- Private Wealth

- Wealth Management

- Enrich Banking

- i-Free Banking

- Private Banking

- Corporate BankingCorporate Banking

- SME in One

- RMB Services

- Cross-border Financial and Remittance Services

- Deposits

- InvestmentInvestment

- Securities

- Latest Promotion

- Securities Trading Services

- Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect

- US Securities

- Monthly Stocks Savings Plan

- Family Securities Accounts

- IPO Shares Subscription and IPO Financing

- Securities Margin Trading Services

- Securities Club

- Virtual Securities Investment Platform

- Stock Information

- Fund

- Foreign Exchange

- Securities

- Mortgage

- Loan

- InsuranceInsurance

- Latest Promotion

- RMB Insurance Services

- MaxiWealth ULife Insurance Plan

- Forever Glorious ULife Plan II

- ReachUp Insurance Plan

- SmartGuard Critical Illness Plan

- iTarget 3 Years Savings Insurance Plan

- BOC Life Deferred Annuity (Fixed Term)

- BOC Life Deferred Annuity (Lifetime)

- BOC Life Deferred Annuity (Fixed Term) (Apply via mobile banking)

- Forever Wellbeing Whole Life Plan

- Glamorous Glow Whole Life Insurance Plan

- CoverU Whole Life Insurance Plan

- Personal Life Insurance

- Latest Promotion

- Business Protection

- Medical and Accident Protection

- Gostudy Student Insurance

- BOC Standard Voluntary Health Insurance Scheme Certified Plan

- BOC Flexi Voluntary Health Insurance Scheme Certified Plan

- BOC Worldwide Medical Insurance Plan

- BOC Medical Comprehensive Protection Plan (Series 1)

- Personal Accident Comprehensive Protection Plan

- China Express Accidental Emergency Medical Plan

- Credit Card

- MPF

- MoreMore

- e-Banking Service

- Promotion

- BoC Pay

- QR Cash

- Corporate Internet Banking

- Phone Banking

- Personal Internet Banking

- Personal Mobile Banking

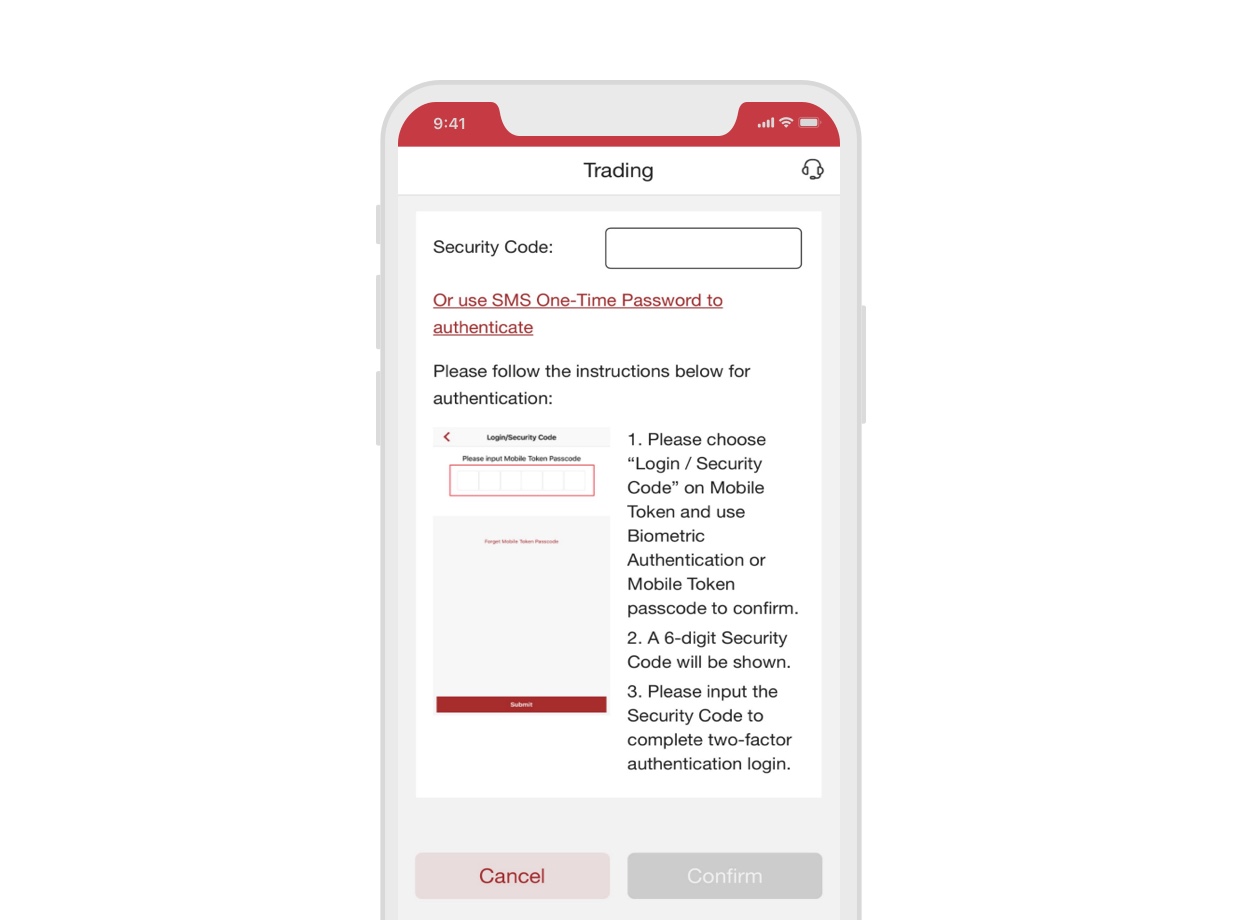

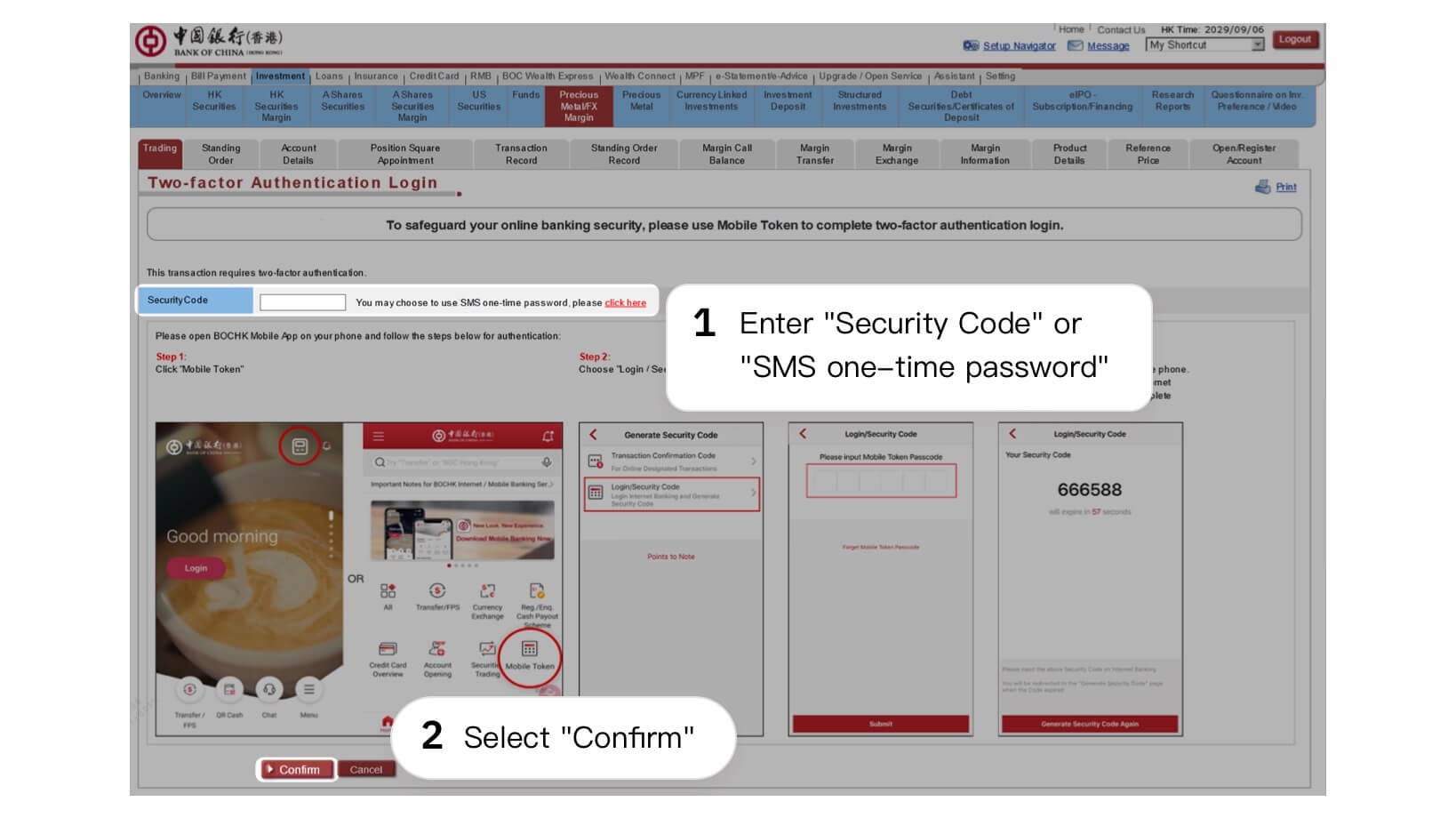

- Two Factor Authentication

- BOCHK Mobile Application

- Automated Banking

- BOCHK Social Media

- e-Statement / e-Advice

- e-Cheques Services

- Smart Account Service

- BOCHK iService

- Finger Vein Authentication

- Faster Payment System

- BoC Bill Integrated Billing Service

- Mobile Account Opening

- e-Banking Service

- Home >

- Investment >

- Precious Metals and FX Margin >

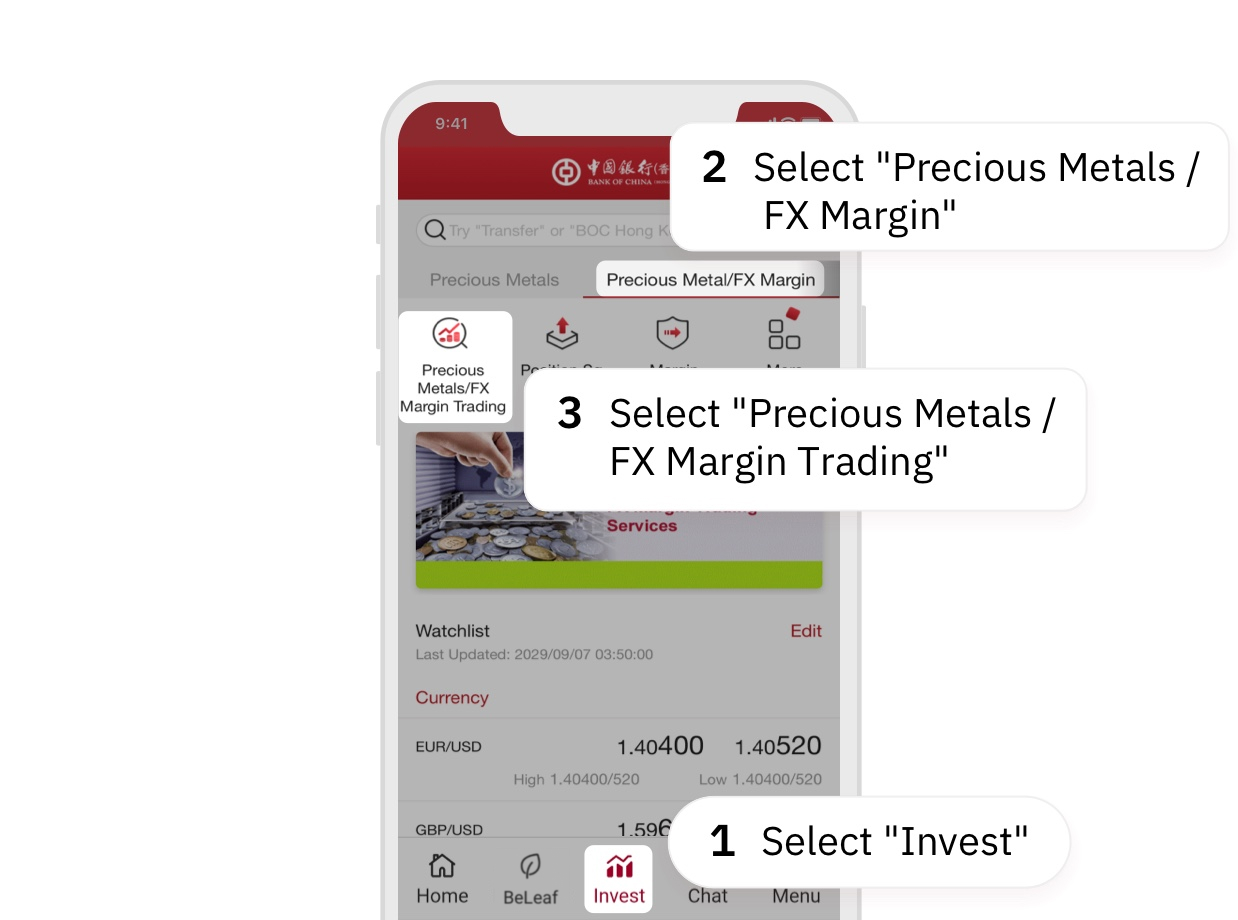

- If you are our existing customer but do not own a Precious Metal/FX Margin AccountLog into Internet Banking

- New Customer can simply

open account withBOCHK Mobile BankingThen you can open a Precious Metal/FX Margin account via Internet Banking

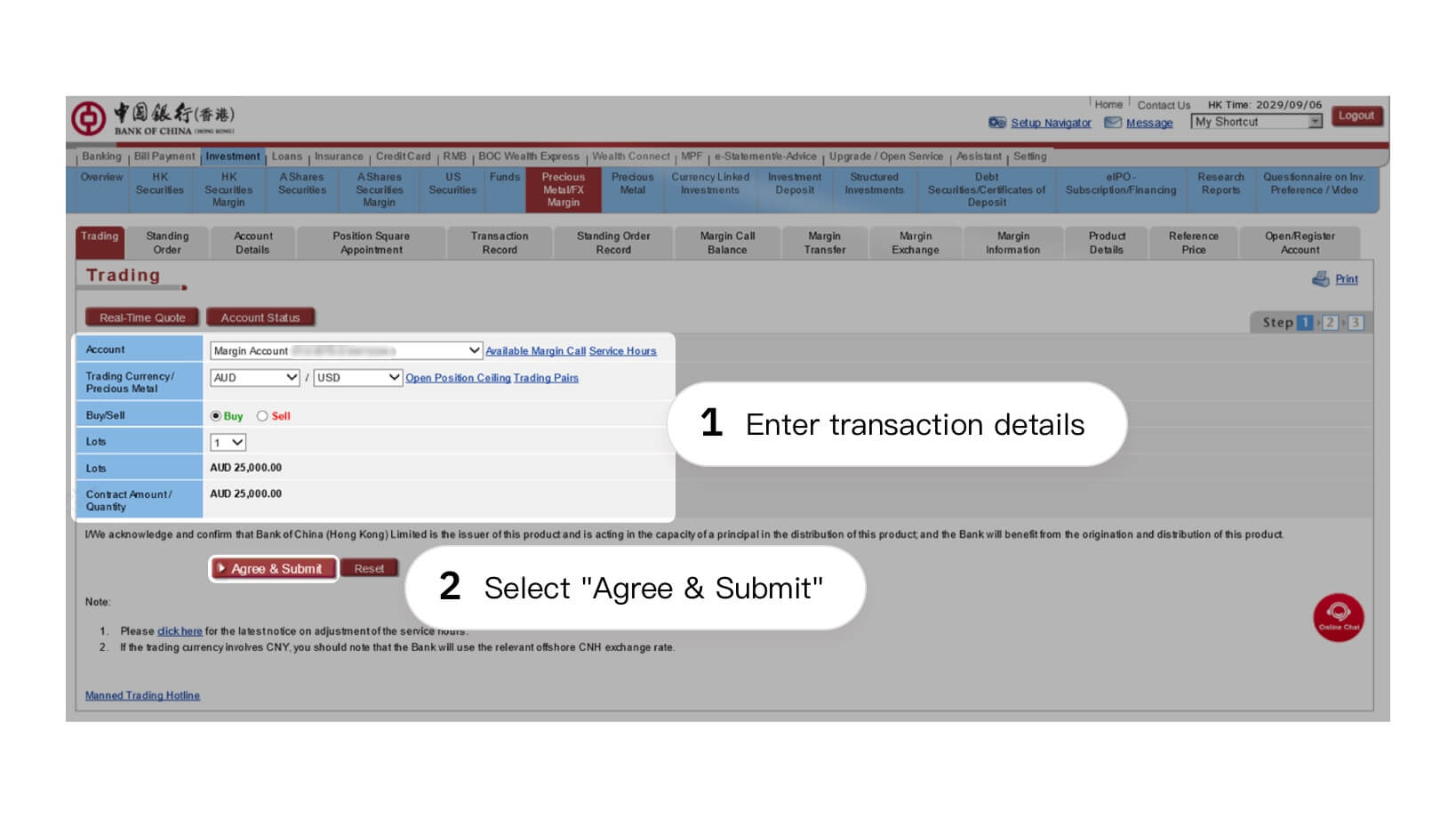

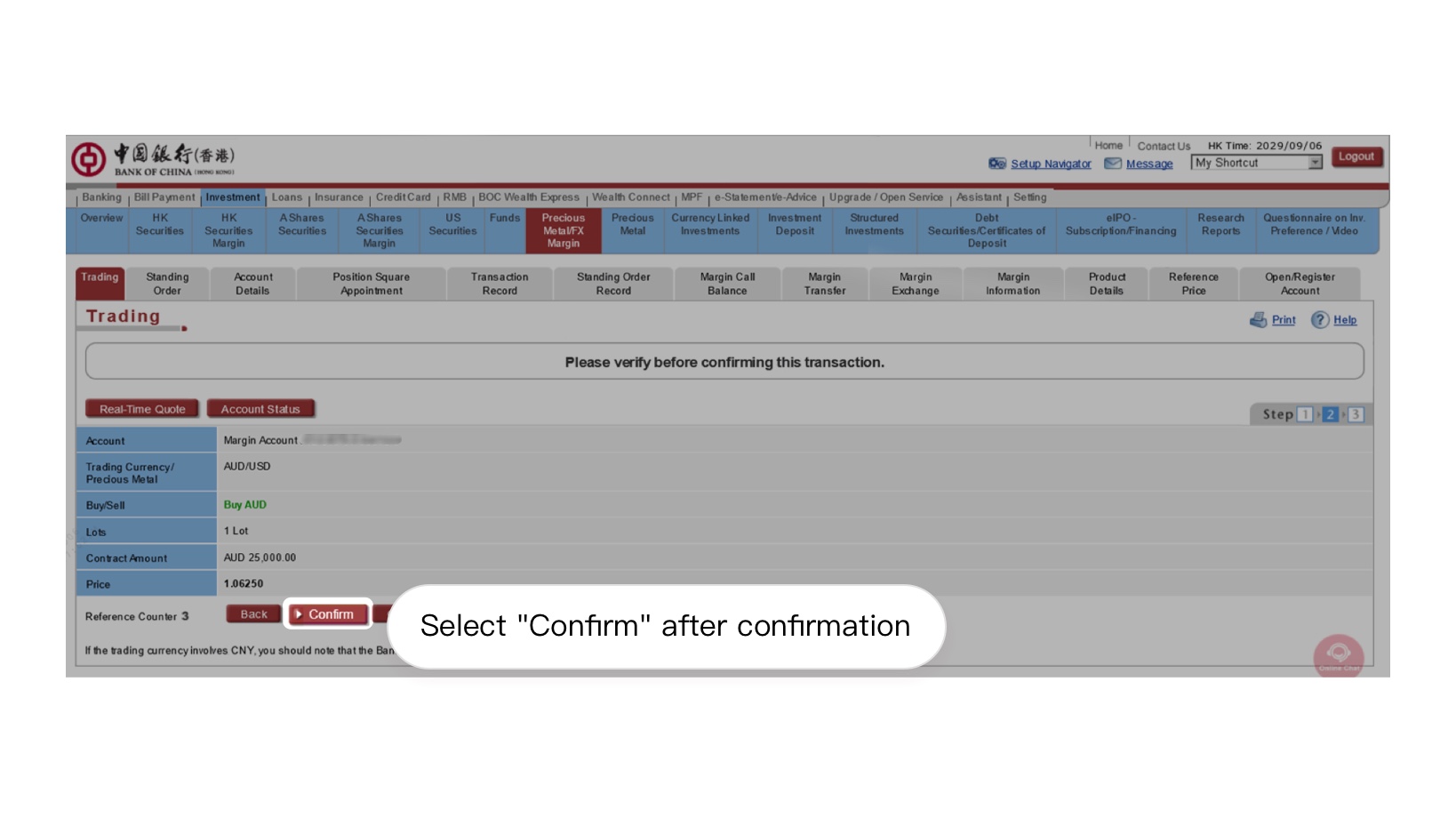

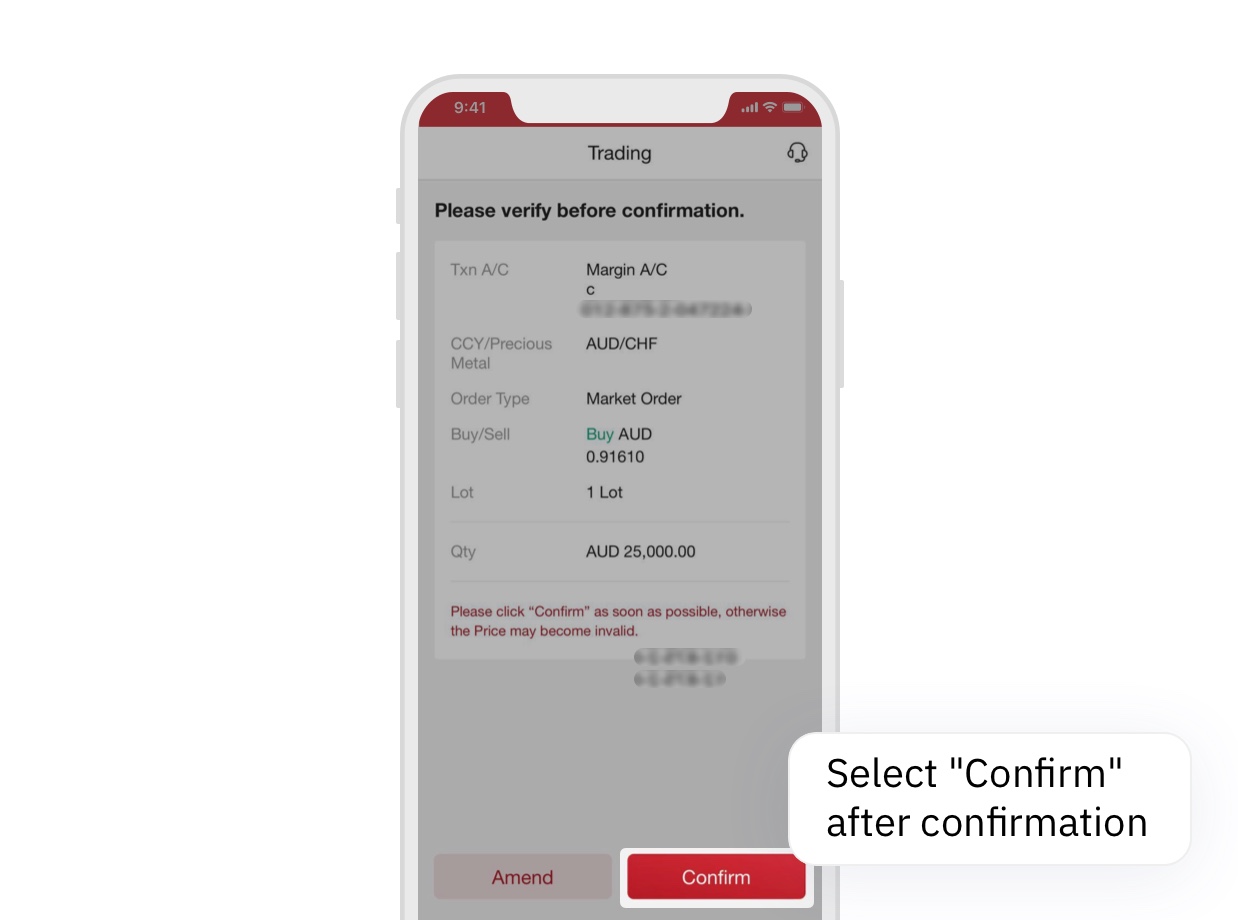

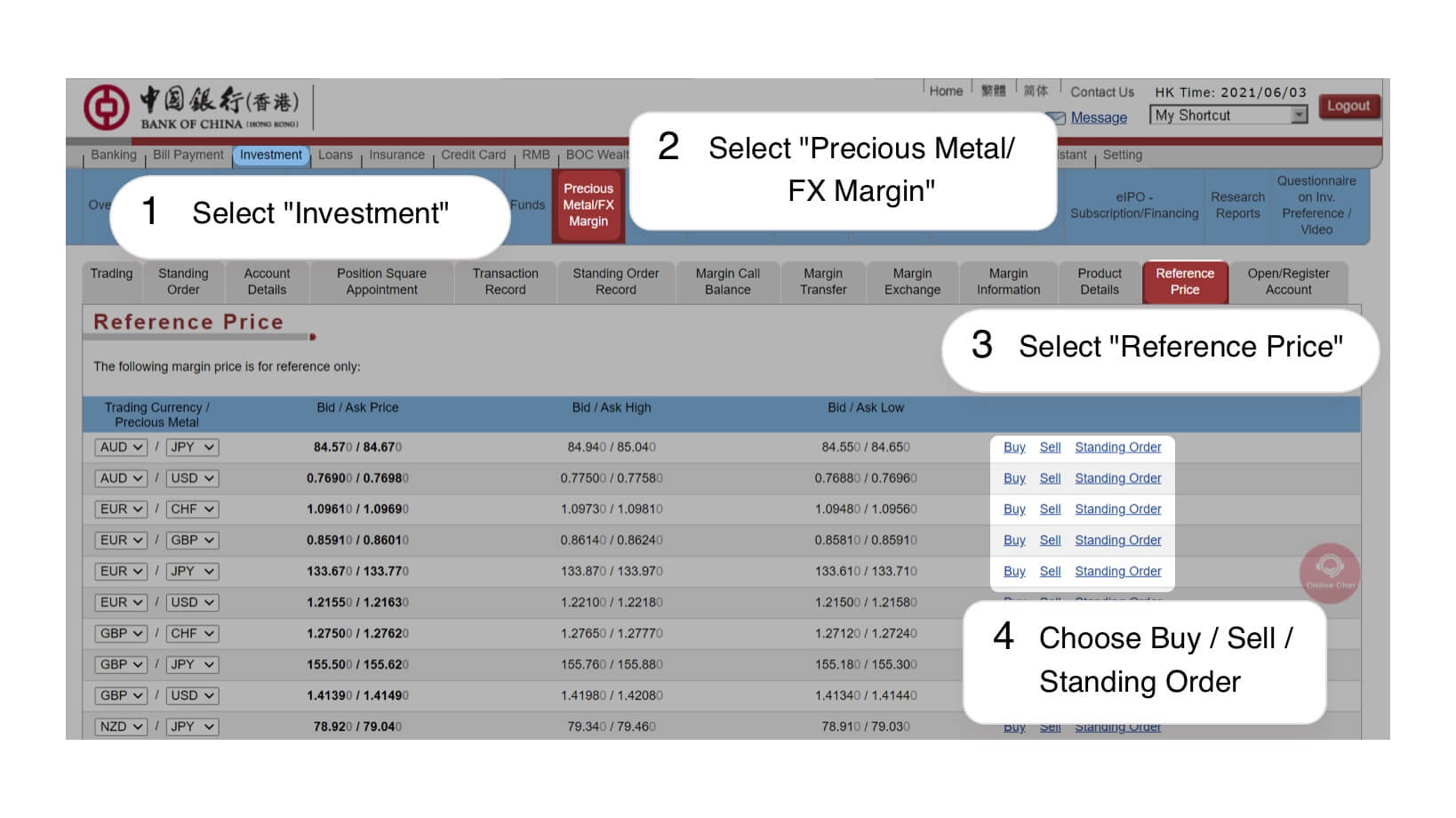

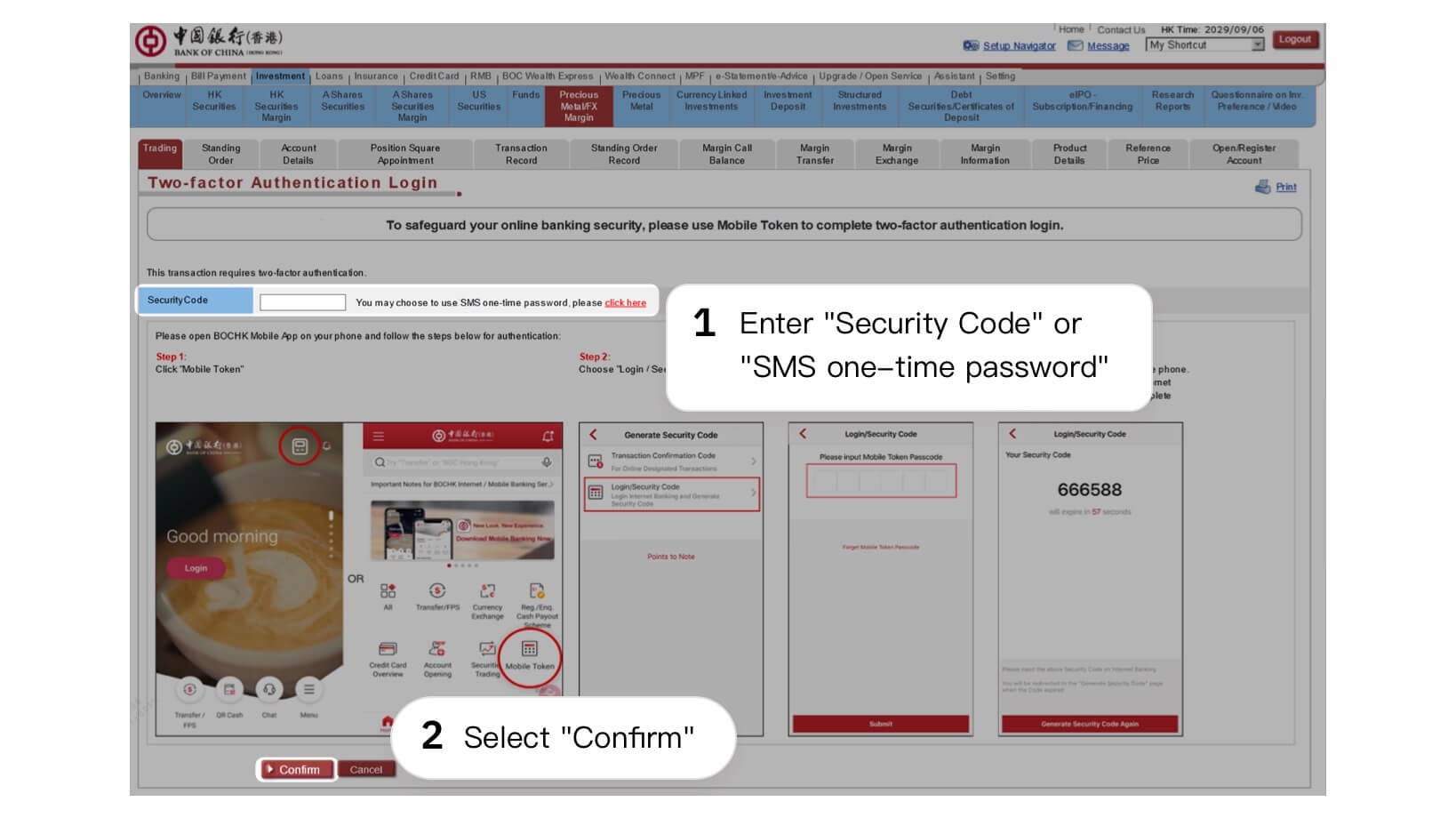

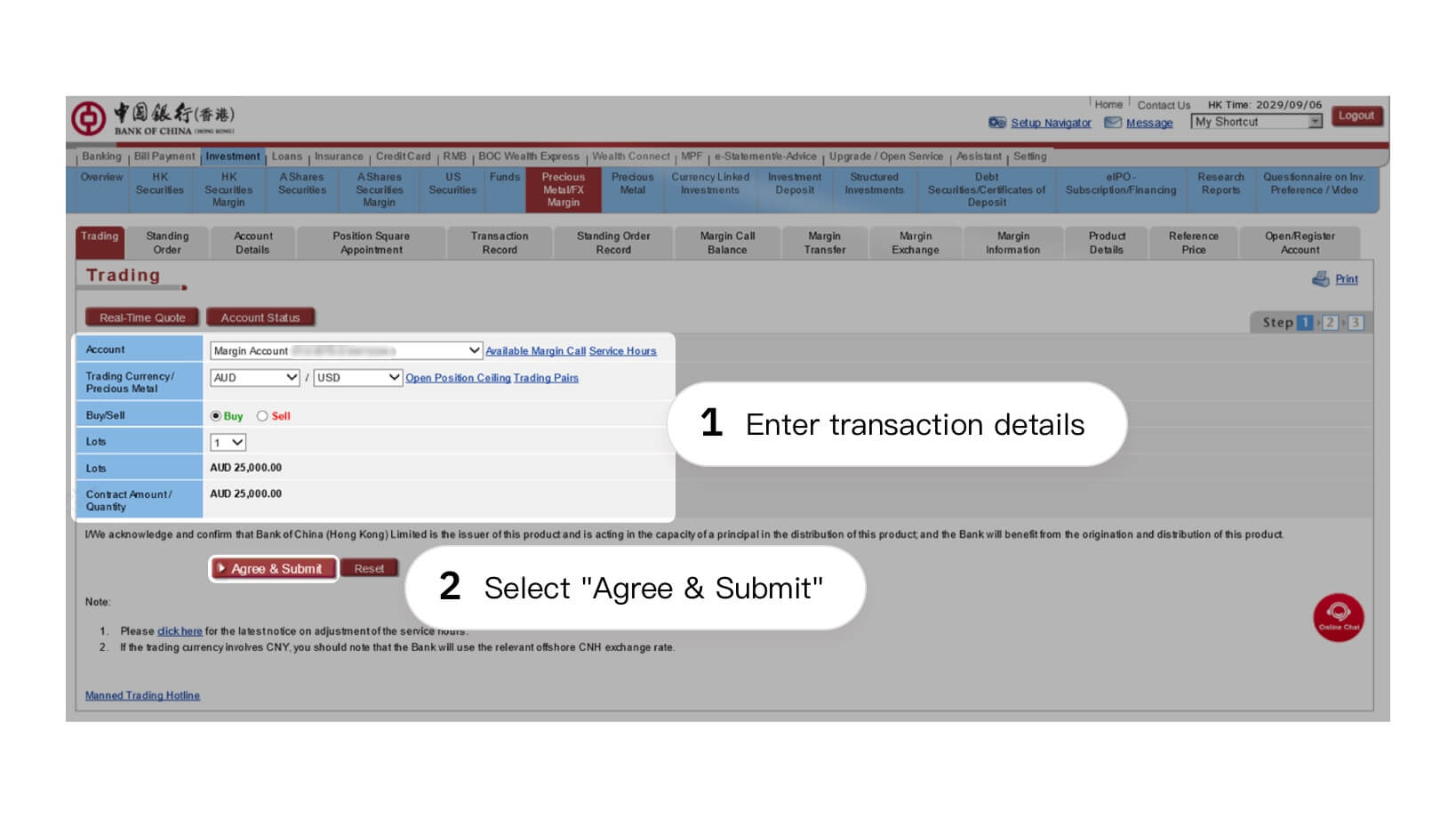

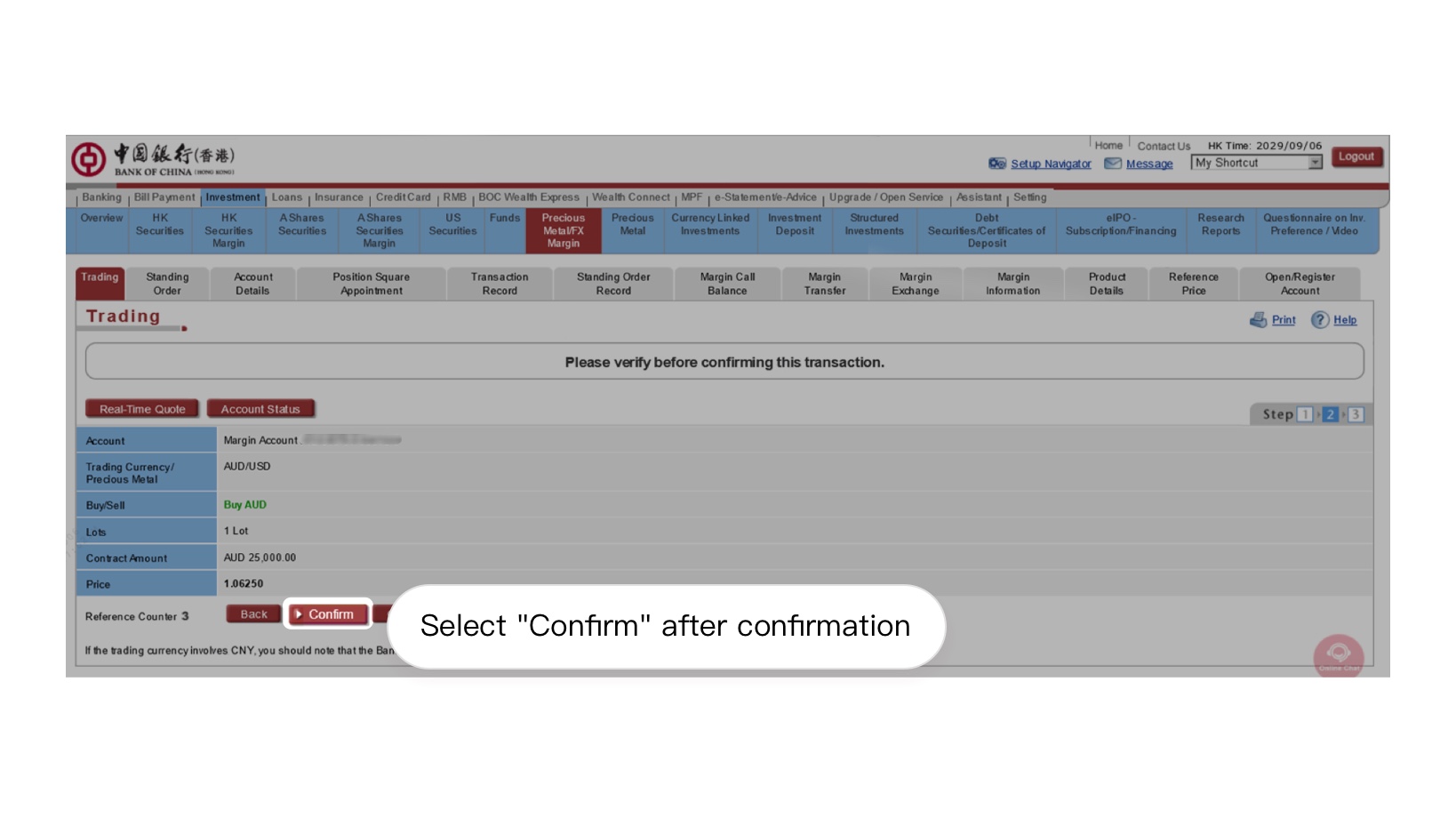

- If you own a Precious Metal/ FX Margin Account Place An Order

- If you are our existing customer but do not own a Precious Metal/FX Margin AccountLog into Internet Banking

- New Customer can simply open account withBOCHK Mobile BankingThen you can open a Precious Metal/FX Margin account via Internet Banking

- If you own a Precious Metal/ FX Margin Account Place An Order

Invest with a leverage ratio up to 20 times from a margin fund as low as 5%

*The above information is only a summary of the product features. Please refer to the "Instruction - Precious Metal/ FX Margin" and "Rules - Precious Metal/ FX Margin Trading" for details. Terms and conditions apply.

Product Features

38 Pairs of Precious Metals and Currencies

Various choices in precious metals and currencies, including HKD, USD, CNY, AUD, CAD, CHF, EUR, GBP, NZD, JPY, London Gold, London Silver, Tael Gold and Kilo Gold. The minimum amount for Precious Metal/ FX Margin trading is 1 lot. Please refer to Details of Trading Pairs for more information on the lot size.

Leveraged Investing

A margin fund as low as 5% can be leveraged up to 20 times. An opportunity to capture higher investment returns through leveraging.

Flexible Order Types

In addition to Market Order, there is a wide selection of standing orders, including "Single", "One-Cancels-the-Other (OCO)" and "If-Then" orders. The validity of standing orders is up to 14 days. Enable greater flexibility in investment.

Trade Anywhere, Anytime

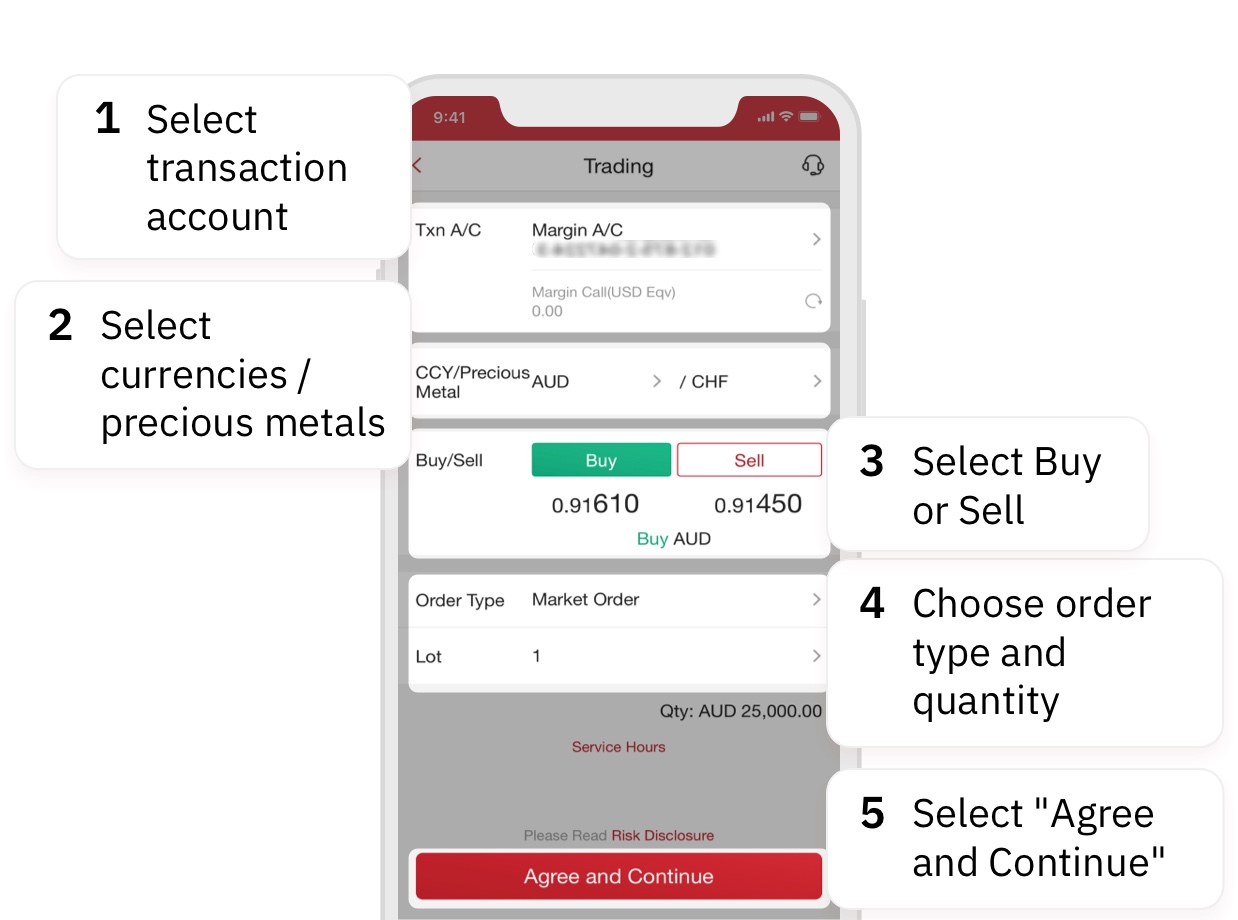

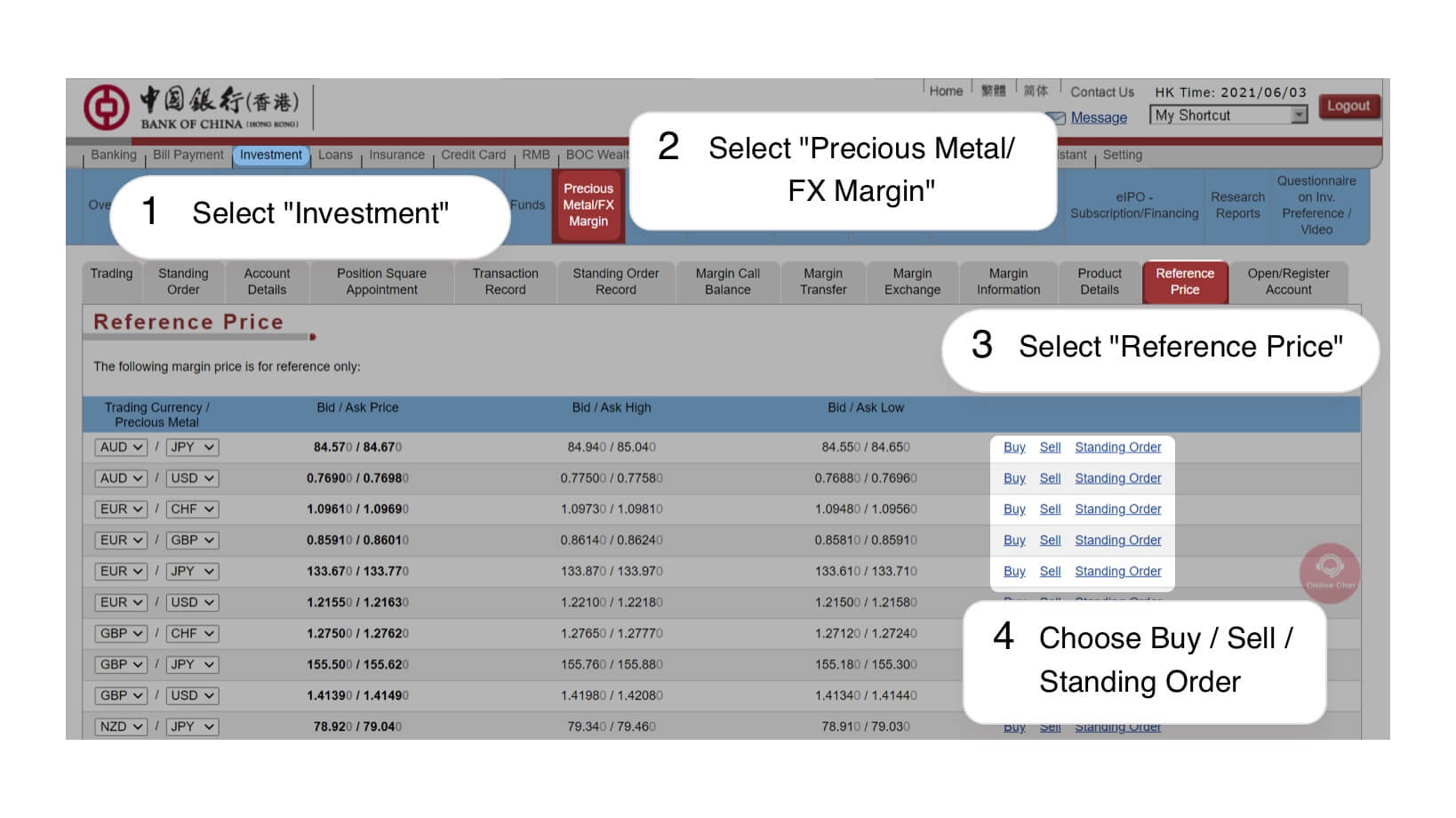

Conduct transactions via our Mobile Banking, Internet Banking or Manned Trading Hotline. Click here to learn more about the service hours.

*The above information is only a summary of the product features. Please refer to the "Instruction - Precious Metal/ FX Margin" and "Rules - Precious Metal/ FX Margin Trading"for details. Terms and conditions apply.

Examples

How it works?

Deposit Money into Margin Trading Account

Increase investment capital up to 20 times the margin deposit through leverage.

Choose Trading Pair

Buy (long position) the currency you hold a bullish view, sell (short position) the currency you are bearish on it. Currencies are traded in pair (e.g. AUD/USD) and the value of a currency is measured relative to the other currency in the pair. If you hold a bullish view on one currency (e.g. AUD), it means you correspondingly hold a bearish view on the other currency (e.g. USD) in that currency pair.

Square Position

If you already have a long position, you need to sell to square off; whereas if you are short, you need to buy to square off. If the currency appreciates (or depreciates) as expected, you will profit from the change in exchange rate, however, if the exchange rate moves in the unexpected direction, there would be a loss.

Customer's Total Profit/Loss

Aside from the change in exchange rate, the customer’s total profit/loss includes interest earned or paid (if any).

Illustrative Example

Terms

Trading Pair

AUD/USD

Initial Margin Required

5% (leveraged ratio = 20)

Initial Margin Required in Margin Trading Account

AUD 250,000 x 0.8 x 5% = USD 10,000

Contract Amount

AUD 250,000 (10 Lots)

AUD to USD Exchange Rate

0.8000

USD Equivalent of the Contract Amount

AUD 250,000 x 0.8 = USD 200,000

Assume AUD/ USD goes up

from 0.8000 to 0.8050

Assume AUD/ USD falls

from 0.8000 to 0.7950

AUD 250,000 x (0.8050 - 0.8000)

= USD 1,250

AUD 250,000 x (0.7950 - 0.8000)

= - USD 1,250

1The profit/loss of the squared position will be settled on the value date of the close out contract. Normally, the value date is two trading days after the trade date (except CAD, Tael Gold and Kilo Gold)

Margin

Receive Interest

AUD Long Position

Receive Interest

USD Short Position

Pay Interest

USD 1,250 + (AUD0.692 - USD 11.083)

= USD equivalent 1,239.474

-USD 1,250 + (AUD 0.692 - USD 11.083)

= - USD equivalent 1,260.534

Interest for the cash margin is accrued from the date it is deposited to the margin trading account (1st March) until withdrawal. Interest for the contract is calculated from the value date of the open contract (3rd March) to the value date of the close out contract (4th March).

Assume AUD has a credit interest rate of 0.1% p.a. whilst USD has a credit interest rate and debit interest rate of 0.11% p.a. and 2.11% p.a. respectively

2AUD interest:AUD 250,000 X (0.1%/360 days) X 1 day

3USD interest:USD 10,000 X (0.11%/360 days) X 2 days – USD(200,000-10,000) X (2.11%/360 days) X 1 day

4Assume the AUD/ USD exchange rate = 0.7980, AUD 0.69 = USD equivalent 0.55

Credit and debit of interest in respect of the FX margin will be settled on the business day before the last business day of each month. Any credit/debit interest accrued from foreign currency margin and contracts, except HKD, will be converted into USD calculated (unless otherwise requested by the customer) based on the closing price quoted by the Bank on the same day or the exchange rate of that day determined by the Bank. Such interest will then be credited to or debited from the margin balance accordingly.

Illustrative Example

Terms

Trading Pair

AUD/USD

Initial Margin Required

5% (leveraged ratio = 20)

Initial Margin Required in Margin Trading Account

AUD 250,000 x 0.8 x 5% = USD 10,000

Contract Amount

AUD 250,000 (10 Lots)

AUD to USD Exchange Rate

0.8000

USD Equivalent of the Contract Amount

AUD 250,000 x 0.8 = USD 200,000

Assume AUD/ USD goes up

from 0.8000 to 0.8050

Assume AUD/ USD falls

from 0.8000 to 0.7950

AUD 250,000 x (0.8050 - 0.8000)

= USD 1,250

AUD 250,000 x (0.7950 - 0.8000)

= - USD 1,250

1The profit/loss of the squared position will be settled on the value date of the close out contract. Normally, the value date is two trading days after the trade date (except CAD, Tael Gold and Kilo Gold)

Margin

Receive Interest

AUD Long Position

Receive Interest

USD Short Position

Pay Interest

USD 1,250 + (AUD0.692 - USD 11.083)

= USD equivalent 1,239.474

-USD 1,250 + (AUD 0.692 - USD 11.083)

= - USD equivalent 1,260.534

Interest for the cash margin is accrued from the date it is deposited to the margin trading account (1st March) until withdrawal. Interest for the contract is calculated from the value date of the open contract (3rd March) to the value date of the close out contract (4th March).

Assume AUD has a credit interest rate of 0.1% p.a. whilst USD has a credit interest rate and debit interest rate of 0.11% p.a. and 2.11% p.a. respectively

2AUD interest:AUD 250,000 X (0.1%/360 days) X 1 day

3USD interest:USD 10,000 X (0.11%/360 days) X 2 days – USD(200,000-10,000) X (2.11%/360 days) X 1 day

4Assume the AUD/ USD exchange rate = 0.7980, AUD 0.69 = USD equivalent 0.55

Credit and debit of interest in respect of the FX margin will be settled on the business day before the last business day of each month. Any credit/debit interest accrued from foreign currency margin and contracts, except HKD, will be converted into USD calculated (unless otherwise requested by the customer) based on the closing price quoted by the Bank on the same day or the exchange rate of that day determined by the Bank. Such interest will then be credited to or debited from the margin balance accordingly.

The above examples are only a summary. Please refer to the "Instruction - Precious Metal/ FX Margin" and "Rules - Precious Metal/ FX Margin Trading" for details.

*The above examples are prepared with hypothetical data, and is not based on the past performance of the currencies as stated herein. They are for reference only and does not guarantee or represent any final returns. No representation or warranty is made by the Bank that any illustration or scenario described above can be duplicated under real investment conditions. Actual results may vary from the results shown above and such variations may be material. The above hypothetical examples should not be relied on as an indication of the actual performance of the precious metals/ currencies or this product. You should not rely on these hypothetical examples when making an investment decision.

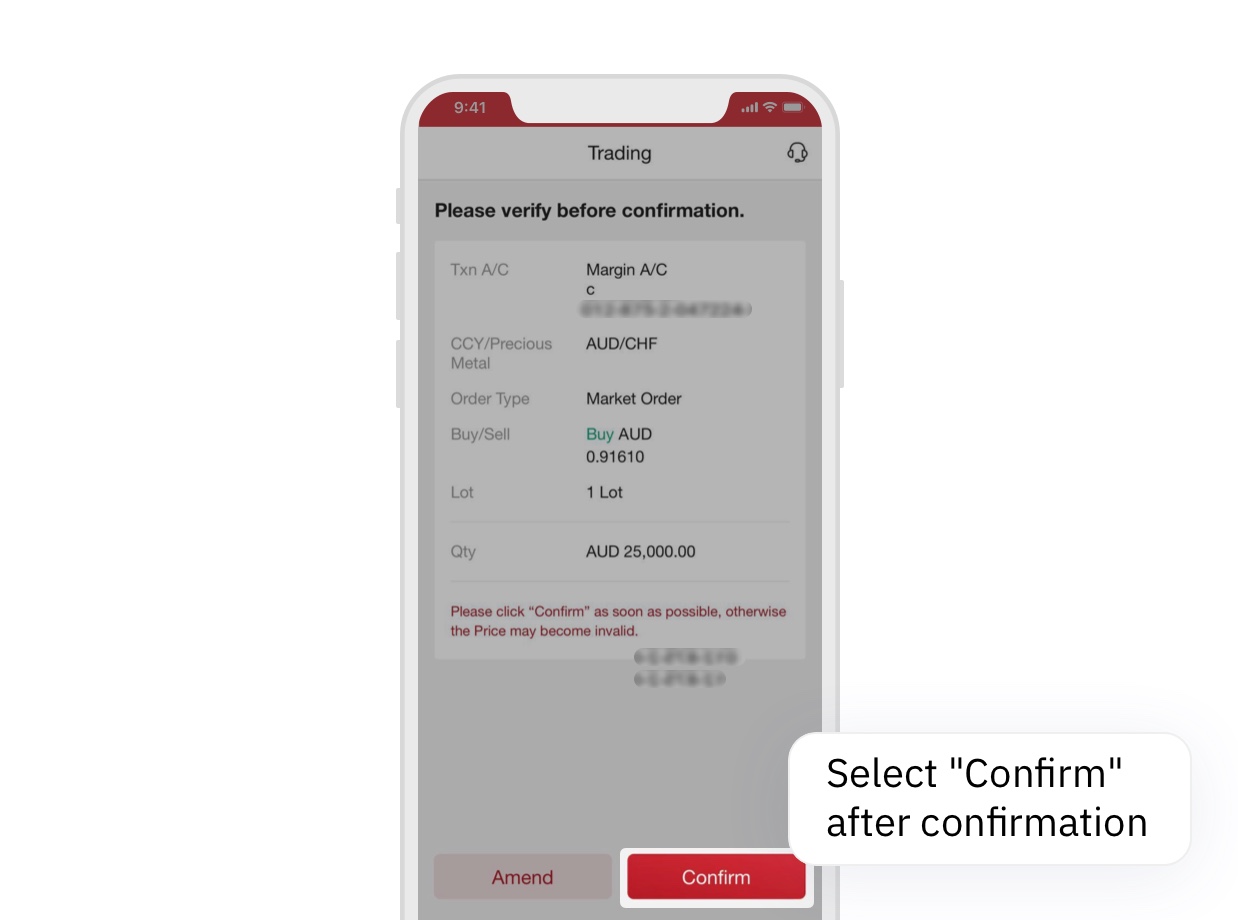

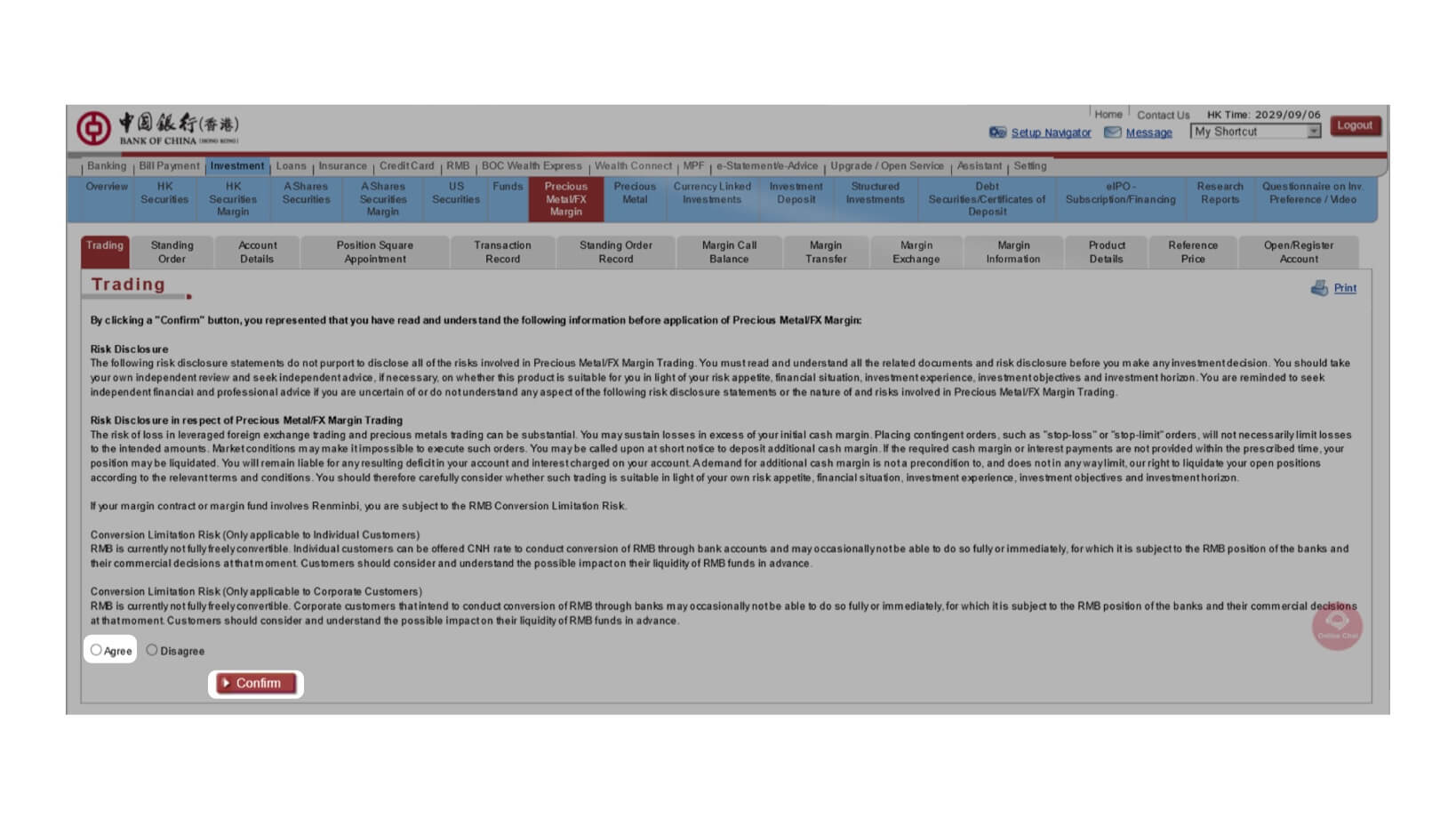

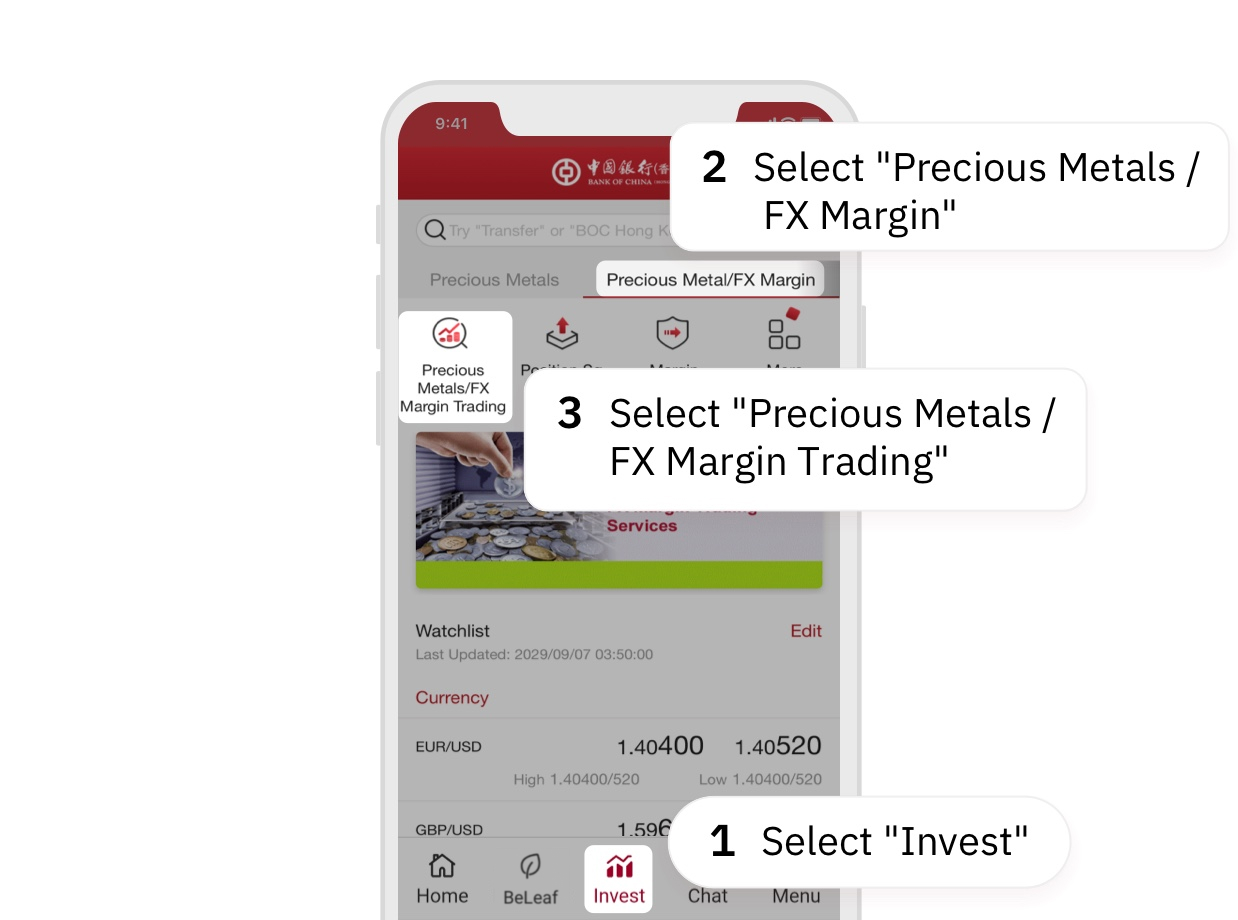

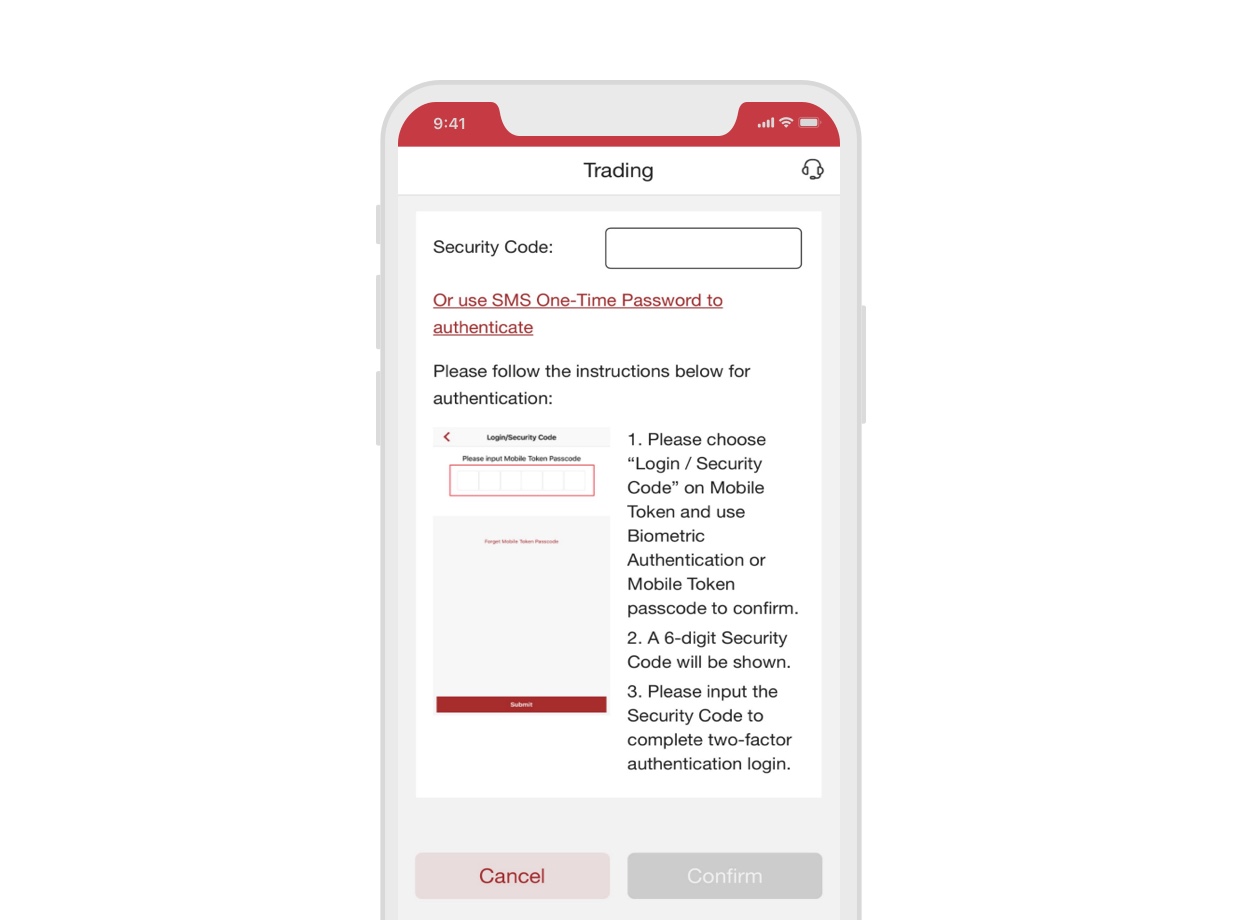

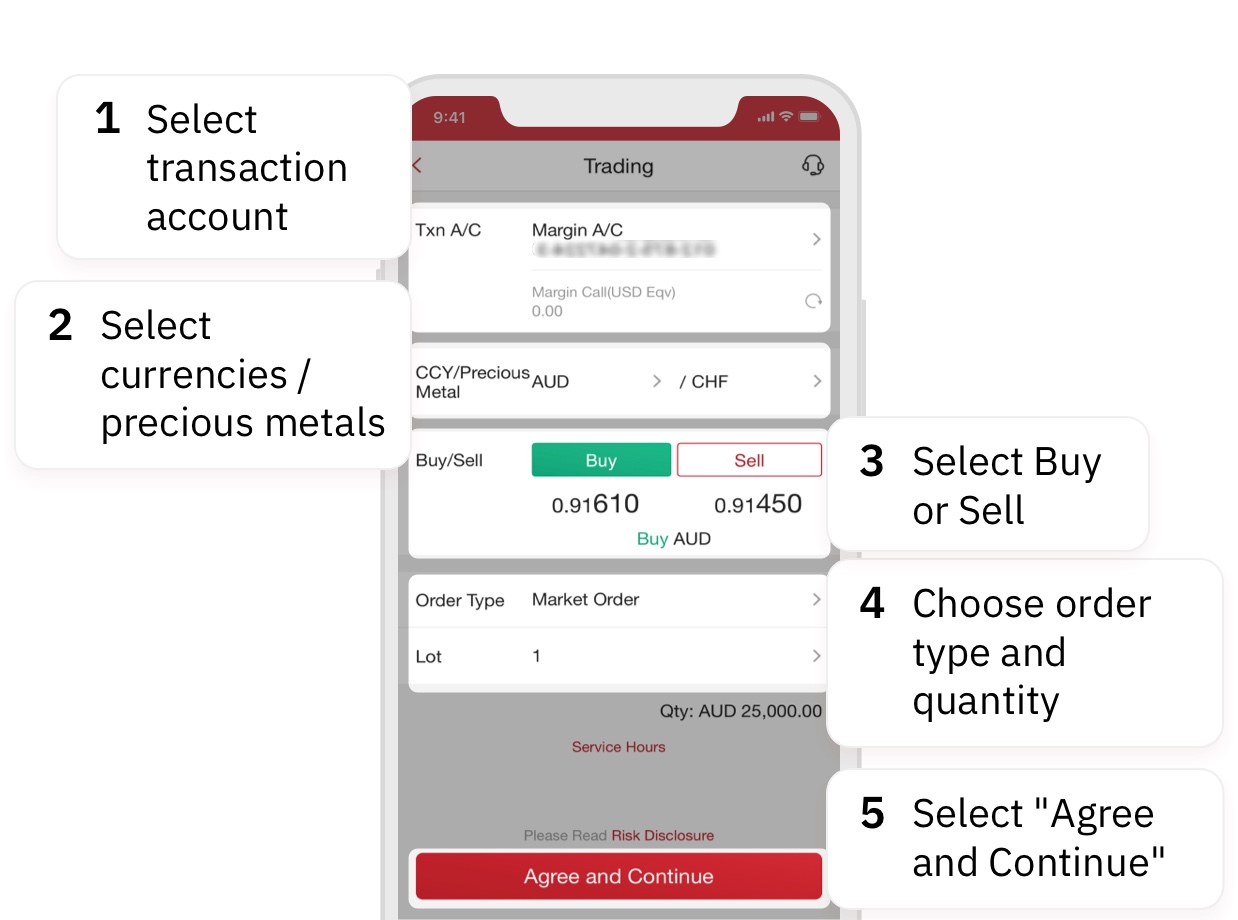

Account Opening and Transaction Process

New customer can simply open account with BOCHK Mobile Banking now. Then you can open a Precious Metal/FX Margin account via Internet Banking

Latest Foreign Currency Exchange Information

Frequently Asked Questions

“Rules – Precious Metal/FX Margin Trading”

This promotional material is for reference only. It is not and does not constitute any offer, solicitation or recommendation to buy or sell any investment product or service, or to effect any transaction.

All examples and other information contained in this material are purely hypothetical for illustrative purpose only and do not reflect a complete analysis of all possible scenarios. You should not make any investment decision based any example or information contained in this material. The Bank shall not be liable in anyway to anyone for any loss or damage arising out of any person’s use of or reliance upon such information.

Our Precious Metal/FX Margin Trading services are only available to persons who are permitted to use those services by applicable laws. Before you open a Precious Metal/FX Margin Trading account or place the instruction of Precious Metal/FX Margin Trading, you are responsible for satisfying yourselves that you may do so under the laws of the geographical location you are situated in and that you are aware of and observe all relevant restrictions that apply to your geographical location.

This promotional material is for reference only. It is not and does not constitute any offer, solicitation or recommendation to buy or sell any investment product or service, or to effect any transaction.

All examples and other information contained in this material are purely hypothetical for illustrative purpose only and do not reflect a complete analysis of all possible scenarios. You should not make any investment decision based any example or information contained in this material. The Bank shall not be liable in anyway to anyone for any loss or damage arising out of any person’s use of or reliance upon such information.

Our Precious Metal/FX Margin Trading services are only available to persons who are permitted to use those services by applicable laws. Before you open a Precious Metal/FX Margin Trading account or place the instruction of Precious Metal/FX Margin Trading, you are responsible for satisfying yourselves that you may do so under the laws of the geographical location you are situated in and that you are aware of and observe all relevant restrictions that apply to your geographical location.

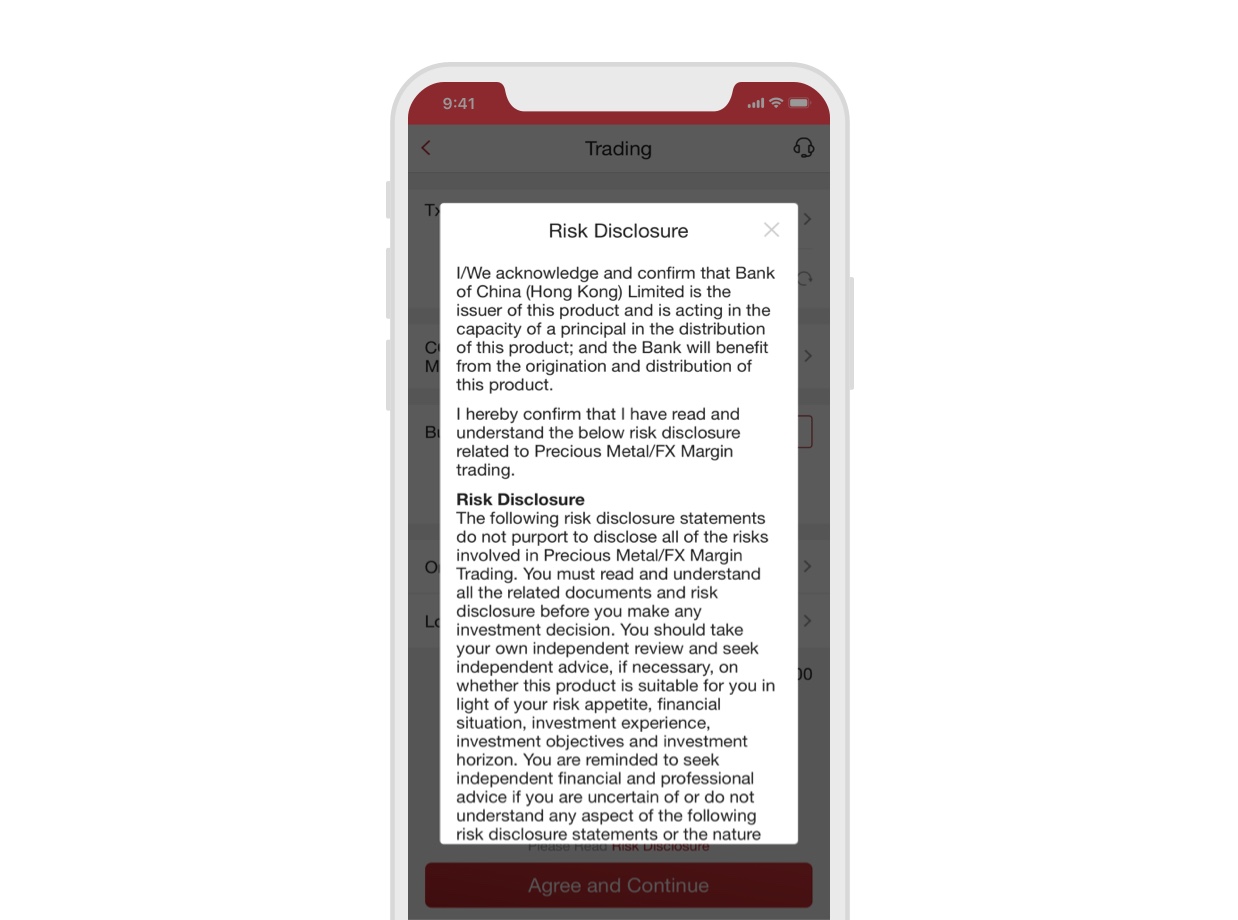

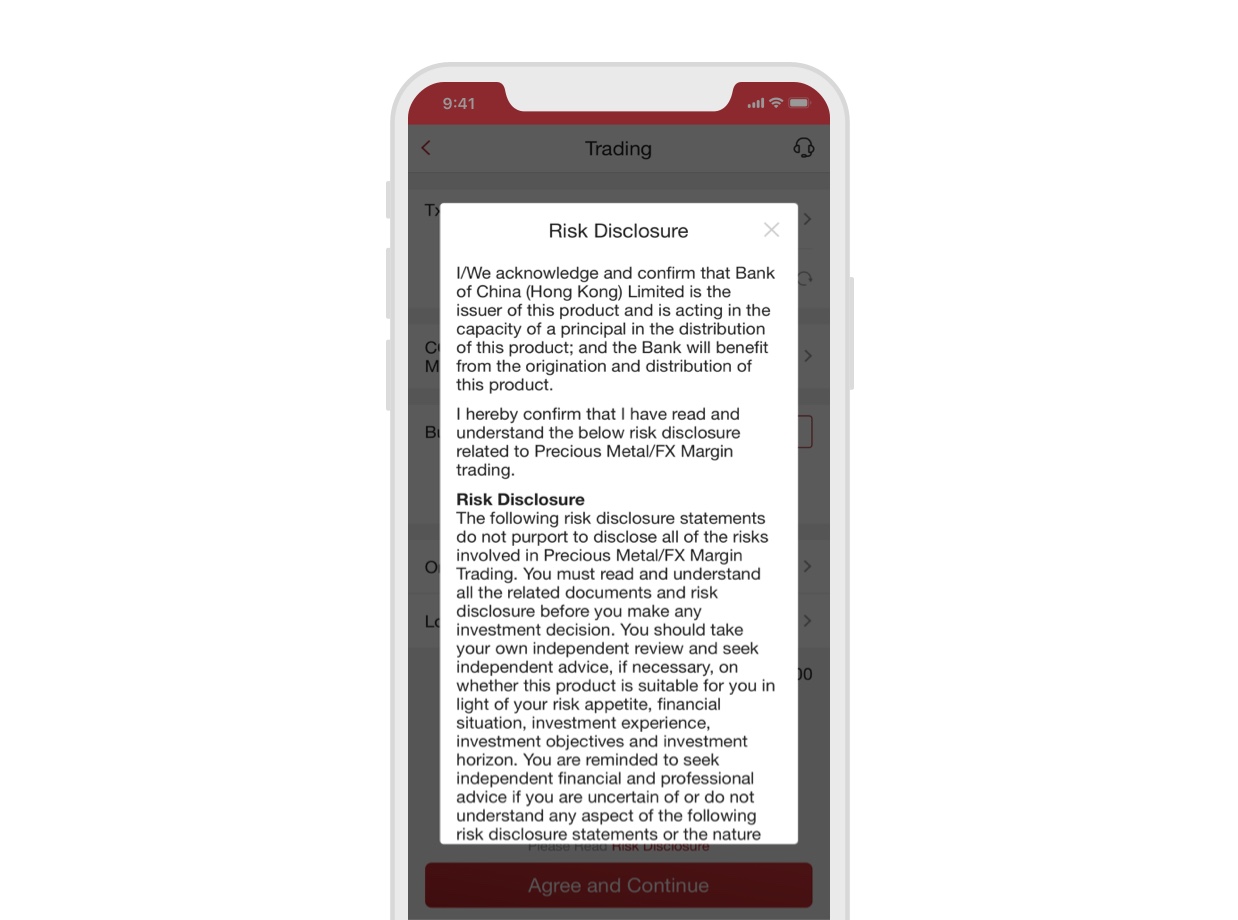

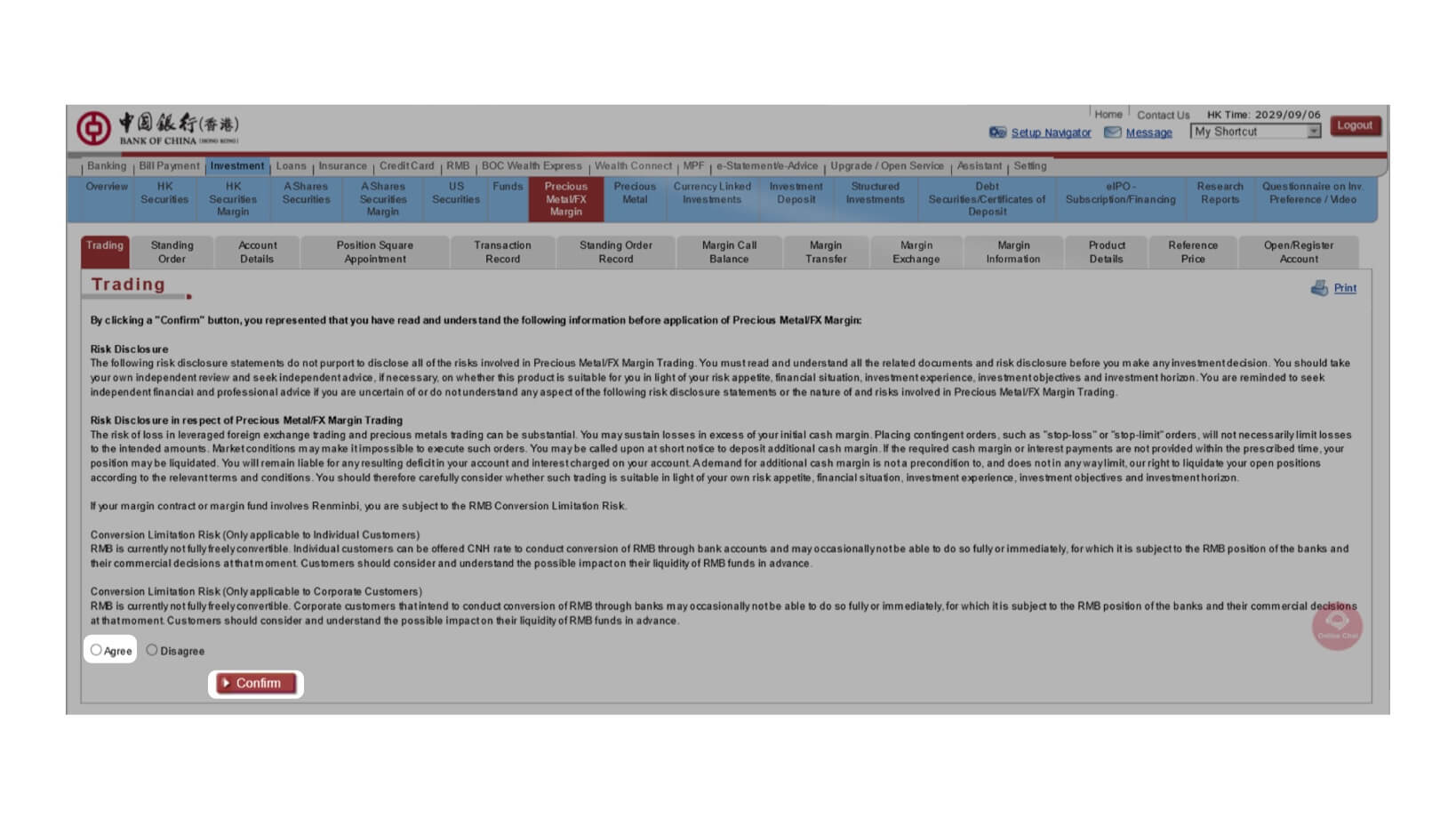

The following risk disclosure statements do not purport to disclose all of the risks involved in Precious Metal/FX Margin Trading. You must read and understand all the related documents and risk disclosure before you make any investment decision. You should take your own independent review and seek independent advice, if necessary, on whether this product is suitable for you in light of your risk appetite, financial situation, investment experience, investment objectives and investment horizon. You are reminded to seek independent financial and professional advice if you are uncertain of or do not understand any aspect of the following risk disclosure statements or the nature of and risks involved in Precious Metal/FX Margin Trading.

The risk of loss in leveraged foreign exchange trading and precious metals trading can be substantial. You may sustain losses in excess of your initial cash margin. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional cash margin. If the required cash margin or interest payments are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account and interest charged on your account. A demand for additional cash margin is not a precondition to, and does not in any way limit, our right to liquidate your open positions according to the relevant terms and conditions. You should therefore carefully consider whether such trading is suitable in light of your own risk appetite, financial situation, investment experience, investment objectives and investment horizon.

If your margin contract or margin fund involves Renminbi, you are subject to the RMB Conversion Limitation Risk.

Conversion Limitation Risk (Only applicable to Individual Customers)

RMB is currently not fully freely convertible. Individual customers can be offered CNH rate to conduct conversion of RMB through bank accounts and may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.

Conversion Limitation Risk (Only applicable to Corporate Customers)

RMB is currently not fully freely convertible. Corporate customers that intend to conduct conversion of RMB through banks may occasionally not be able to do so fully or immediately, for which it is subject to the RMB position of the banks and their commercial decisions at that moment. Customers should consider and understand the possible impact on their liquidity of RMB funds in advance.