- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

- Home >

- Investment >

- Currency Linked Investments >

- Dual Currency Investment >

Meet Your Foreign Currency Needs and Capture Investment Opportunities

*The above information is only a summary of the product features. Please refer to the "Important Facts Statement" for details. Terms and conditions apply.

Product Features

Higher Potential Return

According to your outlook on the currency exchange rate and the performance of the currencies, you will receive the principal and interest at maturity. You have the opportunity to receive the Principal and Interest Amount in the Investment Currency to enhance your potential returns, or buy the Linked Currency at a predetermined conversion rate.

Designate Your Own Currency Pairs

Choose any two of the currencies from HKD, USD, CNY, AUD, NZD, GBP, CAD, EUR or JPY to form a currency pair and capture investment opportunities.

Extensive Investment Choices

Determine your Investment Period. Tenor can range from 1, 2 weeks to 1, 3, or 6 months. The minimum Principal Amount is HKD$50,000 or its equivalent in another currency. Here to provide flexible choices for your various investment needs.

Multi Trading Channels

Subscribe to our investment products via Internet Banking or by calling the Manned Investment Hotline.

Trading Hours Mondays to Fridays 9:00am to 7:00pm except public holidays

*The above information is only a summary of the product features. Please refer to the "Important Facts Statement" for details. Terms and conditions apply.

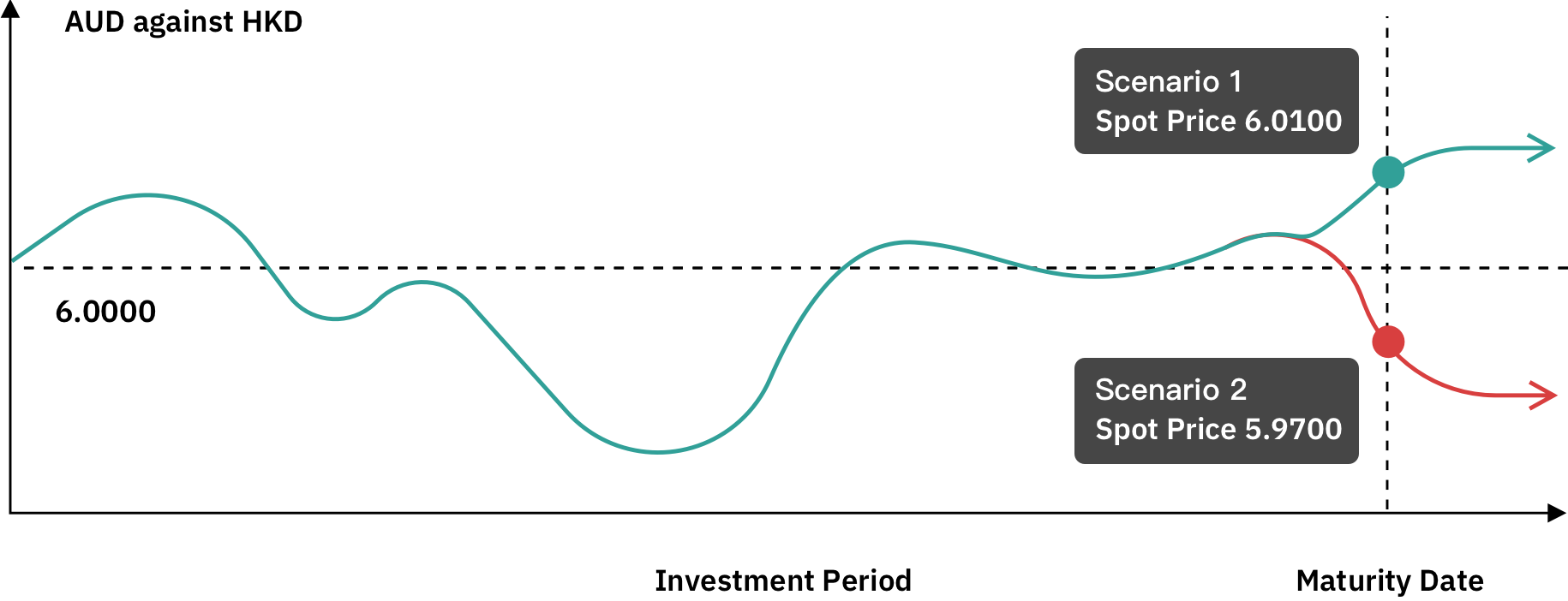

Examples

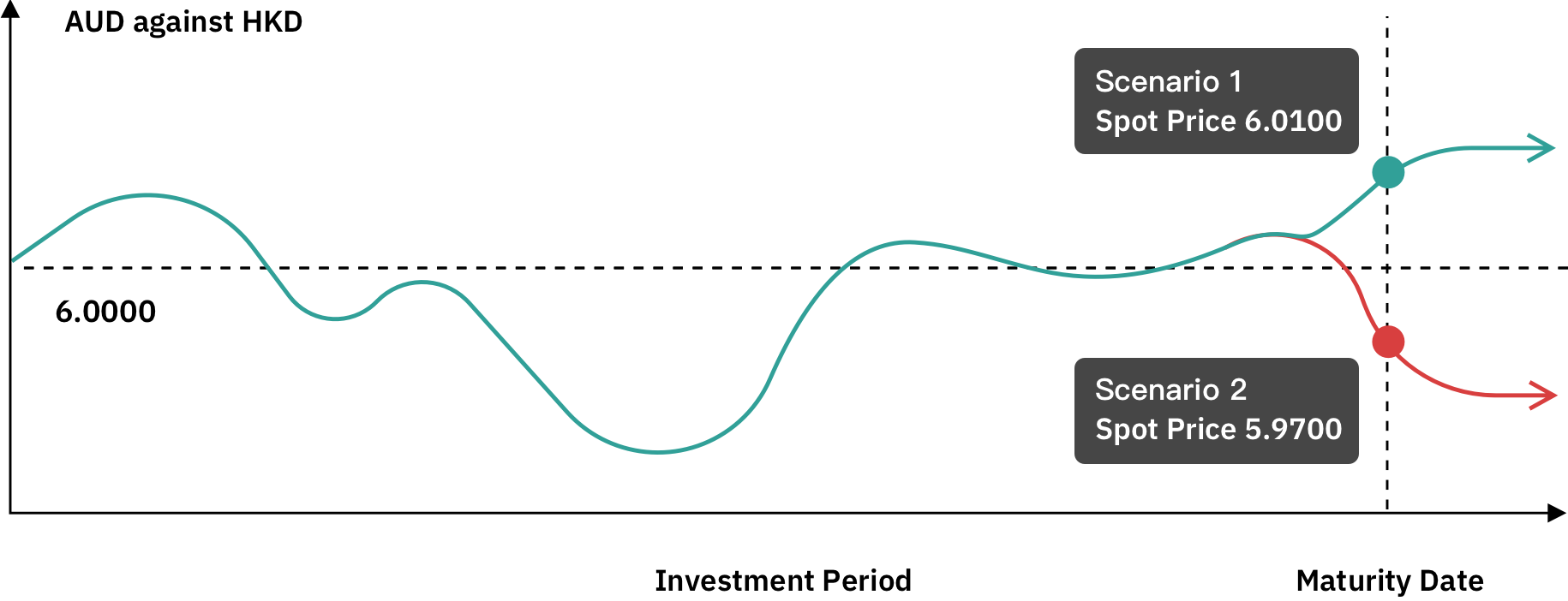

HKD is selected as the Investment Currency whilst AUD is the Linked Currency. The customer expects the AUD to appreciate against the HKD within a week. The customer will receive either the Principal and the Interest in the Investment Currency (HKD) or the Linked Currency (AUD) according to the performance of the currency.

Terms

Principal Amount

HKD 200,000

Investment Currency

HKD

Linked Currency

AUD

Investment Period

1 week (7 days)

Strike Price

(AUD/HKD)6.0000

Premium Interest Rates

14.6975% p.a.

Scenario 1: If the Linked Currency remains unchanged or appreciates against the Investment Currency, you will receive the Principal Amount and the Interest Amount in the Investment Currency.

Scenario 2: Assuming the Linked Currency depreciates against the Investment Currency, you will receive the Principal Amount plus the Interest Amount which has been converted into the Linked Currency at the Strike Price.

^The Spot Price refers to the spot exchange rate quoted by the Bank at 2:00 p.m. on the relevant maturity date. #The Strike Price will be fixed at the time you enter into the transaction with the Bank

Scenario 1

AUD remains unchanged or appreciates against HKD (e.g. Spot Price 6.0100)

Proceeds on the maturity date: HKD Principal Amount + Interest Amount

HKD 200,563.74

Principal + Interest

= HKD 200,000 + HKD (200,000 x 14.6975% x (7/365)) = HKD 200,000 + HKD 563.74

Scenario 2

AUD depreciates against HKD (e.g. Spot Price 5.9700)

Proceeds on the maturity date: AUD Principal Amount + Interest Amount

AUD 33,427.29

Principal + Interest

= (HKD 200,000 + HKD 563.74) / 6.0000 = AUD 33,427.29

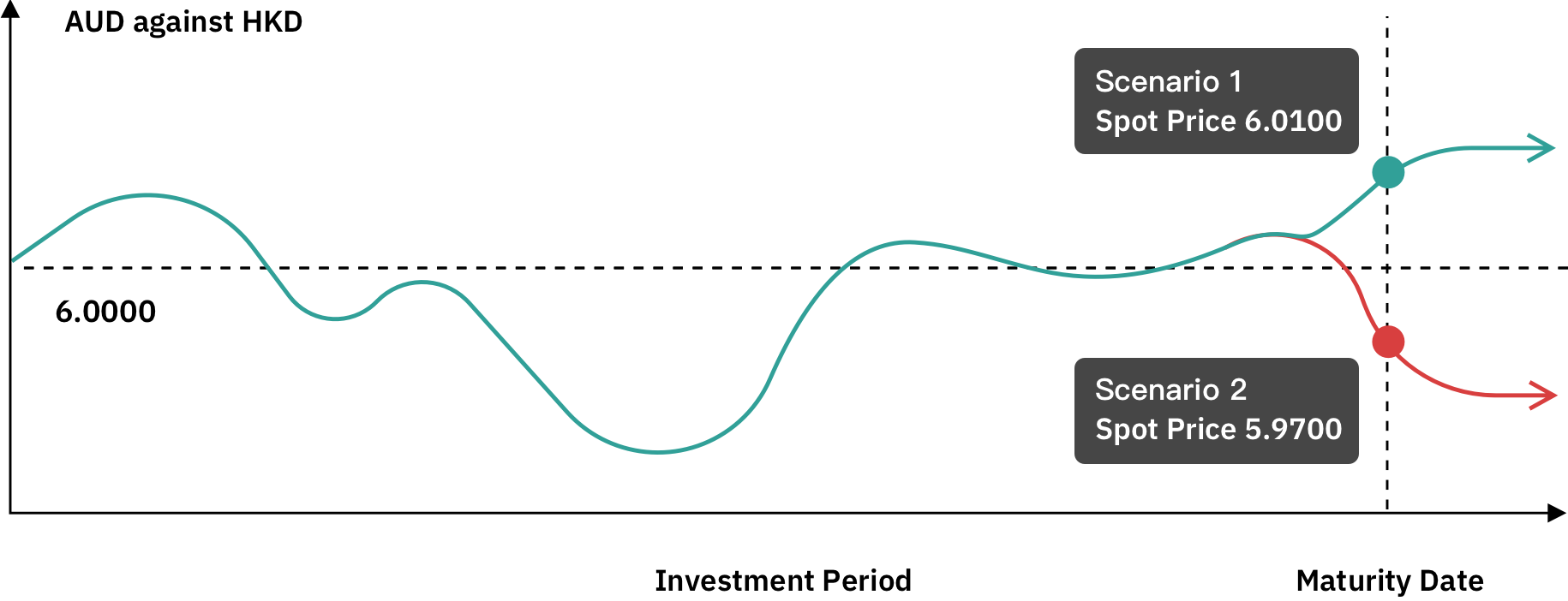

HKD is selected as the Investment Currency whilst AUD is the Linked Currency. The customer expects the AUD to appreciate against the HKD within a week. The customer will receive either the Principal and the Interest in the Investment Currency (HKD) or the Linked Currency (AUD) according to the performance of the currency.

Terms

Principal Amount

HKD 200,000

Investment Currency

HKD

Linked Currency

AUD

Investment Period

1 week (7 days)

Strike Price

(AUD/HKD)6.0000

Premium Interest Rates

14.6975% p.a.

Scenario 1: If the Linked Currency remains unchanged or appreciates against the Investment Currency, you will receive the Principal Amount and the Interest Amount in the Investment Currency.

Scenario 2: Assuming the Linked Currency depreciates against the Investment Currency, you will receive the Principal Amount plus the Interest Amount which has been converted into the Linked Currency at the Strike Price.

^The Spot Price refers to the spot exchange rate quoted by the Bank at 2:00 p.m. on the relevant maturity date. #The Strike Price will be fixed at the time you enter into the transaction with the Bank

Scenario 1

AUD remains unchanged or appreciates against HKD (e.g. Spot Price 6.0100)

Proceeds on the maturity date: HKD Principal Amount + Interest Amount

HKD 200,563.74

Principal + Interest

= HKD 200,000 + HKD (200,000 x 14.6975% x (7/365)) = HKD 200,000 + HKD 563.74

Scenario 2

AUD depreciates against HKD (e.g. Spot Price 5.9700)

Proceeds on the maturity date: AUD Principal Amount + Interest Amount

AUD 33,427.29

Principal + Interest

= (HKD 200,000 + HKD 563.74) / 6.0000 = AUD 33,427.29

Assuming that the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of Bank of China (Hong Kong) Limited regardless of the terms of this product. You may get nothing back and may lose all of your Principal Amount of and the Interest Amount. The above illustrative example and the scenario analysis are prepared with hypothetical data, and not based on the past performance of the currencies as stated herein. They are for reference only and do not guarantee or represent the final returns of Option Linked Investment. The above hypothetical examples should not be relied on as an indication of the actual performance of the Linked Currency or this product. You should not rely on these examples when making an investment decision.

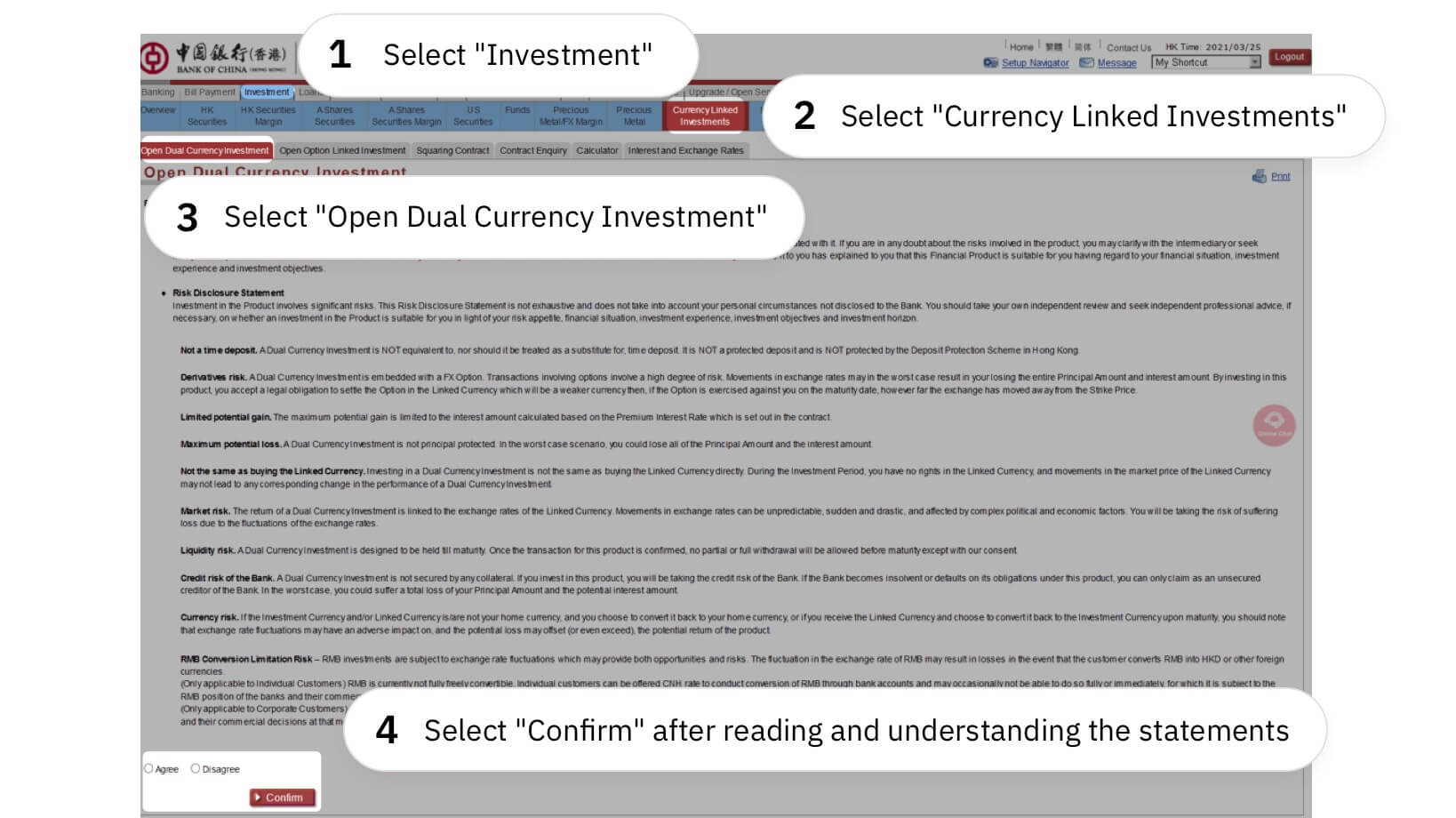

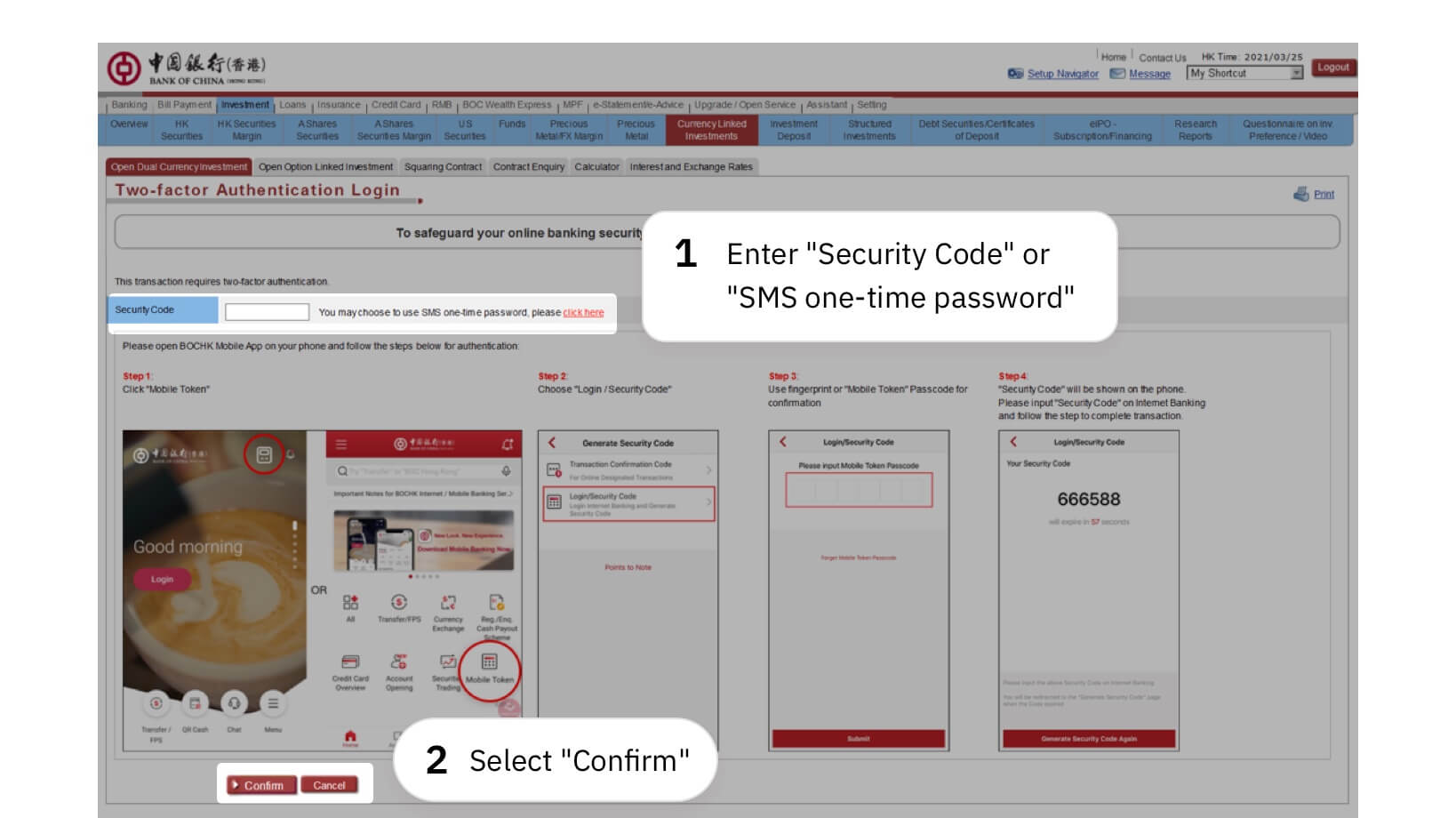

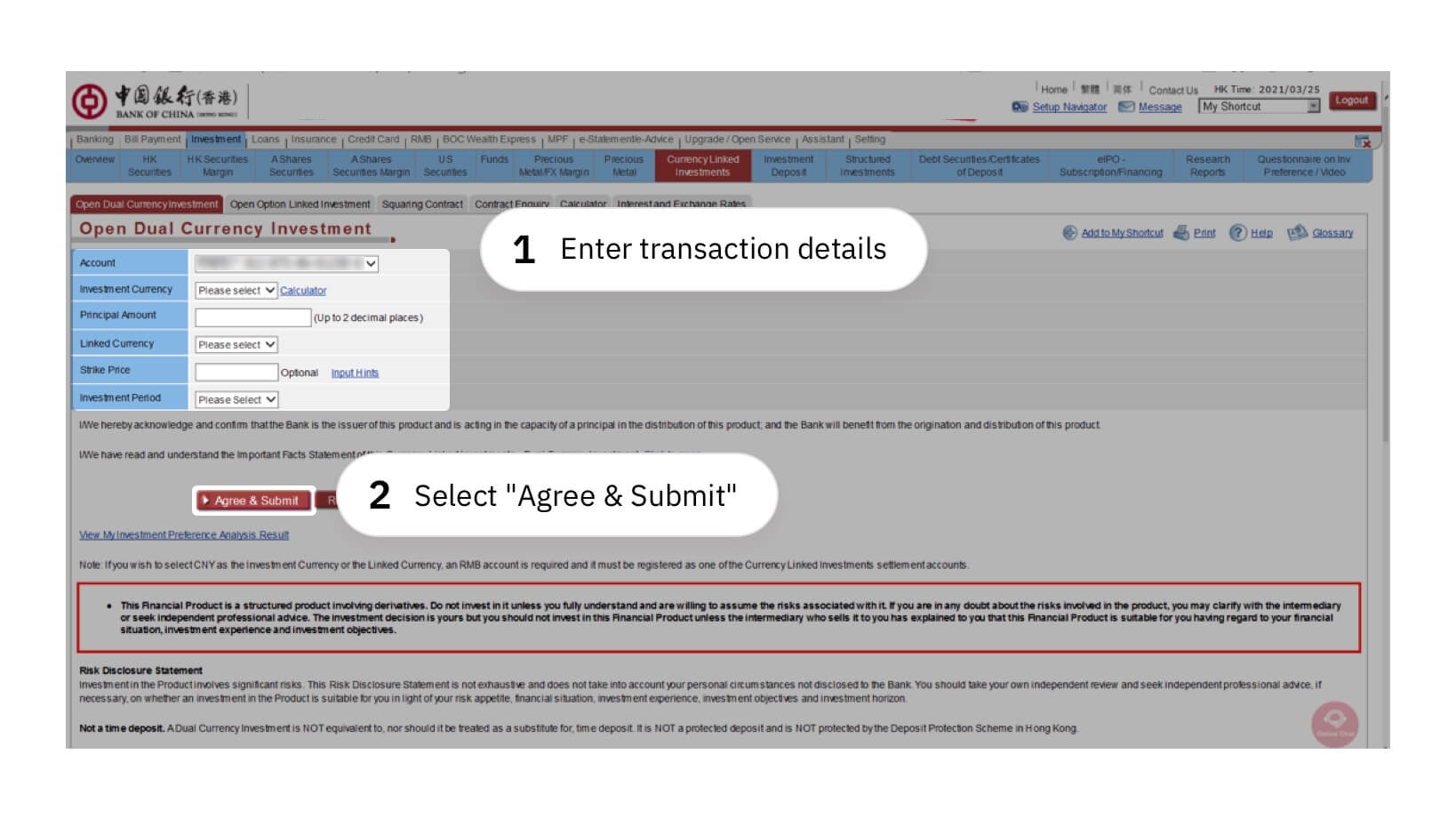

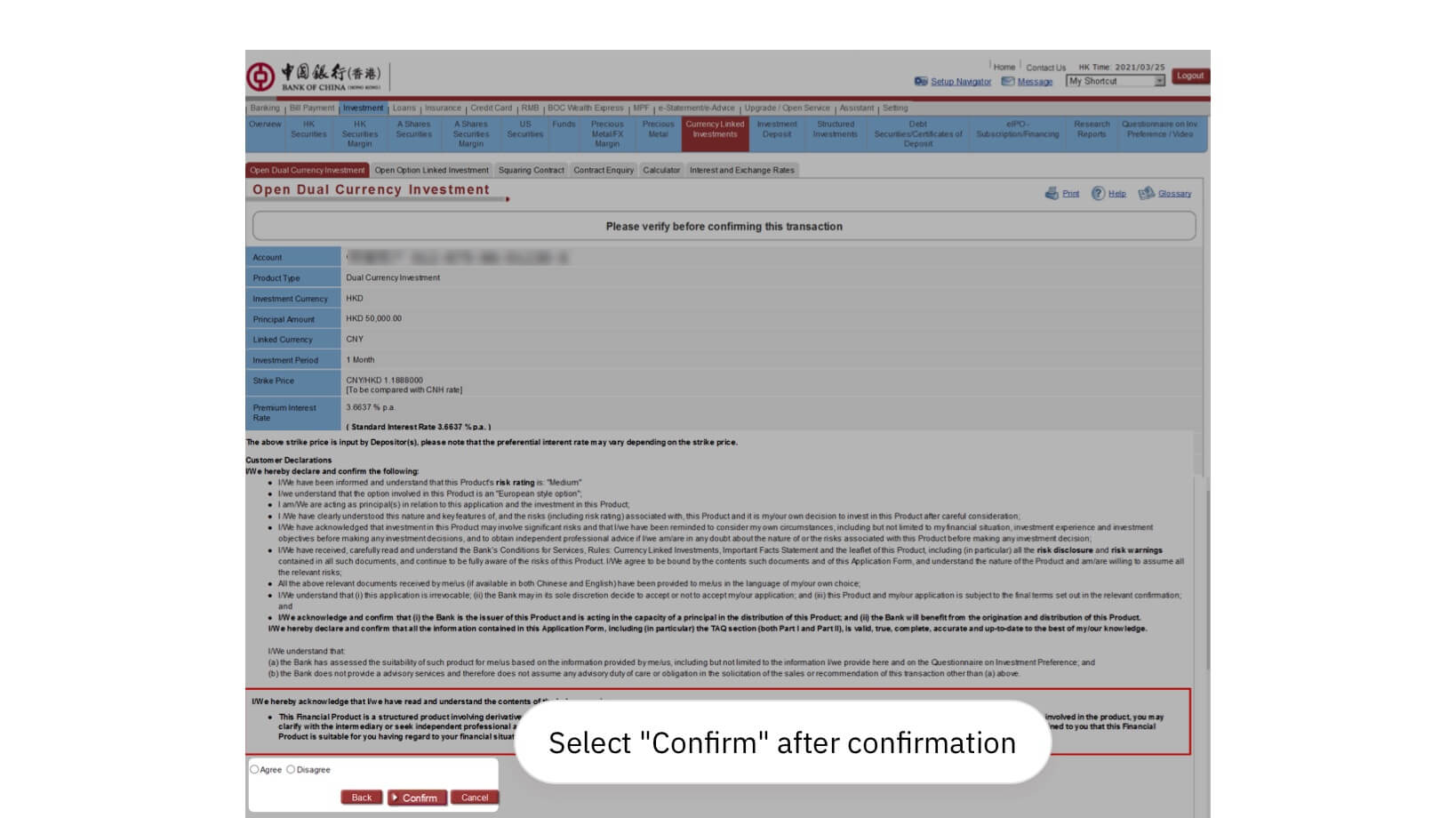

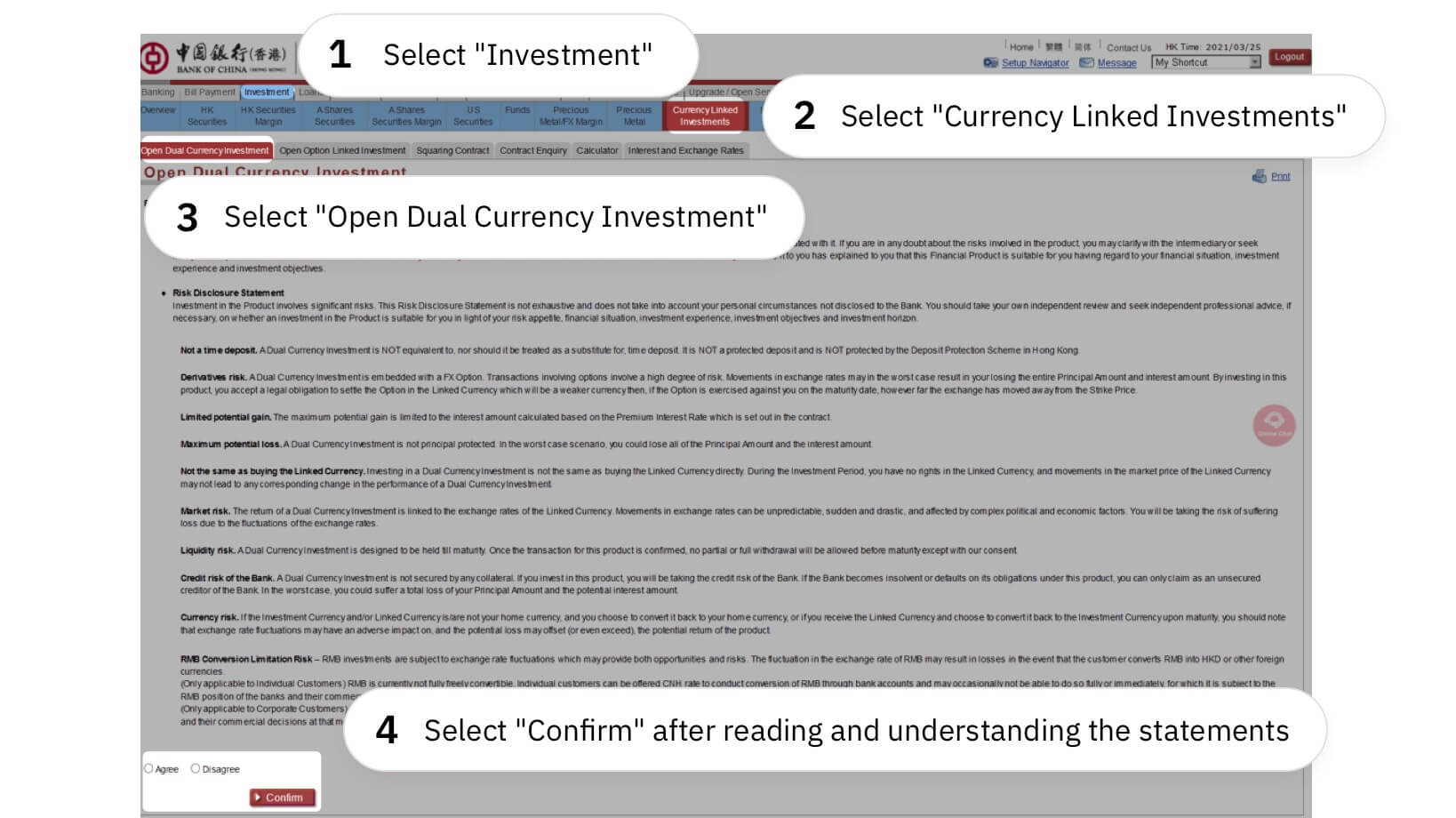

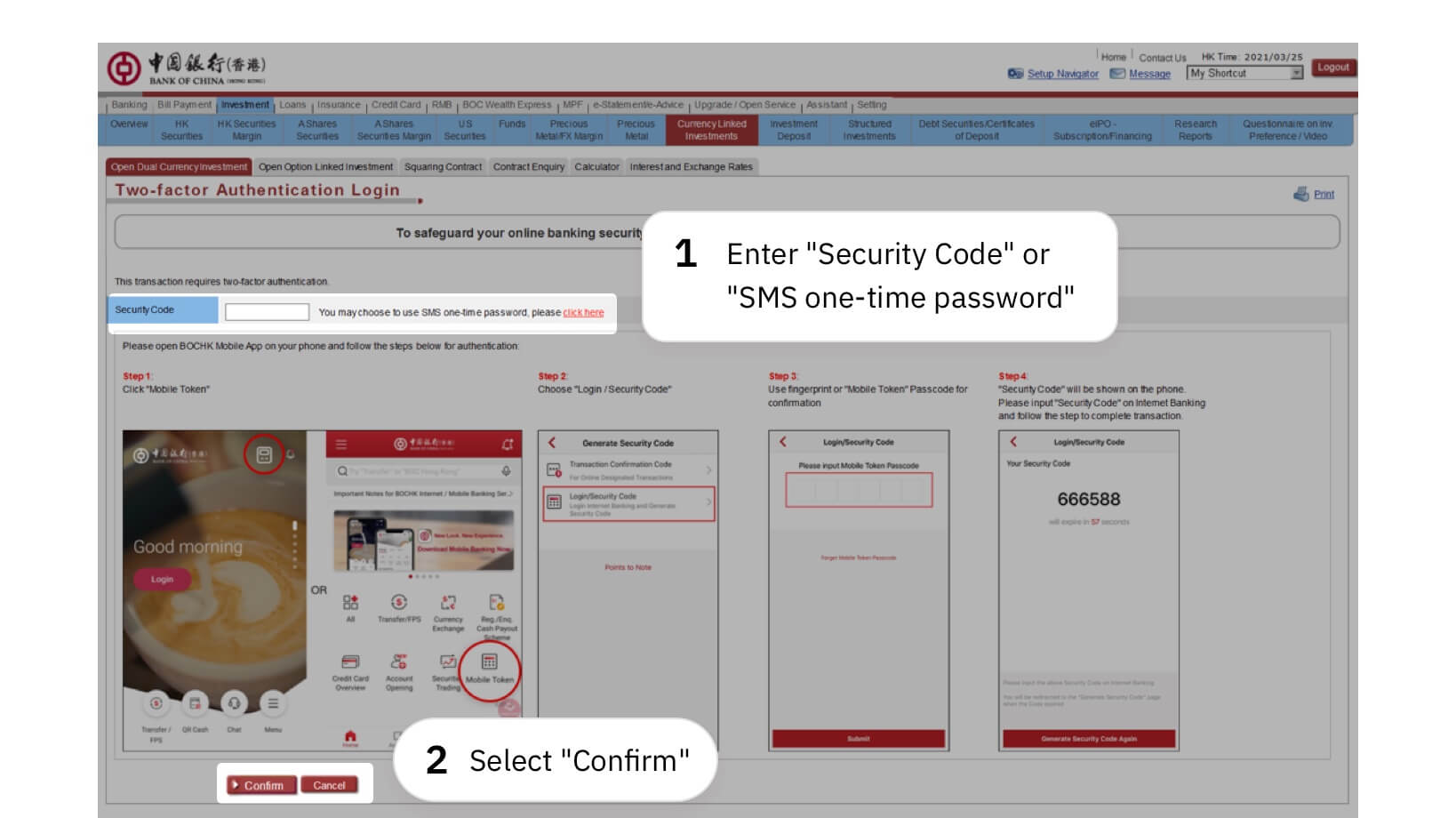

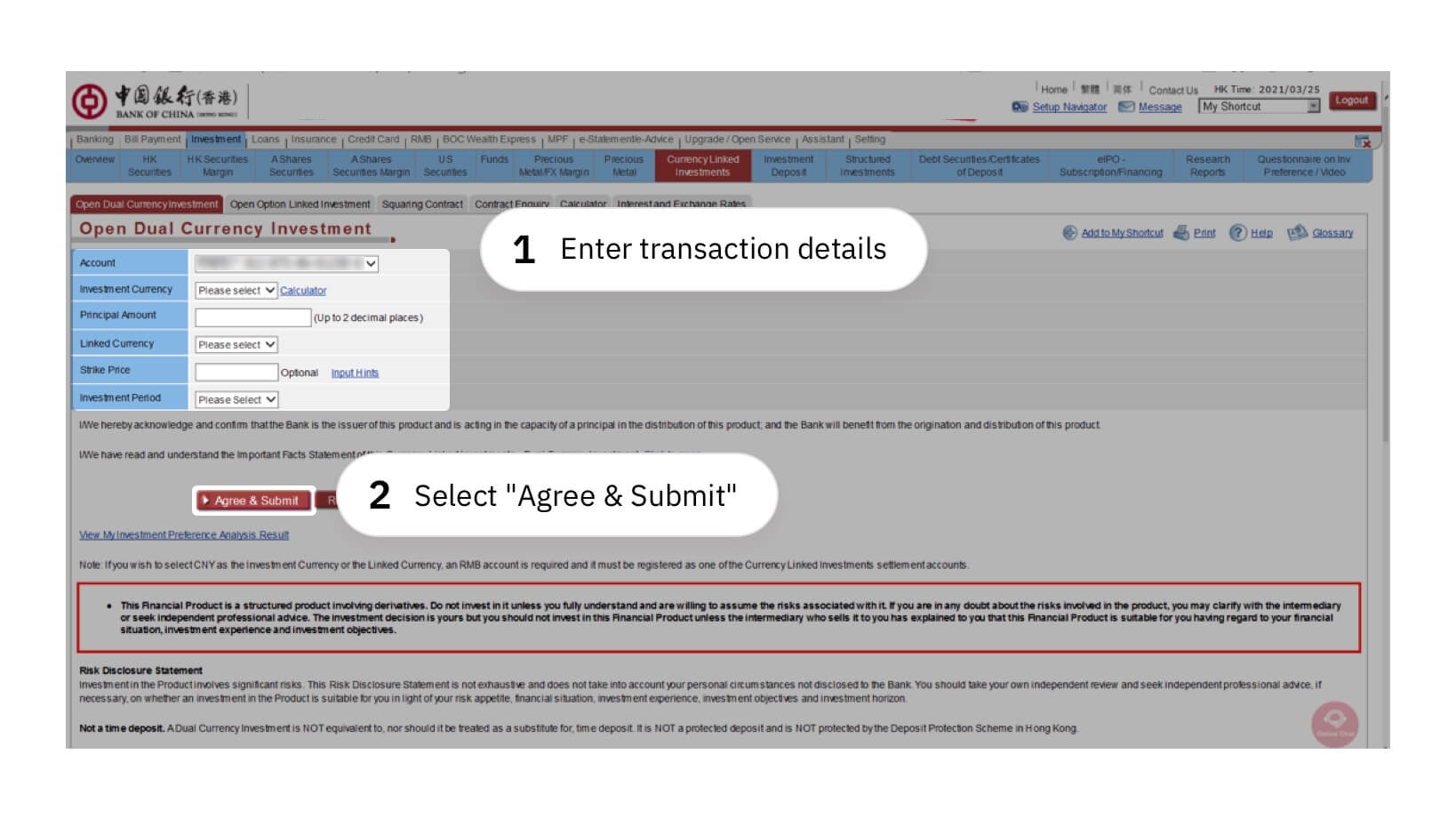

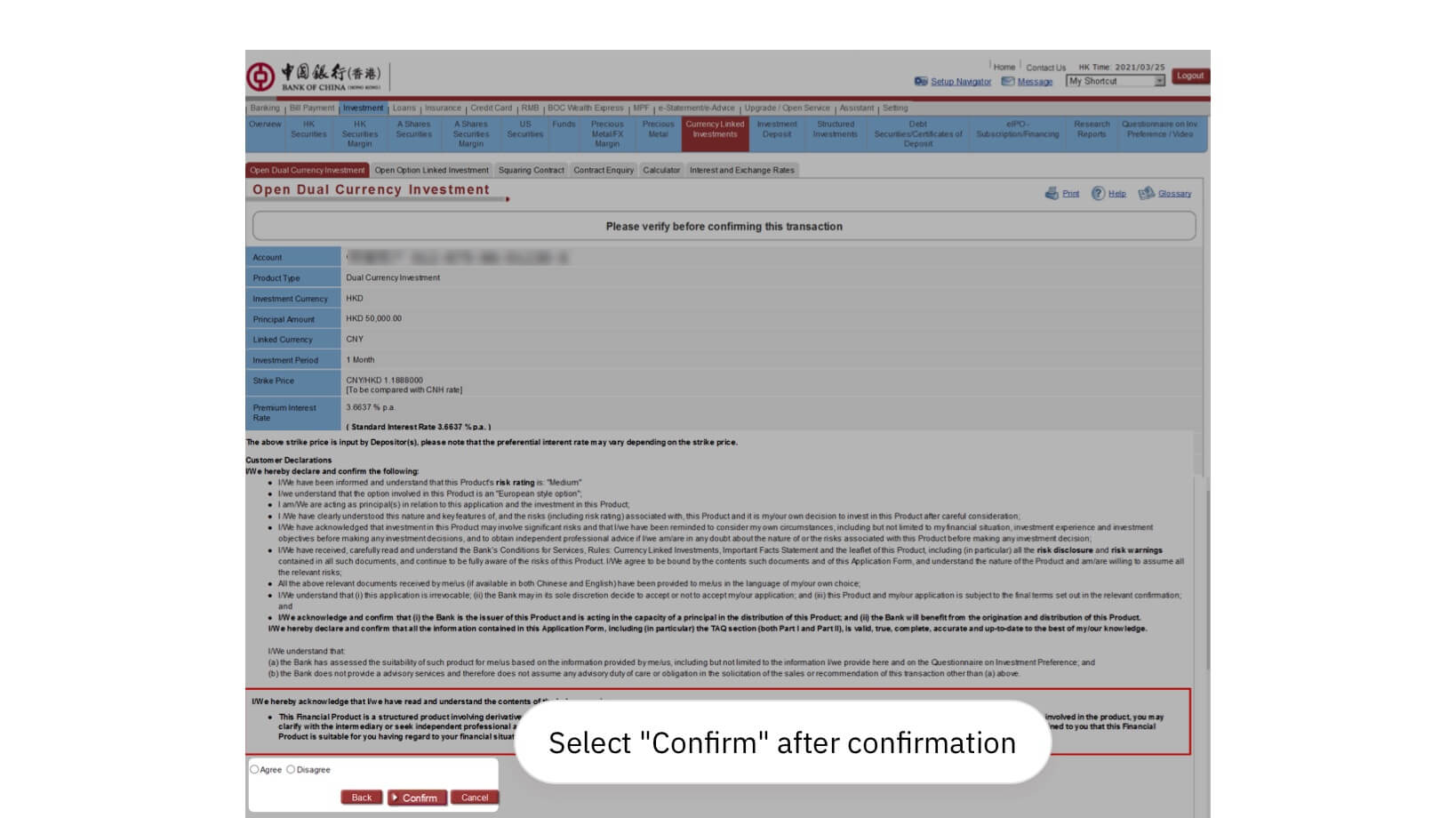

Account Opening and Transaction Process

Latest Foreign Currency Exchange Information

- This is a structured investment product involving derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- This product is not principal protected. You may lose all or part of your Principal Amount and Interest Amount.

- Before making any investment decision, you should take your own independent review on whether the product is suitable for you in light of your own financial situation, investment experience, investment objectives, investment horizon, willingness and ability to bear risks, and whether you understand the nature and risks of the product. If in doubt, you should seek advice from independent financial advisers.

- This promotional material is for reference only. It is not and does not by itself constitute any offer, solicitation or recommendation to buy, sell or provide any investment product or service.

- This is a structured investment product involving derivatives. Do not invest in it unless you fully understand and are willing to assume the risks associated with it. If you are in any doubt about the risks involved in the product, you may clarify with the intermediary or seek independent professional advice. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- This product is not principal protected. You may lose all or part of your Principal Amount and Interest Amount.

- Before making any investment decision, you should take your own independent review on whether the product is suitable for you in light of your own financial situation, investment experience, investment objectives, investment horizon, willingness and ability to bear risks, and whether you understand the nature and risks of the product. If in doubt, you should seek advice from independent financial advisers.

- This promotional material is for reference only. It is not and does not by itself constitute any offer, solicitation or recommendation to buy, sell or provide any investment product or service.

This product is subject to the relevant terms and conditions. For details, please contact our branch staff.

The following risk disclosure statements cannot disclose all the risks involved. Prior to trading or investment, you should collect and study the information required for your investment. You should take your own independent review and seek independent professional advice, if necessary, on whether this product is suitable for you in light of your risk appetite, financial situation, investment experience, investment objectives and investment horizon. If you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment, you should seek independent advice.

Risk Disclosure Statement on Currency Linked Investments- Dual Currency Investment ("this product")

- Not a time deposit - This product is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

- Derivatives risk - This product is embedded with a FX option. Transactions involving options involve a high degree of risk. Movements in exchange rates may in the worst case result in your losing the entire Principal Amount and Interest Amount. By investing in this product, you accept a legal obligation to settle the Option in the Linked Currency which will be a weaker currency then, if the Option is exercised against you on the Maturity Date, however far the exchange has moved away from the Strike Price.

- Limited potential gain - The maximum potential gain is limited to the Interest Amount calculated based on the Premium Interest Rate which is set out in the contract.

- Maximum potential loss - This product is not principal protected. In the worst case scenario, you could lose all of the Principal Amount and the Interest Amount. The Principal Amount and the Interest Amount are also subject to the credit risk of the Bank.

- Not the same as buying the Linked Currency - Investing in this product is not the same as buying the Linked Currency directly. You have no rights in the Linked Currency during the Investment Period. Movements in the market price of the Linked Currency may not lead to any corresponding change in the performance of this product.

- Market risk - The return of this product is linked to the exchange rates of the Linked Currency. Movements in exchange rates can be unpredictable, sudden and drastic, and affected by complex political and economic factors. You will be taking the risk of suffering loss due to the fluctuations of the exchange rates.

- Liquidity risk - This product is designed to be held till maturity. Once the transaction for this product is confirmed, no partial or full withdrawal will be allowed before maturity except with our consent.

- Credit risk of the Bank - This product is not backed by any collateral. If you invest in this product, you will be taking the credit risk of Bank of China (Hong Kong) Limited.

- Currency risk - If the Investment Currency and/or Linked Currency is/are not your home currency, and you choose to convert it back to your home currency, or if you receive the Linked Currency and choose to convert it back to the Investment Currency upon maturity, you should note that exchange rate fluctuations may have an adverse impact on, and the potential loss may offset (or even exceed) , the potential return of the product.

- RMB Conversion Limitation Risk - RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies.

(Only applicable to Individual Customers) RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

(Only applicable to Corporate Customers) RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.