- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

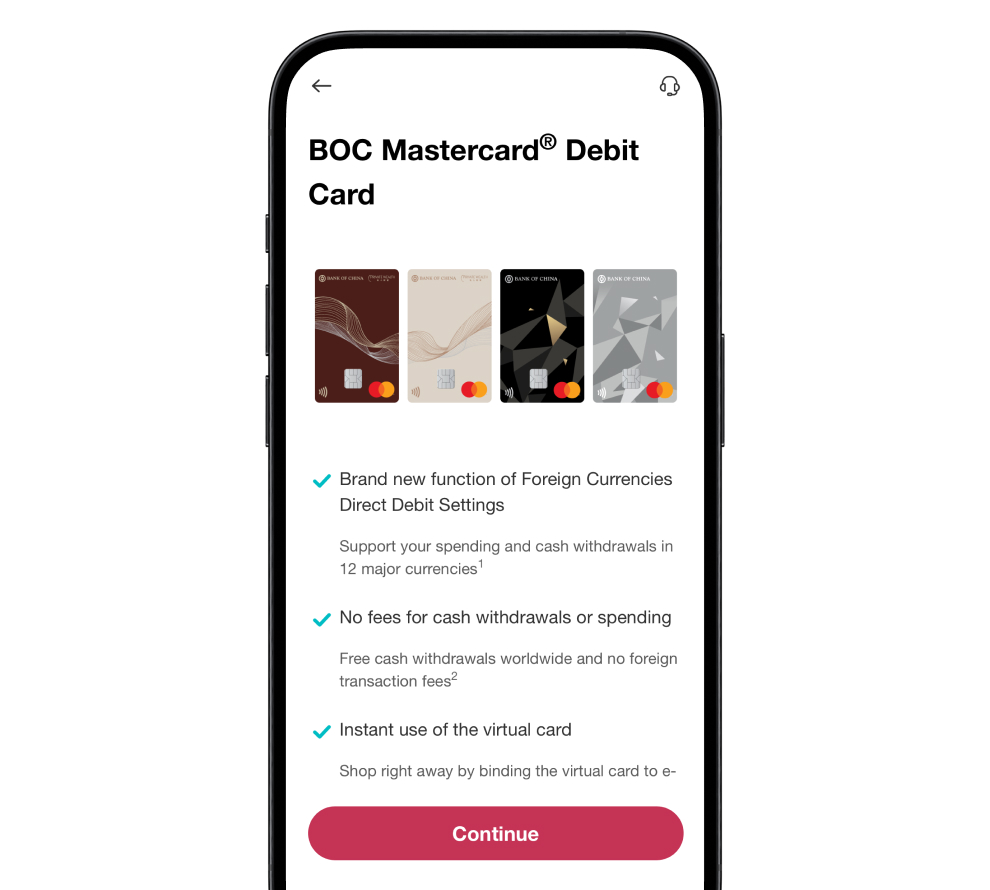

BOC Mastercard® Debit Card

Explore the world with us!

Smart and easy foreign currency spending

Enjoy unlimited

0.5% cash rebate

Learn More

Enjoy unlimited 0.5% cash rebate

Enjoy unlimited 0.5% cash rebate on retail spending at any online, local, and overseas merchants with the BOC Mastercard® Debit Card!

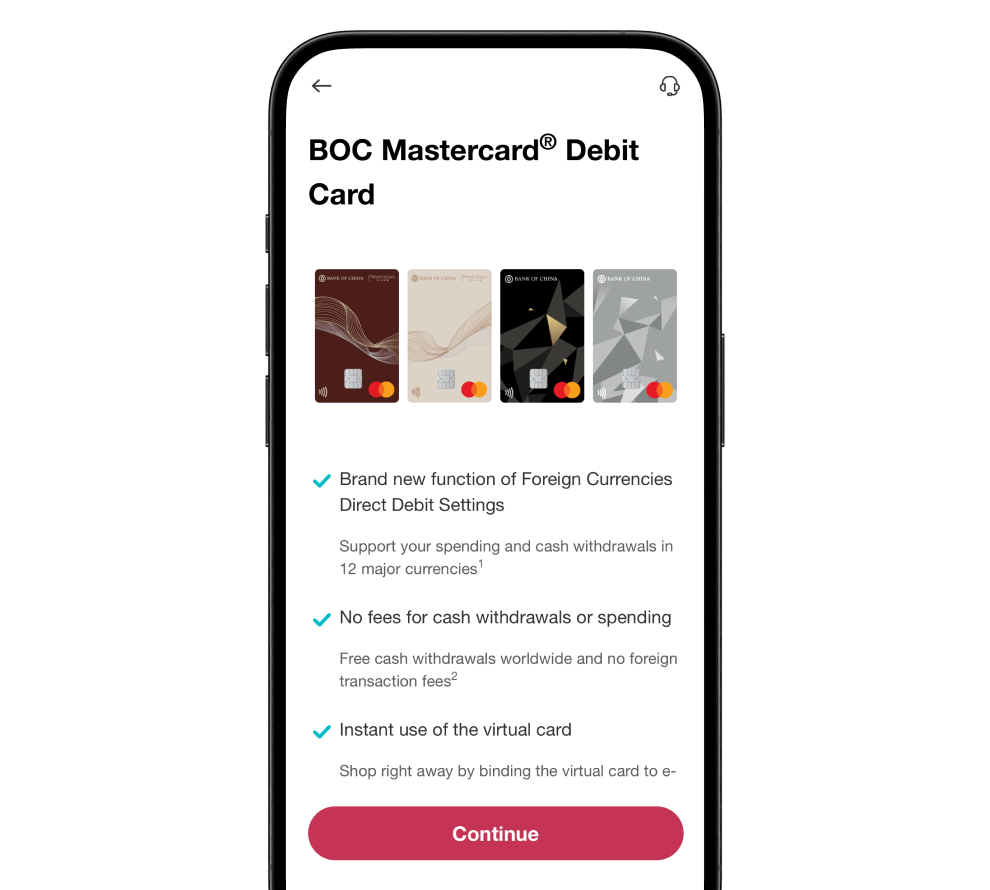

Choose BOC Mastercard® Debit Card and experience the smartest way for your overseas spending, effortlessly enjoying our attentive services.

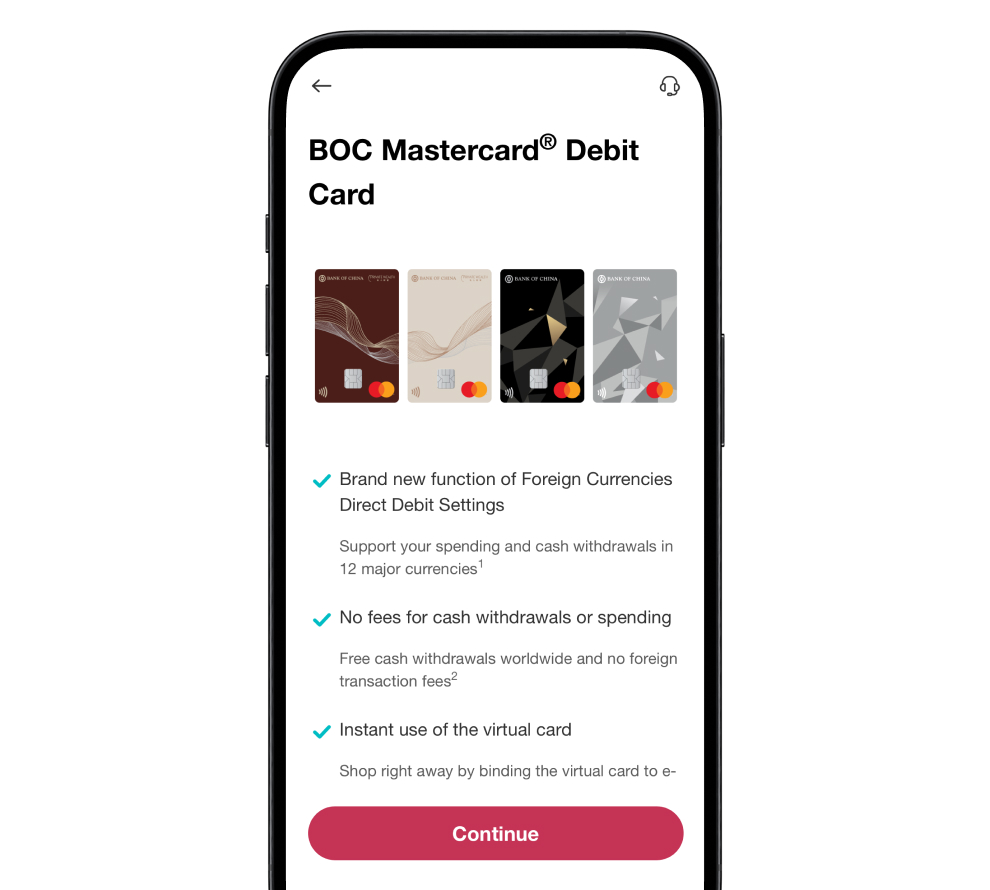

"Smart" Travel Partner

Spend and withdraw cash globally: Pay directly with your debit account with 12 currencies*

- The debit card can be linked to your Multi-Currency Savings account, which can be used to make local & overseas purchases and cash withdrawals directly. You can bind your debit card to your digital wallet instead of carrying a large quantity of cash

- Support 12 currencies: HKD, USD, CNY, GBP, JPY, AUD, NZD, CAD, EUR, CHF, SGD, THB

*You can choose to suspend and/or reactivate this function at anytime via "Foreign Currency Direct Debit Settings".

Boundless rewards: Enjoy local and overseas offers & privileges

- Offers cover both local and overseas merchants – for you live life to the fullest anytime anywhere

- To enjoy extra rebate rewards, register as Mastercard Travel Rewards* member to enjoy extra perks as you spend at over 100 local, overseas and online merchants

*Applicable to Mastercard World card only. The offer is provided by Mastercard and is subject to terms and conditions.

"Smart" Wealth Manager

Easy application: Manage your account and spending safely with no hassle

- Apply simply through Mobile Banking or at a branch. You can also manage the spending and withdrawal limits of your debit card (including supplementary cards) via Mobile Banking anytime

- Instant access to your daily transaction history for better management of your account

Save on overseas spending: Manage foreign currencies anytime, anywhere

- You can flexibly exchange currencies in advance via our 7x24 Mobile Banking/Internet Banking to enjoy exclusive preferential offers before departure

Cash withdrawal without handling fee: Enjoy the convenience of extensive ATM network

- Foreign currency transaction fees are waived for transactions and withdrawals of 12 major currencies

- Cash withdrawal can be made at ATMs of "BOCHK" or "JETCO" network, and with Mastercard logos globally without handling fee*

*Some cash withdrawal transactions may be subject to charges depending on the ATM network and region. For details, please visit www.bochk.com (select "More" > "Terms and Conditions for Services/Products" > "Deposits" > "General Banking Service Charges")

Your "Smart Family Companion"

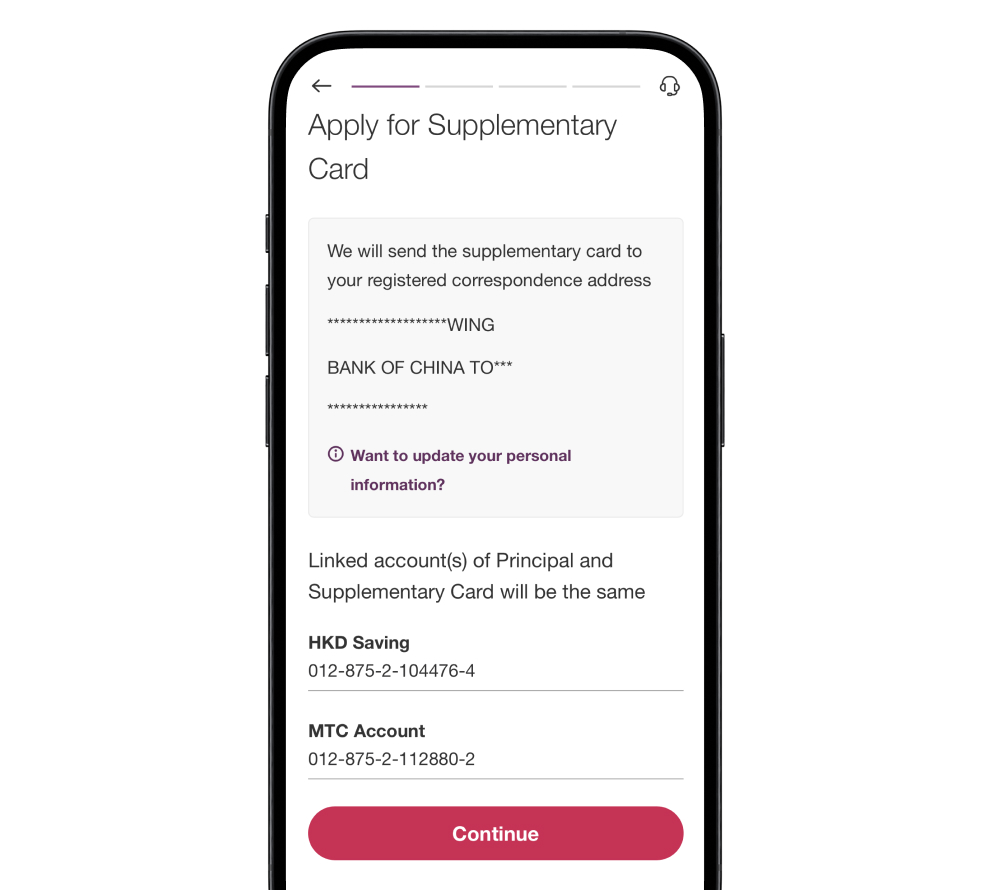

Supplementary card: Take care of your family's needs and apply for a supplementary card for your loved ones

- To meet your family's financial needs (e.g. travel, children studying abroad), you can apply for up to 4 supplementary cards for your children & loved ones, aged 11 or above, to use in Hong Kong and overseas

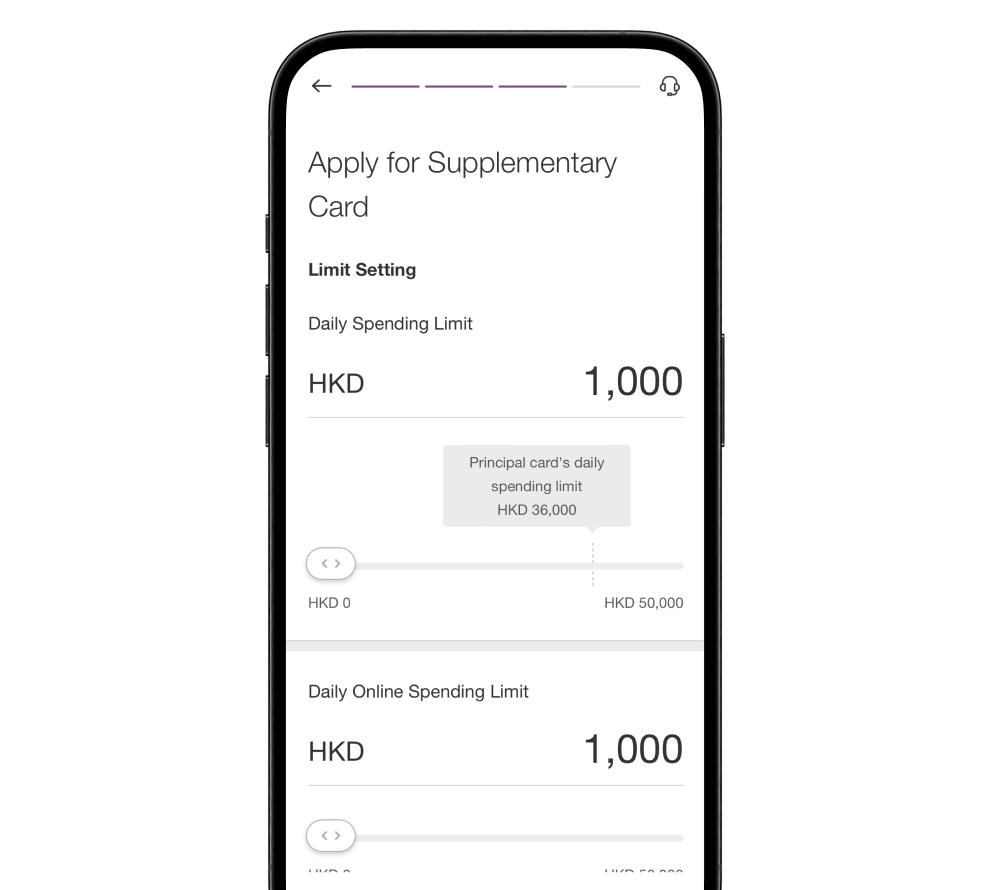

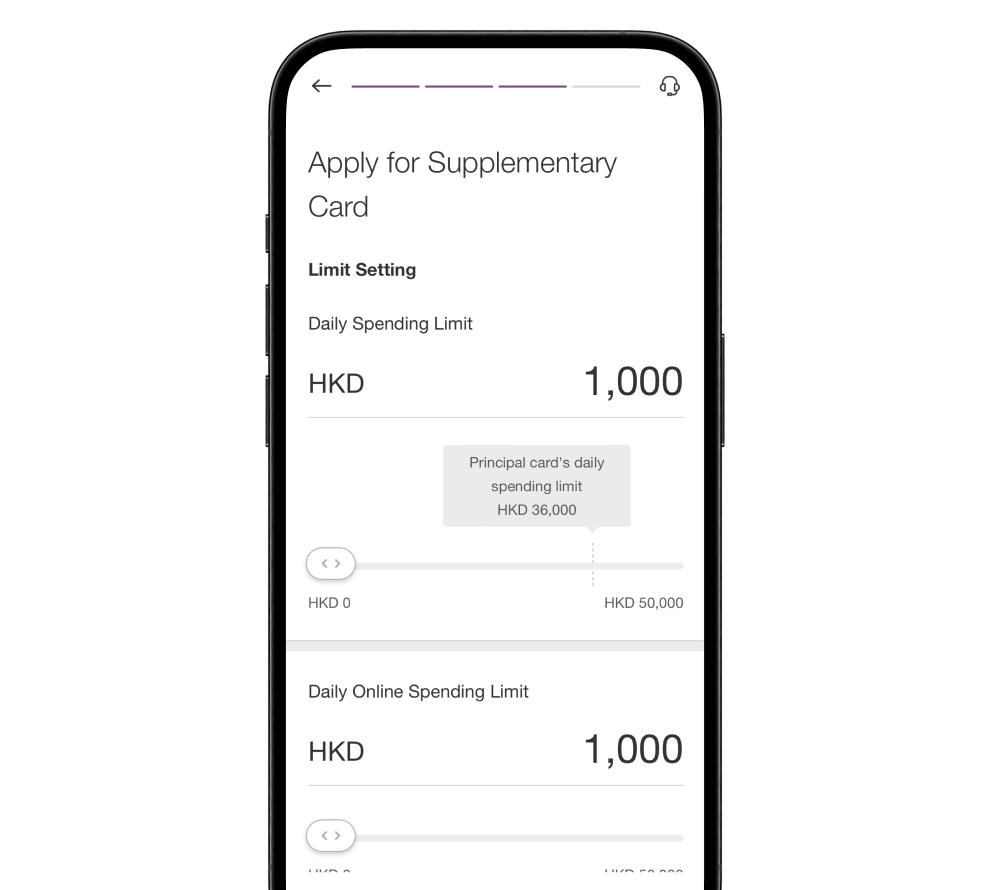

Flexible account management: Set supplementary card limits flexibly for your children and view spending records at a glance

- Different limits can be set for each principal and supplementary card flexibly, with independent spending notifications, which make managing the account much easier.

"Smart" Overview

BOC Private Wealth MasterCard® Debit Card

BOC Private Wealth MasterCard® Debit Card BOC Mastercard® Debit Card

BOC Mastercard® Debit CardCard Type

Card Type

World card

Platinum card

Annual Fee

Annual Fee

Waived

Waived

Daily spending limit

Daily spending limit

HK$300,000

HK$200,000

Daily withdrawal limit

Daily withdrawal limit

HK$80,000

HK$80,000

Privileges

Privileges

Wealth Management and Enrich Banking customer preferential currency exchange rate

Supplementary card

Supplementary card

BOC Private Wealth MasterCard® Debit Card

Supplementary Debit Card

BOC MasterCard® Debit Card

Supplementary Debit Card

- Apply up to 4 supplementary cards, for your beloved one, who is 11 years old or above, to use in Hong Kong and overseas

- Spending limit could be set per each debit card respectively (Daily spending limit HK$300,000<World card>/ HK$200,000<Platinum card>)

Enjoy spending with just a simple tap on your mobile phone

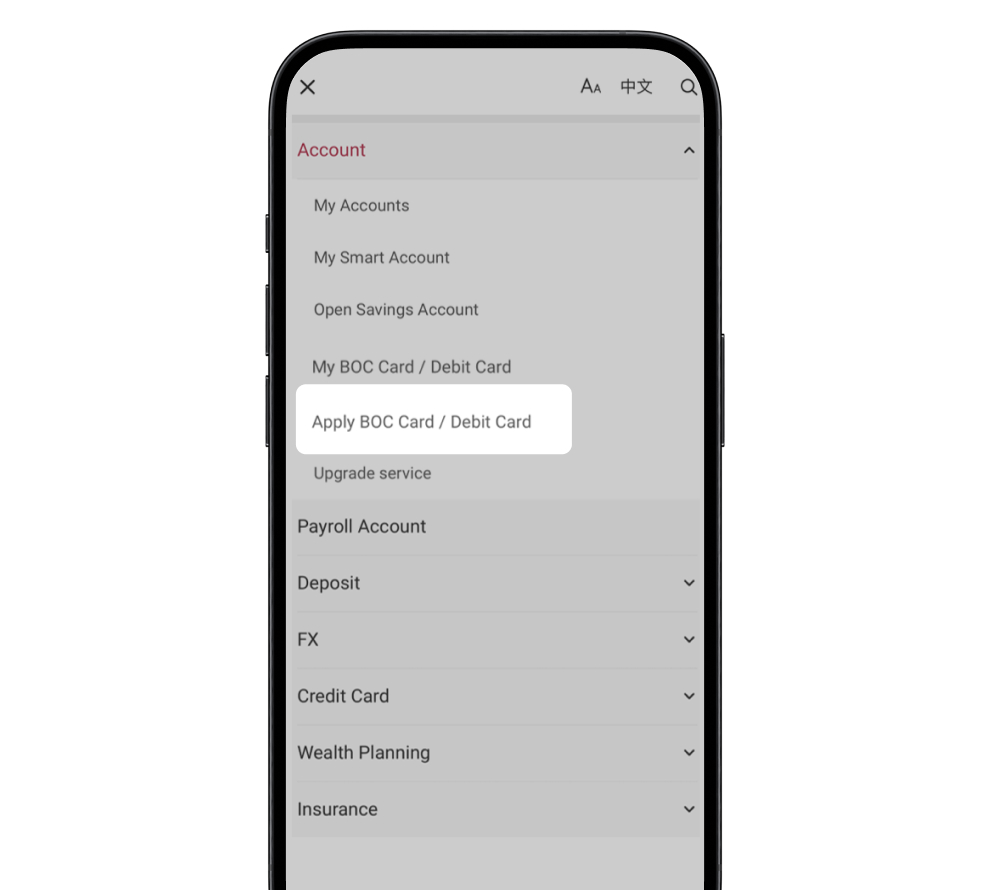

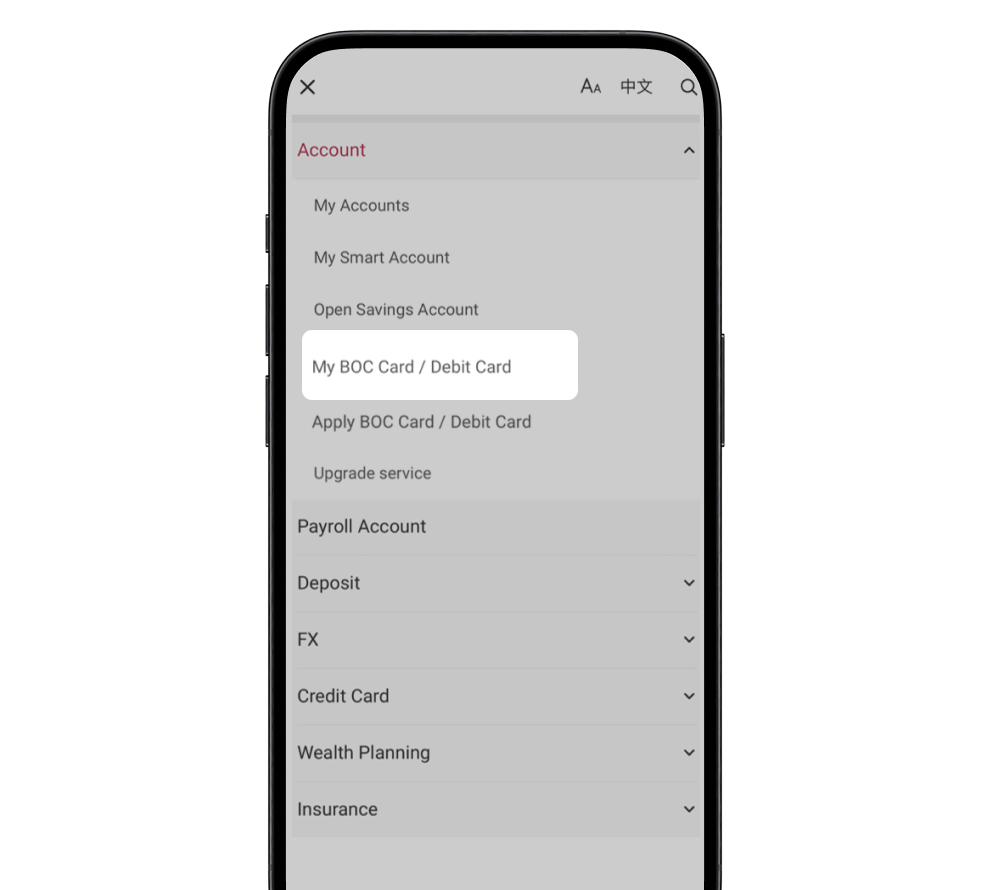

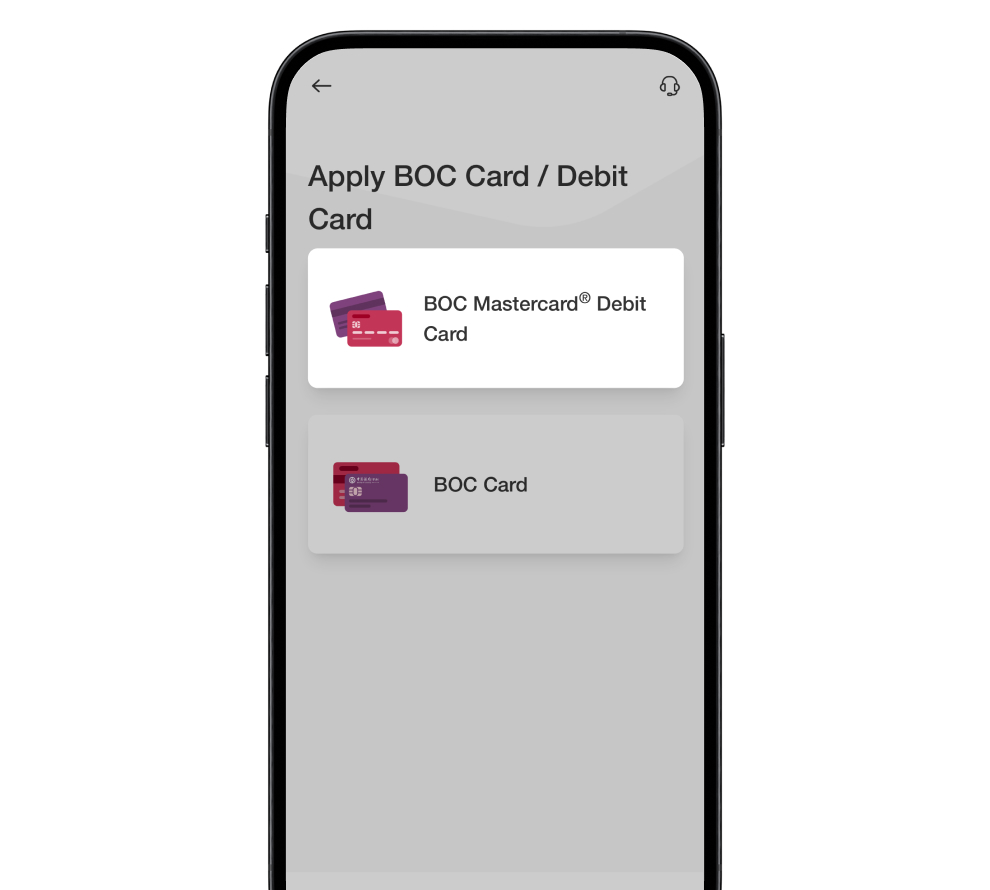

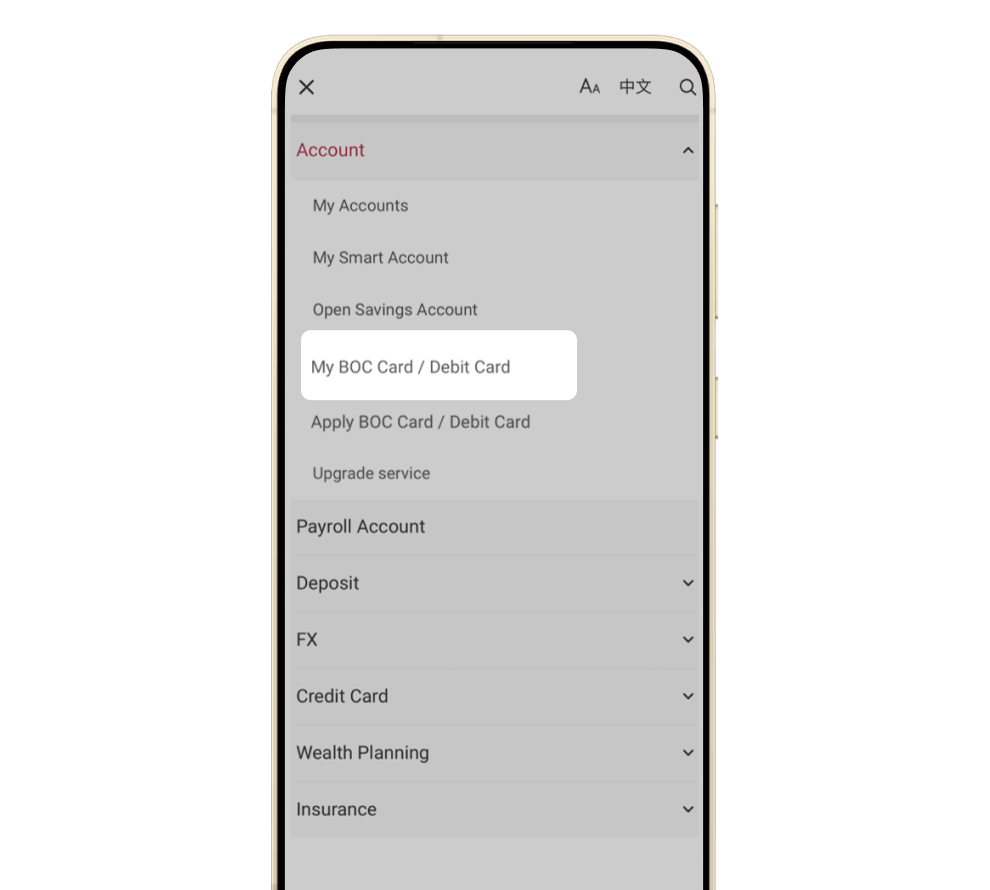

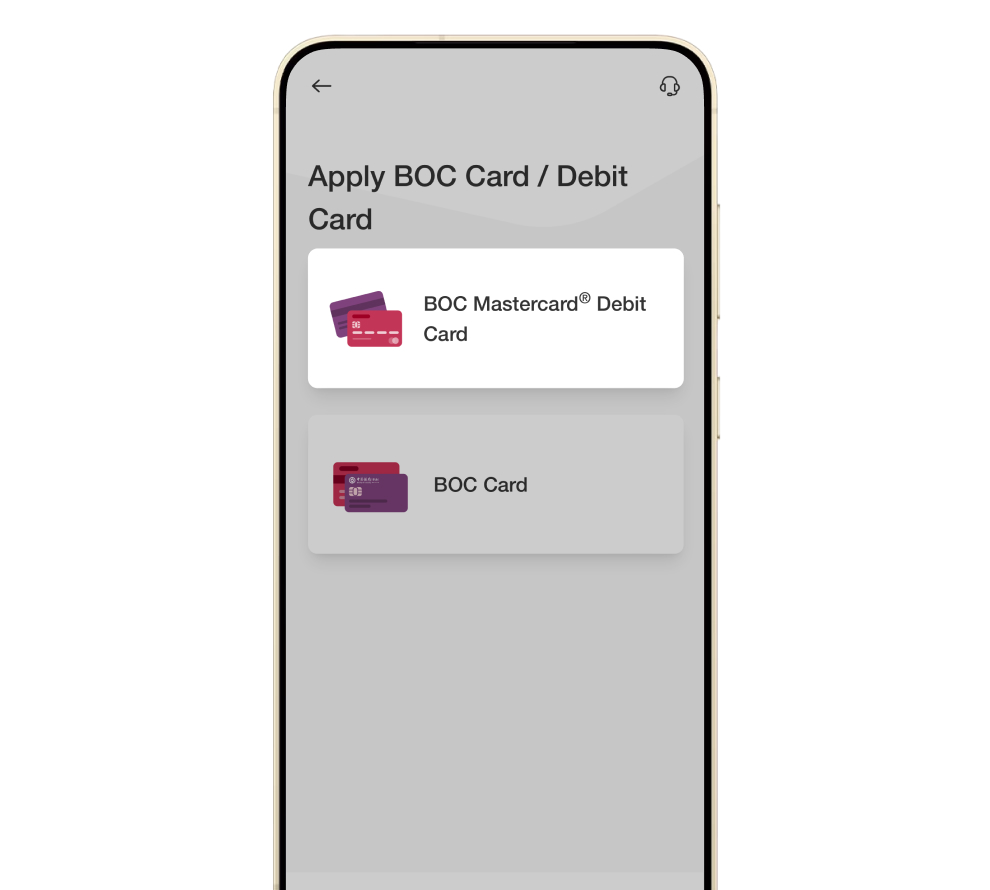

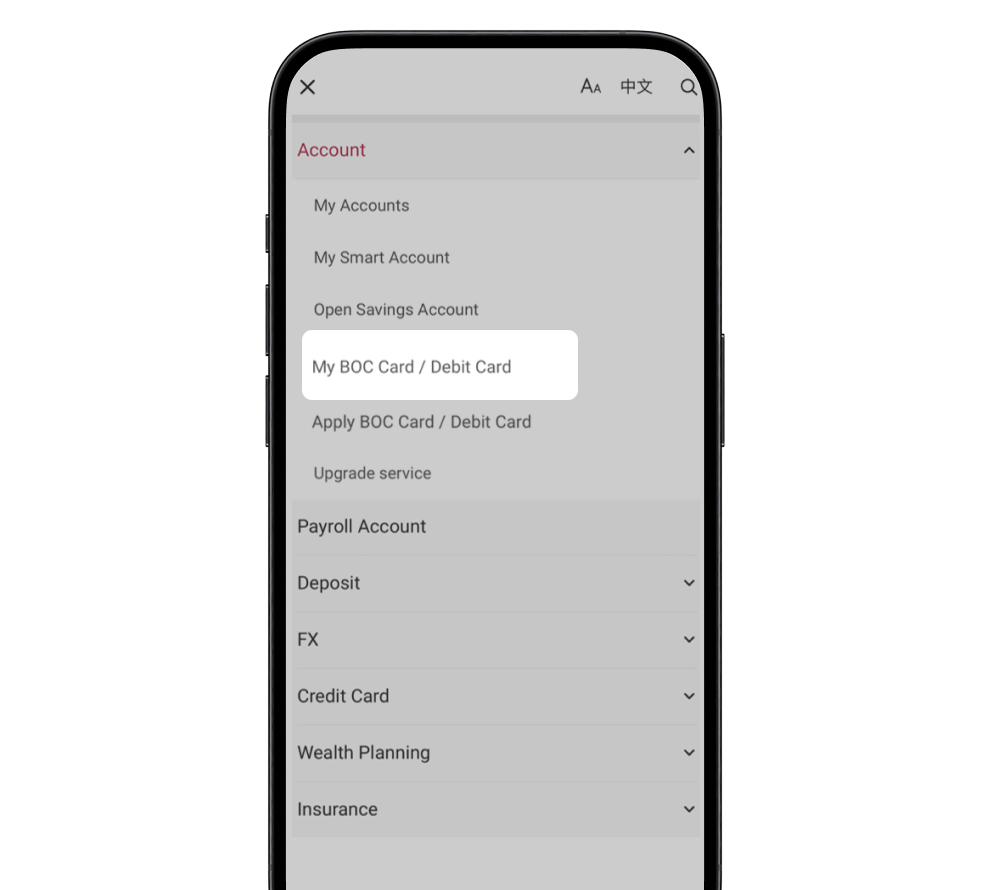

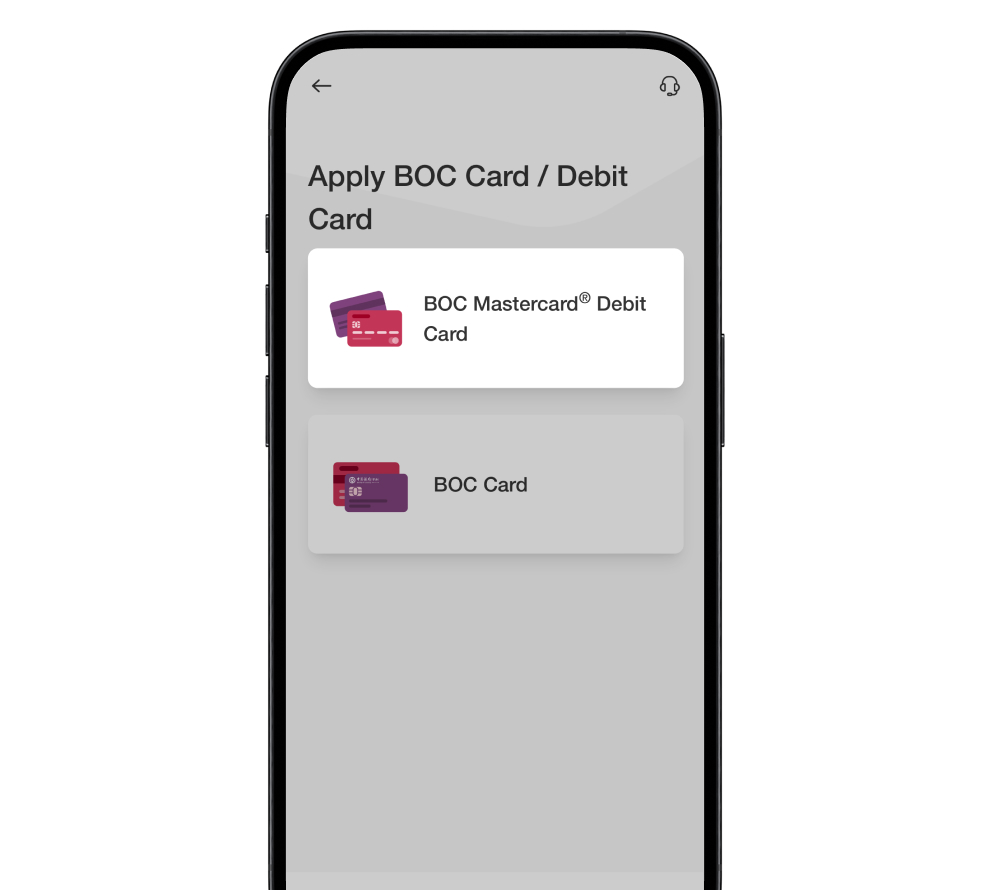

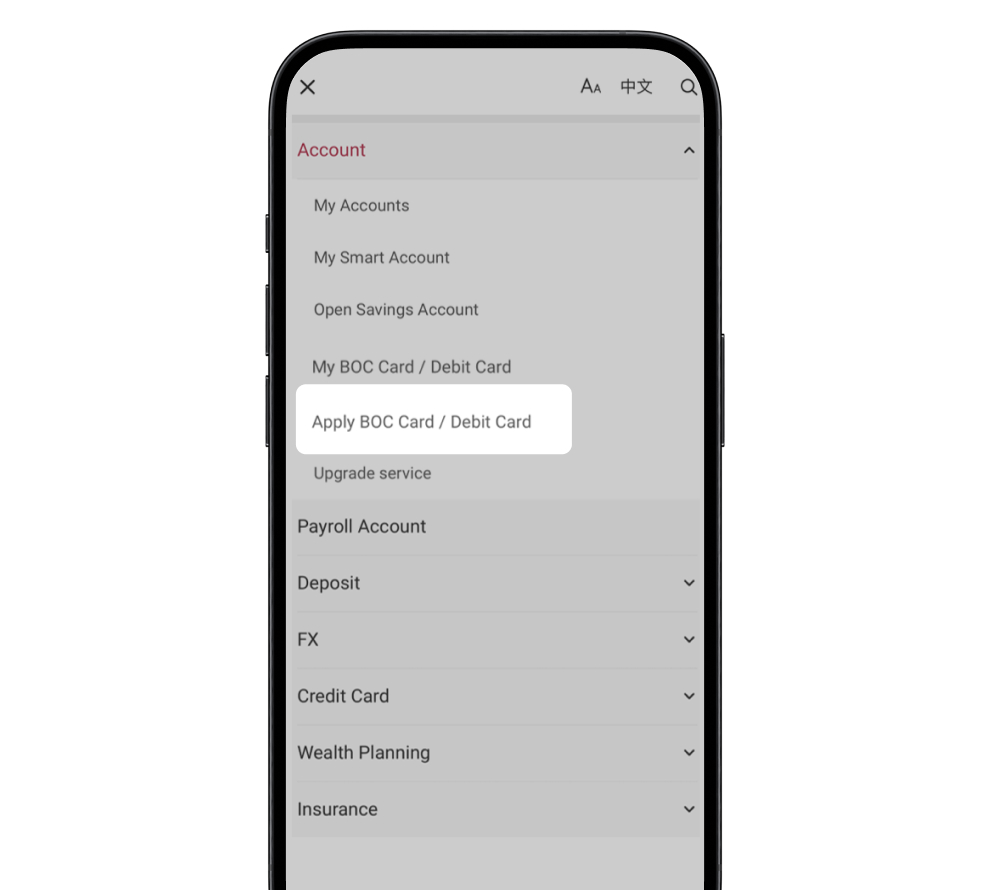

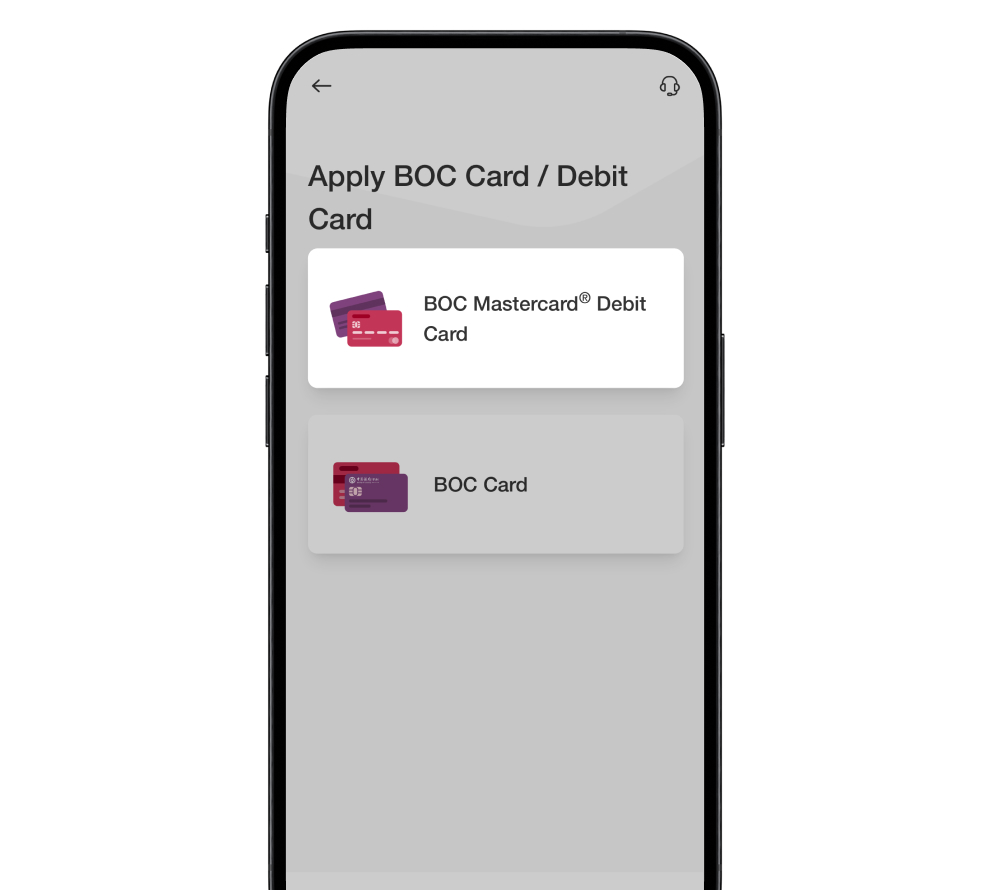

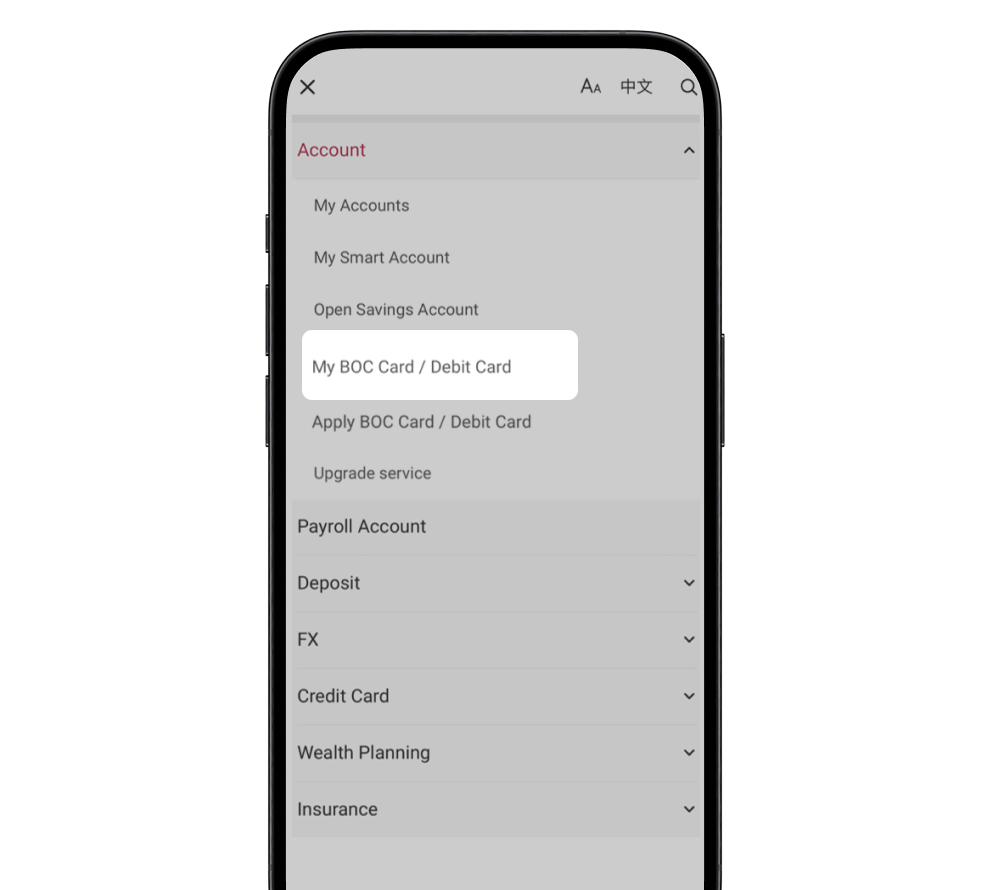

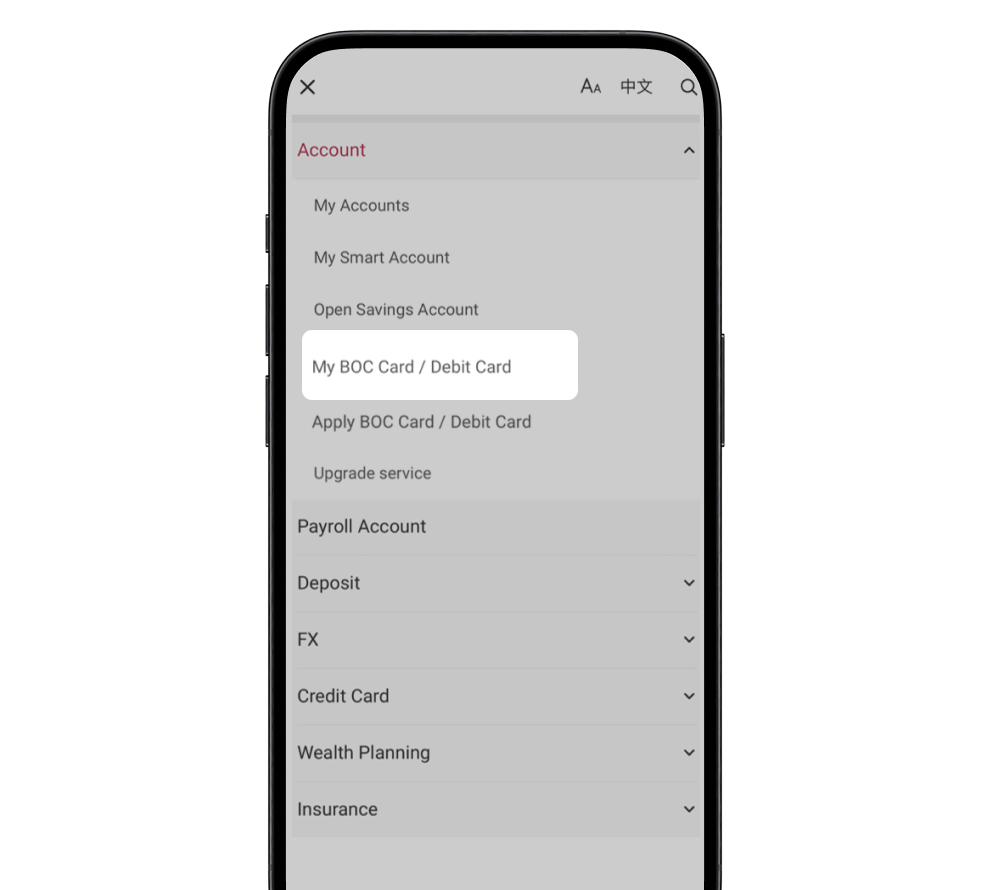

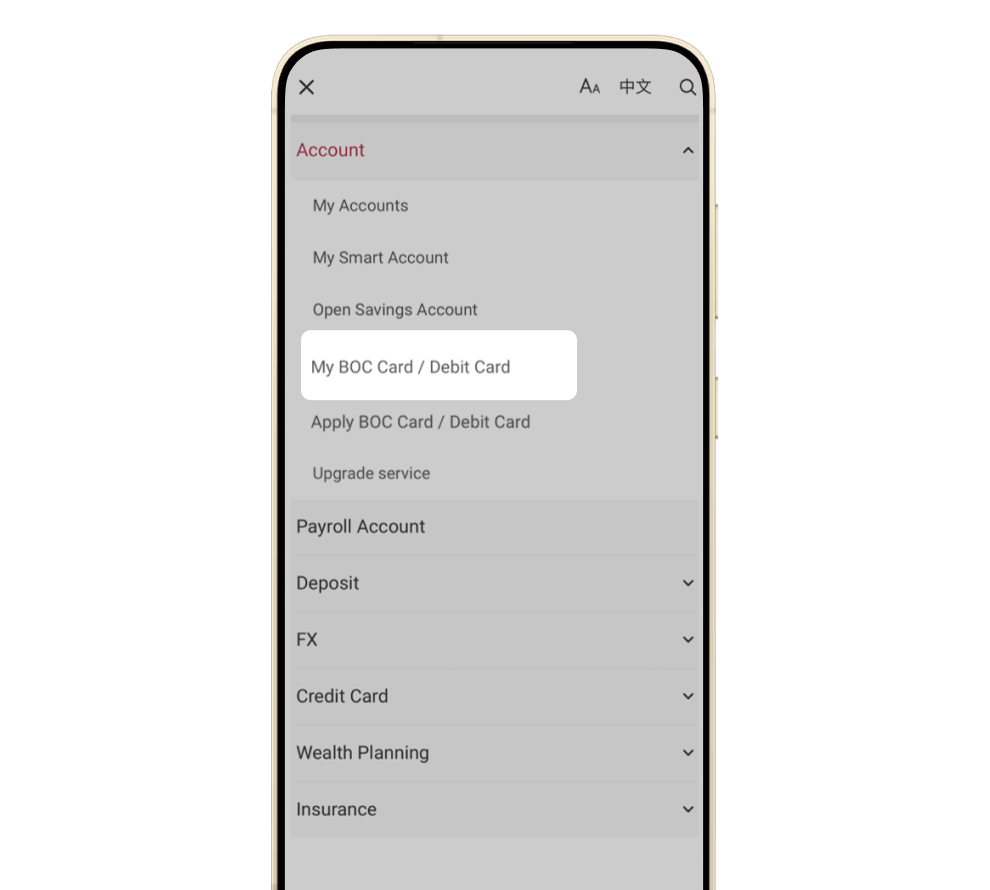

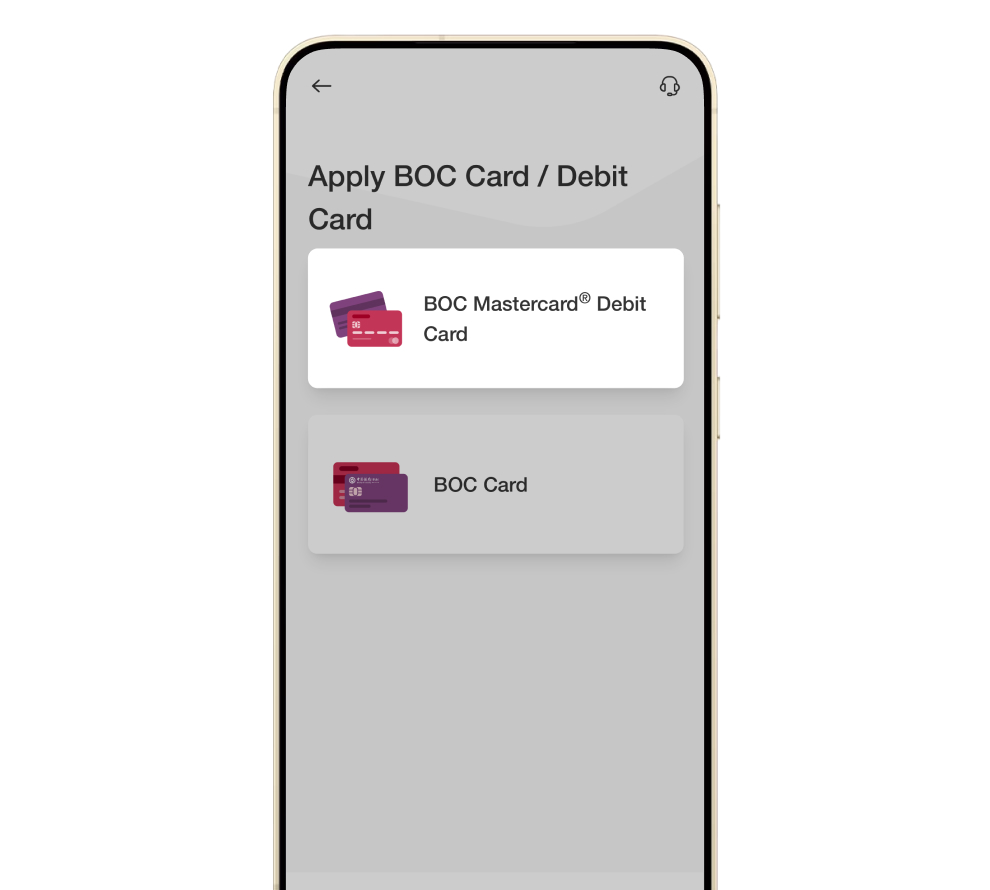

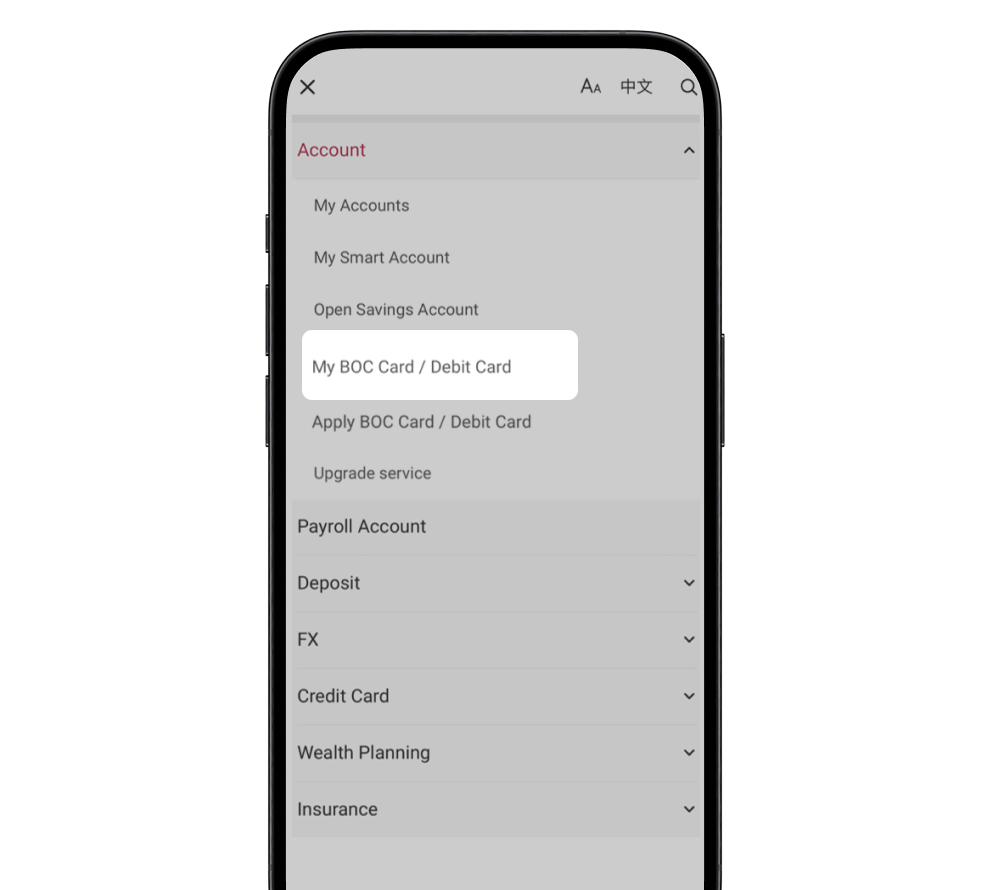

1Log in to Mobile Banking and select "Menu" > "Account" > "Apply BOC Card/Debit Card"

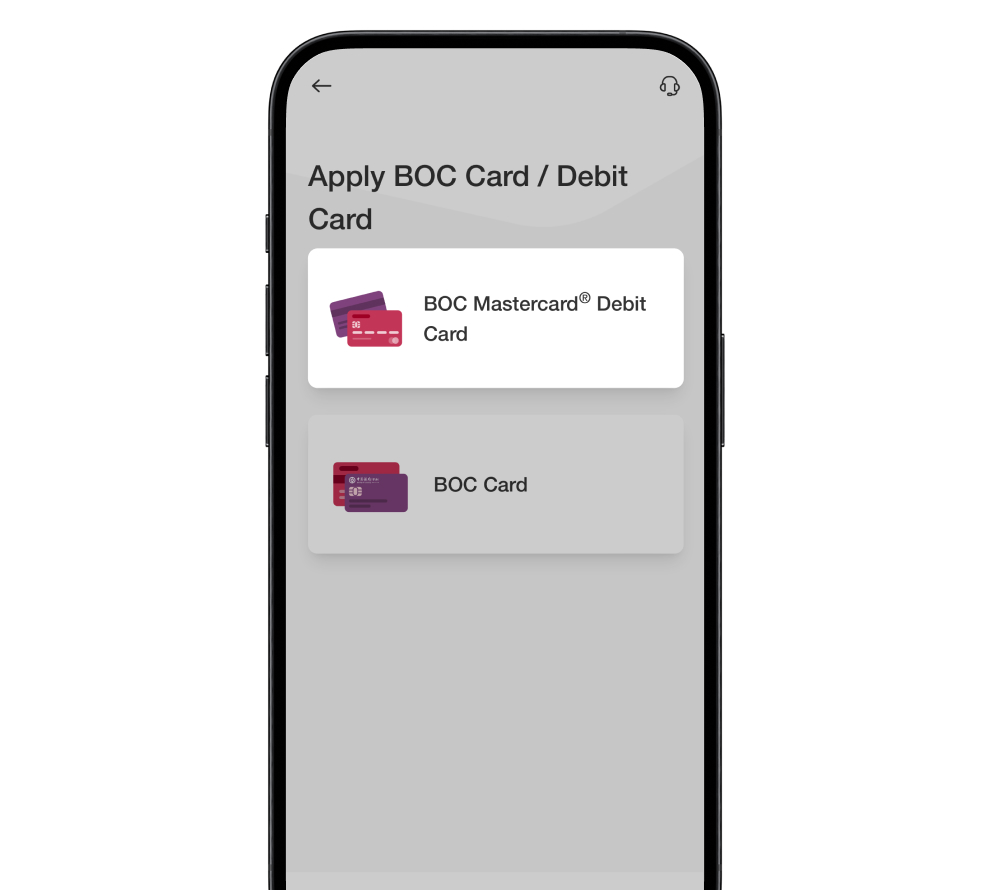

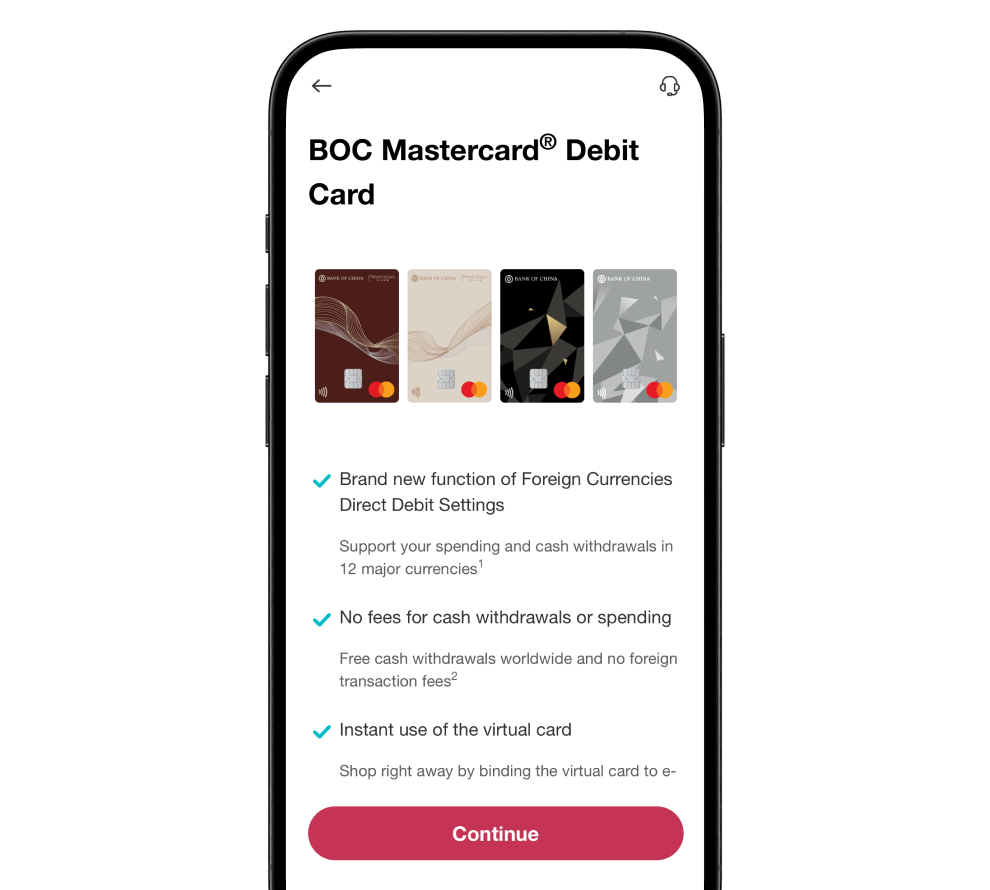

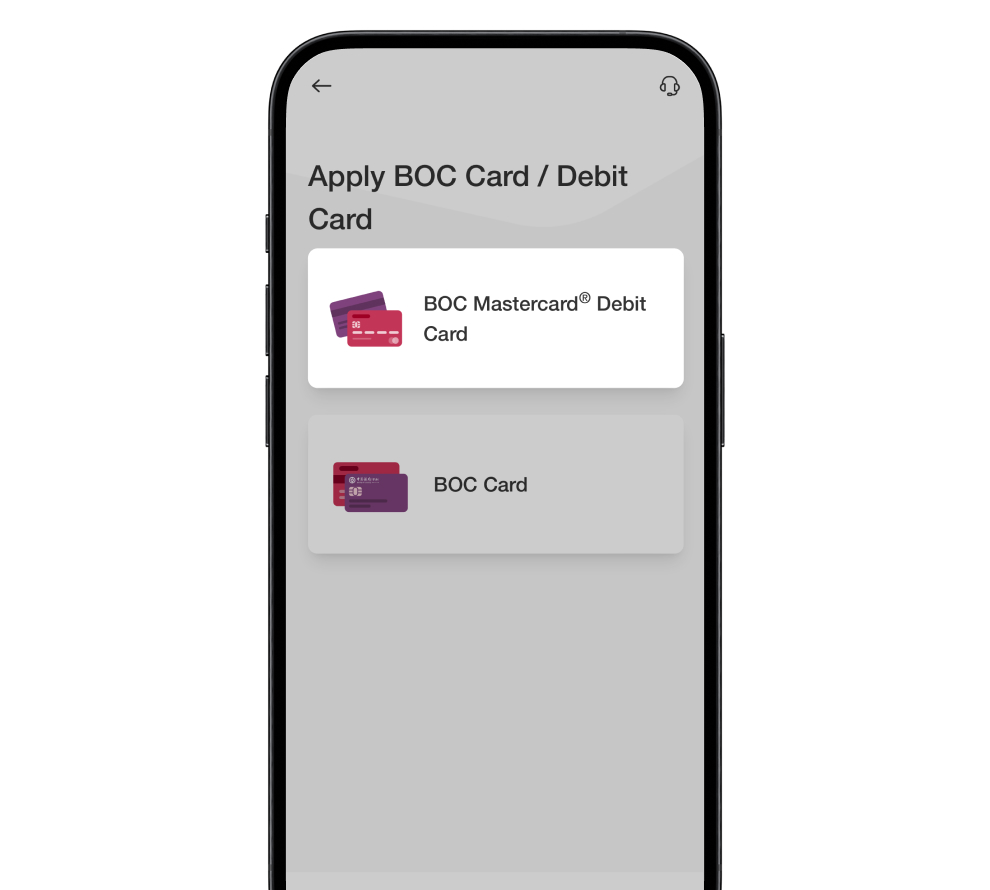

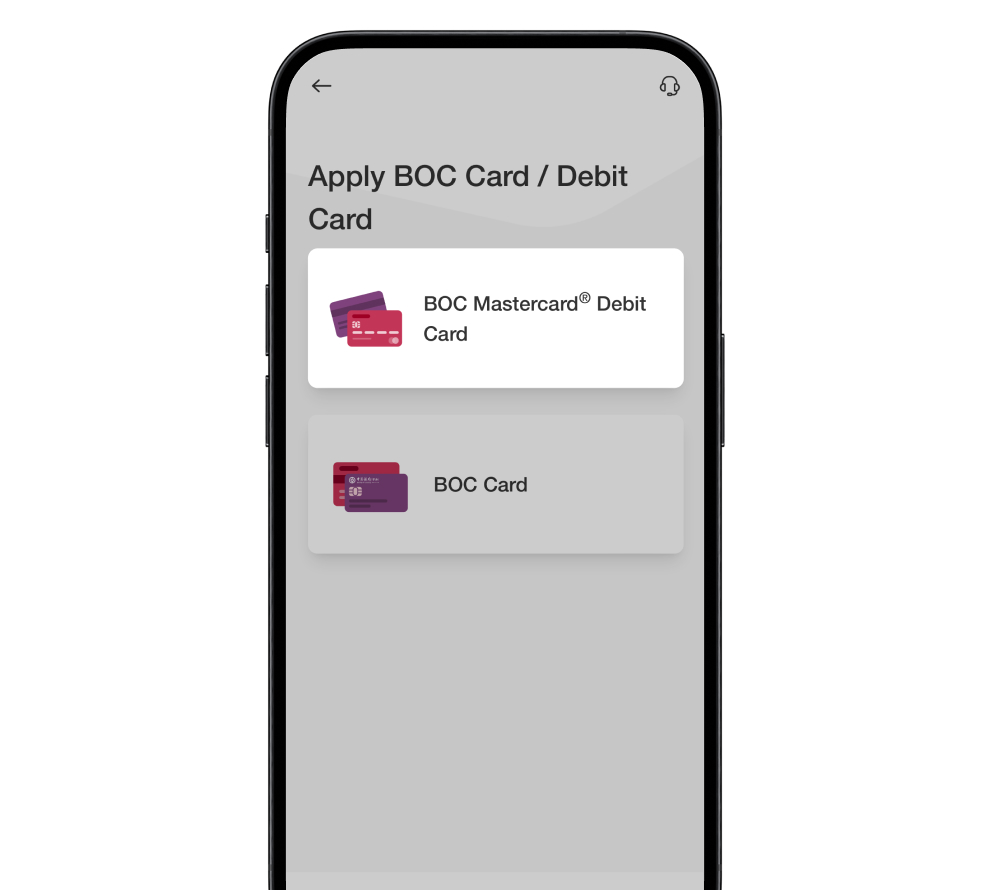

2Select "BOC Mastercard® Debit Card"

3Read product introduction and press "Continue"

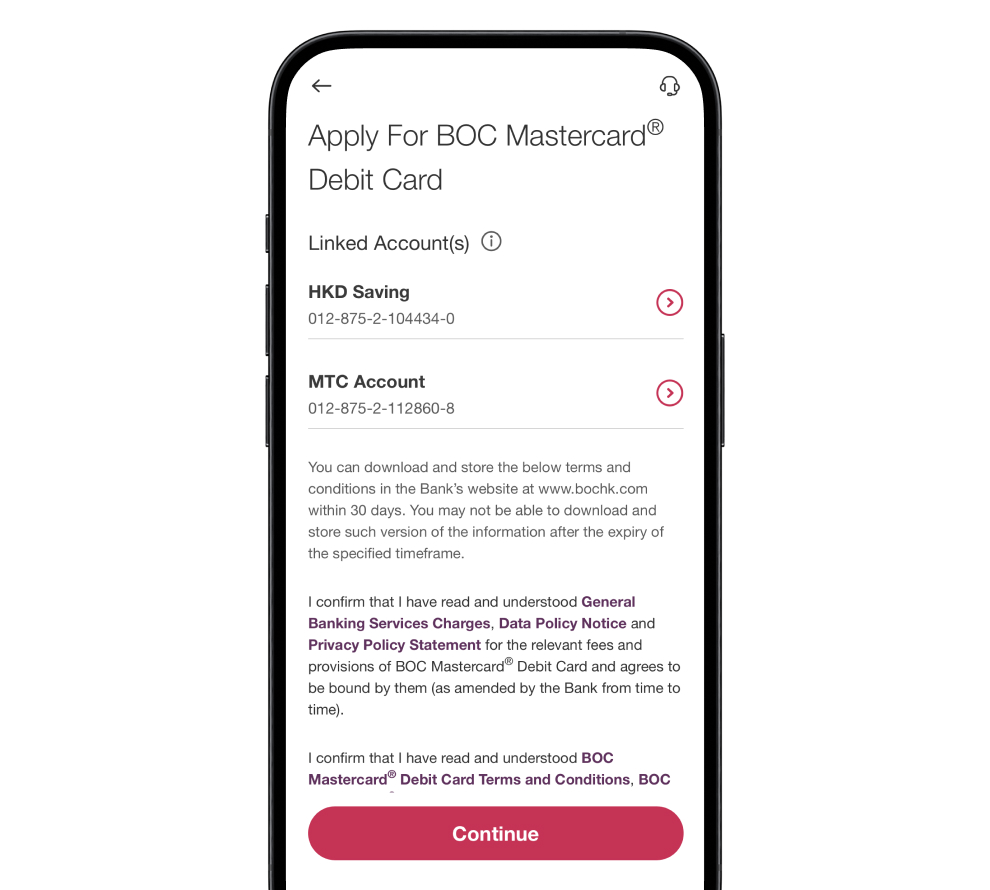

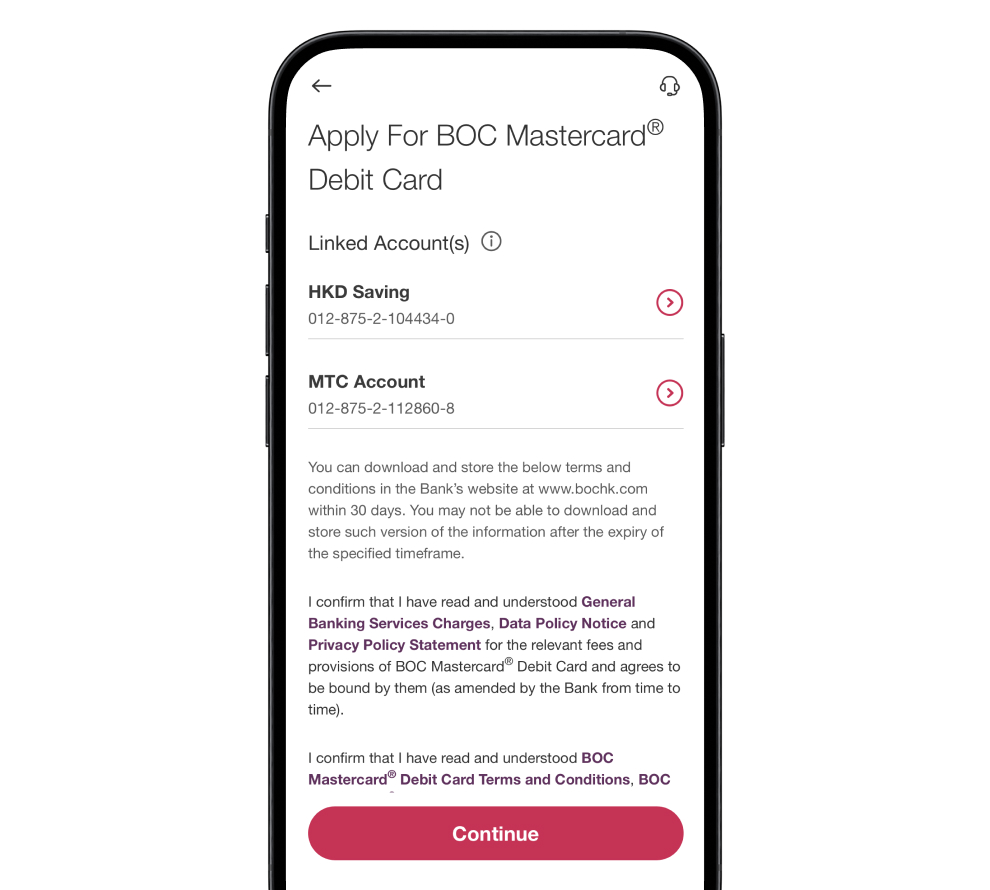

4Select "Linked Account(s)" and press "Continue"

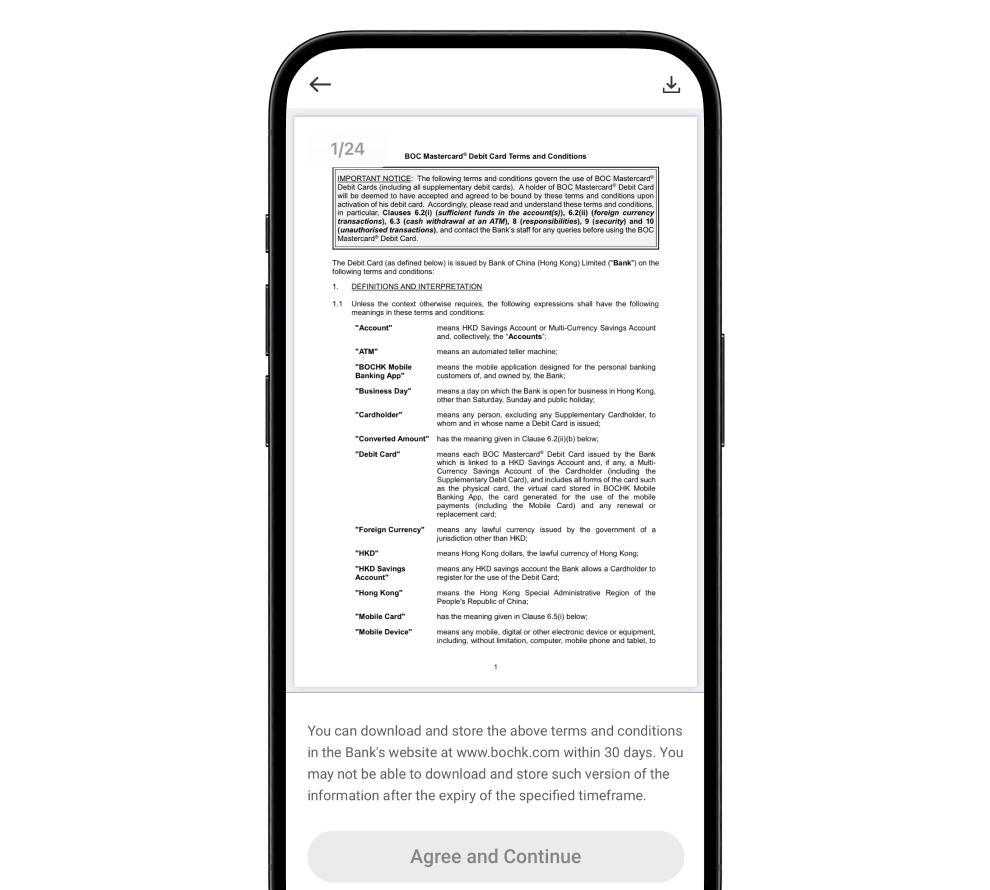

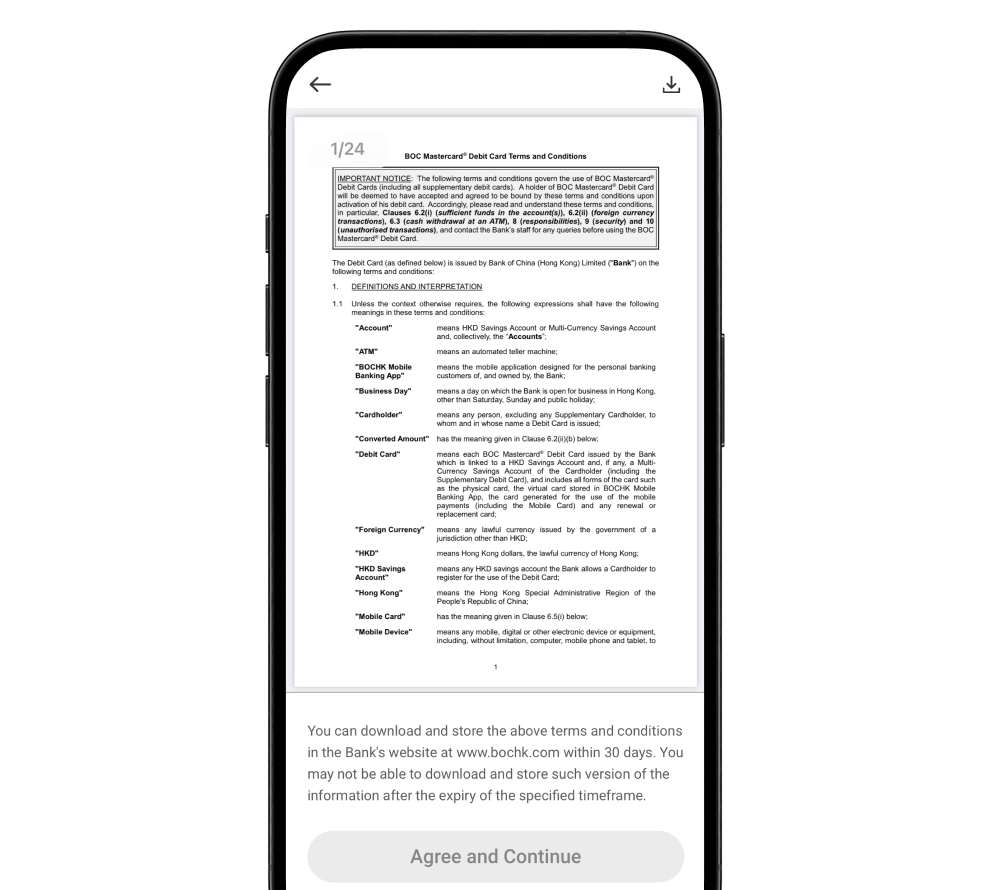

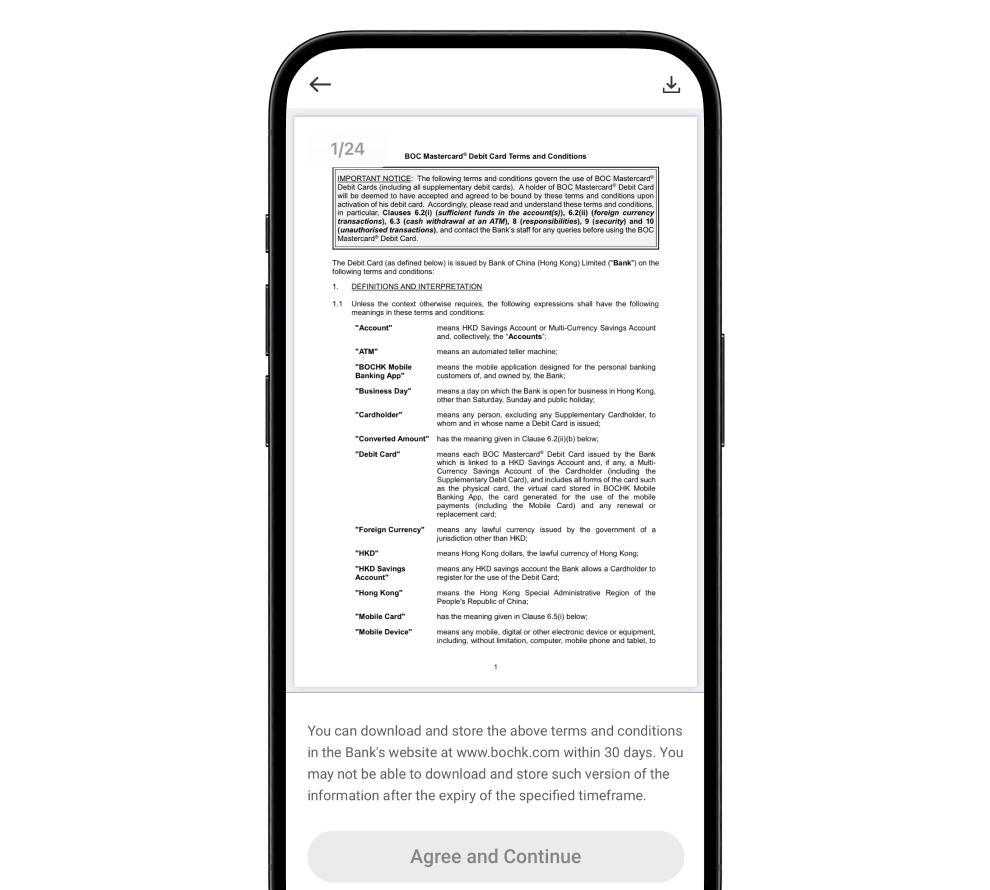

5Read Terms and Conditions and press "Agree and Continue"

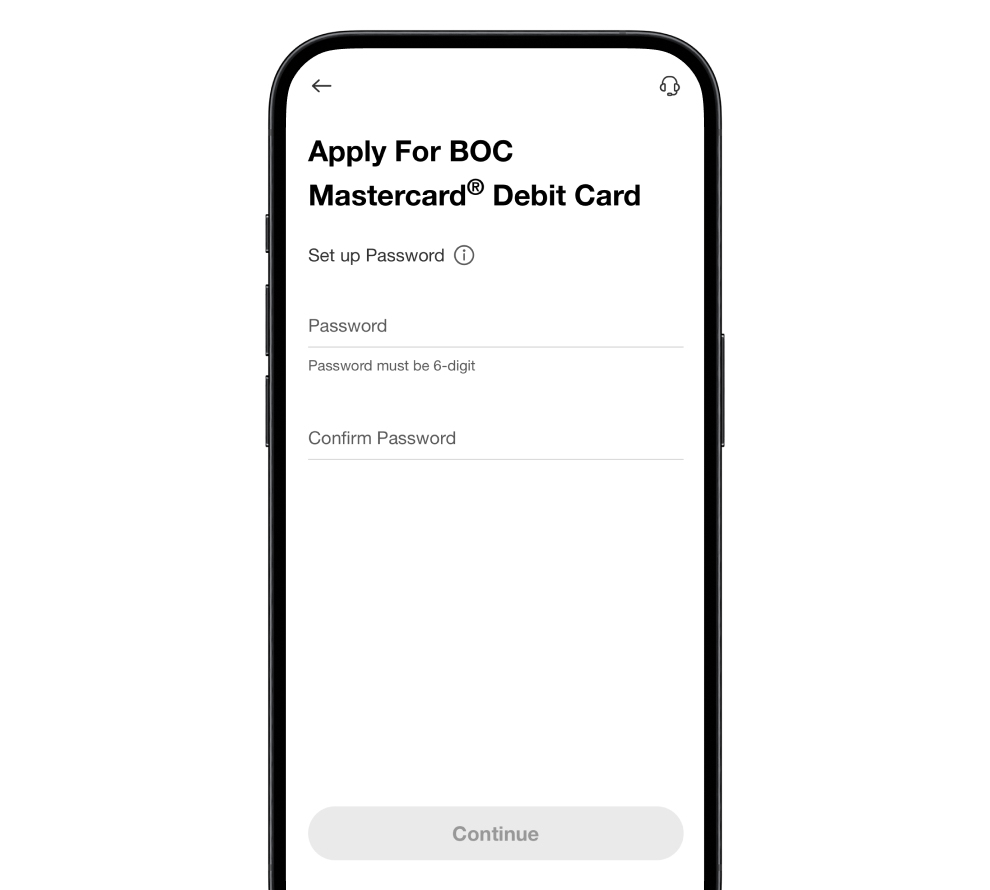

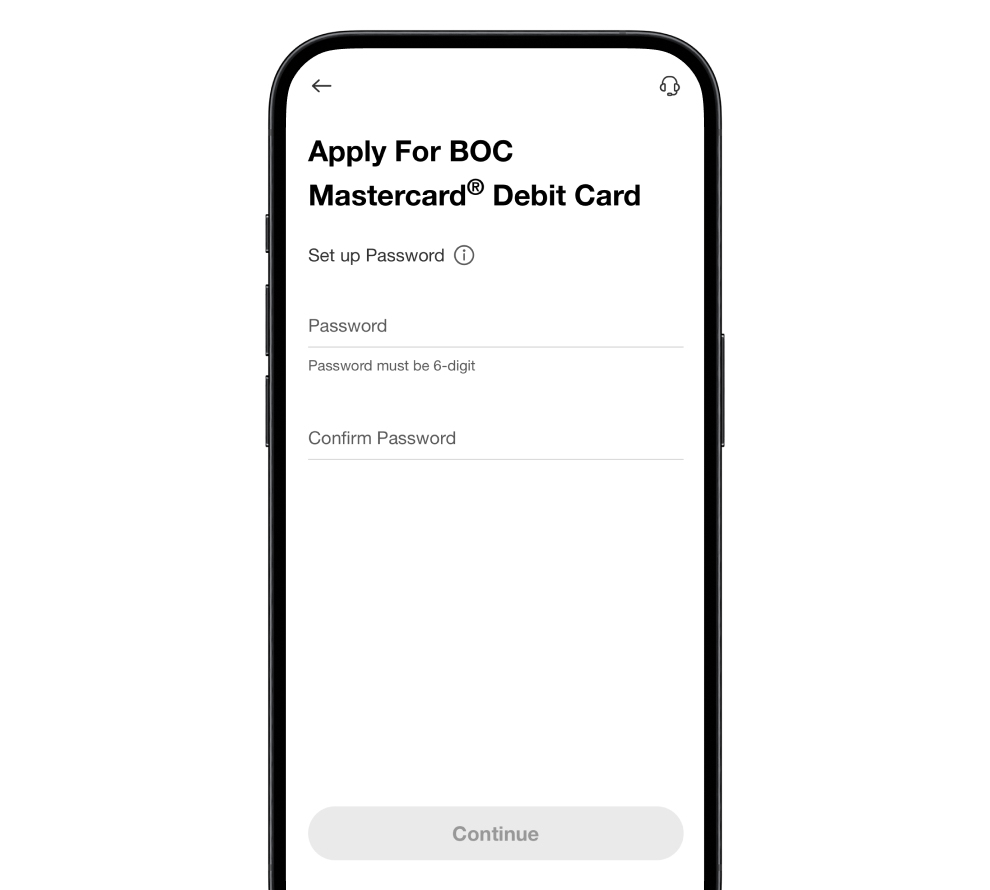

6Set up Password

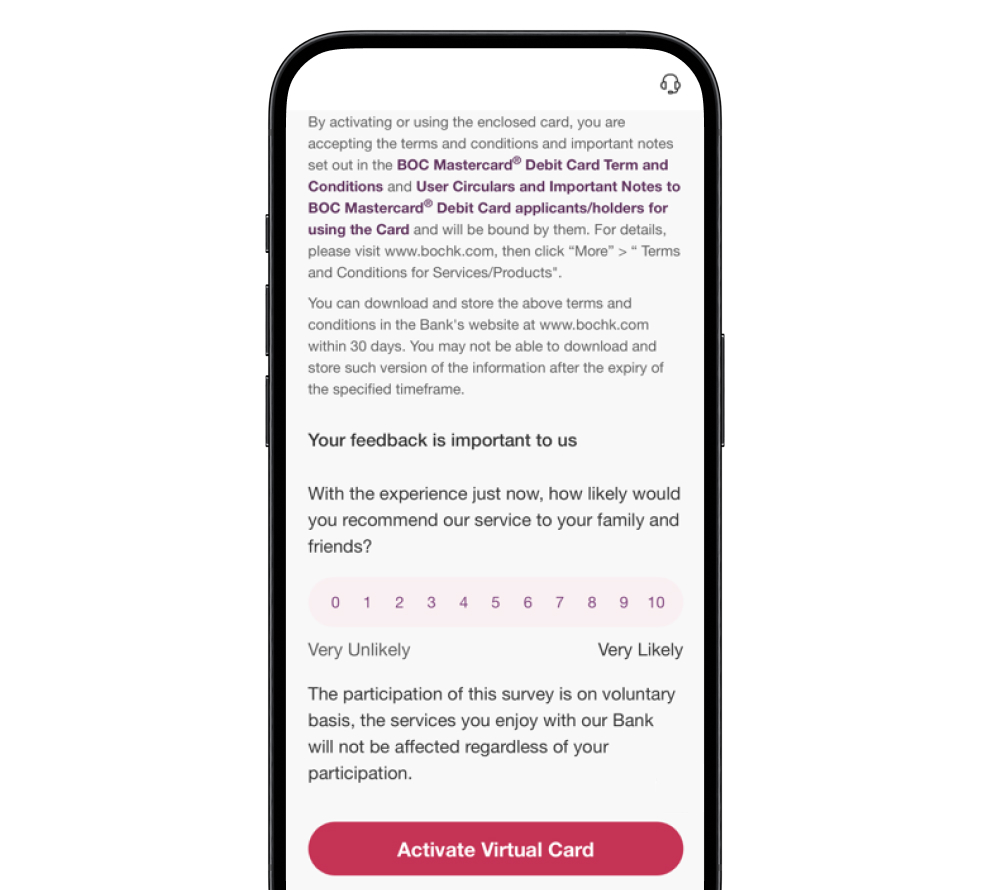

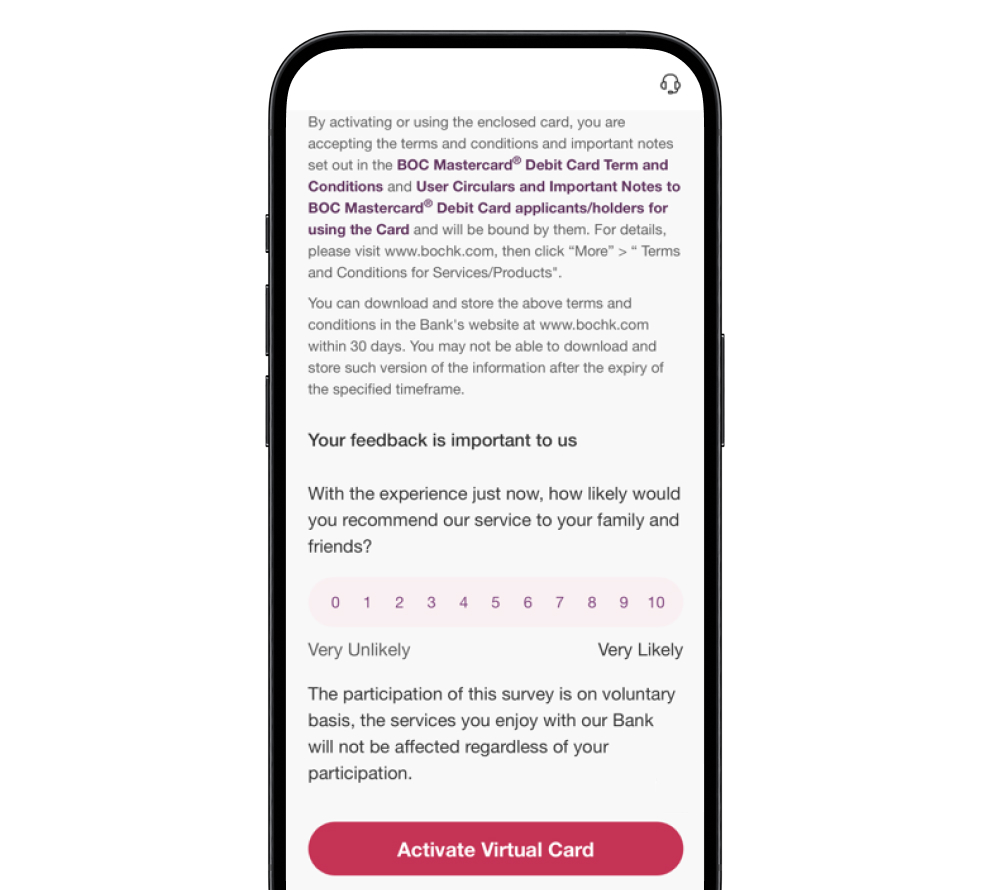

7Your application is successful. Press "Activate Virtual Card" and bind it to your digital wallet instantly for transactions

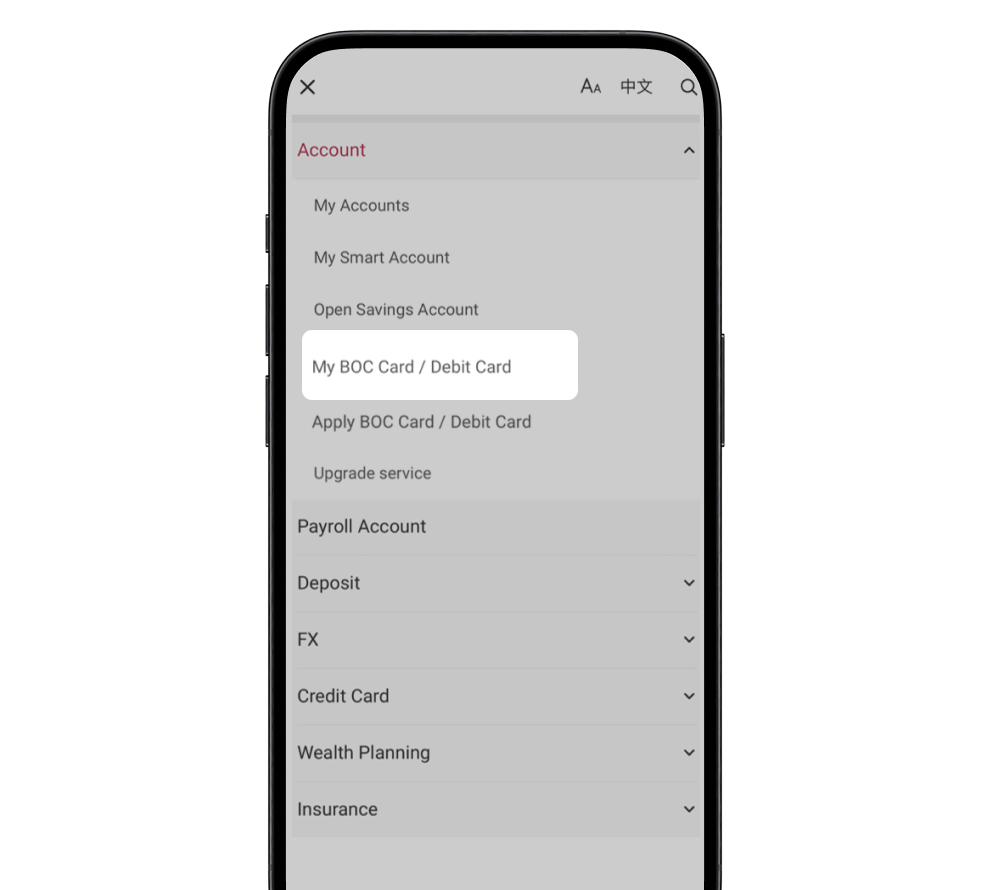

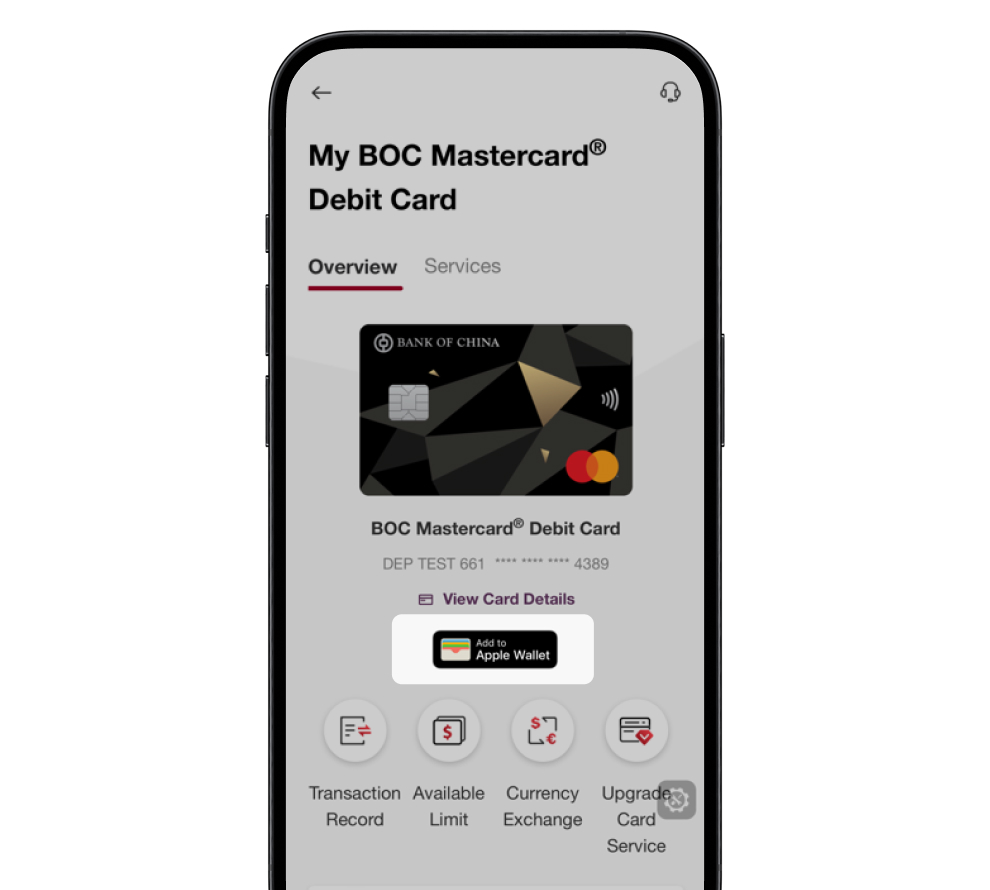

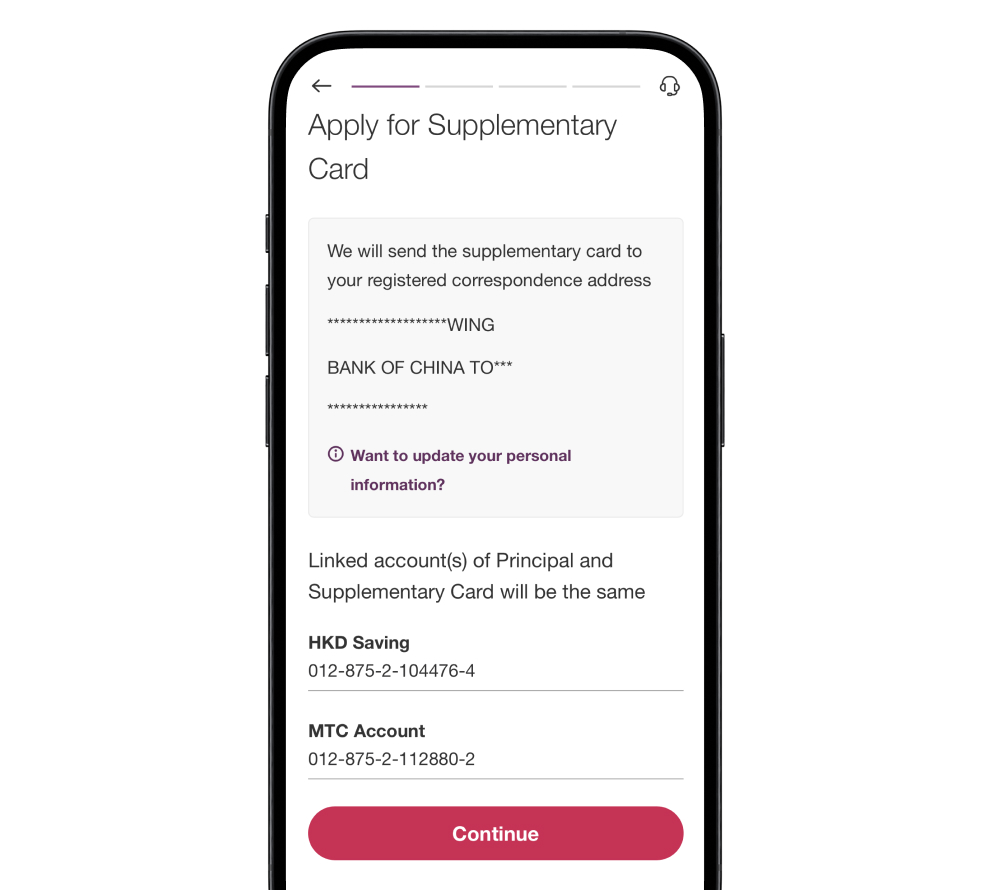

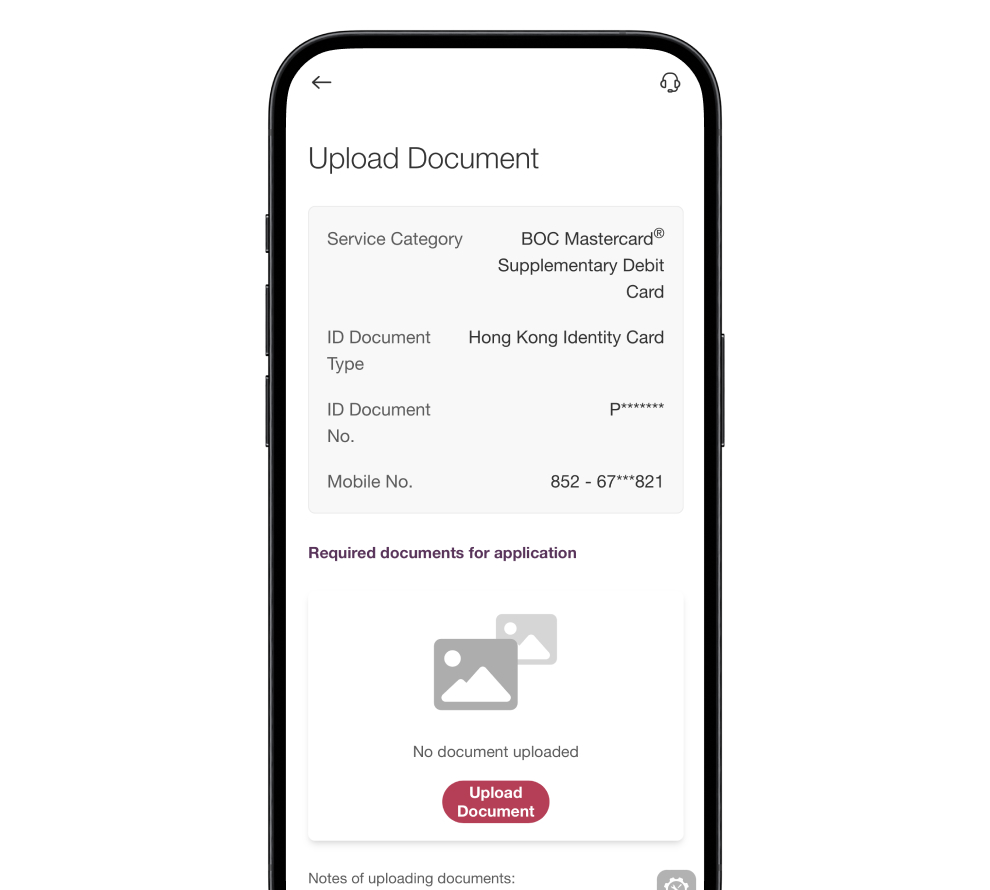

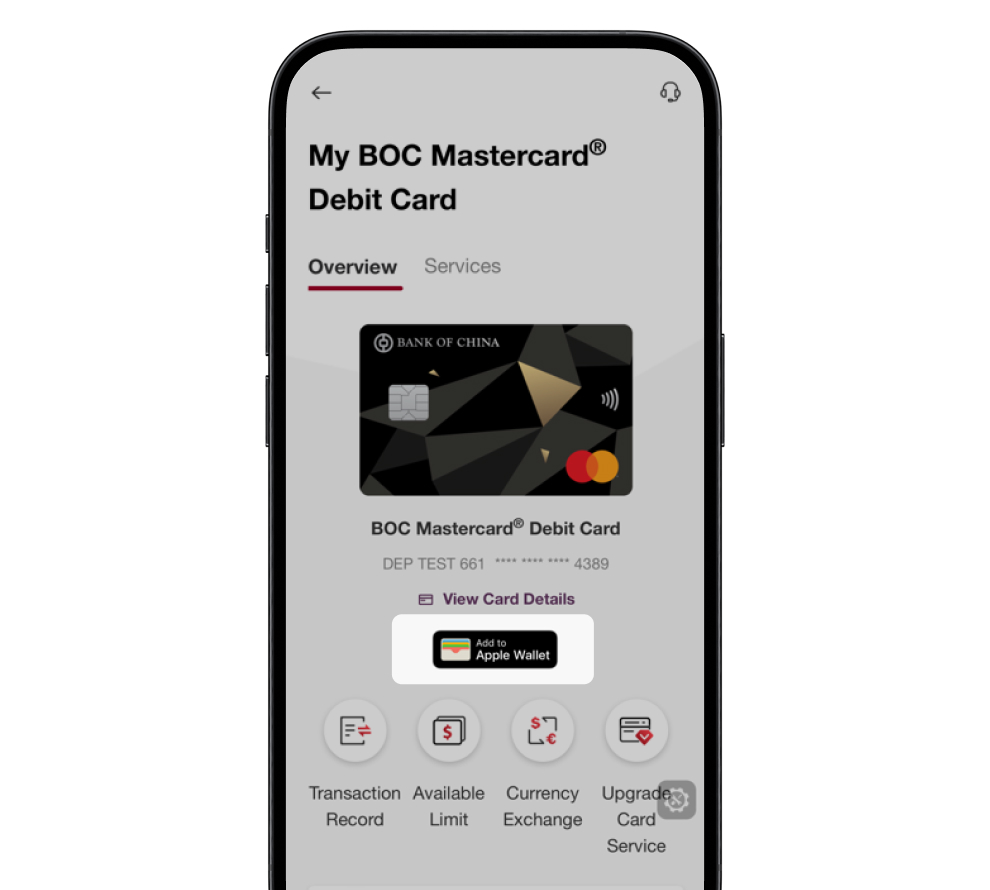

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

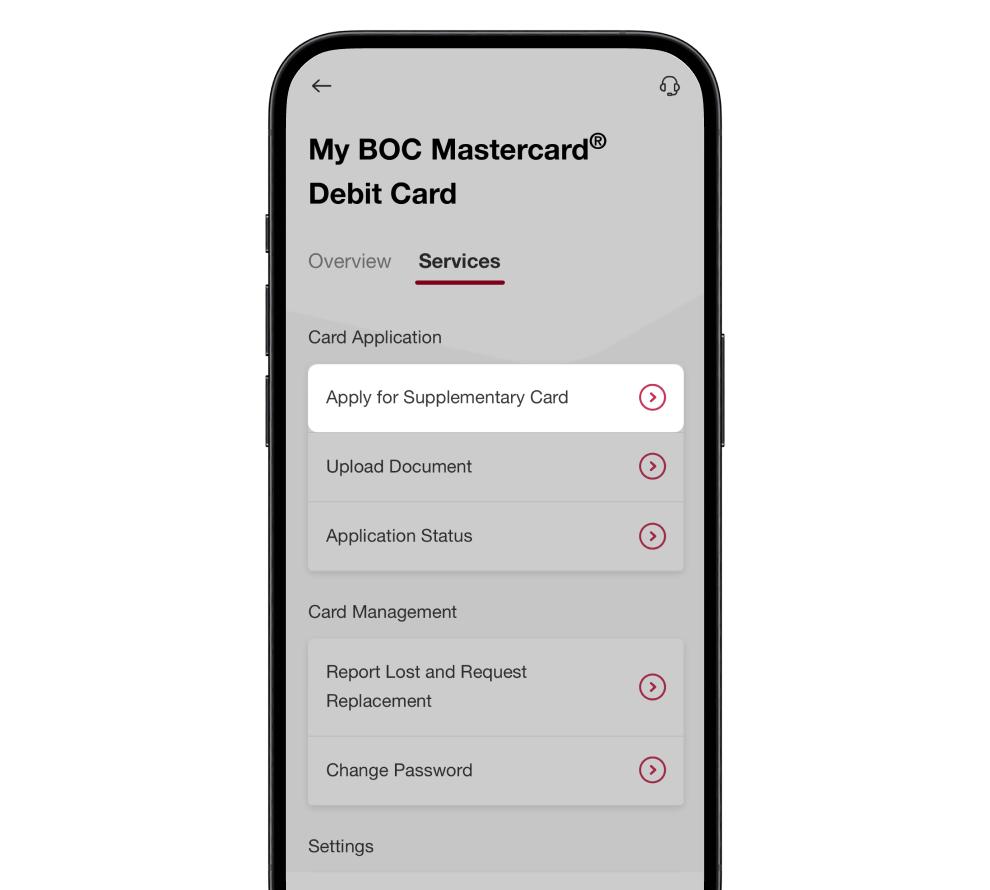

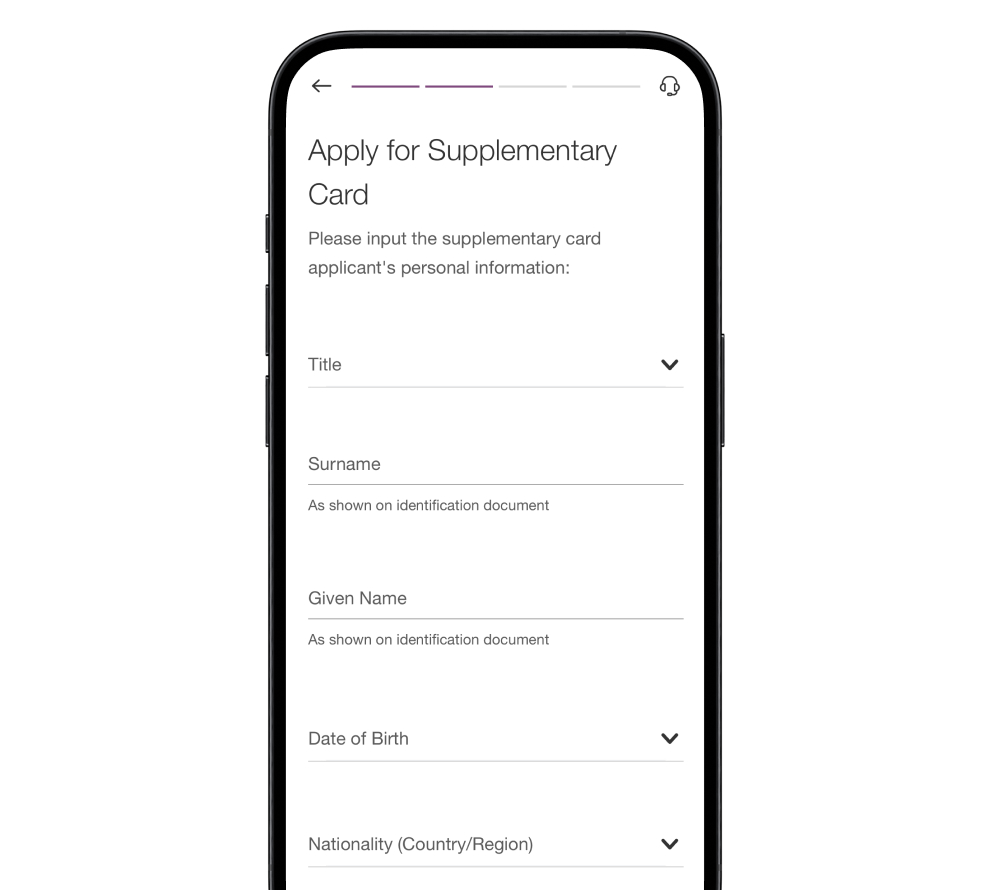

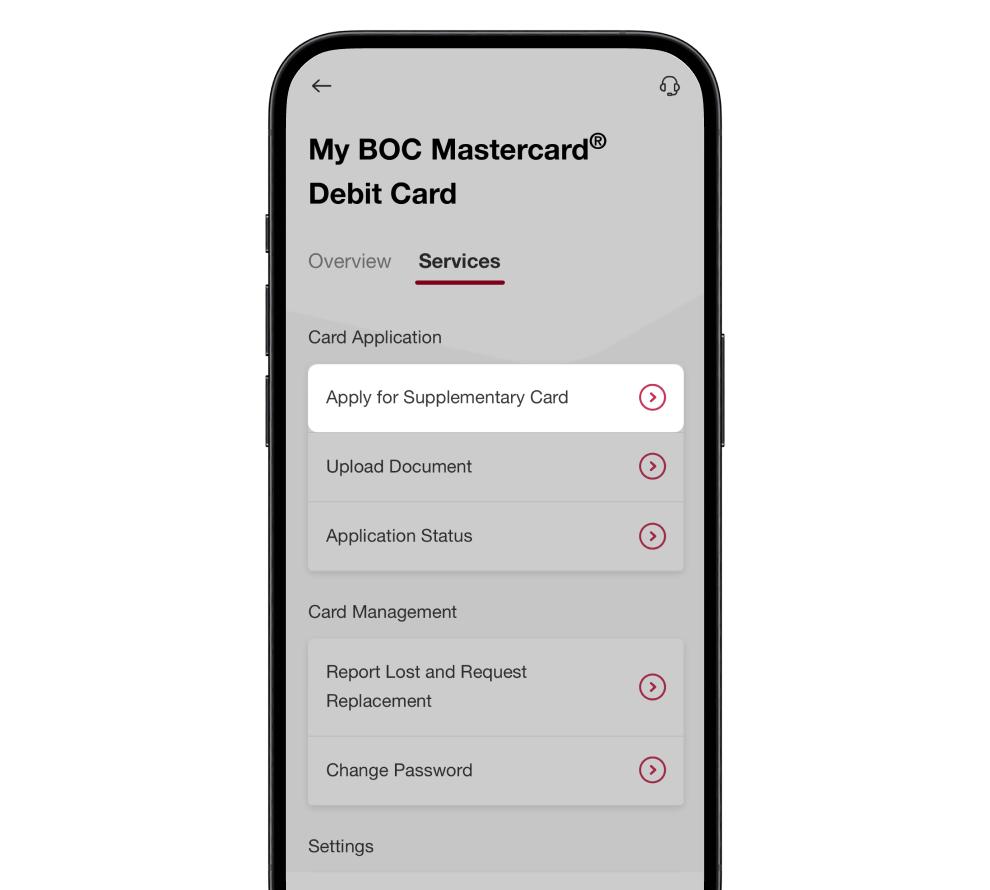

2Select "BOC Mastercard® Debit Card" > "Service" > "Apply for Supplementary Card"

3Read product introduction and press "Continue"

4Confirm "Linked Account(s)"

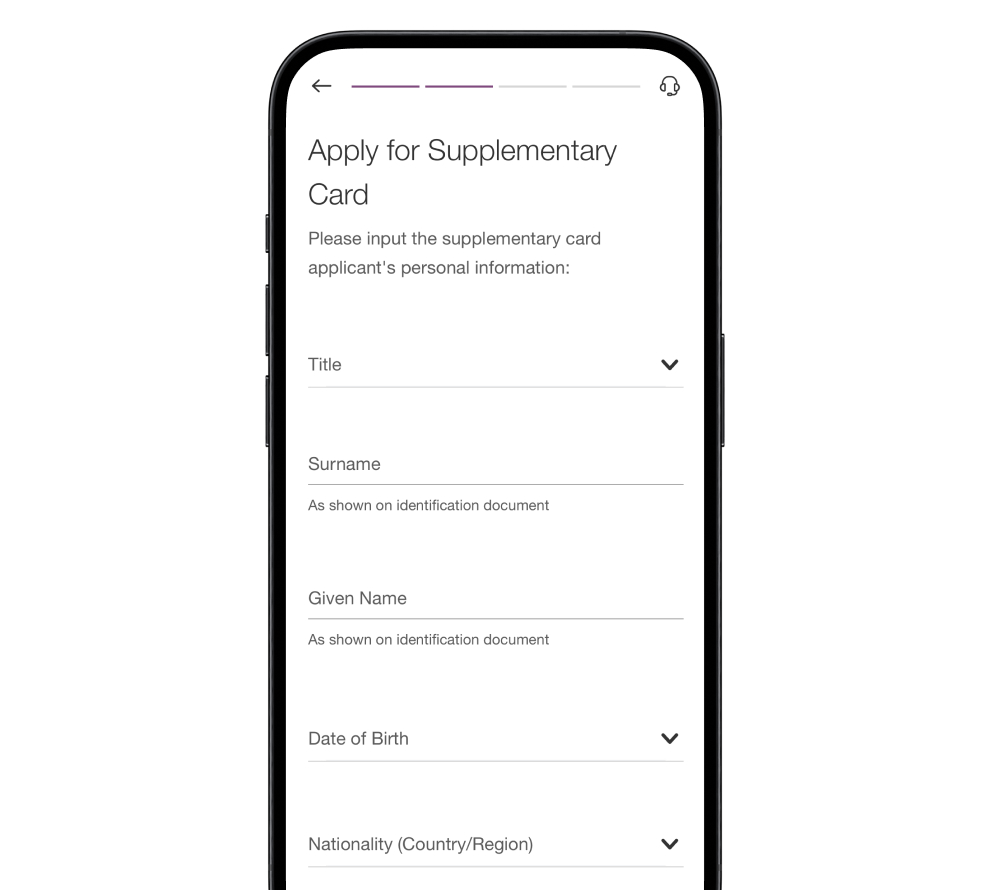

5Input supplementary card applicant’s information

6Set up daily spending and cash withdrawal limit

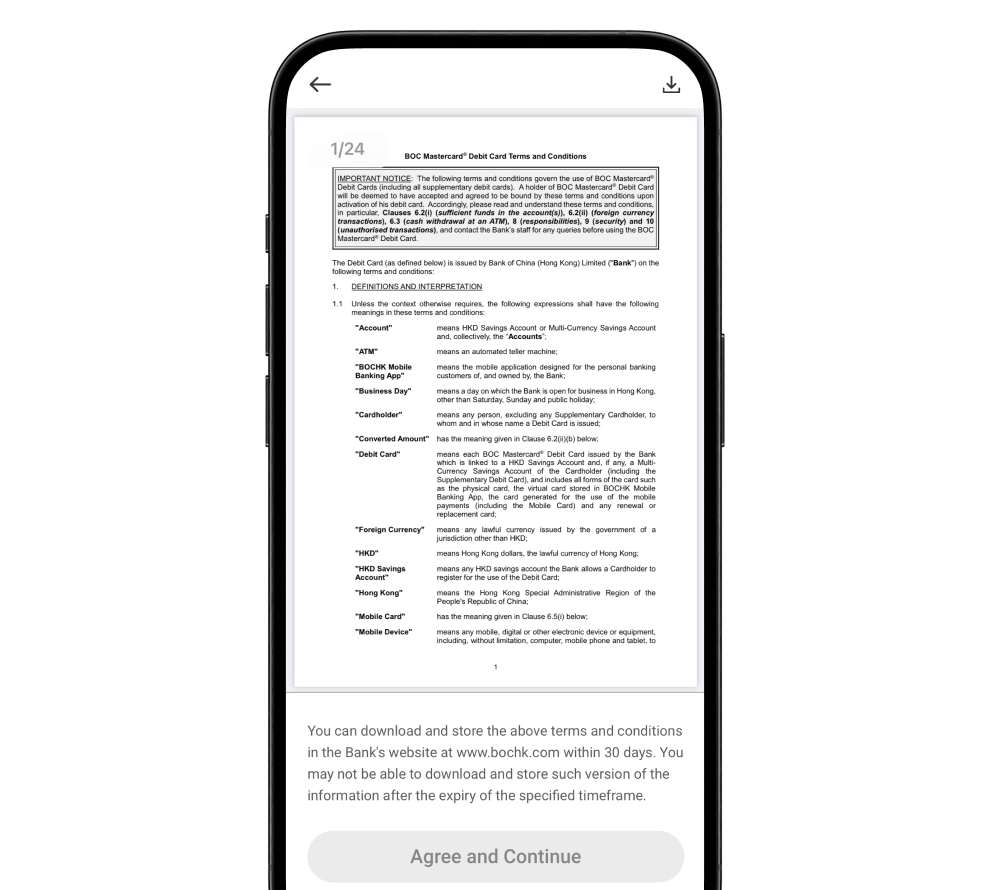

7Read Terms and Conditions and press "Agree and Continue"

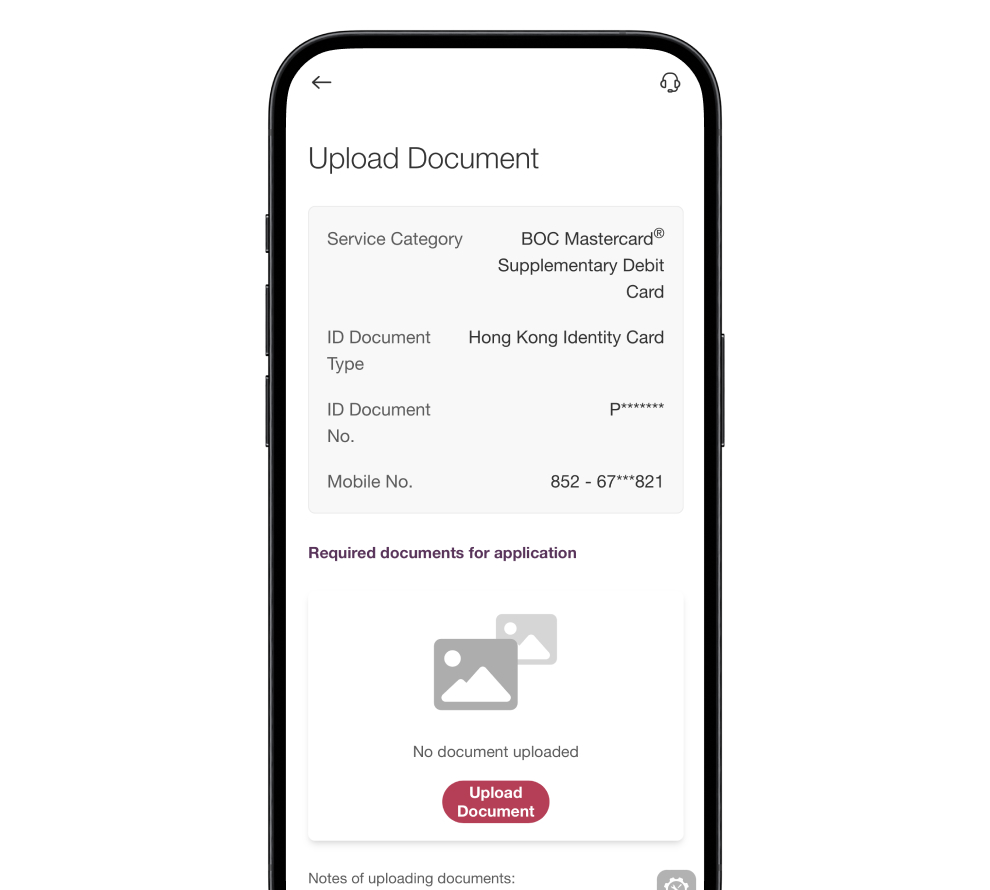

8Upload required documents for application

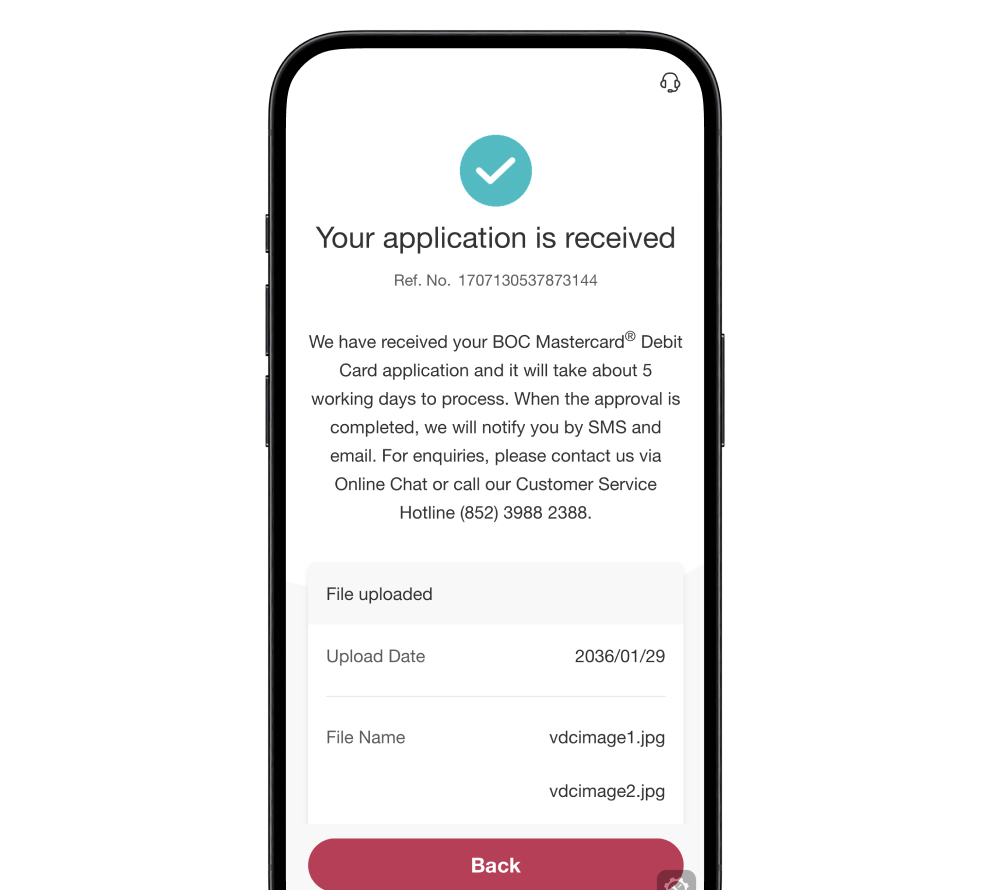

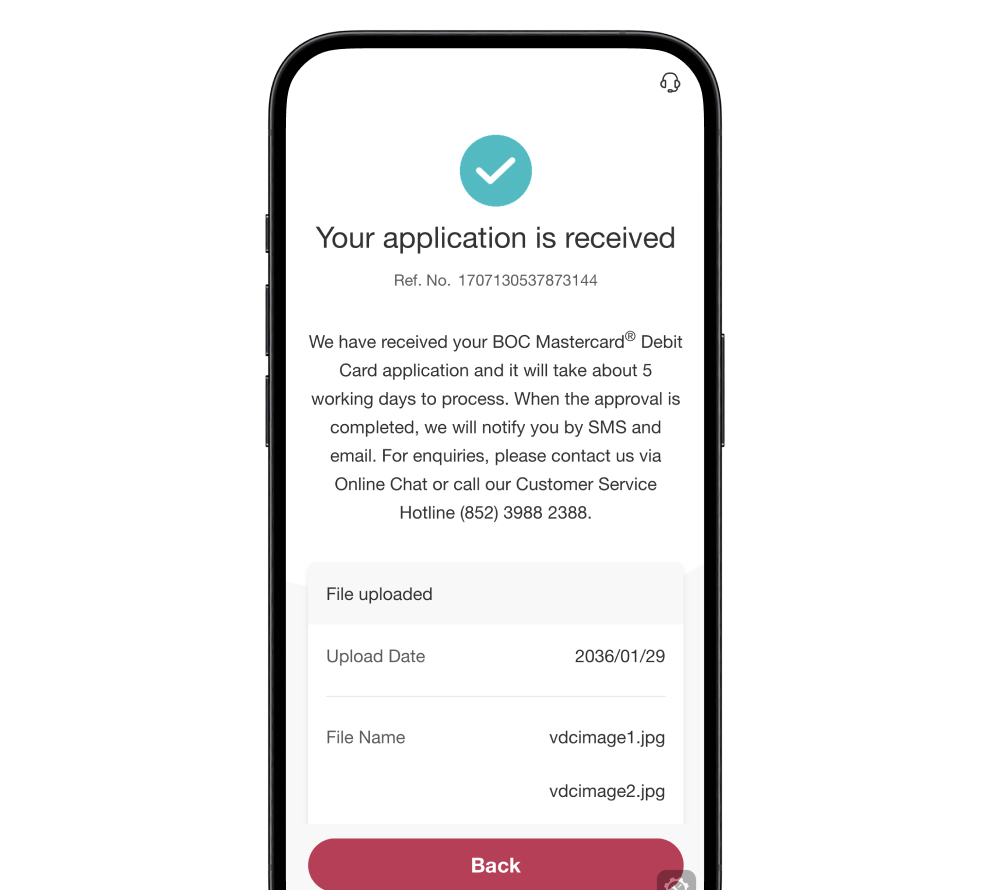

9Your application is received

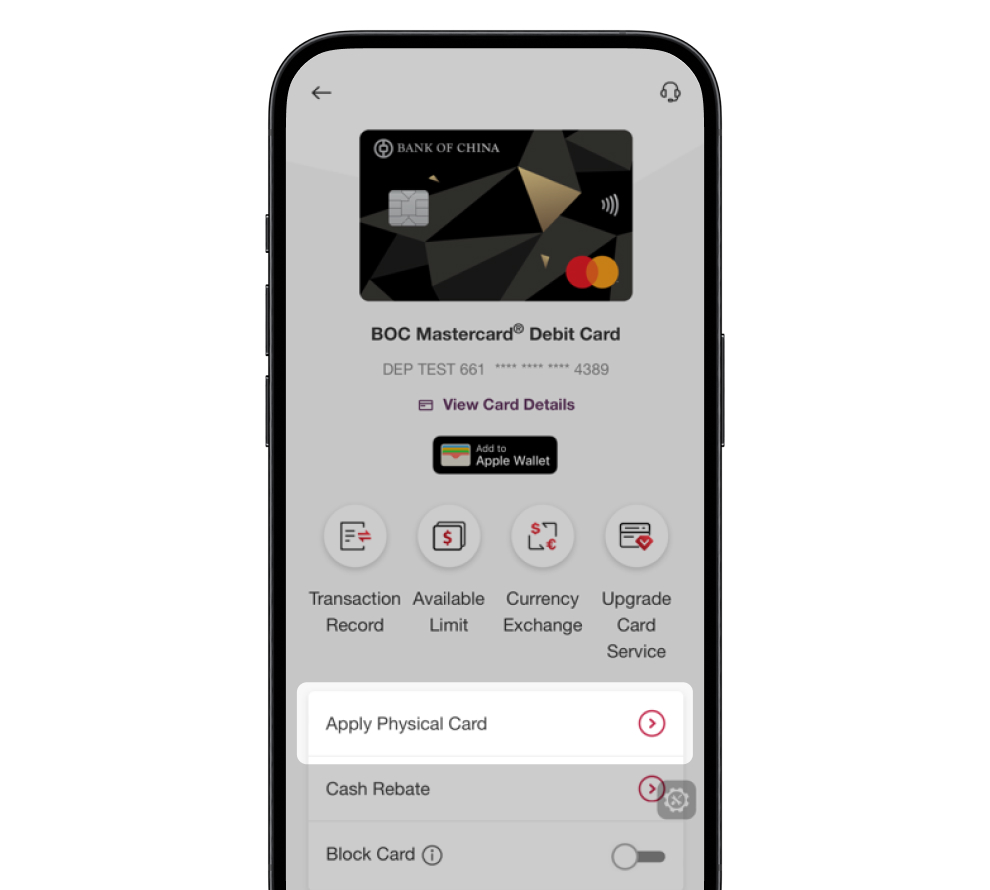

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

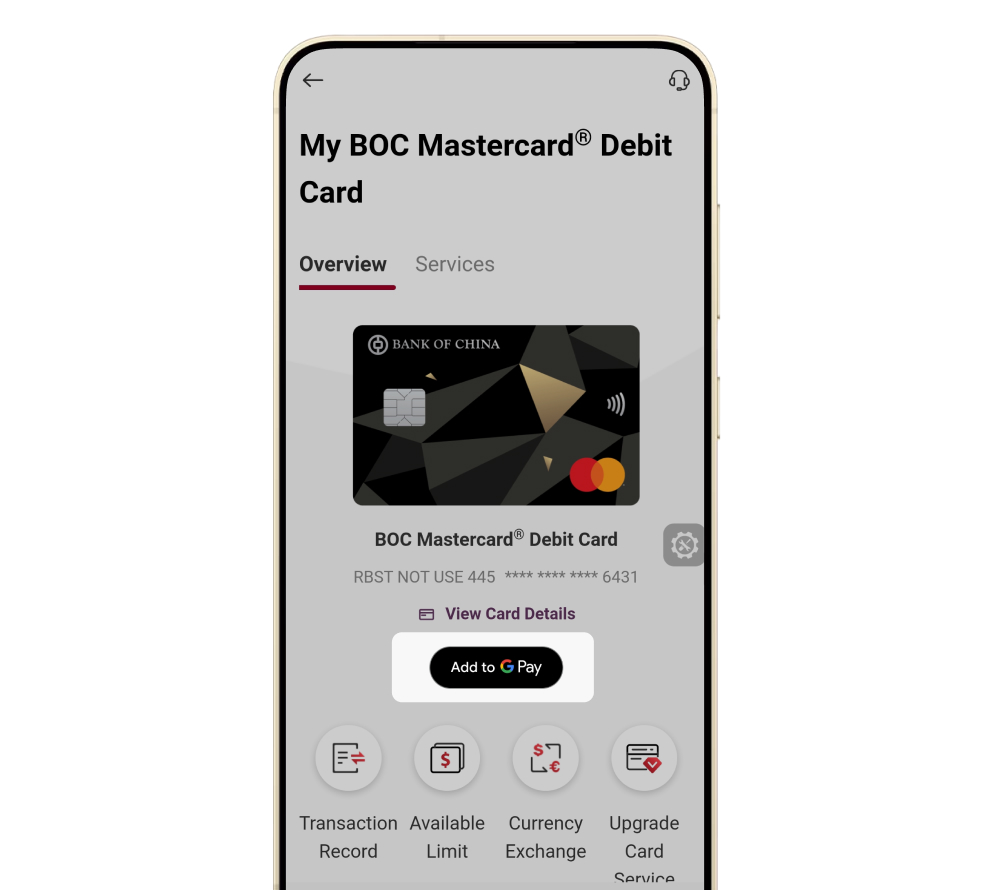

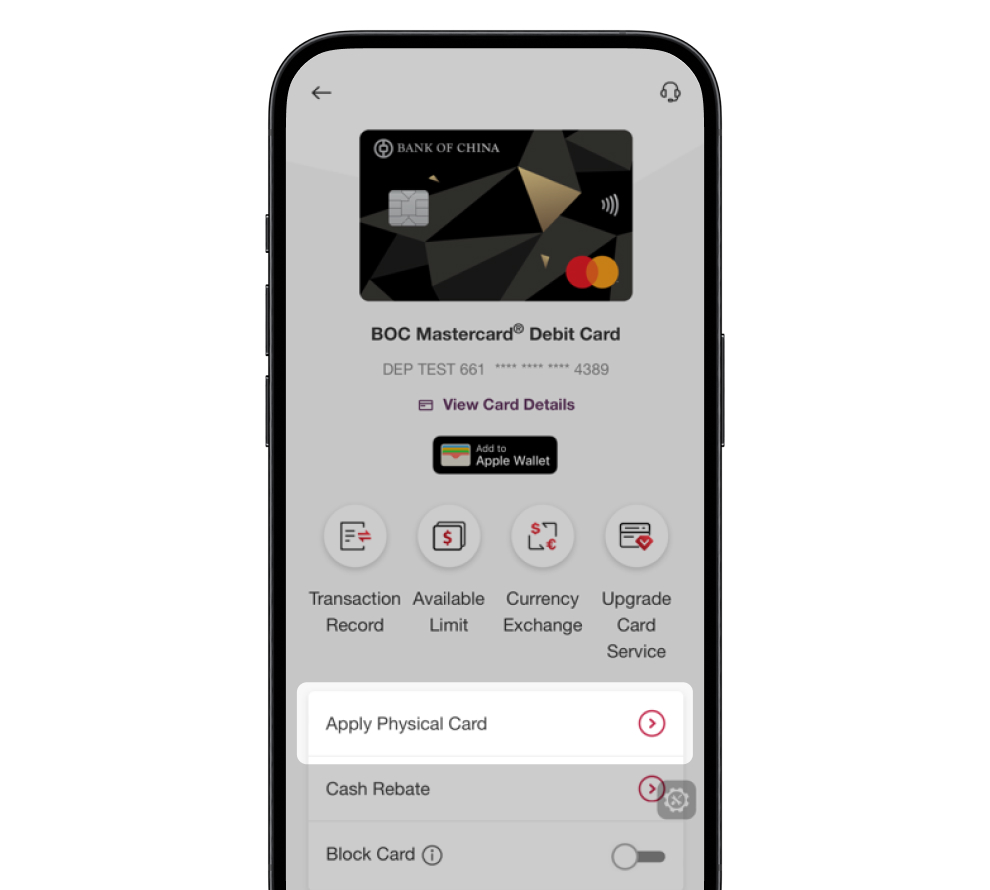

2Select "BOC Mastercard® Debit Card" > "Overview"

3Press "Add to Apple Wallet", and follow the instructions to add card. To pay with Apple Pay online, in-app, or in-store, just look for below symbols

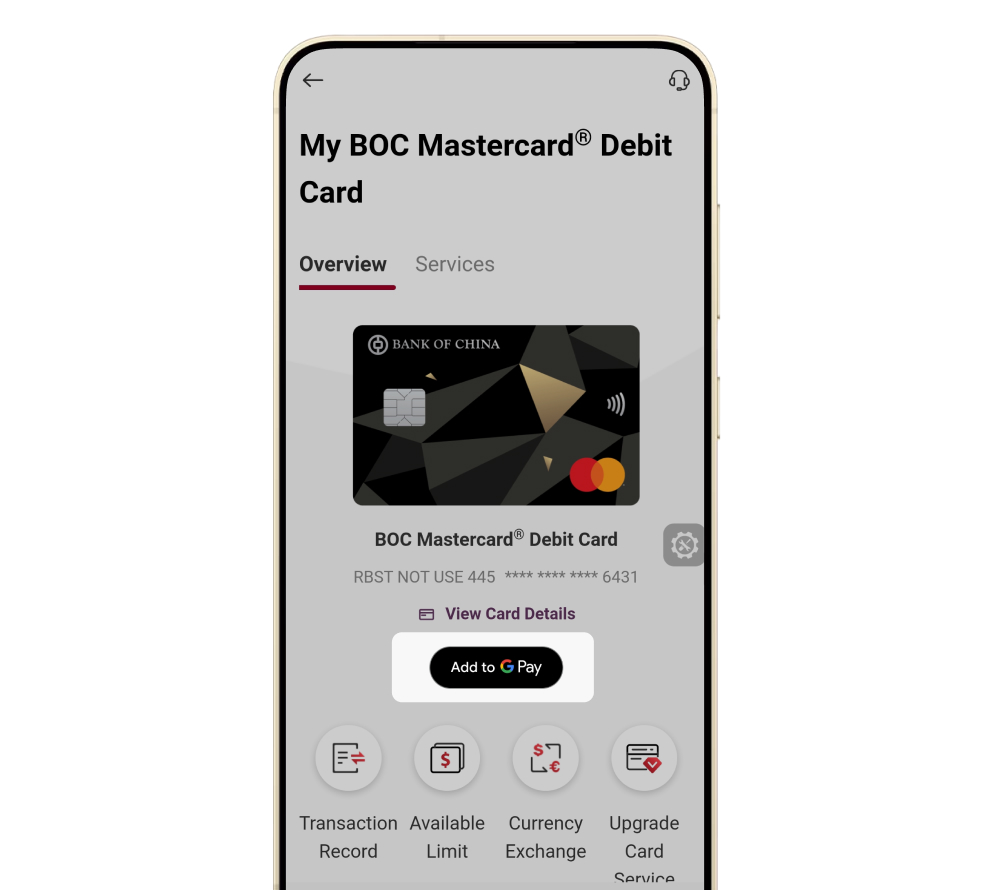

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card" > "Overview"

3Press "Add to G Pay", and follow the instructions to add card. To pay with Google Pay online, in-app, or in-store, just look for below symbols

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card" > "Overview"

3Press "Apply Physical Card" and confirm the application

1Log in to Mobile Banking and select "Menu" > "Account" > "Apply BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card"

3Read product introduction and press "Continue"

4Select "Linked Account(s)" and press "Continue"

5Read Terms and Conditions and press "Agree and Continue"

6Set up Password

7Your application is successful. Press "Activate Virtual Card" and bind it to your digital wallet instantly for transactions

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card" > "Service" > "Apply for Supplementary Card"

3Read product introduction and press "Continue"

4Confirm "Linked Account(s)"

5Input supplementary card applicant’s information

6Set up daily spending and cash withdrawal limit

7Read Terms and Conditions and press "Agree and Continue"

8Upload required documents for application

9Your application is received

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card" > "Overview"

3Press "Add to Apple Wallet", and follow the instructions to add card. To pay with Apple Pay online, in-app, or in-store, just look for below symbols

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card" > "Overview"

3Press "Add to G Pay", and follow the instructions to add card. To pay with Google Pay online, in-app, or in-store, just look for below symbols

1Log in to Mobile Banking and select "Menu" > "Account" > "My BOC Card/Debit Card"

2Select "BOC Mastercard® Debit Card" > "Overview"

3Press "Apply Physical Card" and confirm the application

Other Application Channels

Personal Customer Service Hotline +852 3988 2388

From 9:00 a.m. to 9:00 p.m. between Mondays and Fridays, from 9:00 a.m. to 6:00 p.m. on Saturdays, excluding public holidays

FAQs

Customers who are 18 years old or above and our "Private Wealth", "Wealth Management", "Enrich Banking", "i-Free Banking" customers or selected customers are eligible to apply for a debit card. If you are a "Private Wealth" customer, we will automatically issue a BOC Private Wealth MasterCard® debit card.

Principal cardholder can login to Mobile Banking (BOCHK app) or visit any of our branches in person to apply for a supplementary card for direct relatives who are 11 years old or above. Principal cardholder needs to bring along with the identification document of supplementary card applicants (If it cannot be submitted immediately, it can be submitted within 21 days) and apply up to 4 supplementary cards. Upon successful application, we will send physical supplementary card to the registered correspondence address of principal cardholder in about a week.

If your Debit Card is linked to MTC account, the Debit Card will be automatically debited from the corresponding foreign currency account according to the currency of the transaction by default. If the balance in the designated currency is insufficient, or the "Foreign Currencies Direct Debit Setting" has been suspended, or the currency of the transaction is not among the 12 major currencies supported by the Debit Card, we will convert it to Hong Kong dollars for settlement.

If the balance in the designated currency is insufficient, we will convert the full transaction amount to Hong Kong dollars for settlement.

Transactions in 12 major currencies will use our Bank's T/T exchange rate. 12 major currencies include HKD, USD, CNY, GBP, EUR, JPY, AUD, NZD, CAD, CHF, SGD and THB.

Transactions in non-major currencies will use Mastercard’s exchange rate.

All fees and charges which will apply, including the annual fee, the method of applying exchange rates and/or levies to transactions in foreign currencies or cross-border transactions are provided in General Banking Services Charges. For details, please visit www.bochk.com, then select “More” > "Terms and Conditions for Services/Products" > "Deposits" > "General Banking Service Charges".

If the balance in the designated currency is insufficient, we will convert the full transaction amount to Hong Kong dollars for settlement.

Transactions in 12 major currencies will use our Bank's T/T exchange rate. 12 major currencies include HKD, USD, CNY, GBP, EUR, JPY, AUD, NZD, CAD, CHF, SGD and THB.

Transactions in non-major currencies will use Mastercard’s exchange rate.

All fees and charges which will apply, including the annual fee, the method of applying exchange rates and/or levies to transactions in foreign currencies or cross-border transactions are provided in General Banking Services Charges. For details, please visit www.bochk.com, then select “More” > "Terms and Conditions for Services/Products" > "Deposits" > "General Banking Service Charges".

Cardholders will receive transaction notifications via SMS and email after every card spending transaction. For supplementary card transactions, both principal cardholder and supplementary cardholder will receive the notifications.

Please login to Mobile Banking select "Menu" > "Account" > "My BOC Card / Debit Card" > "BOC Mastercard® Debit Card" > "Overview" > "Cash Rebate" to check your cash rebate details for latest 3 months transaction.

Principal cardholders can login to Mobile Banking select "Menu" > "Account" >"My BOC Card / Debit Card" > "BOC Mastercard® Debit Card" > "Services" > "Daily Spending Limit"/"Daily Cash Withdrawal Limit" to check and set the limit of both principal card and supplementary card. You can also log in to mobile banking at any time before spending/withdrawing funds and select "Menu" > "Account" > "My BOC Card/Debit Card" > "BOC MasterCard® Debit Card" > "Overview" > "Available Limit" to check the available limit at that time.

The maximum daily spending limit (including transferring to other accounts in the same currency (not applicable to supplementary cards), "Mastercard" POS transaction and online spending) for Platinum BOC Mastercard® debit cards (including principal and supplementary cards) is HKD 200,000 (or its equivalent in other currencies) (The default daily spending limit is HKD 50,000 when card newly issued), while the maximum daily spending limit (including transferring to other accounts in the same currency (not applicable to supplementary cards), "Mastercard" POS transaction and online spending) for World BOC Private Wealth Mastercard® debit cards (including principal and supplementary cards) is HKD 300,000 (or its equivalent in other currencies) (The default daily spending limit is HKD 100,000 when card newly issued) and can be adjusted by the principal cardholder. Upon activation of the card, you signify that you agree to such default limit.

The daily cash withdrawal limit for debit cards (including principal and supplementary cards) is subject to the local daily cash withdrawal limit of the principal cardholder. The maximum local daily cash withdrawal limit is HKD 80,000 (or its equivalent in other currencies).

The maximum daily spending limit (including transferring to other accounts in the same currency (not applicable to supplementary cards), "Mastercard" POS transaction and online spending) for Platinum BOC Mastercard® debit cards (including principal and supplementary cards) is HKD 200,000 (or its equivalent in other currencies) (The default daily spending limit is HKD 50,000 when card newly issued), while the maximum daily spending limit (including transferring to other accounts in the same currency (not applicable to supplementary cards), "Mastercard" POS transaction and online spending) for World BOC Private Wealth Mastercard® debit cards (including principal and supplementary cards) is HKD 300,000 (or its equivalent in other currencies) (The default daily spending limit is HKD 100,000 when card newly issued) and can be adjusted by the principal cardholder. Upon activation of the card, you signify that you agree to such default limit.

The daily cash withdrawal limit for debit cards (including principal and supplementary cards) is subject to the local daily cash withdrawal limit of the principal cardholder. The maximum local daily cash withdrawal limit is HKD 80,000 (or its equivalent in other currencies).

Principal cardholder can login to Mobile Banking select "Menu" > "Account" > "My BOC Card / Debit Card" > "BOC Mastercard® Debit Card" > "Services" > "Report Lost and Request Replacement" to report lost for principal card and supplementary card. Principal cardholder and supplementary cardholder can also contact us via Online Chat / Customer Service Hotline (852) 2691 2323 or visit any of our branches to report card lost. Principal cardholder can request replacement of supplementary card. And the card will be sent to principal cardholders' registered correspondence address in about a week. Please set up related electronic payment tool and recurring payment instructions again after the card activation.

If you find any suspicious transactions on your Debit Card, please contact us via Online Chat or Customer Service Hotline (852) 2691 2323 immediately.

Principal cardholders can check all transaction records of the Debit Card (including the principal card and supplementary cards) on BOCHK Mobile Banking Application, Personal Consolidated Monthly Statements or passbooks. Principal cardholders are required to report any unauthorized, erroneous or questionable transaction records to the Bank within 90 days from the date of statement or the transaction date of passbooks, failing which, the Bank shall be entitled to treat the transactions stated in the Statement or passbooks as true and correct in all respects. The chargeback mechanism of the applicable card association is available on the Bank's website at www.bochk.com (Click "More" > "BOC Mastercard® Debit Card" > "Important Notice of BOC Mastercard® Debit Card").

Principal cardholders can check all transaction records of the Debit Card (including the principal card and supplementary cards) on BOCHK Mobile Banking Application, Personal Consolidated Monthly Statements or passbooks. Principal cardholders are required to report any unauthorized, erroneous or questionable transaction records to the Bank within 90 days from the date of statement or the transaction date of passbooks, failing which, the Bank shall be entitled to treat the transactions stated in the Statement or passbooks as true and correct in all respects. The chargeback mechanism of the applicable card association is available on the Bank's website at www.bochk.com (Click "More" > "BOC Mastercard® Debit Card" > "Important Notice of BOC Mastercard® Debit Card").

- The above products, services and offers are subject to the relevant terms. For details, please contact the staff of BOCHK.

- BOCHK reserves the right to change, suspend or terminate the above products, services and to amend the relevant terms and conditions at any time at its sole discretion without prior notice.

- In case of any dispute(s), the decision of BOCHK shall be final.

- Customers can enjoy the above offers simultaneously. However, these offers cannot be used in conjunction with other promotion offers that are not listed in this promotion material.

- In case of any discrepancy between the English and the Chinese version of this promotion material, the Chinese version shall prevail.

- Customers need to pay for the relevant data generated by downloading and/ or using BOCHK Mobile Banking or any designated mobile application mentioned above by themselves.

- Please download mobile applications from official application stores or BOCHK website, and ensure the search wording is correct.

- By using BOCHK Mobile Banking, the viewer agrees to be bound by the content of the disclaimer and policy as it may be amended by BOCHK from time to time and posted on BOCHK Mobile Banking.

- Apple Pay, iPhone and Touch ID are trademarks of Apple Inc., registered in US and other countries. For compatible devices and more details about Apple Pay, please refer to Apple Pay - Apple website.

- Google Pay is a trademark of Google Inc. Google Pay works with NFC capable Android™ devices running Android Lollipop 5.0 or higher.

- Android, Google Play, and the Google Play logo are trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited.

- The above products, services and offers are subject to the relevant terms. For details, please contact the staff of BOCHK.

- BOCHK reserves the right to change, suspend or terminate the above products, services and to amend the relevant terms and conditions at any time at its sole discretion without prior notice.

- In case of any dispute(s), the decision of BOCHK shall be final.

- Customers can enjoy the above offers simultaneously. However, these offers cannot be used in conjunction with other promotion offers that are not listed in this promotion material.

- In case of any discrepancy between the English and the Chinese version of this promotion material, the Chinese version shall prevail.

- Customers need to pay for the relevant data generated by downloading and/ or using BOCHK Mobile Banking or any designated mobile application mentioned above by themselves.

- Please download mobile applications from official application stores or BOCHK website, and ensure the search wording is correct.

- By using BOCHK Mobile Banking, the viewer agrees to be bound by the content of the disclaimer and policy as it may be amended by BOCHK from time to time and posted on BOCHK Mobile Banking.

- Apple Pay, iPhone and Touch ID are trademarks of Apple Inc., registered in US and other countries. For compatible devices and more details about Apple Pay, please refer to Apple Pay - Apple website.

- Google Pay is a trademark of Google Inc. Google Pay works with NFC capable Android™ devices running Android Lollipop 5.0 or higher.

- Android, Google Play, and the Google Play logo are trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited.

This page is issued by Bank of China (Hong Kong) Limited. Its contents have not been reviewed by any regulatory authority in Hong Kong.

Corporate Banking

© 2025 BANK OF CHINA (HONG KONG) LIMITED.

ALL RIGHTS RESERVED.