- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

Corporate Loans

Flexible SME loans for faster financing needs

New HIBOR-based SME Loan

Enjoy Up to 50 Basis Points

Annualised Interest Rate Discount for Online Applications

Enjoy Up to 50 Basis Points

Annualised Interest Rate Discount for Online Applications

New HIBOR-based1 SME Loan

Enjoy Up to 50 Basis Points Annualised Interest Rate Discount for Online Applications*

Enjoy Up to 50 Basis Points Annualised Interest Rate Discount for Online Applications*

*Promotion Period: From now until 31 March 2026, Terms and Conditions apply

New HIBOR-based1 SME Loan

Enjoy Up to 50 Basis Points Annualised Interest Rate Discount for Online Applications*

Enjoy Up to 50 Basis Points Annualised Interest Rate Discount for Online Applications*

*Promotion Period: From now until 31 March 2026, Terms and Conditions apply

Array of loan plans catering to different business needs

Loan Amount and Repayment Period at a Glance

Scroll to view content

80% Guarantee Product4

90% Guarantee Product4

Years of Business Operation

2 years or above

One Year or Above

Not Applicable

Maximum Loan Amount

HK$2 million

HK$18 million

HK$8 million

Maximum Repayment Period

5 years

10 Years

8 Years

Offers/Features

• Provision of collaterals and audited financial statements is not required2

• Capital in hand within 48 hours3

• Capital in hand within 48 hours3

• Guarantee fee rebate up to HK$100,0005

• Loan application fee waiver6

• Loan application fee waiver6

• Guarantee fee rebate up to HK$100,0005

• Loan application fee waiver6

• Loan application fee waiver6

- Latest rate and other details of the Bank’s 1-month HIBOR (“H”) is published on the website of The Hong Kong Association of Banks: www.hkab.org.hk [Home>Rates>HKAB HKD Interest Settlement Rates].

- The Bank reserves the right to request any relevant supporting documents/information from the customer.

- Starting from the date when the Bank receives all the required documents for the loan application (excluding Saturdays, Sundays and Public Holidays), the processing time may vary depending on the actual circumstances.

- For details of the "SME Financing Guarantee Scheme", please visit the website of the Hong Kong Mortgage Corporation Limited (“HKMC”) at www.hkmc.com.hk or contact Bank of China (Hong Kong) Limited (BOCHK). The application period of the 80% Guarantee Product and the 90% Guarantee Product is subject to HKMC’s announcements from time to time.

- Guarantee fee will be approved and determined by HKMC Insurance Limited (“HKMCI”) and is subject to the announcement made by the HKMCI.

- This offer is valid for applications received on or before 31 March 2026 and completed drawdown on or before 31 May 2026.

- Anyone is/are entitled to request for a credit report from all credit reference agencies in Hong Kong approved for participation in the Multiple Credit Reference Agencies Model without charge within any twelve-month period respectively to each selected credit reference agency.

The above products, services and promotional offers are subject to the relevant terms and conditions of BOCHK. For more details, please contact BOCHK's staff. BOCHK reserves the right to amend, suspend or terminate the above products, services and offers, and amend their relevant terms and conditions at any time at its absolute discretion without prior notice. In case of any dispute, the decision of BOCHK shall be final.

BOCHK reserves the right to approve and reject the loan application at its absolute discretion. The actual loan amount, interest rate, handling fee and applicable terms and conditions are subject to BOCHK's final approval.

In case of any discrepancy between the Chinese and English versions, the Chinese version shall prevail.

SME customer applies BOC "Small Business Loan" Unsecured Instalment Loan via BOCHK online channel, with interest rate of 1-month HIBOR.

Without

Discount Offer

Discount Offer

With

Discount Offer

Discount Offer

Standard Rate

Hong Kong Dollar Prime Rate

Loan Amount

HK$2,000,000

Loan Tenor

3 Years

Annualised Interest Rate Discount

N/A

HIBOR-based SME Loan Interest Rate Discount (25 Basis Points)

+

SME Loan Online Application Interest Rate Discount (25 Basis Points )

= 50 Basis Points

= 50 Basis Points

Monthly Repayment Amount

Approx. HK$58,200

Approx. HK$57,700

Total Interest Payment

Approx. HK$94,000

Approx. HK$78,000

Interest Rate Discount

N/A

3 yearsApprox. HK$16,000

- Above for reference only, 1-month HIBOR is assumed to be 3%.

- The standard rate will be determined based on customer’s respective financial situation, the final approved rate would be subjected to the Bank's final determination.

- The standard rate will be determined based on customer’s respective financial situation, the final approved rate would be subjected to the Bank's final determination.

Loan Calculator

Customize Your Loan Plan

Customize Your Loan Plan

10,000.00

4,000,000.00

3%

30%

If the Repayment Period is shorter than 1 year, it shall be treated as 1 full year.

Your Custom Loan Plan*

Monthly repayment amount (HK$)

86,066.43

Total repayment amount (HK$) 1,032,797.16

*The calculation is for reference only

Make an online appointment for a corporate loan application in 3 simple steps

1

Complete company information

2

Upload documents#

3

Our Relationship Manager will follow up with applications

#You may consider uploading relevant documents in advance, so that our Relationship Manager could follow up the information before contacting you.

1

Complete company information

2

Upload documents#

3

Our Relationship Manager will follow up with applications

#You may consider uploading relevant documents in advance, so that our Relationship Manager could follow up the information before contacting you.

Other loan plans to match SME business needs

Followed up by Relationship Manager

Online appointment for other Loan ApplicationNot applicable to SME Financing Guarantee Scheme, BOCHK Bill Merchant Loan Program and BOC "Small Business Loan" Unsecured Loan

Online appointment for other Loan ApplicationNot applicable to SME Financing Guarantee Scheme, BOCHK Bill Merchant Loan Program and BOC "Small Business Loan" Unsecured Loan

Flexible Loan Customer Cases

SME Financing Guarantee Scheme

Flexible financing is vital for business development

“Over the past few years, our company has been expanding our business into the GBA and building a new factory. We are fortunate to have BOCHK as our trusted banking partner to support our funding needs.”

KOLN 3D Founder Mr. Edmond Yau

Overcoming business challenges with our trusted banking partner

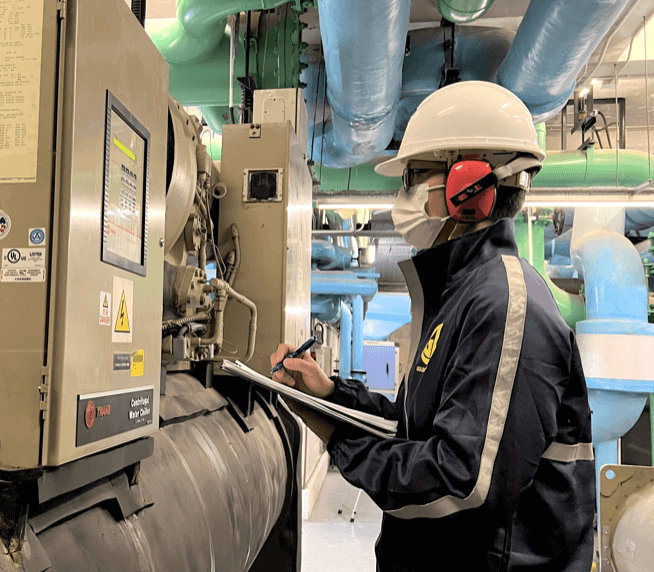

“The engineering business was severely hit by emergency situation over the past few years. BOCHK has supported us along the way in devising strategy for a more sustainable development. With collaborative efforts, we overcame the adversities with success.”

Golden Leaf Founder & Chief Executive Director Mr. Kenny Ip

Flexible Loan Customer Cases

SME Financing Guarantee Scheme

Flexible financing is vital for business development

“Over the past few years, our company has been expanding our business into the GBA and building a new factory. We are fortunate to have BOCHK as our trusted banking partner to support our funding needs.”

KOLN 3D Founder Mr. Edmond Yau

Overcoming business challenges with our trusted banking partner

“The engineering business was severely hit by emergency situation over the past few years. BOCHK has supported us along the way in devising strategy for a more sustainable development. With collaborative efforts, we overcame the adversities with success.”

Golden Leaf Founder & Chief Executive Director Mr. Kenny Ip

Related Products & Promotional Offers

Useful Information

Reminder : To borrow or not to borrow? Borrow only if you can repay!

The above products, services and offers are subject to terms and conditions.

Corporate Banking

© 2026 BANK OF CHINA (HONG KONG) LIMITED.

ALL RIGHTS RESERVED.

Enjoy Up to 50 Basis Points Annualised Interest Rate Discount

for Online Applications

for Online Applications