- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

Achieving different goals for your every beloved family member

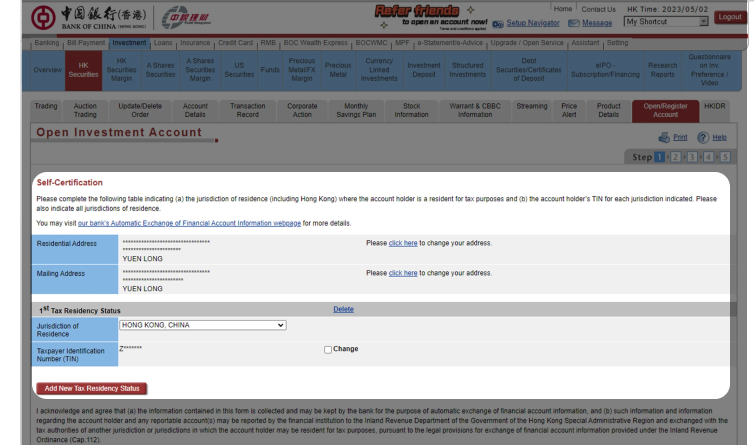

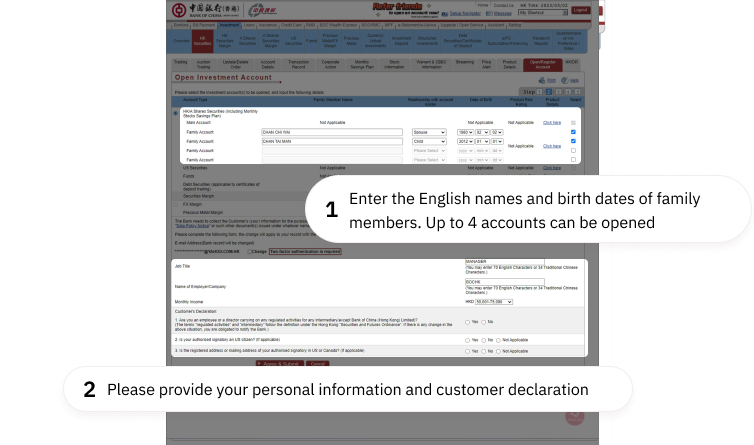

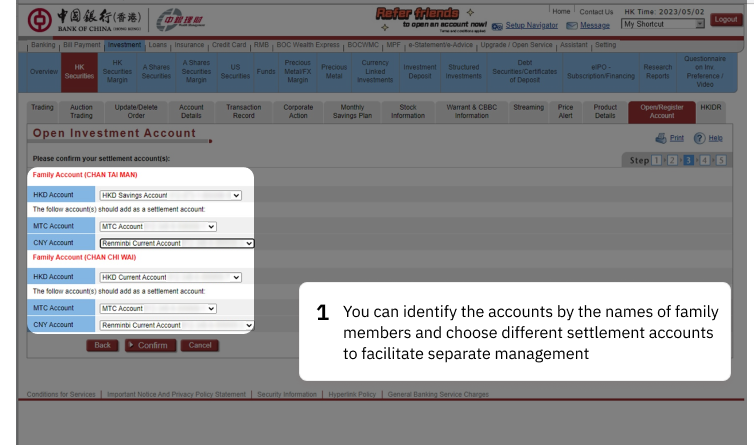

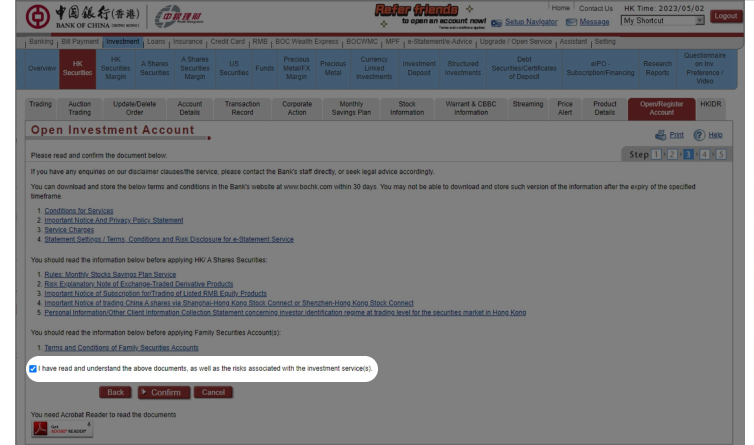

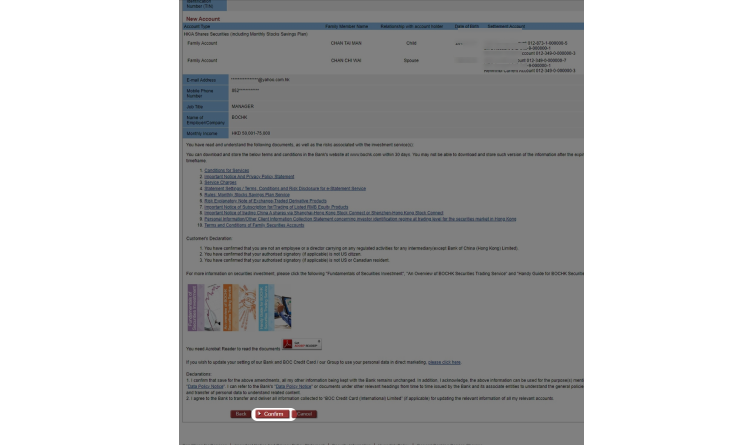

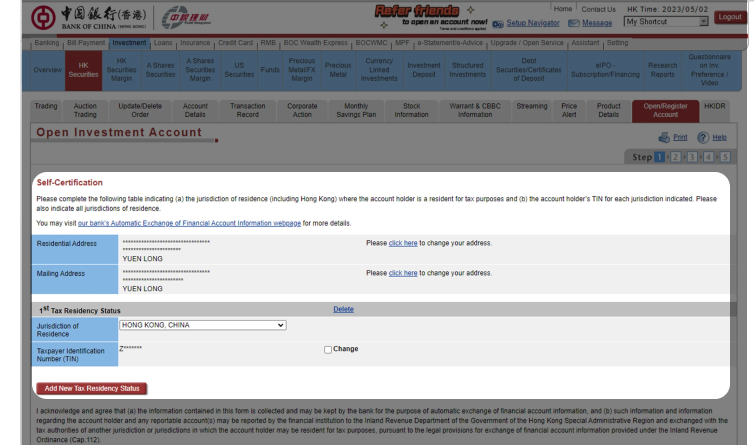

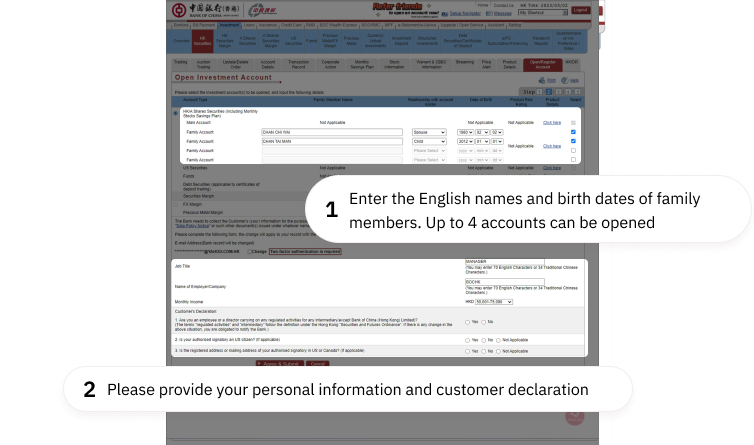

Open Family Securities Account

Please open Securities Account (click here for details)

Please open Securities Account (click here for details)

Latest Promotion

Multichannel Easy Investment

Personal Customer Service Hotline +852 3988 2388

Monday to Friday 9:00 am to 9:00 pm, Saturday 9:00 am to 6:00 pm, closed on Sunday and public holidays

Related Services

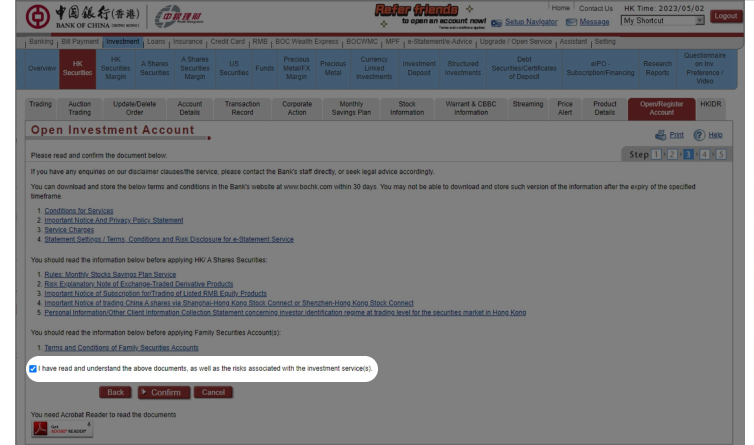

- Family Securities Account (this “Account”) is only applicable to the personal banking securities customers (including sole-name and joint-name securities accounts) who maintain the securities accounts (“Master Securities Accounts”) with Bank of China (Hong Kong) Limited (”BOCHK”). This service is not available for the private banking customers of BOCHK.

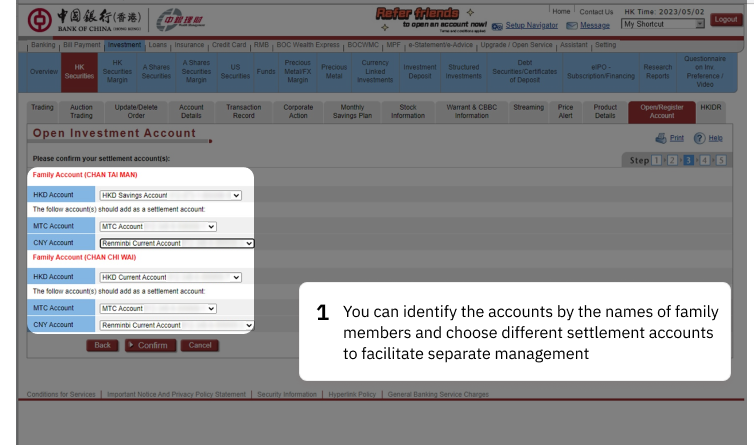

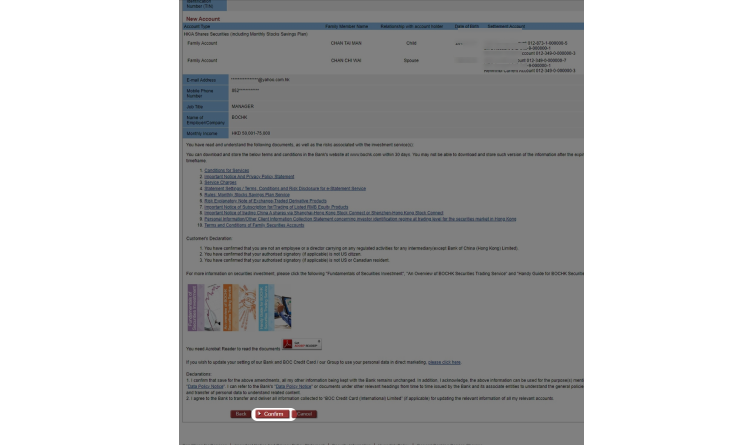

- Customer can open up to 4 additional securities accounts (Family Securities Accounts) in addition to the Master Securities Account and Securities Margin Account. Customers are required to provide the information of the family members under separate Family Securities Accounts from time to time as requested by BOCHK. The names of the family members will be displayed in the monthly statement and notification letter for identifying relevant investment objectives and needs. BOCHK will not or has no responsibility to verify the information of family members provided.

- Family Securities Accounts are not trust accounts. Any registered information of the family members only serve for identification of the relevant investment objectives and needs. Any person (including but not limited to whose particulars have been registered under the Family Securities Accounts) does not acquire any interests or rights of the relevant Family Securities Accounts or authorization to operate the relevant Family Securities Accounts. BOCHK will not disclose any related account information to any registered family members. Customers should be and will be treated as, for all intents and purposes the holder and beneficiary of the Family Securities Accounts.

- Each Family Securities Account should be operated independently and shall be subject to terms and conditions of the securities account. Any one of the Saving or Current account(s)under the name of Master Securities Account holder shall be used as the settlement account of Family Securities Accounts, and BOCHK will calculate the securities transaction charges (including but not limited to services fee, brokerage fee and taxes) based on the existing fees and charges listed in the fees schedule of BOCHK for each Family Securities Account. All securities transaction related to financing service (including but not limited to securities margin services, IPO financing and Secured Overdraft Facility) are not applicable to any Family Securities Accounts. The restriction on Family Securities Accounts will not be added to or affect any operation of the Master Securities Account.

- Customers can only use the Master Securities Account or any one of the Family Securities Accounts to subscribe for IPO shares. In addition, customers can only use the Master Securities Accounts to apply for IPO financing service.

- Customers should still maintain the Master Securities Account (under the same name during the entire period of this Services. In the event of the cancellation or termination of the Master Securities Account for any reasons, BOCHK will have the right to cancel or terminate the Family Securities Accounts at any time without prior notice.

- BOCHK reserves the rights to amend, suspend or terminate this Services and to amend the relevant terms and conditions at any time at its sole discretion without prior notice.

- In case of any dispute(s), the decision of BOCHK shall be final.

- In case of any discrepancy(ies) between the Chinese and English versions of these terms and conditions, the Chinese version shall prevail.

- Family Securities Account (this “Account”) is only applicable to the personal banking securities customers (including sole-name and joint-name securities accounts) who maintain the securities accounts (“Master Securities Accounts”) with Bank of China (Hong Kong) Limited (”BOCHK”). This service is not available for the private banking customers of BOCHK.

- Customer can open up to 4 additional securities accounts (Family Securities Accounts) in addition to the Master Securities Account and Securities Margin Account. Customers are required to provide the information of the family members under separate Family Securities Accounts from time to time as requested by BOCHK. The names of the family members will be displayed in the monthly statement and notification letter for identifying relevant investment objectives and needs. BOCHK will not or has no responsibility to verify the information of family members provided.

- Family Securities Accounts are not trust accounts. Any registered information of the family members only serve for identification of the relevant investment objectives and needs. Any person (including but not limited to whose particulars have been registered under the Family Securities Accounts) does not acquire any interests or rights of the relevant Family Securities Accounts or authorization to operate the relevant Family Securities Accounts. BOCHK will not disclose any related account information to any registered family members. Customers should be and will be treated as, for all intents and purposes the holder and beneficiary of the Family Securities Accounts.

- Each Family Securities Account should be operated independently and shall be subject to terms and conditions of the securities account. Any one of the Saving or Current account(s)under the name of Master Securities Account holder shall be used as the settlement account of Family Securities Accounts, and BOCHK will calculate the securities transaction charges (including but not limited to services fee, brokerage fee and taxes) based on the existing fees and charges listed in the fees schedule of BOCHK for each Family Securities Account. All securities transaction related to financing service (including but not limited to securities margin services, IPO financing and Secured Overdraft Facility) are not applicable to any Family Securities Accounts. The restriction on Family Securities Accounts will not be added to or affect any operation of the Master Securities Account.

- Customers can only use the Master Securities Account or any one of the Family Securities Accounts to subscribe for IPO shares. In addition, customers can only use the Master Securities Accounts to apply for IPO financing service.

- Customers should still maintain the Master Securities Account (under the same name during the entire period of this Services. In the event of the cancellation or termination of the Master Securities Account for any reasons, BOCHK will have the right to cancel or terminate the Family Securities Accounts at any time without prior notice.

- BOCHK reserves the rights to amend, suspend or terminate this Services and to amend the relevant terms and conditions at any time at its sole discretion without prior notice.

- In case of any dispute(s), the decision of BOCHK shall be final.

- In case of any discrepancy(ies) between the Chinese and English versions of these terms and conditions, the Chinese version shall prevail.

Risk Disclosure:

The following risk disclosure statements cannot disclose all the risks involved and does not take into account any personal circumstances unknown to BOCHK. You should undertake your own independent review and seek independent professional advice before you trade or invest especially if you are uncertain of or have not understood any aspect of the following risk disclosure statements or the nature and risks involved in trading or investment. You should carefully consider whether trading or investment is suitable in light of your own risk tolerance, financial situation, investment experience, investment objectives, investment horizon and investment knowledge.

Risk Disclosure of Securities Trading

Risk of Securities Trading

Monthly Stocks Savings Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

You are reminded to understand the relevant details, risks, charges and important notes before investing in Shanghai A shares or Shenzhen A shares. For details, please read the “Important Notice of Trading China A Shares and A Shares Margin Trading via Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect” in BOCHK’s website or the branch staff of BOCHK.

RMB Conversion Limitation Risk

RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies. Currency exchange is also subject to cost (being the spread between the buy and sell of RMB). RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of BOCHKs and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

This promotion material does not constitute any offer, solicitation, recommendation, comment or guarantee to the purchase, subscription or sale of any investment product or service and it should not be considered as investment advice.

This promotion material is issued by BOCHK and the contents have not been reviewed by the Securities and Futures Commission of Hong Kong.