- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

Ranked No. 1*

by Market Share

for 7 Consecutive Years

of Centaline Property Agency Ltd.

Guides you to realise your dream home

Unlock your path to homebuying in the Greater Bay Area

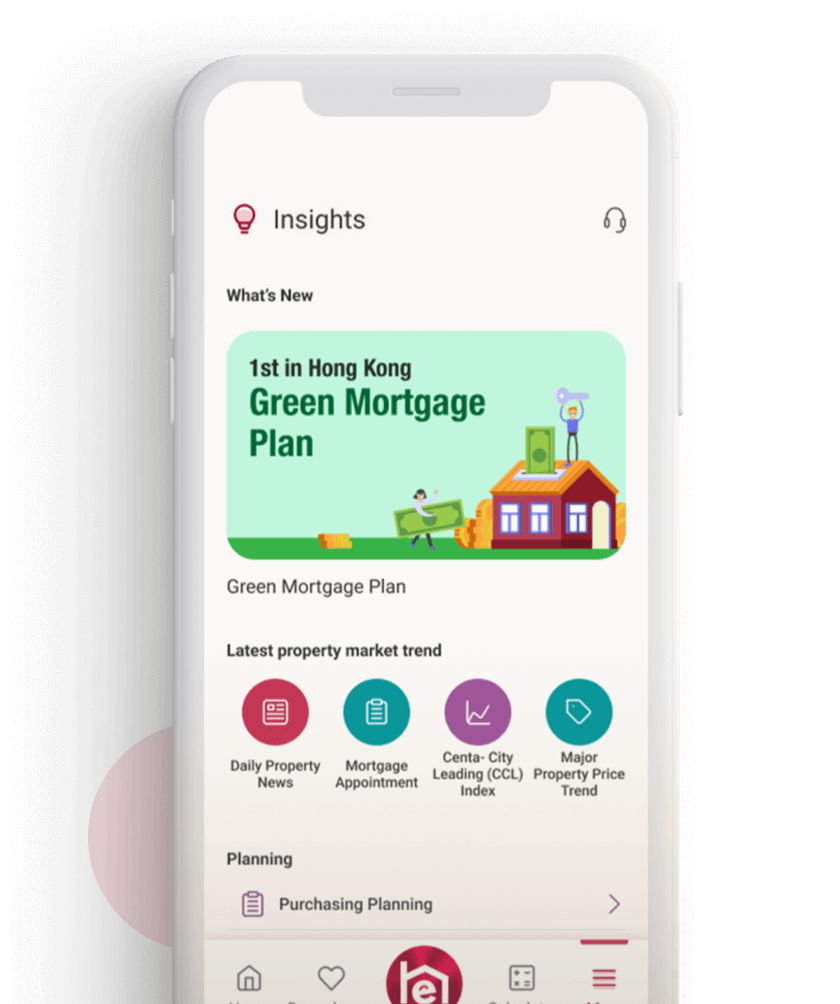

BOCHK "Home Expert"

Tailored excellence for every home

BOCHK has always been customer-centric, offering diverse mortgage solutions and professional, comprehensive services. We continuously innovate and advance, providing all-round support to you along your homeownership journey.

Innovation Highlights

Innovation · Product

We understand our customers' needs and relentlessly pursue innovation. To promote environmental and social sustainability, we proudly launched the first Green Mortgage Plan in Hong Kong. In addition, we offer an array of mortgage solutions for private properties, government housing, village houses, and more. Flexible repayment options are available, with the choice of Prime Rate (P) or Hong Kong Interbank Offered Rate (HIBOR) as the mortgage repayment interest rate, you can also set the repayment period to 2 weeks or 1 month.

Breakthrough · Frontiers

Embracing the integrated lifestyle of the Greater Bay Area, we are among the first to offer mortgage solutions across 9 cities in the Greater Bay Area, with mortgage loan options in both HKD and RMB to fully support your cross-border home ownership needs.

Expansion ·

New Experience

Leveraging digital innovation, we deliver a new level of service experience. Our pioneering "Home Expert" APP is the first of its kind in Hong Kong enables you to search property information, plan budgets, and complete mortgage applications online in one stop. At the same time, our offline network of professional mortgage specialists and customer service representatives are always ready to provide personalized one-on-one support. You may also visit our extensive branch network or mortgage centres for in-person assistance.

Advancement ·

Technology

We actively embrace technology to simplify the mortgage process. As the first bank to accept interbank shared account data via the Interbank Account Data Sharing (IADS) as proof of income, we streamline documentation requirements and accelerate mortgage approval with our commitment to efficiency, detail, and customer convenience.

We truly understand your needs

dedicated to planning with you

dedicated to planning with you

- Down payment of only 10%*

- Loan tenor of up to 30 years

- Insurance premium can be integrated into the loan amount

HK$5,000,000

30 Years (360 months)

(Mortgage Loan up to)

(Mortgage Loan up to)

HK$1,000,000

- The above example is for reference only. Customers shall meet the application and approval requirement of the Mortgage Insurance Programme. Bank of China (Hong Kong) Limited's final approved mortgage amount, interest rate and applicable terms shall be final.

- The above is subject to terms and condition, please click here for details.

Reminder: To borrow or not to borrow? Borrow only if you can repay!

- Loan amount of up to 90% - 100%* of purchase price

- With repayment tenor of up to 30 years

- You may flexibly increase your instalment amount or make repayment without handling fee

- Simple application steps

HK$2,000,000

30 Years (360 Months)

95%

HK$1,900,000

- Annual mortgage interest rate is quoted for reference only. P is the Hong Kong Dollar Prime Lending Rate quoted by Bank of China (Hong Kong) Limited (“The Bank”) from time to time.

- The above information is for reference only. The Bank may at its absolute discretion approve or reject any application for credit facilities and mortgage and may decline any application without assigning any reason. The credit facilities and mortgage shall be subject to the terms and conditions set out in the facility letter and mortgage documents.

- The above is subject to terms and condition, please click here for details.

Reminder : To borrow or not to borrow? Borrow only if you can repay !

- Applicable to first-hand/second-hand private and government subsidized residential projects that have received the BEAM Plus Platinum or Gold Rating issued by Hong Kong Green Building Council

- Experience Paperless, Digital Mortgage Service and protect the environment with low-carbon usage

- Enjoy preferential cash rebate/ rewards

Reminder : To borrow or not to borrow? Borrow only if you can repay !

- Enables you to use your residential properties in Hong Kong as security and convert them into monthly and/ or lump-sum payouts

- Secures your lifetime home residence

- No repayment in your lifetime# and no penalty for early full repayment

- Six-month cooling-off period*

*If a reverse mortgage loan is terminated for whatever reason within the first 6 months, a refund and waiver of mortgage insurance premiums will be given. However, the borrower is still required to bear the accrued interest, financed fees (if any) and the relevant fees in relation to the termination of the reverse mortgage loan.

70

HK$4,000,000

Fixed-rate Mortgage Plan1

- The above monthly payout under the fixed-rate mortgage plan is calculated at the interest rate of 3% p.a. for the first 25 years and the Hong Kong Prime Rate minus 2.5% p.a. thereafter, and is for reference only. The fixed interest rate and the Hong Kong Prime Rate will be determined by The Hong Kong Mortgage Corporation Limited ("HKMC") and HKMC Insurance Limited ("HKMCI") from time to time respectively.

- The above information is for reference only and not complete, customers should fulfil the application and approval requirement. For details of Reverse Mortgage Programme (“RMP”), please call Bank of China (Hong Kong) Limited ("the Bank") ’s hotline on +852 2278 3399 or refer to RMP’s information and relevant documents published by HKMC.

- The above products, services and offers are subject to terms and conditions, please click here for details.

- The Bank, HKMCI and HKMC reserve the right to amend, withhold and/or cancel the above products, services and relevant terms and conditions at its discretion.

Reminder : To borrow or not to borrow? Borrow only if you can repay !

- Enables you to use your life insurance policy as collateral and convert it into monthly and/ or lump-sum payouts

- No repayment in your lifetime#

- No penalty for early full repayment

- Six-month cooling-off period*

*If you terminate your policy reverse mortgage loan for whatever reason within the first 6 months, you will be given a full refund and waiver of the relevant mortgage insurance premiums. However, you still need to bear any accrued interest and financed fees in the outstanding loan amount.

The above monthly payout amounts are based on a specific life insurance policy of a well known insurance company and are for illustration purpose only. The actual monthly payout amount for individual life insurance policies may vary.

65 (Male)

HK$2,000,000

Fixed-rate mortgage plan1

Monthly payout amounts

- The above monthly payout under the fixed-rate mortgage plan is calculated at the interest rate of 4% p.a. for the first 25 years and the Hong Kong Prime Rate minus 2.5% p.a. thereafter, and is for reference only. The fixed interest rate and the Hong Kong Prime Rate will be determined by The Hong Kong Mortgage Corporation Limited ("HKMC") and HKMC Insurance Limited ("HKMCI") from time to time respectively.

- The above information is for reference only, Customers should fulfil the application and approval requirement. For details of the Policy Reverse Mortgage Programme (“PRMP”), please call Bank of China (Hong Kong) Limited ("the Bank") ’s hotline on +852 2278 3399 or refer to PRMP’s information and relevant documents published by HKMC and HKMCI.

- The above is subject to terms and condition, please click here for details.

- The Bank, HKMCI and HKMC reserve the right to amend, withhold and/or cancel the above products, services and relevant terms and conditions at its discretion.

Reminder : To borrow or not to borrow? Borrow only if you can repay !

- Enjoy same preferential deposit interest rate and mortgage interest rate, where the upper limit of deposits bearing a preferential deposit interest rate is up to 50% of the total mortgage outstanding balance

- Link with a maximum of 3 Designated Current Accounts and share higher interest income with your family

- Provide you with monthly Designated Current Account and Mortgage Account Statement with detailed records at a glance

HK$4,000,000

25 years (300 months)

HK$5,000

(Assuming that no withdrawal of deposits is made until full repayment of the entire loan)

interest rate

interest rate

of savings account

of savings account

interest expenses

interest expenses

on Designated

Current Account

on Designated

Current Account

interest expenses4

interest expenses4

HK$500,102

(Saved 22% on net interest expenses)5

- Annual mortgage interest rate is quoted for reference only, P is the Hong Kong Dollar Prime Lending Rate quoted by Bank of China (Hong Kong) Limited (“The Bank”) from time to time.

- The Savings Deposit Rate is 0.875% on 2024/03/06 (Savings interest rate may vary according to the daily account balance. For details, please contact our staff.)

- "Smart" Mortgage Scheme preferential mortgage interest rate (The upper limit of deposits bearing a preferential interest rate is up to 50% of the total outstanding balance of the mortgage loan. This upper limit will be adjusted in line with the total outstanding balance of the mortgage loan.

- Total net interest expenses = Total mortgage interest expenses - total interest income on Designated Current Account.

- In regards to respective situation, you may refer to “Smart” Mortgage Scheme Calculator for actual calculation.

The above information is for reference only. The Bank may at its absolute discretion approve or reject any application for credit facilities and mortgage and may decline any application without assigning any reason. The credit facilities and mortgage shall be subject to the terms and conditions set out in the facility letter and mortgage documents. Please click here for details.

Reminder : To borrow or not to borrow? Borrow only if you can repay !

- Mortgage interest is calculated based on the daily outstanding net balance* of your mortgage loan, enabling you to save interest expenses

- Mortgage, withdrawal and deposits can be clearly reflected in a single statement

- You can take advantage of your financial flexibility by conducting deposits or withdrawal at your convenience

HK$4,000,000

25 years (300 months)

HK$5,000

(Assuming that no withdrawal of deposits is made until full repayment of the entire loan)

interest rate

interest rate

Amount

Amount

interest expenses

interest expenses

(shortened by 84 months)3

HK$755,727

(Saved 31% on net interest expenses)

- Annual mortgage interest rate is quoted for reference only, P is the Hong Kong Dollar Prime Lending Rate quoted by Bank of China (Hong Kong) Limited (“The Bank”) from time to time.

- The repayment tenor for "All-You-Want" Mortgage Scheme assumes that the deposit amount in the "All-You-Want" mortgage account is sufficient to settle and repay all the outstanding mortgage loan amount in respect of the remaining repayment tenor. Customers can then choose to redeem the mortgage loan facility, but a prepayment fee may be required. If customers do not redeem the mortgage loan facility, monthly repayment will be made by customers as usual until the outstanding mortgage loan principal is fully prepaid. The Bank may in its absolute discretion decide any matters in respect of the above mortgage repayment and redemption arrangements. The above calculation adopts a day-to-day interest basis and assumes that calculating interest starts from 1st January. All the information is for reference only.

- In regards to respective situation, you may refer to "All-You-Want" Mortgage Scheme Calculator for actual calculation.

The above information is for reference only. The Bank may at its absolute discretion approve or reject any application for credit facilities and mortgage and may decline any application without assigning any reason. The credit facilities and mortgage shall be subject to the terms and conditions set out in the facility letter and mortgage documents. Please click here for details.

Reminder : To borrow or not to borrow? Borrow only if you can repay !

- You can make use of your asset’s appraised property value for extra cash flow

- Our mortgage specialists will assist you to evaluate your existing mortgage plan and to advise you on the best mortgage solutions

- Provides comprehensive mortgage solution suited to your needs

Purchase Residential Property & Apply for Mortgage

Apply for Refinancing & Top Up

(Assume 70%

Loan-to-value Ratio)

(Assume 70%

Loan-to-value Ratio)

HK$5,600,000

(Mortgage for 10 years)

HK$1,800,000

HK$3,800,000

- The above information is for reference only. Bank of China (Hong Kong) Limited (“The Bank”) may at its absolute discretion approve or reject any application for credit facilities and mortgage and may decline any application without assigning any reason. The credit facilities and mortgage shall be subject to the terms and conditions set out in the facility letter and mortgage documents.

- The above is subject to terms and condition, please click here for details.

Reminder : To borrow or not to borrow? Borrow only if you can repay !

Digital Experience

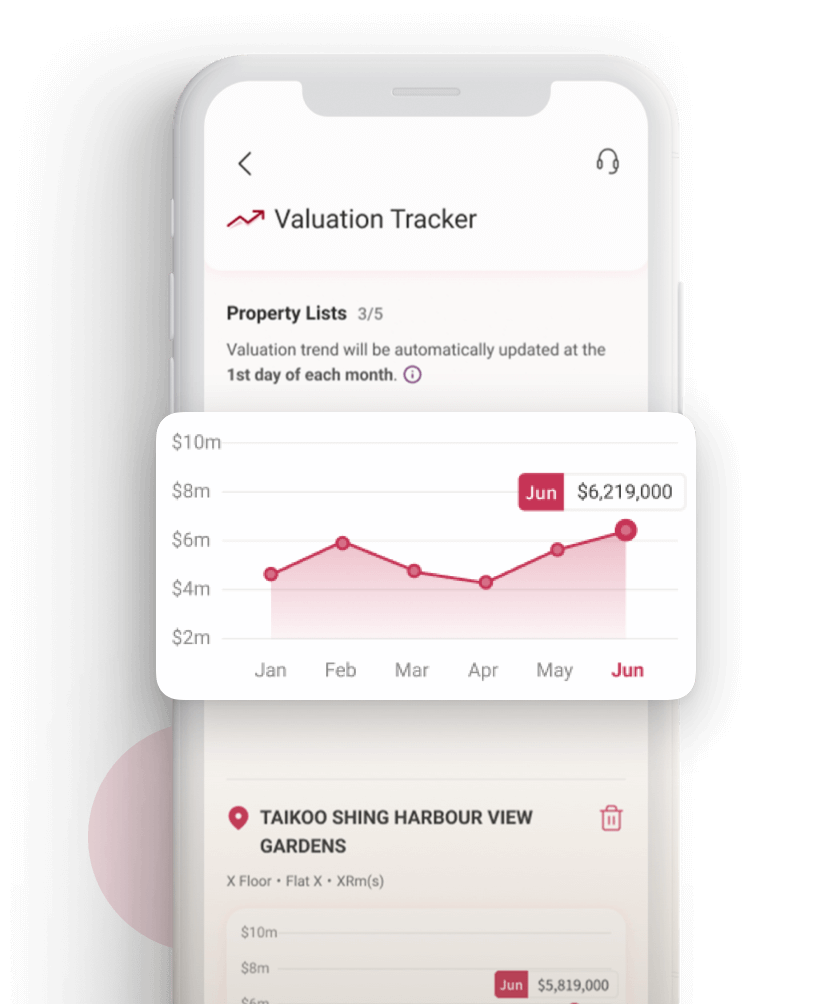

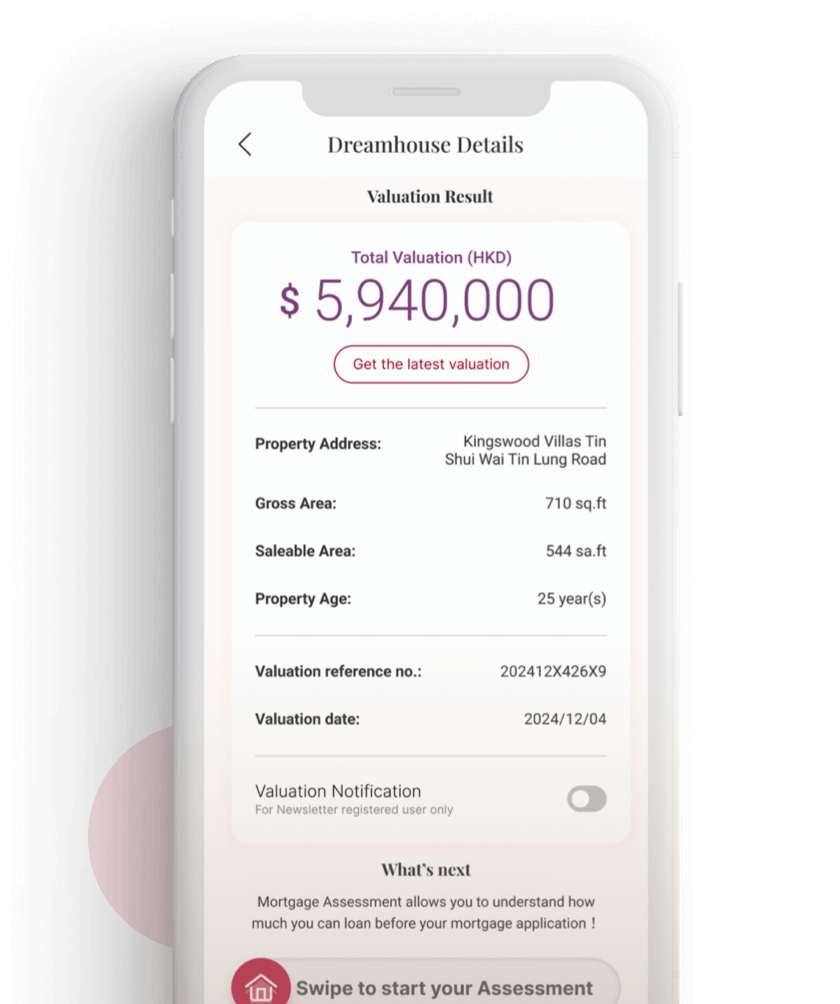

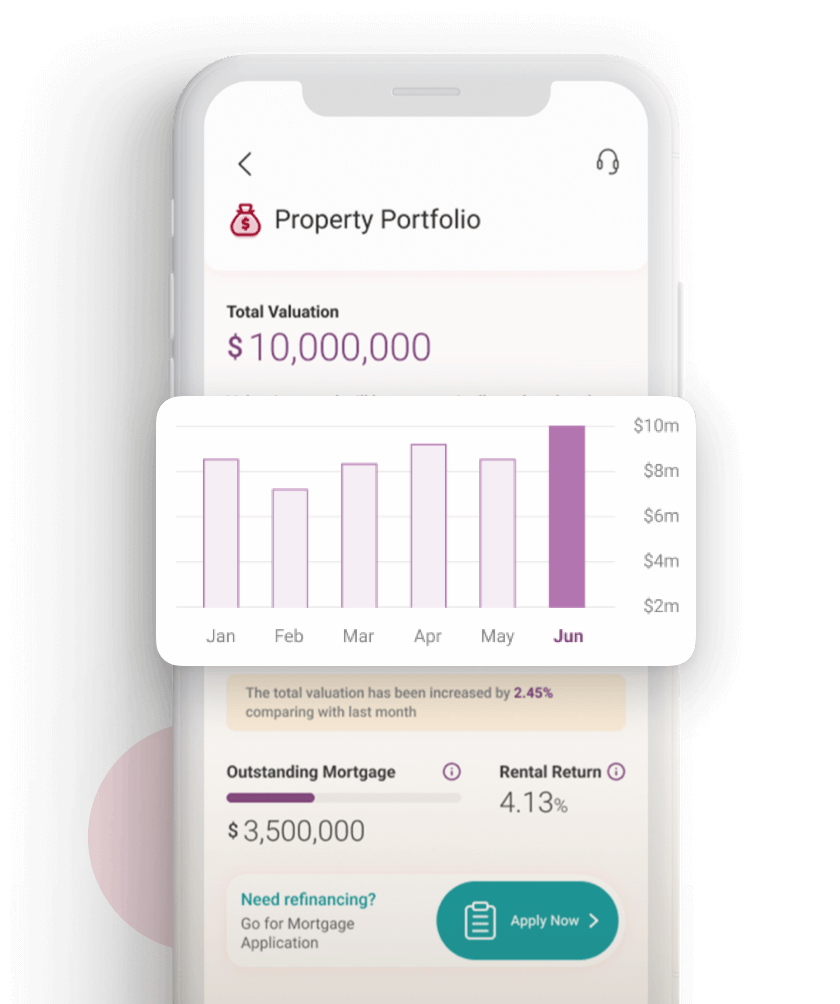

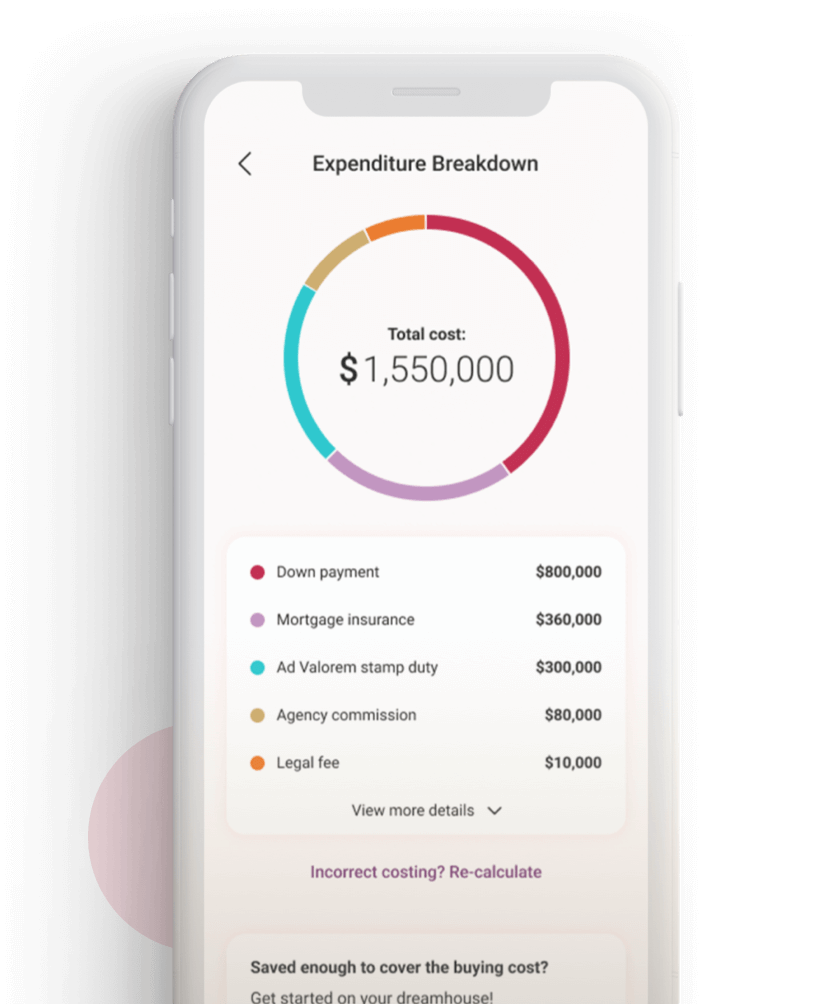

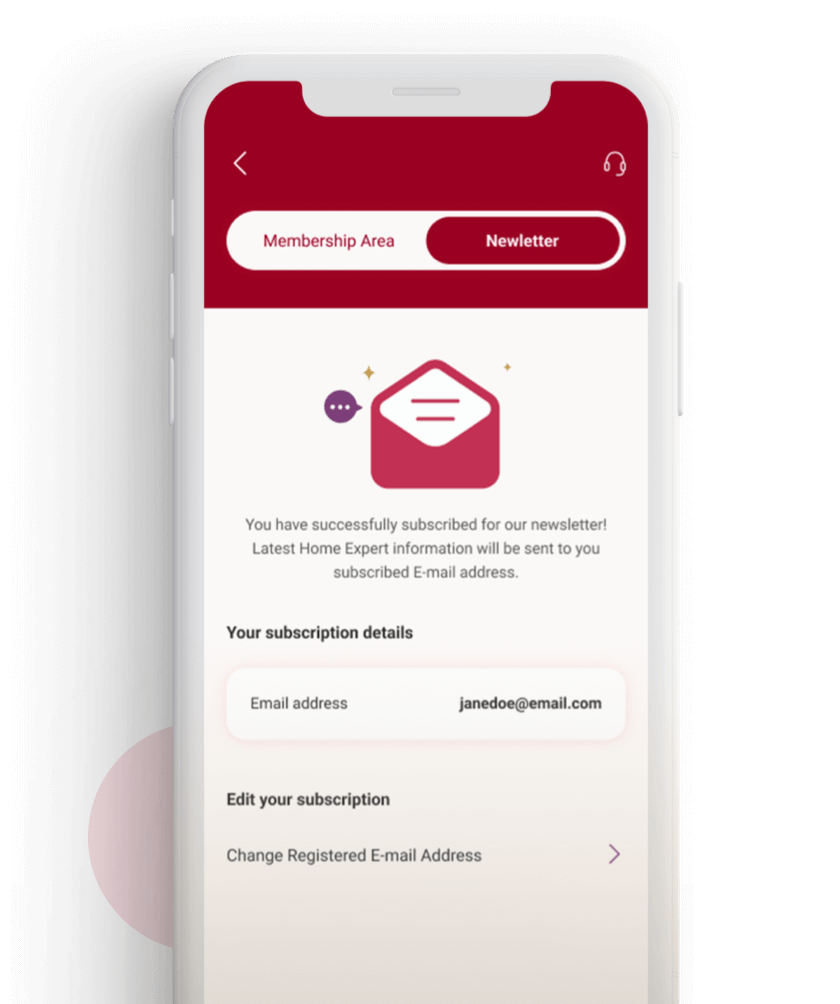

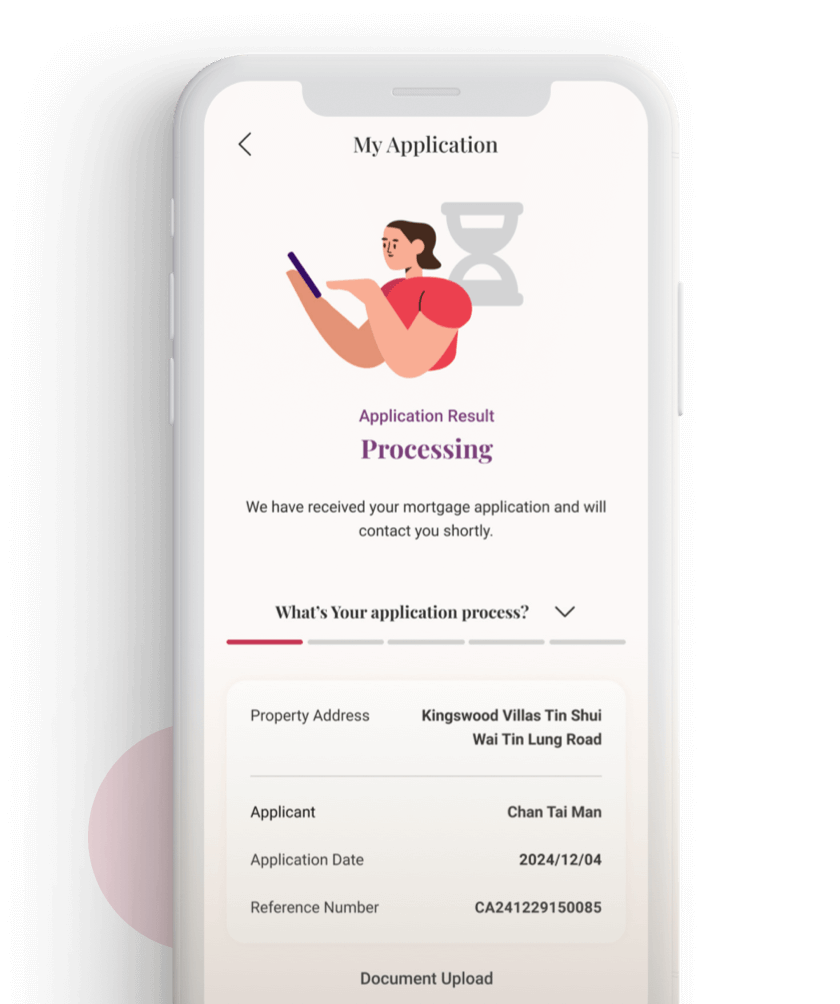

“Home Expert” APP

facilitates you to complete your homebuying journey

The “Home Expert” APP , a one-stop online homebuying platform that guides you through every step of your homebuying journey, facilitating you to achieve your homebuying dream in Hong Kong and Greater Bay Area.

Info

Tracker

Portfolio

- The above information is for reference only. Bank of China (Hong Kong) Limited ("the Bank") may at its absolute discretion approve or reject any application for credit facilities and mortgage and may decline any application without assigning any reason. The final terms and conditions of the mortgage will be governed by the Facility Letter and other relevant documents signed between the loan applicant and the Bank.

- The Bank reserves the right to amend and / or withhold the above offer, relevant terms and conditions of the above promotional offers at its discretion.

- Important Notes On Third Party Referral On Loan Application: We will only proceed with a mortgage application referred by a third party appointed by us, and the appointed third party should not charge any fees from the applicant for loan application referral. For enquiries, please contact our Personal Customer Service Hotline at +852 3988 2388.

- In case of any discrepancies between the Chinese and English version of this web page, the Chinese version shall prevail.

- Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited.

- The above information is for reference only. Bank of China (Hong Kong) Limited ("the Bank") may at its absolute discretion approve or reject any application for credit facilities and mortgage and may decline any application without assigning any reason. The final terms and conditions of the mortgage will be governed by the Facility Letter and other relevant documents signed between the loan applicant and the Bank.

- The Bank reserves the right to amend and / or withhold the above offer, relevant terms and conditions of the above promotional offers at its discretion.

- Important Notes On Third Party Referral On Loan Application: We will only proceed with a mortgage application referred by a third party appointed by us, and the appointed third party should not charge any fees from the applicant for loan application referral. For enquiries, please contact our Personal Customer Service Hotline at +852 3988 2388.

- In case of any discrepancies between the Chinese and English version of this web page, the Chinese version shall prevail.

- Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.. Android, Google Play, and the Google Play logo are trademarks of Google Inc.. Huawei AppGallery is provided by Huawei Services (Hong Kong) Co., Limited.