- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

online and experience membership privileges

service charge

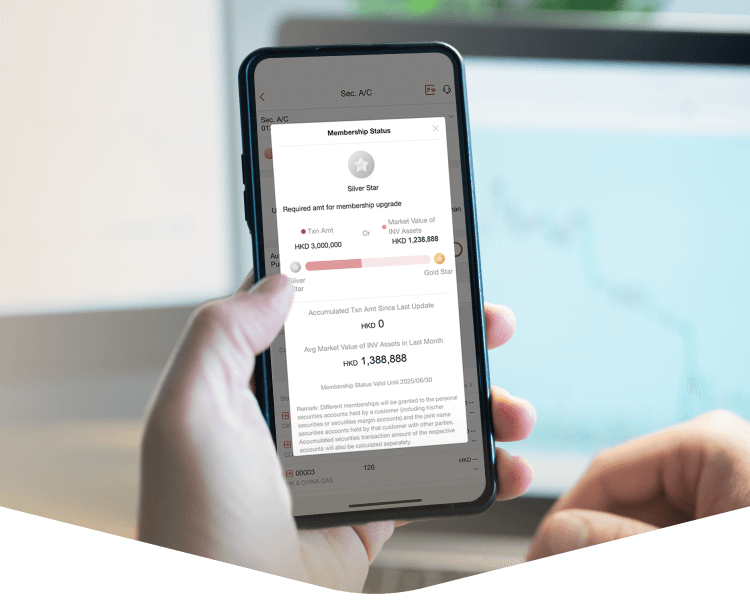

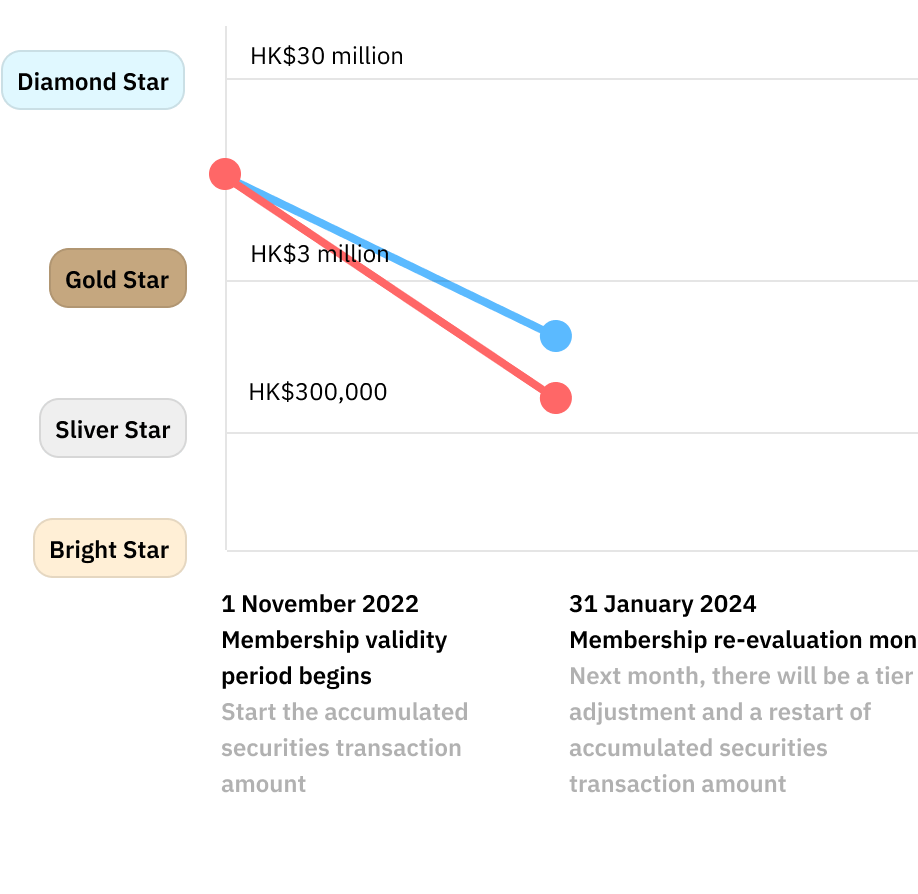

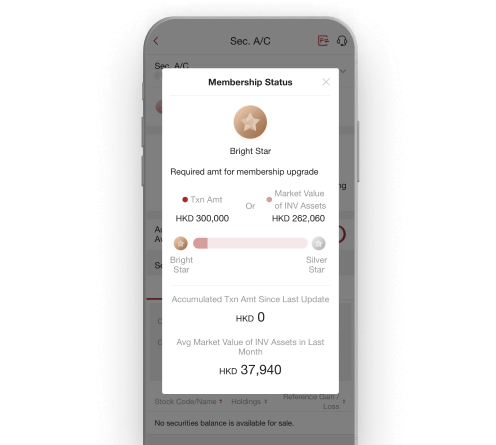

Memberships last for a period of 12 months starting from the securities account opening date or the next business day after the last review date of membership status. Your membership status will be determined according to the accumulated securities transaction amount or Investment Assets Value of securities accounts or securities margin accounts that you hold. The higher the accumulated securities transaction amount or the higher Investment Assets Value, the higher the membership status.

Internet Banking / Automated Stock

Trading Hotline*

Note: The above charges are for reference only. Bank of China (Hong Kong) Limited (“BOCHK”) reserves the right to revise the service fee from time to time.

^ Investment Assets Value includes the value of the following investment items under the customer's name (sole-name account and joint-name account will be calculated separately) in the prevailing month: the average amount of the total day-end balance of Securities, Securities Margin, Bonds, Certificate of Deposit, Funds, Structured Notes, Equity Linked Investments, Currency Linked Investments, Structured Investments, Investment Deposit, Precious Metal / FX Margin, Precious Metals. The Bank will calculate the daily market value according to the features of investment products. Unsettled bought quantities of the stock are excluded while securities collaterals are included. Actual monthly calculation period starts from the last business day of the previous month to the day before last business day of the prevailing month. During the membership period, when your accumulated securities transaction amount or Investment Assets Value fulfils the designated requirement, your membership will be upgraded on the first day of the following month which in turn entitles you to more privileges. If neither your accumulated securities transaction amount nor Investment Assets Value fulfils the requirements of your membership status when your membership expires, your membership will be downgraded accordingly. The accumulated securities transaction amount will be reset upon granting of new membership or expiry of existing membership.

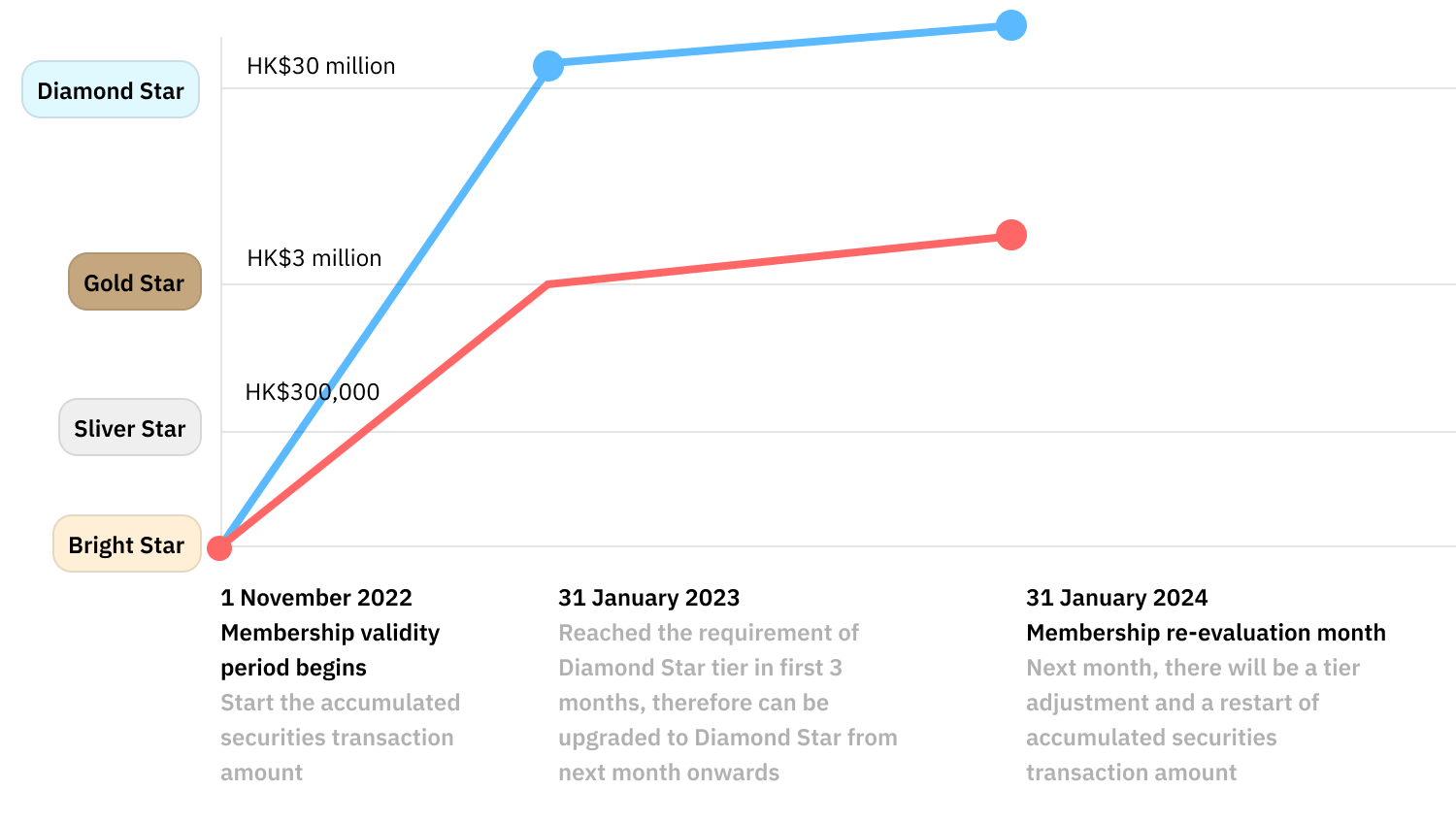

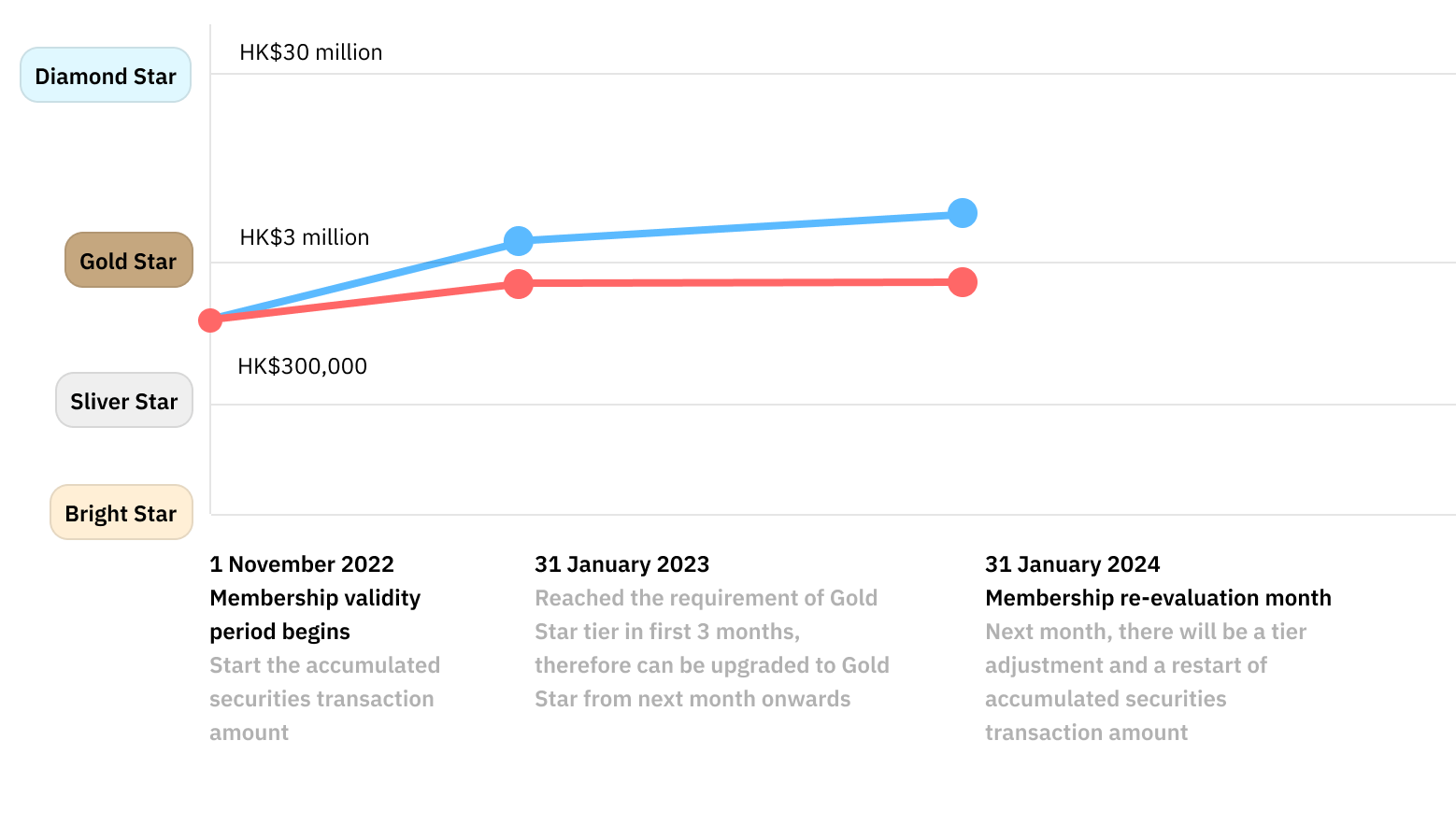

Examples

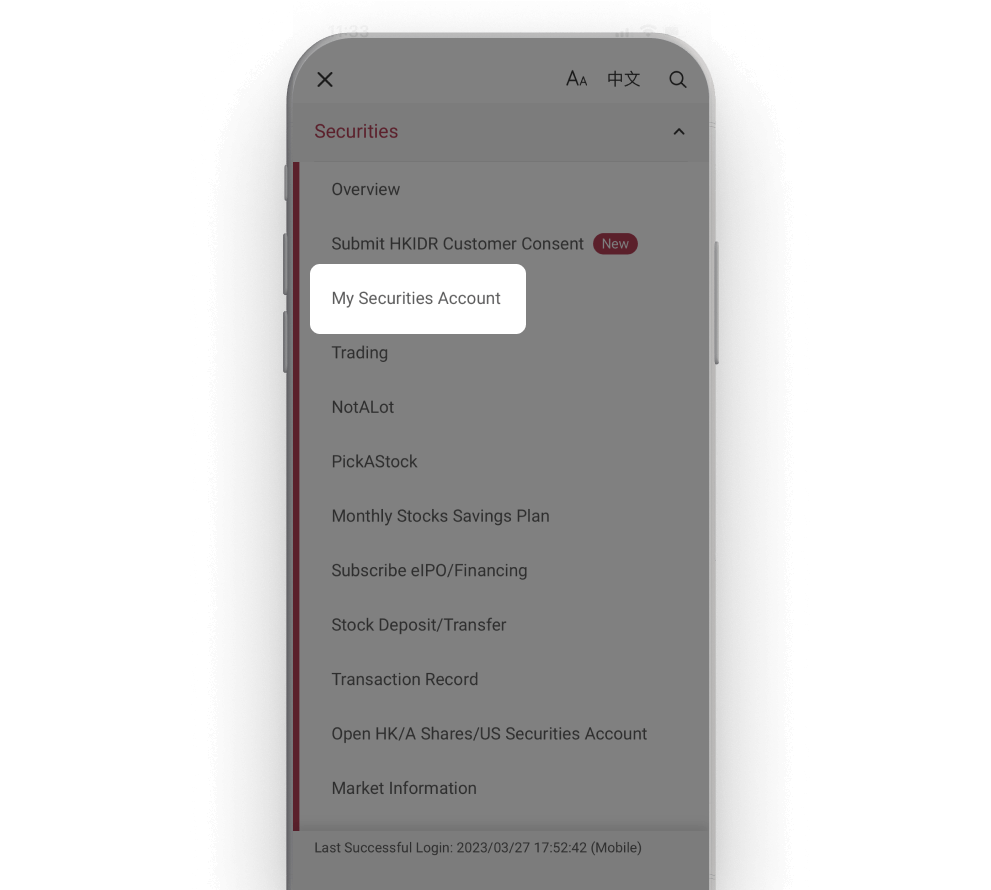

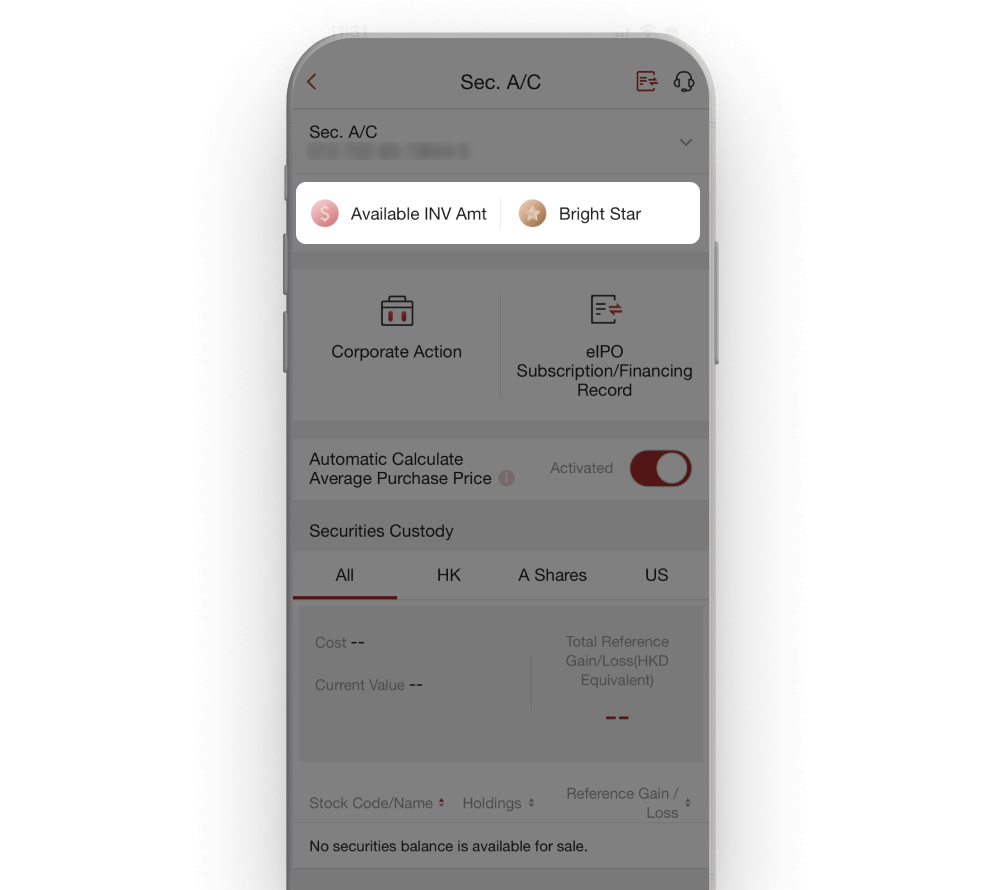

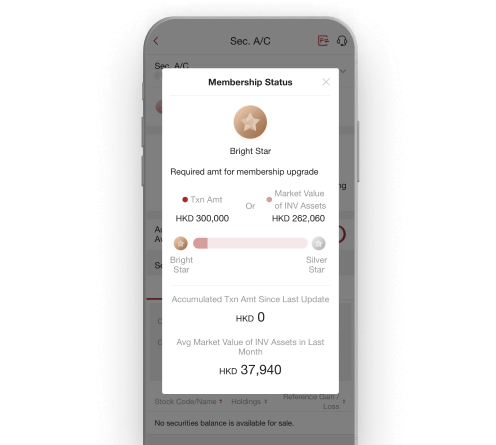

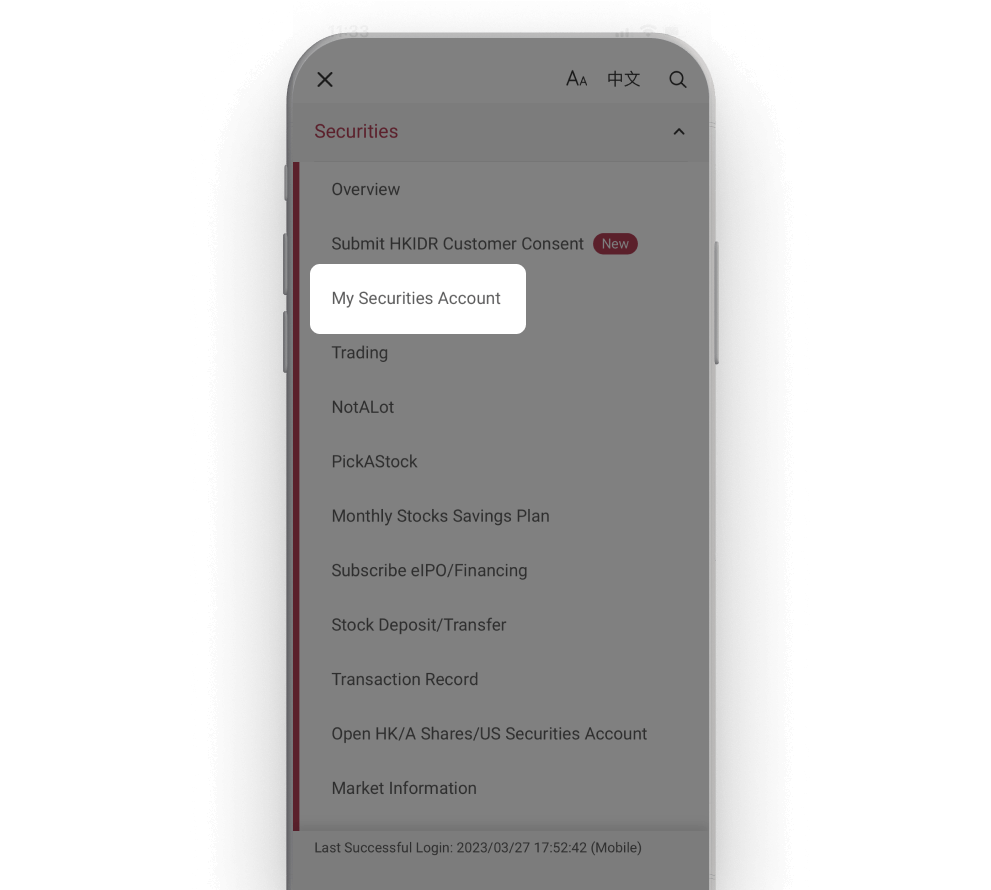

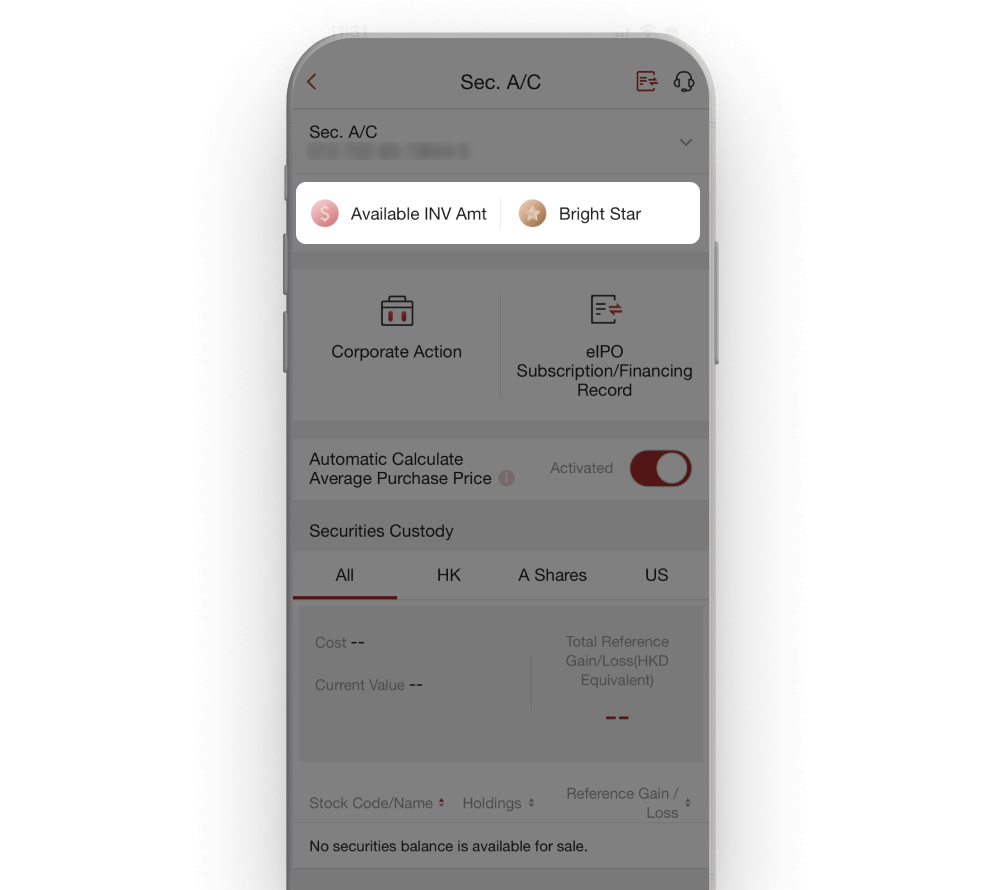

Enquire Securities Club Membership information with Ease

Multichannel Easy Investment

Personal Customer Service Hotline +852 3988 2388

Monday to Friday 9:00 am to 9:00 pm, Saturday 9:00 am to 6:00 pm, closed on Sunday and public holidays

- Securities Club (the "Club") consists of four membership tiers: Diamond Star member, Gold Star member, Silver Star member and Bright Star member. Customers who maintain securities accounts and/or securities margin trading accounts ("Securities Accounts") (including sole-name/joint-name accounts and individual/corporate accounts) with Bank of China (Hong Kong) Limited ("BOCHK")will be granted the relevant membership by the BOCHK according to the accumulated securities transaction amount or Investment Assets Value in principle (excluding Private Banking customers).

- Membership Mechanics

- The membership effective date shall be the next business day after the last review date of membership status or the account opening date of the relevant securities accounts (for new customers only). Unless otherwise specified, the membership status shall be valid for 12 months ("Membership Period"). For details of the Membership Period, please refer to the membership notification letter issued by BOCHK or contact staff of BOCHK.

- Every membership tier has a requirement on the accumulated securities transaction amount for each Membership Period and Investment Assets Value. The relevant requirement is subject to the information quoted by BOCHK from time to time.

- The accumulated securities transaction amount and the Investment Assets Value in the prevailing month of each customer will be reviewed by BOCHK on the last business day of each month. Should the relevant amount reach the required amount for a higher membership tier, the membership of the customers will be upgraded to the relevant tiers in the following month. The membership tiers of the customers will not be downgraded within the Membership Period.

- The accumulated securities transaction amount and the Investment Assets Value in the prevailing month of each customer will be reviewed on the last business day of the month when the relevant membership expires. If the customers fulfil the requirement on the accumulated securities transaction amount or Investment Assets Value of their membership tiers, their membership tiers will be retained. However, if neither the required accumulated securities transaction amount nor Investment Assets Value is fulfilled, the membership of customers will be downgraded to the tiers corresponding to their accumulated securities transaction amount or Investment Assets Value (whichever brings to a higher membership) in the following month.

- Upon the upgrading of membership tier, or the expiry of the Membership Period, the accumulated securities transaction amount of the customers will be re-calculated.

- Different memberships will be granted to the sole-name Securities Accounts held by a customer and the joint-name Securities Accounts held by the aforesaid customer with other parties according to the accumulated securities transaction amount and Investment Assets Value in principle. The relevant accumulated securities transaction amount and Investment Assets Value will be reviewed and calculated respectively and separately.

- Calculation of the Accumulated Securities Transaction Amount

- Customers should successfully conduct the eligible transactions via their Securities Accounts within the Membership Period and the relevant transaction amount (excluding the brokerage fee or other handling fee) will be calculated as the accumulated securities transaction amount. Eligible transactions refer to the buying and selling of securities listed on the Hong Kong Exchanges and Clearing Limited (including securities settled in Hong Kong Dollar and non-Hong Kong Dollar), transactions of Initial Public Offering ("IPO") subscription or IPO subscription financing through yellow form application with shares successfully allotted, and contributions of the Monthly Stocks Savings Plan.

- Eligible transactions settled in non-Hong Kong Dollar will be converted into Hong Kong Dollar at the exchange rate by BOCHK on the transaction day. The transaction amount of each eligible transaction will be rounded down to the nearest dollar (e.g. if the transaction amount is HK$105.8, the amount will be calculated as HK$105.)

- Calculation of Investment Assets Value

- Investment Assets Value maintained includes the value of the following investment items under the customer’s name (sole-name account and joint-name account will be calculated separately) in the prevailing month: the average amount of the total day-end balance of Securities, Securities Margin, Bonds, Certificate of Deposit, Funds, Structured Notes, Equity Linked Investments, Currency Linked Investments, Structured Investments, Investment Deposit, Precious Metal / FX Margin, Precious Metals.

- BOCHK will calculate the daily market value according to the features of investment products. Unsettled bought quantities of the stock are excluded while securities collaterals are included.

- Actual monthly calculation period starts from the last business day of the previous month to the day before last business day of the prevailing month.

- Membership Privileges

- Customers of each membership tier enjoy different services and charges. The relevant services and charges are subject to the latest information revised by BOCHK.

- All services are subject to relevant terms. For details, please refer to the relevant promotional materials or contact the staff of BOCHK.

- Termination of Membership: In case of termination of all Securities Accounts under the same name, the relevant membership, the accumulated securities transaction amount and the privileges will be cancelled immediately.

- The BOCHK's record of the Membership Period, the account opening date, the amount of the eligible transactions and Investment Assets Value shall prevail.

General Terms:

- BOCHK reserves the right to change, suspend or terminate the Club or the above services, and to amend the relevant terms at its sole discretion without prior notice.

- In case of any dispute, the decision of BOCHK shall be final.

- Should there be any discrepancy between the English and Chinese versions of the above content, the Chinese version shall prevail.

- The details of securities services charges are subject to change by BOCHK from time to time. For details, please refer to the service charges table and the offers of securities service charges announced by BOCHK from time to time.

- Securities Club (the "Club") consists of four membership tiers: Diamond Star member, Gold Star member, Silver Star member and Bright Star member. Customers who maintain securities accounts and/or securities margin trading accounts ("Securities Accounts") (including sole-name/joint-name accounts and individual/corporate accounts) with Bank of China (Hong Kong) Limited ("BOCHK")will be granted the relevant membership by the BOCHK according to the accumulated securities transaction amount or Investment Assets Value in principle (excluding Private Banking customers).

- Membership Mechanics

- The membership effective date shall be the next business day after the last review date of membership status or the account opening date of the relevant securities accounts (for new customers only). Unless otherwise specified, the membership status shall be valid for 12 months ("Membership Period"). For details of the Membership Period, please refer to the membership notification letter issued by BOCHK or contact staff of BOCHK.

- Every membership tier has a requirement on the accumulated securities transaction amount for each Membership Period and Investment Assets Value. The relevant requirement is subject to the information quoted by BOCHK from time to time.

- The accumulated securities transaction amount and the Investment Assets Value in the prevailing month of each customer will be reviewed by BOCHK on the last business day of each month. Should the relevant amount reach the required amount for a higher membership tier, the membership of the customers will be upgraded to the relevant tiers in the following month. The membership tiers of the customers will not be downgraded within the Membership Period.

- The accumulated securities transaction amount and the Investment Assets Value in the prevailing month of each customer will be reviewed on the last business day of the month when the relevant membership expires. If the customers fulfil the requirement on the accumulated securities transaction amount or Investment Assets Value of their membership tiers, their membership tiers will be retained. However, if neither the required accumulated securities transaction amount nor Investment Assets Value is fulfilled, the membership of customers will be downgraded to the tiers corresponding to their accumulated securities transaction amount or Investment Assets Value (whichever brings to a higher membership) in the following month.

- Upon the upgrading of membership tier, or the expiry of the Membership Period, the accumulated securities transaction amount of the customers will be re-calculated.

- Different memberships will be granted to the sole-name Securities Accounts held by a customer and the joint-name Securities Accounts held by the aforesaid customer with other parties according to the accumulated securities transaction amount and Investment Assets Value in principle. The relevant accumulated securities transaction amount and Investment Assets Value will be reviewed and calculated respectively and separately.

- Calculation of the Accumulated Securities Transaction Amount

- Customers should successfully conduct the eligible transactions via their Securities Accounts within the Membership Period and the relevant transaction amount (excluding the brokerage fee or other handling fee) will be calculated as the accumulated securities transaction amount. Eligible transactions refer to the buying and selling of securities listed on the Hong Kong Exchanges and Clearing Limited (including securities settled in Hong Kong Dollar and non-Hong Kong Dollar), transactions of Initial Public Offering ("IPO") subscription or IPO subscription financing through yellow form application with shares successfully allotted, and contributions of the Monthly Stocks Savings Plan.

- Eligible transactions settled in non-Hong Kong Dollar will be converted into Hong Kong Dollar at the exchange rate by BOCHK on the transaction day. The transaction amount of each eligible transaction will be rounded down to the nearest dollar (e.g. if the transaction amount is HK$105.8, the amount will be calculated as HK$105.)

- Calculation of Investment Assets Value

- Investment Assets Value maintained includes the value of the following investment items under the customer’s name (sole-name account and joint-name account will be calculated separately) in the prevailing month: the average amount of the total day-end balance of Securities, Securities Margin, Bonds, Certificate of Deposit, Funds, Structured Notes, Equity Linked Investments, Currency Linked Investments, Structured Investments, Investment Deposit, Precious Metal / FX Margin, Precious Metals.

- BOCHK will calculate the daily market value according to the features of investment products. Unsettled bought quantities of the stock are excluded while securities collaterals are included.

- Actual monthly calculation period starts from the last business day of the previous month to the day before last business day of the prevailing month.

- Membership Privileges

- Customers of each membership tier enjoy different services and charges. The relevant services and charges are subject to the latest information revised by BOCHK.

- All services are subject to relevant terms. For details, please refer to the relevant promotional materials or contact the staff of BOCHK.

- Termination of Membership: In case of termination of all Securities Accounts under the same name, the relevant membership, the accumulated securities transaction amount and the privileges will be cancelled immediately.

- The BOCHK's record of the Membership Period, the account opening date, the amount of the eligible transactions and Investment Assets Value shall prevail.

General Terms:

- BOCHK reserves the right to change, suspend or terminate the Club or the above services, and to amend the relevant terms at its sole discretion without prior notice.

- In case of any dispute, the decision of BOCHK shall be final.

- Should there be any discrepancy between the English and Chinese versions of the above content, the Chinese version shall prevail.

- The details of securities services charges are subject to change by BOCHK from time to time. For details, please refer to the service charges table and the offers of securities service charges announced by BOCHK from time to time.

Risk of Securities Trading

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

Risk Disclosure of Securities Margin Trading

The risk of loss in financing a transaction by deposit of collateral is significant. You may sustain losses in excess of your cash and any other assets deposited as collateral with the licensed or registered person. Market conditions may make it impossible to execute contingent orders, such as "stop-loss" or "stop-limit" orders. You may be called upon at short notice to make additional margin or interest payments. If the required margin or interest payments are not made within the prescribed time, your collateral may be liquidated without your consent. Moreover, you will remain liable for any resulting deficit in your account and interest charged on your account. You should therefore carefully consider whether such a financing arrangement is suitable in light of your own risk tolerance, financial situation, investment experience, investment objectives, investment horizon and investment knowledge.

You are reminded to understand the relevant details, charges and important notes before investing in Shanghai A shares or Shenzhen A shares. For details, please read the “Important Notice of Trading China A Shares and A Shares Margin Trading via Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect” in BOCHK’s website or the branch staff of BOCHK.

Conversion Limitation Risk of RMB (Only applicable to Individual Customers)

RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HK$ or other foreign currencies. Currency exchange is also subject to cost (being the spread between the buy and sell of RMB). RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

Conversion Limitation Risk of RMB (Only applicable to Corporate Customers)

RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HK$ or other foreign currencies. Currency exchange is also subject to cost (being the spread between the buy and sell of RMB). RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.