- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

Guaranteed Refund of 101% of Total Premiums Paid1

Enjoy 25% first year premium discount

Product Type: Life Insurance

Insurer: BOC Group Life Assurance Company Limited

The Plan is available for application via mobile banking, easy and quick!

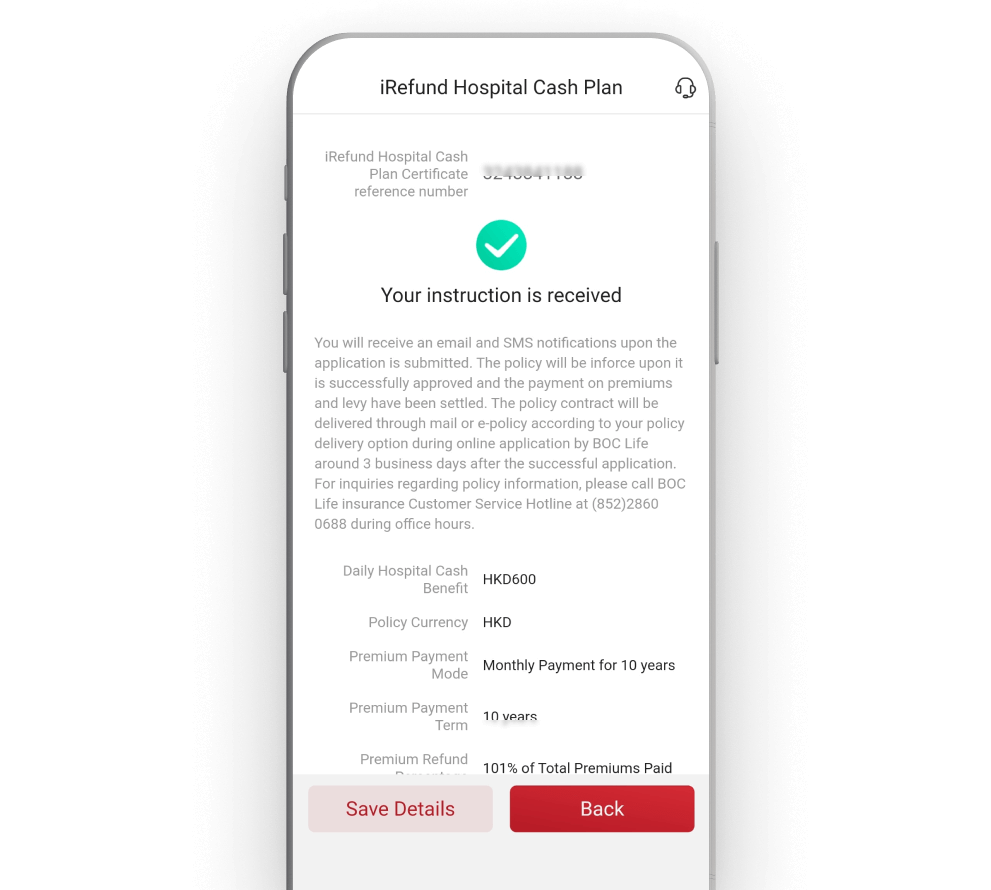

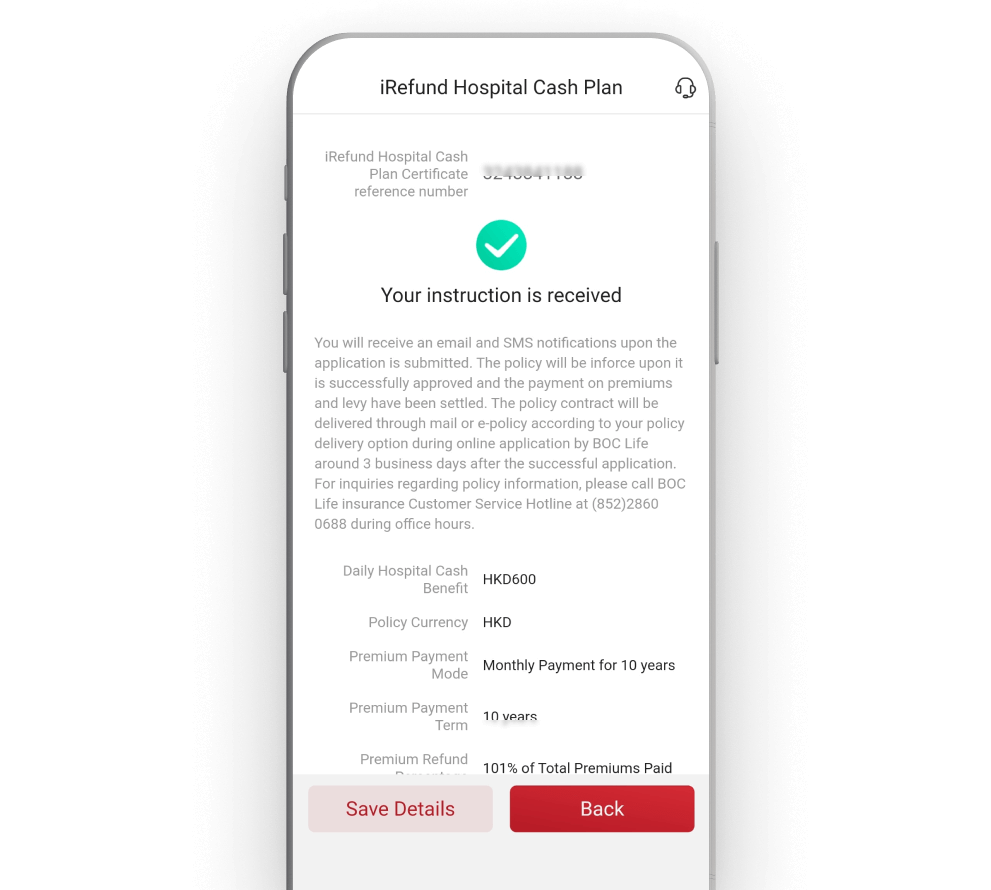

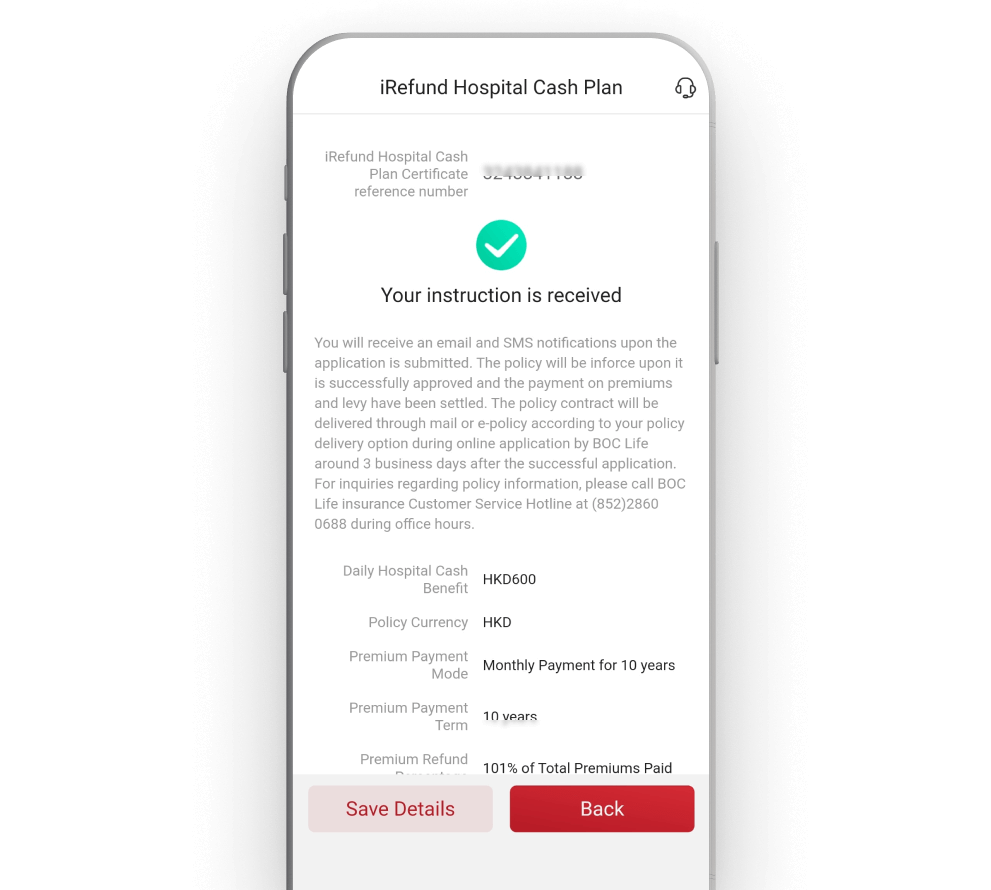

10 years' hospital cash protection plus premium refund2

Guaranteed premium refund of 101%2 of total premiums paid3 upon policy maturity, even if claims have been made

Daily premium from HKD17 only4

Provide Daily Hospital Cash Benefit1 level up to HKD1,200 Daily Hospital Cash Benefit1 coverage per each Disability5 up to 1,000 days6

24-hour Worldwide Emergency Assistance Services

Easy and quick application via mobile7

- No medical examination is required

- Online claims submission service available

Note: Please refer to the product brochure for the product details of the Plan (including the coverage, key risks, major exclusions, etc.).

Before application, please read and understand the related Product Information, Policy Terms and all other relevant document and information carefully.

25% first year premium discount8 upon successful enrolment of the Plan!

600

900

1,200

(30 days for Hospital Confinement outside Hong Kong) (per Disability5)

Illustrative Example

Age 24

Financial protection against adversities (e.g. death), preparation for health care needs, life insurance plan that provides daily hospital cash benefit1 and premium refund2

HKD 118,287

HKD1,200

HKD8,400

she could still receive 101% of the Total Premiums Paid3 as premium refund2

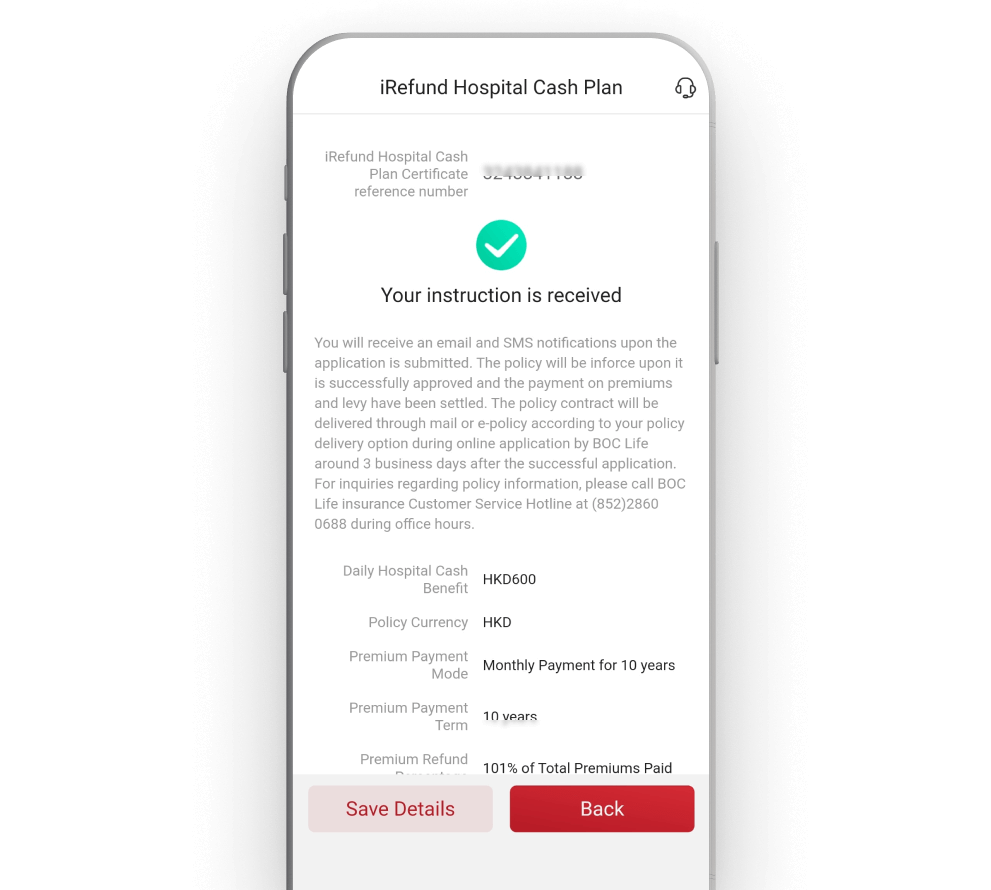

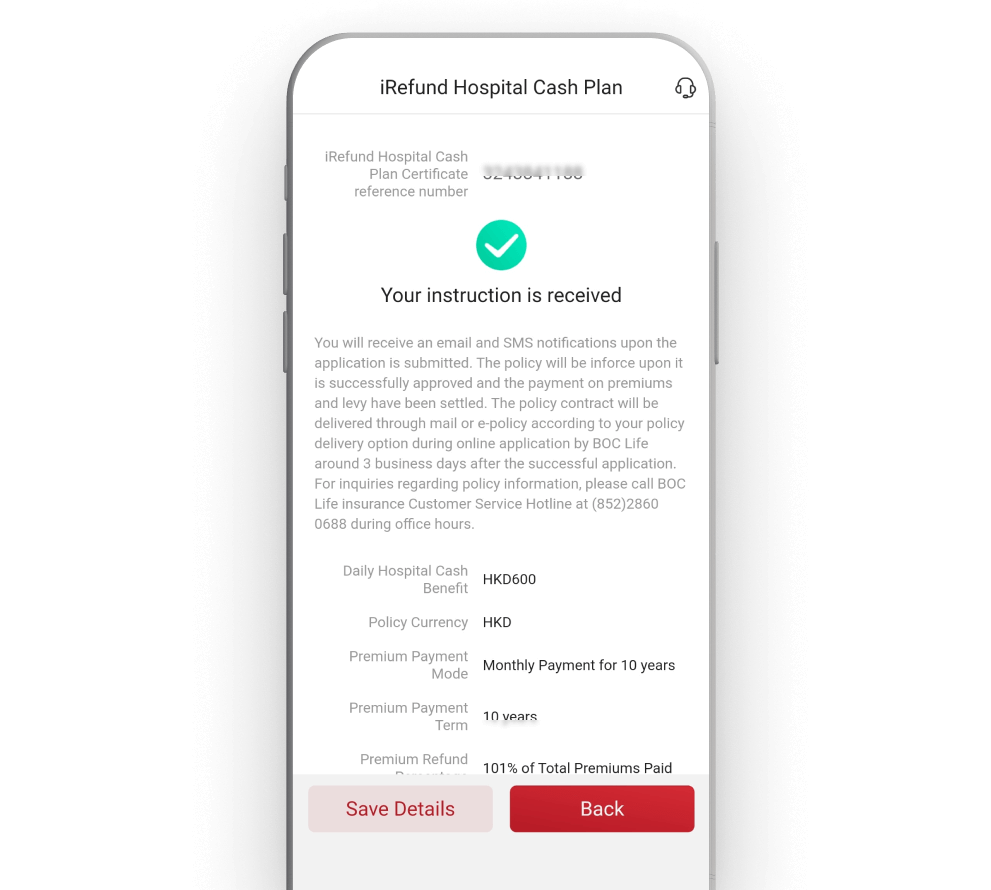

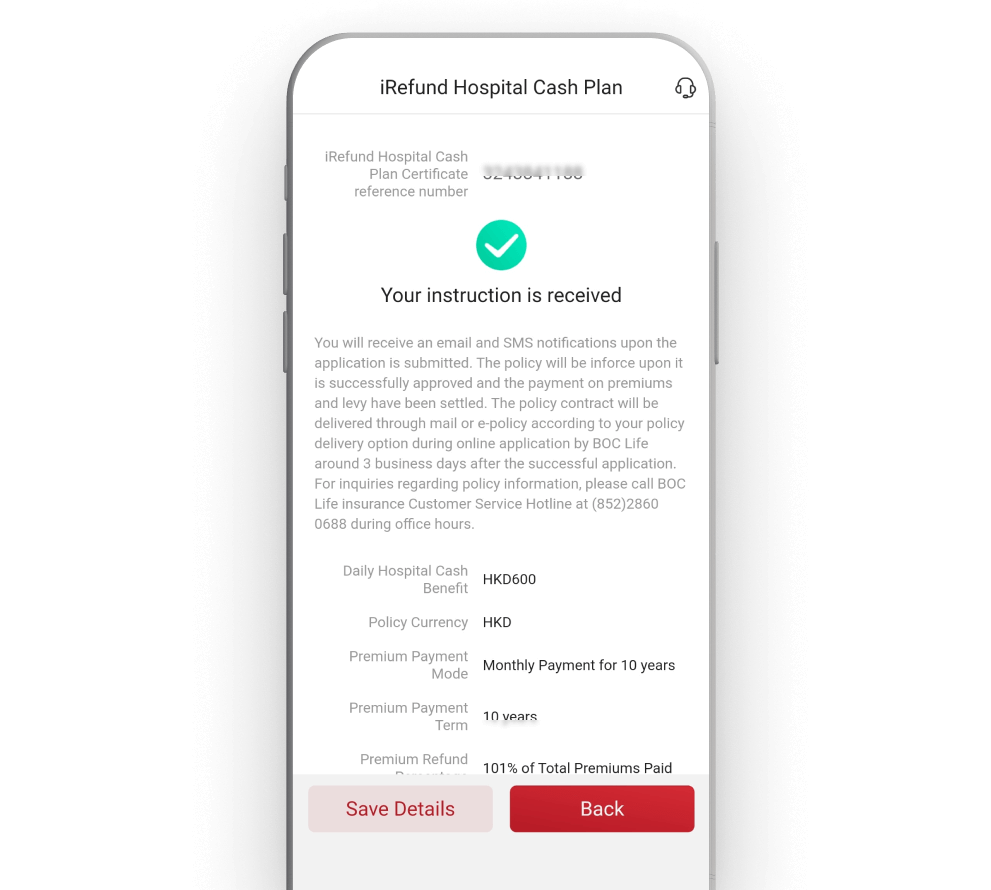

Simple Application on the BOCHK Mobile Banking App

For new customers, please open a BOCHK account first (click here for details)

Download “BOCHK Mobile Banking” > click “Open Account”

For new customers, please open a BOCHK account first (click here for details)

Download “BOCHK Mobile Banking” > click “Open Account”

For new customers, please open a BOCHK account first (click here for details)

Download “BOCHK Mobile Banking” > click “Open Account”

For new customers, please open a BOCHK account first (click here for details)

Download “BOCHK Mobile Banking” > click “Open Account”

Insurance Hotline +852 3669 3003

- The aggregate Daily Hospital Cash Benefit entitlement of each Insured under all policies of the Plan, “Medi-Dollars Hospital Cash Plan” and “Refundable Hospital Cash Plan” shall not exceed HKD2,100. If there is more than one policy of the Plan and/or “Medi-Dollars Hospital Cash Plan” and/or “Refundable Hospital Cash Plan” issued to the Insured with total sum of the Daily Hospital Cash Benefit exceeding HKD2,100, BOC Life will pay the Daily Hospital Cash Benefit by following the sequence of policy issuance and in any event for each day of Hospital Confinement the total Daily Hospital Cash Benefit payable under those policies will not exceed HKD2,100. Hospital Confinement means the admission and confinement of the Insured as an in-patient in a hospital upon recommendation of a Physician for the treatment of a Disability provided that the Insured must be admitted in the hospital as an in-patient for a minimum of six (6) hours and continuously stay in the hospital thereafter prior to his Discharge which incurs a charge for hospital daily room and board or intensive care. Hospital Confinement must be Medically Necessary. The Daily Hospital Cash Benefit will not be payable if the number of hour of Hospital Confinement is less than six (6) hours.

- You may receive premium refund upon surrender starting from the 5th Policy Anniversary and may even receive up to 101% of total premiums paid on the 10th Policy Anniversary (i.e. at policy maturity) as premium refund.

- Total premiums paid amount will be calculated based on premiums paid after premium discount (if any).

- The specified daily premium amount (calculated on the basis of annual premium divided by 365 days per year) is calculated by assuming that the Insured’s age is between 18 and 25 when enrolling in a policy under Plan 1 with monthly payment. The above figure does not include levy and premium discount (if any), also is rounded to the nearest whole number and for illustrative purposes only. Please refer to the policy document for the actual figures.

- Disability means Injury or Sickness. For details, please refer to policy documents and provisions issued by BOC Life.

- For Hospital Confinement outside Hong Kong, the Daily Hospital Cash Benefit coverage per Disability is subject to a maximum of 30 days of Hospital Confinement only.

- The Plan is only available to the holders of BOCHK Mobile Banking account. Applicants must be aged between 18 and 55 and be holders of Hong Kong Permanent Identity Card.

- Premium discount offer is subject to relevant terms and conditions. Please refer to the product brochure for details.

- The Plan is only available for application in Hong Kong.

The premium payable of the Plan is calculated based on protection amount and issue age and is not guaranteed. BOC Life reserves the right to review and adjust the premium payable at any time. Factors leading to such adjustment include but not limited to emergence of difference between actual experience and current expectation.

The Policy Owner is subject to the credit risk of BOC Life. If the Policy Owner discontinues and / or surrenders the insurance plan in the early policy years, the amount of the benefit he / she will get back may be considerably less than the amount of the premium he / she has paid.

- The aggregate Daily Hospital Cash Benefit entitlement of each Insured under all policies of the Plan, “Medi-Dollars Hospital Cash Plan” and “Refundable Hospital Cash Plan” shall not exceed HKD2,100. If there is more than one policy of the Plan and/or “Medi-Dollars Hospital Cash Plan” and/or “Refundable Hospital Cash Plan” issued to the Insured with total sum of the Daily Hospital Cash Benefit exceeding HKD2,100, BOC Life will pay the Daily Hospital Cash Benefit by following the sequence of policy issuance and in any event for each day of Hospital Confinement the total Daily Hospital Cash Benefit payable under those policies will not exceed HKD2,100. Hospital Confinement means the admission and confinement of the Insured as an in-patient in a hospital upon recommendation of a Physician for the treatment of a Disability provided that the Insured must be admitted in the hospital as an in-patient for a minimum of six (6) hours and continuously stay in the hospital thereafter prior to his Discharge which incurs a charge for hospital daily room and board or intensive care. Hospital Confinement must be Medically Necessary. The Daily Hospital Cash Benefit will not be payable if the number of hour of Hospital Confinement is less than six (6) hours.

- You may receive premium refund upon surrender starting from the 5th Policy Anniversary and may even receive up to 101% of total premiums paid on the 10th Policy Anniversary (i.e. at policy maturity) as premium refund.

- Total premiums paid amount will be calculated based on premiums paid after premium discount (if any).

- The specified daily premium amount (calculated on the basis of annual premium divided by 365 days per year) is calculated by assuming that the Insured’s age is between 18 and 25 when enrolling in a policy under Plan 1 with monthly payment. The above figure does not include levy and premium discount (if any), also is rounded to the nearest whole number and for illustrative purposes only. Please refer to the policy document for the actual figures.

- Disability means Injury or Sickness. For details, please refer to policy documents and provisions issued by BOC Life.

- For Hospital Confinement outside Hong Kong, the Daily Hospital Cash Benefit coverage per Disability is subject to a maximum of 30 days of Hospital Confinement only.

- The Plan is only available to the holders of BOCHK Mobile Banking account. Applicants must be aged between 18 and 55 and be holders of Hong Kong Permanent Identity Card.

- Premium discount offer is subject to relevant terms and conditions. Please refer to the product brochure for details.

- The Plan is only available for application in Hong Kong.

The premium payable of the Plan is calculated based on protection amount and issue age and is not guaranteed. BOC Life reserves the right to review and adjust the premium payable at any time. Factors leading to such adjustment include but not limited to emergence of difference between actual experience and current expectation.

The Policy Owner is subject to the credit risk of BOC Life. If the Policy Owner discontinues and / or surrenders the insurance plan in the early policy years, the amount of the benefit he / she will get back may be considerably less than the amount of the premium he / she has paid.

- The Plan is underwritten by BOC Life. Bank of China (Hong Kong) Limited (“BOCHK”) is the major insurance agency appointed by BOC Life.

- BOC Life is authorised and regulated by Insurance Authority to carry on long term business in the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”).

- BOCHK is granted an insurance agency licence under the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) by Insurance Authority in Hong Kong. (insurance agency licence no. FA2855)

- BOC Life reserves the right to decide at its sole discretion to accept or decline any application for the Plan according to the information provided by the proposed Insured and the applicant at the time of application.

- The Plan is subject to the formal policy documents and provisions issued by BOC Life. Please refer to the relevant policy documents and provisions for details of the Insured items and coverage, provisions and exclusions.

- BOCHK is the appointed insurance agency of BOC Life for distribution of life insurance products. The life insurance product is a product of BOC Life but not BOCHK.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BOCHK and the customer out of the selling process or processing of the related transaction, BOCHK is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the insurance product should be resolved between directly BOC Life and the customer.

- BOC Life reserves the right to amend, suspend or terminate the Plan at any time and to amend the relevant terms and conditions. In case of dispute(s), the decision of BOC Life shall be final.

- Customers are responsible for the relevant data charges incurred by using and/or downloading BOCHK Mobile Banking.

- Please download mobile applications from official application stores or BOCHK website or scan the above QR code, and ensure the search wording is correct.

- By using BOCHK Mobile Banking, the viewer agrees to be bound by the content of the disclaimer and policy as it may be amended by BOCHK from time to time and posted on BOCHK Mobile Banking.

Should there be any discrepancy between the Chinese and English versions of this promotion material, the English version shall prevail.

You have an option to purchase the Plan as a standalone hospital cash insurance plan instead of bundling with other type(s) of insurance product.

The product information does not contain the full terms of the policy and the full terms can be found in the policy documents.

This promotion material is for reference only and is intended to be distributed in Hong Kong only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any products of BOC Life outside Hong Kong. Please refer to the policy documents and provisions issued by BOC Life for details (including but not limited to the insured items and coverage, detailed terms, key risks, conditions, exclusions, policy costs and fees) of the Plan. For enquiry about technical support for online application, please contact BOCHK Customer Service Hotline (852) 3669 3003. For enquiry about product and post-sales service, please contact BOC Life Customer Service Hotline (852) 2860 0688.

- The Plan is underwritten by BOC Life. Bank of China (Hong Kong) Limited (“BOCHK”) is the major insurance agency appointed by BOC Life.

- BOC Life is authorised and regulated by Insurance Authority to carry on long term business in the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”).

- BOCHK is granted an insurance agency licence under the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) by Insurance Authority in Hong Kong. (insurance agency licence no. FA2855)

- BOC Life reserves the right to decide at its sole discretion to accept or decline any application for the Plan according to the information provided by the proposed Insured and the applicant at the time of application.

- The Plan is subject to the formal policy documents and provisions issued by BOC Life. Please refer to the relevant policy documents and provisions for details of the Insured items and coverage, provisions and exclusions.

- BOCHK is the appointed insurance agency of BOC Life for distribution of life insurance products. The life insurance product is a product of BOC Life but not BOCHK.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BOCHK and the customer out of the selling process or processing of the related transaction, BOCHK is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the insurance product should be resolved between directly BOC Life and the customer.

- BOC Life reserves the right to amend, suspend or terminate the Plan at any time and to amend the relevant terms and conditions. In case of dispute(s), the decision of BOC Life shall be final.

- Customers are responsible for the relevant data charges incurred by using and/or downloading BOCHK Mobile Banking.

- Please download mobile applications from official application stores or BOCHK website or scan the above QR code, and ensure the search wording is correct.

- By using BOCHK Mobile Banking, the viewer agrees to be bound by the content of the disclaimer and policy as it may be amended by BOCHK from time to time and posted on BOCHK Mobile Banking.

Should there be any discrepancy between the Chinese and English versions of this promotion material, the English version shall prevail.

You have an option to purchase the Plan as a standalone hospital cash insurance plan instead of bundling with other type(s) of insurance product.

The product information does not contain the full terms of the policy and the full terms can be found in the policy documents.

This promotion material is for reference only and is intended to be distributed in Hong Kong only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any products of BOC Life outside Hong Kong. Please refer to the policy documents and provisions issued by BOC Life for details (including but not limited to the insured items and coverage, detailed terms, key risks, conditions, exclusions, policy costs and fees) of the Plan. For enquiry about technical support for online application, please contact BOCHK Customer Service Hotline (852) 3669 3003. For enquiry about product and post-sales service, please contact BOC Life Customer Service Hotline (852) 2860 0688.

This page is issued by Bank of China (Hong Kong) Limited. Its contents have not been reviewed by any regulatory authority in Hong Kong.