- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

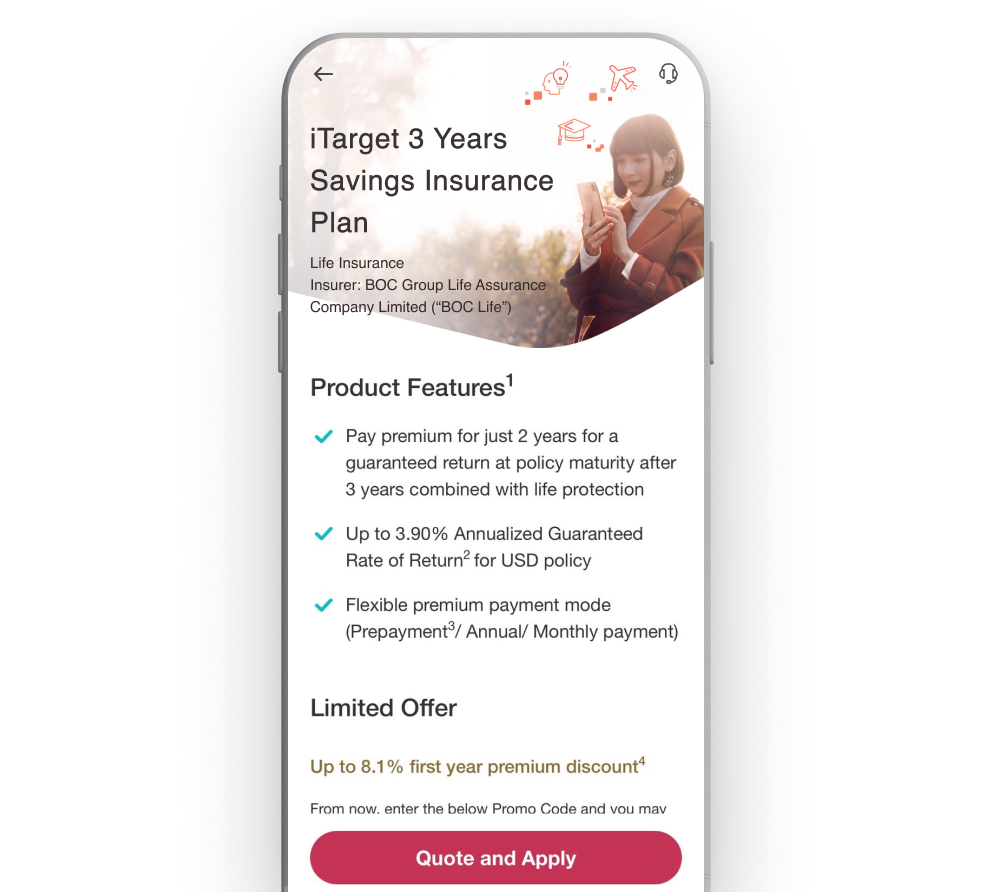

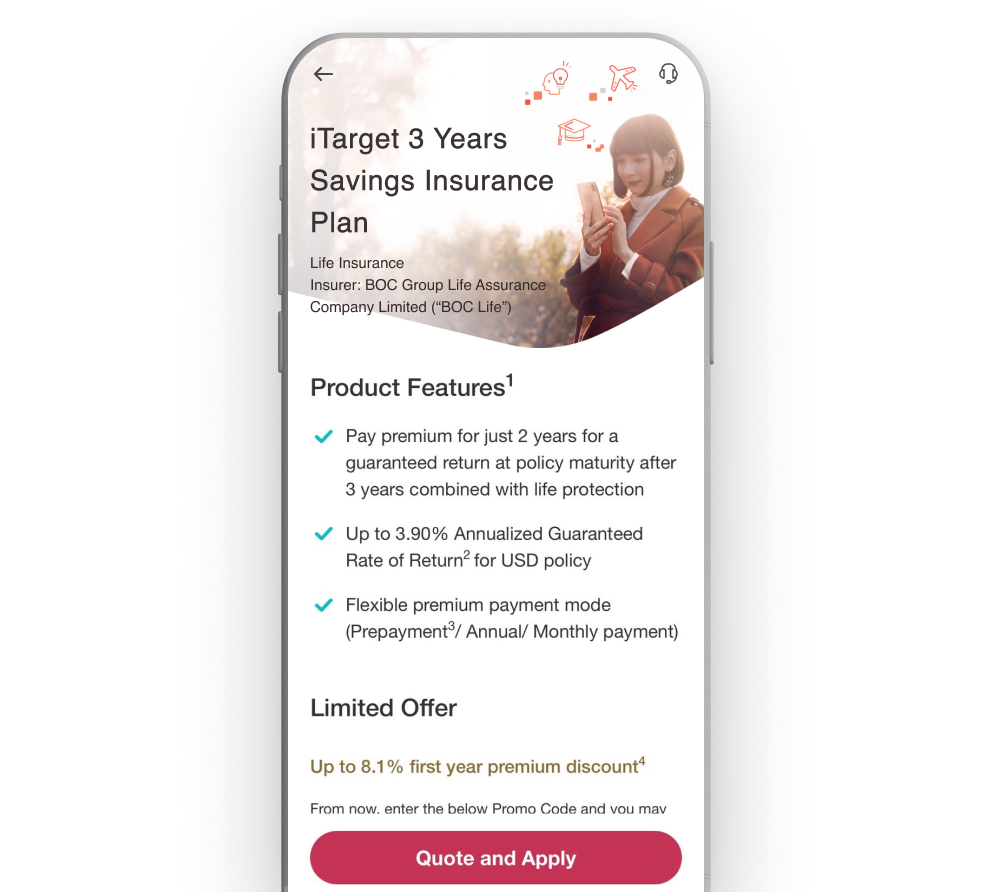

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

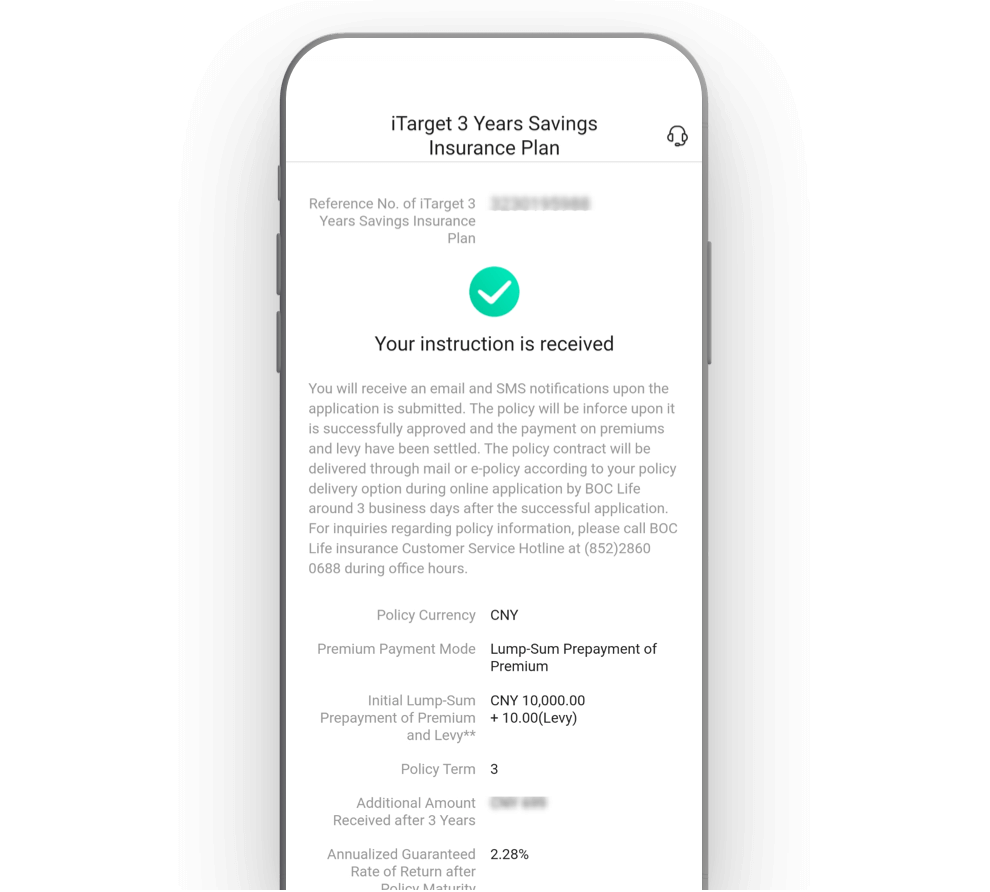

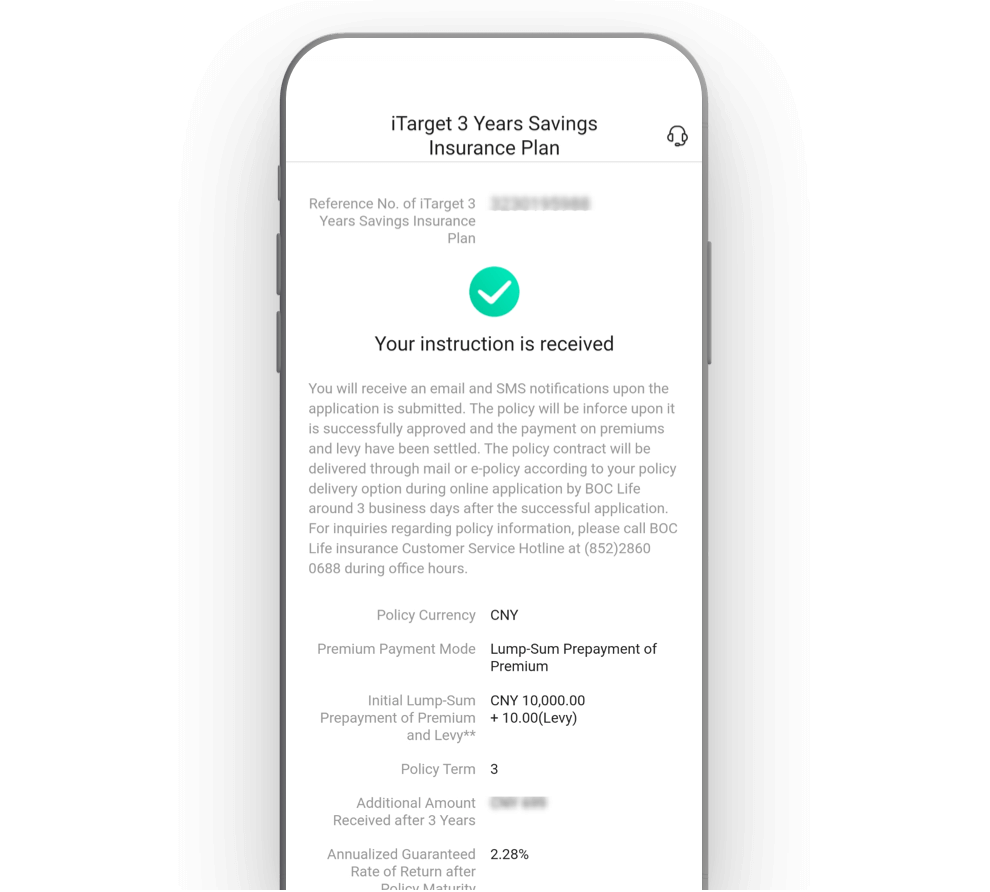

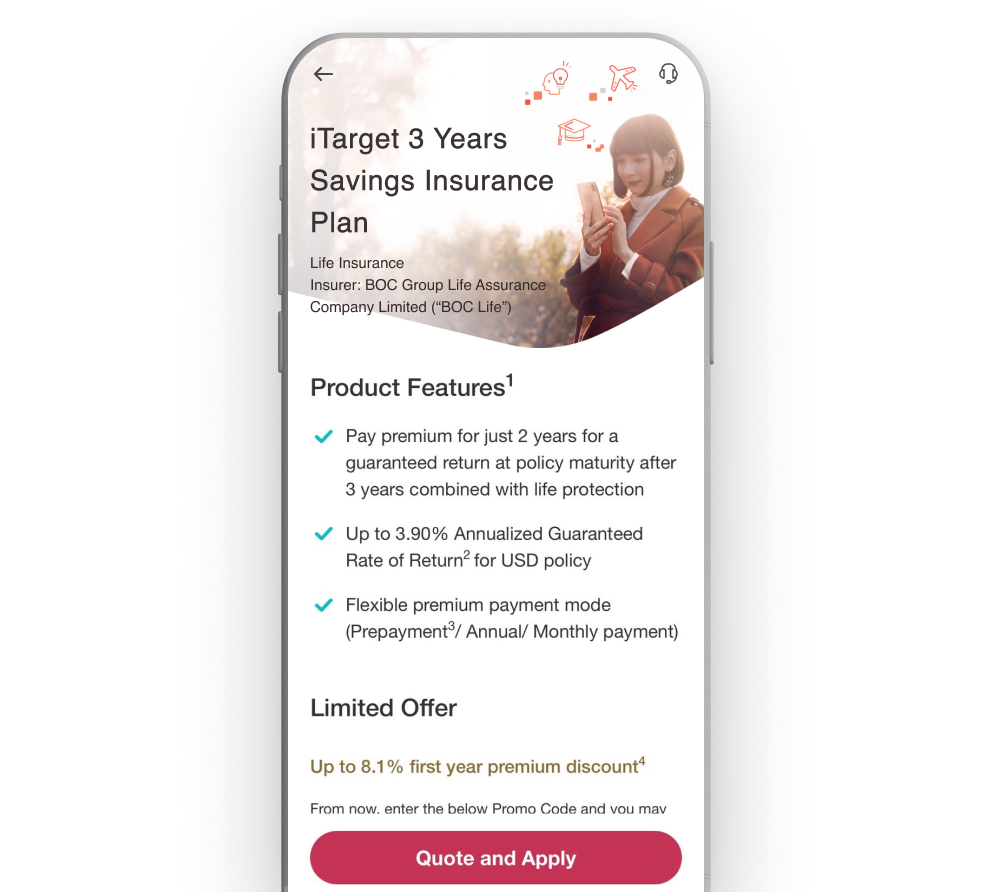

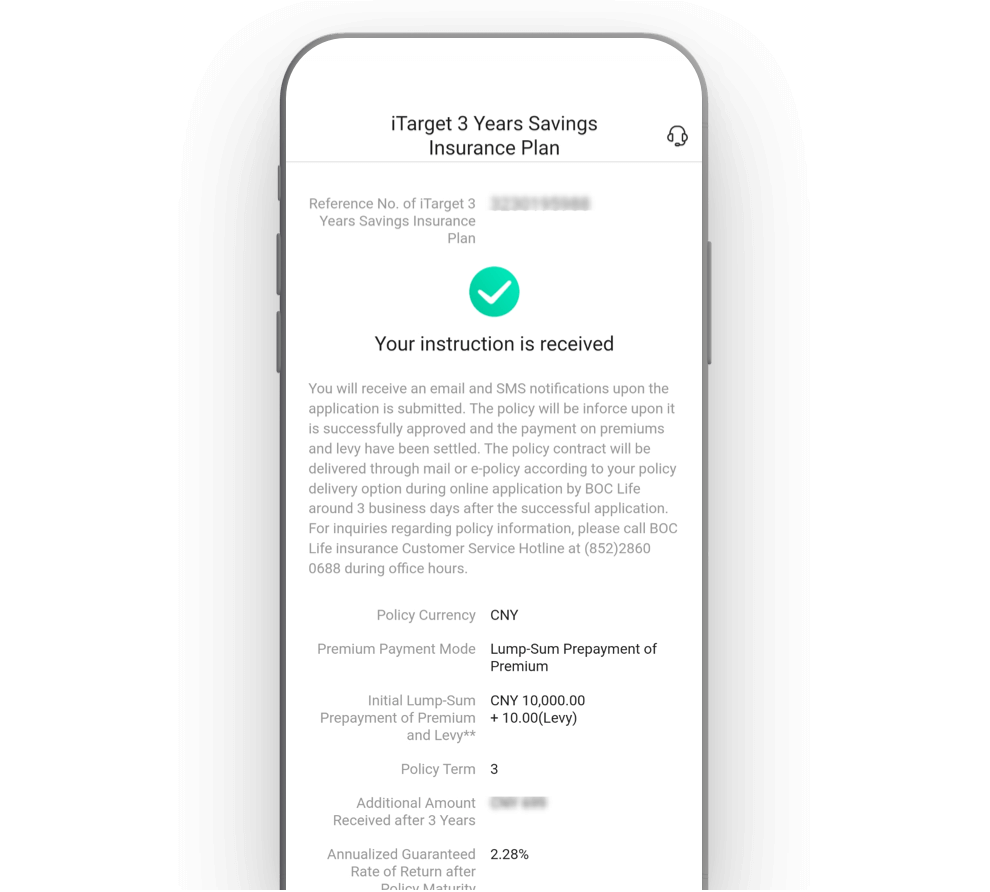

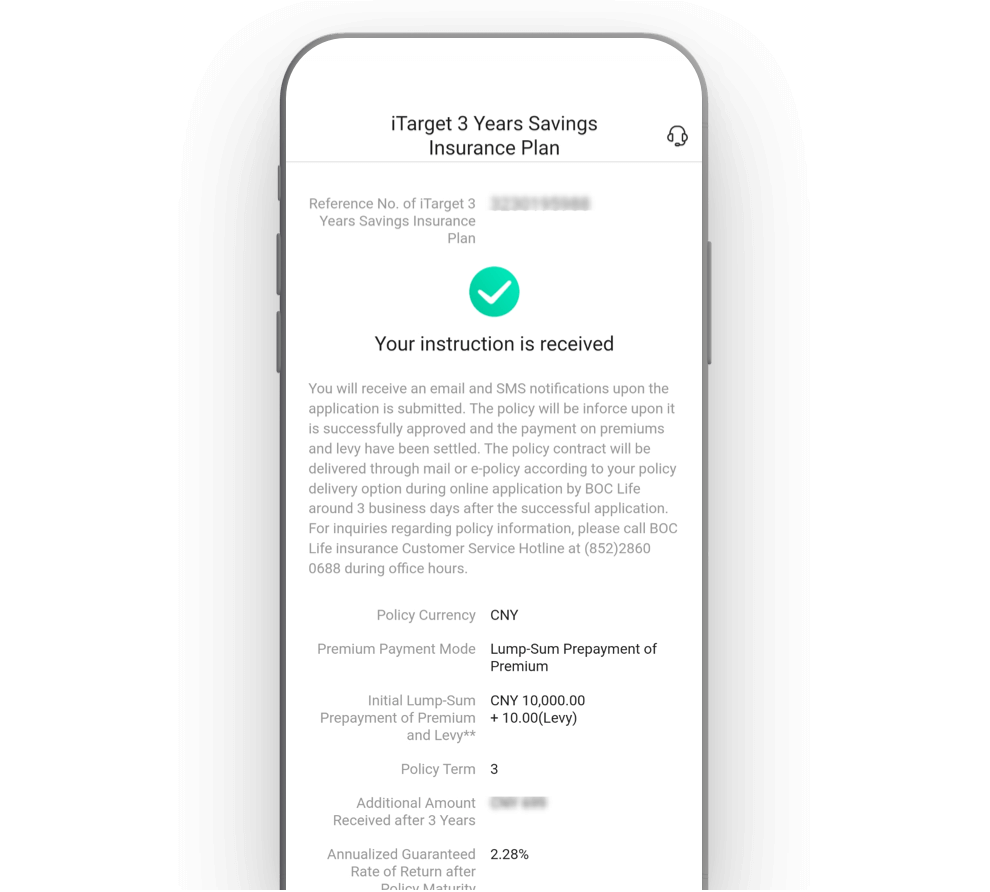

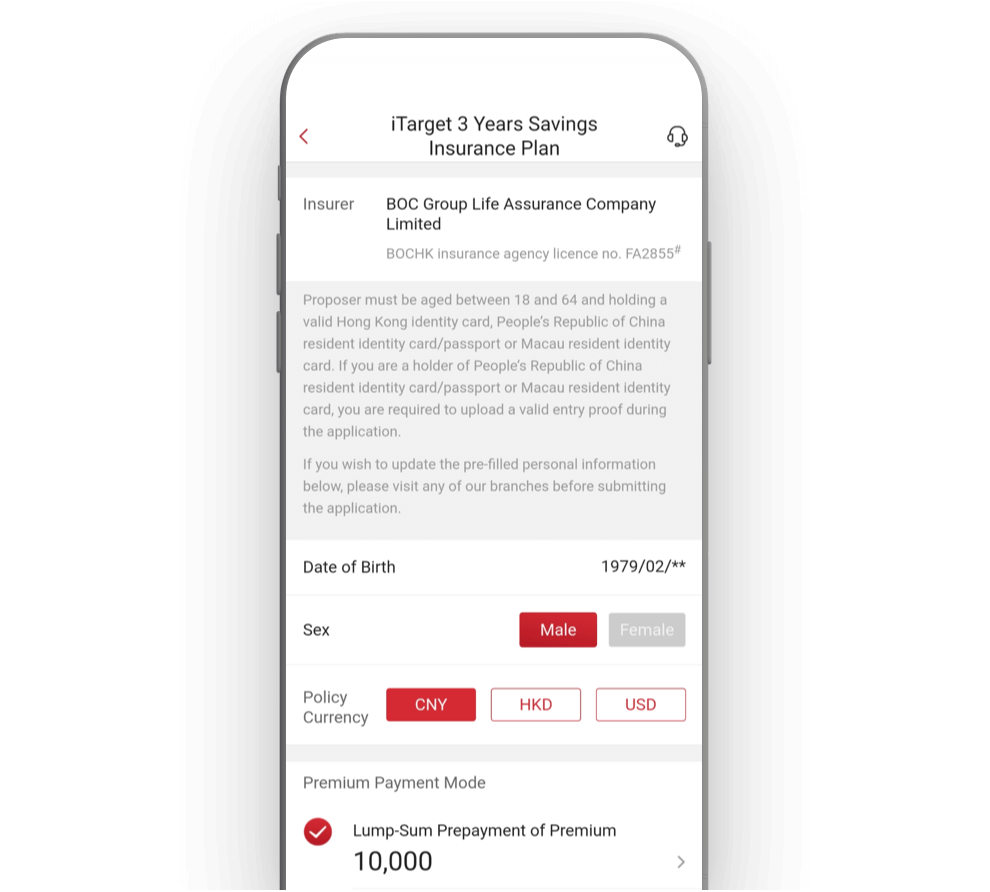

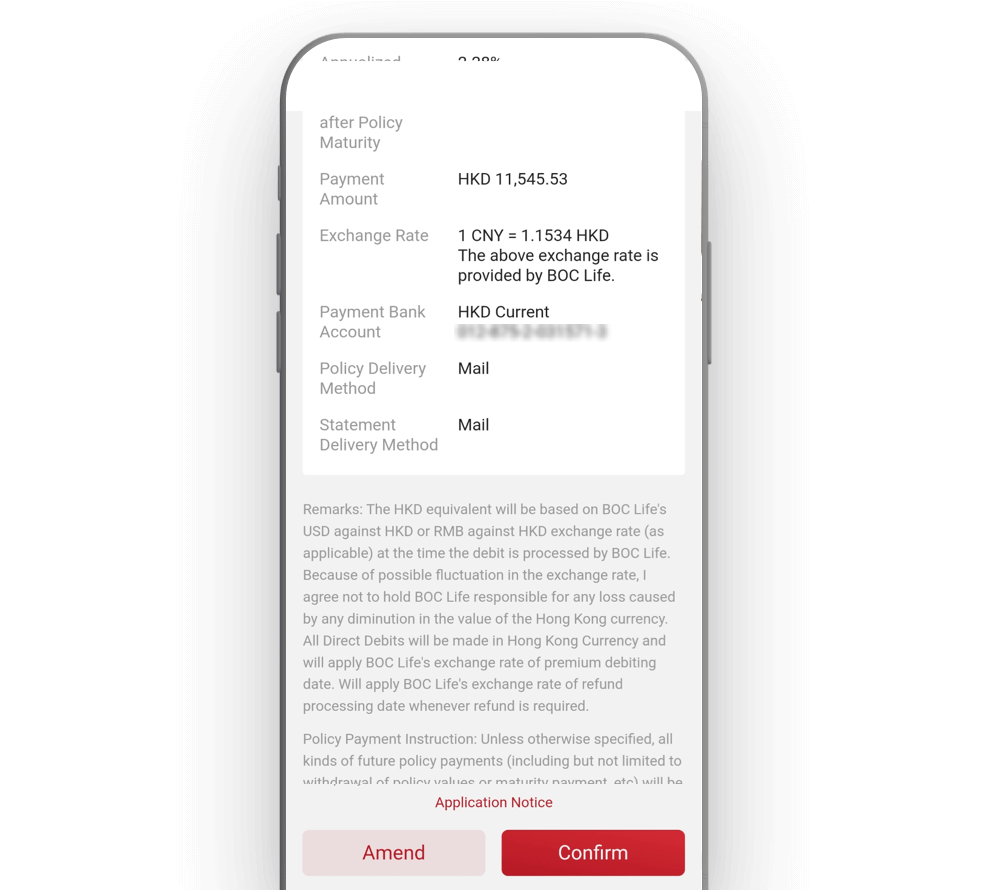

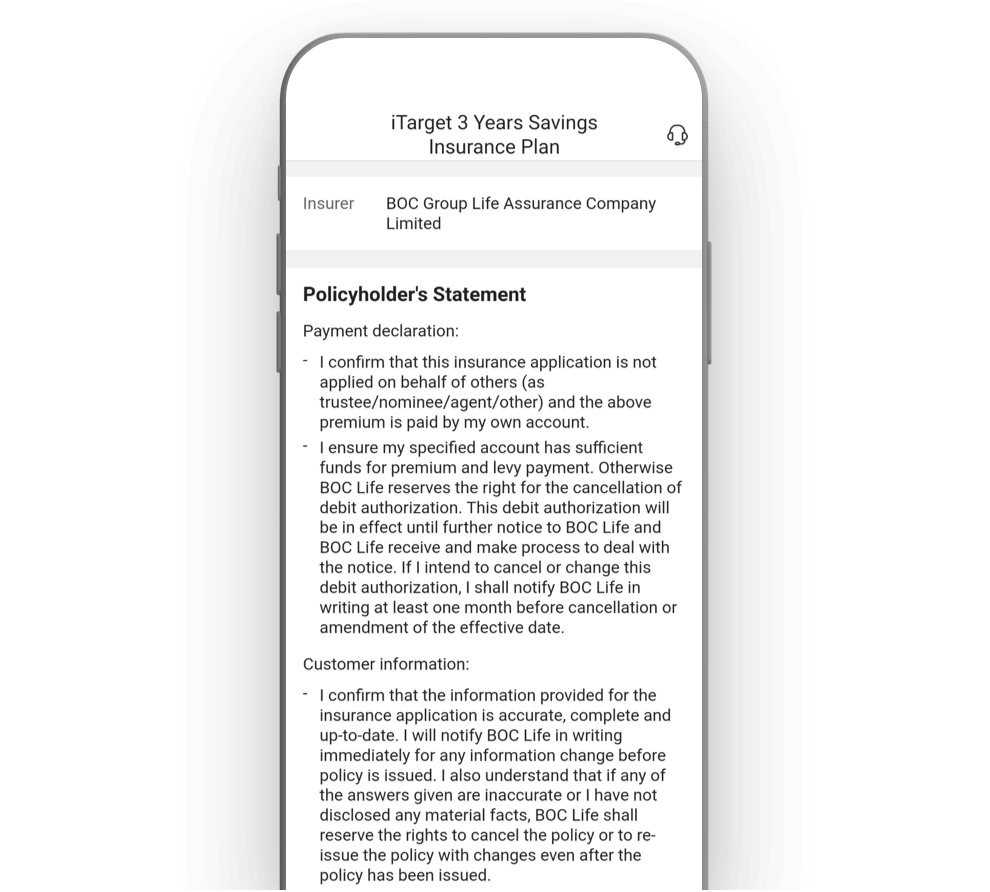

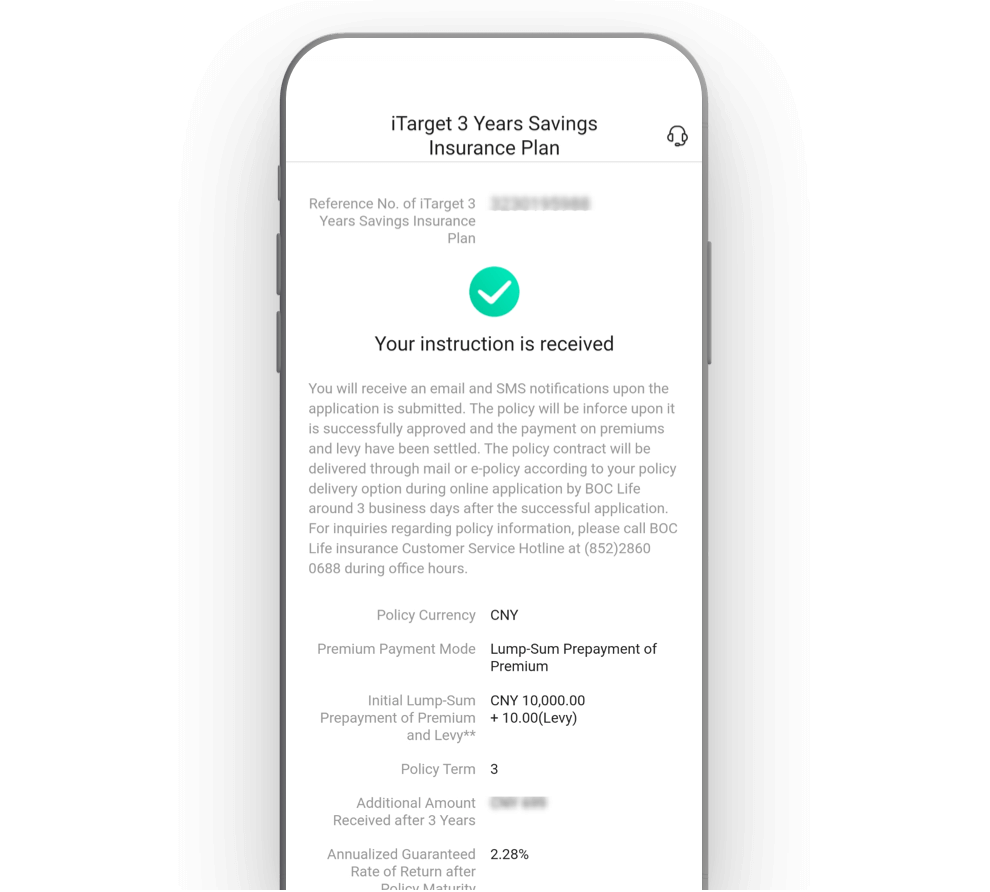

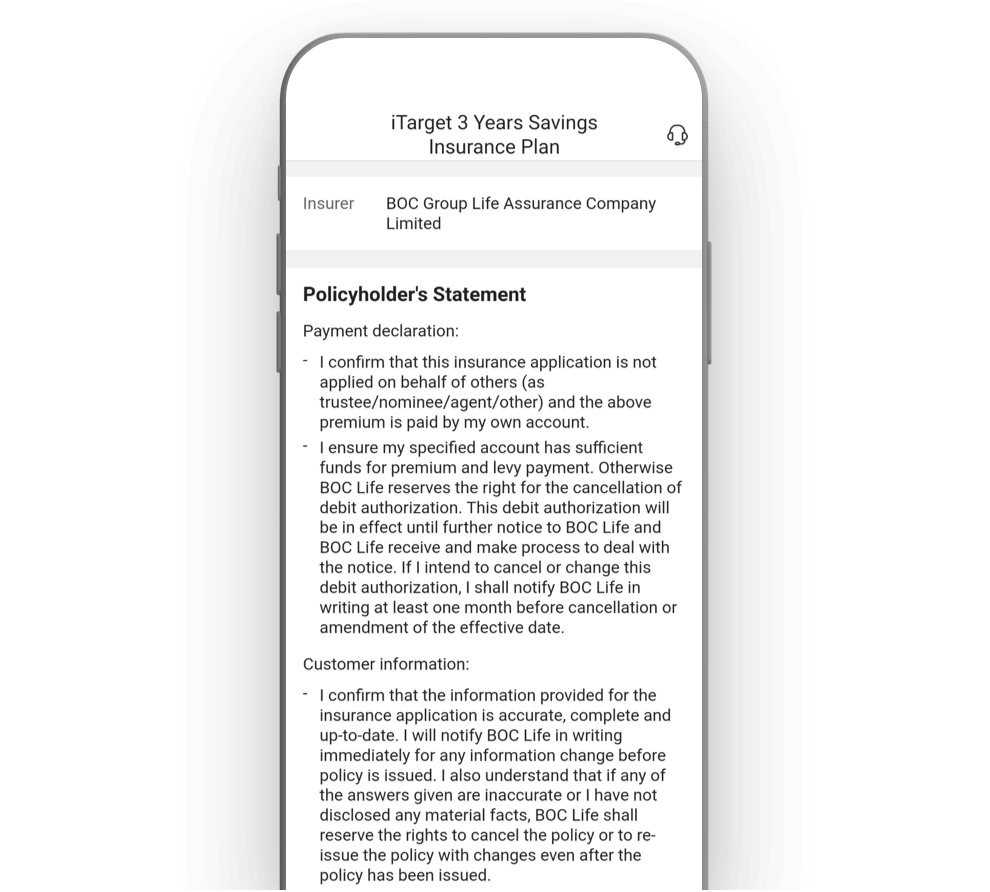

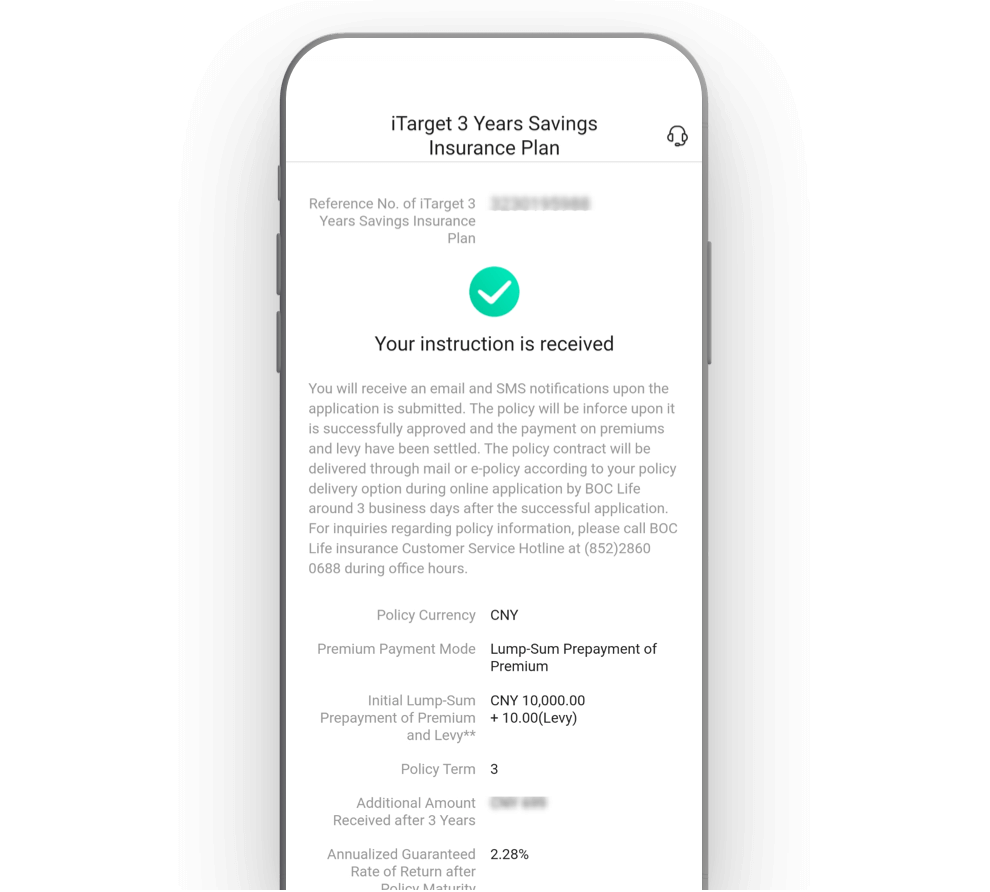

(Apply via Mobile Banking)

Product Type: Life Insurance

Insurer: BOC Group Life Assurance Company Limited

"iTarget 3 Years Savings Insurance Plan"

is No. 1 in the sales volume of life insurance products of BOCHK mobile banking.

Instant Online Application

with 2-year Premium Payment Term and Earn a Steady Return after 3 years

while Achieving your Financial Planning Goals with Life Protection.

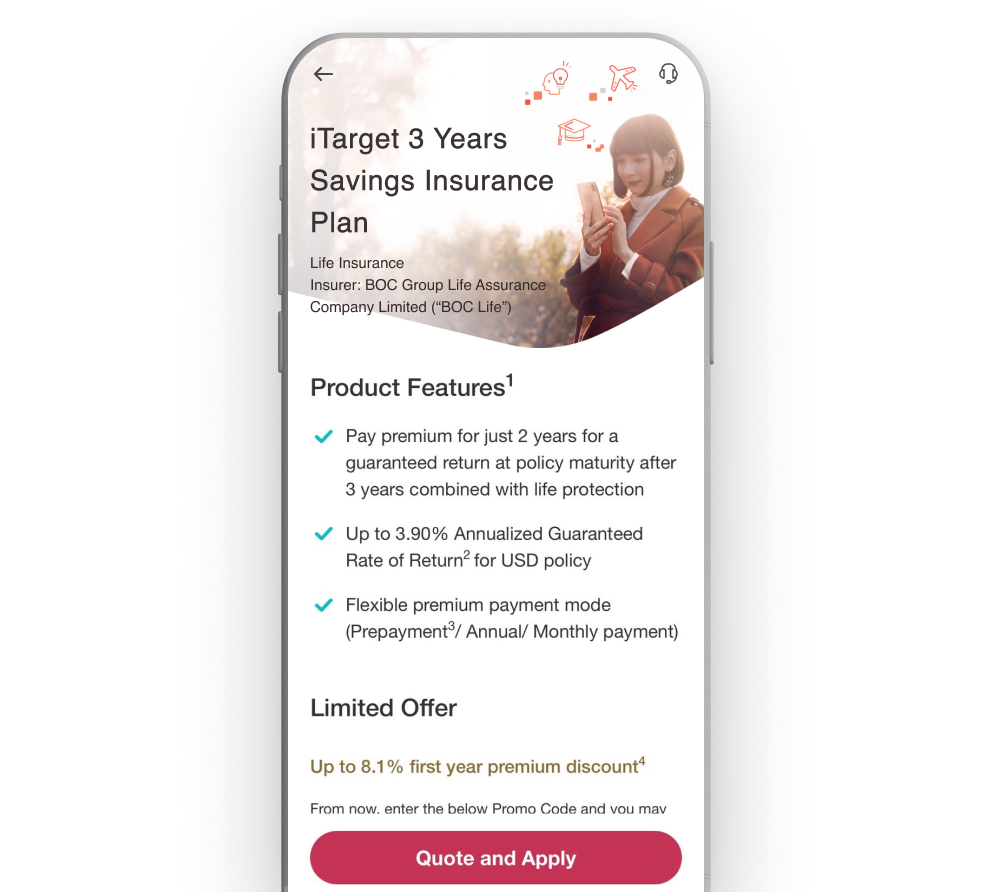

Product Features

Guaranteed Return in 3 Years

Annualized Guaranteed Rate of Return up to 4.00%*

- HKD: 3.60%

- RMB: 2.58%

- USD: 4.00%

Choose your desired policy currency for Prepayment2/ Annual/ Monthly payment

- HKD / RMB/ USD available

- Remaining balance of prepaid premiums (if any)2 with interest accumulation

- Monthly premium from HKD500 only

Savings combined with life protection3 and additional accidental death benefit4

*Annualized guaranteed rate of return varies by your chosen policy currency and premium payment mode. The maximum annualized guaranteed rates of return mentioned above are included first year premium discount. Please refer to the product leaflet for the details.

Before application, please read and understand the related Product Information, Policy Terms and all other relevant document and information carefully.

Discount

Note: First year premium discount offer is subject to terms and conditions. For details, please refer to the product & Promotion leaflet.

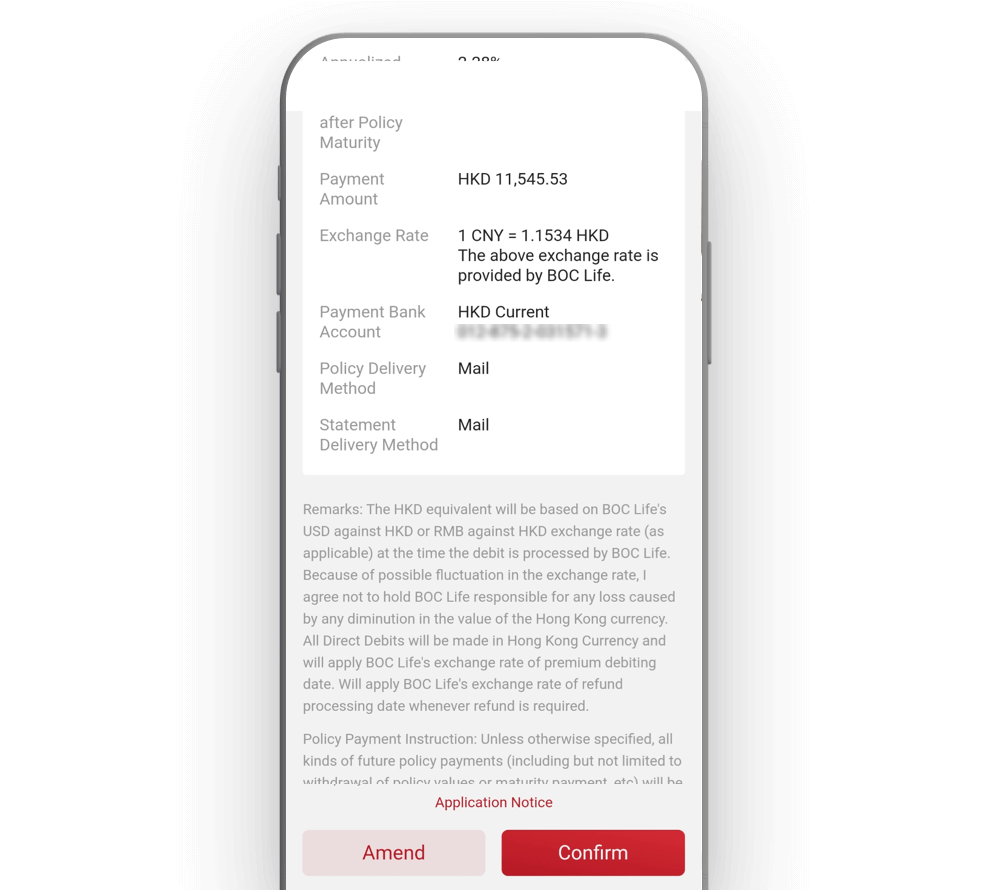

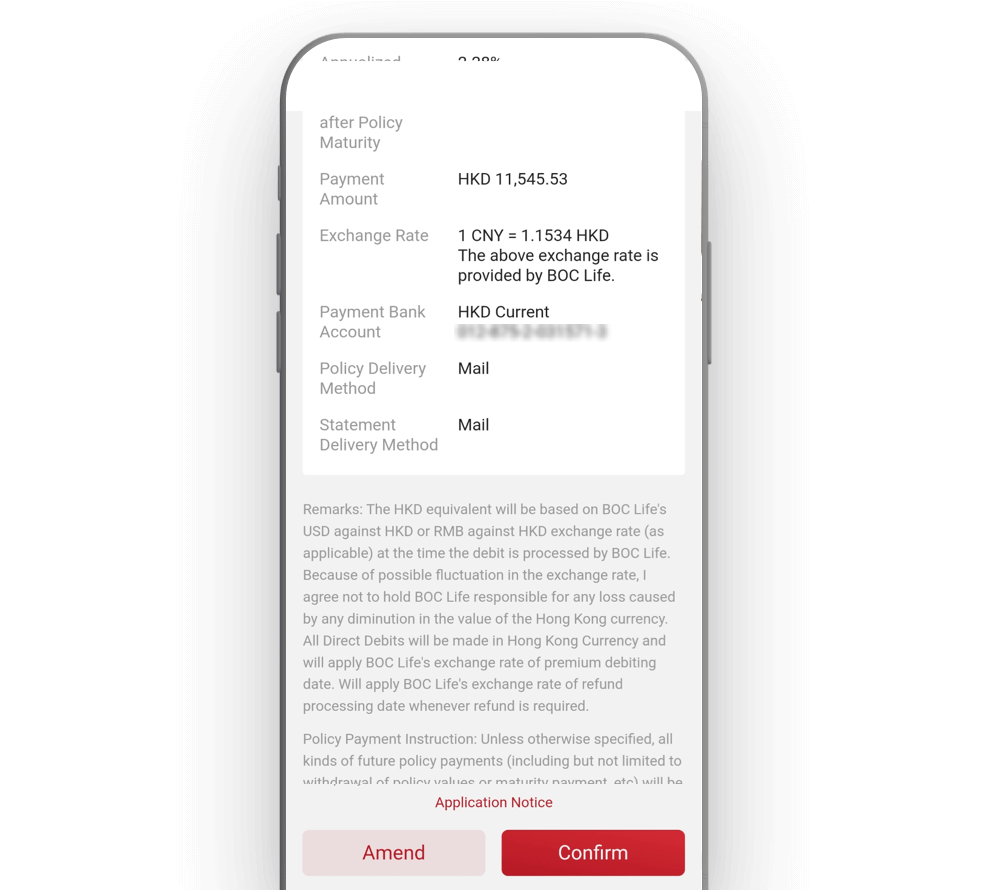

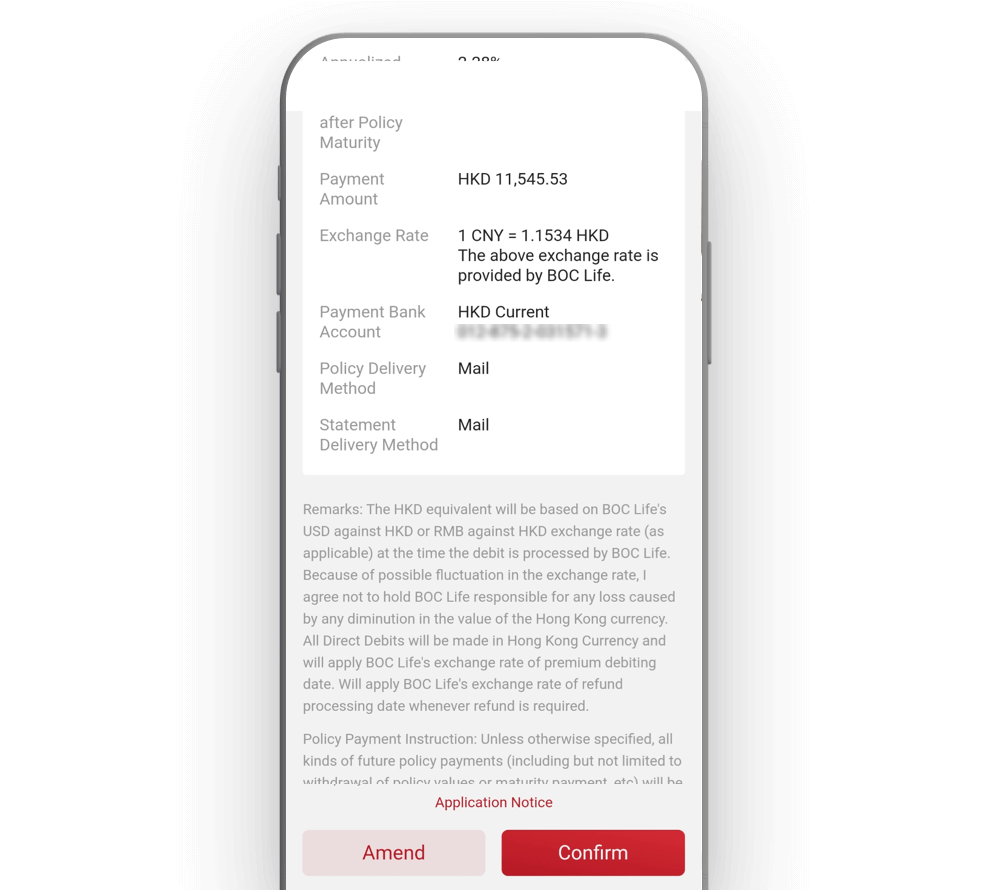

(Direct payment from BOCHK e-Banking Account)

Illustrative Example

Premium Payment Term

2 Years

Premium Payment Mode

Annual Payment for 2 years

Policy Currency

USD

Annual Premium

USD 12,500

Total Premiums

USD 25,000

Actual total premiums paid after first year premium discount

USD 23,920

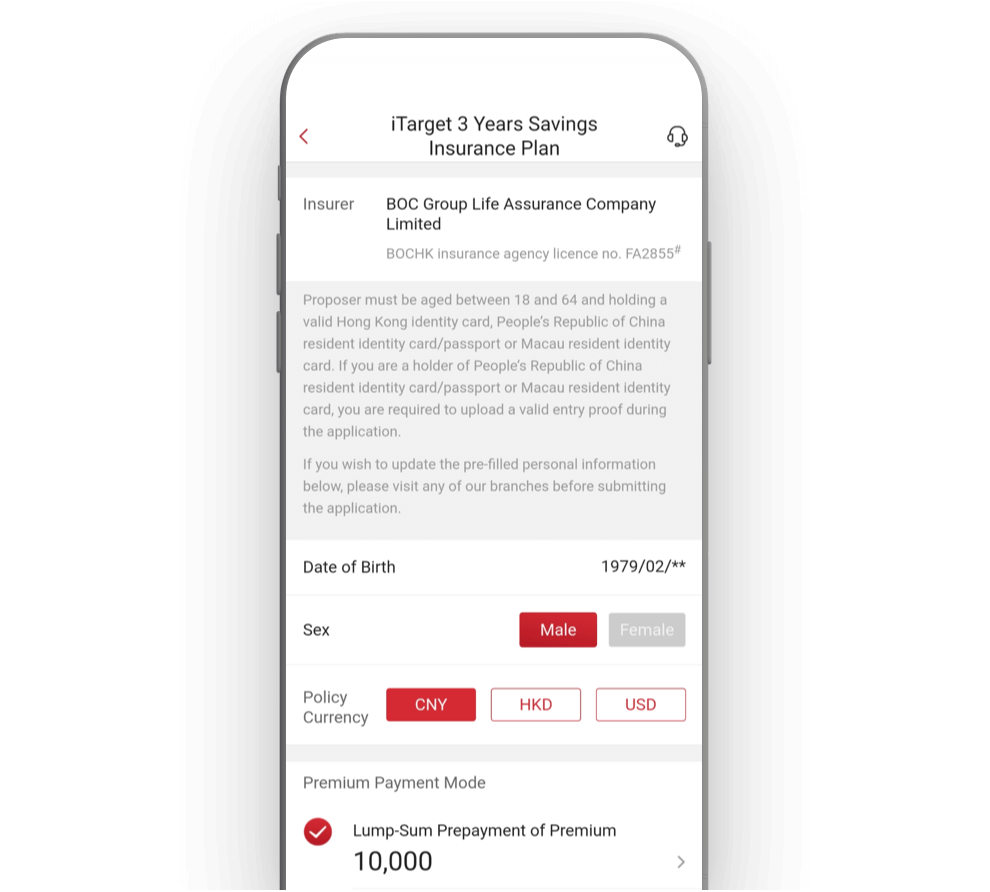

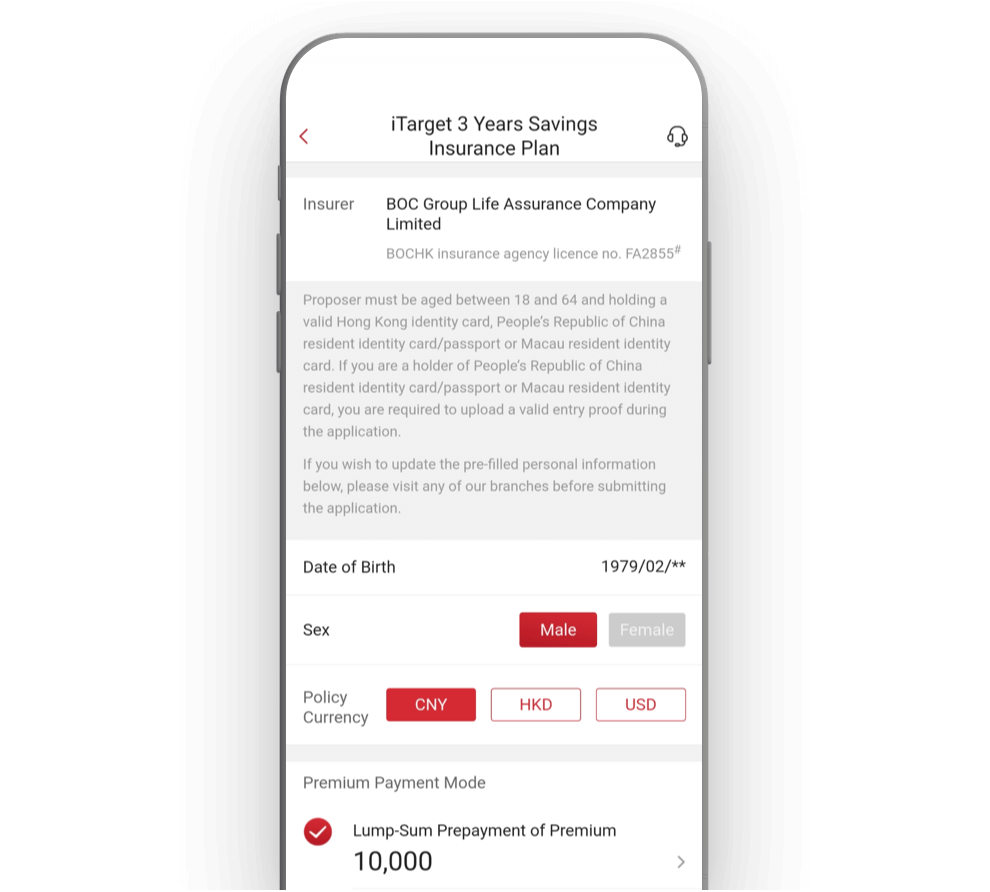

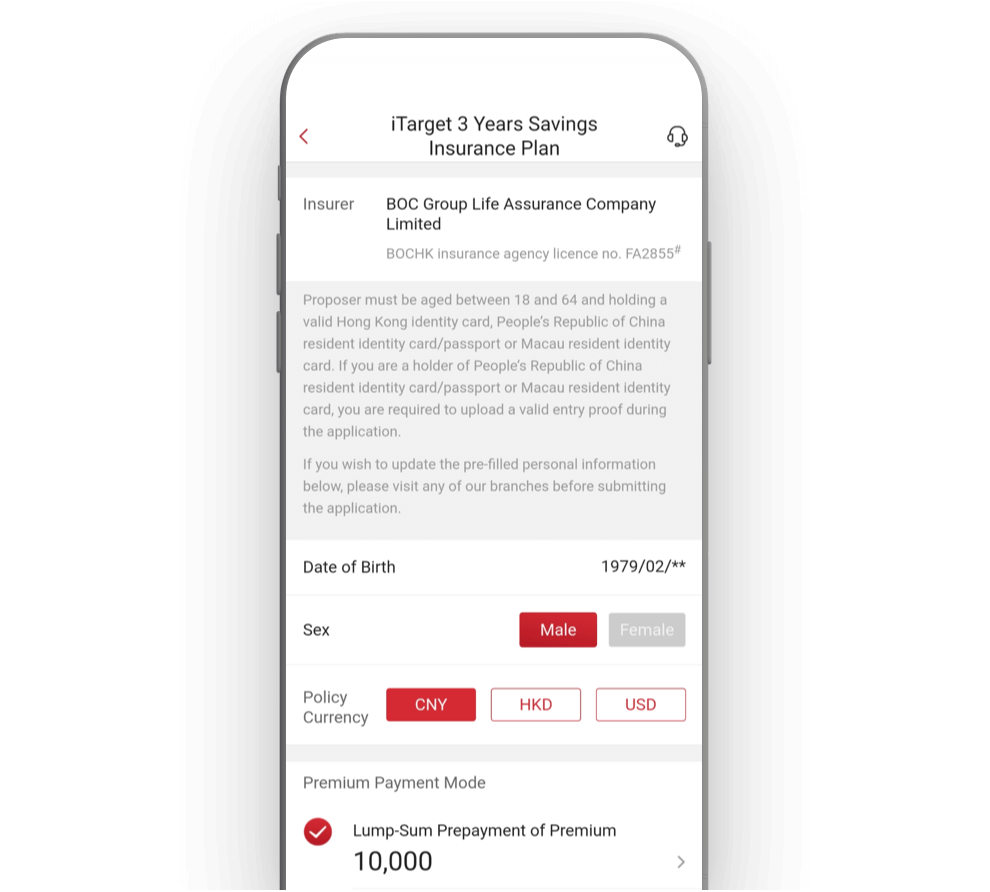

Simple Application on the BOCHK Mobile Banking App

For new customers, please open a BOCHK account first (click here for details)

Download "BOCHK Mobile Banking" > click "Open Account"

For new customers, please open a BOCHK account first (click here for details)

Download "BOCHK Mobile Banking" > click "Open Account"

For new customers, please open a BOCHK account first (click here for details)

Download "BOCHK Mobile Banking" > click "Open Account"

For new customers, please open a BOCHK account first (click here for details)

Download "BOCHK Mobile Banking" > click "Open Account"

Insurance Hotline +852 3669 3003

Remarks:

- Annualized guaranteed rate of return varies by your chosen policy currency and premium payment mode. The annualized guaranteed rates of return mentioned above are rounded to 2 decimal places, and included first year premium discount (if any). The relevant return rates and amounts mentioned above are calculated based on the case with first-year premium discount (if applicable). Please refer to product leaflet for terms and conditions of the first-year premium discount offer.

- Premium Deposit Account is only applicable to policy with annual payment mode. If premiums prepayment option is selected, payable premiums for 2 policy years have to be fully paid upon insurance application. Please refer to the product leaflet for the details.

- The Death Benefit of iTarget 3 Years Savings Insurance Plan ("the Plan") is equivalent to 101% of Total Premiums Paid or Guaranteed Cash Value (whichever is higher) as at the date of death of the Insured less outstanding premiums (if any). “Total Premiums Paid” means the total premiums paid for the basic plan. Any Premium Deposit Account balance shall be excluded. Premium discount (if any) will not be taken into account when calculating the Death Benefit. Regarding the maximum amount of the Death Benefit payable if the Insured is covered by more than one policy under the Plan issued by BOC Life, please refer to the product leaflet, policy documents and provisions issued by BOC Life for details.

- The Additional Accidental Death Benefit is applicable to the Insured of policy’s issue age between 18 and 60, who has an accident before the 1st policy anniversary. Such accident should be direct, independent and the sole cause of, and should result in the death of the Insured within 180 days after the accident and before termination of coverage under the relevant policy. Also, submission of due proof of the Accidental Death of the Insured is required. Please refer to the product leaflet and policy provisions for the details.

- Applicant must be aged between 18 and 64. The plan is available to the holders of Hong Kong Permanent Identity Card / Hong Kong Identity Card, People’s Republic of China Resident Identity Card / Passport or Macau Resident Identity Card, who also have BOCHK e-Banking (mobile banking / internet banking) account, to apply via BOCHK e-Banking in Hong Kong. And the Plan is subject to the relevant requirements on nationality and residency of the applicants and the Insured as determined by BOC Life from time to time. Please refer to the product leaflet and policy provisions for the details of the Plan (including the coverage, key risks, major exclusions, etc.).

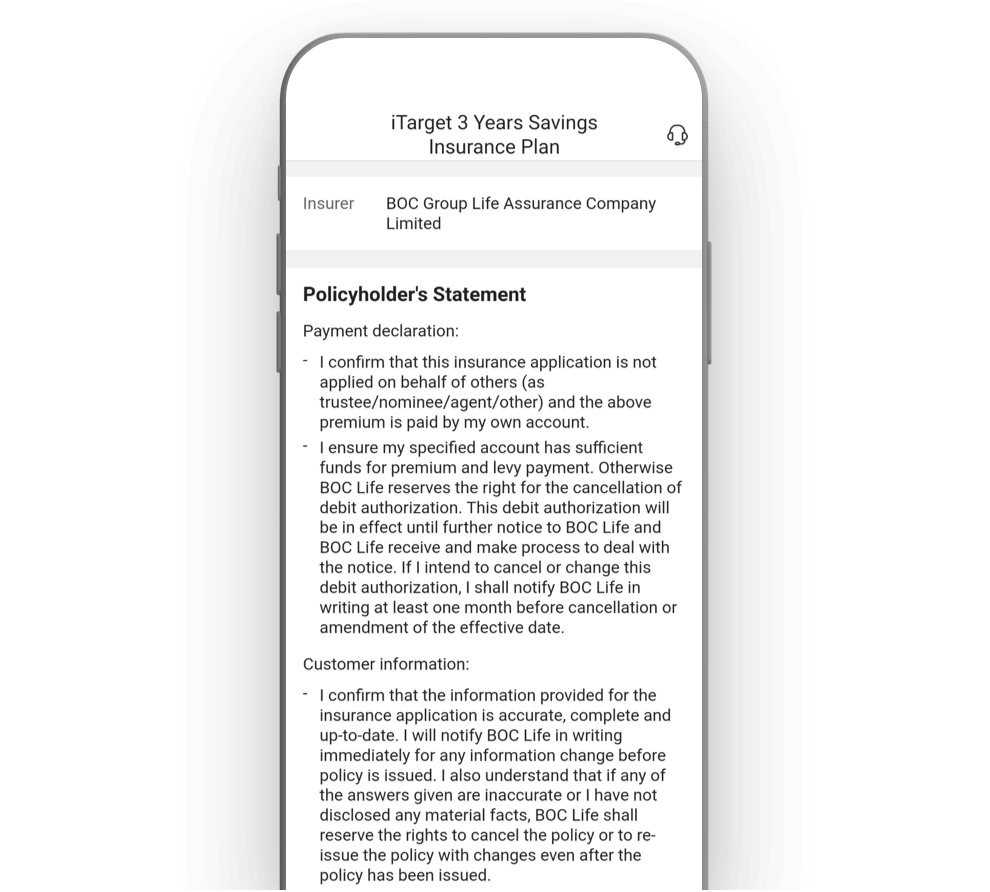

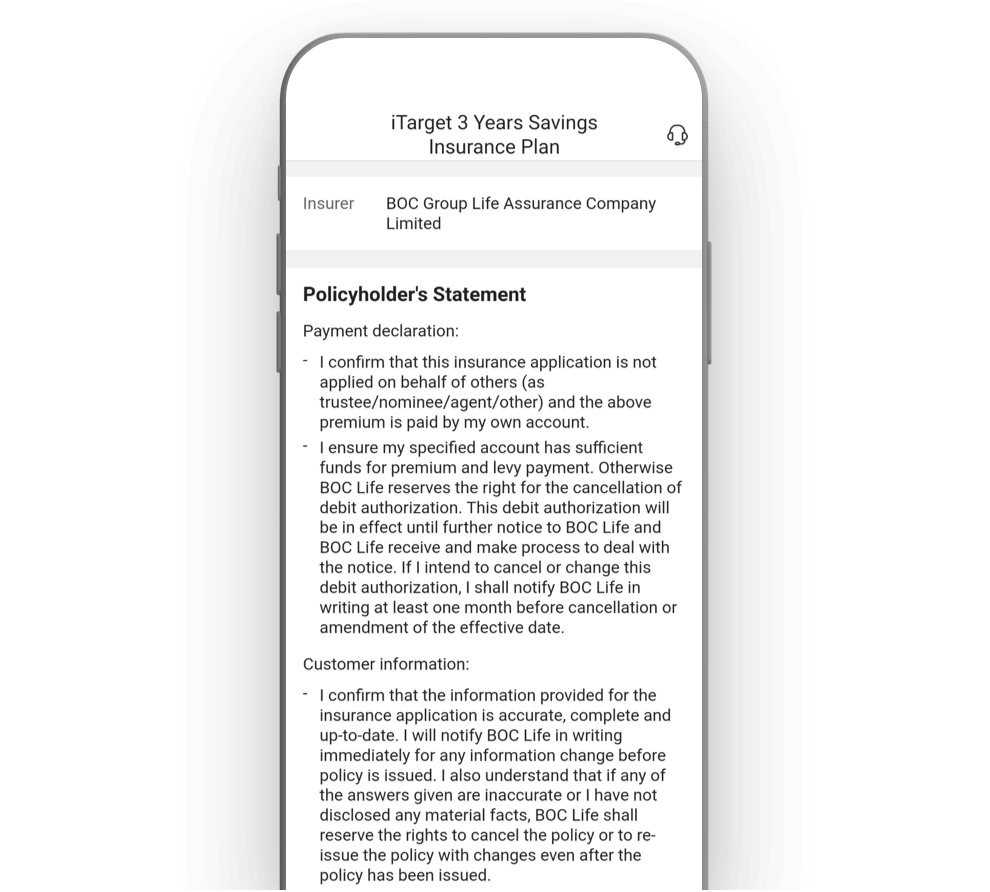

Important Notes:

- iTarget 3 Years Savings Insurance Plan (“the Plan”) is a long-term insurance plan that is underwritten by BOC Group Life Assurance Company Limited (“BOC Life”). It is not a bank deposit scheme or bank savings plan. Bank of China (Hong Kong) Limited ("BOCHK") is the major insurance agency appointed by BOC Life.

- BOC Life is authorised and regulated by the Insurance Authority to carry on long term business in the Hong Kong Special Administrative Region of the People's Republic of China (“Hong Kong”).

- BOCHK is granted an insurance agency licence under the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) by Insurance Authority in Hong Kong. (Insurance agency licence no. of BOCHK is FA2855)

- BOC Life reserves the right to decide at its sole discretion to accept or decline any application for the Plan according to the information provided by the proposed Insured and the applicant at the time of application.

- The Plan is subject to the formal policy documents and provisions issued by BOC Life. Please refer to the relevant policy documents and provisions for details of the Insured items and coverage, provisions and exclusions.

- BOCHK is the appointed insurance agency of BOC Life for distribution of life insurance products. The life insurance product is a product of BOC Life but not BOCHK.

- BOCHK and / or BOC Life reserve the right to amend, suspend or terminate the Plan at any time, and to amend the relevant terms and conditions. In case of dispute(s), the decision of BOCHK and / or BOC Life shall be final.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BOCHK and the customer out of the selling process or processing of the related transaction, BOCHK is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the insurance product should be resolved between directly the insurance company and the customer.

- Cancellation rights and refund of premium(s) and levy within cooling-off period:

Policy Owner has the right to cancel the policy/application form and obtain a refund of any premium(s) and the levy paid, which are collected by BOC Life on behalf of the Insurance Authority according to the relevant requirements, less any difference caused by exchange rate fluctuation, where applicable, by giving a written notice to BOC Life. Policy Owner understands that to exercise this right, the notice of cancellation must be signed by the Policy Owner and received directly by BOC Life’s Principal Office at 13/F, 1111 King’s Road, Taikoo Shing, Hong Kong within the Cooling-off Period. Policy Owner understands that the Cooling-off Period is the period of 21 calendar days immediately following either the day of the delivery of the policy or the Cooling-off Notice to the Policy Owner or the representative nominated by the Policy Owner (whichever is the earlier). Policy Owner understands that BOC Life will indicate the last day of the Cooling-off period in the Cooling-off Notice and text message issued to the Policy Owner (if applicable), if the last day of the Cooling-off Period as indicated in the Cooling-off Notice and the text message (if applicable) is not a working day, the period shall include the next working day. Policy Owner understands that the Cooling-off Notice is a notice that will be sent to the Policy Owner or the nominated representative of the Policy Owner by BOC Life to notify the Policy Owner of the Cooling-off Period around the time the policy is delivered. In addition, the Policy Owner understands that no refund of premium(s) and the levy can be made if a claim payment under the policy has been made to the Policy Owner prior to the request for the cancellation. - This promotion material is for reference on the key product features of this Plan and is intended to be distributed in Hong Kong only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any products of BOC Life outside Hong Kong. You are advised to read in conjunction with the product leaflet of this Plan. Please refer to the sales documents, including product brochure, benefit illustration and policy documents and provisions issued by BOC Life for details (including but not limited to insured items and coverage, detailed terms, key risks, conditions, exclusions, important notes, policy costs and fees) of the Plan.

Remarks:

- Annualized guaranteed rate of return varies by your chosen policy currency and premium payment mode. The annualized guaranteed rates of return mentioned above are rounded to 2 decimal places, and included first year premium discount (if any). The relevant return rates and amounts mentioned above are calculated based on the case with first-year premium discount (if applicable). Please refer to product leaflet for terms and conditions of the first-year premium discount offer.

- Premium Deposit Account is only applicable to policy with annual payment mode. If premiums prepayment option is selected, payable premiums for 2 policy years have to be fully paid upon insurance application. Please refer to the product leaflet for the details.

- The Death Benefit of iTarget 3 Years Savings Insurance Plan ("the Plan") is equivalent to 101% of Total Premiums Paid or Guaranteed Cash Value (whichever is higher) as at the date of death of the Insured less outstanding premiums (if any). “Total Premiums Paid” means the total premiums paid for the basic plan. Any Premium Deposit Account balance shall be excluded. Premium discount (if any) will not be taken into account when calculating the Death Benefit. Regarding the maximum amount of the Death Benefit payable if the Insured is covered by more than one policy under the Plan issued by BOC Life, please refer to the product leaflet, policy documents and provisions issued by BOC Life for details.

- The Additional Accidental Death Benefit is applicable to the Insured of policy’s issue age between 18 and 60, who has an accident before the 1st policy anniversary. Such accident should be direct, independent and the sole cause of, and should result in the death of the Insured within 180 days after the accident and before termination of coverage under the relevant policy. Also, submission of due proof of the Accidental Death of the Insured is required. Please refer to the product leaflet and policy provisions for the details.

- Applicant must be aged between 18 and 64. The plan is available to the holders of Hong Kong Permanent Identity Card / Hong Kong Identity Card, People’s Republic of China Resident Identity Card / Passport or Macau Resident Identity Card, who also have BOCHK e-Banking (mobile banking / internet banking) account, to apply via BOCHK e-Banking in Hong Kong. And the Plan is subject to the relevant requirements on nationality and residency of the applicants and the Insured as determined by BOC Life from time to time. Please refer to the product leaflet and policy provisions for the details of the Plan (including the coverage, key risks, major exclusions, etc.).

Important Notes:

- iTarget 3 Years Savings Insurance Plan (“the Plan”) is a long-term insurance plan that is underwritten by BOC Group Life Assurance Company Limited (“BOC Life”). It is not a bank deposit scheme or bank savings plan. Bank of China (Hong Kong) Limited ("BOCHK") is the major insurance agency appointed by BOC Life.

- BOC Life is authorised and regulated by the Insurance Authority to carry on long term business in the Hong Kong Special Administrative Region of the People's Republic of China (“Hong Kong”).

- BOCHK is granted an insurance agency licence under the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) by Insurance Authority in Hong Kong. (Insurance agency licence no. of BOCHK is FA2855)

- BOC Life reserves the right to decide at its sole discretion to accept or decline any application for the Plan according to the information provided by the proposed Insured and the applicant at the time of application.

- The Plan is subject to the formal policy documents and provisions issued by BOC Life. Please refer to the relevant policy documents and provisions for details of the Insured items and coverage, provisions and exclusions.

- BOCHK is the appointed insurance agency of BOC Life for distribution of life insurance products. The life insurance product is a product of BOC Life but not BOCHK.

- BOCHK and / or BOC Life reserve the right to amend, suspend or terminate the Plan at any time, and to amend the relevant terms and conditions. In case of dispute(s), the decision of BOCHK and / or BOC Life shall be final.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BOCHK and the customer out of the selling process or processing of the related transaction, BOCHK is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the insurance product should be resolved between directly the insurance company and the customer.

- Cancellation rights and refund of premium(s) and levy within cooling-off period:

Policy Owner has the right to cancel the policy/application form and obtain a refund of any premium(s) and the levy paid, which are collected by BOC Life on behalf of the Insurance Authority according to the relevant requirements, less any difference caused by exchange rate fluctuation, where applicable, by giving a written notice to BOC Life. Policy Owner understands that to exercise this right, the notice of cancellation must be signed by the Policy Owner and received directly by BOC Life’s Principal Office at 13/F, 1111 King’s Road, Taikoo Shing, Hong Kong within the Cooling-off Period. Policy Owner understands that the Cooling-off Period is the period of 21 calendar days immediately following either the day of the delivery of the policy or the Cooling-off Notice to the Policy Owner or the representative nominated by the Policy Owner (whichever is the earlier). Policy Owner understands that BOC Life will indicate the last day of the Cooling-off period in the Cooling-off Notice and text message issued to the Policy Owner (if applicable), if the last day of the Cooling-off Period as indicated in the Cooling-off Notice and the text message (if applicable) is not a working day, the period shall include the next working day. Policy Owner understands that the Cooling-off Notice is a notice that will be sent to the Policy Owner or the nominated representative of the Policy Owner by BOC Life to notify the Policy Owner of the Cooling-off Period around the time the policy is delivered. In addition, the Policy Owner understands that no refund of premium(s) and the levy can be made if a claim payment under the policy has been made to the Policy Owner prior to the request for the cancellation. - This promotion material is for reference on the key product features of this Plan and is intended to be distributed in Hong Kong only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any products of BOC Life outside Hong Kong. You are advised to read in conjunction with the product leaflet of this Plan. Please refer to the sales documents, including product brochure, benefit illustration and policy documents and provisions issued by BOC Life for details (including but not limited to insured items and coverage, detailed terms, key risks, conditions, exclusions, important notes, policy costs and fees) of the Plan.

This page is issued by Bank of China (Hong Kong) Limited. Its contents have not been reviewed by any regulatory authority in Hong Kong.