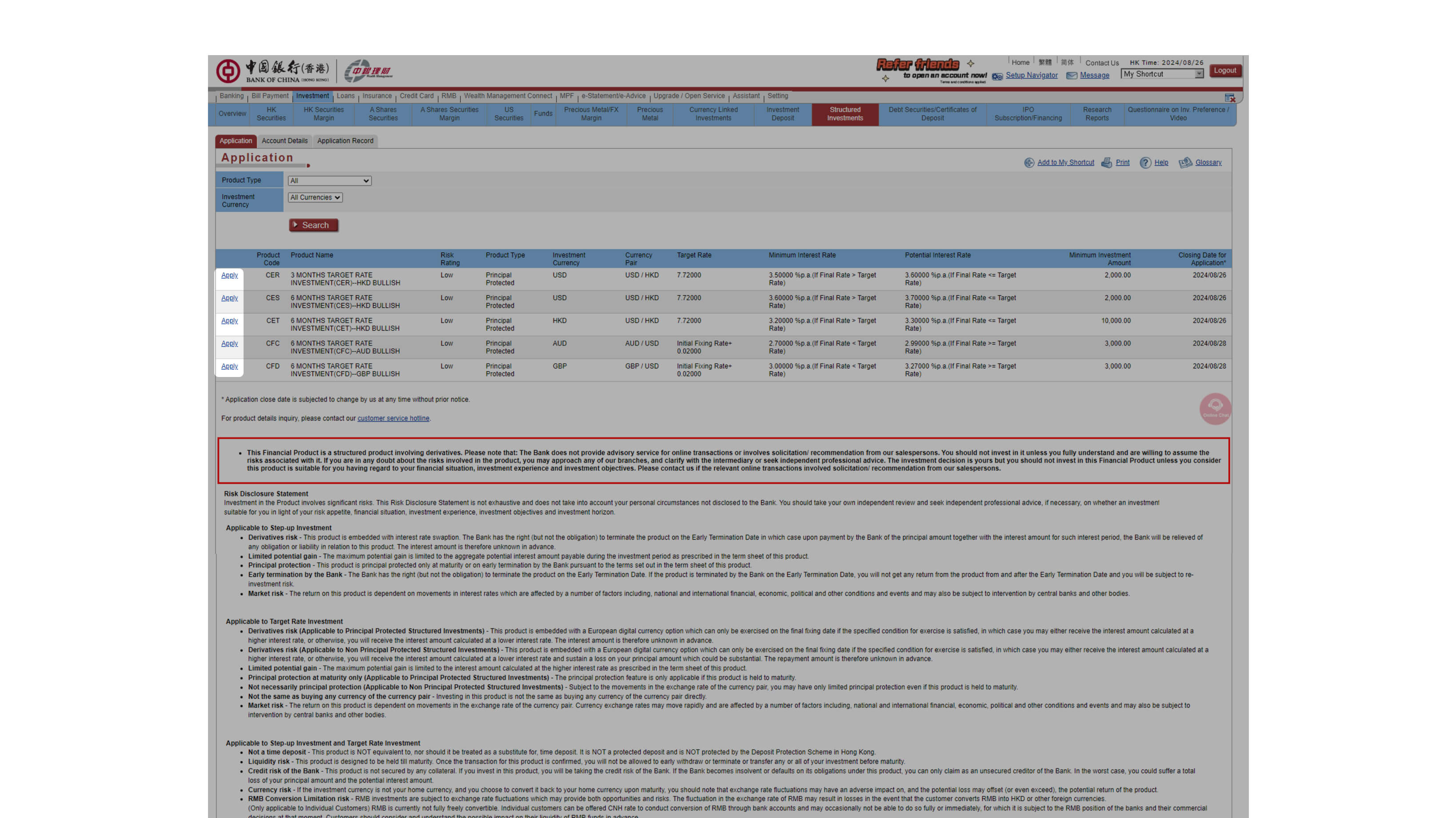

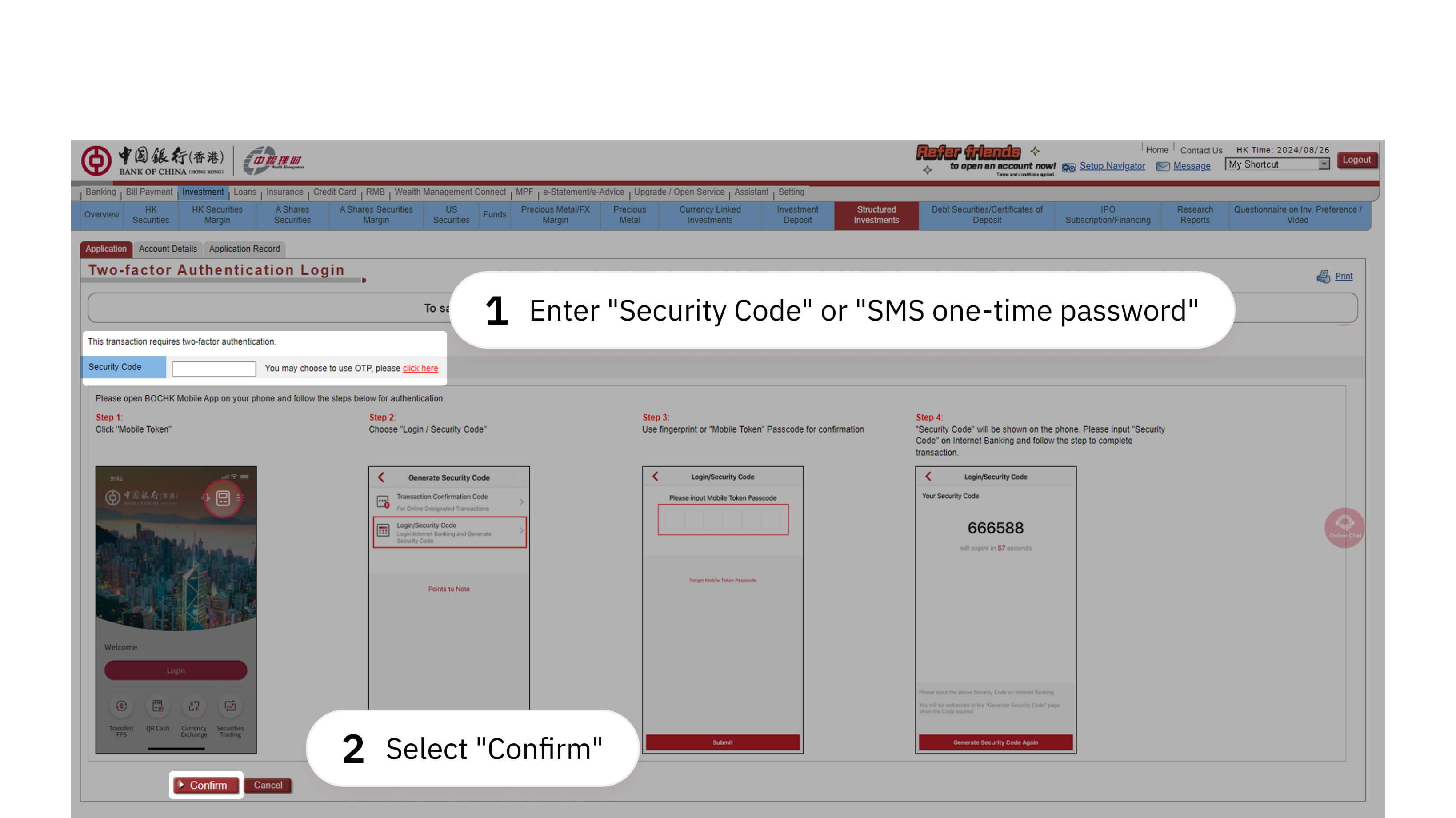

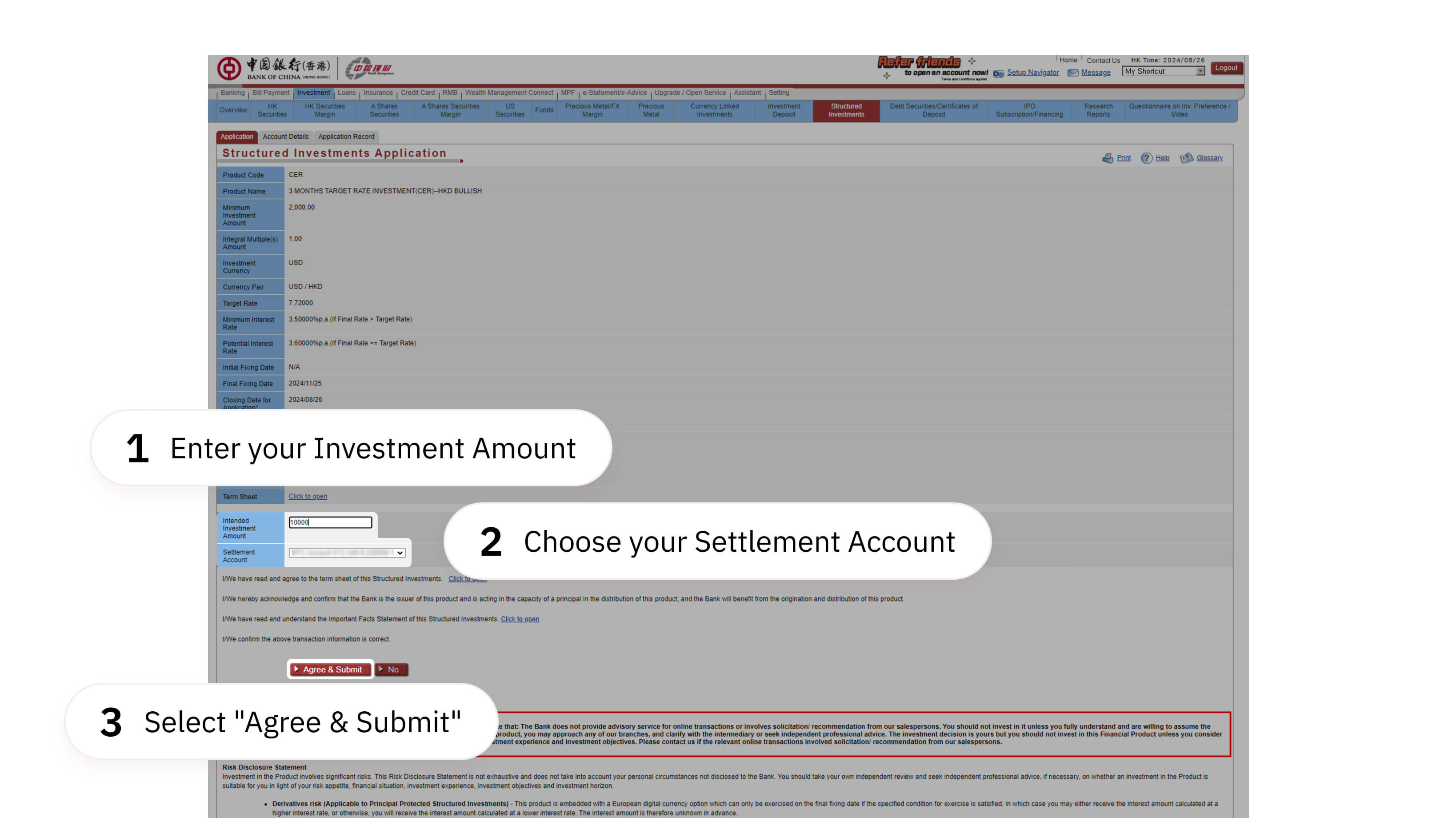

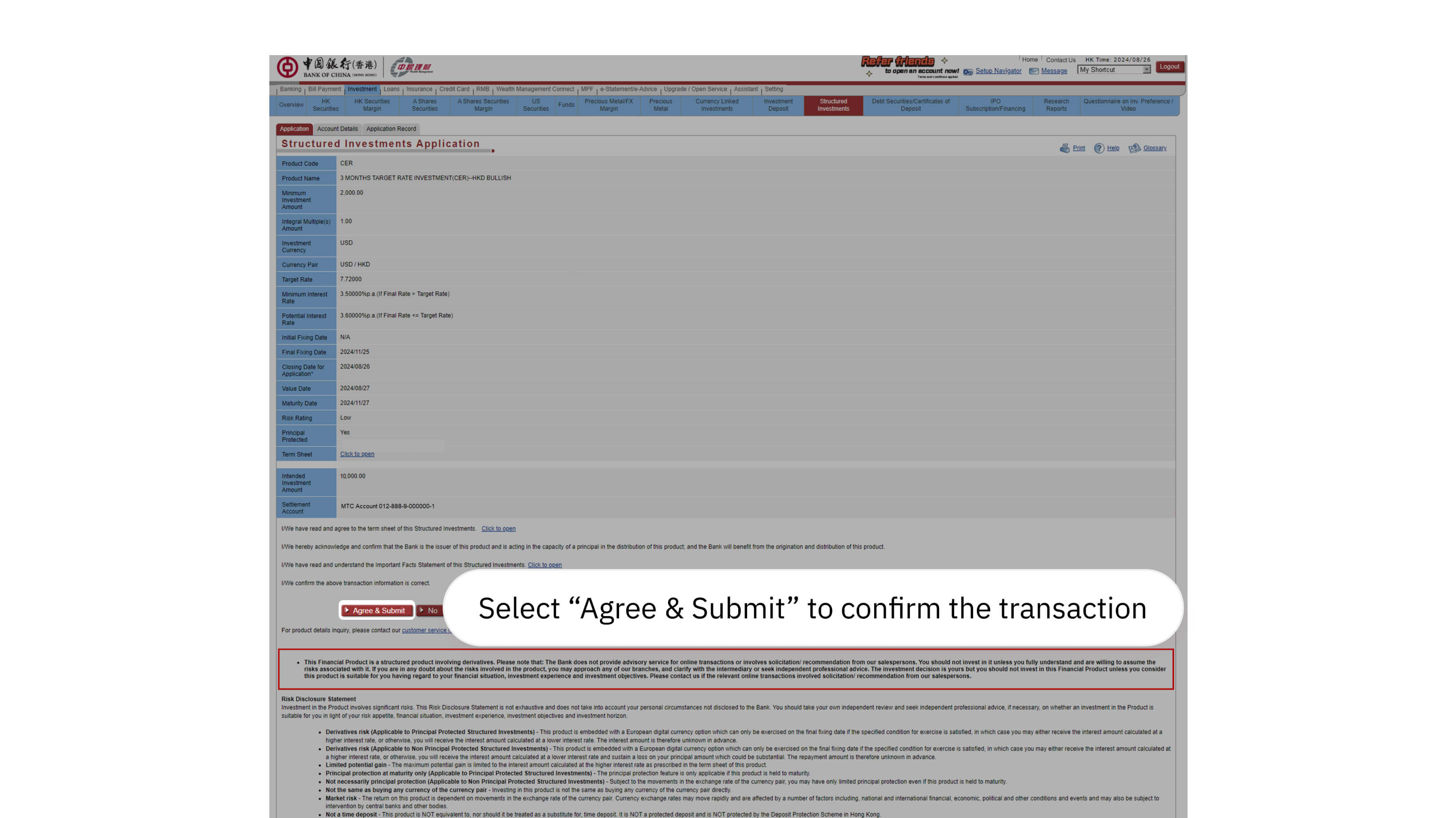

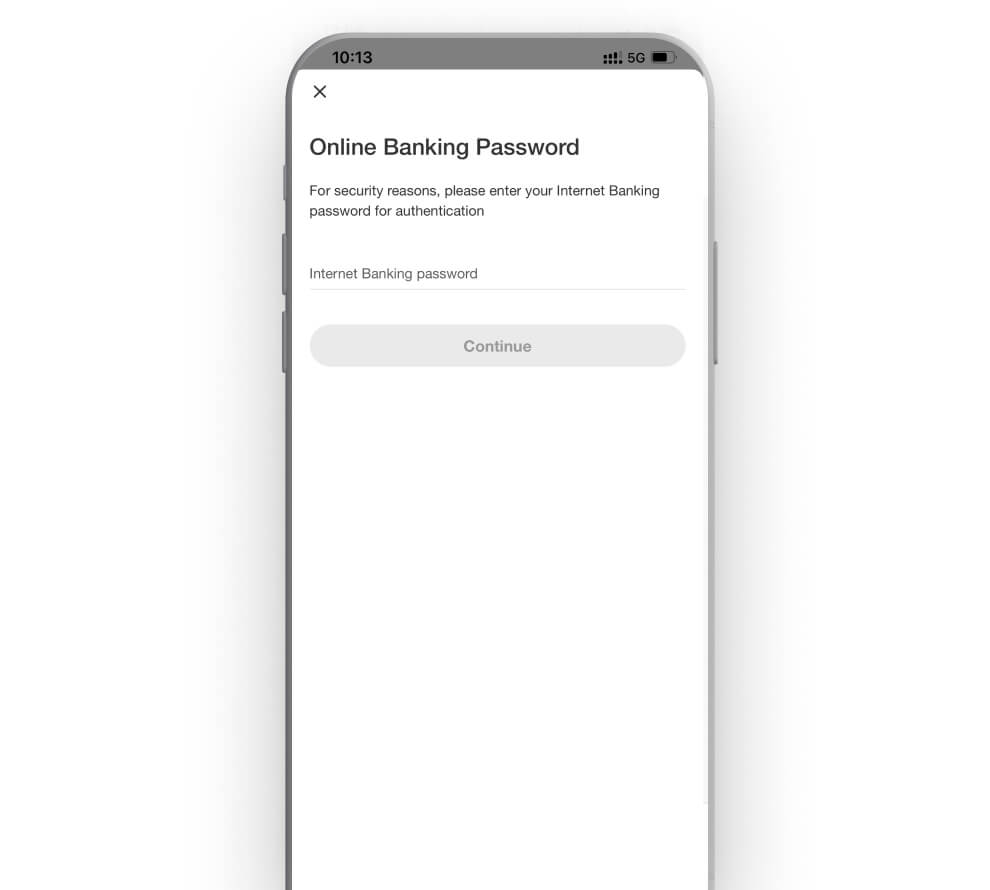

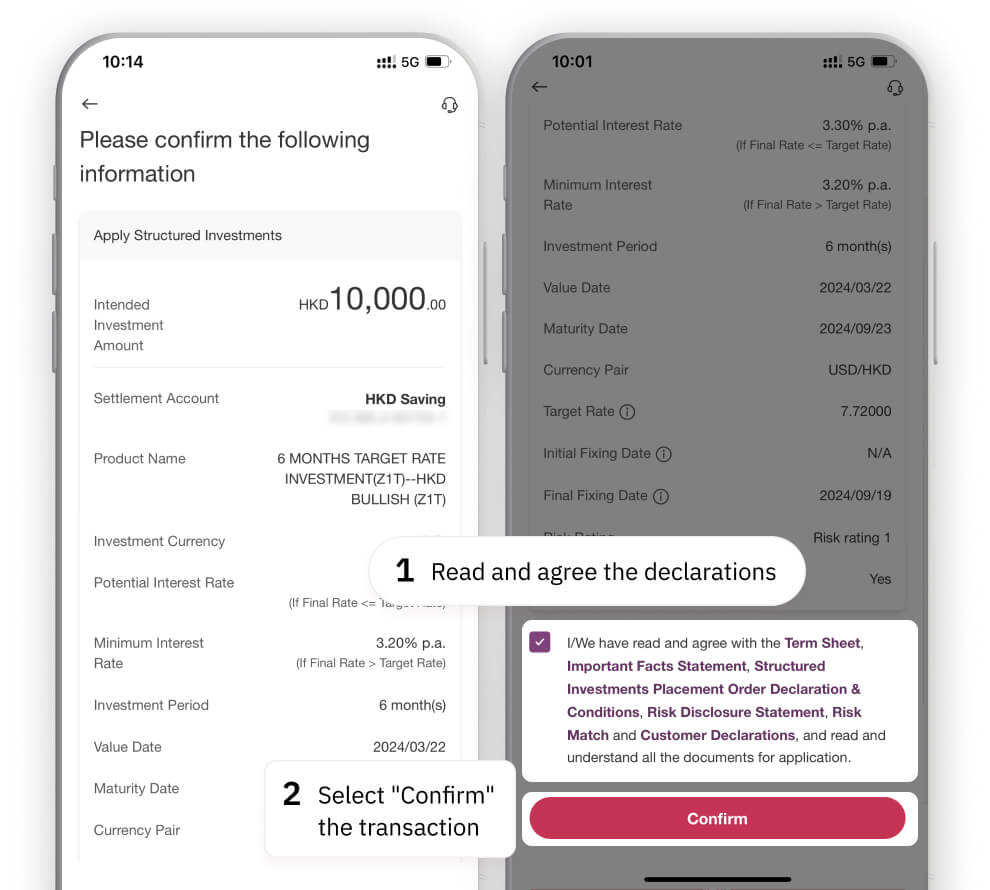

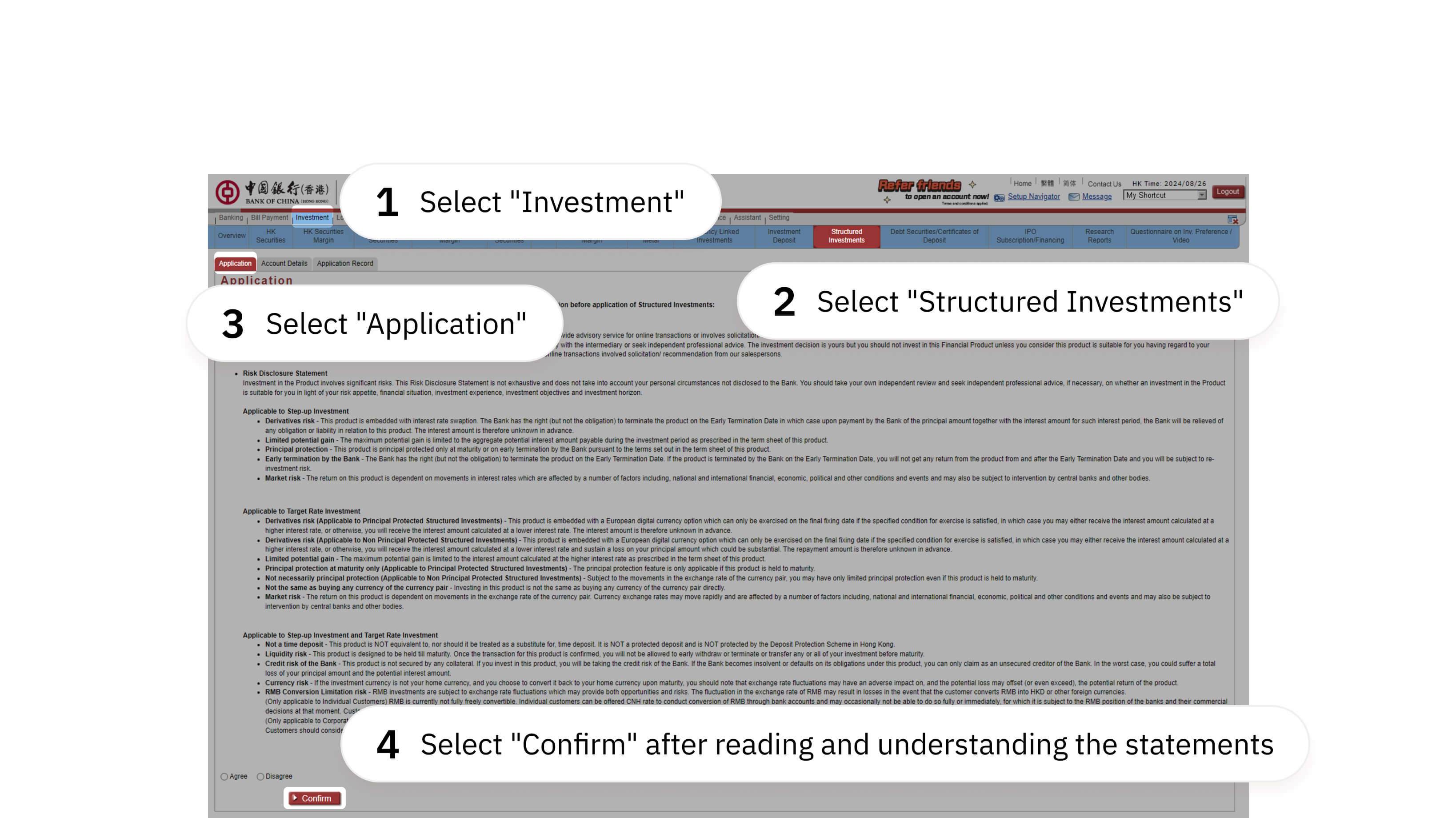

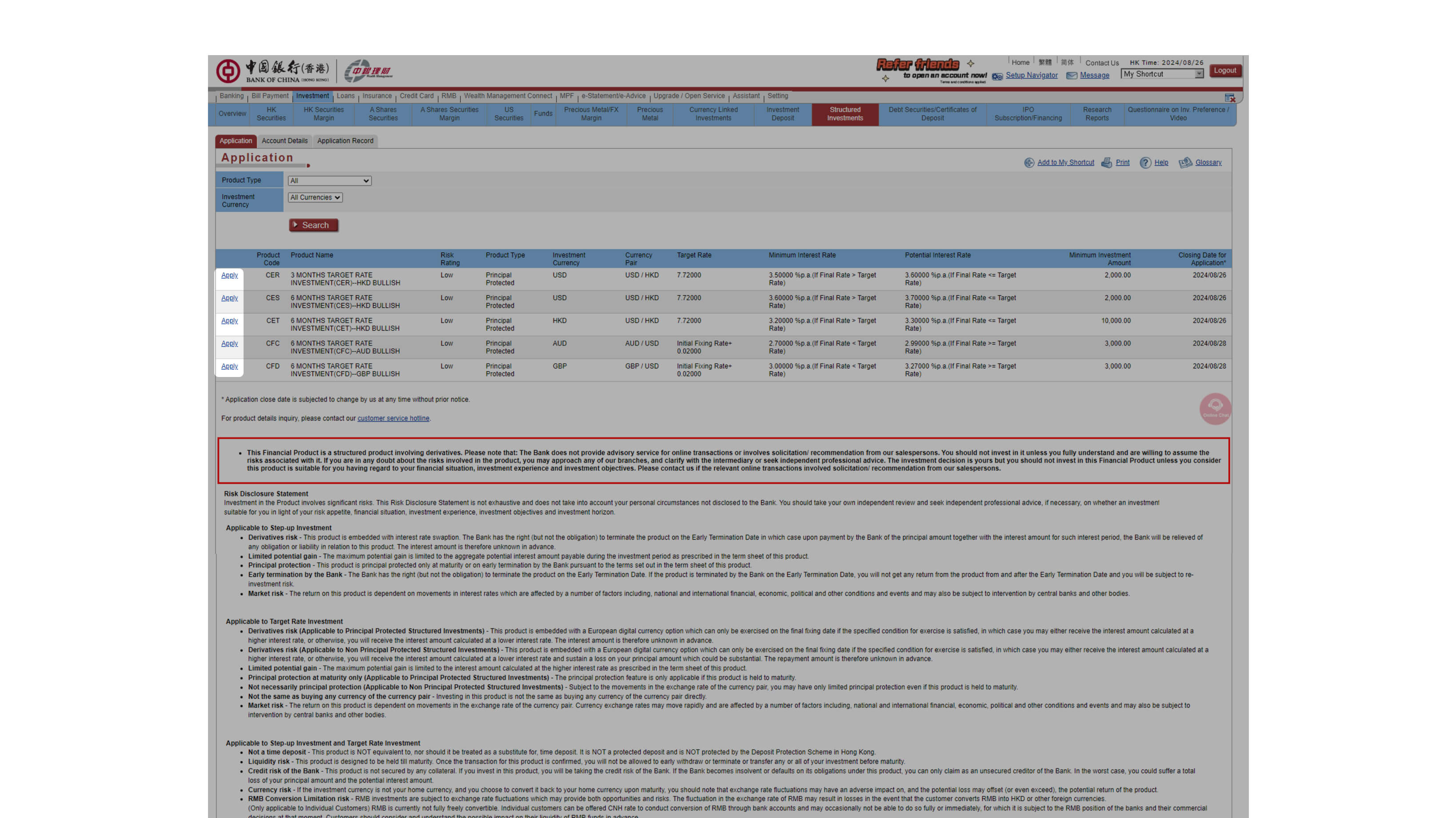

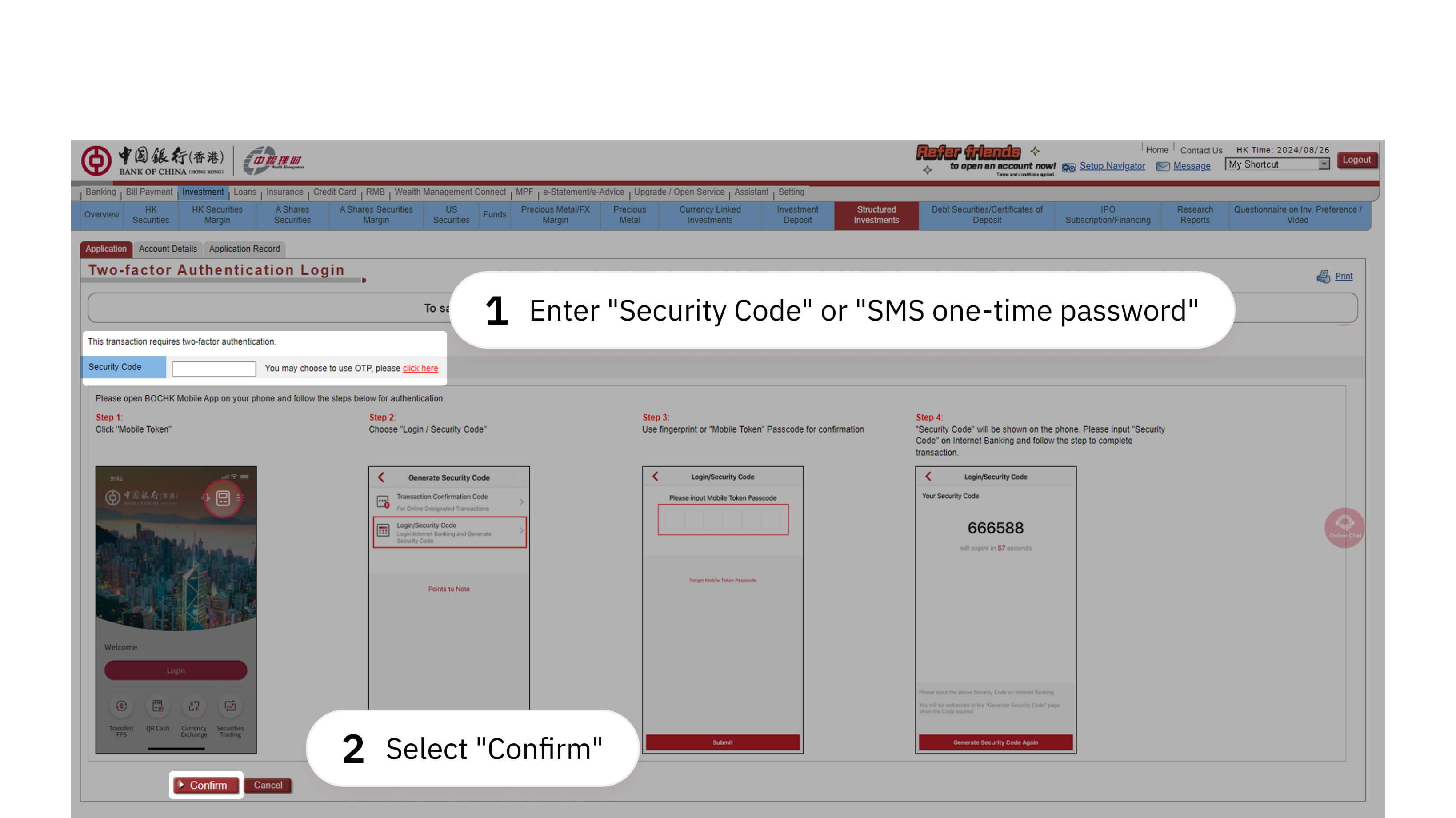

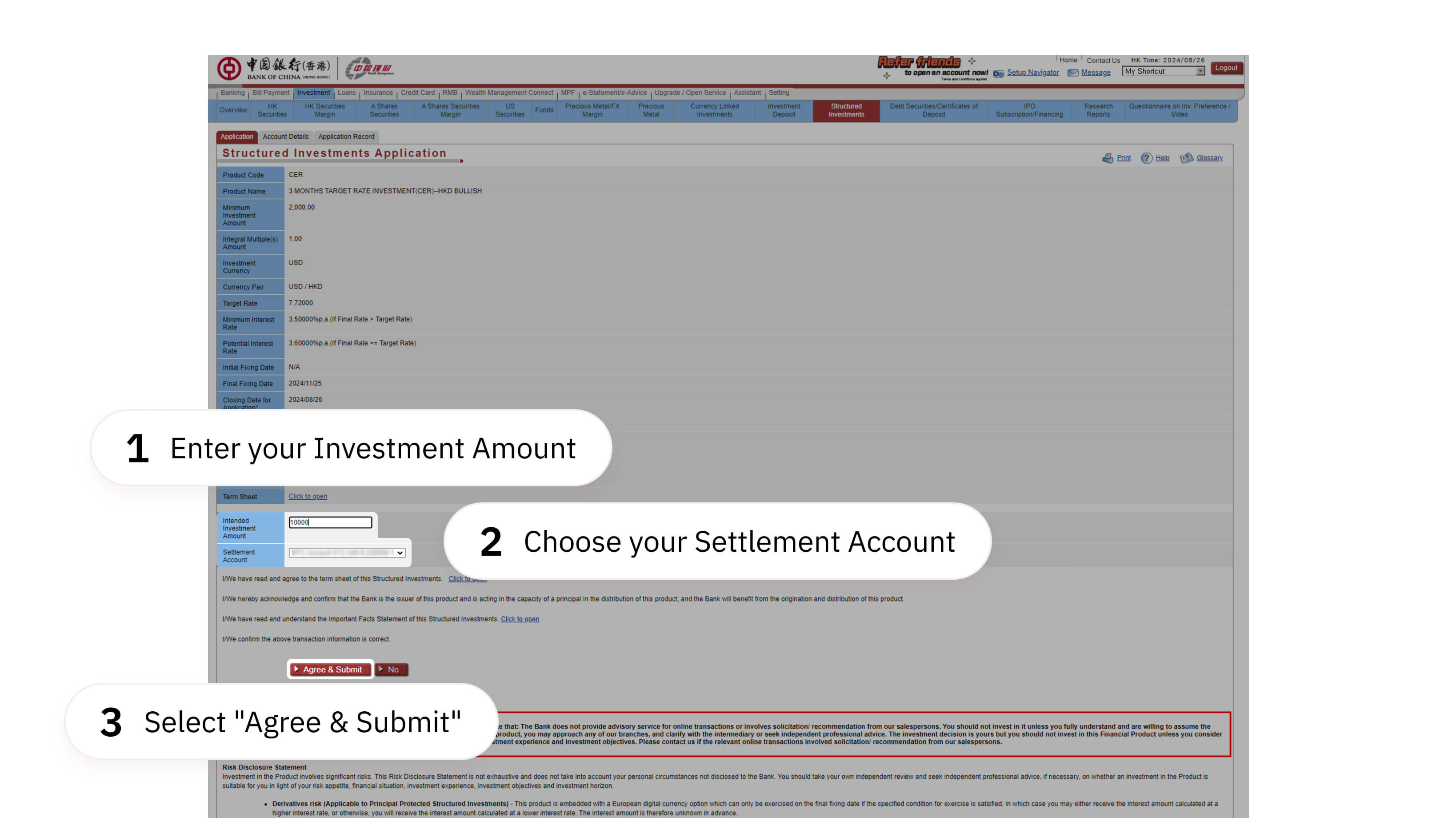

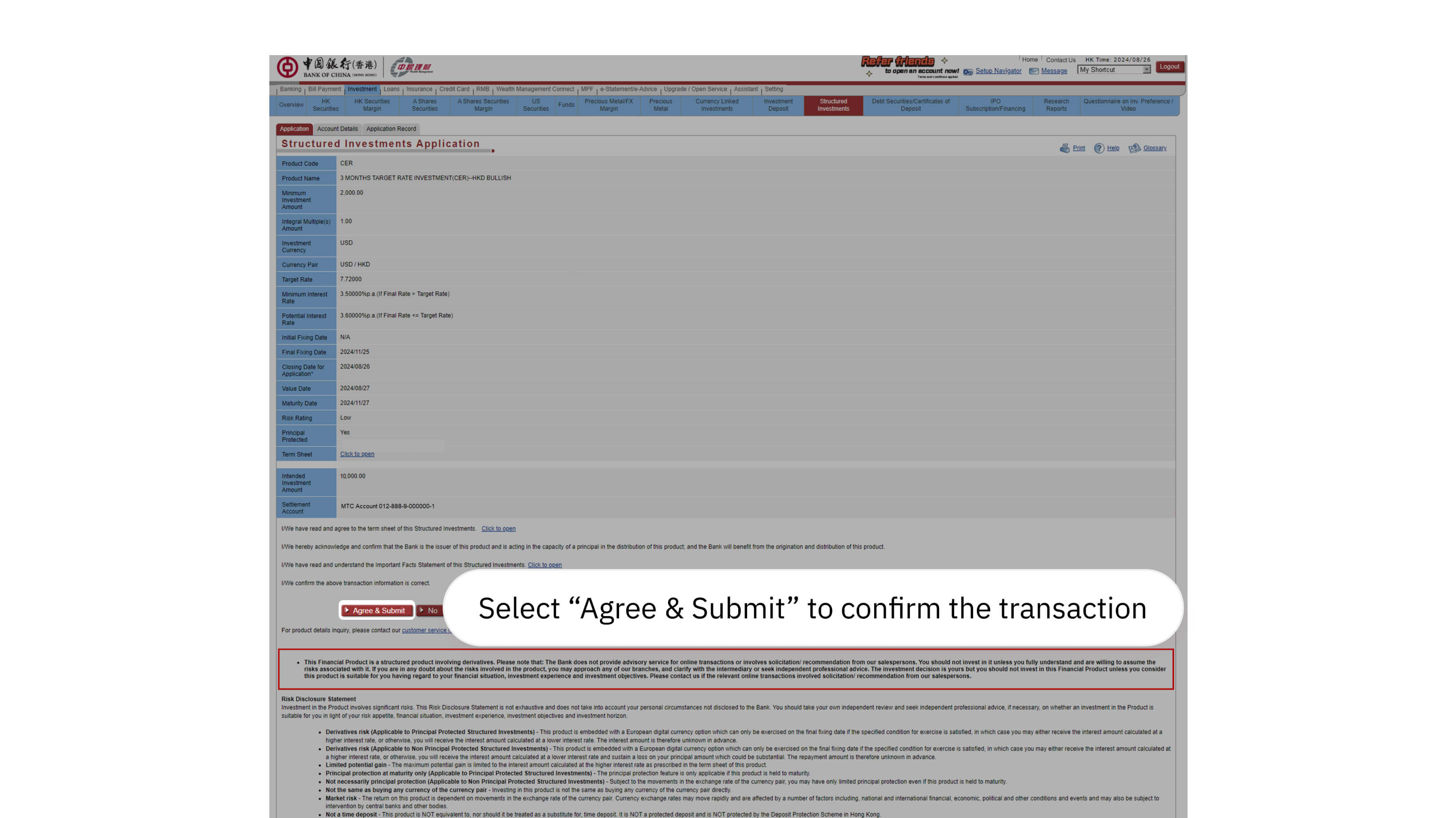

Account Opening and Transaction Process

Latest Foreign Currency Exchange Information

This is a structured investment product involving derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Investment involves risks. You should not invest in Structured Investments based on this page alone. You should read and understand the Bank's Conditions for Services and all of the offering documents including the relevant term sheet, Important Facts Statement and the Structured Investments Application Form, before deciding whether to invest in this product.

The following risk disclosure statements cannot disclose all the risks involved. Prior to trading or investment, you should collect and study the information required for your investment. You should take your own independent review and seek independent professional advice, if necessary, on whether this product is suitable for you in light of your risk appetite, financial situation, investment experience, investment objectives and investment horizon. If you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment, you should seek independent advice.

This is a structured investment product involving derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Investment involves risks. You should not invest in Structured Investments based on this page alone. You should read and understand the Bank's Conditions for Services and all of the offering documents including the relevant term sheet, Important Facts Statement and the Structured Investments Application Form, before deciding whether to invest in this product.

The following risk disclosure statements cannot disclose all the risks involved. Prior to trading or investment, you should collect and study the information required for your investment. You should take your own independent review and seek independent professional advice, if necessary, on whether this product is suitable for you in light of your risk appetite, financial situation, investment experience, investment objectives and investment horizon. If you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment, you should seek independent advice.

- Not a time deposit - Structured Investments is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

- Derivatives risk - Structured Investments is embedded with a European digital currency option which can only be exercised on the final fixing date if the specified condition for exercise is satisfied, in which case you may either receive the interest amount calculated at a higher interest rate, or otherwise, you will receive the interest amount calculated at a lower interest rate. The interest amount is therefore unknown in advance.

- Limited potential gain - The maximum potential gain is limited to the interest amount calculated at the higher interest rate as prescribed in the term sheet of this product.

- Principal protection at maturity only - The principal protection feature is only applicable if the Structured Investments is held to maturity.

- Not the same as buying any currency of the currency pair - Investing in Structured Investments is not the same as buying any currency of the currency pair directly.

- Market risk - The return on Structured Investments is dependent on movements in the exchange rate of the currency pair. Currency exchange rates may move rapidly and are affected by a number of factors including, national and international financial, economic, political and other conditions and events and may also be subject to intervention by central banks and other bodies.

- Liquidity risk - Structured Investments is designed to be held till maturity. Once the transaction for this product is confirmed, you will not be allowed to early withdraw or terminate or transfer any or all of your investment before maturity.

- Credit risk of the Bank - Structured Investments is not secured by any collateral. If you invest in this product, you will be taking the credit risk of the Bank. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your principal amount and the potential interest amount.

- Currency risk - If the investment currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you should note that exchange rate fluctuations may have an adverse impact on, and the potential loss may offset (or even exceed), the potential return of the product.

- RMB Conversion Limitation Risk - RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

(Only applicable to Individual Customers) RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

(Only applicable to Corporate Customers) RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance. - Emerging markets - Investments in emerging markets are more sensitive to social, political or economic development in the region. than those in developed markets, and subject to risk such as market suspension, restrictions on foreign investment and control or repatriation of capital. There are also possibilities of nationalisation, expropriation or confiscatory taxation, foreign exchange control, political changes, government regulation, social instability or diplomatic developments which could adversely affect the economics of the emerging markets or the value of your investment.

- No secondary market - Structured Investments is not a listed security. There is no secondary market for you to sell the Structured Investments prior to its maturity.

- Potential conflict of interest - Although the Bank will act in good faith and in a commercially reasonable manner in making determinations and calculations with respect to the Product, the Bank may encounter conflict of interest arising out of the activities of the Bank and/or any of its affiliates (collectively, the “BOC Group Entities”).The BOC Group Entities may engage in transactions involving or affecting the underlying exchange rate for its proprietary accounts and/or for the accounts of others and/or to hedge against the market risk associated with the Product. These transactions may positively or adversely affect the movements in the underlying exchange rate and thus the return of the Product. None of the BOC Group Entities is under any obligation to avoid or disclose any of the above conflicts.

- Not covered by Investor Compensation Fund - Structured Investments is not covered by the Hong Kong Investor Compensation Fund.