- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

Cross-border Finance

One-stop cross-border financial services

to help you expand your business

in China and overseas markets

to help you expand your business

in China and overseas markets

Welcome offer upon successful SME application of

Business Integrated Account

Business Integrated Account

BOC Connect

The essential interactive corporate

information platform for expanding

into the Greater Bay Area

information platform for expanding

into the Greater Bay Area

Learn more

BOC Connect

The interactive corporate information

platform necessary for developing

in Southeast Asia

platform necessary for developing

in Southeast Asia

Learn more

Business Integrated Account Opening Offers for Corporate Customers of “Top Talent Pass Scheme” and “Quality Migrant Admission Scheme” with designated promotion code via online application Account application fee waiver (Original: HK$1,200), monthly service fee waiver on BIA for the first year, and a wide range of welcome offers.

Terms and Conditions apply

Business Integrated Account Opening Offers for Corporate Customers of “Top Talent Pass Scheme” and “Quality Migrant Admission Scheme” with designated promotion code via online application Account application fee waiver (Original: HK$1,200), monthly service fee waiver on BIA for the first year, and a wide range of welcome offers.

Terms and Conditions apply

All-round SME banking service

Support Various Operational Needs

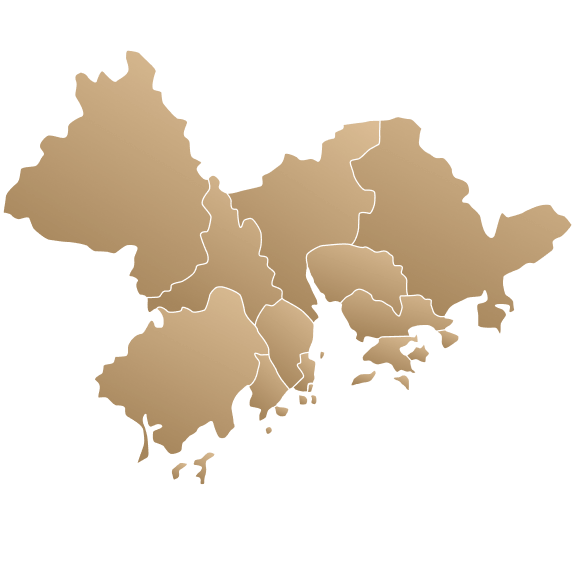

The Greater Bay Area

Integrated financial services for business expansion in the Mainland

Support for the Greater Bay Area

Bank of China (Hong Kong) understands the needs of local businesses and provides cross-border financial services for operating in the Greater Bay Area (GBA). Leveraging the strong network of the parent company, Bank of China, over 1,000 service points across different cities in the GBA, and we offer customized financial services to businesses at different stages of development.

A comprehensive range of cross-border financial services, from company registration, account opening, dual-account management, to cross-border remittance and trade financing are there for you.

A comprehensive range of cross-border financial services, from company registration, account opening, dual-account management, to cross-border remittance and trade financing are there for you.

Customer Service Hotline

Within China

95566

95566

Overseas

+86 95566

+86 95566

Other Greater Bay Area Business Needs

Related Products & Promotional Offers

Useful Information

Reminder : To borrow or not to borrow? Borrow only if you can repay!

This website does not constitute any offer, solicitation, recommendation of any investment products or services. Although investment may bring profit opportunities, each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment products may not be the same as expected by customers. Customers' funds may increase or reduce due to the purchase or sale of investment products. The loss incurred from investment may be the same or greater than the initial investment amount. Proceeds may also change accordingly. Part of the investment may not be able to liquidate immediately under certain market situations. Before making any investment decisions, customers should consider their own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. For the nature and risk disclosures of individual investment products, customers should read carefully the relevant offering documents for details. Customers should seek independent professional advice.

Risk Disclosure of RMB Currencies, Remittance, Investment and Insurance Services

Risk Disclosure of RMB Currencies, Remittance, Investment and Insurance Services

- RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies. For RMB Life Insurance Plans, if calculated in Hong Kong Dollar, premiums, fees and charges, account value / surrender value and benefits payable under RMB policies will vary with the exchange rate. The fluctuation in exchange rate may result in losses if a customer chooses to pay premiums in Hong Kong Dollar, or requests the insurer to pay the account value / surrender value or benefits in Hong Kong Dollar, for a RMB policy.

- RMB is currently not fully freely convertible. Corporate customers who intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- For services involving cross-border flow of RMB funds, they will be subject to the rules and requirements of the Mainland of China.

This website does not constitute any offer, solicitation, recommendation of any investment products or services. Although investment may bring profit opportunities, each investment product or service involves potential risks. Due to dynamic changes in the market, the price movement and volatility of investment products may not be the same as expected by customers. Customers' funds may increase or reduce due to the purchase or sale of investment products. The loss incurred from investment may be the same or greater than the initial investment amount. Proceeds may also change accordingly. Part of the investment may not be able to liquidate immediately under certain market situations. Before making any investment decisions, customers should consider their own financial situation, investment objectives and experiences, risk acceptance and ability to understand the nature and risks of the relevant product. For the nature and risk disclosures of individual investment products, customers should read carefully the relevant offering documents for details. Customers should seek independent professional advice.

Risk Disclosure of RMB Currencies, Remittance, Investment and Insurance Services

Risk Disclosure of RMB Currencies, Remittance, Investment and Insurance Services

- RMB investments are subject to exchange rate fluctuations which may provide both opportunities and risks. The fluctuation in the exchange rate of RMB may result in losses in the event that the customer converts RMB into HKD or other foreign currencies. For RMB Life Insurance Plans, if calculated in Hong Kong Dollar, premiums, fees and charges, account value / surrender value and benefits payable under RMB policies will vary with the exchange rate. The fluctuation in exchange rate may result in losses if a customer chooses to pay premiums in Hong Kong Dollar, or requests the insurer to pay the account value / surrender value or benefits in Hong Kong Dollar, for a RMB policy.

- RMB is currently not fully freely convertible. Corporate customers who intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

- For services involving cross-border flow of RMB funds, they will be subject to the rules and requirements of the Mainland of China.

The above products, services and offers are subject to terms and conditions.

Corporate Banking

© 2026 BANK OF CHINA (HONG KONG) LIMITED.

ALL RIGHTS RESERVED.

CNY Super Reward Duo

Selected Corporate Customers Super Red Packet Valued at over HK$32,888

Selected Corporate Customers Super Red Packet Valued at over HK$32,888